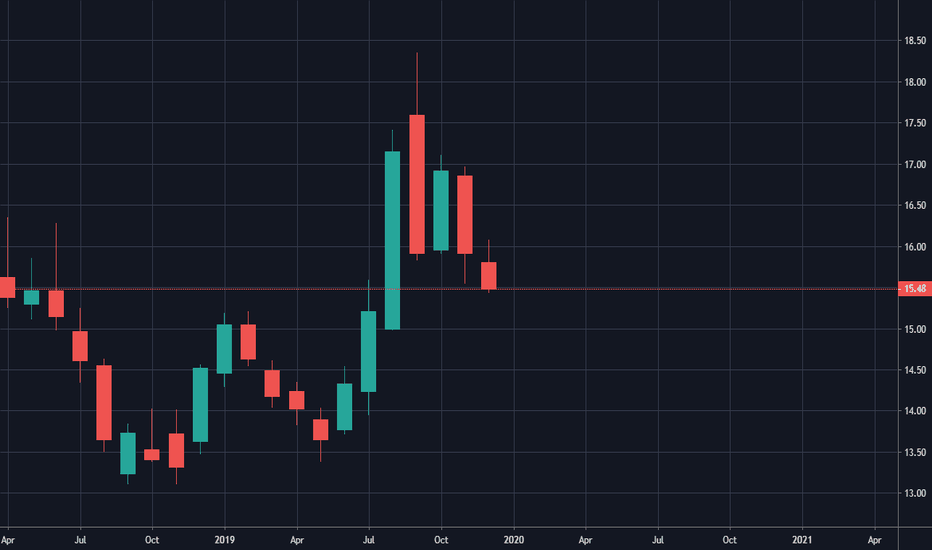

NZDJPY Sell from the topHi everyone:

Looking at NZDJPY for sell opportunities.

Price is sitting at the top of the larger structure, double tops, and correctively moving up in an ascending channel.

I will be waiting for a confirm breakout from that channel, and lower time frame continuation correction to get in the sell.

Look to see how price will do once hits the bottom of the higher time frame structure.

Thank you

Flag-pattern

GOLD (XAUUSD) - more upside probable. This is an update on the daily time frame for gold. Things have changed.

I see some sort of continuation pattern developing creating probability for the upside. Note carefully my disclaimer below.

For every probability estimate in one direction there is always a residual probability for the opposite direction (- this is why we have stop-losses which must always be affordable).

For the record - and just in case - I never predicted that Gold was gonna crash. This doesn't mean it can't crash. What I said on a previous occasion was that 'Gold could be in trouble' and yes it could still be in trouble even if it punches north.

Disclaimers : This is not advice or encouragement to trade securities. No predictions and no guarantees supplied or implied. Heavy losses can be expected. Any previous advantageous performance shown in other scenarios, is not indicative of future performance. If you make decisions based on opinion expressed here or on my profile and you lose your money, or miss opportunity, kindly sue yourself.

XRP/BTC forming a Bull flag?BINANCE:XRPBTC

Hi Everyone, XRP/BTC has been consolidating for several days, forming a resistance/support level pattern that looks like a bull flag , I also noticed that every time the market get to the resistance level , they are pushing really quickly the price back, forming doji all the way. This particular dojis can be interpreted as market showing off strength. Right now we are at the very top of one of the important resistances. if we break out that resistance price can shoot up 10 to 15%, behavior of a breakout can be different than others. Sometimes we tend to see a retracement to test the new support that use to be resistance before push to a higher levels. Im looking for confirmation on a break out of either, resistances or support. But so far my Position is Bullish on this trade. In addition, there are some bullish divergence on the momentum indicators that it is really interesting to me.

Cheers!

SLV Long Bull flag on monthly chart Monthly Chart shows a very nice Bull Flag for SLV A long stock play can be done if I want to hang onto the stocks for a few months. The length of the flag pole shows about a $3.5 move, so an option about half way up that move with the expiration of March would also work. In fact. I'm looking at the decently16 s priced strike that expires on March 31 2020

a Debit spread can also be done if i also sell the 17 strike on the same expiration That would make the cost of the spread at the current market price $21 with a profit potential of $79

matic/btcentry : 0.00000169 -0.00000176

-------------------------------------

t1:210

t2:250

-------------------------------------

stop loss :156

-------------------------------------

Flag pattern being created in gold signals a breakout coming.We are seeing a nice flag formation in the gold price. Such triangular patterns are always followed by a breakout that bulls and bears will be watching closely. Will it be a break higher, or a break lower? Which one are you -Bull or bear, or don't care??

