Britannia: FMCG Bounce in Play?🚀 Britannia: FMCG Bounce in Play? 🚀

📉 Current Market Price (CMP): ₹4845

🔒 Stop Loss: ₹4690

📈 Targets: ₹5045 | ₹5232

📊 Why Britannia Looks Promising:

🔹 Sector Rotation Insight:

After a strong run in Nifty, Banking, and IT sectors, FMCG appears primed for a potential bounce—and Britannia stands out as a top pick for this move.

🔹 Technical Setup:

The stock is holding key support levels, presenting a low-risk, high-reward opportunity for a short-term bounce.

💡 Strategy & Risk Management:

🔒 Stop Loss: Maintain a strict stop loss at ₹4690 to limit downside risk and protect capital.

📈 Staggered Entry: With the recent market rally, adopt a phased entry approach to mitigate volatility and enhance risk management.

⚠️ Caution: The market has already experienced a significant move—position sizing should be adjusted carefully to maintain a favorable risk-to-reward ratio.

📍 Outlook:

As FMCG gears up for a potential bounce, Britannia offers a timely swing trading opportunity with defined risk parameters and clear technical targets.

💬 Do you see FMCG leading the next market move? Share your insights below!

📅 Follow for more technical insights and actionable market updates.

📈 #Britannia #FMCG #SwingTrading #TechnicalAnalysis #StockMarket #InvestmentOpportunity

📉 Disclaimer: As a non-SEBI registered analyst, I encourage investors to conduct independent research or consult with financial professionals before making investment decisions.

Fibonacci Retracement

ETH gives a strong exit from the descending channel!Hello everyone, I invite you to review the current situation on ETH, because you can see a significant rebound at the level of 30% from the last low. When we enter the four-hour interval, we can see how the ETH price moved in the local downtrend channel, from which we got an exit at the top, such a scenario often gives increases at the level of the channel height, which would bring the price closer to the levels of $ 2100.

Here you can see how the current rebound brought the movement closer to the resistance at the level of $ 1830, and then resistance is visible at the price of $ 1950, where the ETH price must then face a strong resistance zone from $ 2060 to $ 2100, where there could potentially be an upward movement after leaving the channel as in this case.

Looking the other way, you can see that when the trend reverses, we first have support at the level of $ 1730, but if it is broken, the ETH price may continue to fall and return to a strong support zone from $ 1480 to $ 1380.

It is worth paying attention to the MACD and RSI indicators because you can see how in the 4H interval we have gone beyond the upper limits of the ranges, which may translate into visible price consolidation on the chart in order to cool the situation.

SOLANA → Pre-breakout consolidation relative to 136.00BINANCE:SOLUSDT relative to the range support forms a false breakdown. The market reacts quite positively and the price recovers, forming a consolidation in front of strong resistance

Bitcoin is also in consolidation, as well as SOL, in general the movements coincide, but lately bitcoin is leading relative to the stock market.

SOL is in consolidation in front of a strong resistance level at 136.00. The primary test may end with a small correction to 0.5 fibo, or consolidation near the level, but a breakout and price consolidation above the current consolidation will be a positive signal for continued growth. The global trend reversal is out of the question, we are aiming at local targets, such as 140, 147, 152.

Resistance levels: 147,152

Support levels: 129, 123, 111

In general, the global market situation is bearish, the local situation is neutral as the price is in a sideways range. A false breakdown was formed against the support of the current range. Technically, due to liquidity imbalance (after the false breakdown) the price may head towards such zones as 147 - 152

Regards R. Linda!

GBPUSD → A false breakout can trigger a correction FX:GBPUSD is strengthening as part of the rally associated with the fall in the dollar index, but there is a technically strong resistance zone ahead that could trigger a correction...

The dollar index, due to US politics, desire for lower interest rates, tariff war, continues its decline, giving an advantage to the currency pairs of the main basket.

Against this background, the pound sterling is strengthening and is ready to test the key resistance at the moment: 1.343. The huge pool of liquidity, accumulated behind this area may not let the price up at the first time. The last test and confirmation of this level was half a year ago.

Resistance levels: 1.343

Support levels: 1.3292, 1.3207

A sharp approach to resistance, a false breakout without the possibility of growth continuation and consolidation below the resistance 1.3430 may provoke a correction in the imbalance zone or liquidity 1.3292.

Regards R. Linda!

