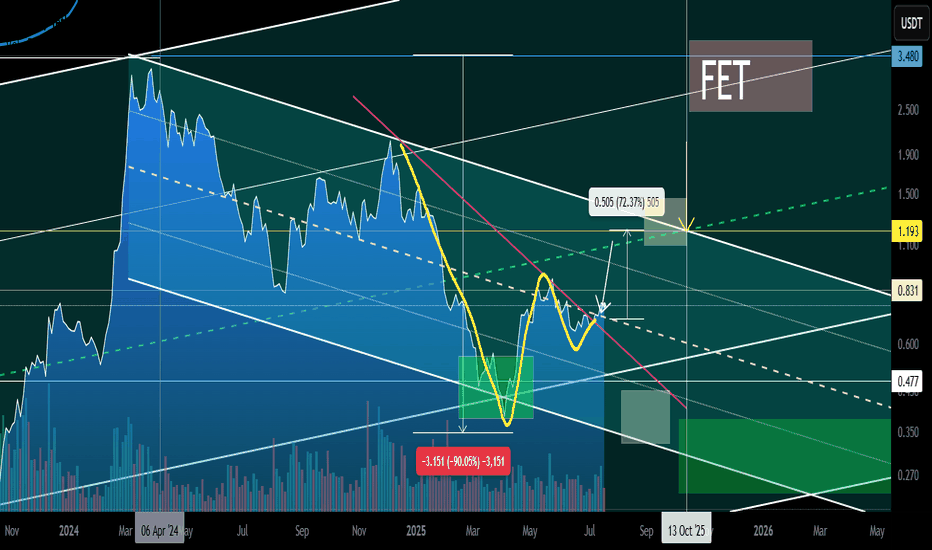

FET Secondary trend 19 07 2025Logarithm. Time frame 1 week for clarity.

Main trend is an ascending channel.

Secondary trend is a descending channel

Local trend is a Ross hook, at the median resistance. Reversal zone.

By the way, the trading idea from 2022 FET/BTC is still relevant. Pay attention to where the price is.

FET/BTC Main trend. Pump zone cycles . 2022 06

FETBTC

#FET/USDT Preparing for a Major Rally ?#FET

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.655, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.650.

Entry price: 0.665

First target: 0.688

Second target: 0.716

Third target: 0.750

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

#FET/USDT#FET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are seeing a rebound from the lower boundary of the descending channel. This support is at 0.634.

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.661

First target: 0.684

Second target: 0.720

Third target: 0.754

#FET/USDT#FET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.814.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.823

First target: 0.866

Second target: 0.912

Third target: 0.957

#FET/USDT#FET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.696.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.721

First target: 0.779

Second target: 0.817

Third target: 0.863

#FET/USDT#FET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.695.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, which supports the upward trend.

We are heading towards stability above the 100 moving average.

Entry price: 0.730

First target: 0.765

Second target: 0.810

Third target: 0.850

#FET/USDT#FET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 620.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.625

First target: 0.659

Second target: 0.647

Third target: 0.659

#FET/USDT Futures Trade Setup!#FET looks good if you missed.

Two options to enter:

1. You can accumulate .5869 to .6080

2. Wait for the US Open and buy at CMP with confirmations.

Targets : .6377 .6522, .6755, .6838 and .7021

SL .5772

Dyor, NFA

Do hit the like button if you want me to post more setups like this.

Thank you

#PEACE

FET/USDT - Trendline Breakout (22.04.2025)The FET/USDT Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 0.553

2nd Support – 0.516

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

#FET/USDT#FET

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.477.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.500

First target: 0.513

Second target: 0.529

Third target: 0.550

FETUSDT at Key Support with Bullish Indicators!FETUSDT Technical analysis update

FET/USDT is currently trading at its major support zone. Key observations:

-The resistance from March 2022 and March 2023 is now acting as support.

-The daily chart's RSI has dropped below 30, indicating oversold conditions.

-A bullish MACD crossover has occurred below the histogram.

-A bullish divergence is visible in the RSI on the daily chart.

#FET/USDT

#FET

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.00

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.05

First target 110

Second target 1.16

Third target 1.22

#FET/USDT Ready to go higher#FET

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.26

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 1.28

First target 1.33

Second target 1.37

Third target 1.44

Rebuy Setup For FET (8H)This analysis is an update of the analysis you see in the "Related publications" section

As we showed in the previous analysis, FET is in a large diametric pattern. Currently, wave F is forming, and it will soon be completed, leading to the beginning of wave G.

Wave G is bullish. The targets have been marked on the chart.

Closing a daily candle below the invalidation level will violate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

FET/USDT Chart Analysis and Trade Setup. FET/USDT has broken out of a descending trendline, confirming bullish momentum.

The consolidation along the trendline suggests a potential continuation toward the target.

The price has reclaimed the moving average (purple line), which now acts as dynamic support, strengthening the bullish case.

Around $1.27 after a successful retest of the breakout level.

Below $1.24 to minimize downside risk.

Take Profit Levels:

TP1: $1.50 (interim resistance)

TP2: $1.62 (major target)

Ensure a steady increase to confirm breakout strength.

