Very important Economic Calendar 28.07–01.08: FOMC, BTC, tariffsThis Week (July 28 – August 1) — the final week of the month is packed with key events.

Save this post and forward it to 3 friends 😉

📋 High volatility ahead — as the Fed’s key "threelemma" (inflation, labor market, tariffs) comes into focus.

Several important macro releases are scheduled — each one matters on its own, but combined, they can move markets sharply.

🗓 Monday (July 28)

▪️ 12:30 UTC – QRA (Part 1): upcoming US Treasury borrowing needs

▪️ 16:00 UTC – 2Y & 5Y bond auctions – key indicator of market expectations ahead of FOMC

🔗 Strong demand = stronger rate cut expectations

🗓 Tuesday (July 29)

▪️ 12:30 UTC – US GDP (Q2 estimate)

▪️ 16:00 UTC – 7Y bond auction

🗓 Wednesday (July 30)

▪️ 12:15 UTC – ADP employment report – early signal ahead of NFP

▪️ 12:30 UTC – QRA (Part 2): breakdown of Treasury borrowing

▪️ 18:00 UTC – FOMC rate decision (no change expected – 4.5%) + Powell’s press conference

🗓 Thursday (July 31)

▪️ 12:30 UTC – PCE inflation (June) – Fed’s favorite inflation gauge

🗓 Friday (August 1)

▪️ 12:30 UTC – Nonfarm Payrolls (employment)

▪️ 13:00 UTC – ISM Manufacturing Index (July)

▪️ 13:00 UTC – Univ. of Michigan Consumer Sentiment Index

▪️ All day – July auto sales data

🚨 LIBERATION DAY 2.0

Potentially the most impactful event of the week: the Trump administration will begin sending “tariff letters” to ~200 countries.

This marks the end of the temporary tariff relief (April 8 – August 1).

Markets expect a new wave of global trade tension — timing is still uncertain.

💡 Summary:

Every day brings a new potential driver.

Markets are nervous and highly reactive — sharp moves are likely...

CRYPTOCAP:BTC is currently being held above $117K, but Wednesday and Friday bring high risk of "news bombs".

Fedrate

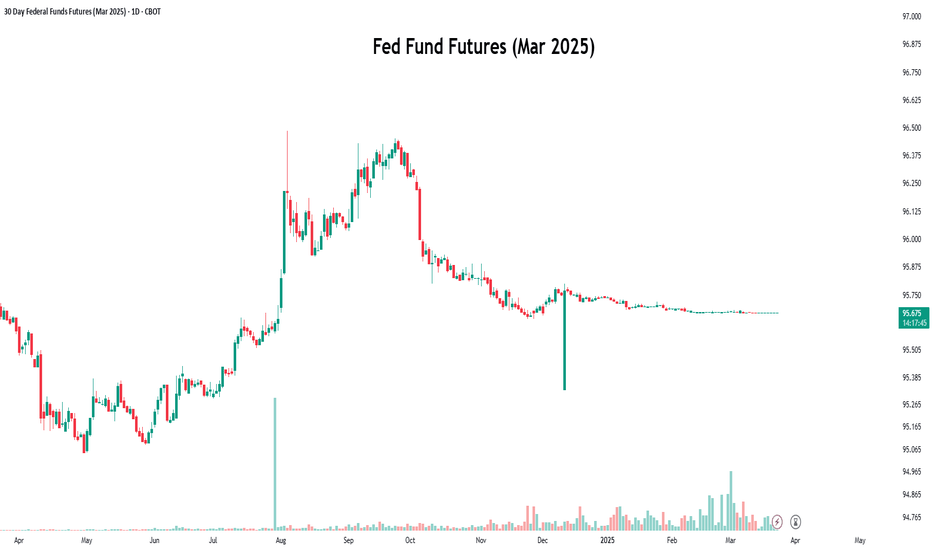

Decoding Fed Rate Changes via Federal Funds Futures Index◉ What Are Federal Funds Futures?

● Definition: Federal Funds Futures are financial contracts traded on the Chicago Mercantile Exchange (CME) that allow market participants to bet on or hedge against future changes in the federal funds rate (the interest rate at which banks lend to each other overnight).

