Fibonacci Retracement

$ETH 2nd Weekly Close Above 50MA = Alt Season2nd Consecutive Weekly Close

above the 50MA for CRYPTOCAP:ETH

✅ Volume to confirm the breakout.

✅ RSI has bottomed.

WHAT TO WATCH 👀

┛Bullish Cross on the 20/50MA to confirm the next leg up.

┛Approaching some resistance ahead at the .236 Fib

┛Expect a small pullback in the next week or two so make sure to get your bids in.

Remember the rotation:

✅ BTC > ✅ ETH > Large Caps > Mid Caps > Micro Caps.

SOL/USD 4H📉 Price

Current price: approximately $183–$184

We see a decline from the resistance zone around $194.56. The price has broken through support at $187.31 and is heading towards lower support at:

🔴 $183.18 – local support (being tested now),

🔴 $175.58 – key support (potential target if current support breaks).

📊 Market structure

Short-term trend: Downtrend (lower highs and lower lows after a rebound from $194.56).

Volume: Increased volume on bearish candles – confirming supply pressure.

Previous trend: Uptrend with strong momentum from July 18th to July 21st.

🔁 Technical Levels

Resistance:

🟢 USD 187.31 – last broken support, now acting as resistance.

🟢 USD 194.56 – strong resistance (tested twice).

🟢 USD 206.43 – local high, strong resistance level from higher timeframes.

Support:

🔴 USD 183.18 – currently being tested.

🔴 USD 175.58 – stronger support from lower swing highs.

📉 Stochastic RSI

Located in the oversold zone (<20) and pointing down.

No upside crossover yet → no buy signal yet.

If a reversal occurs, a technical rebound is possible.

📌 Conclusions and Scenarios

🔻 Downside scenario (more likely currently):

Breakthrough of support at $183.18 ➜ further decline to $175.58.

Potential entry into a correction of the entire upward movement from July 18-21.

🔺 Upside scenario (alternative):

Support at $183.18 held + Stoch RSI signal ➜ rebound to $187.31.

If buying volume increases, a retest of resistance at $194.56 is possible.

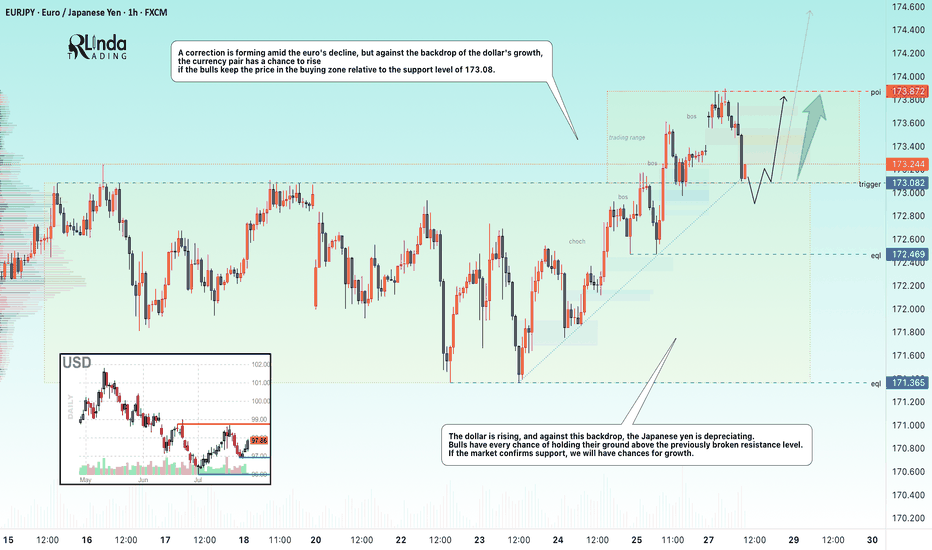

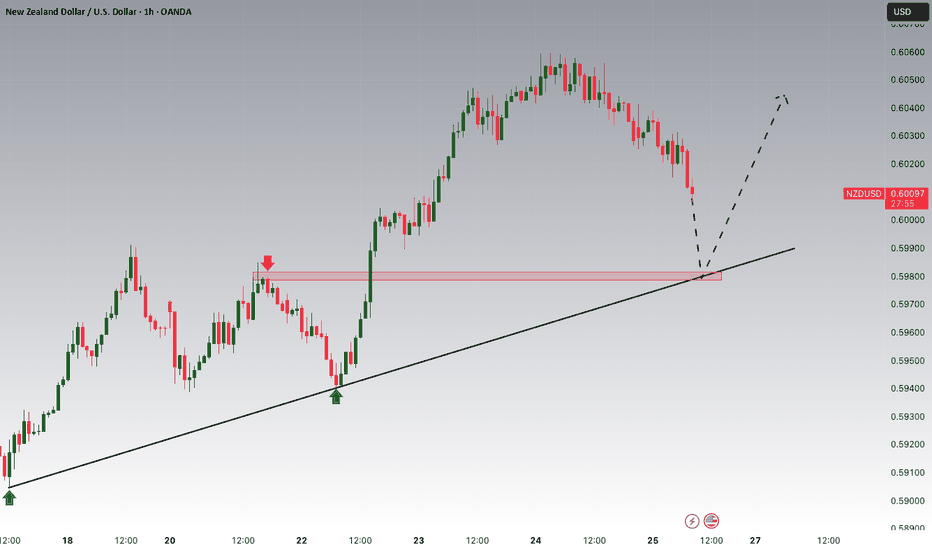

EURJPY → Retest support before growthFX:EURJPY has been correcting since the opening of the European session. The movement was triggered by yesterday's news related to the trade deal between the US and Europe...

