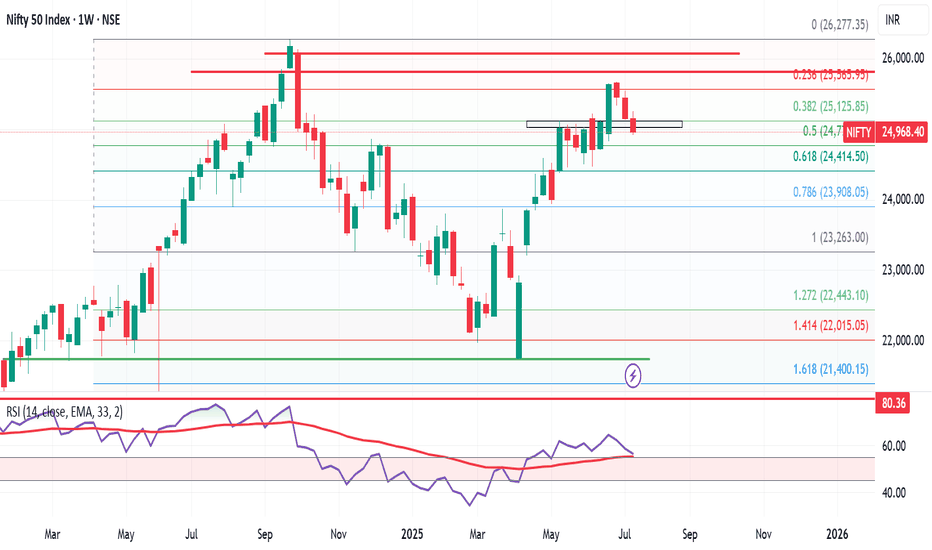

Wkly Market Wrap: Nifty Under Pressure, S&P 500 Hits Record HighThe Nifty 50 closed the week at 24,968, down 180 points from the previous week's close. It traded within a tight range, posting a high of 25,255 and a low of 24,918—perfectly aligning with the range I’ve been tracking between 25,600 and 24,700.

As I’ve been highlighting over the past few weeks, the monthly chart continues to show weakness, and now even the weekly chart is starting to reflect bearish signals. This growing weakness is a notable concern.

What to Watch for Next Week:

If Nifty sustains above 25,100, we could see a potential rebound toward the 25,400–25,450 resistance zone.

However, a breakdown below this week's low of 24,918 opens the door to a retest of key support near 24,500.

What’s interesting is that, despite Nifty’s indecision, the number of bullish stocks on the monthly time frame has increased significantly. Last week, there were 18 such stocks on my radar; now that number has jumped to 26, even after excluding about 10 others that showed bullish patterns but had high volatility.

This divergence—index showing weakness while quality stocks turn bullish—could indicate a possible bear trap being set by institutional players. If true, we might see a sharp short-covering rally after a final shakeout.

Nifty Outlook:

For the upcoming week, I expect Nifty to remain range-bound between 25,400 and 24,500. A decisive breakout or breakdown from this range could lead to sharp directional movement, so traders should stay alert.

Global Markets: S&P 500 Soars to New Highs

The S&P 500 closed at a record high of 6,296, with a weekly high of 6,315 and low of 6,201. The index remains in strong uptrend mode.

A breakout above 6,315 could see it testing 6,376, 6,454, and potentially 6,500 in the coming sessions.

My next major Fibonacci target is 6,568.

As long as 6,149 holds on a weekly closing basis, I continue to view every dip as a buying opportunity.

Final Thoughts:

The Indian markets are sending mixed signals, with the broader index showing caution while individual stock strength is quietly building. This divergence warrants a tactical approach—stay nimble, respect levels, and be ready for sharp reversals or breakouts.

Next week could be crucial. Stay focused, stay disciplined.

Fibnoacci

Cup & Handle Formation in process but..Cup & Handle Formation in process but Yes, there is a Bearish Divergence

on Weekly Tf.

Resisted exactly from the mentioned level around 116-117.

Could not Sustain this level.

Now Weekly Closing above 104 - 105 is important.

Next Support lies around 96 - 97

If 118 is Crossed & Sustained, we may Target around 145 - 146.

Tesla are we going to 268 or 272 which one is IT???? Good morning Traders

Grab some coffee or a tea and lets get into it

First I do a little bit of wave counting to get you up to speed on where we are going and why

Second I do some four hour projections and 30 minute to figure out our levels going up

Third add in a little spice and throw that pitchfork in to wrap it up all nice

Enjoy the video, if you want more videos or different types of videos please let me know in the comments section.