● Purpose: These futures reflect the market's expectations of where the Fed will set interest rates in the future.

◉ How Federal Funds Futures Work?

● Pricing: The price of a federal funds futures contract is calculated as 100 minus the expected average federal funds rate for the contract month.

➖ Example: If the futures price is 95.00, it implies an expected federal funds rate of 5.00% (100 - 95 = 5).

● Contract Expiry: Each contract represents the market's expectation of the average federal funds rate for a specific month.

◉ Why Use Federal Funds Futures?

● Predict Fed Policy: Traders and investors use these futures to gauge the likelihood of the Fed raising, cutting, or holding interest rates.

● Hedge Risk: Institutions use them to protect against potential losses caused by interest rate changes.

● Market Sentiment: They provide insight into what the broader market expects from the Fed.

◉ Steps to Analyze Fed Policy Using Federal Funds Futures

● Step 1: Check Current Federal Funds Futures Prices

Look up the prices of federal funds futures contracts for the months you're interested in. These are available on financial platforms like Bloomberg, Reuters, or the CME Group website.

● Step 2: Calculate the Implied Federal Funds Rate

Implied Federal Funds Rate = 100 - Futures Price.

➖ Example: If the futures price for March is 95.5, the implied rate is 4.5% (100 - 95.5 = 4.5).

● Step 3: Compare Implied Rates to the Current Rate

If the implied rate is higher than the current federal funds rate, the market expects the Fed to raise rates. If it's lower, the market expects a rate cut.

● Step 4: Estimate the Probability of Rate Changes

By comparing the implied rates of contracts expiring before and after an FOMC meeting, you can estimate the probability of a rate change.

➖ Example: If the implied rate for March is 4.75% and the current rate is 4.5%, the market is pricing in a 25 basis point (0.25%) hike.

● Step 5: Monitor Changes Over Time

Track how futures prices change over time. Shifts in prices indicate changes in market expectations. For example, if futures prices drop (implying higher rates), it suggests the market is anticipating a more hawkish Fed.

◉ Practical Applications

● Trading: Traders use federal funds futures to speculate on interest rate movements.

● Economic Forecasting: Economists use them to predict the Fed's monetary policy and its impact on the economy.

● Investment Strategy: Investors adjust their portfolios based on expected rate changes (e.g., shifting from bonds to equities if rates are expected to rise).

◉ Limitations of Federal Funds Futures

● Market Sentiment: Futures prices reflect market expectations, which can be influenced by sentiment and may not always accurately predict Fed actions.

● External Shocks: Unexpected events (e.g., geopolitical crisis, pandemics) can disrupt rate expectations.

● Liquidity: Less liquid contracts (further out in time) may not accurately reflect expectations.

◉ Example Analysis

Let’s assume:

➖ Current federal funds rate: 4.5%

➖ March federal funds futures price: 95.5

● Step 1: Calculate the implied rate:

100 − 95.5 = 4.5%.

● Step 2: Compare to the current rate:

The implied rate (4.5%) is equal to the current rate (4.5%), suggesting the market expects no change in rates by March.

● Step 3:

If the futures price drops to 95.25, the implied rate becomes 4.75%, indicating the market now expects a 25 basis point rate hike..

◉ Why This Matters?

● For Traders: Federal funds futures provide a direct way to bet on or hedge against interest rate changes.

● For Investors: Understanding rate expectations helps in making informed decisions about asset allocation.

● For Economists: These futures offer valuable insights into market expectations of monetary policy.

◉ Conclusion

Federal funds futures are a powerful tool for analyzing and predicting the Fed's interest rate decisions. By understanding how to interpret these futures, traders, investors, and economists can gain valuable insights into market expectations and make more informed decisions. However, it's important to consider their limitations and use them in conjunction with other economic indicators for a comprehensive analysis.

Bitcoin PerspectiveMany people have been confused by this Bitcoin cycle. Here I offer a different perspective taking into consideration both the halving dates and US Interest Rates.

Keep in mind that interest rates tend to have a lagging effect on the market.

Observations:

- Slightly lagging behind interest rates higher rates seem to suppress Bitcoin's upward movement. Cause consolidation.

