AVAX / AVAXUSDT | 1H | Avax will be the rocketHey there;

I have prepared avax analysis for you. All I ask from you is to support this analysis with your likes.

My Avax target level is 22.62 and my stop level is 17.37.

This analysis has a win rate of 2.00

Guys I will update this analysis under this post

Now let's just follow this analysis and see if my analysis is correct or not.

Thank you very much to everyone who has been kind and supported me with their likes.

Thanks to your support, I am constantly preparing special analyzes for you.

I love all my followers very much.

Fibonacci Retracement

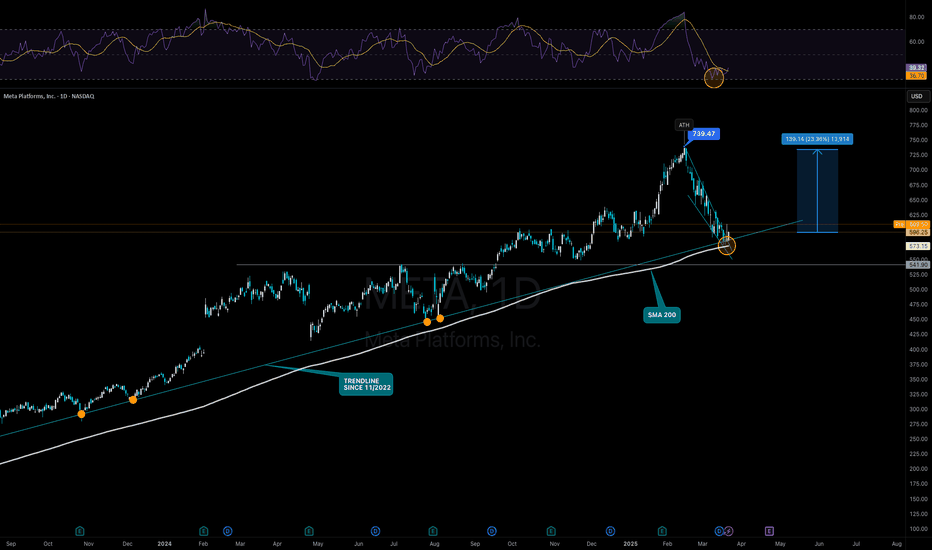

META to $740 - Chance for Strong BounceNASDAQ:META Meta has hit the trend line from November 2022 after a price loss of 20% and has shown with a first small bounce that it is still relevant. At the same time, the SMA200 is also at the same point. Last but not least, the 0.238 Fib is also located in this area (from the entire upward movement from November 2022). Technically, we can therefore definitely expect a bounce that could take us to the previous ATH at $739.

Fundamentally, Meta is also not overvalued due to its strong growth. As with many of the Mag7s, there are still problems with the AI strategy, which does not appear to be well thought out in either monetary or structural terms. However, Meta is a good candidate for actual efficiency gains due to its affiliation with the advertising market. However, the general growth is already reason enough to buy.