My ultimate goal is give you the audience what you need and the skills to become a more profitable and better trader so you too can hit your trading and lifestyle goals

Happy hunting for those trades

MB Trader

USDJPY Buy IdeaOANDA:USDJPY has been in bullish trend. With the recent intervention of bank of japan with over 3.4 trillion yen, It has seen strong move downwards strengthening yen. As, the price is trading at premium fib levels of 50-78% , It can retest ascending trendline and bounce up from there making it an attractive level to look for buying opportunities

SOL/USDT 1DInterval Resistance and SupportHello everyone, I invite you to the chart of SOL in pair to USDT, nm on a one-day time frame. First, we will use the blue lines to mark the downtrend channel where the price is moving at the upper border.

Moving on, we can move on to marking support areas when we start a larger correction. And here, in the first place, we have a support zone from $ 22.54 to $ 19.88 in which the price is currently located, then we have support at the price of $ 17.68, and then at the price of $ 15.14.

Looking the other way, we see that the price has rebounded from the important resistance zone from $ 23.44 to $ 27.05, which so far has no strength to break. However, if we manage to break out of this zone above, we have another resistance at the price of $ 32.24.

As we can see, EMA Cross 10 and 30 indicate the beginning of an uptrend, but be careful if it will not be a false break.

Please look at the CHOP index, which indicates that we have the energy for the upcoming move, the MACD indicates that we are in an uptrend, while the RSI is moving around the middle of the range, which gives room for increases after a small correction.

Pre Market Levels are CRITICAL in Day Trading 10X Gains For MeCME_MINI:ES1! AMEX:SPY NASDAQ:QQQ CME_MINI:NQ1! NASDAQ:TSLA

I wanted to share a basic strategy I've been using that has helped me increase my profitability almost 10X

Most people don't know that when the regular trading hours (RTH) markets are closed, the futures markets are running

Generally overnight action during the pre market will set a clear high and a clear low. Those key pivots are hidden support and resistance that you WILL NOT see on the normal chart.

Strategy

1 - Draw the Pre Market High/Low

2 - Use the Fibonacci tool in the direction of the overnight action either Bullish or Bearish

3 - Use the 0.618 Level as the KEY Algo level where you BUY THE DIP or SELL THE RIP

4 - Rinse and repeat - Always have a stop loss at the last major pivot and scale out profits over 25%

Here is a more complete video guide from a trade I took last week:

www.youtube.com

$TBLT Next Target PTs 9-13 and higherToughBuilt Industries, Inc. designs, develops, manufactures, and distributes home improvement and construction products for the building industry in the United States and internationally. It offers tool pouches, tool rigs, tool belts and accessories, tools bags, totes, various storage solutions, and office organizers/bags for laptop/tablet/cellphones, etc.; and kneepads. The company also provides sawhorses, miter saws, table saws, roller stands, and workbenches; sawhorse/jobsite tables; and digital measure and levels. It offers its products under the TOUGHBUILT brand through various home improvement big box stores, professional outlets, and direct marketing to construction companies and trade/wholesale outlets. The company was formerly known as Phalanx, Inc. and changed its name to ToughBuilt Industries, Inc. in December 2015. ToughBuilt Industries, Inc. was incorporated in 2012 and is based in Lake Forest, California.

EOS / ETH ↗️Buy Signals:

- Bullish Divergence BB%B

- Fibonacci Confluence matches div ( 3rd Fib cluster )

- Potentially bottomed in large channel

Other Signals

- Bollinger Band Squeeze ( potential large move in either direction )

- BBW all time high( existing trend is ending )

- Pending price action when price approaches the cloud.

Invalidation:

- Increased Volume and rejection in or before the cloud. ( strong resistance )

- BB%B fails to make a higher high and double tops.

- Rejection of the first Fibonacci price cluster.

Target Price:

- 1rst target: 0.0017-0.0018 ETH

- 2nd target: pending price / volume action in 1rst cluster.

- 3rd target: pending price / volume action in 1rst cluster.

- Ultimate target: 0.0065 ETH ( anticipate price to touch the beginning of the div )

Stop Loss:

0.0006712 ETH

Strategy:

- Dollar cost averaging while under first target.

Type of Trade:

- Long Swing Trade

- Ongoing purchase for contract deployment as insurance for increased contract costs.

Why buy:

- Ideal trade for any developer planning to migrate from ETH to EOS, potentially saving on EOS smart contract deployment costs.

Fundamental

- Unpopular opinion: Despite its controversial beginnings, EOS is a genuine blockchain with a unique resource model allowing feeless transactions, it only lacks a larger following, development of more trendy products, and is often overshadowed by its genesis.

- EOS EVM is being launched.

Long term outlook:

- EOS is highly inflationary and unlikely to create a long term bullish trend against ETH, however in the short term is likely to outpace ETH.

- EOS/USD is a different assessment.

