S&P500 Breakout Long! Buy!

Hello,Traders!

S&P500 broke out of the bullish flag pattern

Which makes me locally bullish biased

And I think that after the pullback

And retest of the broken level

We will see a move up

Towards the target above

Buy!

Like, comment and subscribe to boost your trading!

See other ideas below too!

FLAG

worst case scenario #BTCUSD #BearishI hope that this would be a false break

while 38.6k could make a powerful support besides S1 Pivot 30, historical price, and almost reaching RSI to selling saturation, we can consider this as a clear Bearish trend. It's been repeating a pattern for a while and it'd be a shame for market Bulls.

let's think that market is on Bears' hands and it'd would go for 36.65K

#Bitcoin looks attractive againThe crypto market is giving bullisg signs. TRADESTATION:BTCUSD made a good breakout from an ascending triangle and now is making a flag pattern. A breakout from this zone should confirm the next bull run for crypto. Even stocks with influence on the crypto market are looking good, like NYSE:SI , which I have it on my watchlist,

I will take a position on the green zone with a target sell at the blue zone for a +12% profit. But, depending on how it behaves I may hold to the resistance zone at $63,500 or even buy more on the way up.

FTM USDT - LONG SHORT analysis Flag patternmy first trend analysis on FTMUSDT

we can see flag pattern on 1H time frame

now we should wait to see what happened.

SHIB/ USDTVery interesting , now there are 2 clear options if you see a descending triangle that's means is a down trend the price will hit lower targets but if you see again candle pattern the its clear visible a FLAG Pattern , and FLAG is a up Trend that's why i share both scenario.

Note: While Trading Keep eye on Bitcoin behavior

Hit like more i receive like more i share ideas

LTC*USDT Possible bearish flag in 4h tfTaking in to account the current situation of BTC that in my opinion made a weak bounce from support of 39k like you can see in my other analysis i expect it to touch the 37,5k level and then we will see if it holds.

Meanwhile i see this a probably good trade.

Because of:

-Touching resistance

-Touching upper line of ascending

-Weak state of BTC

----------------------------------------------------------------

Target and stop in chart

This in only my opinion, is not a financial advice, never risk your capital before making your own research and having a good risk management.

I would be pleased to see what do you think in the comments.

Regards and happy trading neither fear nor hope.

⭕️SELL GBPCAD ; its time to sell 🧐⭕️You see the analysis of the pound against the Canadian dollar in the daily time (GBPCAD , 1D)❗️🔎

🔰As you can see, the price moves in a flag-like pattern where the top and bottom lines are highlighted in white. Given the price in the lower line of the flag-like pattern and its uptrend line, as well as the purple supply range, buying this low-risk currency pair makes sense🧐

The target is also placed in the range of the resistance line (orange line)❗️

The profit and loss limits are also shown in the picture👌

⚠️⚠️Please observe capital management and open a low volume transaction❗️❗️

I hope this analysis is useful for you🙏🏻🌹

📌Please introduce the "TRADER STREET" to your friends 🙏🏻

____________________📈TRADER STREET📉___________________

LULU - expecting more upside in medium termLULU was forming an inverted Head & Shoulders (a potential sign of trend reversal), which eventually broke up strongly upon Earnings Release.

I would classify the gap that accompanied this breakup as a "breakaway" gap (gap that occurs at the beginning of a trend change, usually signifying the new trend has some room to move).

However it soon hit into a "horizontal support that now turned resistance" around 390 and has since been correcting from there. As I believe the uptrend as room (considering the breakaway gap), the recent pullback is likely a bull flag. I would long the breakup of this bull flag @ 369.5 with initial stop just below 358.

Scale out 1/3 position near 390 and hold the rest to see if it would break out of this resistence eventually.

Disclaimer: TA is about improving our odds of a successful trade (not a guarantee). This is just my own analysis and opinion for discussion and is NOT a trade advice. Please your own due diligence and trade according to your own risk tolerance and don't forget that money management is important! Cheers.

⭕️BUY BITCOIN at the safest place and price ✅⭕️You see bitcoin analysis in four hours(BTCUSDT)🔎

🔰As shown in the picture, Bitcoin moves in a flag-like pattern.

The safest price to buy bitcoin is the price that is at the intersection of the uptrend line (white) and the support line (orange), and I set the target in the supply range (purple).🧐

⚠️⚠️Please observe capital management and open a low volume transaction❗️❗️

I hope this analysis is useful for you🙏🏻🌹

📌Please introduce the "TRADER STREET" to your friends 🙏🏻

____________________📈TRADER STREET📉________________________

Bearish Flag on CHZUSDTBased on technical factors ( Flag pattern ) there is a short position in :

📊 CHZUSDT Chiliz

🔴 Short Now 0.2425

🧯 Stop loss 0.2665

🏹 Target 1 0.2200

🏹 Target 2 0.1900

🏹 Target 3 0.1650

🏹 Target 4 0.1470

💸Capital : 1%

We hope it is profitable for you ❤️

Please support our activity with your likes👍 and comments📝

BTCUSD - Bitcoin resistance and bullish divergence 20110410Bitcoin didn't break to the upside according to the previous target but it's still contained between the upward sloping lines of the ascending channel. The price suffered some pressure and broke to the lower part of the channel (below the median line).

