Aussie slides on Fed hawkishnessThe Australian dollar is sharply lower on Thursday. In North American trade, AUD/USD is trading at 0.6755, down 1.58%.

Australia's robust labour market continues to impress, with a stellar performance in November. The economy created 64,000 new jobs, above the October reading of 32,000 and blowing away the consensus of 19,000. The unemployment rate was unchanged at 3.4%.

There was more good news as the Melbourne Institute's Inflation Expectations fell to 5.2%, down from 6.0% previously and below the consensus of 5.7%. The reading has been overshadowed by the employment report and the Fed rate meeting, but is an indication that stubborn inflation is falling. The Reserve Bank of Australia doesn't meet until February and a lot can happen until then, but as things stand now, we can expect a fourth straight hike of 25 basis points at the next meeting.

The Federal Reserve has been talking hawkish for months, but the markets haven't been listening all that well. Soft inflation reports and a better-than expected nonfarm payrolls had the markets convinced that the Fed was poised to wind up its current rate cycle, which sent equities higher and the US dollar sharply lower. Investors were subject to a cold shower on Wednesday as the Fed sounded much more hawkish than the markets had anticipated. Policy makers shrugged off the recent declines in inflation, instead focusing on strong job gains and the high level of inflation. The Fed plans to maintain a restrictive policy into 2023 in order to continue the battle with inflation, and it's clear that the current tightening cycle will continue for some time. The hawkish performance sent risk apprehension higher and boosted the US dollar.

AUD/USD is testing support at 0.6772. The next support level is at 0.6693

There is resistance at 0.6875 and 0.6954

Federalreserve

The Fed won't be able to get inflation back to 2%The Fed says they are trying hard to get inflation down however the commodities chart is sticking out it's tongue at the Fed.

Everyone on social media is screaming: The Fed is going to cause a major RECESSION; MAJOR RECESSION IS COMING!!!

Yet this chart is not screaming a major recession is coming (nor is it at all scared by the Central Banks "hawkish" talk)?

Let's look at past recessions (notated by the vertical red lines):

July 2008-Notice how commodities plummeted after the high was made...literally just straight down due to the nature of the recession. (During the recession commodities dropped about 57%)

March 2020-Commodities started to plummet in Jan 2020 and then plummeted hard during the short lived recession. (During the recession commodities dropped about 40%)

April 2001-Commodities started to weaken after double topping in 2000 but didn't come down too much during the recession. (During the recession commodities dropped about 27%)

What does this analysis tell me?

1. That we are not on the brink of a severe recession (like 2008). At this point; commodities are just in correction mode.

2. During a recession commodities plummet along with all the Indexes. Therefore, if this chart plummets so will just about every other chart.

4. We have a double breakout in commodities from the LT downtrend line & the LT horizontal trend line...any good pullbacks in commodities will be met with buyers hence inflation is NOT transitory and will remain sticky.

5. The soft landing narrative is a farce because you cannot get commodities to plummet unless you cause some sort of recession.

6. Commodities are saying the FED is actually not being hawkish enough.

7. The reason for inflation is very simple: money flowed into commodities. It all starts with raw materials.

So are the Central Banks around the world really trying to get inflation under control? Or are they just "talking the talk"?

At this point, the only way to get inflation down to 2% would be to cause a major recession but the rate hikes thus far have NOT scared the commodity chart into submission therefore Powell and all the other central bankers around the world are actually not doing enough at this point.

So.....Stagflation continues!

(BTW...the bond market has spoken: Cheap debt won't be making a comeback anytime soon!)

NZD/USD awaits Fed, GDPAll eyes are on the Federal Reserve, which winds up its policy meeting later today. Policy makers are expected to raise rates by 50 basis points at this final meeting of 2022, with an outside chance of a more aggressive 75 basis point hike. This year has set a record for tightening, but despite that, the Fed stills finds itself in an uphill battle to convince the markets that it remains in a hawkish mode. The dramatic inflation report on Tuesday was softer than expected at 7.1%, once again raising risk appetite and sending the US dollar sharply lower.

Any drop in inflation is welcome news for the Fed, but let's not forget that inflation is still more than three times the Fed target of 2%. The Fed has reiterated that it is committed to curbing inflation and has not given any indications of winding up the current tightening cycle, stating that it expects the terminal rate to be "somewhat higher" than anticipated in September. Despite this, speculation is growing that the Fed might deliver one more rate hike in February, perhaps by 25 bp, and then call it quits.

New Zealand releases fourth-quarter GDP later today, and the markets are bracing for a weak gain of 0.8% q/q. This follows the 1.2% gain in Q3, as the economy was boosted by the booming tourist trade as the border reopened. The New Zealand dollar has recovered nicely, gaining about 400 points against the US dollar since October 1st. The Reserve Bank of New Zealand will be on a long break, as the next policy meeting is not until February 22nd. We could see some volatility from NZD/USD in today's North American session, with the Fed rate announcement and the New Zealand GDP release.

