Goodnight...There's nothing to fear ATH at almost in reach. There's no such thing as MONSTERS! >=)

The only thing they FEAR is my Bag...

What are your thoughts? Is it bad that people like to realize gains or just something else?

-No advice to give just thoughts that I can't shake after the last 6 years in the world of "CRYPTO"

""KEEP CALM AND MANAGE THY RISK!""

Fear-indicator

Wanna know how big this rout might be? VIX patterns give a hintComparing the end 2019 into 2020 VIX technical pattern, there is a similar consolidation, followed by a breakout. Even the MACD and BMT ( custom relative strength and momentum combines indicator ) set up appear similar for both scenarios.

( Ignore the Buy Sell signals, they are not reliable on the VIX chart )

Does this suggest a blow up of some kind in the making?

Too many parallels...

Why I'm optimistic about the EuroDespite the uncertainty in the markets (Gold and VIX) and the fundamentals (productivity and consumption) indicate a faster recovery in the United States, which theoretically should appreciate the USD, in my opinion the market remains irrational.

But following Keynes' advice "markets can stay irrational longer than you can stay solvent", I prefer not to take a stand against the market.

The Fear & Greed indicator created by MagicEins, based on CNN's F&G Index is very useful for analyzing market sentiment, we can see that there is still a lot of room to reach the Jan/2020 greed levels.

In the short term we follow the sentiment and the market flow, the CoT shows that the large speculators continue to bet in favor of EUR. The last time speculators were bought on more than 100k contracts was in mid-2018, when EURUSD quote was ~ 1.17.

Another important reason in the short term is the EU summit taking place this weekend, where the EU leaders are edging closer to a deal on a Europe Recovery Fund. This can generate great optimism against the EUR.

Technically we are at an important top and the tendency of the retail trader is selling tops, but as most of these traders are losers in the long run - I will bet against.

Let's try to guess ... when it will end. S&PHello friends.

I took the fear index on s&p - vix, we now have almost its maximum purpose, imposed fibonacci ... just for fun, and got the result of 2200. I do not advise buying from this value. Just guessing.

Of all the events, only 2 factors confuse me: the fall rate is too high and the fact that this happens on the eve of the Trump election.

Corona Crash Fear Index Super VolatileOn a weekly chart, the VIX Volatility Index has surpassed the dotcom crash of 2000 and will in the next week probably surpass 2007/8. Contrary to what Marketwatch.com says, it is not yet higher than in 2008. But it soon will be.

Extreme fear is gripping the markets.

We shall survive, well probably 95% of us.

Deepest respect and prayers go out to anyone affected, take care of your family, friends, and neighbors.

The world is going biblical. Massive locust swarms in Africa, huge wildfires in Australia, Disease sweeping the world. WTF. I am going to start building an Arc ready for the frickin flood.

VIX - fear index analysisHello traders,

Description of the analysis:

Vix is currently in extreme resistance +-50 to strong resistance but there is room for its further growth to 90. The unpredictable coronavir fundament can cause further declines. Be careful, but there is slowly room to build your long positions from the long term.

About me:

Hi, my name is Jacob Kovarik and I´m trading on stock exchange since 2008. I started with a capital of 3000 USD. My first strategy was based on OTM options. (American stock index and their ETF ). I´ve learnt on my path that professional trading is based on two main fundaments which have to complement each other, to make a bussiness attitude profitable. I´ve tried a lot of techniques and many manners how to analyze the market. From basic technical analysis to fundamental analysis of single title. My analytics gradually changed into professional attitude. I work with logical advantages of stock exchange (return of value back to average, volume , expected volatility , advantage of high stop-loss, the breakdown of time in options, statistics and cosistent thorough control of risk). At the moment, my main target is ITM on SPM index. Biggest part of my current bussiness activity comes from e mini futures (NQ, ES). I´m trader of positions. I´m from Czech republic and I take care of a private fund (700 000 USD). During my career I´ve earned a lot of valuable experience, such as functionality of strategies and what is more important, control of emotions. Professional trading is, in my opinion, certain kind of mental training and if we are able to control our emotions, accomplishment will show up. I will share with you my analysis and trades on my profile. I wish to all of you successul trades.

Jacob Kovarik

Another Total Market Cap Update #2Update:

A few more lines added in to show direction

Down to 190 Billion then...

Up to 212 Billion...

Most likely a dump to follow,

if we break up from 212 then we may be seeing a reversal on the market.

Hard to speculate where we will go from here.

I still seeing the details laid out in my last update panning out,

refer to my last post for relevant data.

When there is Greed in The Market be fearful ...One of many Zilliqa advocates ends up one of his videos

with one of Warren Buffett's phrases:

"When there is Greed in The Market be fearful, but

when there is fear in the Market, be Greedy.

Is this the case?

Is it here where we should be greedy

and buy our place in paradise?

Of course, this is the kind of question which

cannot have a human answer.

