LC EARNINGS PLAY – STRIKE WHILE IT'S HOT!**

🚨 **LC EARNINGS PLAY – STRIKE WHILE IT'S HOT!** 🚨

📅 **Earnings Season Heat Check: LC | Jul 29**

💰 **Positioning for a Post-Earnings POP!**

---

🔥 **The Setup:**

LC’s earnings momentum is real –

📈 TTM Rev Growth: **+13.1%**

💹 EPS Surprise Rate: **150% avg**

📊 75% Beat Rate History

💵 Analyst Consensus: **Strong Buy (1.8/5)**

---

📉 **Technical Tailwind:**

✅ Price above 20D + 200D MA

✅ RSI: **60.07** – room to run

📈 Volume Spike: **+61% above 10-day avg**

🚀 Options flow targeting **\$14 CALLS** w/ OI: **864** / Vol: **737**

---

📌 **TRADE IDEA**

🎯 Buy: **\$14.00 Call @ \$0.70**

📆 Exp: **Aug 15, 2025**

🎯 Target: **\$2.10** (Risk/Reward = 1:3)

🛑 Stop: **\$0.35**

---

⚠️ **Earnings Risk:** IV crush real.

🎯 Exit within 2 hours **post-EPS** if no move.

Macro tailwinds + financial sector rotation = 🚀 fuel.

**Beta = 2.45** → Big move potential incoming!

---

🧠 Confidence Level: **75%**

⏰ Timing: Pre-Earnings Close

🧾 Model-Driven Strategy | No Hype, Just Edge.

---

💥 Let’s ride the LC earnings wave – \$15+ in sight! 💥

\#LendingClub #LC #EarningsPlay #OptionsTrading #TradingView #StocksToWatch #CallOption #Fintech #SwingTrade #EarningsHustle #BullishSetup #IVCrush #EarningsGamma #ShortTermTrade

Fintech

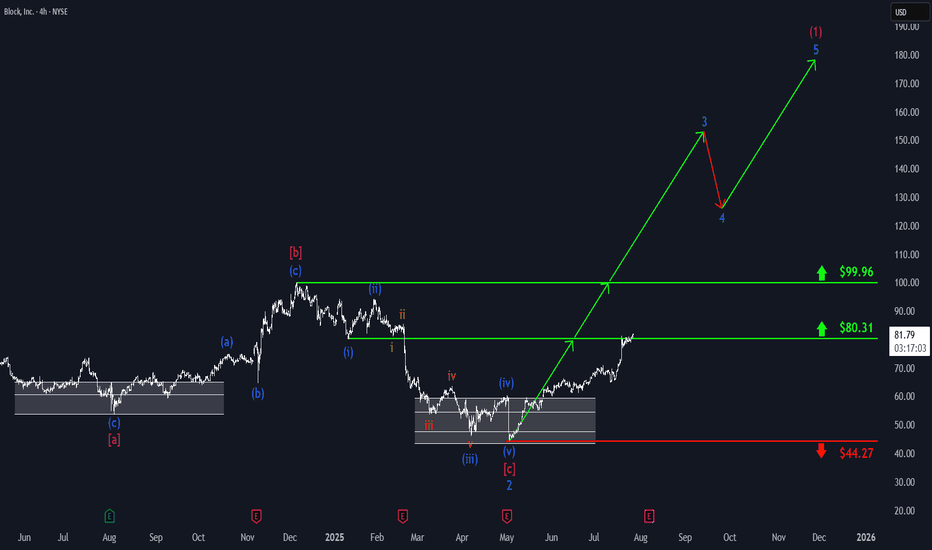

Block: Key Resistance HitBlock has made a strong upward move, reaching resistance at $80.31. Thanks to this positive momentum in our primary scenario, we fully focus on further gains as part of turquoise wave 3, which is expected to push the price decisively above the next resistance at $99.96. The subsequent pullback in wave 4 should also occur above this level, before wave 5 ultimately completes magenta wave (1) – marking the first major leg up in the ongoing bullish impulse.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

Block | XYZ | Long at $64.84Block's NYSE:XYZ revenue is anticipated to grow from $24 billion in FY2024 to $32 billion in FY2027. With a current price-to-earnings ratio of 13.8x, debt-to-equity ratio of 0.36x, and rising cash flow in the billions, it's a decent value stock at its current price. Understandably, there is some hesitation among investors due to competitive fintech market and economic headwinds. But, like PayPal NASDAQ:PYPL , growth is building.