0.6472 is a weak resistance line. Above, there is resistance at 0.6591

There is support at 0.6388 and 0.6311

USD/JPY takes a tumble after soft CPIThe Japanese yen is sharply higher on Tuesday. In the North American session, USD/JPY is trading at 134.97, down 1.95%.

The US dollar is in broad retreat after US CPI was softer than expected. The November reading dropped to 7.1% y/y, down from 7.7% in October and slightly lower than the 7.3% consensus. The trend was similar for core CPI, which dipped to 6.0%, down from 6.3% and below the consensus of 6.1%. We've seen this story before - equities jump and the US dollar slides after a soft CPI report, as the markets speculate that the Fed could make a dovish pivot in response to falling inflation.

What makes this inflation report even more interesting is that the Fed winds up its policy meeting on Wednesday. Today's CPI data hasn't changed the pricing of a 50-bp hike tomorrow, which has about an 80% likelihood. The markets will be listening carefully to the tone of Jerome Powell's rate statement and follow-up remarks, hoping for clues about the next meeting in February. There is a strong chance that the Fed will hike by 25 bp and then take a pause - this would be significant because it would that the rate tightening cycle would terminate at 4.75%, below the 5.00% level or higher which many forecasts projected for the terminal rate.

In all the market enthusiasm, investors would be well to remember that even with the recent fall in inflation, it remains more than three times the Fed's target of 2%. The battle with inflation is far from over and we are yet to hear the Fed utter the magic phrase that "inflation has peaked". Jerome Powell and Co. may continue to drum out a hawkish message, but the critical question is whether anyone in the market is listening.

USD/JPY broke below support at 136.20 earlier. This is followed by support at 1.3453

There is resistance at 1.3734

impact of two important following news on DXYTwo important factors that been driving Dollar prices in last several month as we all know is Federal Funds Rate and Inflation data like CPI.

In this week we have both of them coming out on Tuesday and Wednesday, now we want to see how it can affect the market.

Price usually tend to be at important resistive or supportive areas at the time of important news hit the market and as we can see now price is at supporting area and at the Daily low which probably will remain here until the news hit the market so we can expect of low volatility movement on USD and other major crosses, But what will happen when the news releases?

As we know CPI balance is curving to downside and shows that inflation is cooling down and as we see the prediction of tomorrow CPI news we can see that the market expect this trend to continue. Now here is the tricky part, if CPI data put out like prediction or lower than the prediction this means that fed has the inflation under control which makes trader to believe that federal reserve would not need to raise prices very aggressively like before and as a result we may see a risk on environment in the market which can lead Dollar prices to come lower, but on the other hand SPX, TLT, EUR,JPY and also commodity currencies like AUD,NZD to take benefit from the situation.

But if CPI data comes out higher than expectation then we can argue that federal reserve do not have inflation under control so it needs to continue hiking prices like before and this situation may lead to higher prices for Dollar and lower prices for all the other assets that we covered above.

Also if the second scenario take place tomorrow we can expect USYIELD to continue going higher which have negative effect on US treasury bond and very bad effect on SPX index.

Put CPI analysis apart the other important news that can shake prices real hard is federal reserve which going to hit the market on Wednesday. On that time we can see that what exactly is in the mind of federal reserve and how they are going to impact the economy. In overall, if they raise rate same or below the expectation its going to be very good for risky assets since it shows that we are getting close to end of rate hiking cycle but if federal reserve going for raising rate higher than expectation then it will have a very good impact on Dollar but bad impact on risky assets.

Inflation Slowing, but Still a Concern for the Federal ReserveInflation in the United States, as measured by the consumer price index (CPI), is expected to have slowed again in November. This is due in part to a weaker economy, which has reduced inflation pressures. However, the expected 0.3% increase in the CPI is not enough to ease concerns at the Federal Reserve or prevent the central bank from raising interest rates even higher to slow the economy.

Gas prices have fallen since the summer, reversing the spike in spring that sent inflation to a 40-year high. As a result, the cost of living has risen more slowly in the past four months. If the forecast is accurate, the annual rate of inflation would taper off to 7.3% from 7.7% in October and a peak of 9.1% in June.

The core rate of inflation, which excludes food and gas, is also forecast to rise 0.3% in November. This is still higher than the monthly gains that were the norm before the pandemic. The yearly rate of core inflation may fall slightly to 6.1% from 6.3% in the previous month. The rate peaked at 6.6% in November.

The increase in the cost of goods, excluding energy, has relaxed to 5% in October from 12.4% in February. However, the increase in the price of services continues to accelerate. The cost of services, excluding energy, has risen 6.8% in the past year. This is due in part to the increasing cost of labor, which is the biggest expense for most service-oriented businesses.

Rents have jumped 7.5% in the past year, marking the biggest surge since 1982. Rents are starting to decrease as the economy slows, but the Fed and Wall Street are watching for clear evidence of a reversal. Even if rents and home prices level off, the change may not immediately show up in the CPI report.