Support Zones

$580.00

$541.00

Target Zones

$740.00

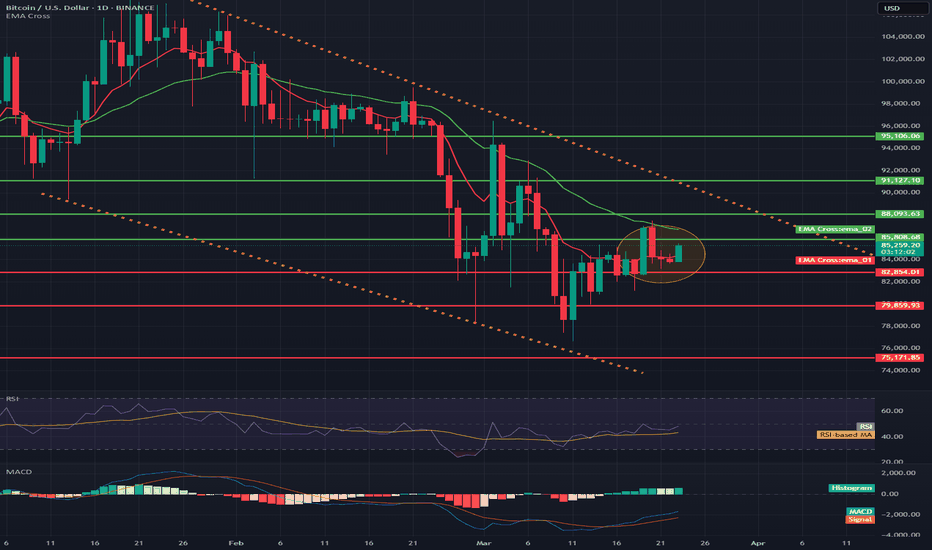

BTC/USD 1D Chart ReviewHello everyone, let's look at the 1D BTC to USD chart, in this situation we can see how the price is moving in the designated downward channel, in which the price started to grow again. What's more, we can see consolidations on the EMA Cross indicator and here it is worth watching the movement of the red line to see if it will again go up from the green line, which would confirm the return of the uptrend.

Let's start by defining the goals for the near future that the price must face:

T1 = 85808 USD

T2 = 88093 USD

Т3 = 91127 USD

Т4 = 95106 USD

Now let's move on to the stop-loss in case the market continues to fall:

SL1 = 82854 USD

SL2 = 79859 USD

SL3 = 75171 USD

If we look at the MACD indicator, we can see how it indicates an uptrend, but we still have to wait for a return to a strong main uptrend. The RSI shows rebounds near the middle of the range, which we are approaching again, and it is worth paying attention to how the price will behave now.

Bitcoin - This bear flag will send BTC to 72,000! (sell now)The whole crypto market and Bitcoin are crashing, and it looks like 2025 will be a very red year! From a bitcoin cycle's perspective, bitcoin has entered a bear market. Let's look at the latest technical analysis on the 6H chart. Bitcoin hit a new all-time high on January 20, exactly the same day as Trump's first day in office. Thereafter, Bitcoin has been crashing.

Currently, the price prints a bearish flag on the 1H chart and a descending channel on the 6H chart. As long as Bitcoin is inside this descending channel, we have to stay bearish and trade with the trend until the end. This bear flag is also a problem because you would rather not see such patterns in a bull market in general. My next target is 72k, from here we could expect a bounce. Why 72k? Because it's the Fibonacci retracement of the previous major wave from 49k to 110k.

Write a comment with your altcoin + hit the like button, and I will make an analysis for you in response. Trading is not hard if you have a good coach! This is not a trade setup, as there is no stop-loss or profit target. I share my trades privately. Thank you, and I wish you successful trades!

BITCOIN → Flag (consolidation) before falling to 78-73KBINANCE:BTCUSD is consolidating after a short-squeeze relative to 85-87K. A bearish set-up is being formed, the break of which may strengthen further decline to the key target of 73K

A symmetrical triangle is forming within the downtrend on D1, a breakdown of this structure may strengthen the decline. Locally, within the channel a flag - bearish figure is formed (on the local TF false uptrend, the crowd enters to buy from the support or at the break of local resistance, at accumulation of the necessary potential the big player removes the limit order and releases the price, which is dispersed by liquidation of traders), regarding 85K-86.6K the liquidity capture is formed and the price returns to the selling zone. Consolidation below 85K may trigger a breakdown of the figure support and further fall to 80K-78K

Fundamentally: the market sells off any positive news very quickly (negative background is created):

crypto summits, (Trump said nothing new at the second summit)

positive resolutions of problems (for example between SEC and XRP, or removal of restrictions from local exchanges)

crypto reserve

The only nuance, bitcoin's dominance index is still high despite the price drop...

Resistance levels: 85150, 866700, 89400

Support levels: 82K, 80K, 78200

There are no positive signs for growth. The zone where we can consider a trend reversal ( if something supernatural happens ) is 89-91K, but it is very far away.