From a technical analysis perspective, the price dropped to within my historical simple moving average bands. Often, but not always, this signals a momentum change and the historical simple moving average lines indicate an upward change may be ahead. While the open price gaps on the daily chart in the $40s and GETTEX:50S may be closed before a true move up occurs, NYSE:XYZ is in a personal buy zone at $64.84.

Targets:

$80.00

$90.00

$100.00

[*) $134.00 (very long-term)

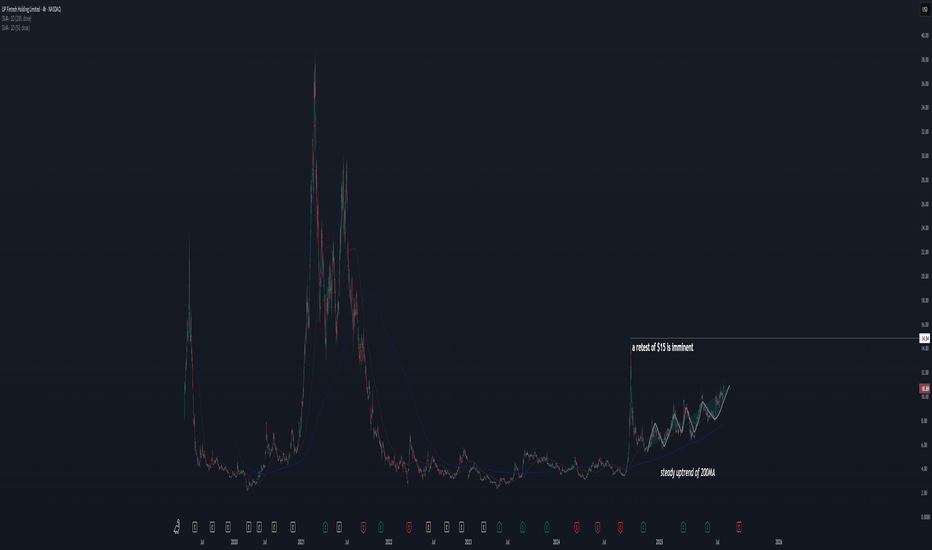

Next Robinhood? TIGR, a hidden gem.We all know the story about retail going crazy on $HOOD. But what about its SEA counterpart, TIGR? Will our SEA friends follow the same trend?

With more and more retail traders rushing to the stock market, TIGR is a safe grab to get on the retail frenzy.

This is also supported from a technical side:

1) a zigzag pattern trending up,

2) a slow and steady uptrend of the 200MA,

3) 3 consecutive earning beats during the last 3 quarters.

All these is suggesting that a retest of the previous high at $15 will happen very soon, if not more (I think there will be more upside, but I have to wait and see how patterns develop when the previous high will be tested).

I am holding TIGR I purchased at 9.55 with a 2.3% portfolio size, with the expectation of reaching at least $15 before/around Oct.

ALPHA GROUP INTERNATIONAL will keep its momentum going!#ALPHA is a fintech company that offers currency risk management and payment solutions.

With a price-to-earnings ratio of approximately 12,

it signifies a solid investment for a growth-oriented fintech firm that is increasing its earnings by about 20 to 25% annually.

In light of the #UKX breaking through and reaching new highs, and beginning to accelerate towards my long-standing projections that the FTSE would hit 5 figures, ALPHA appears to be a unique opportunity in the UK markets, which, as we know, are relatively sparse compared to the USA.

Given the inability to purchase shares of #Revolut, it is likely that capital will flow into this ticker.

Life360(LIF)–Expanding Beyond Location into a Lifestyle PlatformCompany Snapshot:

Life360 NASDAQ:LIF is evolving from a location-sharing app into a comprehensive family safety and services platform, now integrating offerings across auto insurance, elderly care, and financial tools to deepen user engagement and drive revenue diversification.

Key Catalysts:

Feature Expansion & Tile Integration 🧩

The integration of Tile trackers and enhanced in-app features are significantly boosting platform utility, retention, and cross-selling opportunities.

International Momentum 🌍

International MAUs surged 46% YoY in 2024, with low market penetration pointing to substantial global upside as localization and partnerships scale.