EURJPY is reacting to news related to the deal between the US and Europe. A correction is forming amid the fall of the euro, but against the backdrop of the dollar's growth, the currency pair has a chance to rise if the bulls keep the price in the buying zone relative to the support level of 173.08.

The dollar is rising, and against this backdrop, the Japanese yen is falling. Bulls have every chance of holding their ground above the previously broken resistance. If the market confirms support, we will have chances for growth.

Resistance levels: 173.87

Support levels: 173.082, 172.47

The currency pair may form a liquidity trap relative to the previously broken consolidation resistance. A false breakdown of support and price consolidation in the buying zone (above 173.1) could trigger further growth.

Best regards, R. Linda!

ETH/USDT 4H Chart📊 General Context

Ethereum is rising in a strong short-term uptrend, supported by a rising trendline (orange).

Current price: 3831 USDT

We are approaching a significant resistance level around 3842–3850 USDT (green line).

Technical support is located around 3760 USDT (previous consolidation level and 50/200 SMA).

🔍 Technical Levels

Resistance:

3842–3850 USDT – local high, currently being tested.

4006 USDT – key psychological level and the last local high on the chart.

Support:

3762 USDT – previous resistance, currently turned into support (may be tested in a correction).

3650 USDT – strong technical support, confirmed several times in the past.

SMA50 and SMA200 – currently just below the price, also acting as dynamic support.

📈 Technical Indicators

MACD:

The histogram is rising and positive → bullish momentum.

The MACD line crosses the signal line from below → a buy signal.

RSI (14):

Currently: around 64 → not yet overbought, but close to the overbought zone.

Slightly rising trend, but may suggest impending market overheating with further gains.

🧭 Trend

Short-term: strong uptrend (trend line, green candles, breakout from consolidation).

Medium-term: higher lows and higher highs – the uptrend is maintained.

The price is holding above the 50 and 200 SMAs – confirming bullish sentiment.

⚠️ What to watch next?

A 4-hour candle close above 3842 USDT → confirmation of a breakout, a potential attack on 4000–4010 USDT.

A break of the trend line (orange) → a possible correction to 3760 or even 3650 USDT is possible.

An RSI rise above 70 → an overbought signal, a possible pullback or consolidation.

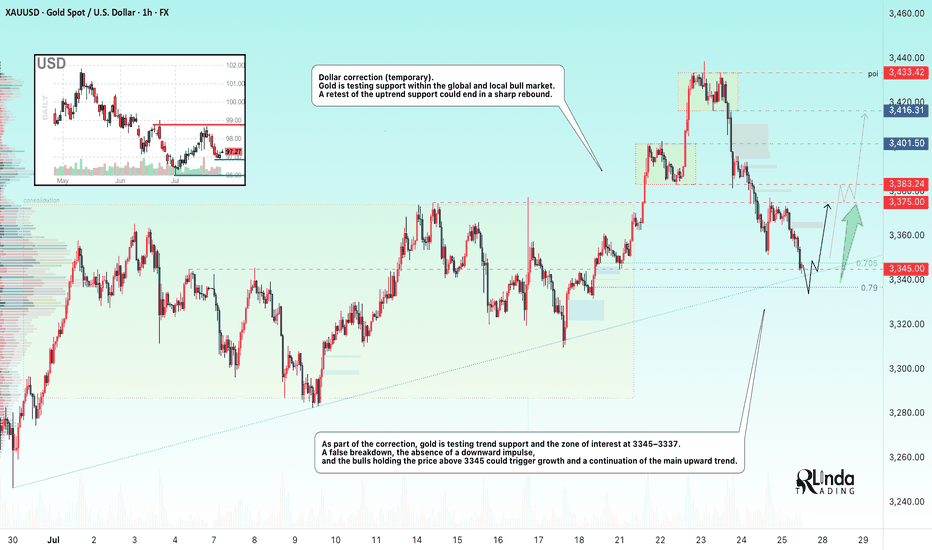

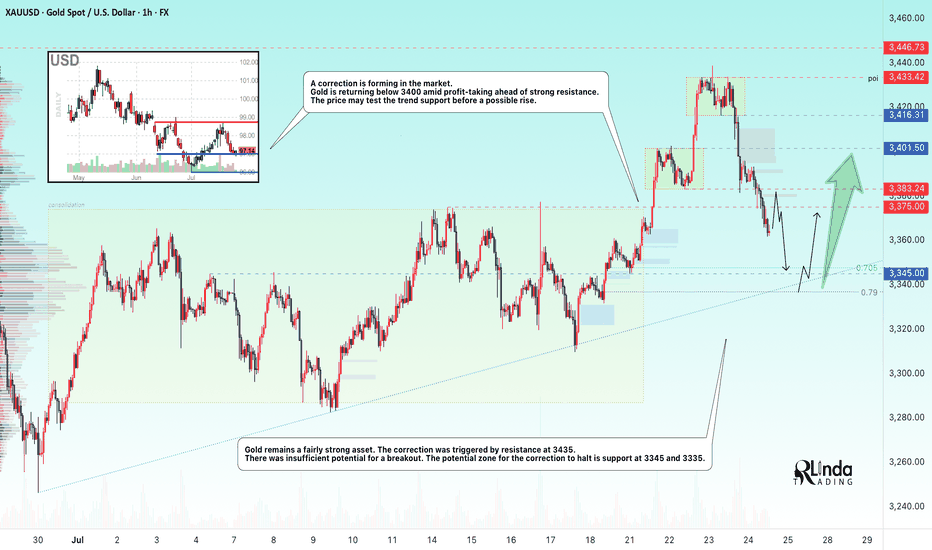

GOLD → Countertrend correction, retest of 3345 before growthFX:XAUUSD , undergoing a deep correction after a false breakout of local resistance at 3433, has reached the support of the upward trend. Will the bulls be able to maintain the trend?