But now I would consider a breakdown of the flag, or 83.5 - 82.5 and price consolidation below this zone with the purpose of further fall to the local important level 78173. Then another consolidation or correction is possible before a further fall to 73.5K

Regards R. Linda!

BNB/USDT 1D chart, target and stop-lossHello everyone, let's look at the 1D BNB chart to USDT, in this situation we can see how the price came out of the top of the ongoing downward trend.

Going further, let's check the places of potential target for the price:

T1 = $ 646

T2 = $ 683

Т3 = $ 732

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = $ 592

SL2 = $ 558

SL3 = $ 535

SL4 = $ 505

Looking at the RSI indicator, we see

As we entered the upper part of the range again, however, there is still a place for the price to go higher, giving more targets.

EURUSD | 4H | WAIT BREAKOUTHey there, Traders,

I’ve put together an analysis for EUR/USD. Right now, I’m watching it like a hunter, waiting for a breakout. As soon as it happens, I’ll drop updates right here under this analysis.

Big thanks to everyone who supports me with likes—you guys are awesome!

God bless you all

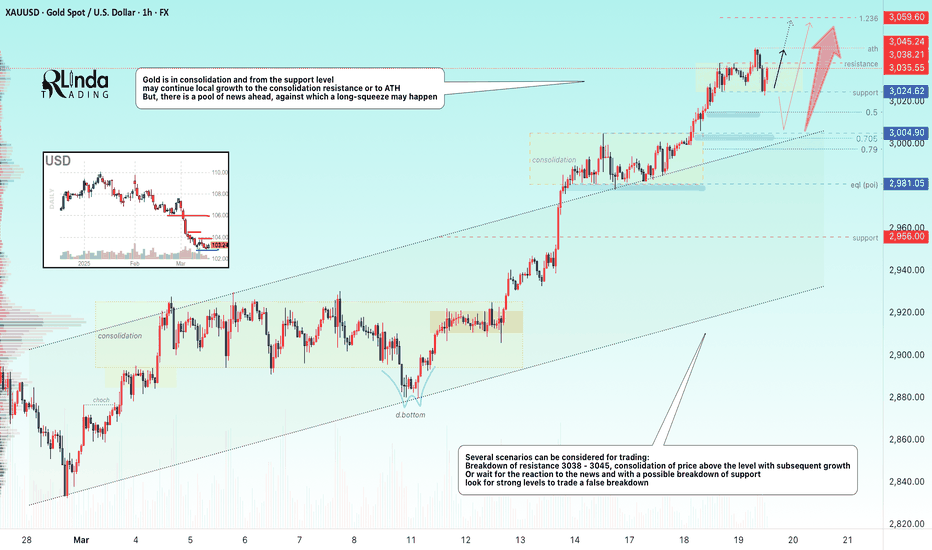

GOLD → Consolidation (correction) before growth to $3100FX:XAUUSD is going into consolidation after strong growth on the back of dollar correction. The metal may test deeper support areas before attempting a new high

Gold is correcting, but remains in an uptrend

The decline in quotations may be seen as a buying opportunity, given the economic uncertainty due to Trump's tariffs and expectations of Fed rate cuts.

The Fed reiterated its forecast of two rate cuts in 2025 despite Powell's cautious comments. Gold is further supported by rising inflation risks and geopolitical tensions in the Middle East.

Resistance levels: 3045, 3057

Support levels: 3024, trending, 3004

Reaction to support is weakening, even amid the uptrend. Gold may stay in this consolidation until the middle of next week, or it may try to break out of the consolidation to retest deeper support zones, such as the rising trend line or the 3004 imbalance zone, from which the growth may resume.

Regards R. Linda!

EURJPY → False breakout of key resistance ...FX:EURJPY is forming a false breakdown of resistance and draws us a reversal pattern against the upper boundary of the descending price channel, as well as the pressure on the market creates the correction of the dollar...