Estimated Path To Next SummerFull analysis to follow with specific near-term levels. Prior Intermediate 5 did not move as expected so that likely puts us inside of Primary wave B heading down. Early estimates have us in

Primary B

Intermediate A

Minor 3

Minute 2

This means wave 3 of 3 is next with the inflation report tomorrow morning. Early signs per this would have November inflation hotter than expected. Fed also determines next rate hike on Wednesday. Looks like first near-term bottom could be prior to Christmas followed by highs after New Year while most of January points down. The January bottom should hold for quite some time as we should rally after the late January low until the early summer. The final downturn is still slated to begin in early to mid summer for northern hemisphere folks. Early estimates still place the final bottom around 2200-2400 by March 2025.

USD/JPY dips lower as PPI jumpsThe Japanese yen has started the week with losses. In the North American session, USD/JPY is trading at 137.44, down 0.64%.

Japanese wholesale inflation climbed 9.3% y/y in November, a drop lower than the 9.4% gain in October. This was above the consensus of 8.9%, as a peak in inflation remains elusive. The continuing increase in raw material costs has forced companies to pass on these costs. Higher commodity prices and a weak yen have raised the costs of imports, which has boosted wholesale and consumer inflation. If this upward trend continues, it could damage Japan's fragile economy, but the Bank of Japan has insisted that inflation is transitory and has been unwilling to change its ultra-accommodative policy.

Is this the calm before the storm? USD/JPY has been subdued for almost a week, but I would not be surprised to see stronger movement in the next day or two, with a host of key events on the economic calendar. On Tuesday, Japan releases the BoJ Tankan report, which is expected to show a slowdown in manufacturing, but stronger non-manufacturing activity due to the easing in Covid restrictions. The US releases the November CPI report, and we have seen how softer-than-expected CPI data sent risk appetite flying and the US dollar tumbling lower. The consensus for CPI is 7.3%, following a 7.7% gain in October.

The inflation report will be followed by the Federal Reserve rate announcement on Wednesday. The Fed is expected to deliver a 50-basis point hike, which is an oversize rate increase. Still, coming after four straight hikes of 75 bp, the Fed has found it difficult to dampen investor speculation that the Fed may soon wind up the current tightening cycle. The Fed recently paraded a stream of FOMC members to deliver hawkish messages, but the markets seem intent on seizing any data that supports the equity markets, and another soft inflation report could achieve that result and send the dollar downwards.

USD/JPY tested resistance at 137.13 earlier. Above, there is resistance at 138.25

There is support at 136.37 and 135.07

The Inflation of the 1980s Tells the Same Story: Pivot=DeclineI have heard both sides: 1) Historically, the Fed pivot will result in a decline in equities because they are pivoting in response to negative economic data which drags on equities, and 2) this time is different, negative economic data is positive for equites because it means inflation is on its way down.

When people reference the former, for whatever reason, they don't take a look at the effective Fed Funds Rate in the high inflationary period of the late 1970's and early 80's and compare the Fed's pivot to equities. In the chart shown, you can see that once Volcker, the Chairman of the Fed, finally took a steadfast position against inflation and rose rates violently, inflation began to cool. Both in part of this raise in rates and the public's belief that Volcker had no intention of letting up, ridding the public of inflationary expectations.

If you look at the charts, you can see that as inflation rose so did the markets. But as Volcker stamped his foot and pushed rates up, inflation began to cool. USIRRY, the third chart down, shows this. Equities began to decline due to this restrictive economic environment and belief the Volcker would not let up.

Notice that, as a result, unemployment (bottom chart) began to rise. This had no positive impact on equities, contrary to what some might think because it would indicate inflation was being taken care of. Instead, the U.S. entered a recession and equities continued to decline. It was only once the Fed stopped lowering rates, unemployment peaked, and inflation neared their target rate did equities bottom.

It is not fair to compare equities and pivots to the Great Recession or the .com Bubble, yet even in historical inflationary periods the same story plays out: the markets bottom well after the Fed pivots

However, this time could be different in that Powell showed no hesitation in attacking inflation and destroying inflationary expectations. He has taken a direct lesson from history. As a result, unemployment could potentially peak faster than expected, inflation could decrease faster than expected, and equities could bottom faster than expected. I believe today's outcome will be similar to that of the early 80's, but that outcome will happen much, much faster. The markets have not bottomed in my opinion, but I expect them to in mid-late 2023.

It's always best to keep equity exposure to avoid missing the bottom.

Because you never know .

