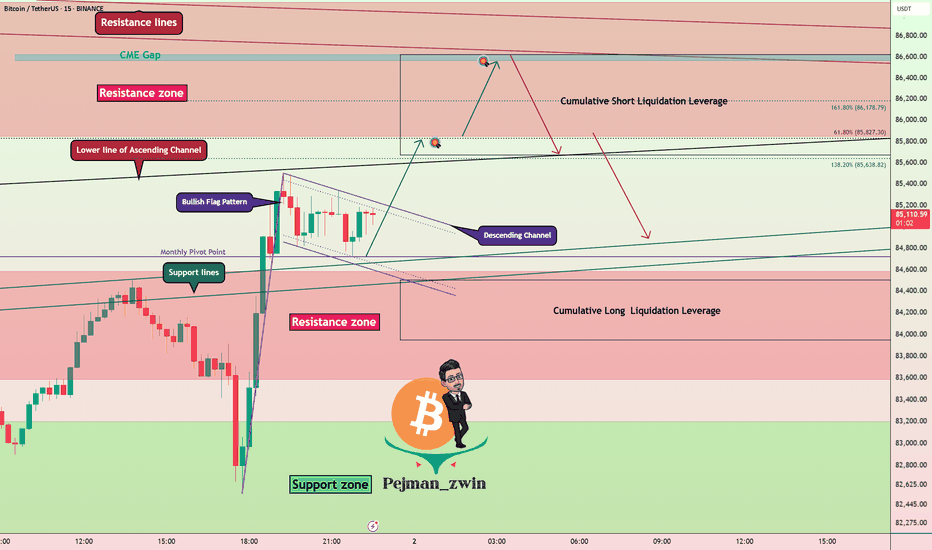

Bitcoin Breaks Resistance – Bullish Flag in Play(Short-term)!!!Bitcoin ( BINANCE:BTCUSDT ) started to rise and pump after '' the Mastercard Plans to Enable 3.5 Billion Cardholders to Transact with Bitcoin and Crypto, " and the US indexes movements and managed to break the Resistance zone($84,380_$83,580) .

Bitcoin is moving near the Monthly Pivot Point and Support lines .

Bitcoin seems to be completing the Bullish Flag Pattern .

I expect Bitcoin to reach the Targets I have outlined on the chart in the coming hours and most likely fill the CME Gap($86,620_$86,565) .

There is a possibility that Bitcoin will fall again after this increase. What do you think!?

Note: The Crypto market is full of excitement. Please pay more attention to capital management than before.

Note: This analysis could be a short-term Roadmap for Bitcoin .

Note: If Bitcoin falls below $83,500, we should expect further declines, possibly heavy declines.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Flag

Can we be optimistic that this will come true?( road to $1 )As you can see, the price has now formed an ascending wedge or ascending flag , which is promising. The price could rise to $1 after breaking this wedge...

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Apple May Have PeakedApple has tried to bounce recently, but some traders may think the tech giant has peaked.

The first pattern on today’s chart is the February low of $225.70. AAPL broke under the level on March 11 and has stayed there since. That may suggest old support is new resistance.

The stock has also remained below a 50 percent retracement of last month’s slide, which may confirm downward price action.

Third, the bounce in the last 2-3 weeks may be viewed as a potential bearish flag. Would a move under the line represent a breakdown?

Next, stochastics are nearing an overbought condition. A dip from here may suggest the recent strength is fading.