On the daily chart the structure is bearish. After the false breakout of the global resistance a correction is formed, within which the price can test the imbalance zone or the previously broken resistance and continue its fall after the liquidity capture. The global trend is neutral and in this case it is worth considering local support levels as targets

Resistance levels: channel boundary, 162.3, 163.0

Support levels: 160.84, 158.9

A retest of the channel resistance or the area of 162.4 - 163 is possible. But any return of the price under the resistance of the descending channel and consolidation of the price in the selling zone may provoke further decline

Regards R. Linda!

Manappuram Finance: Long-Term Breakout Alert🚀 Manappuram Finance: Long-Term Breakout Alert! 🚀

🔹 CMP: ₹230 | Stop Loss: ₹170 | Target: ₹290 | ₹372

🔍 Why Manappuram Looks Promising?

🔄 Technical Breakout:

A rounding bottom (or cup-and-handle) breakout with a well-defined base formation—indicating potential long-term upside.

📊 Accumulation Opportunity:

As the breakout occurs, retests may follow—offering an ideal opportunity for staggered accumulation. Long-term investors can accumulate on dips for better risk-reward.

📈 Target Calculation:

📏 Pattern Depth Approach: Targets are derived from the depth of the rounding bottom or cup-and-handle pattern.

📊 Fibonacci Validation:

✅ Retracement Levels (Stop Loss Zones): ₹138 & ₹230

✅ Extension Levels (Price Targets): ₹81.5, ₹230 & ₹138

📌 Pro Tip: Plot these Fibonacci levels yourself to build conviction and sharpen your analysis.

📉 Risk Management:

Stop loss is carefully aligned with Fibonacci retracement to minimize downside risk.

Follow strict position sizing to safeguard capital—especially in volatile market conditions.

⚠️ Caution: Market conditions can shift quickly—adjust your position size based on your risk tolerance and trading plan.

📍 Outlook:

With a confirmed breakout and strong technical alignment, Manappuram Finance offers a high-probability swing trade for long-term investors.

📣 What are your thoughts on this breakout? Share your views in the comments!

📅 Follow for more technical insights and market updates.

📈 #ManappuramFinance #BreakoutAlert #TechnicalAnalysis #SwingTrading #InvestmentOpportunity

📉 Disclaimer: As a non-SEBI registered analyst, I encourage you to conduct independent research or consult a financial professional before making investment decisions.

GOLD → Fading out before the news. Possible long-squeezeFX:XAUUSD continues its bullish trend, but locally, the movement is in a very narrow channel (wedge). To form a potential for further movement, the price may form a long-squeeze before or at the time of news...

Fundamentally, gold remains a bullish asset due to the Fed's rate cut forecasts and economic risks associated with Trump's tariff policy. Gold hit a new high on Wednesday after the Fed reiterated plans to cut rates twice this year, raised its inflation forecast and worsened growth and employment estimates.The price is further supported by escalating geopolitical tensions in the Middle East, with Israel announcing the resumption of ground operations in Gaza.

Gold is forming a bull market. Before further growth (before the news) the price may enter the liquidity zone (fvg, 3028, 3024), after which it will continue to grow. Dollar enters local correction before the news, which creates pressure on gold

Resistance levels: 3046, 3051, 3056

Support levels: 3038, 3030, 3024

Price is forming a retest of the wedge support, which increases the chances of a breakdown. If the support fails to hold, the price may go down to the above support before rising further.

But! If gold bounces from 3038 and consolidates above 3044, the growth will continue without a deep pullback

Regards R. Linda!

TRUP/USDT in the coming hoursHello everyone, let's look at the 4H TRUMP to USDT chart, in this situation we can see how it has come out of the triangle on top and currently we can see a fight with the current resistance at $11.45, in a situation when it comes out of it on top it can go towards the targets at the levels:

T1 = $11.89

T2 = $12.58

Т3 = $13.08

Now let's move on to the stop-loss in case the market continues to fall:

SL1 = $11.06

SL2 = $10.40

SL3 = $9.76

When we look at the RSI indicator we can see how on the 4h interval we have come out of the range on top, which however in the short term may give an attempt to recover the price or a temporary sideways trend.

