ZenMode Snapshot: Bitcoin Fundamental/Technical AnalysisStill think the fundamentals for bitcoin are incredibly bullish:

Miners:

Outflows - Bearish

Miners still depositing to exchanges - Bearish

BTC Whales:

Reserves Increasing - Bullish

Transferring BTC off exchanges - Bullish

Institutions:

Still a narrative of corporations acquiring BTC in leu of traditional treasury assets - like treasuries

Bombarded with treasury yields now indicating inflation is coming

$1.9 T Stimulus

I have gotten questions about why the sell off in commodities, crypto, treasuries and equities last week - and aside from technical reasons, the article sourced below from Bloomberg is a must read:

"Already low short-term interest rates are set to sink further, potentially below zero, after the Treasury announced plans earlier this month to reduce the stockpile of cash it amassed at the Fed over the last year to fight the pandemic and the deep recession it caused. The move, which aims to return its cash position at the central bank to more normal levels, will flood the financial system with liquidity and complicate Powell’s effort to keep a tight grip over money market rates.”

" ... a drop in short-term market rates into negative territory could prove disruptive, especially for money market funds that invest in short-dated Treasury securities. Banks may also find themselves hamstrung by effectively being forced to hold large unwanted cash balances at the central bank. The Treasury’s decision -- unveiled at its quarterly refunding announcement -- will help unleash what Credit Suisse Group AG analyst Zoltan Pozsar calls a “tsunami” of reserves into the financial system and on to the Fed’s balance sheet. Combined with the Fed’s asset purchases, that could swell reserves to about $5 trillion by the end of June, from an already lofty $3.3 trillion now."

"Here’s how it works: Treasury sends out checks drawn on its general account at the Fed, which operates like the government’s checking account. When recipients deposit the funds with their bank, the bank presents the check to the Fed, which debits the Treasury’s account and credits the bank’s Fed account, otherwise known as their reserve balance."

So think about this from the perspective of a financial institution, they would have to make the Treasury market holding a product with potentially negative yield - while also forced to buy insurance on the larger reserves they will need to manage. If you are a financial institution are you going to want to offer financing in the overnight market that has negative yield so a company you work with can hold Treasuries? And with the flood of Treasuries & Liquidity this also has muscled up the 5Y yield while the repo market might potentially be going negative. With the 5Y yield up now in Treasuries I am reading how the 10Y yield is comparable now to the SPY Dividend of 1.45% - and keep in mind the reduced risks in holding Treasuries. They are practically as good as gold for a corpo.

10Y Yield

10Y Bond

5Y Yield

5Y Bond

So while the Federal Reserve controls the Federal Funds Rate, the Treasury Department can absolutely impact the yield in treasuries, and impact the overnight rate.

This hurt risk assets, as the market now needs to price in Treasuries actually offering yields potentially worth getting into. A fascinating exchange exchange with MicroStrategy CEO Saylor talking to Bloomberg discusses thought that even now this yield is a pittance when compared to the cost of capital for companies. It is telling that a company with modest cash flow is saying that rather that investing into their operations further, and rather than giving back to shareholders, or doing share buy backs they are purchasing bitcoin as the yield on bitcoin is stunning relative to Treasuries or holding a basket of FANG stocks.

Really interesting interview worth watching:

www.youtube.com

The key is if other executives will follow the lead of TSLA, SQ, MSTR and add Bitcoin on the balance sheet. While it may seem unconventional, keep in mind if you are a multinational corporation it is perfectly normal to have hundreds of bank accounts, like Disney, Microsoft or Facebook for example because you have vendors all over the world you will need to compensate for their services, in their currencies.

Technical Snapshots:

If price continues to sell off nice confluence of support with pivot points/fibonacci fan & bollingers at $40k - $40k breaks, we could hit $38k rather rapidly before I imagine buyers will be attracted

Bulls will have a tough time breaking $48.5k followed by $50k . Even then, we might form a lower higher, and test support yet another time before continuing to new ATH

I remain long, and am nibbling on dips, and enjoying these rips. I plan on adding to the position if we break $40k. My exit strategy will be to bail If we fall under $28k, as at that point I would have 3X'd the initial cost basis of this position.