- When interest rate hikes paused Bitcoin immediately started climbing.

- Interest rates did not start rising until after the 2nd halving.

- Interest rate hikes had already paused before the 4th halving.

- During times of low interest rates Bitcoin has seen large growth.

- (Outside this chart) The last 2 times the FED started cutting rates we reached 0.25 in less than 1 1/2 years.

- The average Bitcoin Bull Cycle lasted between 756 days and 826 days.

- We are currently 665 days into this cycle.

I'll let you decide what this all means. I just thought I would share my observations.

SPY500 $SPY | RALLY AFTER FED RATE CUT - Sep. 19th, 2024SPY AMEX:SPY | RALLY AFTER FED RATE CUT - Sep. 19th, 2024

BUY/LONG ZONE (GREEN): $552.50 - $575.00

WEAKER BULLISH ZONE (PALE GREEN): $552.50 - $540.50

Weekly: Bullish

Daily: Bullish

4H: Bullish

This was my analysis for the end of the day yesterday, forgot to post it. Price has already rallied fairly well today. The Fed cut rates yesterday 50bps, down from 5.50 to 5.00. Here is what I was looking at as the market became volatile when reacting to the news. Despite the market already quickly moving in favor of the bullish zone, I still think we will reach the top of that zone before any form of reversal or significant pullback.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technicalindicators, supportandresistance, rangebreakout, rangebreakdown, rangetrading, chartpatterntrading, chartpatterns, spy, sp500, s&p, AMEX:SPY , fed, federalreserve, fedrate, fedratecut, interestrate, jeromepowell, fedchair, 50bps, volatile, volatility,

Fed Rate: How to Trade Gold Amidst Market Uncertainty?

The excitement is building as the Federal Reserve is about to announce its rate decision—whether it's a 25 or 50 basis point cut. Will gold reach new highs or begin a downward trend? Let’s wait and see.

From a personal perspective, I'm not particularly concerned about the impact on trading. Whether the market moves up or down, it will eventually return to the current price levels. Especially after a surge, there’s no need to worry too much.

For those trading today, do not set stop losses on short positions. If gold rises, simply add to your position or hedge by opening long trades. The 2600 level is a critical resistance point, and even if it breaks through due to the announcement, it won’t hold for long without a retracement. At that point, simply close your long positions and add more short positions.

This trading strategy should be helpful for those looking to navigate the volatility. Feel free to ask any questions or leave comments!

The Dollar Remains On TrackThe dollar is right on its projected path as expected. Inflation has prevented the Fed from lowering rates at least once. Can we expect a rate drop before the end of the year?

My guess is that even with a bit of inflation showing the Fed will drop rates at least once. There are several reasons for my conclusion here not least of which are weakening economic indications which are too numerous to list for the purposes of this post but some of which are the collapsing car market, cc default rates exploding, commercial real estate vacancies still increasing, and many other factors and lead indicators.

There is also the fact that the Fed was initially expected to drop rates 3 times in 2024. Failing to drop at least once before the end of the year would have psychological ramifications on the market that potentially could be disastrous.

And finally, there is the fun fact that historically the Fed has always adjusted rates in an election year. There is only one exception to this rule …2012. Based upon this statistic alone we can see that the probability of a rate adjustment this year is high. And we know that if there is an adjustment, it will almost certainly be to the downside as that is what has been expected all along. Any anomaly to expectations would cause chaos and catastrophe in the markets.

All this being said we can then continue to expect the dollar to travel its expected pathway …down. 103.5 is the next support. Below that is that pink ascending trendline around 102 and rising.

Options Trading is Not about the GreeksCME: E-Mini S&P 500 Options ( CME_MINI:ES1! )

On March 24th, I published a trade idea, “Buckle Your Seatbelt for a Market Correction”, where I suggested that the US stock market was due for a major correction. Buying a Put contract on CME E-Mini S&P 500 Futures would be a trade to express this market view.

How is this trade panning out?

• On March 24th, the June S&P futures contract (ESM4) was settled at 5,289.75. The out-of-the-money (OTM) put strike 5,100 was quoted at 63.

• To purchase a Put, a trader would pay an upfront premium of $3,150 (= 63 x 50).