Now in layman's terms:

Should Zilliqa goes back

to its former price shown here by 08 Jun. Only a couple of Months ago;

greed could have eventually tripled the money invested, although

there is nothing to indicate that anything like that is

about to happen in the same length of time.

All we can see is that bears are getting their share of Fear as well.

Always make sure that you understand the risks involved whenever and wherever you invest your hard earned money.

Please, do not take this comment as financial advice or suggestion to perform any action by anybody. Don't worry..... be happy.

Crypto Fear & Greed Index can tell you when to buy BTCWhy Measure Fear and Greed?

Crypto market behavior is very emotional. People tend to get greedy when the market is rising which results in FOMO (Fear of missing out). Also, people often sell their coins in the irrational reaction of seeing red numbers. With our Fear and Greed Index, we try to save you from your own emotional overreactions. There are two simple assumptions:

Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

When Investors are getting too greedy, that means the market is due for a correction.

Therefore, alternative.me analyze the current sentiment of the Bitcoin market and crunch the numbers into a simple meter from 0 to 100. Zero means "Extreme Fear", while 100 means "Extreme Greed".

You can find the indicator in TradingView and it is quite amazing what it shows.

In a bull market, it actually shows you great buy opportunities for buying the dips or playing the swings!

Hope you will enjoy it!

If you like this post give us a like also. Thank you!

Prepare for US GDP, ECB results and Fear IndexAt yesterdays' meeting, the Governing Council of the European Central Bank (ECB) decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively. Nevertheless, the comments from the Central Bank turned out to be very dovish, opening the way to further monetary easing in September. For the euro, of course, this is not a positive sign.

However, we do not throw the euro under a bus yet, because next week’s meeting of the Federal Reserve will likely mark the beginning of a prolonged period of lower interest rates, in our opinion, this event is more important than words about future easing (in the battle of facts with expectations, we will give preference to facts). Also, the euro is supported by the head of the European Central Bank, Mario Draghi, who said that officials had not discussed the rate cut. Our position is unchanged - we buy EURUSD with current price with stops lower than 1.11.

The data on the US GDP for the second quarter will be published today. GDP probably expanded 1.8% in the second quarter, down from 3.1%. If the growth is 2.2-2.5%, then the dollar, perhaps, is not in danger until Wednesday. But if 1.8%, it cannot avoid sales.

So, dollar current price seems to us extremely attractive for its sales.

Meanwhile, the VIX Index ( it is also known by other names like "Fear Gauge" or "Fear Index) dropped to Multi-Year Lows. That is, traders and investors have calmed down. That calls into the question the safe-haven assets growth demand and explains yesterday's weakness of the yen and gold. Given then the level of volatility in gold has increased, we prefer to trade with the Japanese yen. Its purchase against the dollar is still relevant for us.

Our trading recommendations for today: We will continue to look for opportunities for selling the dollar across the foreign exchange market entire spectrum, buying the pound against the dollar as well as against the euro, selling oil and the Russian ruble, and also buying the Japanese yen against the dollar. As for gold, in the oversold we buy and in the overbought area we sell gold.

Copper --> Trade war indicatorConcern grows over global economic slowdown. The US continues to be a leader (for now).

China is the largest copper consumer, and has been beaten down. Technicals don't look good at all. At least there is no divergence.

If Trump and Xi don't reach a deal, you must know - copper will absolutely go down.

P.S:

COPX (Global Copper miners)

CPER (United States Copper)

"VIX, a powerfull tool to use on SP500" by ThinkingAntsOk

-Today we are going to show Vix Index on daily chat compared to SP500 (orange line).

The first thing we noticed is the Wedge formations on the chart.

-As Vix starts going down, SP500 keeps rising, the concept is that people trust on the strength of the bullish trend, on this process we can see the Wedge patterns on VIX, and bullish trends on SP500.

-To see the Wedge Pattern we only need to draw a line between the higher lows on VIX.

-OK great! But how can I do something with this?

-Let’s see it on this way, imagine you have been following a bullish movement on SP500 and you see that is about to face a major resistance zone and you observe that the bullish trend is losing strength.

When you detect this, you are going to Focus you attention on the VIX chart, and you are going to ask yourself the next question.

-Is price inside the Wedge Pattern or is about to break out?

-If the price has broken out the structure and SP500 is on a Major reversal zone, then, that’s a strong bearish confirmation to start thinking on bearish setups.

-Why should I look for bearish setups?

Because that means that people is starting to have fear of a possible bearish movement that’s the reason VIX is making new highs and has broken the Wedge pattern, we should complement this by seeing bearish candlesticks on SP500 with high volume on them.

-Conclusion: see on the pictures how Vix preceded the beginning of the two previous bearish trends with a breakout signal.

-Complementing charts is always a good way of making your setups more solid.

*Please note that the above perspective is our view on the market, We do not give signals and take no responsibility for your trades.

The fear in their eyesThe VIX is known as the 'fear index'. It has taken a pulse north which is not unexpected, as volatility on the P SPX500 took a leap recently.