In closing, do not forget, why is the Repo market going negative, and why are 5Y yields rising? Inflation concerns. The formula for inflation is M2*V= inflation. Velocity will increase as the nation opens back up causing inflation, especially as the M2 supply is about to take on another jolt. I suspect this stimulus will pass, and I think Bitcoin is a potential lifeboat when inflation hits. Yes, we need to price in treasuries now - and yes I thought it was bonkers that the market suddenly tanks treasuries to pop yield for inflation and then - the market rotates into the dollar? So inflation is coming and the dollar rises as it did on Friday? I think I would recommend parking some wealth in the bitcoin lifeboat. Perhaps a moonshot, but this macro-narrative warrants it in my opinion.

Final Quote coming from Michael Burry last week:

"The US government is inviting inflation with its MMT-tinged policies. Brisk Debt/GDP, M2 increases while retail sales, PMI stage V recovery. Trillions more stimulus & re-opening to boost demand as employee and supply chain costs skyrocket." #ParadigmShift

— Cassandra (@michaeljburry) February 20, 2021

Good luck traders! If you enjoy please be sure to hit the like button, and tell me what you think! Hope you all make a million! :)

Keep in mind when the gold-bitcoin bears come out saying that it is too volatile, it is worth advising that even with this sell off you can still acquire an ounce of gold for only 0.038 BTC:

Or 745 barrels of oil:

Source:

www.bloomberg.com

Fixedincome

Monitor Bond Yields - Feels like 1987?Hey there, thanks for reading my idea! This isn't financial advice. Remember to do your own DD. Investing is risky.

This is connected to my "Feeling Overextended?" idea which can be found here .

An important metric to watch when determining whether a recession is imminent is the inversion of the Treasury bonds yield curve. Most specifically, the 3-month, 2-year and 10-year yields. The inversion occurs when the shorter-term note yields begin to rise and exceed long-term note yields.

Ideal bull market conditions would have higher yields in long-term notes and lower yields in short-term notes. Higher long-term yields forecast economic growth where the Government can be expected to be able to pay back the bond. Typically, higher yields are associated with higher interest rates, which poses as an investor risk, hence the higher yield premium. Meanwhile, higher short-term yields forecast economic downturn as investors look for shorter time horizon returns to minimize risk.

We have to remember that the Fed is expanding it's balance sheet through QE by buying certain assets such as mortgage-backed securities and TREASURY NOTES from the market, and J. Powell is confidently using his tools to prevent a market crash. By buying Treasury notes, the Fed can manipulate yields to create a positive outlook of the economy through a "positive" yield curve, rather than an inverted yield curve. In fact, the Fed has accumulated approximately $3billion in Treasury notes since the Covid crash. (source here , scroll down to the Fed Balance Sheet graph.)

Is it recession time yet according to the yields? Maybe not yet, but once the 3 month and 2 year yields begin to rise, this should place pressure on the 10 year yield to fall., setting the stage for the next downward cycle.

PCI Gap fill play - 20.55 Thought I published this yesterday, was thinking that the gaps on this might get filled. Not overly optimistic about a run down to 20.35, let alone the one below 20, compromising with an order for a few. Tiny starter position at 20.55 for 14 shares, might just say screw it, we may get get some more bearishness tomorrow or the next week, but as we close in on the holidays, unless pension fund re-balancing manifests as we've been warned for the last few weeks (I think they did it during the election), or another catalyst manifests, I'll just by somewhere in the current vicinity and look forward to that firehose of 2.30$ USD per month pumping profits into my investment account. Monthly payer, so every bit counts when you're small potatoes.

RSI is confirming a breakdown in price on the 30 min, but might be using 4 hr to confirm buy signal if my price is not met in the next day or so. Being impatient on more than a couple of plays in the last week, but so far, any dip seems to be bought up in whatever I am trying to purchase at a discount.

Gap filling strategy - PCIDo all gaps get filled? No, but sometimes it pays to have an order or two in, especially when the market is as it is - overvalued. PCI seems like a relatively decent instrument to harvest dividends over the long-term, but...as always, I want a better price. Not being overly ambitious in trying for the second gap, tiny position planned, but as always, I like to try things on for size before I start to build a position in earnest. 20.35 for a few shares doesn't seem like too much of a stretch, and we are due for a correction imho. More aggressive buyers would probably look to get filled on the gap down to 20.77, and if it appears, I might just get impatient and go with that. I am not looking for growth here, just another steady payer. Will start digging into the financials today.

You have to pay attention to this...So we are probably all aware of the stock market sell off that is currently occurring.