• On April 18th, the S&P has been down for five straight days, and ESM4 was settled at 5,49, losing about 4.6% since we first placed the trade on. Meanwhile, the 5100 put is now trading at 150.75.

• Our put position is valued at $7,537.50 (= 150.75 x 50). If we were to close the trade now, we would realize a hypothetical return of +139.3% (= 150.75/63 -1) in less than a month, excluding transaction cost.

While the underlying stock index is lowered for less than 5%, and the put strike is barely in-the-money (5049 is 51 points below 5100), the value of the put contract has been more than doubled. This trade showcases the attractiveness of an options strategy.

Firstly, there is time value on the put contract. We have two more months to trade until the options expire on June 21st, the 3rd Friday of the contract month. The probability that the S&P could go significantly lower than 5100 makes the put options very valuable.

Secondly, there is a multiplier of 50 built into the options contract. Each index point that the S&P moves in-the-money, the Put position will gain $50 per contract.

Thirdly, the volatility of the S&P 500 index has increased 50% in the past month, from 12-12.50 to 18-19.50. Higher volatility makes options contracts more valuable.

Options Greeks are Lagging Indicators

My trade idea did not price in volatility increase. In fact, it did not even mention any of the options Greeks – Delta, Gamma, Theta, Vega, and Rho.

In my opinion, the Greeks are concurrent indicators or lagging indicators. Take the VIX index as an example. It captures historical volatility about the S&P 500. However, options are priced by the implied volatility. It is the market consensus, or collective sentiments from all the buyers and sellers, about what volatility would be in the future. In this case, historical volatility is not very useful in gauging future volatility.

All sophisticated options pricing models eventually bog down to a subjective estimate of the implied volatility. The Greeks are precise about what the market has been, but they are not useful in assessing how market sentiment will be a month from now.

We could illustrate this with CME Group’s FedWatch Tool, which shows real-time market sentiments in Fed rate cut probability.

• On March 24th, it indicated the probability of a 25-bp cut in June at 75.5%. There was a 77% chance that Fed Funds move to 4.50%-4.75% by year end, indicating a total of three rate cuts in 2024. Four total rate cuts, which would be a full percentage point lower, was priced at 43% probability.

• On April 18th, the probability of a 25-bp cut in June is now down to just 15.3%. The probability for total rate cuts in 2024 are: 2 cuts (32.4%), 1 cut (36%) and no cut (15%). We may recall that only four months ago the market consensus was 6-7 rate cuts.

(Link: www.cmegroup.com)

If you measured the market last month based on the Greeks, you would have expected the S&P to go higher. Instead, market sentiment turned upside down as March CPI and Nonfarm payroll data completely destroyed the hope of near-term Fed rate cuts.

Trading with E-Mini S&P Options

In my opinion, the market correction is not over yet. There is a good likelihood that the S&P to move down 10%-15% from its peak of 5,265, to the range of 4,475-4739. Here are the key drivers:

• US stock market had a spectacular run in the past two years on the back on AI revolution. While the seven Big Tech companies gained over 50%, the remaining 493 stocks registered low single-digit returns. We are now at the breaking point where the Magnificent Seven could no longer carry the heavy burden of the mediocre performance of the rest.

• The lowered expectation of Fed rate cuts results in higher-than-expected future interest rates. This puts downward pressure on company valuation. I had several writings explaining how the discounted cash flow (DCF) valuation works.

• Escalated geopolitical tension triggers a flight to safe-haven securities. Gold would gain in value while the stock market would decline.

CME Group E-Mini S&P 500 Options provide leverage and capital efficiency. Options are based on futures contracts. The contract notional is $50 x S&P 500 Index.

On April 19th, the June S&P futures contract (ESM4) is now quoted at 5,031.75. The 4,850-strike put is quoted at 64.75. To purchase a Put, a trader would pay an upfront premium for $3,237.50 (= 64.75 x 50).

Hypothetically, if the S&P lowered 10% from its peak to 4,739, the put position would be 111 points in-the-money (= 4850-4739). The trader could exercise the options to capture the price difference or sell the put at a higher price.

If the S&P ends up with a smaller correction, the trader could lose money, up to the full amount of the upfront premium.