InTheMoney

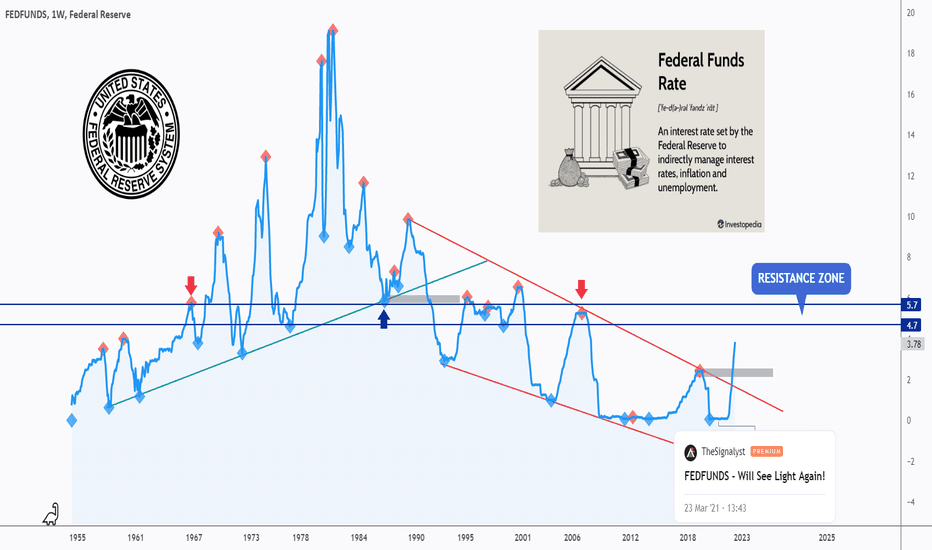

All Eyes On Fed Funds Rate 🏛Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

I am not a fundamental expert (nor an economist) but I found FEDFUNDS chart really interesting!

I never thought that basic technical analysis tools can also be applied to such economic instruments!

As per my last analysis (attached on the chart) FEDFUNDS traded higher and broke the red wedge pattern upward.

Now we are technically bullish, expecting big impulse movements to push price higher, and small bearish correction movements.

We all know that Federal Reserve will most probably increase the interest rates by another 50 basis points (0.5%) next week (on Wednesday)

By adding another 0.5% , FEDFUNDS will be approaching a strong resistance zone in blue (4.7% - 5.7%) which might hold the price down for a bearish correction to start and push price lower till the previous high in gray again.

It would be interesting to hear your thoughts on this one.

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

GBP/USD edges higher, US PPI loomsThe British pound has posted slight gains today. In the European session, GBP/USD is trading at 1.2257, up 0.32%.

After a rather uneventful week for the US dollar, next week could be marked by plenty of action, with a host of key releases on both sides of the pond. The BoE and Federal Reserve are expected to deliver 50 bp hikes, and we'll get a look at the latest inflation data from both the UK and the US.

Like the Federal Reserve, the BoE has also circled inflation as public enemy number one, but Governor Bailey doesn't have the luxury of a strong economy to work with. With GDP in negative territory and inflation at a staggering 11.1%, the economy may already be experiencing stagflation, but Bailey can ill afford to allow inflation expectations to become more entrenched. Winter is likely to be a season of discontent, with railroad and other public workers threatening to go on strike, as the cost-of-living crisis has hit households hard.

The Federal Reserve will be keeping a close eye on the US inflation report, which will be released just one day before the Fed's policy meeting. Inflation has eased over the past several months, but the Fed has been very cautious and is still reluctant to declare that inflation has peaked. The Fed has not looked kindly on market exuberance triggered by soft inflation reports, and paraded a stream of Fed members to remind investors that inflation remains unacceptably high and the fight to curb inflation remains far from over.

The markets will get a look at US inflation data later today, with the release of the Producer Price Index (PPI). The index is expected to drop to 7.4%, down from 8.0%. A decline in PPI would reinforce expectations that we'll see a drop in CPI as well next week.

1.2169 and 1.2027 are the next support levels

GBP/USD is testing support at 1.2169. Below, there is support at 1.2027

Oil Prices Struggle amid Growing Recession Fears and Fed HikesEarlier today, oil prices were on the rise after the shutdown of the Keystone pipeline. However, this rally was quickly wiped out as sellers attacked the market, pushing prices even lower. The oil market has been struggling due to growing concerns about a potential recession and the belief that central banks have tightened monetary policy too much.

This fall in oil prices has also had the side effect of reversing inflation, which can be seen as a positive for central banks. Despite this, there is some support for oil prices at the $70 level, as this is when the White House talked about refilling the Strategic Petroleum Reserve (SPR).

Overall, the outlook for the oil market remains uncertain, with concerns about a potential recession and the actions of central banks continuing to weigh on prices. However, some analysts believe that a relief rally is still possible in the coming days and weeks, as the shutdown of the Keystone pipeline and other factors could provide support for oil prices.

Jargon Explained

Strategic Petroleum Reserve

The Strategic Petroleum Reserve (SPR) is a reserve of crude oil stored by the United States government in underground salt caverns. The SPR was created in response to the oil embargo of the 1970s, and its purpose is to provide a emergency supply of crude oil that can be quickly released onto the market in the event of a supply disruption.

