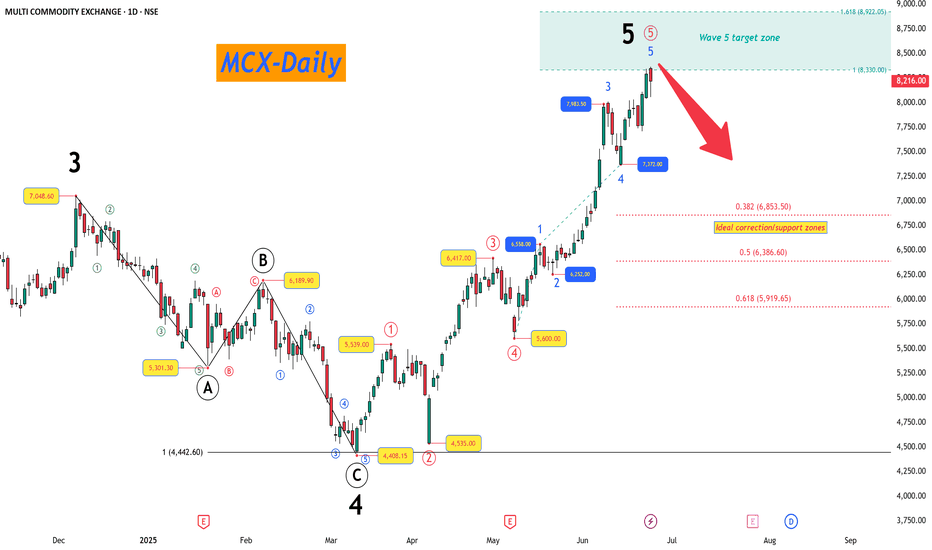

MCX - 5-Wave Impulse Complete, Correction Ahead?The recent price action in MCX has completed a 5-wave impulsive sequence, giving us valuable insights into potential upcoming moves.

The Larger Picture (Daily Timeframe) :

Starting from the prior major low, we have witnessed a clean impulse structure unfolding.

Wave 3 topped at 7,048.60, completing its previous impulse sequence.

Following this, a textbook ABC corrective structure unfolded into Wave 4, completing near 4,408.15. The internal symmetry within this ABC correction was near perfect, with Wave C nearly matching Wave A (100% projection).

Post Wave 4, the price resumed higher into Wave 5, where we now observe signs of completion.

Wave 5 Extension and Target Zone

Wave 5 extended strongly and has already entered its projected target zone:

100% projection of Wave 1 placed near 8,330.

1.618 extension projection reached near 8,922.

Ideal Correction Zones

Now that Wave 5 may have completed or is very close to doing so, we shift focus to probable retracement areas where price may find support in case of a corrective phase:

0.382 retracement at 6,853.50

0.5 retracement at 6,386.60

0.618 retracement at 5,919.65

Dynamic Update Note

The correction zones have been plotted based on the current observed Wave 5 high. Should Wave 5 extend further, these support levels will be recalculated accordingly. Traders are advised to keep monitoring for further price action confirmation before positioning.

The overall Elliott Wave structure here reflects the market may now enter a corrective phase as per standard wave behavior after a completed 5-wave advance.

Fibextension

Tesla’s Next Move: Riding the Q3 MomentumDescription:

In this analysis, we dive deep into Tesla’s recent performance and explore potential future price action. Fueled by an impressive Q3 earnings beat, Tesla has seen a bullish surge. Here, I’ll guide you through key technical and fundamental insights, using the FibExtender Pro to map out support and resistance zones, and provide a structured plan for potential entry, profit targets, and stop-loss levels. My goal is to offer a clear perspective for those considering Tesla’s next moves, balancing optimistic outlooks with realistic caution in case of market reversals.

Introduction:

NASDAQ:TSLA has been the talk of the market this past week, with its third-quarter earnings report surprising analysts and investors alike. The company not only exceeded revenue expectations but also showcased significant growth in profit margins, particularly in its energy generation and storage segments. This recent performance has set a bullish tone, sparking a 26% surge in Tesla’s stock price over just a few days. This idea aims to explore Tesla’s current momentum, analyze key technical levels using the FibExtender Pro script, and present potential trading opportunities for the days ahead. I’ll break down my thoughts into straightforward sections for entry points, profit targets, and stop-loss levels based on recent data, technical indicators, and broader market sentiment.