GOLD → Consolidation ahead of Fed rate meeting...FX:XAUUSD goes into consolidation 3038 - 3024 before the news - Fed rate meeting. The situation is generally predictable, but gold is reacting to rising geopolitical risks.

Gold is stabilizing before the Fed decision , markets are waiting for the data. The regulator is expected to keep rates, but Powell's forecasts will determine further dynamics.

“Hawkish” tone of the Fed may lead to the strengthening of the dollar and gold correction.

“Dovish” signals about economic risks will support the growth of metal prices.

Geopolitical tensions and Trump's tariffs continue to have an impact.The market is preparing for high volatility on the background of the Fed's decision and events in the world

Resistance levels: 2038, 2045

Support levels: 3024, 3015, 3004.9

Several scenarios can be considered for trading:

Breakdown of resistance 3038 - 3045, consolidation of the price above the level with subsequent growth to 3050 - 3060.

Or wait for the reaction to the news and with a possible breakdown of support to look for strong levels to trade a false breakdown, for example 3024, 3015, 3005.

Regards R. Linda!

USDJPY → Resistance retest (wedge) before the Fed meetingFX:USDJPY is forming a correction to trend resistance as part of the dollar index consolidation. An interesting situation is forming which could be a continuation of the downtrend.

Fundamentally, today is an important day. The FED interest rate meeting is ahead. Traders are waiting, the dollar is consolidating at this time. Most likely the rate will remain unchanged, but in this key everyone is interested in Powell's comments on monetary policy and their future actions.

USDJPY at this time is forming a correction to the bearish trend resistance, before the news the currency pair may test the resistance conglomerate: a wedge, 0.79 fibo, or an orderblock located outside the channel

Resistance levels: 150.16, 150.95

Support levels: 148.92

False breakout of the resistance zone can provoke a fall, as well as breakdown of the support of the “wedge” with the subsequent consolidation of the price in the selling zone. The price may test the zone of interest at 147.6, 146.54.

Regards R. Linda!

Will THETA return to an upward trend?Hello everyone, I invite you to review the current situation on Theta Token. When we enter the one-day interval, we can see how the price moved in the formed downtrend channel. What's more, we can see here the movement at the lower border of the channel and how the price maintains a strong support at the level of $ 0.90, however, if we go lower, just below the channel border, a very strong support zone for the price from $ 0.69 to $ 0.42 is visible.

We can also see how the price enters a slight sideways trend in which it can approach the downtrend line lasting inside the downtrend channel, such consolidation and gathering of energy can have a positive impact on the movement in the coming weeks, which can lead to growth. When such a scenario works, we can see a nice upward movement around $ 1.36, another significant resistance can be seen at $ 1.75, and then we have strong resistance around $ 2.36.

It is worth paying attention to the MACD indicator here, which shows how we are staying in the lower range and the ongoing movement is visible here, which may also indicate a potential attempt to rebound the price.

GOLD → Consolidation for continued growth. 3025?FX:XAUUSD is consolidating between 2981 - 2993. After strong growth there is no hint of a possible reversal, and consolidation above the channel boundary indicates readiness to continue growth

The gold price remains below the record $3,005 but is supported by the trade war, geopolitical tensions and expectations of Fed policy easing. The escalating US conflict with Yemen, the escalation in Gaza and possible talks between Trump and Putin are boosting demand for defensive assets. China's stimulus is also supporting prices. U.S. retail sales data may influence the dollar and further gold movement, but investors are cautious in anticipation of the Fed meeting.

Resistance levels: 2993, 3008

Support levels: 2891, 2956

Consolidation is being formed, regarding which, against the background of the bullish trend, two strategies can be considered:

1) resistance breakdown and consolidation above 2993 with the purpose of growth continuation

2) false breakdown of support 2981 and further growth after liquidity capture.