Options traders could find CME’s Options Calculator an easy-to-use tool in structuring their options strategies. The best part, it is free.

www.cmegroup.com

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Potential Market Reversal by May 2024Overview

I can't shake the feeling that a large market correction is around the corner and at the same time the market contradicts my sentiments by appearing stronger every day. So I decided to investigate the 1 Year Treasury Note ( TVC:US01Y ) which is directly affected by Fed Rates to see how the market correlated to those changes in the past. What I found leads me to believe that a steep -- but temporary -- correction is approaching between late March and early May 2024.

Historical Data (Feb 2016-Feb 2024)

While it may not always feel like it, the stock market appears to have an overall bullish affinity even during economic struggle such as can be seen during the pandemic of 2020. After an average of three FOMC (Federal Open Market Committee) meetings, a sharp correction took place within the FOMC meeting range or shortly following the third meeting. This is the case for all but the fourth window which actually manifested a reversal to what has become the rally we are experiencing today.

The chart above compares the TVC:US01Y (Top) to the SP:SPX (Bottom Left) and TVC:DJI (Bottom Right). I interpreted this data as potentially two truths:

1) Institutional investors retreat during transitional periods then resurface when the outlook is more clear, typically reigniting the previous trend despite an overall trend change within Fed rates.

2) Fed rate changes are a precursor for market reversals. While not the only factor, they appear to hold a significant weight that if supported could lead to a reverse in market trajectory as can be seen after the third and fourth window of FOMC meetings.

**I only accounted for FOMC meetings where the 1 Year Treasury Note experienced significant trend changes**

Market Projections

I do not believe an apocalyptic correction is coming, but I do believe there will be a significant dip across the board following one of the next two consecutive FOMC meetings. The current dates for those meetings are March 19-20 and April 30 - May 1, 2024. It is my opinion that the 50%-61.8% Fibonacci Retracement levels serve as a good opportunity to enter a position should a correction occur. However, technical indicators should be closely watched for signs of a recovery before entering any positions.

Dollar Index (DXY): FED Rate AHEAD! 💵

Today, we are expecting FED interest rate decision and FED press conference.

In this video, I share a detailed technical outlook and potential scenarios for Dollar Index.

Watch carefully, because it will help you to prepare for the coming news.

❤️Please, support my work with like, thank you!❤️

us10y and the secondary wave of inflation.before you read any further, read my post from april:

---

it has been awhile since i've given a public update on the us10y and my general theory about where i believe these rates are headed.

back in april of 2023, i gave an upside target of 5.9% for the us10y.

as of today, i'm raising the range for that upside target into the window between 6-9%, going into the end of 2024.

i'm aware that jpow has mentioned in the last few fed meetings that he has no intention of raising the rates any further, but i'm seeing a significant development on many of the charts this week which tells me otherwise. so i'm calling him out on his bluff.

---

us10y w5 algo = 6-9%

impact of two important following news on DXYTwo important factors that been driving Dollar prices in last several month as we all know is Federal Funds Rate and Inflation data like CPI.

In this week we have both of them coming out on Tuesday and Wednesday, now we want to see how it can affect the market.

Price usually tend to be at important resistive or supportive areas at the time of important news hit the market and as we can see now price is at supporting area and at the Daily low which probably will remain here until the news hit the market so we can expect of low volatility movement on USD and other major crosses, But what will happen when the news releases?

As we know CPI balance is curving to downside and shows that inflation is cooling down and as we see the prediction of tomorrow CPI news we can see that the market expect this trend to continue. Now here is the tricky part, if CPI data put out like prediction or lower than the prediction this means that fed has the inflation under control which makes trader to believe that federal reserve would not need to raise prices very aggressively like before and as a result we may see a risk on environment in the market which can lead Dollar prices to come lower, but on the other hand SPX, TLT, EUR,JPY and also commodity currencies like AUD,NZD to take benefit from the situation.

But if CPI data comes out higher than expectation then we can argue that federal reserve do not have inflation under control so it needs to continue hiking prices like before and this situation may lead to higher prices for Dollar and lower prices for all the other assets that we covered above.

Also if the second scenario take place tomorrow we can expect USYIELD to continue going higher which have negative effect on US treasury bond and very bad effect on SPX index.