Keystone Pipeline

The Keystone pipeline is a system of oil pipelines that transport crude oil from Canada to refineries in the United States. The pipeline system consists of two phases: the first carries oil from the oil sands of Alberta, Canada to refineries in Illinois and Oklahoma, while the second phase, known as Keystone XL, would carry oil from Alberta to refineries on the Gulf Coast of Texas. The Keystone pipeline has been the subject of controversy, with opponents arguing that it poses risks to the environment and to local communities.

FOMC Meeting Next Week: Bank of America Expects 50bp Rate Hike The Federal Open Market Committee (FOMC) is set to meet next week, and investors are eagerly anticipating the outcome of the meeting. Bank of America Global Research has discussed its expectations for the meeting, saying that it expects the Fed to raise its target range for the federal funds rate by 50bp in December to 4.25-4.5%.

According to Bank of America, the Fed has telegraphed this move over the last few weeks through its communications. However, the more important question is where the Fed will go next. Bank of America expects the median forecast for 2023 to move up by 50bp to 5.125%, which is consistent with its terminal rate. The bank also expects the dot plot to show 100bp of cuts each in 2024 and 2025.

In addition, Bank of America expects the macro projections in the Statement of Economic Projections (SEP) to be revised to show lower GDP growth and inflation than in September, and higher unemployment.

At the press conference following the FOMC meeting, Bank of America expects Chair Powell to push back against easing in financial conditions and remind investors that a slower pace of hikes does not mean a lower terminal rate. The bank believes that Powell will stress that the Fed's job is far from done.

Overall, Bank of America expects the FOMC meeting next week to be consistent with the Fed's previous communications and for there to be no major surprises or shifts in policy.

Some Jargon Explained

The Dot Plot

The dot plot, also known as the Summary of Economic Projections (SEP), is a visual representation of Federal Reserve policymakers' individual forecasts for where they think key interest rates will be in the coming years. The dot plot shows the central tendency, or the middle of the range, of the individual forecasts for the federal funds rate.

Each participant in the FOMC meeting provides their own individual forecast for the federal funds rate at the end of each calendar year, as well as over the longer run. These forecasts are then plotted on a chart, with the dots representing the individual forecasts and the lines connecting the dots indicating the median of the group's forecasts.

The dot plot is released four times per year, along with the FOMC's policy statement, and provides insight into the collective thinking of FOMC members about the future path of interest rates. It is an important tool for investors to gauge the future direction of monetary policy.

The Terminal Rate

The terminal rate, also known as the long-run federal funds rate or the equilibrium real interest rate, is the interest rate that the Federal Reserve believes is consistent with the long-run health of the economy. It represents the level of the federal funds rate that is neither expansionary nor contractionary and is expected to prevail in the long run, once the economy has reached its full employment and price stability goals.

The terminal rate is not a fixed number, and can change over time depending on a variety of factors such as changes in the underlying productivity and demographic trends of the economy. The Federal Reserve uses the terminal rate as a reference point when setting its short-term interest rate targets.

In general, the terminal rate is expected to be lower than the current federal funds rate, as the Fed typically raises interest rates in the short run to prevent the economy from overheating and then lowers them in the long run to support economic growth. This means that the terminal rate can provide important information about the future direction of monetary policy.

SPY Price action is a bit different this time aroundUmmm, the fast and short answer is that I am overall bearish on the SPY and anticipate we ultimately get rejected from this ATH (all time high) trendline ...however, it is starting to get complicated, lol.

Disclaimer: Be aware the following comments are just my observations and I am not a professional trader. I am school teacher by day and stock junky by night, lol. I just enjoy looking at the charts, doing light TA and occasionally making a little money, lol.

Anyways, here we go:

We have finally reached the major downward sloping trend line or what I call the all time high trendline (ATH). There is the possibility that we can get a slight push above the ATH (all time high) trendline (currently $408-$407.5) - with the more likely contested area being between $409 - $415. I’m still a bit confused as to why anyone would think SPY would ever "breakout" above of this downtrend now. Our government is aggressively trying to reverse inflation - a breakout would be fighting against their efforts. I know I've said this a few times before - but a breakout would be flirting with a bull market - and I guess if that were to happen, I'd imagine that the FED would not only continue interest rate hikes, but they would also become even more aggressive. With that being said, I guess it would be judicious for me to also explore the bullish side of all of this, lol.

Price action has been unusual and unlike the past two occasions we’ve approached the ATH trendline, this time has been with tremendous momentum. Also, it’s worth noting we’ve been in the general trend line area for over 3 days. The first time we touch the trendline (March 29th) we spent about 24 hours before diving back down. The second time (August 16th) we were rejected immediately. However, this time around we tagged the trend line around 3-4 times and even broke above it one of those days. Here is a pic of the charts for comparison:

This could mean nothing at all – but I do think it is important to note that this time around it has been different. Perhaps it is signaling that the bear market is near it’s end but we might have one more leg down coming.