Gold held below $3,400 on Friday, rebounding from $3,350, and is poised to end the week higher. Investors are watching the conflict between Thailand and Cambodia, which is boosting demand for safe-haven assets, and are also awaiting decisions from the Fed and the Bank of Japan next week. The markets received additional support from US trade deals with Asian countries and progress in negotiations with the EU, easing fears of a tariff war.

As part of the correction, gold is testing trend support and the 3345-3337 zone of interest. A false breakdown, lack of downward momentum, and bulls holding prices above 3345 could trigger growth and a continuation of the main upward trend.

Resistance levels: 3375, 3383

Support levels: 3345, 3337, 3330

Technically, the support level of 3345 plays a fairly important role in the market. If, during the correction, the bulls manage to hold their ground above this zone, the prospects for recovery will be high, especially against the backdrop of geopolitical problems.

Best regards, R. Linda!

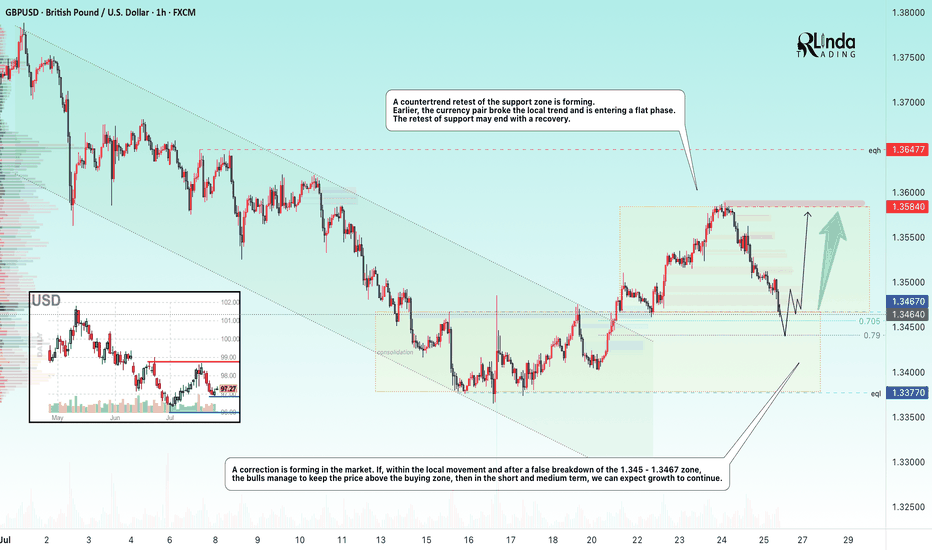

GBPUSD → Retest of previously broken resistance...FX:GBPUSD has entered a correction phase after breaking through the local downtrend. If the price remains in the 1.3450–1.346 zone, this will confirm the formation of a new trading range...

The market is entering a correction phase due to the dollar. A countertrend retest of the support zone is forming. Earlier, the currency pair broke the local trend and is entering a flat phase. The retest of support may end with a recovery. If, within the local movement and after a false breakout of the 1.345 - 1.3467 zone, the bulls keep the price above the buying zone, then in the short and medium term, we can expect growth to continue.

Support levels: 1.3467, 1.345

Resistance levels: 1.35, 1.3584

A false breakdown of support at 1.3467 will confirm a change in the local trend (correction). The market may return to the recovery phase of the global trend.

Best regards, R. Linda!

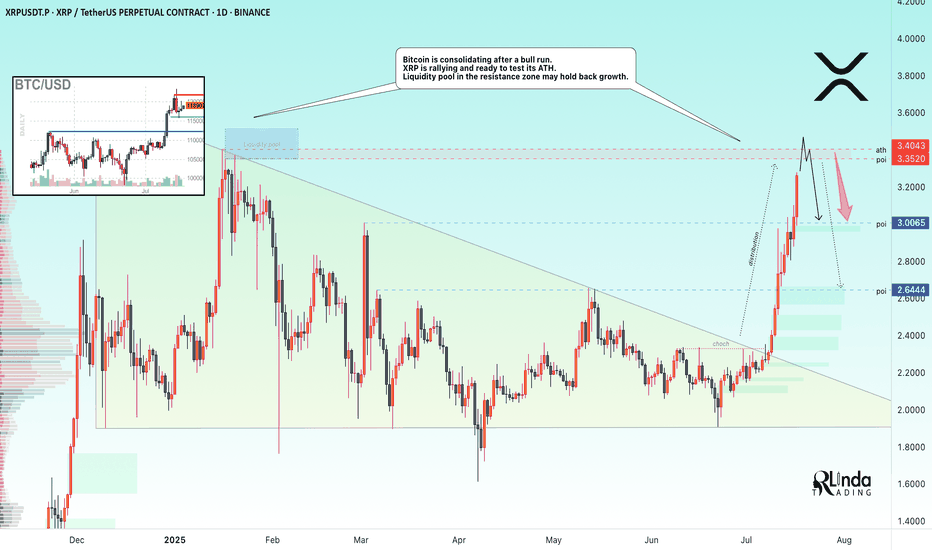

XRP → ATH retest. Reversal or continued growth?BINANCE:XRPUSDT.P is rallying and ready to test the resistance zone - ATH. Against this backdrop, Bitcoin is consolidating after a bull run. The liquidity pool may hold back growth.

Fundamentally, there is excitement across the entire cryptocurrency market. Altcoins are rallying after Bitcoin hit a new high and entered consolidation. The BTC.D index is declining, which generally provides a good opportunity for altcoins to grow. However, the index is approaching technical support, which may affect market sentiment overall...