Tesla’s Q3 Earnings Fueling the Bullish Trend

Tesla’s third-quarter report painted an impressive picture, with strong revenue growth and margin improvements that bucked some of the broader economic trends affecting the automotive industry. As electric vehicle adoption accelerates, Tesla continues to leverage its market leadership, supported by CEO Elon Musk’s optimistic guidance on future vehicle sales and advancements in autonomous technology. Notably, the company reported a significant 20-30% expected vehicle sales growth for 2025, adding fuel to the stock’s upward momentum.

This positive sentiment, combined with Tesla’s ambitious long-term goals (such as robotaxi deployment by 2026), has prompted many analysts to revise their price targets. While some have remained cautious, noting high valuations, the consensus leans towards a bullish short- to mid-term outlook, primarily due to Tesla’s earnings momentum and strong brand positioning.

Technical Analysis with FibExtender Pro: Key Levels to Watch

Using the FibExtender Pro script, which identifies Fibonacci-based support and resistance zones, we can map out Tesla’s potential price action in the short term. As illustrated in the chart, two crucial levels have emerged: a resistance zone near $277 and a support zone around $233. Let’s walk through these levels and explore possible scenarios for Tesla’s price action.

Resistance at $277 :

This level has been marked as a critical resistance zone based on recent price action and Fibonacci retracement levels. Given Tesla’s recent surge, reaching this level is a strong possibility if the bullish momentum continues. A breakout above $277 would indicate a strong bullish continuation and could open doors for Tesla to test even higher resistance levels, potentially moving towards the $290-$300 range.

Support at $233 :

On the downside, $233 represents a major support level where buyers may step in if Tesla faces a pullback. This level serves as a safeguard against market reversals, providing a solid entry for those looking to buy Tesla at a discount if market conditions turn volatile.

Potential Trade Setup

Entry Point:

If Tesla’s bullish momentum continues, entering around the $250-$255 range would be ideal. This level allows us to capitalize on upward momentum while keeping a buffer below the resistance zone. However, patience may be key here; waiting for a slight pullback or a consolidation period around this range could provide a better risk-to-reward setup.

Profit Targets:

First Target at $277 : This is the initial resistance level, and a prudent place to secure partial profits, particularly if Tesla faces resistance here as it did previously.

Extended Target at $290-$300 : If Tesla breaks above $277 with strong volume, the next resistance zone sits in the $290-$300 range. Reaching this level would signal continued bullish strength and could offer further upside for those willing to hold.

Stop-Loss Level:

To manage risk, consider placing a stop-loss just below the support level at $233. This stop will protect against a deeper pullback, potentially caused by profit-taking or broader market weakness. A more conservative stop could be placed at $240 to accommodate minor fluctuations while still protecting capital.

Analyzing Broader Market Conditions

While Tesla’s recent earnings and price action are compelling, it’s crucial to account for the broader market context. Macro-economic headwinds, particularly interest rate hikes and inflation concerns, continue to affect growth stocks. Additionally, Tesla’s valuation remains high, and any negative shift in investor sentiment could lead to a correction. Here’s how these factors play into our analysis:

Interest Rates : Rising interest rates could create resistance for high-growth stocks like Tesla, as higher borrowing costs can impact both consumer spending and Tesla’s operational expenses.

EV Competition : Although Tesla remains the market leader, increased competition from other automakers, such as Ford and Rivian, could influence its long-term dominance. Keeping an eye on developments within the EV sector is essential for assessing Tesla’s sustainability.

Considering these factors helps us balance the optimistic outlook with realistic caution, preparing for any unexpected shifts in market sentiment.

My Thought Process Behind This Trade Idea

From a technical perspective, Tesla’s recent surge post-earnings provides a strong bullish setup. By analyzing the FibExtender Pro ’s support and resistance levels, I’ve identified the $277 level as a short-term profit target. My goal is to provide readers with a comprehensive view of Tesla’s current momentum and map out a clear trading strategy, combining fundamental strength with Fibonacci-based technical analysis . This approach is especially helpful in markets like Tesla’s, where rapid moves often require adaptable entry and exit points.