Finally, AAPL is one of the most active underliers in the options market. (Its average daily volume of 897,000 contracts in the last month ranks third in the S&P 500, according to TradeStation data.) That may help traders take positions with calls and puts.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

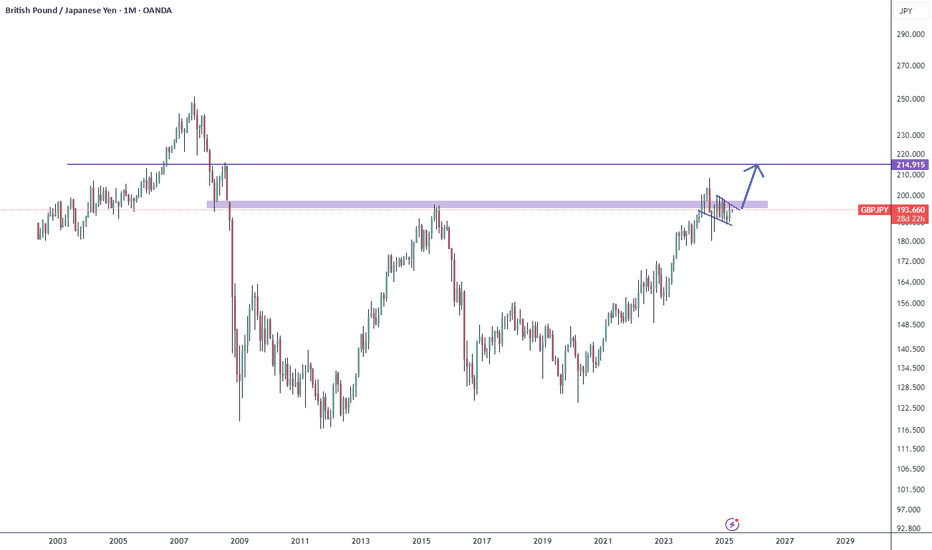

It's about to explodeThe British Pound looks very strong across the board. Check my post of GPBCHF lines below. Is forming a bullish flag at the monthly resistance to break it up violently. If it pulls back I'll add more. SL triggers is a weekly candles closes under the bottom of the flag but I hardly doubt it. I'm almost all in on the British Pound.

Some of you won't be able to holdWeekly stoch RSI crossed bullish. It's the weekly, some more downturns can be had. But are you waiting to time this? Seriously?

Check out my other CHZ ideas for different views on this coin.

Will you be able to hold till the top? It might come within 3 months.

Rustle

MarketBreakdown | EURUSD, GBPUSD, USDJPY, AUDUSD

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #EURUSD daily time frame 🇪🇺🇺🇸

For the last 2 weeks, EURUSD shows a strong bearish momentum.

The price managed to break and close below a key daily support cluster.

A strong bearish reaction that followed after its retest confirms a strong

selling pressure.

I think that the pair has a potential to drop lower this week.

2️⃣ #GBPUSD daily time frame 🇬🇧🇺🇸

In comparison to EURUSD, GBPUSD looks very stable.

The pair is consolidating within quite a wide range on a daily.

For now, probabilities are high that sideways movement will continue.

Consider trading the upper and lower boundary of the underlined channel.

Alternatively, a breakout of one of the underlined structures will give you a strong

bullish/breaish signal.

3️⃣ #USDJPY daily time frame 🇺🇸🇯🇵

Looks like the market is returning to a mid-term bearish trend.

The price is currently breaking a support line of a bearish flag pattern.

A daily candle close below its support will provide a strong bearish confirmation.

4️⃣ #AUDUSD daily time frame 🇦🇺🇺🇸

I see a completed head & shoulders pattern on a daily.

The price is currently breaking its neckline.

A daily candle close below that will provide a strong bearish confirmation

and suggest a highly probable bearish continuation.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

