BA heads up into $230: Strong fib zone might cause a serious dipBA has been flying (lol) from its last crash caused crash.

About to test a signrificant resistance at $229.82-230.73

Expect at least some "orbits" or a pullback from this zone.

.

Previous analysis that caught THE BOTTOM:

==================================================

.

Fibonacci

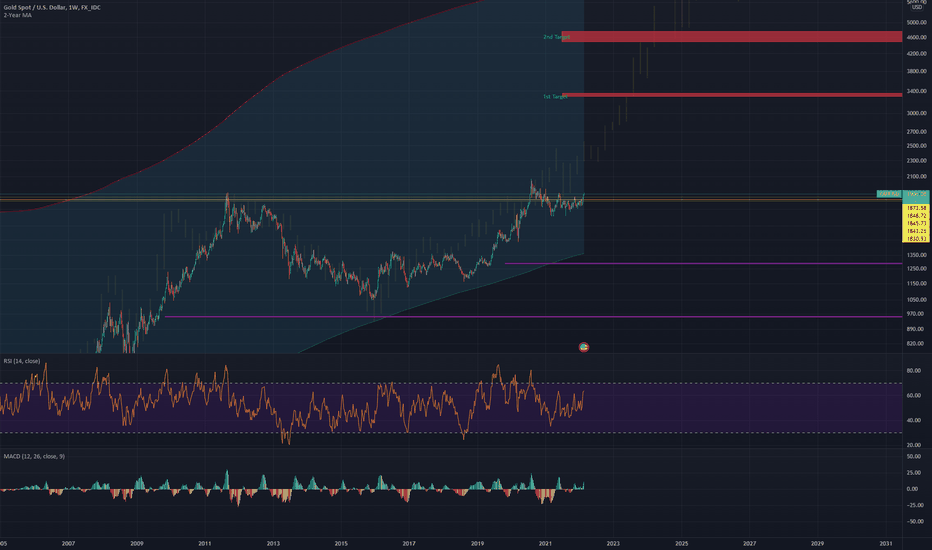

Gold’s Bullish Range Holds – Is This the Dip to Buy?With tensions easing in the Middle East and risk appetite moderating, gold has settled into a bullish daily range. The metal recently broke a key high, confirming its upward momentum, but now appears to be consolidating. The central question is whether gold will break lower for a deeper correction or whether this is merely a pause before the next leg higher.

Reduced geopolitical risk has tempered the “risk-on” rally in gold, but the metal remains firmly within a bullish daily range. This indicates that the underlying bid has not disappeared—only short-term speculative flows have adjusted.

Gold recently breached a protected high—likely a higher high or significant resistance level—reinforcing the prevailing bullish momentum. A pullback into imbalance or demand zones is anticipated; however, if a catalyst emerges, price could resume its advance from current levels, with the 0.328 Fibonacci retracement acting as a strong support.

Meanwhile, the DXY is exhibiting signs of a pullback but lacks the fundamental drivers necessary to sustain a broader rally.

Bearish Reversal Zone Approaching🔹 Pair: USDCAD

🔹 Timeframe: H4

🔹 Price: 1.36806

🔹 Bias: Short/SELL Setup Pending

---

💡 Analysis Summary:

USDCAD is approaching a major resistance zone aligned with the 61.8% Fibonacci retracement level from the previous bearish leg.

Structure shows a clear ABC corrective pattern with signs of exhaustion at current levels.

---

📌 Key Levels to Watch:

🔺 Resistance: 1.3720–1.3740 (Potential Reversal Zone)

🔻 Target Zone: 1.3450–1.3500

🔓 Invalidation Above: 1.3760

---

📉 Plan:

Watch for bearish confirmation (e.g., bearish engulfing, double top, divergence) at resistance before entry.

High RR setup expected if price rejects near 1.3740.

---

🔁 Wait. Confirm. Execute.

🧠 Trade smart, not fast.

📊 More updates coming daily.

Arm Pulls BackArm Holdings rallied sharply last month, and now the AI chip stock has pulled back.

The first pattern on today’s chart is the advance from May 30 through June 30. ARM retraced half that move and is trying to bounce, which may confirm its upward direction.

Second, prices have retested their rising 21-day exponential moving average (EMA). The 8-day EMA is also above the 21-day EMA. Those signals may be consistent with short-term bullishness.

Third, the 50-day simple moving average (SMA) is nearing a potential “golden cross” above the 200-day SMA. That could reflect longer-term bullishness.

Finally, a four-session consolidation zone formed in late June between roughly $143 and $149. Will it now emerge as new support?

Check out TradingView's The Leap competition sponsored by TradeStation.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

GBPCAD - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish move.

No opposite signs.

Expecting further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

AUDUSD 4H: Sell Zone Confirmed📉 AUDUSD Analysis – Current Trend & Trade Opportunity

Hello Traders,

I’ve prepared an updated analysis for the AUDUSD pair.