As for XRP, there is a fairly strong liquidity pool ahead — the ATH resistance zone. The price is in a distribution phase after a change in character and a breakout of the downtrend resistance in the 2.33 zone. The momentum may exhaust its potential to break through the 3.35-3.34 zone, and growth may be halted for correction or reversal (in correlation with Bitcoin's dominance in the market).

Resistance levels: 3.35-3.40

Support levels: 3.0, 2.64

A breakout of resistance without the possibility of further growth, a return of the price below the level (i.e., inside the global flat) will confirm the fact of a false breakout of resistance, which may trigger a correction or even a reversal.

Best regards, R. Linda!

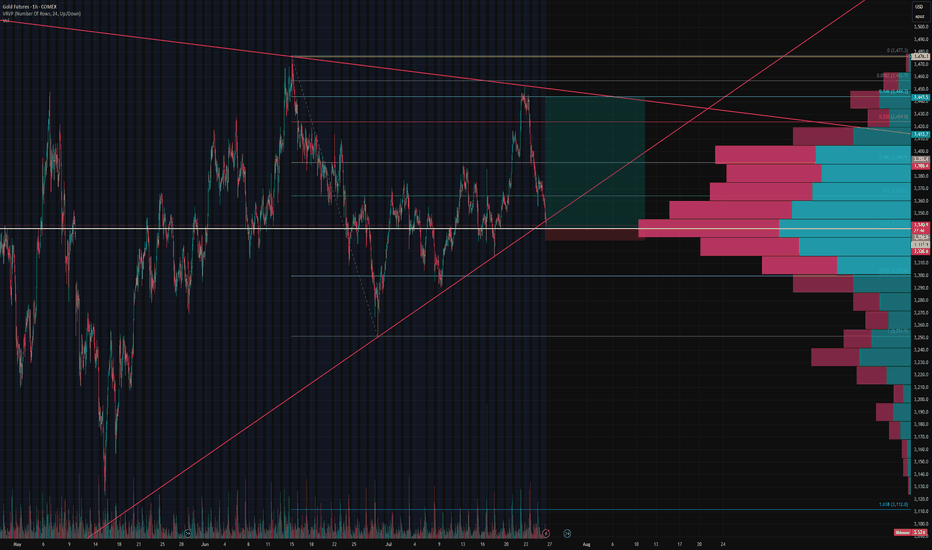

Gold Futures Update – 0.5 Fib Stop Hit, Eyes on 0.618 ConfluenceGold Futures Update – 0.5 Fib Stop Hit, Eyes on 0.618 Confluence

Our initial long setup at the 0.5 Fibonacci retracement level has been stopped out, but the structure remains constructive.

Price is now approaching a key confluence zone at $3,336 , where:

The 0.618 fib retracement from the recent swing low to high aligns perfectly,

The ascending trendline support (respected multiple times since May) intersects, and

The oint of Control (POC) from the visible volume profile shows dominant volume transacted.

This area represents a high-probability support level where bulls may attempt to defend again. We’re monitoring for reaction and potential entry signals around this level. A break below would invalidate the rising wedge structure and shift bias toward lower fib extensions.

GOLD → Countertrend correction. Where will growth begin?FX:XAUUSD faced pressure in the 3430 zone, traders moved into profit-taking mode, triggering a correction. The price entered the sell-off zone...

On Thursday, gold is trading below $3400 as traders assess progress in US-EU trade talks and await preliminary PMI data from the US and the EU. These indicators could influence expectations for Fed and ECB rates. Optimism is being bolstered by reports of trade agreements between the US and Japan and other countries. The ECB is expected to keep rates unchanged, while the probability of a Fed rate cut in September is estimated at 60%. Investors are also watching Trump's conflict with Powell amid his visit to the Fed. Technically, the daily market structure is not broken, and a correction is forming within acceptable limits.

Based on the current direction, the market may test the intermediate bottom: trend support, the 3345-3320 area.

Resistance levels: 3375, 3383, 3400.

Support levels: 3345, 3320

A retest of resistance at 3375-3383 is possible. If the bears keep the price below this zone, the metal may continue its correction phase towards the zone of interest indicated on the chart. Local sell-offs have not yet broken the bullish daily structure.

However, the absence of a downward impulse and consolidation in 3375 - 3383 with a subsequent breakout of local resistance could increase demand again, which would generally lead to premature growth to 3400 - 3435.

Best regards, R. Linda!

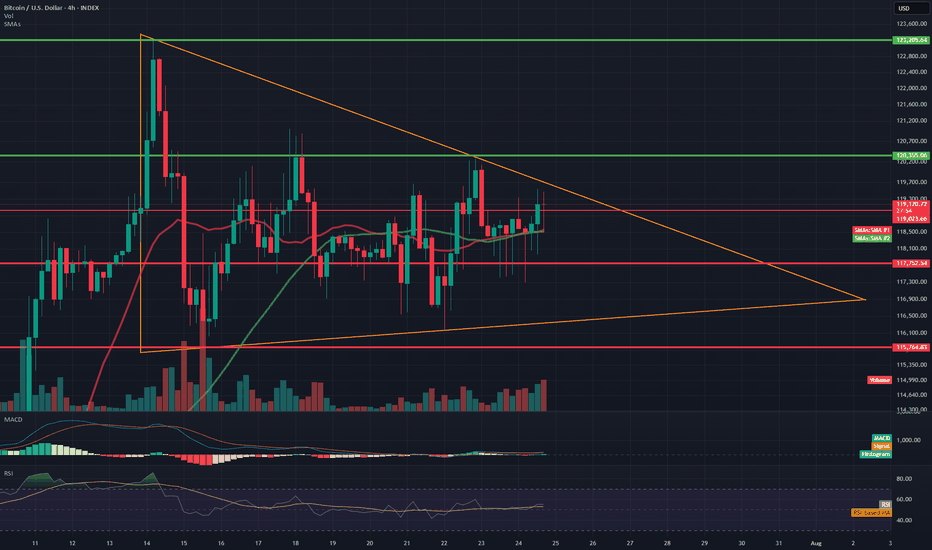

BTC/USD 4H Chart Review📊 Technical Structure (Symmetrical Triangle)

Formation: The symmetrical triangle (orange lines) remains intact—price continues to move within it.