…Oh and I just want to address one more thing, lol. The “Christmas Rally” - for all those who might be confused about when Christmas rallies typically occur, here you go: “A Santa Claus rally describes a sustained increase in the stock market that occurs in the week leading up to Dec. 25.”

Santa Claus Rally Definition (investopedia.com)

A very real possibility is that SPY begins that leg down now (as in next week, lol), creates the ultimate bottom (possibly the $330 area) and then Santa comes along sometime after the 18th and saves Christmas – and the market, lol.

USD/CAD eyes Bank of Canada meetThe Canadian dollar is slightly lower on Tuesday. In the European session, USD/CAD is trading at 1.3620, up 0.24%.

The Bank of Canada has been aggressive in its tightening, including a whopping full-point hike in July, which brought the cash rate to 2.50%. The BoC has been gradually easing since then, raising rates by 75 bp and then 50 bp, bringing the cash rate to 3.75%. Will the trend continue on Wednesday? According to the markets, probably yes. There is a 72% chance of a 25 bp move, with a 28% likelihood of a second straight 50 bp move.

At the October meeting, there was a 50/50 split over whether the BoC would raise rates by 50 or 75 bp, and the Bank opted for the more conservative move. With the Canadian economy showing signs of slowing down amidst an uncertain global outlook, a modest 25-bp hike would make sense. Still, it must be remembered that inflation remains very high at 6.9% and the BoC has shown that it is willing to keep the rate pedal on the floor if necessary. If the BoC goes for the 50 bp increase, it would be viewed as a hawkish surprise which would likely boost the Canadian dollar.

What can we expect from the BoC in 2023? The terminal rate is projected at around 4.5%, which would mean several more rate hikes early in the New Year. Of course, rate policy will be heavily dictated by key data such as employment, consumer spending and inflation. In addition, the BoC will want to keep pace (or close to it) with the Federal Reserve, which is widely expected to raise rates by 50 bp next week.

USD/CAD is testing resistance at 1.3619. Above, there is resistance at 1.3762

There is support at 1.3502 and 1.3359

As we approach the last Fed/ECB meetings of the year.Last week, while the Federal Reserve changed its rhetoric from ‘hiking to fight inflation at all cost’ to ‘slow the pace of rate hike’, seismic waves rolled over the markets.

As we approach the last central bank meetings of the year, the ECB meets on (15th Dec), Fed on the (14th Dec). A temperature check on the expected path of rates for the 2 major central banks would give us a good sense to position ourselves.

The Fed

After Fed Chair Jerome Powell’s speech last Wednesday at the Brookings Institution in Washington, one line in particular (“The time for moderating the pace of rate increases may come as soon as the December meeting.”) shifted the market’s perspective. With the USD weakening further and terminal rates repricing slower and lower than expected, markets seem to have priced in a 50-basis point hike by the Fed in its December meeting. A slowdown from the back-to-back 75 basis point hikes we have come accustomed to.

As noted in the chart above the EURUSD pair has generally moved alongside the dollar direction, should the dollar continue its tumble downwards, the EURUSD is likely to trade higher.

The ECB

After raising rates by 75 basis points in the last meeting to 1.5%, the ECB still faces mounting inflation. Market expectations still swing between a 50 to 75 bps hike for the upcoming ECB meeting as the Eurozone still struggles with high inflation. The ECB may also have more headroom to maneuver as current rates remain below the expected terminal rate and the 200 basis points hike still pales in comparison to the Fed’s 375 basis points move.

However, we do have to caveat that intricacies matter here, for example, the inflationary effects in the US are largely driven by the demand side, while in the Eurozone are driven by supply-side effects. Regardless, the next few days will remain key for any policymaker comments to guide the markets as the meeting date nears.

Policy timing and direction uncertainty put the EURUSD pair on our watchlist. The last time the 2 central banking policy timelines diverged, we called it out on one of our previous ideas. You can check out here .

Additionally, we spot an ascending triangle pattern on the chart which generally signifies a bullish continuation. With the previous ascending triangle breaking out in a textbook manner, we will watch if the current setup trades the same. Prices have also broken a previous support-turn-resistance level, which could prove as further conviction of the upward move.

With a clear technical setup and the potential for the ECB to surprise hikes to the upside, we lean bullish on the EURUSD pair. We set our stop at the 1.0440 level, and take profit level at 1.0900, with each 0.00005 increment per EUR in the EURUSD futures contract equal to 6.25$.

The charts above were generated using CME’s Real-Time data available on TradingView. Inspirante Trading Solutions is subscribed to both TradingView Premium and CME Real-time Market Data which allows us to identify trading set-ups in real-time and express our market opinions. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

Sources:

www.cmegroup.com

www.ecb.europa.eu

www.federalreserve.gov

Exciting Times for $ Denominated Pairs!In this video we look into DXY structure and how this is so exciting for a few USD pairs.