Monetization Strength 💵

Ad and partnership revenue rose 41% YoY to $36M, reflecting the platform’s growing ability to monetize its large and highly engaged user base.

Investment Outlook:

Bullish Entry Zone: Above $55.00–$56.00

Upside Target: $85.00–$87.00, supported by product innovation, international expansion, and ad monetization gains.

📊 As Life360 transitions into a full-stack digital safety and services hub, it’s unlocking scalable growth across multiple verticals.

#Life360 #LIF #FamilyTech #LocationSharing #AutoInsurance #Fintech #ElderlyCare #UserGrowth #AdTech #TechStocks #GlobalExpansion

UP Fintech Holding Ltd. (TIGR) – Fintech Expansion in MotionCompany Snapshot:

NASDAQ:TIGR is a digital-first brokerage gaining global traction by combining smart technology, cost efficiency, and a user-friendly experience that appeals to both retail and institutional investors.

Key Catalysts:

User Growth Acceleration 🚀

In Q2 2025, TIGR added 60,900 new funded accounts—a 111.2% YoY surge, signaling successful customer acquisition strategies and platform stickiness.

Diversified Capital Flows 💼

Net inflows from both retail and institutional segments reflect a broad and balanced client base, enhancing revenue durability and cross-sell opportunities.

Operational Efficiency 💰

With a gross margin of 83.8%, TIGR exhibits strong pricing power and scalability, positioning it well for future international expansion and product diversification.

Investment Outlook:

Bullish Entry Zone: Above $8.25–$8.50

Upside Target: $14.50–$15.00, backed by its asset-light model, tech-first approach, and rising user momentum.

📱 As global fintech adoption rises, TIGR’s digital brokerage model is proving both resilient and scalable.

#TIGR #Fintech #OnlineBrokerage #DigitalFinance #UserGrowth #MarginExpansion #GlobalInvesting #ScalableTech #FinancialInclusion #StockMarket

Visa: Resistance ApproachingThe next key step for Visa should be overcoming resistance at $394.49 during magenta wave . However, if support at $339.61 fails to hold, our alternative scenario (33% probability) will be activated—suggesting the recent high already marked the end of the corrective wave alt. in magenta. In that case, a renewed decline below the $299 mark would be likely, aiming to complete the alternative turquoise wave alt.4 on a larger scale.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

PayPal: Rebound or Rerun?PayPal in 2025: A breakout with backbone or just another spineless fintech?

PayPal is still in the rehabilitation ward after its fall from grace in 2021. Management drama, growth slowdown — the full fintech fatigue package. But something has shifted behind the scenes. A new CEO is cutting costs, AI integration is being whispered about, and earnings have started to surprise again. Wall Street pretends not to notice — but volume tells a different story.

Technically, we’re looking at a well-formed inverse head and shoulders. The neckline stretches from $72.00 to $74.76, aligning with the 0.5 Fibonacci level. A confirmed breakout above this zone opens the path to a clear target at $93.66 — the 1.0 Fibonacci extension. Multiple EMA clusters and strong pattern symmetry reinforce the setup. But no fairy tales here: the real entry comes after a retest. Without confirmation, it’s just another pretty formation for chart enthusiasts.

HOOD (Robinhood) - Price Above Bollinger Band and Shooting StarsHOOD (Robinhood) stock price has been in an uptrend since May 2025.

Recent fundamentals such as corporate earnings, EPS, Revenue, Acquisitions have been good in Q2 2025.

However currently, HOOD price has printed 2 shooting stars above the upper bollinger band and linear regression lines (blue arrow).

Potential selling and profit-taking could occur, especially if there is a significant bearish catalyst or news in the stock market.

A -4% or -8% move selloff could occur over time if the price gaps up to an overextended level too fast, such as $80 to $85.

Both the weekly and daily charts are starting to show bearish divergence so I am watching both the technicals and fundamentals this month.

Nu Holdings: Is Latin America's Fintech Star Sustainable?Nu Holdings Ltd. stands as a prominent neobank, revolutionizing financial services across Latin America. The company leverages the region's accelerating smartphone adoption and burgeoning digital payment trends, offering a comprehensive suite of services from checking accounts to insurance. Nu's impressive trajectory includes acquiring 118.6 million customers, accumulating $54 billion in assets, and consistently demonstrating robust revenue and net income growth, primarily driven by its strong presence in Brazil, Mexico, and Colombia; - this strategic alignment with digital transformation positions Nu as a significant player in the evolving financial landscape.