Approaching the apex: The closer to the intersection of the triangle's arms, the greater the probability of a breakout. The current candle is testing the upper boundary of the formation (around $119,300), but has not yet broken it.

Direction: The formation is neutral, but tension is increasing. A breakout of either line (the upper boundary ≈$119,500 or the lower boundary ≈$117,700) could trigger a dynamic move with a range of around $3,000 (the height of the triangle at its widest point).

🧱 Support and Resistance Levels (Red and Green Lines)

Type Level (USD) Description

Resistance 123205 All-Time High – Possible Target After an Upward Breakout

Resistance 120556 Local Resistance – Triangle Breakout Range

Resistance 119200–119300 Currently Tested Level

Support 117752 Lower Triangle Boundary – Critical Defense Line

Support 115764 Next Local Support

📈 Technical Indicators

🔵 RSI (Relative Strength Index)

Currently: ~55 – indicates a neutral situation, having broken down from the overbought level (~74).

Indicates that the market has temporarily cooled down after a previous impulse. There is still room for further upward movement without exceeding 70.

🔵 MACD

The MACD and signal lines are approaching a crossover – if the MACD crosses the signal line upward, it could be a bullish signal.

The histogram is slightly positive – indicating weak but growing bullish momentum.

📊 Volume

Slightly increasing in the last candles – no confirmation of a strong breakout yet, but upward pressure is building.

🧠 Interpretation

Scenario Technical Conditions Movement Objective

🔼 Upward Breakout

Candlestick close above $119,500 USD 122,000–$123,200 USD

🔽 Downward Breakout

Close below 117,750 and confirmed by volume at 115,700, then 114,000 USD

🔄 Consolidation

Inconclusive, continued sideways movement

Between $117,700 and $119,500 USD

✅ Summary

Bitcoin is still in a neutral symmetrical triangle formation but is approaching a turning point.

The RSI has broken out of the overbought range, and the MACD is signaling a potential upside breakout.

Volume confirmation is still lacking, but technical conditions favor the bulls – if it manages to break above 119,500 and hold above, a move towards 122,000–123,000 USD can be expected.

In the event of a rejection, maintaining 117750 will be key; breaking it opens the way to 115700 and below.

XAUUSD - Bullish Direction BiasThe Gold USD market on the 15-minute timeframe shows a notable downtrend followed by a retracement phase. The price is currently moving in a potential reversal structure with key areas marked as possible retracement or continuation points.

The chart highlights multiple potential support and resistance zones, indicated with small orange boxes, which mark anticipated areas for price reactions during the expected short-term moves.

The trading plan anticipates price to move upward towards these intermediate zones sequentially, with each zone acting as a minor resistance before price attempts to continue its bullish retracement. After reaching the higher target zone near 3424, a reversal or new wave is expected to unfold, potentially resuming the downtrend.

This plan emphasizes careful monitoring of price action at these key zones to confirm reversal or continuation signals. Traders should look for confirmation signals like pin bars, candle patterns, or volume clues at each zone before entering the trade.

Risk management involves setting appropriate stops beyond these resistance zones to protect against false breakouts or sudden trend changes.

This approach uses a combination of technical levels, price action confirmation, and careful zone analysis to guide trading decisions in a fast-moving market.