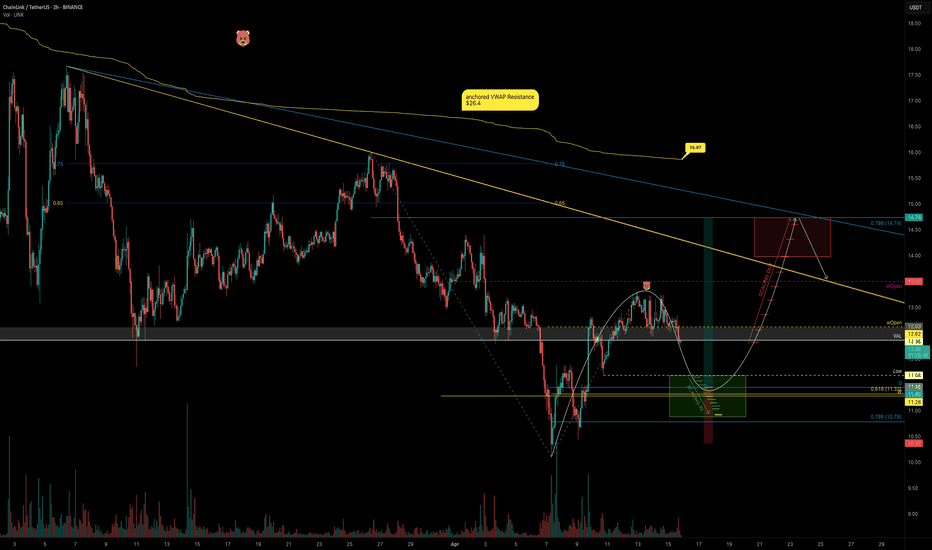

Panic Selling LINK? Here’s Your Master PlanBuckle up! LINK has been riding a relentless bearish trend for 113 days, ever since it kissed its peak of $30.94 back in December 2024. With economic uncertainty casting a shadow over the markets and fear gripping investors, the big questions loom: Is this the dip to buy while others panic-sell? Or is it wiser to sit on the sidelines? Let’s slice through the noise, dissect LINK’s chart like a seasoned pro, and uncover the setups that could turn this chaos into opportunity. Let’s dive in!

The Big Picture: LINK’s Bearish Blueprint

LINK is currently trading at $13, a far cry from its yearly open of $20. April has kicked off, and LINK has already surrendered the monthly open at $13.5, a critical level now acting as a brick wall overhead. Zooming out, the trend is unmistakably bearish: lower highs and lower lows dominate the chart. Adding fuel to the fire, LINK is languishing below the Point of Control (POC) at $14.32, derived from a 1.5-year trading range. This is a market screaming caution for bulls and whispering opportunity for bears, at least for now.

But charts don’t lie, and they’re packed with clues. Let’s map out the key levels, pinpoint trade setups, and arm ourselves with a plan that’d make even the most seasoned traders nod in approval.

Resistance Zones: Where Bears Sharpen Their Claws

1.) Resistance - The Golden Pocket ($13.6 - $13.7)

Using the Fibonacci retracement tool on the latest downward wave, the golden pocket (0.618 - 0.65 Fib) aligns beautifully with the monthly open at $13.5. Oh wait there’s more, this zone overlaps with a Fair Value Gap (FVG), making it a magnet for price action.

Trade Setup (Short):

Entry: ~$13.5 (if price tests and rejects this zone).

Stop Loss (SL): Above the recent swing high at $14.4.

Take Profit (TP): First target at $11.85 (swing low), with a stretch goal at $11.

Risk-to-Reward (R:R): A solid 2:1.

The Play: If LINK crawls up to this resistance and gets smacked down, bears can pounce. Watch for rejection candles (e.g., shooting star, bearish engulfing) to confirm the move.

2. Key Resistance - Cloud Edge & VWAP ($15.74 - $16.5)

The Cloud edge of my indicator sits at $15.74, while the anchored VWAP (from the $26.4 high) hovers at $16.5. A break above $16.5 would flip the script, snapping the bearish structure and signaling a potential trend reversal.

Bullish Scenario: If bulls reclaim $16.5 as support, it’s a green light for a long trade. Until then, this is a fortress for bears to defend.

The Play: No bullish setups here yet.

Support Zones: Where Bulls Build Their Base

1.) Support - Swing Low ($11.85)

This is the first line in the sand for bulls. A potential Swing Failure Pattern (SFP), where price dips below $11.85, sweeps liquidity, and reverses—could spark a long trade.

The Play: Watch for a bullish reversal candle or volume spike here.

2.) Major Support Cluster - The Golden Zone ($10 - $11.85)

This is where the chart sings a symphony of confluence:

Swing Low: $11.85.

POC: $11.33 (1.5-year trading range).