Watch for overbought conditions near $1.60.

FET/USDT has strong bullish potential after the breakout. A well-placed stop loss and high reward potential make this a favorable trade setup. Monitor closely for volume and momentum confirmations.

DYOR, NFA

@Peter_CSAdmin

FETUSDT | Very Important AreaIn my analyses over the last two days, I highlighted the possibility of a pullback in the crypto market leading up to Christmas. This cautionary outlook led me to recommend setting buy points significantly lower. However, I advise waiting for BTC to show signs of meeting buyers before acting on these points.

For FET/USDT, I’ve identified a critical demand region, marked by the blue box on the chart. I consider this zone highly valuable, as it represents an area where meaningful buyer reactions could emerge. Observing the price action in this region will be essential to evaluate its potential.

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active

FETUSDT | Lets Try To Snipe ItIn this setup, I've identified two key green zones as potential demand areas based on historical price action. These areas are where price wicks have previously formed, suggesting strong buying interest.

Why These Zones?

The green boxes highlight regions where buyers have aggressively entered the market in the past, creating significant wicks.

On lower timeframes (LTF), such areas are often liquidity zones, where institutional traders may step in to fill large orders.

Stop-Loss Placement

The stop-loss is set at 1.77, slightly below the second green box. This placement minimizes risk while accounting for potential liquidity grabs before a reversal.

Trading Plan:

Wait for the price to revisit the green zones.

Look for bullish confirmation signals (e.g., candlestick patterns, order flow shifts) before entering long positions.

Target key resistance levels for exits, ensuring a favorable risk-to-reward ratio.

Always trade with proper risk management and adjust stops if market structure changes. Let’s see how the price reacts! 🚀

I keep my charts clean and simple because I believe clarity leads to better decisions. Trading doesn’t have to be overly complicated, and I enjoy sharing setups that have worked well for me.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups. It’s all about learning and growing together as traders, and I’m here to share what I see.

The markets can confirm what the charts whisper if we’re paying attention. I hope these levels help you as much as they’ve helped me in the past. Let’s see how this plays out!

My Previous Hits

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

FET can fly again (8H)From where we placed the green arrow on the chart, it seems that FET has entered the bullish phase.

This phase looks like a diametric diamond.

We have identified two entry points for this position.

The targets are also marked on the image.

Closing a daily candle below the invalidation level will violate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

TradeCityPro | FETUSDT Progress Toward a New All-Time High👋 Welcome to the TradeCityPro channel!

Let's analyze one of the top AI-focused crypto projects, Fetch.AI (FET), and identify opportunities for both spot buying and futures trading.

🌍 Market Overview

Before diving into FETUSDT, it’s essential to check Bitcoin’s behavior. Bitcoin continues to range, a trend that might persist for a few more days.

However, with the dominance of altcoins on the rise, attention remains on them. Bitcoin’s eventual breach of $100K could temporarily restore its dominance.

🕒 Weekly Time Frame

FET is one of the most bullish altcoins, having risen without revisiting its 2023 lows, largely due to the AI hype.

After rebounding from the $0.056 support, it surged to $3.104, followed by a significant correction to $0.745. This zone was an ideal Potential Reversal Zone (PRZ) as it aligned with the trendline and Fibonacci levels.

FET has bounced off the 0.382 Fibonacci level, and breaking above $3.104 could lead to targets of $4.868, $7.849, and $13.828 (calculated using Fibonacci extension).

Last week’s candle closed above the $1.613 resistance, signaling bullish momentum. You could consider buying with a stop loss at $1.094. For those holding from lower levels, it might be wise to secure initial capital and some profits.

As long as FET remains above its trendline, the outlook remains bullish.

📊 Daily Time Frame

FET is entering a significant resistance box between $1.99 and $2.54—potentially the final stronghold for sellers.

After breaking this zone, the path becomes clearer for higher targets, but expect temporary resistance or price fluctuations within this range. A breakout above $2.637 could provide another buying opportunity.

🕒 4-Hour Time Frame

FET is currently breaking out of the $1.957 resistance, aiming for the $2.637 target.

📈 Long Position Trigger

place a stop-buy above the current candle and set a secure stop loss around $1.739 to avoid being stopped out during minor pullbacks. This ensures you stay positioned for the longer-term uptrend.

📉 Short Position Trigger

avoid trading against the trend in a bull market. Focus on resting and preparing for the next upward wave.

💡 BTC Pair Insight

Against Bitcoin, FET has also shown strength, avoiding drops below the 0.00001390 support.

After breaking 0.00002574, this pair could witness significant bullish moves, making it a good time to hold onto FET.

🛠️ Summary & Strategy

Spot Buyers: Watch for pullbacks within the resistance box and aim for targets using Fibonacci extensions.

Futures Traders: Prioritize long positions aligned with the bullish trend and avoid counter-trend shorts.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

#FET/USDT#FET

The price is moving in a descending channel on the 4-hour frame upwards and is expected to continue

We have a trend to stabilize above the moving average 100 again

We have a bearish trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 1.28:

Entry price 1.40

First target 1.54

Second target 1.68

Third target 1.83