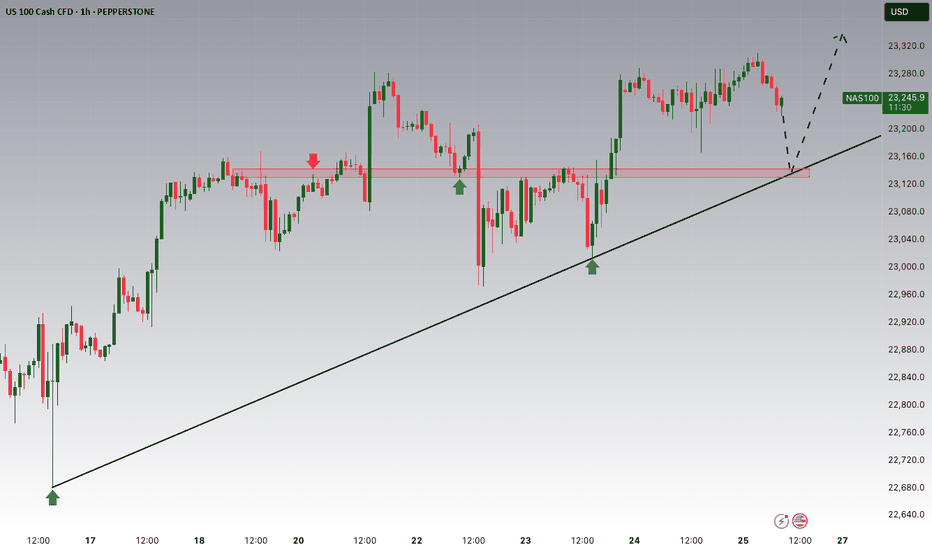

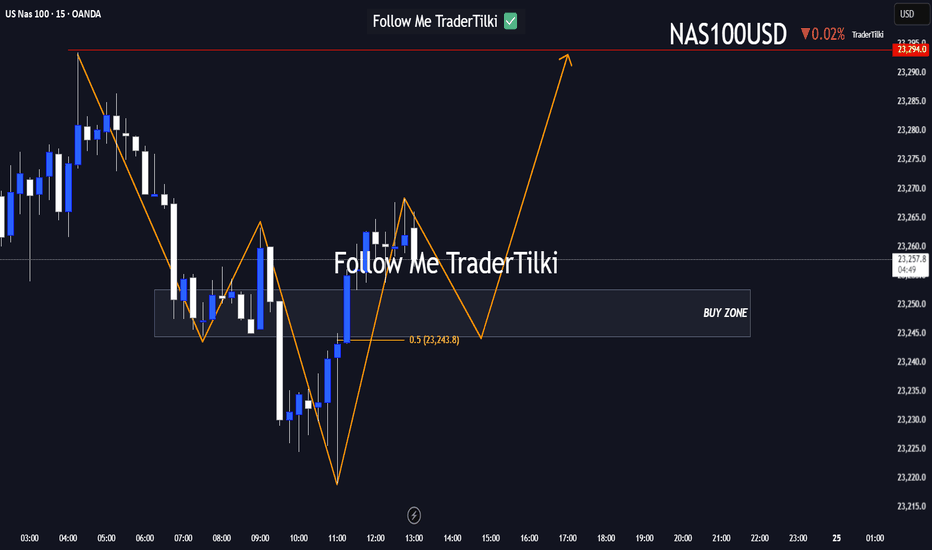

Here’s a fresh Nasdaq100 analysis I’ve put together for you.Hey Guys,

Here’s a fresh Nasdaq100 analysis I’ve put together for you.

I’ve marked the buy zone between 23,252 and 23,240. If price dips into that range, I’m anticipating a potential move upward toward 23,294.

Your likes and support are my biggest source of motivation to keep sharing these insights.

Huge thanks to everyone backing me with a thumbs-up!

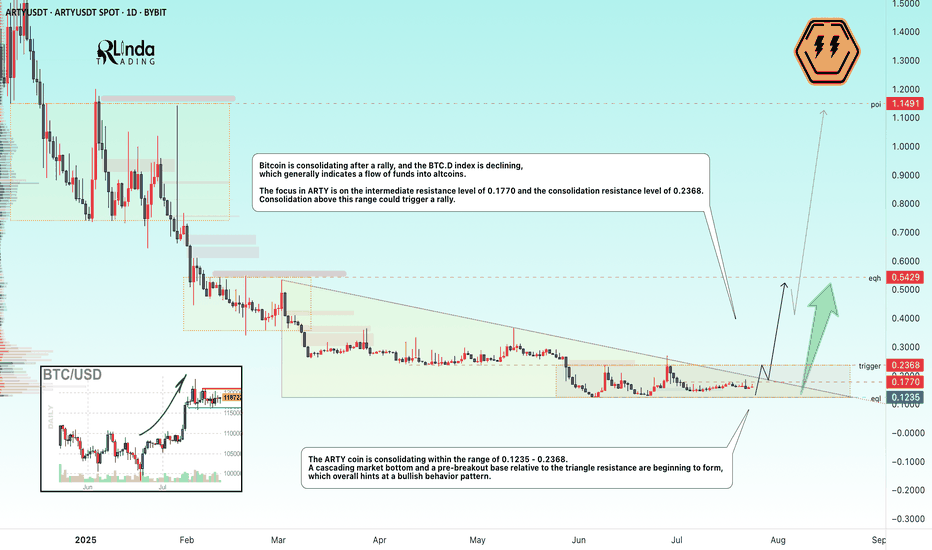

ARTYUSDT → A breakout of resistance could trigger another rallyBYBIT:ARTYUSDT is forming a cascading bottom as part of consolidation before a possible breakout of resistance. The decline in Bitcoin's market dominance gives altcoins a chance.

( (Idea from September 29, 2024!) We previously discussed this coin before its 300% rally. The root causes of its emergence from accumulation and readiness for strong growth were correctly identified).

The dump phase is coming to an end, a cascading market bottom is beginning to form, and a pre-breakout base relative to the triangle resistance is forming, which overall hints at a bullish behavior pattern.

Bitcoin is currently consolidating after the rally, and the Bitcoin dominance index is declining, which generally indicates a flow of funds into altcoins. The situation is such that the altcoin market has another chance for the season. The correction across the entire market may end in the near future, and under favorable conditions (the fundamental background is strengthening, Trump has announced another important event for cryptocurrencies), the market may return to strong movements...

The focus in ARTY is on the intermediate resistance at 0.1770 and the consolidation resistance at 0.2368. Consolidation above this range could trigger a rally.

Resistance levels: 0.2368

Support levels: 0.1235

Technically, a few days ago, the coin tested the consolidation resistance, but the decline did not continue, which generally indicates that buyers are showing interest and holding the market. Consolidation in the near term may end with a retest of 0.1770, 0.2368, a breakout, and further growth.

Best regards, R. Linda!