Despite its remarkable expansion and optimistic projections for continued customer and asset growth, Nu faces notable financial headwinds. The company experiences an erosion in its net interest margin (NIM), influenced by increased funding costs from attracting new, high-quality customers and a strategic shift towards lower-yield, secured lending products. Furthermore, the depreciation of the Brazilian Real and Mexican Peso against the US dollar impacts their reported earnings. Nu's ambitious ventures, such as the NuCel mobile phone service, require substantial capital investments, introducing execution risks and demanding efficient capital allocation.

Beyond internal financial dynamics, a significant, albeit external, geopolitical risk looms: a potential Chinese invasion of Taiwan. This event would trigger a global embargo on China, leading to unprecedented supply chain disruptions, widespread stagflation, and hyperinflation worldwide. Such a catastrophic economic cascade would profoundly impact Nu Holdings, even given its regional focus. It would likely result in drastically reduced consumer spending, a surge in loan defaults, severe challenges in accessing funding, further currency devaluations, and soaring operational costs, thereby threatening the company's stability and growth prospects.

Ultimately, Nu Holdings presents a compelling growth narrative rooted in its innovative model and strong market penetration. However, internal pressures from evolving interest margins and high capital expenditure, combined with the low-probability but high-impact global economic upheaval stemming from geopolitical tensions, necessitate a cautious and comprehensive assessment. Investors must weigh Nu's demonstrated success against these complex, intertwined risks, acknowledging that its future prosperity is inextricably linked to both regional economic stability and the broader global geopolitical climate.

FICO's Monopoly: Cracks in the Credit Kingdom?For decades, Fair Isaac Corporation (FICO) has maintained an unparalleled grip on the American credit system. Its FICO score became the de facto standard for assessing creditworthiness, underpinning virtually every mortgage, loan, and credit card. This dominance was cemented by a highly profitable business model: the three major credit bureaus—Equifax, Experian, and TransUnion—each paid FICO for independent licenses, generating a significant percentage of revenue per inquiry and establishing a seemingly unassailable monopoly.

However, this long-standing reign now faces an unprecedented challenge. The Federal Housing Finance Agency (FHFA) Director, Bill Pulte, recently signaled a potential shift to a "2-out-of-3" model for credit bureaus. This seemingly technical adjustment carries profound implications, as it could render one of FICO's three bureau licenses redundant, potentially evaporating up to 33% of its highly profitable revenue. Director Pulte has also publicly criticized FICO's recent 41% increase in wholesale mortgage score fees, contributing to significant declines in FICO's stock price and drawing broader regulatory scrutiny over its perceived anti-competitive practices.

This regulatory pressure extends beyond FICO's immediate revenue, hinting at a broader dismantling of the traditional credit monopoly. The FHFA's actions could pave the way for alternative credit scoring models, like VantageScore, and encourage innovation from fintech companies and other data sources. This increased competition threatens to reshape the landscape of credit assessment, potentially leading to a more diversified and competitive market where FICO's once-unchallenged position is significantly diluted.

Despite these formidable headwinds, FICO retains considerable financial strength, boasting impressive profit margins and robust revenue growth, particularly within its Scores segment. The company's Software segment, offering a decision intelligence platform, also presents a significant growth opportunity, with projected increases in annual recurring revenue. While FICO navigates this pivotal period of regulatory scrutiny and emerging competition, its ability to adapt and leverage its diversified business will be crucial in determining its future role in the evolving American credit market.

I’d Like to Be, Under the $SELong term buys from here down to a possible gap fill (low 30's from 2019-2020 pre pump to 300s) have a great R:R if you have a long enough time horizon. Company is putting in the money now to have effortless positive earnings/share in the future. Hard to ignore at these levels with the CEO still so heavily invested and holding strong. Long term price target > $100 and willing to hold for 5+ years to possibly see >200 and a run to ATH for a 10x. Buying anything barring new information.

Is PayPal's Dominance Built on Tech and Ties?PayPal strategically positions itself at the forefront of digital commerce by combining advanced technological capabilities with key partnerships. A core element of this strategy is the company's robust fraud prevention infrastructure, heavily reliant on sophisticated machine learning. By analyzing vast datasets from its extensive user base, PayPal's systems proactively detect and mitigate fraudulent activities in real time, providing a critical layer of security for consumers and businesses in an increasingly complex online environment. This technological edge is particularly vital in markets facing elevated fraud risks, where tailored solutions offer enhanced protection.