Gold'd-dA "Triangular Flag" pattern is generally a very bullish signal for short term traders. Basically it consists of a spike (the flagpole), followed by a period of sideways trading where the swings up and down gradually become smaller (the triangular flag). At some point, we reach the tip of the flag (the pointed end). The price can then break up or down from there. Usually its to the upside. Many traders are watching for this break, so when it comes it is usually fat and furious (another flag pole).

Previous peaks tend to act as resistance levels. When a resistance level has been solidly broken, that resistance area turns into a support area. On the graph above, I have drawn in the recently broken resistance levels. They should act as support if the price of gold falls.

On the chart I have also drawn the resistance levels which have not yet been broken. These are the green lines. The next resistance level is about $1438. It's very close. We already touched that level but couldn't break through If we break that $1438 level, then gold should quickly run up to the next resistance level of $1489.50 before pulling back and sideways trading in the $1438 to $1489 range.

It is bound to take some time before the $1489 level is broken. However, when it is broken, there is very little to stop gold shooting to over à1$612.

More upside is to expectedSo if you missed the up move a few days ago then don't worry. Right now there is a flag forming or a correction if you will. Once it breaks out of this flag formation then there will be more profit to be made.

I expect it to break the top of late 2019, so there should at least be around 15% profit to be made from now on.

Happy trading!

Updated Bitcoin Cash Bull Flag (30% Gain)Entry .04

Target .0535

Stop Loss .0375

Bull Flag Pattern and .5 Extension of ABC

USD/JPY - INTRADAY - FURTHER UPSIDEThe pair is currently forming a flag continuation patter therefore I'm interested towards buying.

All the details are on the chart

Entry @ 111.735 (Buy Stop)

Stop @ 111.486

TP1 @ 112.030

TP2 @ 112.146

Disclaimer:

For risk and money management purposes, always determine a max. of 2% risk on every trade.

For example on a $50,000 account, this would be equivalent to 1,25 Lots with an 80 pip stop loss.

Targets and closure of positions may be subject to alteration throughout the course of the trade. This is due to the ever-changing and unpredictable nature of the market.

This post is set to be used and serve as an example and in an educational manner and is not to be taken as direct investment advice.

USDJPY TRADES INSIDE BEARISH FLAG PATTERNThe US dollar continues to struggle for direction against the Japanese yen on Friday, as financial markets calm after recent fears about the Turkish economy. The USDJPY pair currently trades within a well-defined bear flag pattern which extends from 110.65 to the 111.25 level. Traders should also note that price is also trading inside a much larger bearish head and shoulders pattern.

The USDJPY pair is only bearish while trading below the 110.65 level, key support is now found at the 110.10 and 109.56 levels.

If the USDJPY pair trades above the 111.25 level, buyers are likely to test towards the 111.37 and 111.80 resistance levels.

USD/CAD flag pattern; fundamental breakout expectedReally nice looking flag pattern on the 1H chart of USD/CAD.

Only problem is that those moves are mainly caused by high volatility fundamental moves, and they are difficult to catch.

Plus the fact that another big fundamental piece of news is about to be released within the next 3 hours (NFP).

Anyways, the technicals are there.

1.30 break , aim for 1.31 then.

The neighbors on the other side. (AUDNZD)It's been a while but lets get right to it.

Weekly

The orange line I drew up is from the highest high back in 2011 (about a 3,745 pip range). This line was broken last year in July. Recently it's established a consolidation area in the past month and can be seen that momentum has slowed for a bullish outlook. As you can see the recent top has not been touched since late 2015.

Daily

The daily RSI shows some up-ticks, and the MACD shows a bullish crossover though prices on the chart are consolidating. This timeframe also allows us to see the bullish flag in the making, along with the intended target. I've also played the opposing side to see the strength of a bearish turnout. The elliot wave has not finished developing either and we can be seeing a rise to the .618 retracement then a fall down to the .382 retracement.

Although this analysis is brief I do believe the chart will go up to retest the 2015 high. So far I am bullish because we still have some room to go up, if not to the top of the channel, then to the resistance from (0)-(1) on the bullish wave (approx. 1.0826).

Looking for an entry point?