UPS looking DOWNSNice head and Shoulders on the United Parcel Service

#UPS and FEDEX are the new dow transport indicator.

An underlying determinant of how the consumer is faring

Since the US is a consumer economy and Online shopping is the majority of retail

if we see new highs on the Indicies, and the home delivery carriers continue to deteriorate

it would give your non confirmation Top

Similar to Dow theory of new High's in the Industrials , but the transports lagging and indeed falling.

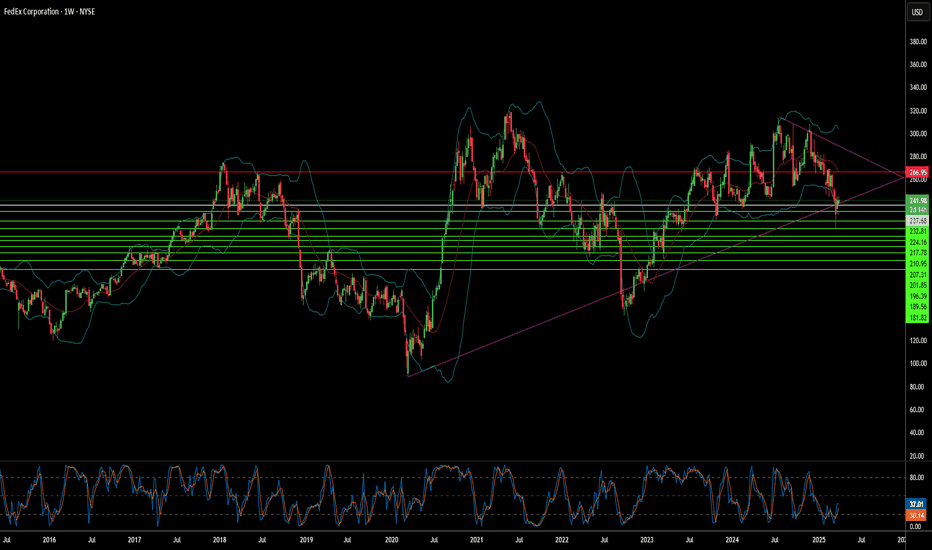

Fedex

FedEx: Balancing Act or Precarious Gamble?Recent market activity highlights significant pressure on FedEx, as the logistics giant grapples with prevailing economic uncertainty. A notable drop in its stock price followed the company's decision to lower its revenue and profit outlook for fiscal year 2025. Management attributes this revision to weakening shipping demand, particularly in the crucial business-to-business sector, stemming from softness in the US industrial economy and persistent inflationary pressures. This development reflects broader economic concerns that are also impacting consumer spending and prompting caution across the corporate landscape.

In response to these domestic headwinds, FedEx has adopted a more conservative operational stance, evidenced by a reduced planned capital spending for the upcoming fiscal year. This move signals an emphasis on cost management and efficiency as the company navigates the current economic climate within its established markets. It suggests a strategic adjustment to align spending with the revised, more cautious revenue expectations.

However, this domestic caution contrasts sharply with FedEx's concurrent and ambitious expansion strategy in China. Despite geopolitical complexities, the company is making substantial investments to enlarge its footprint, building new operational centers, upgrading existing gateways, and increasing flight frequencies to enhance connectivity. This dual approach underscores the central challenge facing FedEx: balancing immediate economic pressures and operational adjustments at home while pursuing a long-term, high-stakes growth initiative in a critical international market, all within an uncertain global environment.

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t sold FDX before the previous earnings:

Now analyzing the options chain and the chart patterns of FDX FedEx Corporation prior to the earnings report this week,

I would consider purchasing the 240usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $12.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

FEDEX AT MY LEVEL DEC17 2024Last post about FEDEX when it was trading around 284 was to wait for 275s. Here we are at 275 &expect to hit all time high or at least 315 asap.

I don't trade news so I am not worried about earnings.

I am a price action trader.

Trade safely as per you RR & risk tolerance levels.

Technical Analysis on FedEx (FDX)Despite the long- and short-term uptrend, FedEx stock displays some peculiar behavior, with frequent gap ups and gap downs, mostly occurring around earnings reports. Some gap downs have reached up to 20%, but were quickly filled shortly thereafter.

Recently, the stock reached its all-time high, only to be rejected. Therefore, the $320 area serves as a strong resistance (RES) that needs to be broken for the stock to resume its bullish trend.

Bullish Scenario

Following the release of the latest earnings report and declining revenue, the stock dropped 15% in a single day, creating a new gap down. With this decline, the price is now approaching a key volume area, the POC zone around $250. This area could act as support, containing the price and potentially initiating a rebound.

Bearish Scenario

If the POC area fails to hold the price, the stock could continue its decline toward a static support zone around $200.