It's likely due to a combination of things...

The reflation trade reaching a short term top...

The holiday weekend profit taking...

And a bit of a rotation out of tech to value.

Stocks have been hit pretty hard.

And when stocks are hit hard...

The financial media have a field day.

The problem is that the financial media trot themselves out when the 'knowns' are available...

That is, once the move has happened.

So listen to this.

Whenever CNBC releases their 'Markets In Turmoil' segment...

The SP500 has an average weekly return of 1.5%...

Over 3 months, that return jumps to 5.4%.

And after a year...

A staggering 20.8% average return after this segment.

Guess what?

CNBC just released this segment this afternoon.

Now, I'm not saying this is a bottom (although it could be)...

But it's something to pay attention to, alongside other factors that may prevent you from catching a falling knife.

Being a bear is a tricky thing to be when the fundamentals don't necessarily support a bearish market.

What I mean by this is that the risk free rate of return is all that matters - and that risk free rate of return tends to be the US 10 year benchmark yield....

Central bankers are very dovish, which means that they support more liquidity via monetary easing, which implies even lower yields in the mid term.

No matter what you think of valuations - generally people think they're too high - the equity risk premium (the price paid above the risk free rate of return) is extremely low.

Until this decompresses, risk will remain bid, and tech stocks will remain acting like sovereign bonds (acting like a replacement for this risk free rate of return).

I think you can tell what my stance here is!

Strong Upward MovementRisk appetite is back on the menu and YYY is primed for more upward momentum in the current market environment. It currently yields over 11% and the fact that it is up today on the record date is very bullish. It's rare to have a fixed income product act like equity, so might as well capitalize. *P/L targets on chart

-personal analysis, not investment advice, and best of luck!

10Y US TREASURY NOTE|PREMIUM[LONG-TERM]YIELD ANALYSIS|PART 2/2"US10y : Series on Bonds - Sept 20th 2019(7-8 minute read)

For the past couple of month yield curves, particularly the 10 year vs the short term maturities have been a popular topic in the mainstream media, mostly because of the yield curve inversion . This analysis aims to provide a well detailed approach to some of the crucial factors regarding the US Treasuries yield curve. Relatively to part one(linked below as #1), this is a much more complex analysis.

Before I start analysing the yield on the US10 year treasury, addressing some of the criticism from my previous analysis that they are too complex to understand. If it takes me several hours and even days or weeks to notice a pattern, it should take at least 30 mins to properly understand my charts. Most people on this platform have an unrealistic expectation of understanding an unknown method of chart analysing within 30 seconds . In this yield analysis I am utilizing Elliott Waves, Pitchfork Trends, Ichimoku cloud , Harmonic Patterns and EMA/Moving averages in addition to my fundamental approach.

Beginning with this analysis by analysing the pitchfork . It is the most complex and largest part of the analysis. It took me about a month to perfect it and from my thorough understanding, the pitchfork base formed after the mild early 90's recession(w) . You can see my initial sketch for this analysis here: ibb.co To my credit, the same pattern can be observed after the FED rates breakout from bullish cone in my previous analysis on the cycles of FED rates(linked as #2) . It is hard to understand the yield curve without a through understand of monetary policy. I will get back to this point on the pitchfork later in the conclusions.

After the dot.com bubble, a bullish triangle( wedge ) formed in the US10Y . This pattern lasted until the real beginning of the recovery in 2012, after the financial crisis of 08'. At the same time it formed the bottom in yields labelled as e(z), which still stands as the main support. Since the recovery, thanks to Trump's tax reform , the yields managed to make a top close to the long-term resistance ~3.3% in late 2018 . However, there was a hard rejection near the 200 monthly MA and the pitchfork median . Persistently, since the early 90's, I noticed that the 100 Monthly EMA (blue line) has been the primary resistance, in addition to the ichimoku cloud. On the bearish side in yields, it is important to emphasize here the recent yield curve inversion.

The significance of the latest inversion is that is that it has predicted the previous 6 recessions. Now obviously, this pattern may not occur again since we are at such low rates anyways. Personally, I do not see the yield curve as the factor foreshadowing the next recession, it is more of a symptom of a recession. The actual issues that are cooling off the global economy which obviously has a major impact on the US economy, are the downtrend in trade caused by the trade war, Brexit and the economic pessimism in the Euro Zone . I will not discuss these factors in this analysis(you can read about them in my previous posts).