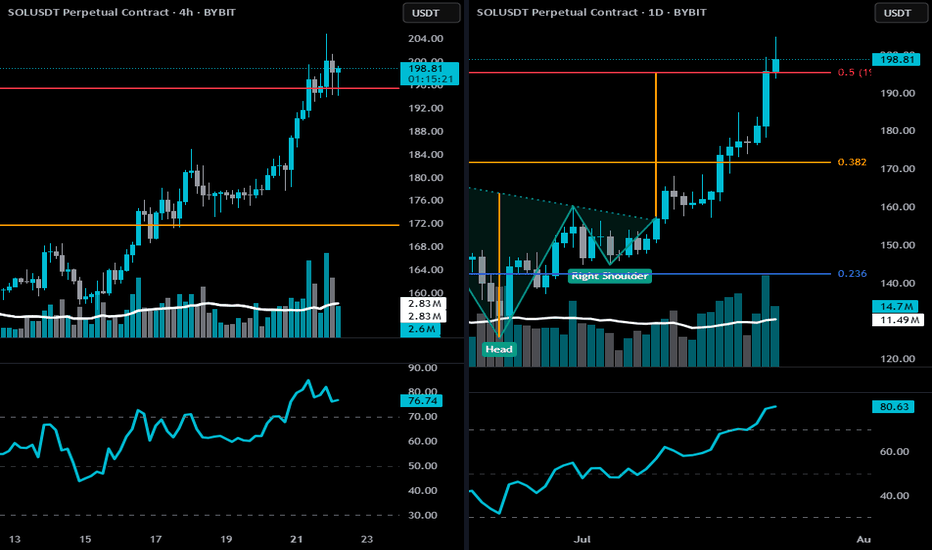

SOL CRUSHING-bearish risks developing🔻 4-Hour Bearish Thesis

🔸 Price Action Clues

SOL is currently stalling at the 0.5 Fibonacci retracement (~$198.18) of the full macro move — a classic profit-taking zone.

Multiple upper wicks and indecisive candles at resistance indicate supply absorption and buyer exhaustion.

After a steep rally, price is moving sideways in a rising wedge/flag, which is a bearish continuation pattern if broken downward.

🔸 Momentum + RSI

RSI at 76 is extended and flattening — often a zone where short-term pullbacks begin.

No confirmed bearish divergence yet, but momentum is weakening compared to earlier stages of the rally.

🔸 Volume Profile

Volume on recent pushes is lower than during breakout, suggesting diminishing bullish conviction.

Bearish if a breakdown below $194 occurs — that's the former breakout level and wedge support.

🧨 4H Breakdown Confirmation

Break below $194 (key short-term support) → opens downside targets:

🔻 $186–$182 (prior breakout base)

🔻 $171 (0.382 Fib retracement zone)

🔻 Daily Bearish Thesis

🔸 Price Action + Key Zone

Price is pressing against the neckline target ($198.18) of the inverse H&S pattern.

Stalling under the red resistance line and 0.5 Fib.

Recent candle closed with a small upper wick + reduced body size, hinting at hesitation after a parabolic run.

🔸 RSI Risk

RSI is at 80.41 — very overbought on daily.

While not immediately bearish on its own, this often precedes either:

Sharp correction, or

Prolonged consolidation

🔸 Fibonacci & Macro Resistance

$198–$200 is a confluence zone of:

0.5 Fib retracement

Previous structural resistance

Measured target of inverse H&S pattern ALREADY HIT.

This is not a great spot to initiate new longs — any weakness here invites a pullback.

⚠️ Invalidation of Bearish Thesis

A strong daily close above $200–$204, ideally with expanding volume, would invalidate the bearish outlook and shift momentum toward $219 (0.618 Fib).

🧠 Summary:

Yes, there is a short-to-mid-term bearish risk developing on both 4h and daily:

Overbought RSI

Stalling at major Fib resistance

Decreasing momentum

Vulnerable if $194–$195 breaks

Remember: this WILL MOST LIKELY BE A SHORT-SHORT pullback, not a confirmed trend reversal… yet. BUT I'VE INITIATED A STARTING POSITION!

THIS IS NOT FINANCIAL ADVICE. DrAnkin Smöökëē Whizkee. Edumacational Purpiz Only!

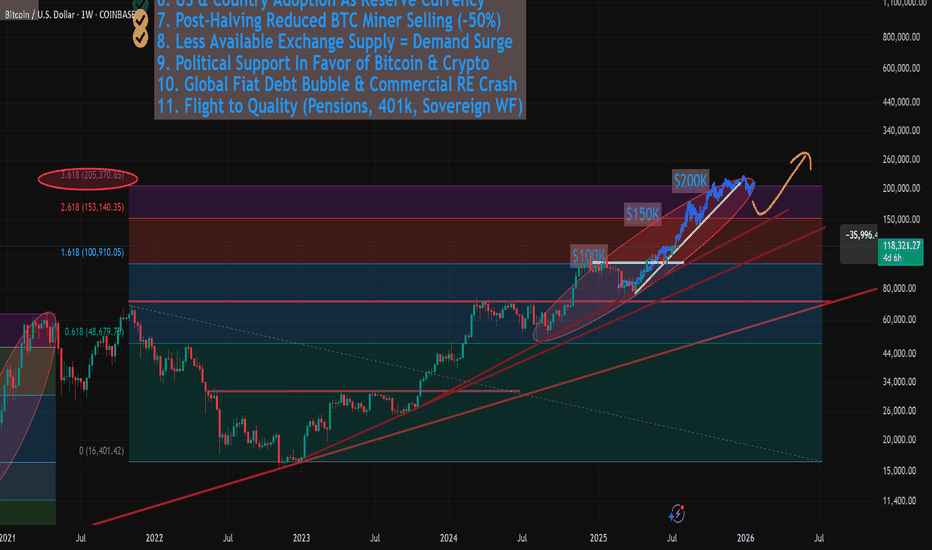

Revsiting $150k - $200k Bitcoin (AND Next Bear Market Bottom)In this video I revisit my 2-year old study showing the potential path for Bitcoin to $150k to $200k and not only how we might get there, but the 11 reasons WHY we can this cycle.

This is the same Fibonacci series that predicted the 2021 cycle high at the 3.618 (Log chart) and used the same way this cycle, with some interesting 2025 forecasts of:

1.618 - $100k

2.618 - $150k

3.618 - $200k

There are quite a few confluences that we get to $150k like the measured moves from both the recent mini bull flag, but also the larger one from earlier this year.