Monthly Level: $11.02.

Fib Retracement: 0.886 at $10.69 and 0.786 (log scale) at $10.77.

Psychological Level: $10.

Trade Setup (Long):

Entry: Dollar-Cost Average (DCA) between $11.85 and $10.

Stop Loss (SL): Below $10

Take Profit (TP): First target: $13.5 (monthly open), stretch goal: $20 (yearly open).

Risk-to-Reward (R:R): A monstrous 6:1 or better, depending on your average entry. This is the kind of trade we are looking for!

The Play: Patience is key. Wait for confirmation—think bullish engulfing candles, a surge in volume, or positive order-flow momentum. This isn’t a “hope and pray” trade; it’s a calculated ambush on the bears.

Market Structure: Bears Rule, But Bulls Lurk

Right now, LINK’s chart is a bear’s playground—lower highs, lower lows, and no bullish momentum to speak of. The $16.5 VWAP is the line in the sand for a trend shift, but until then, short trades take priority. That said, the $10 - $11.85 support zone is a coiled spring for bulls. If fear drives LINK into this range, it’s time to load the boat with longs—provided confirmation aligns.

Your Trading Edge

LINK’s 113-day bearish descent is a wild ride, but it’s not random chaos—it’s a roadmap. Bears can feast on rejections at $13.5 - $13.7 with a tidy 2:1 R:R short. Bulls, meanwhile, should stalk the $10 - $11.85 zone for a high-probability long with a 6:1+ R:R payoff. Whether you’re scalping the dips or swinging for the fences, these levels give you the edge to trade with confidence.

So, what’s it gonna be? Short the resistance and ride the wave down? Or stack bids at support and catch the reversal of a lifetime? The chart’s laid bare—now it’s your move. Drop your thoughts below, and let’s conquer this market together!

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know, I’m here to break down the charts you want to see.

Happy trading =)

LINK’s Swing Setup Could Push Past $15LINK bounced right off the $10 mark, charging upward toward the monthly open before slamming into resistance around $13.25. But now what?

Let’s break it down — because the next high-probability setup is taking shape, and it’s one you don’t want to miss.

The Current Situation:

LINK is:

Below the Point of Control (POC) of this trading range (~$11.35).

Below the monthly open at $13.5.

Still in a bearish trend on the 4H, showing lower highs.

Facing decent rejection from the monthly level.

We’re currently trading below the weekly open at $12.62, now sitting right on the Value Area Low (VAL) at $12.36. That puts us in a precarious spot and sets the stage for the next move.

Bearish, bearish, bearish. When bullish sir? Staying patient and waiting for a real shift in market structure is key.

The Bearish Play: Liquidity Grab Incoming?

There’s a liquidity pocket waiting below at $11.68, the most recent swing low. If LINK loses VAL and bearish pressure kicks in, this becomes the next logical target.

But here's where things get interesting...

The Bullish Setup: Confluence-Backed Long Opportunity

This isn’t just any random support zone — there’s a perfect confluence stack forming:

Swing low: $11.68

Daily support level: $11.45

Weekly support level: $11.28

POC of trading range: ~$11.35

0.618 Fibonacci retracement lands in this zone as well

That’s four layers of support in one tight cluster. This is where we want to scale into longs.

The Play: Scaling In

Entry: Ladder long positions from $11.68 down to the 0.786 fib (near $11.2)

Stop Loss: Below $10.35 for invalidation

Target: 0.786 fib retracement of the previous downward wave at ~$14.5

R:R: Approx. 3:1, with a potential +30% gain

The trend remains bearish but the chart is setting up a prime reversal zone. Patience is key here.

🔔 Set alerts. Watch for volume spikes. Look for SFPs or bullish engulfing candles etc.

The next move on LINK could offer one of the best swing setups especially since this trade could extend past the $15 mark, putting you ahead of the curve.

💬 Found this helpful? Drop a like and comment below. Want TA on another coin? Let me know and I’ll break it down for you.

Happy trading everyone! 💪

ETHEREUM | 1H | IMPORTANT LEVELS AND MY TARGETHey there, my dear friends!

I’ve taken a deep dive into BINANCE:ETHUSDT just for you. If it breaks above the 1,693 level, the next target will be 1,800.0. On the flip side, a key support level sits around 1,473.0.

All I ask in return is your support through likes — it really means a lot!

Big thanks to everyone showing love and support with those likes!

Ethereum Hits Support – Time to Load Up?🎢 The Great 112‑Day Drop

What happened? Over the past 112 days, ETH tumbled –66%, sliding from $4109 down to $1383 and oh yeah, it even poked its nose below the January 2018 all-time high. 7 years ago!