Furthermore, it’s essential to consider profit-taking strategies. As Tesla approaches each resistance level, locking in partial profits can protect against sudden reversals, while maintaining upside exposure for continued gains. With stop-losses positioned below support, this strategy offers a structured risk-reward setup, balancing bullish optimism with prudent risk management.

Conclusion

Tesla’s recent performance and bullish sentiment provide a promising outlook for the stock. However, as with any trading decision, it’s essential to balance the potential upside with well-planned risk management. Based on the FibExtender Pro analysis, Tesla’s next key resistance level lies at $277, with an extended target of $290-$300. Support at $233 offers a safety net in case of market corrections.

This idea aims to guide traders through Tesla’s current setup, blending fundamental insights with technical precision. By following this structured approach, we can make informed decisions, capitalizing on Tesla’s momentum while safeguarding against potential pullbacks. Whether Tesla continues its bullish climb or encounters resistance, this analysis provides a framework to adapt and respond confidently.

Key Takeaways:

Entry Range : $250-$255

Profit Targets : $277 (first target), $290-$300 (extended target)

Stop-Loss : Below $233 (preferably around $240 for a conservative buffer)

This trading idea seeks to balance optimism with caution, setting realistic targets that align with Tesla’s recent performance and technical signals. Remember, while the bullish setup is promising, unexpected market shifts could impact Tesla’s trajectory. Stay alert, manage your risks, and adjust your strategy based on real-time market feedback.

Trade safe and stay informed! Let’s make smart moves together. – TradeVizion

ARM eyes on $103.xx: Key resistance to determine trend directionThis is a follow up to my $90 entry call (click).

After a considerable retrace we have a bounce.

The bounce is at a significant and key resistance.

What happens here could determine the next trend.

Immediate resistance zone is $103.14 to $103.82

Break above should run to golden fib at $117.36

Rejection could drop to golden below at $73.57

==============================================

BTCUSD retraced its trend down of mid January LONGBitcoin has retraced the trend down from the January 11 pivot high. The retracement is 0.5 Fib

level. The zero-lag MACD and dual TF RSI both show bullish momentum. I believe BTCUSD

may consolidate here and then at least by the Luxalgo Echo indicator bullish continuation

will restart. I see a good entry at 43800 with a stop loss below the 0.5 Fib level at 43250

which would be about 1.25% My target at the second upper VWAP band line is 47800 or about

8% upside. This is confluent with the 0.618 Fib extension. The reward to risk would be 4000 /

550 or about 7.

SPA Healthy correction After 300% Breakout, Continuing Bullrun The ADX is 12 and obviously Bottoming Out.

The MACD is hovering below the signal line waiting to Make a Move.

We Broke out ran 300% to have a health pullback and run 100% again

This is a low marketcap token with a lot of potential and even has a 3x margin available on kucoin.

Don't miss this banger!

📈 *Name*: Sperax

🔖 *Symbol*: SPA

💲 *Price*: $0.011076170319746786

📉 *24h Change*: -9.79%

📊 *7d Change*: -17.16%

💰 *Market Cap*: $18737070.61

🔄 *24h Volume*: $13850112.77

🏷️ *Tags*: alameda-research-portfolio, arbitrum-ecosytem, dwf-labs-portfolio

USD/ZAR LongUSD/ZAR pair has been moving bullish over the last few weeks. Looking at the daily time frame. It is now consolidating in a bull flag right in the middle of the channel at resistance after retracing to the 0.618 fib level. With a good breakout of the bull flag resistance should be broken and become support.

I am looking to enter upon the break out and close above BOTH the flag and the 16.1148 resistance level. Doing this would make it highly probable to complete its move to the top of the channel which is the 0.618 fib extension at just over 17.500.

BTCUSDT Anatomy read the description Hi,,,

Today I will show you the anatomy of BTCUSDT using Dow theory chart patterns with RSI & Gann method and at the last I will put my opinion ,

First using Dow theory BTC trends are:

1- Primary bull trend

2- Secondary bearish trend

3- Minor bull trend

if we want to be in a secondary bull market we should close above 46K or we will stay at secondary bearish trend.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Second using chart patterns:

1- BTCUSDT breaks the Primary descending channel small divergence (semi-positive).

2- BTCUSDT is inside the ascending triangle there is small divergence (semi-positive).

3- BTCUSDT is now inside small ascending channel and there no divergence (positive).