To conclude this analysis on the US 10 year treasury note; without a trade deal, it simply illogical to be long in this market . In addition to the drop in yields(Where's the positive correlation kicking in??), with the recent earnings miss from Fedex (FDX) and the poor performance of the transportation sectors and the rise of defensive sectors(XLU) (XLI-Linked as #3); it is very surprising that some of the cyclical equities haven't taken a major bearish hit yet . These are the fundamental factors necessary for a cycle extension and a healthier economy.

In case a recession happens and that is obviously inevitable( to FED's/ECB's surprise ), from this analysis after the 10 year note breaks the current support at e(z)~1.3-1.5%, several bottom supports from the pitchfork can be observed . The US10Y is currently in a Bearish Rectangle. Contrary to the negative yields that have occured in a good number of the OECD economies, in my opinion the US yields should follow the drawn pitchfork and form a bottom close to 0, but not necessarily cross the line and turn negative in the medium term. This concludes the two part analysis on the US 10 year Treasury note.

Hope that anyone reading this post found it useful and enjoyed it!

|Step_Ahead_oftheMarket|

P.s. Would appreciate some feedback charts or simple comments expressing your opinion on the bond market, thanks!

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and get informed in the greatest of details, every thumbs up or follow is greatly appreciated !

Some of my popular analysis relevant to the bond market:

1. Part one- ZB1! US 10 Year Treasury note Price analysis :

2. FED Rates SuperCycle Analysis :

3. XLI- US Industrials :

Full Disclosure: This is just an opinion, you decide what to do with your own money. For any further references or use of my content for private or corporate purposes- contact me through any of my social media channels.

10Y US TREASURY NOTE|PREMIUM[LONG-TERM]PRICE ANALYSIS|PART 1/2|ZN1! : Series on Bonds - Sept 20th 2019(4-5 minute read)

This is a two part analysis on the US 10 year Treasury note , the second part analyses the yield. In my opinion, technical analysis is somewhat (okay-ish) effective in analysing bond price action, especially to bonds with longer maturities. This is because they are priced in terms of private expectations. Which are based on market psychology principles that are one of the main foundations for technical analysis. Fundamentally, building models with matrixes of auctions prices is the better method , however as an individual retail trader with limited time, it's quite an unrealistic thing for me to do.

Now, let's begin by analysing the structural wave build up. The closing monthly top on Wave 1 after the 2001 recession(~117$) provided for the impulsive wave buildup. Unfortunately, I would have prefered if the data extended back to 1984 for a more accurate trend analysis, but from the current chart a precise EW buildup can be observed. Wave 3 (top 134) happened after the 2008 recession.

Both of these bullish waves continued to form, despite an official NBER recession ending announcement. In my opinion, a more accurate estimation of the recovery in the economy can be observed from the bond market as compared to purely basing such an observation from equities . Despite the official end of the recession being June 2009, the unemployment rate peaked later that year .

I know it's extremely inappropriate to perform a trend analysis on the unemployment rate, but this is just to support my previous argument and strictly informational.

What are the expectations moving forward? Similarly to the WXY 03'-07' expansion , the current WXY expansion (12'-19') is near its ending. Perhaps with the current " mid-cycle" rate adjustments and medium fiscal stimulus the cycle could extend . If a US/China deal gets done and cycle extension does happen, it won't completely undermine the increased probability of a recession in the next 3 years . What further complicates things are the 2 020 US elections, Brexit and the cooling down situation in the Eurozone . Hence, I see a formation of a bullish triangle in Bond prices .

Zoomed in chart 2019-2023 potential triangle build up in case a cycle extension happens.

To sum up this analysis, in case a recession occurs, based on the wave build up- the maximum target for wave 5, would be in the range of 146-153 . I am not sure if the Wave V would have have a 2.62 extension( based on the already low yields This analysis supports my previous extensive work on FED rate cycles(Link #1 below). The blurry WXY at the end of the chart is what I would expect during the next extension. I have to emphasize that I attempted to find a pattern in the Moving averages and other technical indicators, but came to the conclusion that they are simply not as precise as the Elliott Wave Setup . This is it for part one, make sure to check the much more complicated Part two Yield analysis on the 10 year US T Note.

|Step_Ahead_oftheMarket|

P.s. Would appreciate some feedback charts or simple comments expressing your opinion on the bond market, thanks!