The VIX is not an index I trade, nor do I know anyone who trades it. Its value is in keeping a finger on the 'pulse' of the stock market.

When the VIX begins to pulse, expect trouble. Some see trouble only after it has happened.

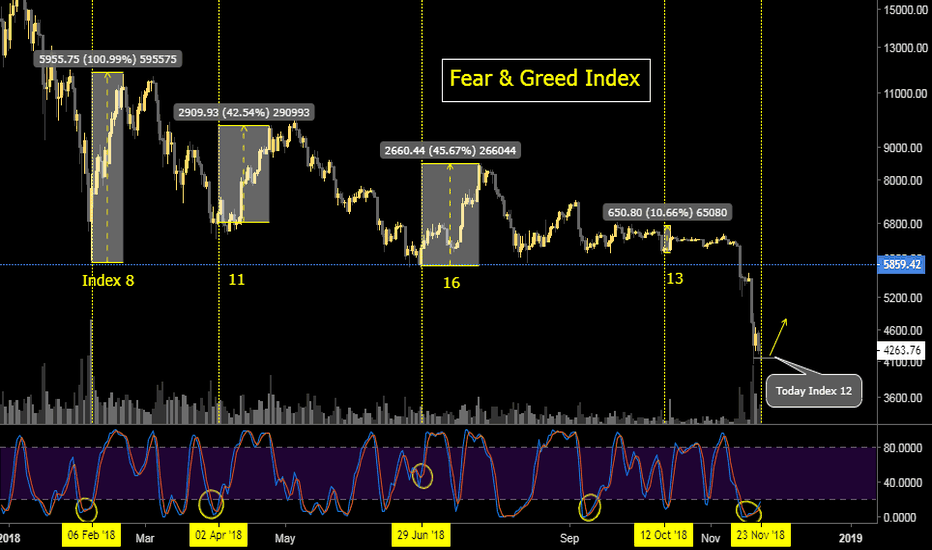

BTC - Fear & Greed Index vs price, can repeat history?Hi I show you some different view on Bitcoin now, I am looking for sentiment and Fear & Greed Index.

Fear & Greed Index is now on 12, that low was in April 2. Everytime in this year if index was under 15 than price go up.

Stochastic in history look similar like now.

Februar 2. Index 8 (100% up in 13 days)

April 2. Index 11 (42% up in 21 day)

June 29. Index 16 (45% up in 20 days)

October 18. Index 13 (10% up in 4 days)

November 23. ?????

This is just my idea about this Fear & Greed Index, looks possitive for me, so I want to share with you.

I will be update it

Thank you

S&P500 Monthly Head & Shoulders, Tech Stock/Cannabis BubbleTech stocks and Cannabis have been seeing massive growth over the past few months. Because of Trumps Tax Cuts and Jobs Act of 2017 tech companies have bigger profit margins, they reinvest their profits in Company Share Buybacks, job growth hasn't increased much. The problem is this has caused a massive BOOM in the market this year, we are seeing exponential growth in FAANGs and other Tech Companies. Venture Capital firms are betting Millions and Billions of dollars to new Tech Startups (Unicorn Startups) www.inc.com , believing they have the potential to be the next Amazon/Netflix with these companies having very little to zero profits and actually operating on losses.

The biggest reason that the SP:SPX , NASDAQ:IXIC , and DJ:DJI have DROPPED is because companies that have been buying back their own shares, with this recent October Blackout fear has slowly started creeping in as companies cannot buyback their own shares for a few days before quarterly earnings. This massively decreased volume of an already overextended US Equities market www.wsj.com if these companies don't have big profits/earnings this holiday season. They will need to sell their shares flooding the market.

"Buybacks have been one of the big stories supporting the market this year. DataTrek estimates that in the last 12 months, the companies in the S&P 500 have purchased $646 billion of their own stock, 29 percent more than the previous 12 months. And there's plenty of "dry powder" left. One firm estimates at least $350 billion of buybacks that have been planned for the year and are just waiting to be put to work.

And no, it is not just Apple that is buying its own stock. More than 300 large-cap companies have active buyback programs."

There are many more indicators such as the Fear & Greed Index showing that the market is turning for the worst money.cnn.com . The CBOE:VIX has also signaled from Fear in Oct 5th to Extreme Fear today.

Cannabis Bubble is also coming to an end, we've all seen what NASDAQ:TLRY , NYSE:CGC , OTC:ACBFF , NYSE:PM . All investments in these companies is Hype driven, "$12 billion valuation for Tilray stock makes no sense, since the company is slated to generate less than $160 million of revenue next year. Even though the cannabis market will be huge, the current valuation of Tilray stock is premature and overly optimistic".

For Trump, it was the lost art of the dealMexico and the Mexican Peso are the "silent" winner. Europe and European Stockmarkets should be same.

Quote: "For President Donald Trump, the collapse on Friday of his first legislative priority, a healthcare reform bill, was an embarrassing loss of face ....

It brings into question the neophyte president’s ability to move big-ticket legislation through Congress.

Source: www.investing.com