Regards R. Linda!

OMUSDT → Paranormal behavior. Rally readinessBINANCE:OMUSDT as a whole looks stronger than the market. After a strong rally a correction in the format of a bearish wedge is formed, subsequently the price broke the resistance and is trying to consolidate above the key support

Against the background of a weak market OM coin has good prospects as technically someone is interested in this project and the coin as a whole behaves strongly and looks stronger than the market.

A breakout of the bearish wedge (consolidation pattern within the correction) is forming. If the bulls keep the coin above the previously broken figure resistance and above the base of the 6.752 reversal pattern, the growth may continue in the short to medium term

Resistance levels: 7.39, 7.98

Support levels: 6.752, 6.51

One of the few coins that is rising while bitcoin is falling. Focus on the previously mentioned support levels, as well as on the local resistance 7.05, the break of which may provoke a prolongation of growth

Regards R. Linda!

GBPUSD → Consolidation after a trend breakout. Long-Squeeze?FX:GBPUSD may test the local support amid the pre-news correction of the DOLLAR. Traders are waiting for inflation data, high volatility is possible

The fundamnetal situation is predisposed in favor of the pound sterling, which has an advantage on the back of the falling dollar, which is likely to take a medium-term position on the back of the Trump administration.

Technically, GBPUSD is consolidating above the key support zone of 1.286 - 1.280 below which a huge pool of liquidity has formed which could be tested before the trend continues.

Important news ahead. Traders are waiting for CPI data. High volatility is possible

Resistance levels: 1.2938 (trigger)

Support levels: 1.2868, 1.281, 1.2728

Bulls may be aggressive and keep the price from correcting downwards. In this case, price consolidation above 1.2938 could be a good entry point for the continuation of growth. But because of the upcoming news, I would prefer to wait for a retest of the liquidity zone 1.2868 - 1.281 before taking action to open a position.

Regards R. Linda!

NZDJPY → Attempting to change the downtrendFX:NZDJPY is trying to get out of the downtrend by breaking the channel resistance. Against the background of local strengthening of the dollar, the currency pair has all chances.

Technically, buyers are starting to gain momentum and support the market, it can be seen on the background of locally growing minmiums, which gradually leads to the breakout of the channel resistance. The trigger in our case is the resistance 85.240 - a key level that divides the market into 2 planes.

If the bulls are able to consolidate above 85.240, an impulse to 86.13, then 86.88 may be formed in the short-term.

Support levels: 84.500, 84.00

Resistance levels: 85.240, 86.13

Initial testing of the trigger may end in a small pullback due to liquidity formed above. The pullback may be directed towards the previously broken channel resistance. But the emphasis is on price consolidation above 85.240, as this will be a prerequisite that the bulls are holding the market in the moment and are ready to keep going up.

Regards R. Linda!

EURAUD → False breakout & Pin-Bar on W1FX:EURAUD is testing important resistance from the weekly timeframe. A false breakout is formed after liquidity capture. There is no potential for continuation of growth and the chart is drawing everyone's favorite “pin-bar”

After the price exits the consolidation, the resistance of which was the level of 1.6787, a distributive pattern is formed, the target of which was the liquidity behind the weekly resistance of 1.7196.

The target has been reached and the price is consolidating below the base of the reversal structure and thus preparing to continue falling. It is possible formation of liquidation or downward impulse to 1.71 - 1.70. The forex market has been behaving calmly since the opening of the week and the market can work out technical nuances calmly, until the fundamental factors are connected.

Resistance levels: 1.7196 - 1.7304

Support levels: 1.7107, 1.7016

Zones of interest are located behind the local lows, but from a technical point of view, the market is most interested in liquidity beyond 1.6787 and there are all chances to reach this zone, as there are no obstacles below 1.7016. Accordingly, when the support at 1.7016 is broken, a free zone will open up

Regards R. Linda!