>> I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories .>>

However, if you'd like to support me and get informed in the greatest of details, every thumbs up or follow is greatly appreciated !

Some of my popular analysis relevant to the bond market :

1. RECESSION IMPENDING?(PART2)FED RATES SUPERCYCLE|PREMIUM ANALYSIS:

2. The VIX :

3. XLU - SPX Sectors Finale :

Full Disclosure : This is just an opinion, you decide what to do with your own money. For any further references or use of my content for private or corporate purposes- contact me through any of my social media channels.

RECESSION IMPENDING?(PART2)FED RATES SUPERCYCLE|PREMIUM ANALYSISFED INTEREST RATES( FRED ) - Extension(PART 2) to the US (SPX) Sectors Technical Analysis Series - 18th of August 2019 (9-10 Minute Read)

Everyone complains about the FED rates. That's our only job, it seems . Judging by his tweets, no one has been more eager to express their dissatisfaction, than Pres. Trump (bit' of sarcasm) .

This is Part 2 - of an extremely complex(Premium) cycle analysis . The purpose of this chart is to showcase the historical relationship between FED Rates and economic cycles . In order to understand this analysis; in depth historical knowledge of the FED's Monetary Policy is necessary (besides my personal need, of my work actually being understood properly).

Now, let's start with a chronological setup(Blue #number labels) that will be used to analyse rates. The beginning of the Bullish Cone was the Impulsive Intermediate Wave 1(in the late 50's ). By the early 70's and the occurrence of the OPEC crisis ; a supercyclical Wave 1 and 2 were formed. Wave 2 gave the bottom support of the Bullish cone in FED interest rates. As it's labelled on the chart the importance of the bullish cone is that it signifies the Peak of Capitalism .

The implications of this peak were a consumption driven economy, combined with excessive cycle volatility. At the same time this was the Fixed Incomes' Golden Age ; as practically every American individual was told that buying a house is the utmost important aim in life. Obviously at the time, this was quite logical, since home equity is an effective way to protect your wealth from inflation. The Fibonacci Circles used on the chart show the pattern of cycles that formed the Bullish Cone. Each end of a circle forms a trough and consequently a peak in a given cycle time span.

What Changed ? - Our understanding of Monetary policy changed (Credit to Barro and Gordon,1983) . The early 80's were extremely turbulent years with immensely high inflation . The end result was an exit out of the old equilibrium and a break-off from the Bullish Cone, into a new Equilibrium . The trend that formed the New Equilibrium in general economic terms is referred to as the "Great Moderation" . This is why the chart is divided with a cross, centered around Q2,1984 that was the start of the "Great Moderation". The occurrence of this event can be observed in the clear difference with the synch of the sin-line with the different cycles between the 2 periods. The new equilibrium is extensively supported by the rise of Globalization . In effect this is the first part of this analysis.

Part 2 of this analysis is, what started this idea with the downward trending wedge ( Pitchfork ) in interest rates since the "Great Moderation". This was my primary sketch from a week ago.

Just so, I am not boring and do not repeat myself- I will not discuss the labels post 84' neither on the sketch or the chart. What is important in the current interest rate environment are the implications of the prolong duration of these extremely low rates . Hence, the chart is divided between 2% and below(RED) and above Green . The rationale behind this division, is that there are plenty of fundamental issues that appear if rates are lower than 2%(in addition to low growth/inflation). Unfortunately we've practically been in such environment for about 9 years now . Implications of this environment can be credited to James Bullards (2016) "Perma-Zero" paper.

One of the major issues is the trade-off between debt and equity . In the current environment stocks on average are trading 14-17 x(times) their earnings (x17 P/E) . We have an enormous amount of laughable companies available to stay in business with continuously negative EPS . One example that I can think of is WeWork Ltd . (In order to spread awareness, I need your help on this one- comment as many companies that come on you mind that fit this description) . This is a healthy and necessary discussion to have . Low rates do stimulate innovation, but the inevitable cost is that due to competition- the majority of these startups become unproductive and hardly ever profitable.The best description that I think it fits these worthless capital soaking "Business Ideas" is to classify them as Malinvestments .