Support Zone: 0.786 + Volume Profile

0.786 Fib: $1,570.85 (drawn from the 2022 low $870.80 to that $4109 high).

5‑Year POC: $1565

Hold Tight: For 2 weeks, the 0.786 level has acted as support, bouncing price right back up.

Sell in May and go away? Rather buy in May and grab some gains on the way?

Trade Blueprint: Your Ethereum Game Plan

Entry Zone: $1570.85

Stop Loss: Below $1369.79

Profit Targets: $1800, $2000 ,$2500, $3000

Risk/Reward: Risk ≈13%, Reward ≈91%, a solid 7:1 R:R

DCA

Missed the perfect entry? No drama... dollar‑cost average between $1700 and $1500.

Keep an eye on the monthly open at $1822. Bulls need to break this resistance zone.

Bottom Line

Ethereum’s –66% dive has handed us a golden ticket at the 0.786 fib and 5‑year POC. This is one of those “buy the dip” moments.

________________________________

💬 Found this helpful? Drop a like and comment below. Want TA on another coin? Let me know and I’ll break it down for you.

Happy trading everyone! 💪

BTCUSD | 1H | IMPORTANT LEVELSHey There;

I’ve prepared a fresh Bitcoin analysis just for you.📈

Key resistance levels for Bitcoin are 85,892.00 and 86,192.00, while the support level stands at 83,190.00.⚠️

If Bitcoin breaks above the 86,192.00 level, the next target could be around 88,860.00.📣

I truly care about you all, and keeping you informed is something I see as my responsibility.🥰

Wishing you an amazing day ahead!💙

GOLD → Correction after reaching 3500. What's next?FX:XAUUSD updates high to $3,500 amid Trump's attacks on the Fed, we are still in the aggressive trend phase. North train makes a small stop which may give us a chance to trade...

Investors are fleeing to safe-haven assets amid an escalating US-China trade war and Trump's verbal attacks on Fed chief Powell.

Trump is blaming the Fed for the slowing economy and demanding immediate rate cuts, which is undermining confidence in the dollar and boosting demand for gold.

3500 is a psychologically important target and once it is reached, traders have moved to profit-taking, which could lead to a small correction...

Resistance levels: 3475, 3500

Support levels: 3441, 3408, 3385

As part of the correction, the price may test 3440, or 3410. The trend is aggressively bullish and sales should not be considered. The ideal scenario would be liquidity capture relative to 3410 and rebound or continuation of growth, as the fundamental background is on the side of gold....

Regards R. Linda!

POLUSDT → Rally for liquidity accumulation before the fall?BINANCE:POLUSDT.P is currently inside the trading range forming a counter-trend rally within the global downtrend. There is a rather strong liquidity zone ahead....

The distribution is formed after consolidation inside 0.1929 - 0.175. The realization phase can be stopped in the zone 0.228 - 0.2438. This will be confirmed by a stop and a false breakout.

The market is still weak, despite the local growth of bitcoin, as the flagship on the daily timeframe is still trading in the selling zone and based on the current situation we can conclude that the market is forming a collection of liquidity before the continuation of the fall.

Technically, the current rally in POL may end with a false breakout of 0.2284 or 0.2438 followed by a correction or reversal.

Resistance levels: 0.2284, 0.24388, 0.2465

Support levels: 0.2061, 0.1929.

If the price continues to approach this resistance with such speed, at some point the potential and energy may be exhausted and it will not be enough to continue the movement. In this case, we can catch a correction or even a reversal to continue the global trend.

Regards R. Linda!

Waaree Energies Ltd (WRTL)🛒 Buy Recommendation

Buy Zone: ₹2,180–₹2,230

The stock is trading close to a support zone near the 23.6% Fib level (₹2,305) and trying to break out of the falling trendline.

RSI has bounced from the oversold region and is near 50, indicating a possible reversal.

🎯 Targets (Short to Medium-Term)

Target 1 – ₹2,585 (38.2% Fibonacci level)

Target 2 – ₹2,810 (50% Fibonacci level)

Target 3 – ₹3,036 (61.8% Fibonacci level – major resistance)

Swing Target – ₹3,766 (100% Fibonacci level – recent high)

🛑 Stop Loss

SL: ₹2,050 (Below recent swing low & below trendline support)

Risk is around ₹180 from entry; ideal for a reward of 1.5x–3x on targets.

🔎 Additional Technical Signals

Volume: Increasing volume on green candles shows buying interest.