Put CPI analysis apart the other important news that can shake prices real hard is federal reserve which going to hit the market on Wednesday. On that time we can see that what exactly is in the mind of federal reserve and how they are going to impact the economy. In overall, if they raise rate same or below the expectation its going to be very good for risky assets since it shows that we are getting close to end of rate hiking cycle but if federal reserve going for raising rate higher than expectation then it will have a very good impact on Dollar but bad impact on risky assets.

Gold trade idea, base on US calendar data printWeekly gold analysis

📌 Key points and overview:

Technical view, can range between 1730$ and 1764$

Any lower than expectations can be a helping hand for gold to rise, and any US data more than expected can be a downward pressure for downside gold.

📝 Fundamental Analysis:

After the sharp rise of gold, last week we saw the correction of gold in the range of 1730 dollars.

The correction was due to lower-than-expected inflation data for the United States.

But after that, the re-decline of the US dollar and the retreat of US bond yields helped gold to move slightly higher and reach the $1,760 range.

But for this week.

In incoming week all economic data from the US are expected to be lower than the previous value.

it makes the retail traders inclined to sell the dollar, and therefore in the short term we will see the growth of gold, but we have to wait for the result of the actual data.

Any lower than expectations can be a helping hand for gold to rise, and any US data more than expected can be a downward pressure for downside gold.

CME Group's FedWatch tool shows that markets have priced in a 70% chance of a 50bp FED rate hike in December.

As a result, good economic data will have less impact on the rise of the dollar, while bad economic data can severely downward pressure for the US dollar.

📉 Technical view:

From a technical point of view, gold was able to establish itself above the range of $1730. It can range between 1730$ and 1764$

Also, the price is currently trading above the moving average of 200, which shows that the bullish bias stays intact.

1705$ and 1734$-1730$ are important support levels.

1760$ and 1780$ are important resistance.

📰 Important calendar events:

ADP NONFARM EMPLOYMENT CHANGE, JOB OPENINGS, HOME SALES, JOBLESS CLAIMS and ISM PMI

On Friday, the Bureau of Labor Statistics will publish labor market data for the month of November.

Non-farm payrolls (NFP) are expected to decline by 39,000 following growth of 239,000 in October.

A print of less than 200,000 will likely weigh on the US dollar and push gold higher.

A disappointing jobs report on Wednesday and Thursday could signal a smaller interest rate hike for the Federal Reserve.

If the market has such an assessment, it will reduce the yield of US bonds, which is extremely beneficial for the rise of gold.

On Thursday, the ISM Institute will release the manufacturing PMI data for November. The PMI is expected to drop to 49.8 from 50.2 in October.

If the ISM PMI report shows that price pressures ease in November, the US dollar may come under selling pressure. And in this scenario, gold prices can rise in short-term reactions

DXY Can the Dollar keep falling ahead of next week's Fed Rate?This 1M chart focuses on the U.S. Dollar Index (green trend-line), which is seeing its first serious and sustainable pull-back after a long time as since September 28 it has been trading on Lower Highs and Lower Lows (not seen on this monthly time-frame though). This week the low completed a -4.50% from its peak, which is the strongest pull-back since the January 05 2021 bottom! With the upcoming Fed Rate Decision next week, the question is, is it possible for the USD to continue falling without the Fed changing the narrative, i.e. without continue hiking (raising the rates)?

A simple answer would be no. That is because in general terms since the mid 80s, the USD and the Fed Interest Rate (black trend-line) have been strongly correlated. It is no surprise that the USD's hyper strong rally this year started right when the Fed announced their hiking plan. Why they did that? In order to battle and bring down the raging inflation (blue trend-line) that came with the trillion dollar rescue packages during the COVID lockdowns. That is the key to our question before and provides a more detailed answer.

It is also important to consider the low unemployment rate (red trend-line) in this equation. As you see the only times in the past +30 years that we've had the Inflation peaking and pulling-back while the unemployment was bottom low and with the USD reversing, was when the Fed cut the Interest Rates after at least a year of hiking. So in order to complete the pattern we are currently in and see the USD extend its pull-back is to see the Fed cut back or at least adopt a more accommodative/ less aggressive hike with a specific horizon to stop. And the key to that as mentioned would be for them to be convinced that the current 3 month drop straight on the Inflation Rate is sustainable, thus under control.

