Financials

$JSESLM forming a bearish rising wedge formationSanlam has spent the last couple of weeks consolidating in the form of a bearish rising wedge formation. The move higher off the lows has appeared on lower volume which gives bulls little confidence in this move. Should we manage to see a convincing close below the rising wedge at +- R56.00, this rising wedge could play out with a downside target of R41.50. What is also interesting to note is that the stock has battled to make any progress above the declining 50 day moving average (purple line) which has been respected by the market. Keep a close eye here as the target is quite rewarding should this pattern play out in textbook fashion.

GE More Down Side to Come (Revised)General Electric Company (NYSE: GE )

What is General Electric Company:

Is a diversified corporation and will its products include from electrical and electronic equipment, aircraft engines, and financial services.

JesusTrades Score:

Sell

Scale Score:

Risky (8/10)

Portfolio Hold:

1 month

ROYAL BANK OF SCOTLAND - TIme to ZOOMRBS faces its earnings tomorrow, which although may be patchy, should not be cruelly wounding to their overall growth. We have a beautiful sign of a golden cross forming here, as seen highlighted within the blue circle. We have a previous divergence, leading up to us sitting on top of the marked support. It's clear RBS is interested in sitting at a higher level than previously before, and accompanied with the sufficient volume, this could really take off should the circumstances come correct.

The SL is marked just below where we wicked down to an hour previous. There is no guarantee that this support will hold, but it seems relatively strong, especially comparing it to the past performances in its existence. It helps a lot that we have pushed through this support rather than fallen to it, as it indicates that this price level is secure and potentially trustworthy.

Hopefully RBS can show us some green over the next couple of weeks. This is mapped for more of a long term hold, maybe exiting in mid-May.

CLEAR ascending support on JPM - and we are lazy at it right nowAscending support on JPM - some will also identify the pivot highs calling for a triangle pattern.

Keep an eye on this support level if the market gets weaker - looking for things that were already lazy when the market was strong... looking for those to then get even weaker when the market gets weak... this is a good way to find intraday setups!

Hope this chart perspective helps the community

xeenos trading - sending positive energy to all those watching.

Double Bottom Formation Makes DFS a Screaming BuyKeep in mind, charting patterns in this coronavirus-driven market may seem like a bad idea. So let's take a look at the financials: Dirt cheap even for the recession we're in (P/E ratio: 3.41) and certainly oversold (RSI dropping below 30). Nice paying dividend currently over 5% - DFS is a screaming buy right now. Buy it and ride these tough times out.

$GDOT can fall in the next daysContextual immersion trading strategy idea.

Green Dot Corporation has a strong downside trend.

Due to the huge market volatility and possible crisis, all financial sector falls.

This and other conditions can cause a fall in the share price in the next days.

So I opened a short position from $15,9;

stop-loss — $18,76.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

Goldman Sachs ominously below 200IF you follow me, you’d know that earlier this week, I already saw the S&P500 revisiting and exceeding the last low. While the earlier part of this week saw a rebound, it is wide ranged and volatile. It is about time for a revisit to the lows, and did you know that Goldman Sachs (financials) are leading the way?

Technically bearish, GS is leading the reversal down...

SG DBS BREAKING DOWN DBS is very weak now. Having bounced off 25 twice in recent time, it failed to make higher highs, failed the 55EMA, and is likely to revisit 25.

MACD supportive of bearish bias.

Going for a bounce at 24.50, and to consolidate at 24 for deliberation of a possible major rally to 40.

New Tax Year To Complete This Pennant!?AJ Bell is big on their ISA products with lower fees than Hargreaves Lansdown. Since the stock market overall is booming and investor confidence is high, I think many will have maxed their 2019 ISA allowance and will be waiting to inject cash for this coming new tax year. More cash injected into accounts = more fees for AJB.

GLUU Price Target Going into Earnings Feb 5thPT $6.79 with $7.30+ on good financials, conference call / new game releases, news etc on Feb 5th, 2020.

Good news will send us to $7.30+

Stop Loss at $5.76

Bank ETF Pulls Back Before EarningsBanks ended 2019 on a strong note as gloom toward the economy lifted and investors started to appreciate their low valuations. Now a key exchange-traded fund has pulled back to a potentially important level: The SPDR Regional Bank ETF .

KRE is holding the same $57 area where it peaked in February and November. The 50-day simple moving average (SMA) has also risen up to the same area, producing a confluence zone.

Stochastics are also showing a potentially oversold condition.

Earnings season next week may provide some catalysts as well. The reports begin with big names like JPMorgan Chase , Citigroup and Wells Fargo on Tuesday, with smaller regional lenders following soon after.

The recent Iranian turmoil has hurt banks, however the broader backdrop could favor them: Economic growth continues to improve and the Fed is keeping short-term rates down. That could steepen the yield curve , one of the key ways that financials make money.

Value investors might also like the multiples on banks because KRE's price/earnings ratio is under 13x, according to ETFdb. Compare that to 23x on the QQQ (Nasdaq-100) or 20x for SPY (S&P 500).

CWB: Upside Canadian Bank; Look Hard for Value in 2020CWB is mostly an "unheard-of" Canadian bank, but still 'big enough' to offer shareholders decent gains and capital appreciation. In-fact, it ranks as one of the top consistent dividend hiking companies with a streak spanning near 30 years - far better than any other bank in Canada/USA!

2020 will be a year where looking for value will be harder and harder as P/Es approach a whopping 30-50 on average for many companies, and P/Bs surge into double digits.