The company actively pursues strategic collaborations to expand its reach and integrate its services into new digital ecosystems. The partnership with Perplexity to power "agentic commerce" exemplifies this, embedding PayPal's secure checkout solutions directly within AI-driven chat interfaces. This move anticipates the future of online shopping, where AI agents will facilitate transactions. Furthermore, initiatives like PayPal Complete Payments demonstrate a commitment to empowering businesses globally, offering a unified platform for accepting diverse payment methods across numerous markets, optimizing financial operations, and reinforcing security measures.

PayPal also adeptly navigates regulatory landscapes to broaden its service offerings and enhance user convenience. Responding to directives like the EU's Digital Markets Act, PayPal has enabled contactless payments on iPhones in Germany, providing consumers with a direct alternative to existing mobile payment options. This ability to leverage regulatory changes to expand accessibility and choice, coupled with its foundational technological strength and strategic alliances, underpins PayPal's assertive approach to maintaining its leadership position in the dynamic global payments market.

Coinbase Global (COIN) – Bridging Crypto and Traditional FinanceCompany Snapshot:

Coinbase NASDAQ:COIN is cementing its role as the gateway to the crypto economy, offering secure trading, custody, and institutional-grade financial services—positioning itself for expansion well beyond retail.

Key Catalysts:

Bank Charter Ambitions 🏦

Exploring a bank charter, potentially evolving into a full-service financial institution

Would diversify revenue and boost regulatory credibility, key in the maturing crypto sector

Institutional Growth Momentum 📈

Extending credit to major players like CleanSpark

Building sticky, high-value relationships and reducing retail dependency

Strengthening Financials 💰

14.8% pre-tax margin

39.16% profit contribution margin → Clear operating leverage and path to sustainable, scalable profitability

Trusted Brand Advantage 🛡️

Strong institutional trust + regulatory compliance reputation → defensible moat in a volatile industry

Investment Outlook:

✅ Bullish Above: $160.00–$162.00

🚀 Target Range: $280.00–$290.00

🔑 Thesis: Regulatory expansion + institutional scale-up + financial efficiency = long-term crypto-finance powerhouse

📢 COIN: Not just a crypto exchange—an evolving financial institution for the digital future.

#CryptoFinance #Coinbase #DigitalAssets #Fintech #InstitutionalGrowth #BankingFuture

$UPST down 50% is in correction territoryEarlier in this space on 13 Feb 2025 we have discussed the resurgence of the Fintech sector and the base building of the famous fintech ETF form Ark investments $ARKF. Many Fintech stocks like NASDAQ:HOOD , NASDAQ:COIN , NASDAQ:PYPL , NYSE:XYZ etc had a great Nov 2024 to Jan 2025. The story was the same for the fintech stock Upstart which had an AI component in it. The AI-based lending platform was up almost 180% last year with 95 $ as an ATH. But since then, the correction in S&P and NASDAQ has been unforgiving for stocks like $UPST.

Upstart is down 50% in this correction phase and below its 20, 50 and 100-Day SMA. But it is still above its 200-Day SMA. In technical analysis, we would say that as long as the previous tops which act as support holds then we can remain bullish on the stock. This sentiment washout for NASDAQ:UPST might be coming to its end. As long as the stock is above the 200-Day SMA of 48 $ and consolidating here the strategy is to go long $UPST.

NASDAQ:UPST long above 48 $.

BigCommerce | BIGC | Long at $7.15BigCommerce NASDAQ:BIGC is growing. Revenue in FY2020 was $152 million and in FY2024 it rose to $333 million. In 2025, the company is targeting $342.1M-$350.1M revenue with focus on B2B growth. Free cash flow in FY2024 was positive for the first time at $22 million. Stay cautious, however, with a high debt-to-equity ratio of 6x... insiders have recently grabbed $100k+ in shares as well as awarded themselves options. While the price gap near the mid $5 range may be closed in the near-term, the longer-term outlook here seems positive unless the company fundamentals change. The price has also entered my historical simple moving average zone/lines, which is often a bullish signal. Thus, at $7.15, NASDAQ:BIGC is in a personal buy zone.