Brace for a really really interesting week ahead.

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDJPY EURUSD AUDUSD GBPUSD Markup No trade for me todayIt's FOMC Day today. Im in Asia. I wont be getting into any trades until tomorrow asia time after the FOMC result.

Just a few thoughts. 75bps is pretty much priced in the market, so i think if its only 75bps plus a dovish message along with it I think market well have a breather and see DXY correcting. Anything higher than 75bps is gonna be wild..

Goodluck trading out there.

here are some markups

USDJPY

eurusd

audusd

www.tradingview.com

gbpusd

1w trading below quarterly level looks over extended very bearish

4h no sign of reversal. Prev candlw was a bullish one but current seems bearish . Stay away

GOLD vs Fed Rate Hikes. How does the metal reacts historically?This is a cross-asset analysis of Gold (black trend-line) and the Effective Federal Funds Rate (green trend-line). Following the aggressive rate hiking by the Fed since the start of the year in an attempt to battle an out of hand rise on inflation, the idea of this study is to see how Gold historically reacts to raises on the Fed Interest Rates.

The Red Shapes are periods when Gold declines while the Rate is rising. The Green Shapes represent periods when Gold and the Rate rise together while the Blue Shapes are when Gold stays neutral amid Rate rises.

It is easy to see that the Red periods dominate the chart since 1980, which means that most of the times, when the Fed has risen the Rates, the precious metal is getting sold. 2022 so far seems no different as, excluding a March flash rise due to the Russian invasion in Ukraine, Gold has lost value since the start of the year and would probably be even lower if it weren't for the war.

How low it can go is anybody's guess, but this chart shows that normally during rate hike periods, Gold loses much more value than it has currently done so.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

VISA. Ascending Triangle on Weekly. 3:1 RRR.NYSE:V is breaking a year long ascending triangle on the weekly time scale. Measuring by the height of the triangle, about $80, from the top of the triangle gives us a target of $296. This is 35% potential profit from the current price of $219.

Taking the recent swing low as a guide, we can set our stop loss at $189.

The triangle is not considered broken upwards until we see next week's candle trading above current week's candle, given that this week's close is above the triangle.

Unfortunately I can't give a time window for this move.

From a fundamental point of view, I suspect that Visa benefits from the Fed's increased interest rates. But I would need more research to understand precisely the magnitude of such effect.

BTC Fed Rate Cuts2019:

Aug 1 2.25% Lowered rates despite growth

Sep 19 2.0% Fed was concerned about slowing growth.

Oct 31 1.75% Slow global growth and muted inflation.

2020:

March 3 1.25% Corona virus outbreakw

2/3 times in 2019 BTC has had a significant downside after a Fed rate cut so watch out for another mid-term drop in comparison to what has happened before.

I Spy A Fed Guy; Two Roads Diverge...Take Less Traveled?!Terrific rally to the 0.786 Fibo; looks like a slamdown at 290 today. We all expected a rally, but this one blew us away. Now we are back in the middle; higher prices but year. Pullback seems imminent; look carefully, however, you may find at least three similar Doji's that fooled us. Cautiously shorting in anticipation of trade and Fed combo worries leading up to FOMC meet next week. No guarantees in this game.

Two roads diverge at the meeting: a rate cut will trigger massive upside explosion and race to new ATH in July. EW theory suggests we may be in a 2nd of 5th wave, if so, a 3rd-of-5th would be terrifically bullish, a final blowoff meltup to cap the final surge of the Great Bull. These Elliot Waves are always and only clear in the Retrospectometer.

FOMC Disappointment... well, you know.

Trade at your own risk; GLTA!

USDJPY - Weekly Market Analysis - October 2018, Wk 3USDJPY has a major retrace last week and this could be the result of President Donald Trump shared on Social Media that the Fed has gone crazy in, increasing the interest rate;

OR

it could be just the market retracement.

In anyway, the retracement is well supported at the previous resistance area, let's see how market forms up.

USDJPY on the Daily Chart remains Bullish.