Why Cost of Living is Still a Concern?Why is the cost of living still a concern, even though inflation has declined to 2.6%?

In many elections over the past two years, voters have ranked inflation as their top concern.

As we can see, the prices of many commodities remain above pre-COVID levels, with gold and meat prices currently much higher than they were at the inflation peak in 2022.

Consciously or unconsciously, both investors and consumers seem to feel that the cost of living will remain elevated for a prolonged period. Moreover, there is always a risk that inflation might creep back up again.

Feeder Cattle Futures & Options

Ticker: GF

Minimum fluctuation:

0.00025 per pound = $12.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Feedercattle

Long August Feeder Cattle: GFQ2023Seasonally supported for Buys May/June >> into July. Typical seasonal Low mid-late June (agreement across 5yr, 15yr, 40yr data).

I like how this has retraced down to old Aug'15 high and rejected that dynamically (see the GF1! W graphic). I very much like the perfectly 'clean' equal highs from 2015-2023 (see GF1! weekly graphic).

I prefer not to see price return back below the island reversal gap; though stop is set a wee bit deeper still just in case.

Looking to hold this until completion or stop out. But if we make some progress up and we get into Mid-July =>> i may consider exiting early.

3 Inflation Scenarios for 2023There are only 3 inflation scenarios that will happen till the end of 2023:

i. Improve CPI to 2%

ii. Range CPI to hover between the band of 5-8%

iii. Continue to trend higher breaking above 9%

Many investors believe scenario (i) & (iii) will be unlikely.

70% of the investors feel that CPI should settle unchanged from how the year started at between 5%-8%.

Therefore, what is moving up then? Both the long-term and short-term? I have explained in the above video.

Feeder Cattle Futures

Minimum price fluctuation:

0.00025 per pound = $12.50

TAS: Zero or +/- 4 ticks in the minimum tick increment of the outright

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Live Cattle Fundamental and Technical UpdateMonday’s Slaughter is estimated at 125,000. Unchanged from last week, but 8,000 more than the same week last year.

Monday’s Cutout Values

Choice: 270.54, Down .78 from the previous day.

Select: 247.45, Down 1.44 from the previous day.

Choice/Select Spread: 23.09

5 Area Average Cattle Price

Live Steer: 140.14

Live Heifer: 138.35

Dressed Steer: 226.03

Dressed Heifer: 225.95

Live Cattle

Technicals (August): August live cattle got taken to the woodshed yesterday, along with nearly every other market out there as a risk-off sentiment fed on itself ahead of this week’s Federal Reserve meeting where the chances of a .75 rate hike went from 25% to 94% over the span of one trading session. As painful as yesterday may have been, it prices in the bearishness that comes with a more rapid rate increase and leaves room for outside markets to rally if the Fed only comes in with a .50 hike. If the Fed hiked rates a full point, that would obviously be another story. Needless to say, outside market money flow and sentiment will be a key catalyst through tomorrow’s Fed meeting.

Resistance: 136.025-136.625***, 137.90-137.95**, 138.75**, 140.275**

Pivot: 135.10-135.475

Support: 134.40-135.10***, 132.45-132.775**, 129.975-130.725****

Futures trading involves substantial risk of loss and may not be suitable for all investors. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Feeder Cattle Need to Defend Support to Keep Momentum

Feeder Cattle

Commitments of Traders Update: Friday’s CoT report showed Managed Money were net buyers of 3,798 futures/options contracts, through June 7th. This shrinks their net short position to 5,472. Broken down, that is 10,900 longs VS 16,372 shorts.

Technicals (August): August feeder cattle retreated on Friday after failing against technical resistance, which we had outlined in previous reports as 176.75-177.075. This pocket represents previously important price points and the 100-day moving average. If the Bulls can eventually chew through this pocket, it would open the door for a potential run back near 182. On the support side of things, our first pocket from 174.00-174.30 remains intact after holding on Friday’s pullback. If that pocket gives way, we could retrace to last week’s breakout point and the 50-day moving average, 171.50-171.925.

Resistance: 176.75-177.075***, 178.225**, 181.65-182.10****

Support: 174.00-174.30***, 172.90**, 171.50-171.925****

Futures trading involves substantial risk of loss and may not be suitable for all investors. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Hacking For Ransom- A Franchise- When’s The IPO?My phone constantly rings with solicitations for solar energy, extending the automobile warranty for cars I got rid of years ago, and with dire warnings that charges are pending against me from social security, the IRS, or other agencies. Some are annoying, but many are scams.

A few years ago, I opened an email that locked my entire computer system with a message that I would receive the key if I paid a handsome sum in Bitcoin. I chose to get rid of my hard drive and start all over again. Losing years of files was the price for an education. I have never opened a file from an unknown source since that experience. I am even extra careful with attachments from known sources these days.