Targets:

$8.00

$9.00

$10.00

$11.00

MERCADOLIBRE ($MELI) SOARS IN Q4—E-COMMERCE & FINTECH SHINE MERCADOLIBRE ( NASDAQ:MELI ) SOARS IN Q4—E-COMMERCE & FINTECH SHINE

(1/9)

Good evening, Tradingview! MercadoLibre ( NASDAQ:MELI ) is sizzling—Q4 revenue up 37%, a $ 6.1B haul 📈🔥. Fintech and e-commerce fuel a 33% surge—let’s unpack this Latin dynamo! 🚀

(2/9) – REVENUE RUSH

• Q4 Take: $ 6.1B—37% leap, tops $ 5.9B est. 💥

• EPS: $ 12.61—blasts past $ 7.94 hopes 📊

• Net Income: $ 639M—beats $ 402M dreams

NASDAQ:MELI ’s humming—growth’s got zing!

(3/9) – BIG MOVES

• GMV: $ 14.5B—56% jump FX-neutral 🌍

• Payments: $ 58.9B TPV—49% up 🚗

• Credit Boom: $ 6.6B—74% growth 🌟

NASDAQ:MELI ’s flexing muscle—full throttle!

(4/9) – MARKET VIBE

• P/E: ~60—above Amazon’s 40, PDD’s 20 📈

• Growth: 37% smokes peers’ 10%

• Targets: 2,400−3,000—10-38% upside 🌍

Premium price—worth the juice?

(5/9) – RISKS ON DECK

• FX Woes: Brazil, Mexico currencies wobble ⚠️

• Comp: Amazon, locals eye the prize 🏛️

• Rates: $ 6.6B credit—defaults lurk? 📉

Hot run—can it dodge the heat?

(6/9) – SWOT: STRENGTHS

• E-comm: $ 14.5B GMV—LatAm king 🌟

• Fintech: $ 58.9B TPV—Pago’s gold 🔍

• Logistics: 6 new centers—zippy edge 🚦📉

NASDAQ:MELI ’s a double-threat dynamo!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: High P/E, FX swings 💸

• Opportunities: Ad bucks, untapped markets 🌍

Can NASDAQ:MELI zap past the bumps?

(8/9) – NASDAQ:MELI ’s Q4 surge—what’s your vibe?

1️⃣ Bullish—$ 3,000 in sight.

2️⃣ Neutral—Growth’s hot, risks hover.

3️⃣ Bearish—FX bites back.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NASDAQ:MELI ’s $ 6.1B Q4 and fintech flex spark buzz—$ 14.5B GMV shines 🌍🪙. High P/E, but growth rules—champ or chase?

$SOFI is poised to reach the $20 range following its correctionNASDAQ:SOFI 's price began 2025 at $15.40. Today, it traded at $15.56, marking a 1% increase since the start of the year. The forecasted price for SoFi at the end of 2025 is $41.23, representing a year-over-year change of +168%. The expected rise from today to year-end is +165%.

By mid-2025, the price is projected to reach $20-$29.56.

Strong Growth Prospects: NASDAQ:SOFI has shown significant growth in revenue and profitability. The company reported a 35.8% year-over-year revenue growth and a 45% net profit margin in 20241.

Positive Market Trends: Analysts are optimistic about NASDAQ:SOFI 's future performance, with some projecting a 72% upside potential, targeting a $25 share price.

Diverse Financial Services: NASDAQ:SOFI offers a wide range of financial services, including lending, investing, and banking, which helps diversify its revenue streams and reduce risk.

Member Growth: The company has been experiencing robust member growth, which is a positive indicator of its expanding customer base and market reach.

Buy NASDAQ:SOFI now and let's get wealthy!

ROBINHOOD’S Q4 2024—TRADING BOOM FUELS RECORD GAINSROBINHOOD’S Q4 2024—TRADING BOOM FUELS RECORD GAINS NASDAQ:HOOD

(1/9)

Good morning, Tradingview! Robinhood’s Q4 2024 earnings are out 📈🔥—$1.01B in revenue, up 115% YoY, smashing $945M estimates. Post-election trading frenzy in equities and crypto lit the fuse. Let’s break down HOOD’s monster quarter! 🚀

(2/9) – REVENUE & EARNINGS HIGHLIGHTS

• Q4 Revenue: $1.01B, +115% YoY 💥

• Q3 Recap: $637M, +36% YoY

• Q4 EPS: $1.01, beats $0.43 est. 📊

• Net Income: $916M, up 510% from Q3’s $150M

• ARPU: $164, +102% YoY

Record profits, driven by a trading surge!