However, the chart shows a bullish divergence which demonstrates that bears are losing power and that bulls can be ready to control, confirm the bullish divergence with the price and RSI oscillations in the chart. The price should pass the median line of the ascending channel, approximately around $43,500, to enforce the narrative that the bulls are taking control.

There's some resistance at around $45,600 and $46,900 so the price may struggle to break these levels, something to watch closely.

If the price breaks above $43,500 it can go to around $45,600. If the price doesn't break above $43,500 it can go sideways or to the lower trend line of the ascending channel around $40,000.

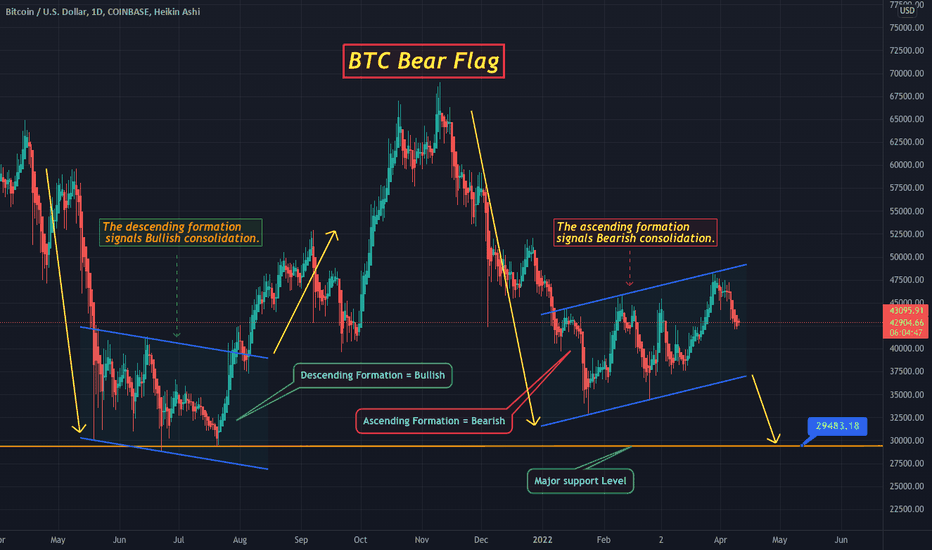

Bitcoin Bear Flag - What this means for Bitcoin's Future...Hello Traders,

Today I will be discussing the formation of a Bear Flag and what this means for Bitcoin.

- As you can see on the chart BTC has been consolidating in an "Ascending" parallel channel since January.

1) An ascending formation is typically a Bearish signal.

2) In conjunction with the downtrend from the highs at $69K in November, this creates a bear flag.

- Now I'm sure some of you may be wondering... Well BTC consolidated last year in a channel before the massive pump to $69K, so won't Bitcoin do the same this time? - The answer is no.

- Last year Bitcoin consolidated in a "Descending" channel which is typically Bullish.

- As expected BTC pumped coming out of that Bullish consolidation.

- This time BTC has created a Bear Flag and has a much higher probability of continuing lower before hitting previous ATH's.

So what does this mean for BTC? Here are the 3 possibilities I see playing out..

1) (Highest Probability) BTC retests the $36K support level

2) (Medium Probability) BTC retests the $29K support level

3) (Lowest Probability) BTC retest the $20K support level.

I want to emphasize... Patterns have a certain probability of playing out. Bear flags have a relatively high probability of playing out and BTC has formed a textbook Bear Flag. This means the probability of BTC breaking down and even hitting $20K are still relatively high. Sometimes you have to zoom out and look at the bigger picture. I'm sure a lot of you will be discouraged by this, but think of how incredible it would be to accumulate BTC back at $20K!?

Good luck everyone and happy trading!

LRC shortPrice in range on daily chart, had fake out but broke back into range. Price formed head and shoulders type pattern, broke support and retested support turned resistance and 4h 20 day ema. Had a high volume breakout of trend line on 30 min chart, bears currently following thru.

Stop loss: Above chop, above resistance

Take profit: Above highest volitility level of total range, just above a daily resistance level near mid point of range

APE bear flagPrice in mid term down trend, retested previous breakout area as resistance. Had a 50% retracement, rejecting at resistance / 50% fib level. Began to see wicks at upper bb band, price over extended - ma crossing bearish on stoch. Closed with a bearish engulfing on 15 min.

Stop loss: Placed above resistance - past high wick

Take profit: At support low - half order. Second half to hold on to break of flag - fib extension levels

Corn - Bullish Flag Corn is trading inside a bullish flag on Daily/Weekly charts. I'm looking for either a breakout or buy from the bottom of the flag (in case we see a bounce here rather than a breakout).

Targets at 800 and 880.

Invalidation - breakout below the flag structure.