** Also I touch on revisiting my study from 2 years ago where I may have discovered the retracemebnt multiple that correctlty predicted and held the 2022 lowes around $16k. **

It's a VERY interesting number you all will recognize (buy may not agree with).

Let me know what you think.

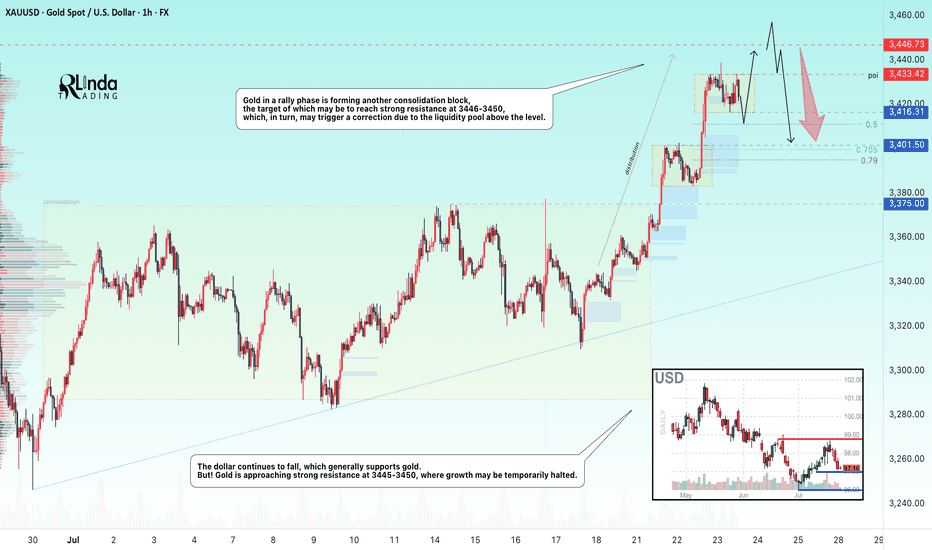

GOLD → Consolidation before the next jump to 3450?FX:XAUUSD continues to rally, with the price updating its local high to 3438 and moving into consolidation, possibly for another jump...

After hitting a five-week high of $3,438, traders are taking a break. Optimism is fuelled by Trump's statements about the largest deal with Japan and negotiations with Canada, but uncertainty about the details of the agreements and political instability in Japan are keeping caution in check. The market is waiting for further signals on trade and political issues, which remain key factors for gold.

Technically, the dollar continues to fall, which generally supports gold. But! Gold is approaching strong resistance at 3445-3450, where growth may be temporarily halted.

Resistance levels: 3433, 3446

Support levels: 3416, 3401, 3375

As part of a local correction, gold may test consolidation support or 0.5-0.7f before continuing to rise. There are quite a few orders in the 3433-3446 zone, and it will be difficult to break through this area to reach the target. Consolidation before this level may help the rise to continue.

Best regards, R. Linda!

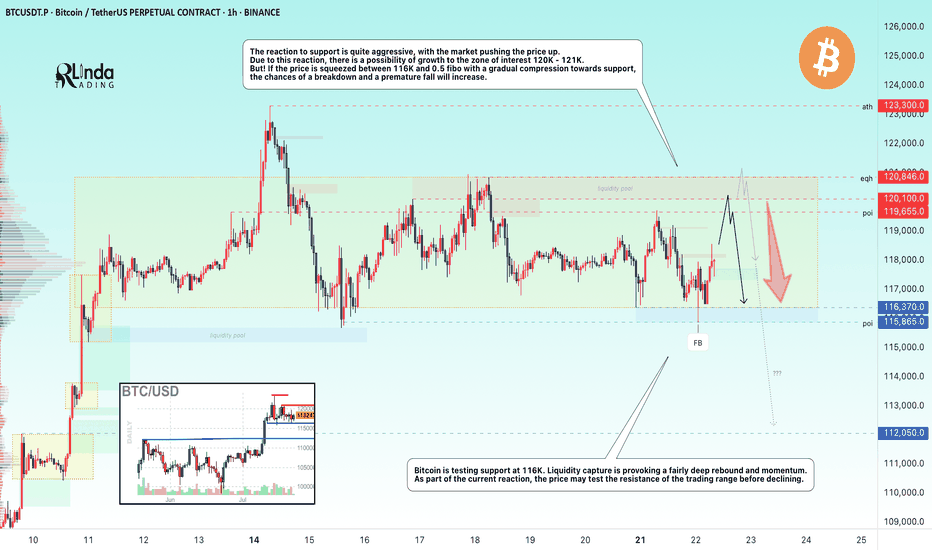

BITCOIN → Consolidation and compression to 116K. Correction?BINANCE:BTCUSDT.P continues to consolidate, with the price testing support at 116K, leaving behind the zone of interest at 120K-121K. Are there any chances for further growth?

(Alternative scenario (if growth to 120K does not occur))

Fundamentally, there is nothing particularly new, and the hype surrounding Bitcoin is stagnating. Technically, on D1, consolidation is underway with pressure from bears against the backdrop of an outflow of funds into altcoins. However, the dominance index is starting to rise, which could trigger some correction in the market. The price on the working timeframe, without updating local highs, is testing lows, and the latest retest of the liquidity zone is provoking a fairly aggressive reaction that could bring the price to retest the zone of interest at 120K-121K.

But! If the price is squeezed between 116K and 0.5 Fib with a gradual squeeze towards support, the chances of a breakdown and a premature fall will increase.

Support levels: 116370, 115860

Resistance levels: 119650, 120100

Technically, the market needs a breather or correction, which is generally a sign of health. The nuance with Bitcoin is that below 115860 there is no support until 112K, and if the market breaks the current consolidation boundary, the further correction could be quite deep. In the current situation, I do not yet see any drivers or reasons for another rally.

Best regards, R. Linda!