(3/9) – KEY WINS

• Net Deposits: $16.1B, +42% QoQ 🌍

• New Tools: Index options, futures, Robinhood Legend launched late 2024 🚗

• SEC Settlement: $45M in Jan 2025 clears past compliance woes ✅

HOOD’s expanding fast and cleaning house!

(4/9) – SECTOR SHOWDOWN

• Market Cap: $56.4B, Stock: $65.28 🌟

• Trailing P/E: 40.9x vs. IBKR (50x), SCHW (20x)

• Revenue Growth: 115% YoY crushes sector avg (5.7%)

Outpaces peers in growth, but valuation’s a hot debate!

(5/9) – RISKS ON DECK

• Market Volatility: Trading boom could fade 📉

• Regs: $45M SEC hit flags ongoing scrutiny 🏛️

• Competition: Schwab, Coinbase closing in ⚔️

• Economy: $1.21T credit card debt, layoffs loom ⚠️

Big gains, big risks—tightrope ahead!

(6/9) – SWOT: STRENGTHS

• Revenue: 115% YoY, $916M profit shines 🌟

• User Loyalty: $16.1B deposits, 2.2M+ Gold subs 🔍

• Innovation: Futures, options expand the game 🚦

HOOD’s firing on all cylinders!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Trading reliance, reg baggage 💸

• Opportunities: Futures growth, crypto-friendly regs, global push 🌍

Can NASDAQ:HOOD turn momentum into a dynasty?

(8/9) – HOOD’s Q4 is a banger—where’s it headed?

1️⃣ Bullish—Growth keeps roaring.

2️⃣ Neutral—Solid, but risks loom.

3️⃣ Bearish—Peak’s in, fade coming.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

Robinhood’s Q4 is a SEED_TVCODER77_ETHBTCDATA:1B thunderclap—trading, deposits, and profits soar 🌍. But volatility and regs lurk. Undervalued or overhyped?

XRP FINAL STEEP DISCOUNT OPPORTUNITY IS IMMINENTMy time-wave cycles analysis (among other components) indicating we will have a final sell wave to 1.45-1.7 zone over coming days (before FOMC meeting in March imo).

Granted I was a little off on exact timing to reach the buy-side targets back in December but nonetheless accurate on projected price levels..See prior analysis at attached link for the projected high coming in at 3.1-3.3, exactly as it happened...

I have no doubt this final sell wave will also occur. Depending on your goals & trading style, you may treat this next sell wave as an opportunity to simply add more at discounted levels via DCA'ing....or choose to sell at these relative highs to maximize position size once again from sub-1.70 levels.. I DO NOT EXPECT US TO SEE sub-3$ ANYTIMEagain after this next sell wave completes & then buyers take us to 4+ in q2 & beyond.

Expecting this to be the FINAL steep discount buying opportunity for those interested in maximizing their capital purchasing power for long term speculative hodling

Follow for additional actionable alerts & analysis. Appreciate the boosts & looking forward to your comments as well!

COINBASE ($COIN) – RECORD EARNINGS, VOLATILE REACTIONCOINBASE ( NASDAQ:COIN ) – RECORD EARNINGS, VOLATILE REACTION

(1/8)

Coinbase just posted a Q4 2024 revenue of $2.27B (+138% YoY, +89% QoQ!)—crushing estimates of $1.87B. Transaction revenue soared 194% YoY to $1.6B. Ready to dive in? Let’s go! 🚀💸

(2/8) – EARNINGS BEAT

• EPS: $4.68, smashing estimates of $2.04 🤯

• Net income: up 300% YoY, fueled by trading volume +185% 📈

• Assets on platform: +46%, sign of growing trust and adoption 👥

(3/8) – STOCK REACTION?