Generally across the board on the HTF we are seeing lots of corrective patterns completing their moves. These are nearly always followed by large impulsive movements in the market which are fantastic to capitalise on.

USDJPY and GBPUSD see some clear impulsive phases beginning and we forecast how those entries may present themselves.

Whilst we have to remain impartial, the Macro perspective on the $ looks like we could see some weakness and the £ seems like we could see some strength. This look particularly good for GBPUSD. If the markets are pricing the future rate hikes in this coming week then we could see some big movements. If not, we might be looking at some corrective behaviour until 14th December.

This will be a very interesting week, for sure.

Please comment below and engage with the post - would love to hear your thoughts.

Euro pauses after sharp gains, NFP loomsEUR/USD is unchanged on Friday, trading at 1.0524.

The week wraps up with one of most important releases on the calendar, US nonfarm payrolls. The robust labour market is showing signs of cooling down, as rising interest rates have slowed economic activity. Nonfarm payrolls have been falling and the trend is expected to continue, with a consensus of 200,000 for November, down from 261,000 a month earlier. With the Fed holding its policy meeting on December 14th, the NFP report will be closely watched by policy makers, who have relied on a strong job market to press ahead with an aggressive rate cycle.

The US dollar has been in retreat since Jerome Powell's speech on Wednesday. The speech was balanced, with Powell reiterating that inflation remained too high and rates would continue to rise higher. Still, the markets focussed on the fact that Powell strongly hinted the Fed would ease rates at the December meeting with a 50-bp hike, and the optimism sent equities higher and the dollar lower.

The euro has made the most of the dollar's weakness, and EUR/USD posted its best month since 2012, with gains in November of 5.3%. Still, the euro has been on a prolonged decline and started 2022 close to 1.14. The outlook for the euro is weak, as the European Commission expects the eurozone economy to decline in Q4 2022 and Q1 2023. The driver of the expected decline is the huge jump in energy prices caused by the war in Ukraine. The eurozone has been hit hard by double-digit inflation, and the ECB will have to continue raising rates, despite weak economic conditions, until it is convinced that inflation has peaked.

EUR/USD faces resistance at 1.0583, followed by a monthly line at 1.0683

There is support at 1.0490 and 1.03537

Soft German retail sales can't stop EUR/USDThe euro has climbed to its highest level since June 29th, as the US dollar continues to struggle. In the North American session, EUR/USD is trading at 1.0496, up 0.85%.

German consumers are being squeezed by the double-whammy of rising interest rates and double-digit inflation, and the October retail sales report shows that consumer spending was sharply lower. Retail sales dropped 2.8% YoY, versus 1.2% in September and a consensus of -0.6%. On an annualized basis, retail sales plunged 5.0%, much worse than the September read of -0.9% and the consensus of -2.8%.

The soft retail sales report couldn't dampen the shine on the euro, which has climbed sharply as the US dollar can't find its footing. The dollar found itself in full retreat after Fed Chair Jerome Powell's speech on Wednesday. Powell's comments were balanced and didn't stray from the steady stream of Fedspeak we've been hearing for weeks, but investors still treated the speech as dovish, sending equity markets higher and the US dollar lower. The markets were delighted that Powell essentially confirmed that the Fed would ease policy as soon as the December meeting. After four straight rate increases of 75 basis points, the Fed is poised to deliver a milder 50-bp hike, with perhaps smaller hikes in the new year.

Powell said that smaller rate increases were less important than the question of high to hike and for how long. Powell added that the direction of inflation remains "highly uncertain", and that more evidence was needed to demonstrate that inflation had peaked. As well, he said that rates will likely rise "somewhat higher" than the September forecast. That certainly sounds like a hawkish stance, but the markets chose to focus on Powell's broad hint that the Fed would likely begin lowering rates as soon as next week. The Fed may not consider that a dovish pivot, but the fact remains that Powell's comments have renewed optimism, sending stocks higher and the US dollar lower.

EUR/USD is testing resistance at 1.0490. Above, there is resistance at 1.0583

There is support at 1.03537 and 1.0264

EUR/USD edges higher as CPI fallsIt continues to be a quiet week for the euro. In the European session, EUR/USD is trading at 1.0363.

The ECB's number one priority has been bringing down inflation, which has hit double-digits. ECB policy makers are no doubt pleased that November CPI fell sharply to 10.0%, down from 10.6% a month earlier. This beat the consensus of 10.4%, and the euro has responded with slight gains.

The drop in eurozone inflation was the first since June 2021, and investors will be hoping that this indicates that inflation is finally peaking. On Tuesday, German CPI showed a similar trend, falling to 10.0%, down from 10.4% (10.3% est). Still, eurozone Core CPI remained unchanged at 5.0%, matching the forecast. One inflation report is not sufficient to indicate a trend, and with inflation still in double digits, nobody is declaring victory in the battle against inflation. Still, the drop in German and eurozone inflation increases the likelihood of a 50 basis-point increase at the December 12th meeting, following two straight hikes of 75 basis points.