FedEx remains an interesting stock to watch, especially considering how it reacts in the coming weeks and its ability to maintain key support levels.

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t bought FDX before the previous earnings:

Now analyzing the options chain and the chart patterns of FDX FedEx Corporation prior to the earnings report this week,

I would consider purchasing the 270usd strike price Puts with

an expiration date of 2024-9-20,

for a premium of approximately $4.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

UPS: A Hidden Gem in the Logistics SectorUPS stock has been decimated recently, but this presents a prime opportunity for savvy investors.

If you, like me, believe in the future of e-commerce and global logistics, UPS is a stock you cannot afford to overlook.

As a leader in the logistics industry, UPS is integral to the global supply chain.

The stock is a key component in many ETFs focused on transportation and logistics, alongside giants like FedEx and DHL.

With the growing demand for efficient delivery services, UPS's pivotal role in the supply chain ensures it is well-positioned for substantial long-term growth.

Invest in UPS now to capitalize on the future of global commerce.

Trading at 20% below estimate of its fair value

Earnings are forecast to grow 15% per year

Dividend of 5%. So holding for the long term.

Profit margins down to 6% from 10% :(

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t bought FDX calls ahead of the previous earnings:

Now analyzing the options chain and the chart patterns of FDX FedEx Corporation prior to the earnings report this week,

I would consider purchasing the 260usd strike price Calls with

an expiration date of 2024-12-20,

for a premium of approximately $19.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

FedEx Stock Soars on Strong Results, Potential SpinoffFedEx's (FDX) fiscal Q4 results exceeded analyst expectations, propelling its stock towards a potential all-time high. This momentum is driven by several key factors:

Margin Expansion via DRIVE Program: Despite tepid revenue growth, FedEx's DRIVE program delivered significant cost reductions, leading to margin improvement across segments.

Cautiously Optimistic Guidance: The company forecasts low-to-mid single-digit revenue growth for fiscal 2025, accompanied by continued margin expansion. This cautious optimism reflects strategic initiatives aimed at maximizing profitability.

Analyst Revisions and Price Target Increases: The success of the DRIVE program and FedEx's shift toward profitable growth have garnered positive analyst revisions, including price target increases.

Potential Spinoff of FedEx Freight: The company's ongoing evaluation of FedEx Freight's role within its portfolio has sparked speculation about a potential spinoff. This scenario has the potential to unlock significant shareholder value.

Looking forward, FedEx's fiscal 2025 outlook remains optimistic. The company projects low-to-mid single-digit revenue growth and adjusted EPS of $20.00-$22.00. Furthermore, FedEx plans to repurchase $2.5 billion in stock and achieve its $4 billion cost-cutting target through the DRIVE program.

In conclusion, FedEx's strategic focus on operational efficiency, the success of the DRIVE program, and the potential for a FedEx Freight spinoff combine to create a compelling investment opportunity. This confluence of factors positions FDX for a strong year with the potential to reach new highs.

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t bought FDX ahead of the previous earnings:

Then analyzing the options chain and the chart patterns of FDX FedEx Corporation prior to the earnings report this week,

I would consider purchasing the 250usd strike price Calls with

an expiration date of 2024-6-21,

for a premium of approximately $16.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

FedEx Surprises Wall Street with Strong EarningsFedEx ( NYSE:FDX ) astounded Wall Street with better-than-expected third-quarter earnings for fiscal 2024, despite revenue falling slightly short of expectations. The shipping giant's robust performance comes amidst a backdrop of economic uncertainty and volatile macroeconomic conditions. As FedEx ( NYSE:FDX ) maintains its outlook for the remainder of the fiscal year, investors are closely monitoring the company's negotiations with the United Postal Service (USPS) and its positioning within the competitive parcel delivery landscape.

FedEx ( NYSE:FDX ) delivered a pleasant surprise to investors as it announced its third-quarter earnings for fiscal 2024, surpassing analysts' expectations despite challenges in the global economy. The company reported earnings of $3.86 per share, marking a significant 13% increase compared to the same period last year. However, revenue dipped by 2% to $21.74 billion, slightly missing Wall Street's projections of $21.95 billion.

The decline in revenue was primarily attributed to lower fuel surcharges across all transportation segments and reduced volumes in FedEx Express and FedEx Freight divisions. Despite these headwinds, FedEx's package delivery business saw a marginal increase in revenue, while the freight segment experienced a modest decline.

Looking ahead, FedEx ( NYSE:FDX ) remains cautious about the economic landscape, anticipating ongoing volatility that could affect customer demand and yield growth. The company expects revenue to face pressure from macroeconomic conditions, prompting it to narrow its earnings outlook for the full fiscal year to $17.25-$18.25 per share. Additionally, FedEx ( NYSE:FDX ) is in the midst of negotiating a new multi-year contract agreement with the USPS, underscoring its commitment to strategic partnerships and operational efficiency.