• Surprisingly flat or slightly down post-earnings 🤔

• Market may have priced in these mega-growth numbers already

• High beta (3.61) means volatility—strap in! ⚠️

(4/8) – SECTOR SNAPSHOT

• P/E ratio ~49.5 (forward 43.76)—high, but robust growth could justify 🏦

• Analysts’ avg. price target: $274.65 vs. current price ~$300—some see overvaluation unless growth keeps surging 💹

• Faster revenue growth than many fintech peers, yet higher volatility 🌀

(5/8) – RISKS TO WATCH

• Crypto Volatility: If the market cools, trading volume slides 😰

• Regulatory Battles: SEC classification = potential compliance woes ⚖️

• Competition: Binance, Kraken, DeFi—Coinbase must keep innovating 🏁

• Economic Sensitivity: Slowdowns can reduce trading appetite 🌐

(6/8) – SWOT HIGHLIGHTS

Strengths:

• U.S. market leader, regulatory advantage 🇺🇸

• Growing subscription/services revenue (+71% YoY)

• User base & brand loyalty remain strong 🌟

Weaknesses:

• Reliance on crypto market sentiment → volatility

• Elevated valuation vs. peers, less margin for error

Opportunities:

• Expand into regions with surging crypto adoption 🌍

• Tokenization, stablecoins, new blockchain products

• Potentially friendlier crypto regs = less legal risk 👀

Threats:

• Regulatory crackdowns → higher costs, narrower product offerings

• DeFi could disrupt centralized exchanges

• Market saturation → possible price wars 💢

(7/8) –Is Coinbase overvalued at $300 despite epic growth?

1️⃣ Bullish—Crypto momentum will keep fueling NASDAQ:COIN 🚀

2️⃣ Neutral—Growth is great, but so is the price 🤔

3️⃣ Bearish—Regulatory & competition threats loom large 🐻

Vote below! 🗳️👇

UPSTART ($UPST): AI-DRIVEN LENDING ON THE RISEUPSTART ( NASDAQ:UPST ): AI-DRIVEN LENDING ON THE RISE

1/8 – REVENUE & EARNINGS BLAST

• Q4 2024 revenue: $219M (+56% YoY) 🔥

• Powered by a 68% jump in loan originations 💸

• EPS: $0.26, beating estimates by $0.30 (analysts expected -$0.04) 🚀

• Positive Adj. EBITDA—Upstart’s inching closer to sustained profitability 🏆

2/8 – BIG FINANCIAL EVENTS

• Strong focus on AI model innovation + expanding funding supply 🤖

• Management bullish on earnings call—AI improvements = growth catalyst 🚀

• Renowned for bridging lenders & borrowers via advanced, automated credit assessments 🌐

3/8 – SECTOR COMPARISON

• Some valuation measures say overvalued (e.g., GF Value ~$28 vs. market ~$65) 🧐

• Outpacing fintech peers like SoFi, PayPal, Ally in revenue growth 📈

• Profitability & multiples (P/E, P/S) lag behind due to recent net losses 😬

• Unique AI-lending angle may justify a premium—if it pays off 💡

4/8 – RISK ASSESSMENT

• Partner Dependence: A few big lenders = high exposure ⚠️

• Economic Sensitivity: Loan defaults rise if consumer conditions worsen 🌪️

• Regulatory Hurdles: Shifting financial rules could dent operations 🏛️

• Credit Risk: Holding loans on the balance sheet—watch out in downturns 💥

5/8 – SWOT HIGHLIGHTS

Strengths:

• Advanced AI for credit analysis 🤖

• High automation in approvals ⚡️

• Scalable via partner expansions 🌍

Weaknesses:

• Limited operating history ⏳

• Recent financial losses 📉

• Reliance on key partners 🤝

Opportunities:

• New loan products (auto, HELOC, etc.) 🚗🏠

• Expanding digital lending market 🌐

• Gaining market share as AI evolves 🔬

Threats:

• Fierce fintech competition 🏁

• Possible regulatory changes ⚖️

• Macro headwinds affecting credit demand 🌩️

6/8 – UN/UNDERVALUATION DEBATE

• Some see big future potential → undervalued by growth prospects 💹

• Others worry about multiples & an over-reliance on economic upswings 😬

• Recovery depends on broader economic rebound & strong risk management 🏦

7/8 Is Upstart a gem or a risk?

1️⃣ Bullish—AI lending will transform fintech 🏅

2️⃣ Cautiously Optimistic—Need more stability 🤔

3️⃣ Bearish—Valuation & macro risks are too high 🚫

Vote below! 🗳️👇

8/8 – STRATEGY WATCH

• Keep tabs on new loan products & partnerships 🛠️

• Monitor economic indicators (defaults, credit demand) impacting revenue 💼

• Regulatory shifts can either boost or bury AI-lending advantage ⚠️