RSI: Forming a bullish divergence and heading upward.

Breakout Point: A daily close above ₹2,305 would confirm a breakout of the trendline and strengthen the bullish case.

for educational purposes only

GOLD → The rally continues. Waiting for correction to tradeFX:XAUUSD supported by the weakness of the dollar and increased trade tensions between the U.S. and China continues to renew highs. At the moment the market is testing 3400...

After Friday's pullback caused by profit taking, the demand for gold rose again - investors are looking for protection amid the threat of recession in the U.S. and instability in the markets. Additional pressure on the dollar is exerted by the threat to the independence of the Fed, after statements about the possible resignation of Jerome Powell.

It is not worth buying at the highs. Technically, against the background of the uptrend, the market can take a break in the form of a pullback. A bounce from support or a false breakdown of the liquidity zone may provide a good opportunity to enter the market

Resistance levels: 3400, 3410, 3430

Support levels: 3369, 3357, 3344

Undoubtedly, based on the overall fundamental situation, gold is absorbing capital as a safe haven and can continue its growth for a long time. But we should keep an eye on the situation between the US and China, as well as in Eastern Europe. Any de-escalation of the conflict may lead to a correction.

For trading now it is worth waiting for a correction to the above mentioned support levels to find a trading opportunity.

Regards R. Linda!

BITCOIN → Retest 86190. There are chances for growthBINANCE:BTCUSD is starting to show positive signs, but it is too early to talk about a change in the downtrend or a bullish rally. Strong resistance ahead....

Against the background of everything that is happening, from a fundamental point of view, bitcoin in general has withstood the blows quite well and is gradually beginning to recover, but the situation for the crypto community as a whole has not changed in any way, the promises are not yet fulfilled. Bitcoin's strengthening is most likely due to localized growth in indices and discussion of lower interest rates. But the focus is on the tariff war between China and the US, improved relations and lower tariffs could weaken bitcoin.

Technically, we see that the price is moving beyond the resistance of the descending channel. For a few days now, the price has been consolidating in front of the 86190 level, and we have chances to see a rise to the resistance of the 88800 range, from which the future prospects will already depend.

Resistance levels: 86190, 88800, 91280

Support levels: 83170, 78170

The price is slowly approaching the resistance 86190, consolidating without updating the local lows, forming a pre-breakout consolidation. There is a probability of a breakout attempt. Breakout and consolidation of the price above 86190 may give a chance to rise to 88800.

But, regarding 88800 we will have to watch the price reaction. A sharp approach with the purpose of primary testing of the level may end in a false breakout and correction....

Regards, R. Linda!

Will BTC emerge from the local downtrend channel on top?Hello everyone, let's look at the 1D BTC to USD chart, in this situation we can see how the price is moving in a downtrend channel in which we can currently observe an attempt to exit on the top. In such a situation, it must be borne in mind that often exiting the channel gives energy for growth close to the height of the channel itself, which in this situation could give a valuation in the region of $ 100,000 for 1 BTC.

However, before this happens, the price must positively exit the channel and break the first resistance line at $ 88,800, and then a significant level at $ 94,200.

Looking the other way, when the price bounces off the upper boundary of the channel and starts to fall again, we have a visible support zone from $ 85,150 to $ 83,000, and then a second very strong zone from $ 77,200 to $ 74,100.

GOLD → Recovery after the FB of 0.5 fibo. What's next?FX:XAUUSD on Thursday tests 0.5 fibo, which I outlined to you on April 17, forms a false breakdown and recovers amid unstable geopolitical relations in the world. Price may continue its northward run.

The dollar continues to fall. The fundamental background depends on the relationship between the US and China as well as economic data especially after Powell's speech. The weekly session closes close to support, the decline may continue.

Gold after the shakeout is heading back north. Based on the fundamental background, the price may continue to rise. There are three days of downtime ahead as traders rest.

Fundamentally, anything can happen over the weekend, however, technically, the emphasis is on intermediate levels. The trend is still strong and bullish

Resistance levels: 3332, 3344, 3357

Support levels: 3313, 3288, 3284

If nothing supernatural happens over the weekend, gold in the Asian session may bounce off the nearest resistance and test trend support before continuing the uptrend. If there are any critical changes in the mood of countries/politicians then I will update the situation

Regards R. Linda!

I started this analyses Aug 2022. Now I think HEY can grow to 60After the price breaks € 40, the way is open to grow to € 60.

Ofcourse, with ups and downs in between. Never a straight line.

I strarted my analyses August 2022 and since then, I had almost every movement right.

I advise to work with options on this beside stocks.