Investors welcomed the positive earnings surprise, driving NYSE:FDX stock up by 7.75% during Friday's trading session. The stock's performance in March indicates a potential upward trajectory, as FedEx ( NYSE:FDX ) seeks to consolidate gains and navigate through market uncertainties. Analyst sentiment remains mixed, with some expressing caution while others highlight the company's resilience amidst competitive pressures and evolving consumer preferences.

FedEx's ( NYSE:FDX ) strong earnings report contrasts with the challenges faced by its rival UPS, which recently announced workforce reductions and provided guidance below analyst expectations. Both FedEx and UPS are grappling with increasing competition from e-commerce behemoth Amazon, which has emerged as a formidable player in the parcel delivery space.

UPS Rides High on FedEx's Soaring QuarterNYSE:UPS (United Parcel Service) stock witnessed a surge today, buoyed by the impressive performance of its competitor FedEx in the third quarter. FedEx's robust results, including earnings that beat analyst expectations by nearly 12%, lifted UPS shares in sympathy.

In its recent quarterly report, FedEx reported earnings of $3.86 per share, exceeding estimates and marking a significant increase from the previous year. Despite slightly missing revenue estimates, the company showcased its confidence by announcing a new $5 billion share repurchase program, with plans for $500 million in share repurchases in the coming quarter.

While FedEx's success may have set the stage, NYSE:UPS has been holding its ground. Although NYSE:UPS reported a 7.8% revenue decline in its fourth-quarter fiscal 2023 results, its adjusted EPS met consensus estimates. With FedEx's strong showing, investors are hopeful for similar resilience from NYSE:UPS in the quarters to come.

Technical Outlook

NYSE:UPS shares is trading with a moderate Relative Strength Index (RSI) of 58.89 indicating a moderate buying situation. The bulls might continue pushing the share price higher.

In a market where delivery services play an increasingly crucial role, NYSE:UPS 's response to FedEx's success will be closely watched by investors and industry observers alike.

Rail/Transportation Stocks: Macro Fib SchematicsThe biggest rail companies in the world. union Pacific, Berkshire Hathaway, CSX Corp, Northfolk Southern, Canadian Railway Co... GATX is a logistical distributor of railcars, trucks, ect...

FedEx and UPS are postal companies which transport many things.

These Schematics are an eye full but with a careful eye, it is easy to see the patterns of support and resistance. This is a 2 Month chart but they still work with the schematics because all timeframes work in tandem.

Some examples of stock movement include Berkshire Hathaway blasting off from an important Fibonacci Level (RED). Also, there are rejections on GATX and supports on UPS. Canadian Railway is heading into resistance. ECT ECT ECT...

FedEx's Resilience and Strategic Moves Position it for Growth

In the face of various challenges, FedEx Corporation (NYSE: NYSE:FDX ) showcased resilience and strategic adaptability during the second quarter of fiscal year 2024. The company reported a mixed performance across its segments, with some facing revenue declines while others experienced growth. Here's a detailed analysis of the key factors influencing FedEx's current status and a glimpse into why the company may see a spike in the future.

Segmental Performance:

1. FedEx Express:

- Revenues fell by 6% YoY to $10,254 million, primarily due to volume declines, lower fuel surcharges, and a shift towards lower-yielding services.

- Operating income dropped by 60% YoY, reflecting lower revenues, but partially offset by reduced operating expenses.

2. FedEx Ground:

- Revenues increased by 3% YoY to $8,639 million, driven by higher yield.

- Operating income surged by 51% YoY, attributed to yield improvement, cost reductions, and higher volumes.

- Cost per package declined by 2%, thanks to lower line-haul expenses and improved productivity.

3. FedEx Freight:

- Revenues declined by 4% to $2,360 million, while operating income grew by 11% YoY, supported by higher yield and increased efficiency despite lower shipments.

Liquidity:

- FedEx ended Q2 FY2024 with $6,729 million in cash and cash equivalents.

- Long-term debt stood at $20,193 million.

Strategic Moves:

- Completed a $500 million accelerated share repurchase (ASR) transaction, reducing outstanding shares and positively impacting Q2 results.

- Capital expenditures for Q2 FY2024 were $1,305 million.

Outlook and Guidance:

- Revised guidance for 2024 includes an expected decline in revenues by a low-single-digit percentage.

- Adjusted earnings per share (EPS) are projected to be in the range of $15.35-$16.85, with a continued focus on business optimization initiatives.

- Capital spending for fiscal 2024 is anticipated to be $5.7 billion.

- The company aims to repurchase an additional $1 billion of common stock during fiscal 2024.