At the moment, AUDUSD has shifted out of its previous bullish structure and has now entered a bearish trend. Based on this shift, I’m planning to enter a limit sell trade at the level shared below:

🔹 Limit Sell Entry: 0.65232

🔹 Stop Loss: 0.65576

🔹 Targets:

• TP1: 0.64591

• TP2: 0.64591

• TP3: 0.63738

🔸 Risk/Reward Ratio: 4.27

Considering the trend reversal, I’m looking to open a position from these levels.

I meticulously prepare these analyses for you, and I sincerely appreciate your support through likes. Every like from you is my biggest motivation to continue sharing my analyses.

I’m truly grateful for each of you—love to all my followers💙💙💙

Is the Trend Intact? Key Signal Emerging on GER40 4H ChartHey Guys,

We could see a pullback on the GER40 index from the 24,060 level. If that happens, the 23,824 – 23,675 zone could present a potential buying opportunity. The primary trend still points upward, and bullish momentum remains intact.

Also worth noting—the rise in volume is quite striking, which supports my target level of 24,500.

I meticulously prepare these analyses for you, and I sincerely appreciate your support through likes. Every like from you is my biggest motivation to continue sharing my analyses.

I’m truly grateful for each of you—love to all my followers💙💙💙

NASDAQ Potential DownsidesHey Traders, in today's trading session we are monitoring NAS100 for a selling opportunity around 22,750 zone, NASDAQ is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 22,750 support and resistance area.

Trade safe, Joe.

GOLD → Readiness to test the local bottomFX:XAUUSD is under pressure from the rising dollar and uncertainty, breaking through support levels, which opens up a corridor for the market to fall to 3255 - 3246

The price of gold is consolidating around $3300 after falling more than 1% amid expectations of the Fed minutes and news about tariffs.

Investors remain cautious: the dollar is supported by hopes for US trade deals, while the threat of new tariffs from August 1 is holding back gold's growth.

Weak inflation data in China did not support the metal, while expectations that the Fed will not rush to cut rates due to inflationary pressure from tariffs are also limiting interest in gold. Traders are waiting for the Fed minutes and new statements from Trump to determine the further direction.

Technically, the market looks weak (on D1, the price closed below the key level of 3300 on Tuesday) and there is a chance of a further decline.

Resistance levels: 3300, 3311

Support levels: 3295, 3255, 3246

Consolidation below 3295-3300 could trigger a further decline to 3255, from which the market could react with a correction.

Buying can be considered if gold reverses the short scenario, manages to strengthen to 3311, and consolidates above this level. At the moment, the price is in the selling zone...

Best regards, R. Linda!

EURUSD → Bullish daily structure. Correction before growthFX:EURUSD , after significant growth and a break of structure, has entered a local correction, the target of which may be a phase of accumulation of potential for updating intermediate highs (1.183).

The daily market model is bullish. A break of the structure has formed on D1, and the market is entering a correction phase, during which it may be interested in testing 0.5 or the 0.7 Fibonacci area before continuing its growth. I would also like to draw attention to the previously broken resistance level of 1.164 - 1.163, which, within the current correction, may act as a support level for buyers...

In addition, the market has not yet reached the liquidity level it was heading for during the correction for a possible continuation of growth. Zone of interest: 1.168, 1.164, 1.159

Resistance levels: 1.1728, 1.1766

Support levels: 1.168, 1.164, 1.159

A false breakdown of the specified support zone could change the market imbalance and attract buyer interest, which could generally support the bullish trend.

Best regards, R. Linda!

BullsSince hitting 3360+ Gold has formed a channel(flag) on which it has been declining on. Main goal is the 71 -79 retracement region before we get back to buys towards new all time highs.

Currently we at the lower end of the channel giving a buy opportunity towards the 1hr FVG @3325-3330 where we will also look for more sells and target 3280 -3274 (the 71 -79 retracement region).

NB don't force the market and watchout for major news

NQ Power Range Report with FIB Ext - 7/9/2025 SessionCME_MINI:NQU2025

- PR High: 22923.00

- PR Low: 22900.50

- NZ Spread: 50.5

Key scheduled economic events:

10:30 | Crude Oil Inventories

13:00 | 10-Year Note Auction

14:00 | FOMC Meeting Minutes

Session Open Stats (As of 12:25 AM 7/9)

- Session Open ATR: 303.33

- Volume: 16K

- Open Int: 270K

- Trend Grade: Neutral

- From BA ATH: -0.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

ADA | Trade-SetupOur trade worked out exactly as planned, and the price reacted perfectly from the 0.667 level, which also overlaps with the bearish target area (green).

✅First take profit was at the overall correction level (green).

Second take profit is when we reach the 100% correction mark at $0.611. At that point, I will secure most of my position and only let a small portion run.

Gold is at critical support for bullsGold is at a key trend line of support. Most of the world is watching the 3285 level near term, and a break of this level would put the 61.8% Fibonacci retracement at 3248 back in view. A break of this level would target the 3120 level once again. Bulls are nervous, but this key support will be watched carefully into the next trading session.