The hackers have been winning

Companies have been paying- Colonial and JBS

Cryptocurrencies are untraceable

The US government says- You’re on your own

The ramifications are staggering for businesses and markets

Hackers are an ongoing and growing problem for individuals, companies, and even government agencies. Whether they sit in Russia, China, North Korea, or our own backyards, there seems to be no stopping the efforts to extract a ransom. Hackers have been attacking those with insufficient security and have become so technologically sophisticated that they can pierce cyber armor that protects data and the ability to conduct business.

The ransom business is profitable. It has a low overhead and is growing. It is disruptive and dangerous. The nefarious offshoot of technological advances is so successful that a public offering of shares in hacking companies would likely receive a high valuation and lots of interest. After all, it’s a real money maker for the culprits.

The hackers have been winning

Around two years ago, my 91-year-old dad received a phone call from someone saying he was an attorney for his grandson. The caller said my son was involved in a car accident, was in the hospital in Boston, and was under arrest for driving under the influence. He asked my father to send money immediately for his grandson’s defense. Fortunately, he called me, and I immediately called my son, who was sitting at his desk at work in New York City. The call was a scam. I called the FBI, who said they deal with this every day, and there was little they could do as the scammers use networks and phones that are untraceable.

Technology has only made law enforcement’s job more challenging. Savvy criminals have been winning. While we did not fall for the scam, many succumb as they pull on emotional drawstrings. What grandfather would not do anything to help or protect their grandchild? If one out of ten or even one hundred scamming attempts succeeds, the criminal venture is highly profitable.

Meanwhile, hacking computers take scamming to a new level. When a hacker gets inside the systems of a business or a government agency, they can extract valuable data, proprietary corporate information or shut down all business activity. The latter seems to be the most profitable as companies with little choice are paying up and forking over millions, making hackers huge winners.

Companies have been paying- Colonial and JBS

Two hacking instances in 2021 temporarily roiled commodity markets. On May 7, Colonial Pipeline, a US oil pipeline system originating in Houston, Texas carries gasoline and jet fuel to the Southeastern United States, was the victim of a ransomware cyberattack. The hack impacted computerized equipment that manages the pipeline system.

The move created fuel shortages and caused refining spreads to spike higher in mid-May.

The chart shows the spike in the gasoline crack spread to $27.30 per barrel during the week of May 10. The refining margin moved to the highest level since September 2017 as the market feared shortages and consumers in the Southeast began hoarding gasoline.

Jet fuel is a distillate oil product. The NYMEX heating oil futures contract is a proxy for other distillates like jet fuel.

The chart of the heating oil refining spreads illustrates the rise to $21.28 per barrel during the week of May 10 as the Colonial Pipeline hack created fears of shortages. Colonial Pipeline CEO Joseph Blount told the US Senate Committee on Homeland Security and Governmental Affairs; his company paid a $4.4 million ransom on May 8, the day after the attack. The payment was in Bitcoin, the hacker’s currency of choice.

On June 1, JBS, the world’s leading beef supplier, suffered a hack of its computer networks that briefly shut down operations in the US and Australia. While the Colonial hack caused gasoline and distillate prices to spike higher, the beef markets spiked to the downside.

August feeder cattle futures dropped to a low of $1.4510 on June 1.

August live cattle futures plunged to $1.14625 per pound on fears that meat processing plants would not accept animals because of the hack.

JBS CEO Andre Nogueira said the company paid hackers an $11 million ransom “to prevent any further risks for our customers.”

Cryptocurrencies are untraceable

Some market participants and government officials believe that Bitcoin and cryptocurrencies are causing a rise in hacking that holds companies and individuals hostage. Cryptocurrencies are a libertarian form of money that flies beneath the radar of government officials, central banks, and regulators. While the blockchain records transactions, they are anonymous.

Christine Lagarde, the President of the European Central Bank, and Janet Yellen, the US Treasury Secretary, have expressed concerns about the nefarious uses of cryptocurrencies long before the recent hacks.

Passions run high in digital currencies. A few years ago, JP Morgan Chase CEO Jamie Dimon called Bitcoin a “fraud.” At the same time, Warren Buffett, one of the world’s preeminent value investors, said cryptocurrencies are “financial rat poison squared.” Charlie Munger, Mr. Buffet’s 97-year-old partner, doubled down and called cryptocurrencies “disgusting” and a threat to civilization in recent comments.

The lack of regulation and anonymity make Bitcoin and other cryptos a hacker’s dream.

The US government says- You’re on your own

The payment of ransom by companies that are critical parts of the US’s energy and food supply chain infrastructure is a failure of the government to protect the businesses and people they serve. Colonial and JBS pay taxes. The individuals that depend on their products pay taxes. The US government is responsible for a safe environment.

While the Biden administration promised to get to the bottom of the hacking issues, the President said that the businesses were on their own. President Biden told a reporter, “The bottom line is that I cannot dictate that the private companies do certain things relative to cybersecurity. A lot of you are very seasoned reporters; you’ve been covering this debate up on the Capitol Hill for—before I became President—and, unrelated to President Trump, just a debate internally among Senators as to whether or not the government should be assisting. And it gets into privacy issues and a whole range of things.” The ransom payments were a sign that the businesses could not wait or depend on the world’s leading democracy for assistance.