Strengths of FedEx:

- Diversified Portfolio: The company operates in multiple segments, mitigating risks associated with fluctuations in specific markets.

- Cost Efficiency: FedEx's focus on cost reductions and operational efficiency contributed to improved operating income in certain segments.

- Strategic Repurchases: The recent share repurchase and the plan for an additional $1 billion buyback demonstrate confidence in the company's value.

Why FedEx May Rise Again:

- Resilience Amid Challenges: Despite headwinds, NYSE:FDX has demonstrated resilience and adaptability in optimizing operations.

- Strategic Guidance: The company's revised guidance, with an increased EPS range, signals confidence in its ability to navigate challenges and capitalize on opportunities.

- Share Repurchase Program: The ongoing commitment to repurchasing shares reflects management's belief in the company's long-term prospects.

FedEx's strategic moves, financial resilience, and diversified portfolio position the company for future growth. While challenges persist, the company's proactive measures and revised guidance suggest a positive outlook, potentially paving the way for a resurgence in market confidence and a spike in FedEx's performance.

Technical Analysis

Investors have paid higher prices over time to buy FedEx and the stock is in a rising trend channel in the medium long term. This signals increasing optimism among investors and indicates continued rise. The stock is moving within a rectangle formation between support at 232 and resistance at 282. A decisive break through one of these levels indicates the new direction for the stock. The stock has support at dollar 230 and resistance at dollar 268. Negative volume balance weakens the stock in the short term.

FedEx has posted a double top.FedEx Corporation - 30d expiry - We look to Sell at 269.78 (stop at 277.78)

Posted a Double Top formation.

We look for a temporary move higher.

The trend of lower lows is located at 270.

270.46 has been pivotal.

We are trading at overbought extremes.

Our profit targets will be 249.78 and 245.78

Resistance: 250.00 / 258.00 / 270.95

Support: 241.04 / 234.00 / 230.00

Please be advised that the in formation presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group

FEDEX ignoring the market jitters & offers a strong opportunityFedex opened higher today following the favorable fundamentals, ignoring the overall weakness on the market in the Fed aftermath.

Two days ago it achieved a rebound on the MA100 (1d), exactly at the bottom of the Channel Up that started exactly 1 year ago.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 292.00 (-0.382 Fibonacci extension, same as the April 6th High).

Tips:

1. The MACD (1d) just formed a Buy Cross. Every such formation inside the Channel Up has started a rally to a Higher High.

Please like, follow and comment!!

FDX FedEx Corporation Options Ahead of EarningsIf you haven`t bought FDX here:

or ahead of the previous earnings:

Then analyzing the options chain and the chart patterns of FDX FedEx prior to the earnings report this week,

I would consider purchasing the 220usd strike price Puts with

an expiration date of 2023-11-17,

for a premium of approximately $1.96.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Discover the Hottest USA Stock Market Sectors - Get Ready for anI couldn't wait to share the hottest USA stock market sectors set to sizzle this August. Brace yourself for an action-packed month with potential profits and exciting investment opportunities!

1. Technology Titans: The tech sector continues to dominate the market, with innovative companies leading the charge. From cutting-edge software solutions to breakthrough hardware advancements, this sector promises immense growth potential. Stay ahead by closely monitoring tech giants like Apple, Amazon, and Google.

2. Renewable Energy Revolution: The renewable energy sector is rising as the world shifts towards sustainable practices. Solar, wind, and hydroelectric power companies are experiencing a surge in demand, presenting a remarkable chance to invest in a greener future. Keep an eye on industry leaders such as Tesla, First Solar, and NextEra Energy.

3. Biotech Breakthroughs: The biotech sector is witnessing a wave of groundbreaking advancements in healthcare and pharmaceuticals. Companies focused on developing innovative treatments, vaccines, and therapies are gaining substantial attention. Keep a close watch on biotech giants like Moderna, Pfizer, and Johnson & Johnson.

4. E-commerce Explosion: The pandemic has accelerated the growth of the e-commerce sector, and it shows no signs of slowing down. Online retail giants are experiencing exponential growth as consumers embrace the convenience of digital shopping. Keep an eye on industry heavyweights like Amazon, Shopify, and eBay.

Now, here comes the exciting part! To ensure you don't miss any action this August, I encourage you to subscribe to our exclusive newsletter or follow our social media channels. By doing so, you'll receive regular updates, expert insights, timely tips on these hot sectors, and more.

Don't let this opportunity pass you by! Stay ahead of the curve and make informed investment decisions by subscribing or following.

Remember, August is shaping up to be a thrilling month in the stock market, and you don't want to miss out on the potential gains these sectors offer. Subscribe/follow now and get ready for an exhilarating ride!