Finally, what's the conclusion of this extensive FED rates analysis? - Borrowing Capital should have some baseline cost (2-4% would be quite an optimal range) . As discussed in Link #1 and Part 1 of this series based on the VIX that analysed the probability and timing of the next recession; - I t is nearing . Unfortunately, we will not have rate cuts as a tool to stimulate the markets. Whether it is obvious or not; we are quite overdue for a recession . This can also be observed from the sin-line at the bottom right corner; implying a bottom of the cycle in the next 2-3 years . Essentially, this is the reason- why I have dedicated much of my time to at least attempt to provide a series of ideas in my content, that include proper interpretation of the most crucial financial and economic factors .

This idea concludes the extension to the SPX Sector series. Hope you enjoyed it and found it useful.

|Step_Ahead_oftheMarket|

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and get informed in the greatest of details, every thumbs up or follow is greatly appreciated !

I do realize that my charts are quite hard to be understood, mostly because they are labelled to the smallest and extremest of details. If there are any poor understandings of the labels, I'd be able to answer any additional questions in the comments.

{Make sure to check out my previous ideas and my series on US( SPX ) Sector including 11 episodes of the major US sectors}

1. PART 1-VIX: Volatility Index

2. Series Finale ; Episode 11: US Utilities( XLU )

3. SPX : Elliott Wave Analysis of the current Cycle

Full Disclosure : This is just an opinion, you decide what to do with your own money. For any further references or use of my content for private or corporate purposes- contact me through any of my social media channels. Wish that tview had a copy-right option, but it is what it is.

Bonds Likely to Close the GapThe whole world was glued to twitter waiting for an update on the trade war from President Trump. However what they received was rather anticlimactic: a tweet about saying we don't need to rush a trade deal, which was later deleted. It is likely the markets will interpret this as a risk-off event, since they were really expecting more clarification.

Currently, the Kovach Momentum Indicators suggest momentum has stagnated. Bonds are currently ranging, and are likely to drift upward, testing the upper bound of the range.

Bonds Due for a RetracementBonds have been gradually overbought owing to a slew of risk off factors including global economic fears, and the trade war. At this point, we may be due for a corrective phase by the end of the week. There is a representative from China flying in, so this may provide a much needed respite from the doom and gloom.

The Kovach Momentum Indicators suggest that momentum is gradually turning negative, which may support our position. Shorting near current levels would provide high risk reward because there is a vacuum zone to the down side, and new relative highs would provide a good stop loss. We know we're wrong if these are breached.

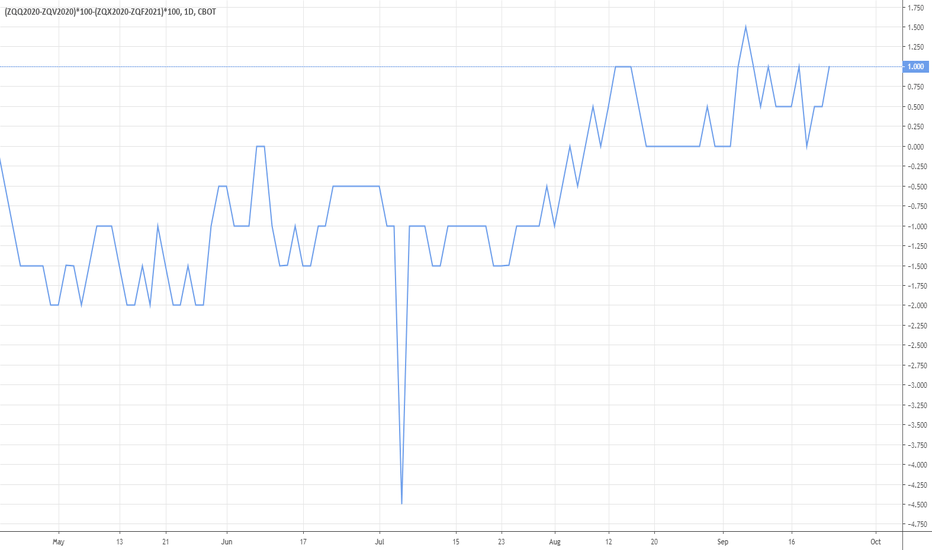

FED FUNDS CONDOR AUG19-OCT19 vs NOV19-JAN19FED FUNDS CONDOR AUG19-OCT19 vs NOV19-JAN19

(FFQ2019-FFV2019)*100-(FFX2019-FFF2020)*100

LIBOR-OIS Curve Trade Mar19 - Dec19LIBOR-OIS Spread between March19 - December19

((FFN2019-QEDM2019)-(FFF2020-QEDZ2019))*100