Some of my top value stocks include CWB, CU, Canadian Energy (SU, CNQ, ENB, TOU) and US Energy (FANG) and many precious metals stocks (or etfs, or the physical).

With low interest rates here to stay, I am not big on the financial sector, however, I believe investors will slowly realize soaring government debt will remain a disaster and never be paid back - as such, yields will rise, DXY will fall, precious metals and commodities will rise, and treasury influxes will decline. This should keep financials relatively stable in 2020 with perhaps a 5% gain (after we get out of the 2020 early short). This will also be the catalyst to let precious metals soar from 2020 and onwards, and allow energy stocks as a whole to rebound quite heavily in 2020/2021.

--

Happy New Year Everyone! Invest smart and look for value.

- zSplit

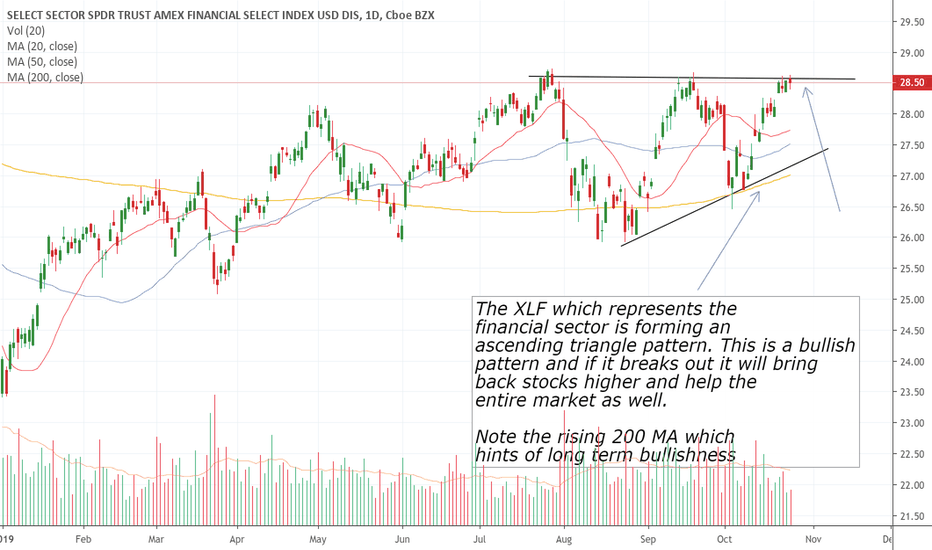

XLF consolidation or will bulls continue to push upTICKER: $XLF

Unlike SPY and QQQ, XLF confirmed its daily bull flag. However, we did see a red candlestick on Friday 12/13 to close out the week.

Could this be the first indication of consolidation for the market? Keep in mind the financial sector is one of the top three section in the market.

Also keep in mind that we closed green for ten weeks straight (see weekly chart). Weekly RSI is approaching 70, but anything above daily support of $30.13 is just a higher low. Break 30.13 and it will be the start of weekly consolidation.

IMPORTANT: XLF is not at its all time high. We are in the resistance zone with XLF's ALL TIME HIGH being $30.97.

Pair Trade Setup : Short Sanlam vs. Long Standard BankSanlam has outperformed Standard bank by a margin of 27% from the lows we saw in May of this year. The chart of their relative ratios ( SLM / SBK ) has now approached an important area of resistance (0.46 to 0.477) which has been in place for the last two years. If you take a look at the individual charts of the underlying counters, one will notice that Sanlam has once again turned off important resistance levels between R82 and R85 while Standard Bank is not trading too far away from its 200 week moving average which has provided important support for the stock over the last two years. In Addition, the Standard Bank daily chart is trading in a triangle with support some R2 away from current levels. This would support my view on the pair trade as i believe that Sanlam will under-perform Standard Bank going forward, or at least, there is sufficient reason to believe that Standard bank has a better chance of climbing higher than Sanlam at this point in time. In Addition, the MACD indicator has made a lower high even though price made a slightly higher swing high which further reinforces my view that price action is weak and should see the pair ratio revert lower.

SLM -> PE ratio: 22.2x DY : 3.85%

SBK -> PE ratio 9.8x DY: 5.69%

From a fundamental perspective, Standard Bank's Price to Earnings Ratio is not demanding whilst also boasting a much better Dividend yield.

Suggested ratio entry point : 0.463 - 0.475

Suggested ratio stop loss: closed above 0.480

Suggested ratio exit point: 0.427 to 0.433

To be entered at a ratio of 1:1. i.e 100k nominal short position in Sanlam vs. 100k nominal long Position in Standard Bank.

Assuming we entered this pair at 0.465 today, used a stop loss at 0.480 and locked in profits @ 0.43, we are risking a move of 3.2% against us to make a potential profit of 7.5% for a risk reward ratio of just over 2.3x

REPOCALYPSE NOW!This is serious. Find out what 'REPOCALYPSE' is about. Protect your positions very carefully.

Get real - I don't know when it's happening nor does anybody else.

REPOCALYPSE is not just doom-saying stuff, though it might appear sensationalist. This is reality mates.

Those who keep there heads in the sand and do not take protective actions will be flushed out.

DISCLAIMER: All statements here are over-simplifications of very complex issues, and are speculative opinion. This is not constructed as advice for making decisions about trading in securities. Your losses are your own.

Declaration : This post is consistent with Tradingview's house rules on text-based analyses.