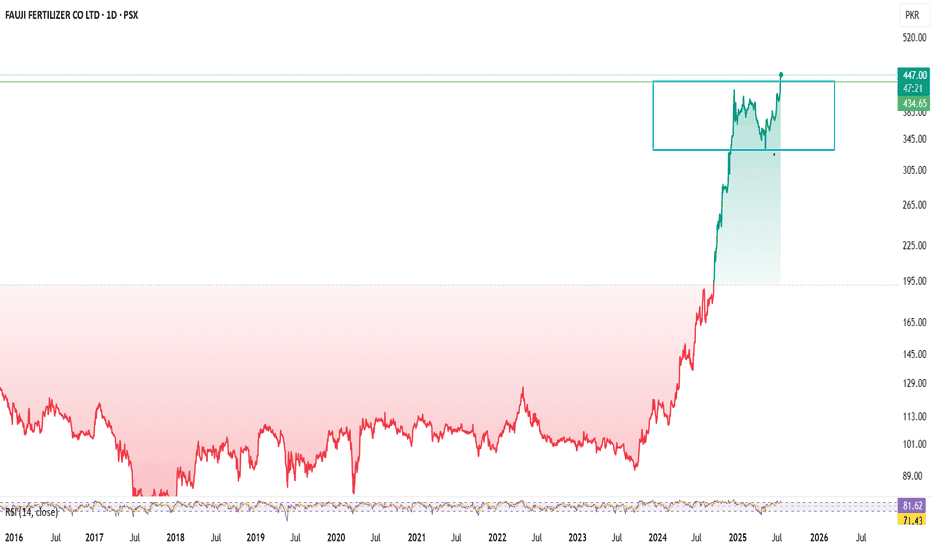

FFCFFC PSX STOCKs breakout Day Level Buy Call

Fundamental Strengths

Robust earnings growth:

FY 2024 net profit ~PKR 64.7 B vs ~PKR 29.7 B (2023) – EPS nearly doubled to PKR 45.49

Pakistan Stock Exchange

+15

StockAnalysis

+15

.

Q1 2025 EPS ~PKR 9.33 (Sep‑Nov on TTM ~PKR 66.6)

Pakistan Stock Exchange

.

Attractive valuation:

TTM P/E ~9.6× (TradingView shows ~6.6×—likely consolidated vs standalone) .

High dividend yield:

~8.7–9.9% yield in 2024, with a ~60% payout ratio

TradingView

.

Diversified portfolio:

Operations across fertiliser, power, food, banking (via Askari Bank), wind generation, phosphate JV – mitigating sector risk

TradingView

+1

+1

Strong ownership:

Backed by Fauji Foundation (~43% owner) – adds stability and governance credibility

FFC

Buy Idea: FAUJI FERTILIZER CO LTD (PSX)🔷 Buy Idea: FAUJI FERTILIZER CO LTD (PSX)

Context:

Price tapped into a discount zone, swept liquidity below the recent lows, and formed a strong bullish engulfing candle. The setup aligns with a low resistance liquidity run toward the higher timeframe distribution zone.

✅ Entry Criteria:

Entry: Above the bullish candle close at ~366

Stop Loss: Below the recent swing low at ~323

Target: Monthly resistance / low resistance area at ~435

RR Ratio: ~1:2.5+

📊 Justification:

Liquidity Sweep: Price swept the previous low (creating inducement)

FVG Reaction: Immediate bullish reaction from the demand/FVG zone

Distribution Zone Targeted: Market is likely to grab liquidity from unfilled sell orders in the upper zone

No major resistance till 435 (clean traffic)

⚠️ Risk Notes:

Confirm daily candle closes above 366 before entry

Monitor any reaction at ~390-400 distribution zone