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Third using Gann methods + Fib extension :

First our main support at 33K,,,,

Second we are at very important resistance it is a cluster of 3 different Gann angles at almost 46K the same price to change the secondary bearish trend int bullish !!

if we want to crosse this level we need a big volume and HUGE bullish candle

if cross happened our first target is 57K and there is another cluster of 3 Gann angles and 0.618 fib extension so I highly recommend you to take your profit if we reach this level because we may have some correction before we continue our bullish market

NOTE: it might keep going up but in my opinion I do not think this will happen.

At the end my opinion is that we will break 46k after few days from now and it is very important that we do not lose our main support at 33K.

and if you have any opinion please feel free to share it in the comments below + if you like my analyze please give me a like and follow me @hazem44 for more

Have a nice day :)))

GBP/USD 1 Hour Double Bottom Pattern? We have a Double Bottom formed on the 1-hour chart for GBP/USD.

List of Confluences that need to be present for a high probability setup

1) We look at the bottom peaks of the double bottom pattern and ideally would like to see the second peak reach just a little lower than the first. This gives us a decent reason to look for divergence. Do we see this here? YES!

2) We need to see that we have Full Divergence across the MacD – This means that we need Divergence across the Histogram and Divergence across the MA Lines. This shows us that sellers are weakening and that buyers will start to take control at some point. Notice the arrows in the chart illustrating this. Do we see this here? YES!

3) We need to see high volume on the break out of the Neck Zone. Do we see this here? YES!

4) We need to see that the trend is coming to an end and that the peak of the W in the double bottom pattern takes out previous resistance and breaks through the trendline. I have drawn what a breakthrough of the trendline should have looked like. Do we see this here? NO!

So, we have four confluences that need to be present. On this pattern, we only have three. Thus, I would not consider this a high probability setup. Nor would I enter this.

Trading is a game of probabilities. By backtesting this setup, I have concluded that I need to see the four above confluences before I think about opening a position.

However, for the sake of this chart, I have presented where my entry would be and where I would place my two targets. I use the fib extension to find my targets. This will be explained properly in another post.

We need to see the price break above the neck zone and retrace back into it for an entry.

We would enter on the retrace of the neck zone.

Post COVID Bull Market Fib ConfluencesSo as i was getting prepped for my weekly video i created this chart and figured i'd share. It's a fib analysis our entire posrt COVID bull market mainly focusing on major pivot lows and the top we printed a few weeks ago. The rectangles and fib confluence zones, or zones in which one could expect to find support based on the Fibonacci sequence. I mainly focused on .618 retracements as well as 1.618+ extensions. We've already found our way through one of them labeled in red, and Friday had wicked the second zone labeled in yellow. The first level was our first real support area before losing it last week. Fib wise it consisted of three .382's, a .5, and a .618. The one we're currently bouncing from consists of two .5's, one .618, and a .786. This chart is not suggesting a retest of the COVID lows, just a pure analysis of the fibs i have on the chart.

Normally i add the addition of trend based fibs and work of off the intraday timeframes as well, but for ease of use this is only fib retracements and their subsequent extensions form major pivot lows to the top printed 09/02.

Obviously this is to be used with other forms of technical analysis including volume profile and just standard price action analysis including support/resistance. More often than not you'll find that they all have a tendency to land at or near the same levels. If you're not familiar with the fiboonacci sequence or do not implement it into your day to day work cycle i highly recommend it.

Next Extension Top 45k ? BTC/USD #Bitcoin $BTC #btcHere we see our Bitcoin 3 day chart from Bitstamp . Can you see our Fib drawdown on the far right of the chart ? And the top fib that is visible says 2.618 at 45424 ? There is a pink arrow underneath it . That's the probable next stop on the way up for Bitcoin. As you can see we already hit the 1.618 fib extension at 29500 so the next one up is the 2.618 fib extension . And that's near 45k ! Looks great though of course there can always be some up and down on the way . I wish these charts let you see above this area! But still you can see this chart is looking good for near future .

But how long will it take to get there ? It's hard to say . It could be weeks or even months , of course no one knows exactly because alts may have their first run. Let's see what happens .

EURCHF BUY Position in 240M hi

we believe there is a buy opportunity as we see a Crab Pattern in the chart and divergence signals us.

it is a short term trade for those, who are filling it is a buy, we have 2 target points.

please write your opinions on it in the comment section...