FDX / FEDEX CORP , Buy now .. its the best opportunity !!!In the first point that i talked about : All the weight fell on the store , which made it descend quickly and surprisingly // And this is a good thing because the store was freed and now it can go back up and rise again as we see

in the second point : Thanks to my analyzes that i just made .. i want to tell you that .. after this point , it will rise by 96% and this is suitable opportunity reap your profits .

As you can see this is my first post here .. but that doesn't mean that i am not a pro !!

Fedex

FedEx Shares Soar 220% in 7 Months!This year has seen a rise in home deliveries, especially during the lockdown period and FedEx

appears to be one of a number of companies benefiting from this trend.

Over the years price has been on a steady growth, and from a low of $34 in March 2009 price grew

by 700% through to January 2018 and reached a high of $274.

A decline was underway from that point, and in just 26 months the share price dropped to $88.

Things did turn around in April this year as price started an impulsive trend back to the upside,

not only breaking above last year's high and the $200 round number, but also the previous all-time high.

As long as the demand for home deliveries remains high, we may see FedEx continue to shine.

The next hurdle in the way is the $300 round number which may act as an obstacle but seeing how

quickly price has climbed lately, the $300 psychological resistance may not cause any long-term problems.

As price has created record highs this month, this stock has moved higher on our watchlist and now we

are just waiting for a high probability setup before entering a position.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

FedEx: Still room to grow. Aiming at the 1W MA200.FDX has seen enormous rise this week, breaking above the 1W MA50 (RSI = 59.573, MACD = -0.910, ADX = 28.559). Despite that, it is still undervalued both on the short and long term. Based on its recovery after the Subprime Mortgage crisis (the pattern then is very similar to today), it is aiming at the 1W MA200 on the short-term (right now at 192.71) and on the long-term to new ATH.

** If you like our free content follow our profile to get more daily ideas. **

Comments and likes are greatly appreciated.

$FDX is in an Important Zone $FDX has had a harsh year:

-From ATH of 274.66 in Jan 2018

-To a short term low of 137.78 in Oct 2019

As you can see, on the monthly chart, we have now touched the (almost) 11-year trend line from 2009:

Transports have been getting the worse end of the stick for a while, and it is right around the holidays - when a lot of shipping happens. I don't want to have a bias either way here yet - but, I can tell you that this is an important zone. You can either expect large buyers to start refueling in this zone, or at least testing the waters.

However, from a fundamental standpoint, $FDX has gotten worse in this time frame - and if large buyers don't step in here, you're likely to see another large down wave.

To zoom in a bit, here is where we are on the weekly:

As you can see, we have touched the (almost) 11-year trend line in a tweezer bottom ever so slightly, and have been looking for direction since in this rectangle.

From this chart, I think it's important to note:

-All 3 of the last large red weekly candles have had the highest volume since 2009 ,

-2 of these weeks recorded all-time high volumes

I do not think this has shown enough strength yet at these levels to warrant a long, however, I am eying this level to show strength by gapping back up into this rectangle, or getting rejected - probably having to retest the (almost) 11-year trend line again:

Will continue to add to this as time goes on...

Feel free to let me know your thoughts, or share any input you have on the fundamental or technical side of things - love to learn and grow with everyone!

This will likely take 2-3 months to pan out, but it could be a once in a decade setup, whichever way the market decides to push it. Keep your eyes open on this one.

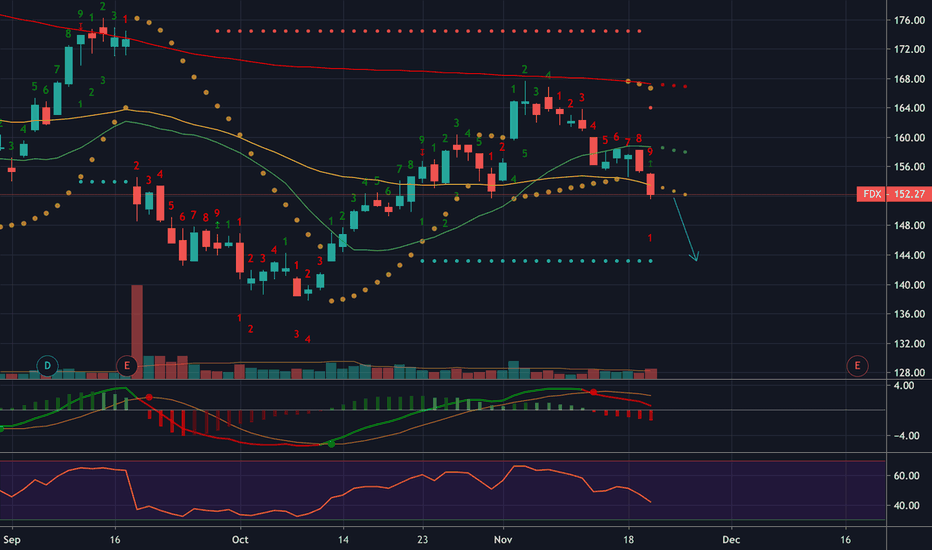

FDX - CounterTrend Play This seems to be an important area for this one. Downtrend in play, however we are in a zone that can bounce with easy stop location for good R:R - take into account this is counter trend on D / 4h .. so easy play - either we stop out or we bounce to TL - at which time take some off or get to BreakEven Point and hold for the break up to the "zone" above.. Big time of year for shipping.. so maybe we get that bounce. Happy trading!..