SAND Potential Swing Long Set Up Update (Breaking Out)A sand break out retest is iminent as sand has broken out of its descending triangle and it could possibly retest and potentially move up to $8

I have set the target take profit areas as the next fibnoacci retracement levels in green, so if and when you open a long position on this coin, use those green lines as take profit with a stop loss right below it previous lows!

BTC 52K inboundWe have broken out of the ascending triangle we have been forming for the past few weeks. Clearly shown by the diagonal support across the bottom and the three touch points on the resistance of 45k. 52k on the .382 Fibonacci retracement which previously acted as support/resistance, this is the breakout target currently to look out for. We are slightly over sold on the 4hr but as long as we can close the weekly candle outside the triangle this is a very bullish scenario.

LTC SHORT to $100-$80Following is my analysis on LTC going SHORT in the next few days

1) The purple wave 1-2-3-4-5 went from $25-$413 from 12 MAr 2020 to 08 May 2021

2) After great impulse comes correction A-B-C wave,

Wave A retraced 78.6% FIB a perfect 5 wave down series in GREEN

Wave B is a perfect 3 wave series in PURPLE

Wave c should be a 5 wave series down so its right now doing subwave 4 in BLUE

Wave C or Wave (5) in Wave C will end around $90 before it makes any move up to complete the full correction

Summary :

LTC going to short to $90 in the next few days

Appreciate everyone's feedback, happy trading

No trade zone GBPUSD - but a foresighted viewWe are currently in a no trade zone in GBPUSD.

Depending on which Diamond Pocket is approached first, a setup results:

Variant A: We test the resistance above and are rejected there for the time being, target area would be the current 4h SR.

Variant B: We lose the 4h S/R here and find support at the lower Daily S/R levels.... Target would be a renewed test of the current 4h S/R.

Wait and see. Happy trading

__________________

BullvsBear Academy

$GSMG Long term PT 20 and higher...timeline Sept 2022Glory Star New Media Group Holdings Limited provides advertisement and content production services in China. The company also engages in mobile and online digital advertising, and media and entertainment businesses. In addition, it operates CHEERS app, an e-commerce platform, which provides online store, live streaming, series TV shows, and online games, as well as online short videos, variety shows, and dramas. Glory Star New Media Group Holdings Limited was founded in 2016 and is headquartered in Beijing, China.

$USWSU.S. Well Services, Inc. operates as an oilfield service company in the United States. It provides hydraulic fracturing services to the oil and natural gas exploration, and production companies. The company was founded in 2012 and is headquartered in Houston, Texas.

XAUUSD BUY / Bull trend higher lowTaking this long on XAUUSD as a possible swing trade

Momentum is bullish with price action making higher lows and higher highs, while price is also above the 20 day EMA

ATR is starting to go up slowly so I would expect some movement to come later today, the only thing that worries me for longs is the fact that we have had some big red candles recently.

ETH/USDT parallel channelBINANCE:ETHUSDT

ETH must move above 1.272 to continue its trend

Hit and hit the roof of the canal and make a pullback on it

The previous ceiling is a good option for entry and if from

Breaking the midline can be a correction to the bottom of the channel

And then it continues to climb again

ETH inverted head and shoulderETH is braking out!!!

on the 2 hour time chart we see a inverted head and shoulder patern forming,

the down was 11%, so according to the head and shoulder patern, after the right shoulder, we go 11% back up again.

This looks like to be enought to brake the level 1,0 fib.

If he breaks, the next goal is 2100. I think that is realistic.

In my opinion this is a good entry, but you also can wait until he brakes, what should be in the next 1/2 days.

no advice, just my opinion.

Tim

$MTRX$MTRX looking like steal as a cup and handle has possibly formed and now looking to take off. This is a higher risk trade than other so please beware. Targets are as shown on charts and blue lines are out "major" resistances. I rather like the idea of the company and what is can provide but only time will tell.

Good luck.

About:

Loop Insights - Like the internet connects websites, Loop connects physical locations – providing the data

connectivity that will level the playing field between brick and mortar retailers and online giants.

www.loopinsights.ai

Don't worry, Bitcoin will go parabolic tooMore Than an Inflation Hedge

"In May, billionaire hedge fund manager Paul Tudor Jones of Tudor Investment Corp. announced in a letter to investors that his fund is buying bitcoin futures as a hedge against “The Great Monetary Inflation.” In his letter, he argued that the $3.9 trillion (6.6 percent of global GDP) printed by central banks since February has the potential to trigger widespread inflation, once the global economy rebounds from the shocks caused by COVID-19".

- www.nasdaq.com

Breif PPO Explanation

"When the PPO is above zero that helps indicate an uptrend, as the short-term EMA is above the longer-term EMA,

The indicator generates a buy signal when the PPO line crosses above the signal line from below".

- Investopedia (www.investopedia.com)

PPO Indicator by @everget