At a recent summit in Geneva, President Biden sought assistance from Russian leader Vladimir Putin as Russia is a leading source of hacking activity. Since the meeting, the hacks continue. Last week, the US leader called his Russian counterpart again to reiterate his displeasure.

The ramifications are staggering for businesses and markets

The ramifications of hacking for ransom are downright scary. If the culprits can hold a critical energy pipeline and the world’s leading beef supplier hostage, what about the US power grid, water supply, farm and logistical networks, and other critical infrastructure? When companies or individuals pay the ransom, there is no guarantee that the hackers will not demand more or refuse to provide the key so systems can operate. Moreover, a hack that takes data or proprietary information could be a gift that keeps on giving to hackers.

It seems that the anonymity of the cryptocurrency asset class only exacerbates the problem. If a hacker cannot receive untraceable payment, they will be less likely to attack. Meanwhile, infrastructure, companies, and individuals remain at risk. With more regulation on the horizon, hackers may use a closing window of opportunity to step up their nefarious activities. A massive hack could impact markets across all asset classes, not only their prices but also their continued operation. Hacking and ransom attacks are a clear and present danger that is growing. They have the potential to disrupt markets and the supply chains for essential products and services.

Use the link below to sign up for the next Monday Night Strategy Call

Trading advice given in this communication, if any, is based on information taken from trades and statistical services and other sources that we believe are reliable. The author does not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects the author’s good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice the author provides will result in profitable trades. There is risk of loss in all futures and options trading. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This article does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.

FEEDER CATTLE FUTURES (GF1!) DailyThe Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing dates. The Djinn Indicators work on all charts, for any asset category and in all time frames.

Dates in the future with the greatest probability for a price high or price low.

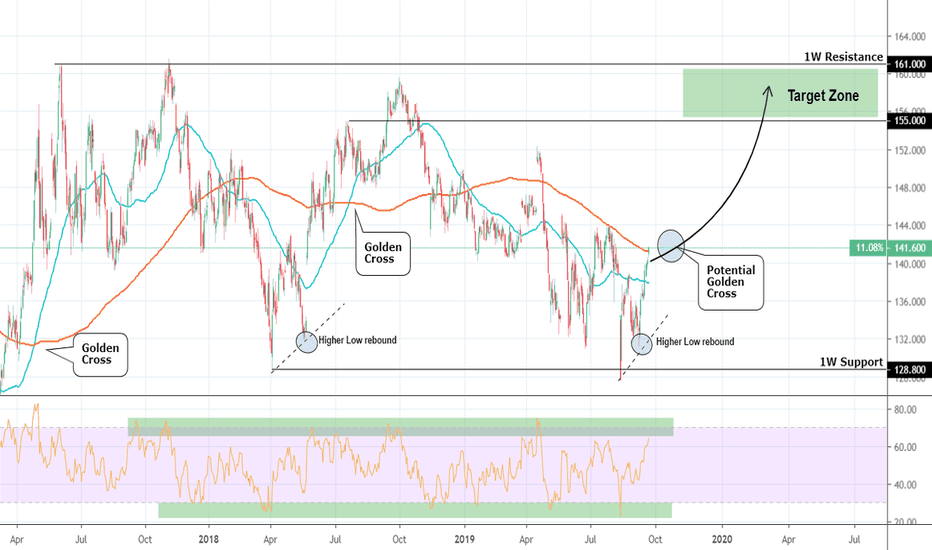

Feeder Cattle: Strong Buy Signal on potential Golden Cross.Feeder Cattle is coming off a strong Higher Low rebound early this month with 1D already on strong bullish technical action (RSI = 60.454, MACD = 0.850, Highs/Lows = 3.0514). Since this bullish sequence started on a strong August rebound on the 128.800 1W Support, it is more likely to see an extension towards the 161.000 1W Resistance.

A potential 1D Golden Cross formation in October should come as validation of this just as it has done twice already since 2017. We are long on GF with 155.000 - 161.000 as our Target Zone.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Feeder Cattle: Long term Buy opportunity.GF is trading on a 1W Ascending Triangle that is near the 139.225 Support and Higher Low zone (RSI = 46.649, MACD = -0.700, Highs/Lows = 0.0000). This creates ideal conditions for a long term buy towards 159.500.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Long term setup within the 1W Channel Up.Feeder Cattle (GF1!) is trading within a long term 1W Channel Up (RSI = 63.368, B/BP = 10.8420) on a very stable pace setup (MACD = 2.490, Highs/Lows = 3.4700) that allows us for a better pattern recognition. If those recurrences are valid, the GF should seek a Higher Low near 155.000 before making a Higher High near 164.000 (target).

1D Channel Down. Short.Feeder Cattle is trading within a Channel Down on 1D (MACD = -0.360, Highs/Lows = -0.0614, B/BP = -1.7440). The neutral RSI = 45.095 suggests that it is coming off a recent Lower High, which as seen on the chart was at 151.500. We have opened short and our TP is 146.900 and 144.975 in extension (we will update if needed to pursuit the extension).