With market direction very much connected to US interest rate movement, a speech from Fed Chair Jerome Powell later today could be a market-mover. Powell is expected to discuss inflation and the labour market, and his remarks could echo the hawkish stance that Fed members have been signalling to the markets over the past several weeks. The market pricing for the December meeting is 65% for a 50-bp move and 35% for a 75-bp hike, which means that the markets aren't all on the Fed easing rates. Even if the Fed does slow to 50 bp in December, it will still be a record year of tightening, at 425 basis points.

EUR/USD is testing resistance at 1.0359. Above, there is resistance at 1.0490

There is support at 1.0264 and 1.0131

DXY liquidity recovers after ThanksgivingThe DXY fluctuated strongly overnight as markets returned after the Thanksgiving weekend.

Comments from Federal Reserve members provided mixed sentiments

- Member Bullard stated that the “Fed will have to pursue rate hikes into 2023” as markets were "underestimating chances of higher rates"

- Member Barkin indicated that he was supportive of a rate path that was “slower, longer but potentially higher.”

- Member Williams said that the "US economy at greater risk of shock that could cause recession"

The DXY currently trades at 106.25 as it reverses from the overnight high of 106.70, with further downside potential toward the key support level of 105.60 and 104.65 likely.

USD/JPY - China jitters propel yen higherAfter strong gains last week, the Japanese yen has extended its gains on Monday. USD/JPY is trading at 138.23 in the European session, down 0.67%.

China has applied its Covid-zero policy with a heavy hand, but Covid cases continue to rise nonetheless. The mass lockdowns have triggered widespread protests, which some injuries reported. The unrest is likely to exacerbate supply-chain disruptions and dampen domestic demand, which has hurt risk appetite. This has resulted in flows to haven assets, such as the Japanese yen. USD/JPY dropped as much as 1% earlier today, but the dollar has managed to recover some of these losses.

The yen also received a boost after Bank of Japan Governor Kuroda said that the tightening labour market will push wages higher. Kuroda has long insisted that rising inflation has driven by import costs and the weak yen and is transient. Higher wages would indicate that inflation is sustained, which could result in the BoJ making some changes in its ultra-loose policy.

After a short trading week in the US due to the Thanksgiving holiday, the markets will have plenty of US events to digest this week. CB Consumer Confidence will be released on Tuesday, with the November report expected to dip to 100.0, down from 102.5. The key release of the week is nonfarm payrolls on Friday, which could have a major impact on the Fed's decision to raise rates by 50 or 75 basis points at the December 14th meeting. Currently, the likelihood of a 50-bp hike is about 75%, versus 25% for a larger 75-bp increase. Investors are viewing a 50-point move as a dovish pivot, which has been putting pressure on the US dollar. Still, even a 50-bp hike would set a record for yearly rate hikes of 4.25%.

There is resistance at 139.82 and 141.58

There is support at 137.39 and 135.63

NZD/USD higher ahead of retail salesThe New Zealand dollar continues to gain ground this week. In the North American session, NZD/USD is trading at 0.6267, up 0.35%.

New Zealand will release retail sales for Q3 later in the day. The markets are expecting a small gain of 0.5%, which would be a turnaround from a disappointing -2.2% in Q2. Consumers continue to struggle with high inflation and rising interest rates, and after back-to-back declines, a gain in retail sales would be welcome news.

The Reserve Bank of New Zealand delivered a huge 75-bp hike on Wednesday, which raised the cash rate to 4.25%. The move had been priced in by the markets, but the New Zealand dollar jumped 1.5%, thanks to the oversize move and a broadly-lower US dollar. The cash rate is the highest among major central banks, but there's more to come. The RBNZ has projected a terminal rate of 5.5% in 2023, which means more rate hikes in 2023. Inflation has been stickier than the RBNZ anticipated, and the bank's Monetary Policy Statement was decidedly hawkish, noting that “core consumer price inflation is too high" and "near-term inflation expectations have risen.”

The statement said that inflation is expected to accelerate to 7.5% in Q4 and would not fall to the midpoint of the 1%-3% target until 2025. The RBNZ is ready for a long fight with inflation, but it remains to be seen if the bank can guide the economy to a soft landing.

The Fed minutes reiterated that lower rates are on the way, which we've been hearing from a stream of Federal members over the past two weeks. The minutes were vague as far as a timeline, noting that smaller rate increases would happen "soon", as the Fed continues to evaluate the impact of the current policy on the economy. Members also voiced concern that inflation was yet to show any signs of peaking. Still, the markets viewed the minutes as dovish, which is weighing on the US dollar today.

NZD/USD is testing resistance at 0.6283. Above, there is resistance at 0.6361

There is support at 0.6217 and 0.6139