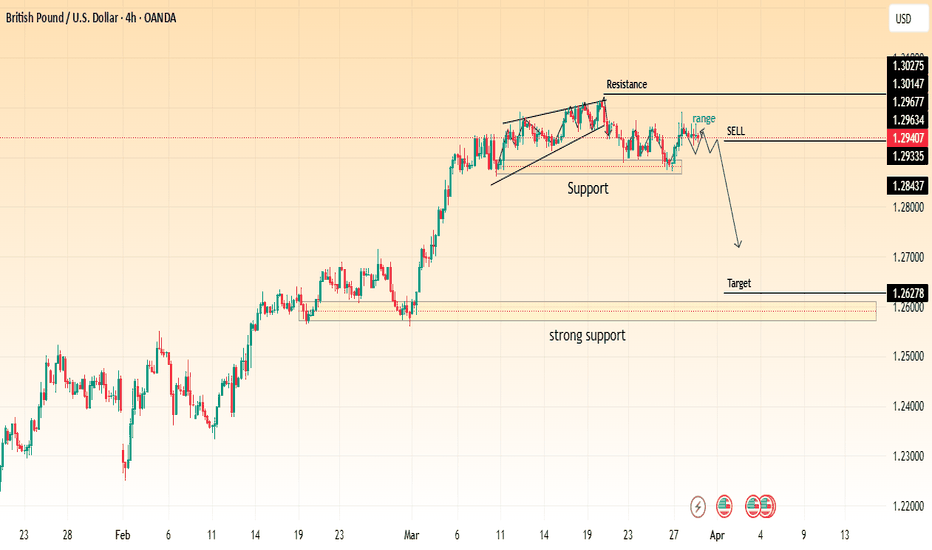

GBP/USD Breakdown: Bearish Setup with Sell Opportunity!"Key Observations:

Rising Wedge Breakdown:

The price initially formed a rising wedge near resistance.

The wedge broke down, indicating bearish momentum.

Support and Resistance Levels:

Resistance Zone: Around 1.3014 – 1.3027, marking a strong rejection area.

Support Zone: Around 1.2933 – 1.2843, where price previously bounced.

Strong Support: Around 1.2627, marked as the target area for a bearish move.

Bearish Setup:

A range-bound consolidation occurred after the breakdown.

The chart marks a sell signal, suggesting a move toward the 1.2627 target zone.

Trading Idea:

Entry: Sell after confirmation below 1.2933.

Target: 1.2627 (major support level).

Stop-Loss: Above 1.3014 (resistance level).

This setup suggests a potential bearish continuation, with price expected to decline further if support breaks. Always confirm with volume and market conditions before entering a trade.

USDJPY bearish engulfing, bearish flag , bearish hammerThe USD JPY was in correction mode of the down trend, On daily time frame it has formed the bearish engulfing candle along with that we can also see a bearish flag and on weekly chart it has formed the inverted hammer , all these indciates the proce gone go down to 145.5 where it has strong support.

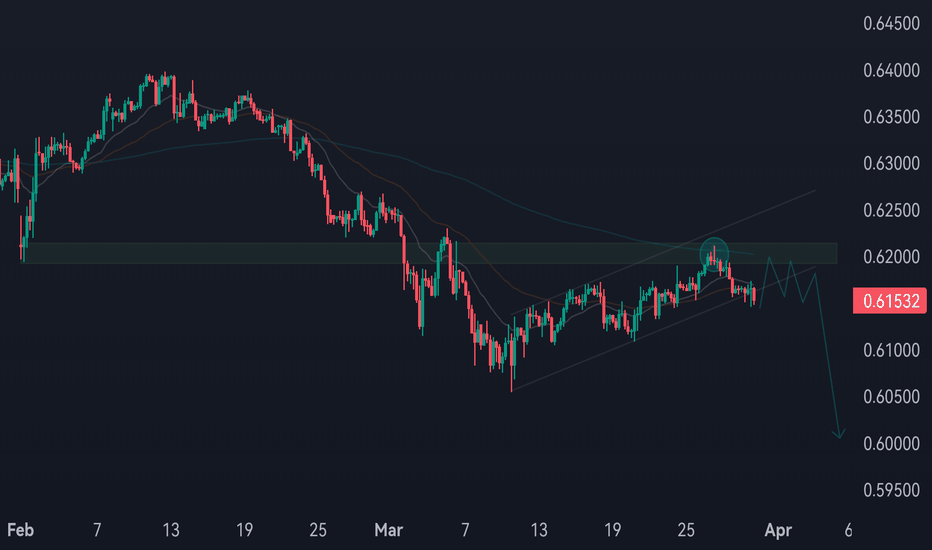

CADCHF Short Bias ! The pair attempted to break above the 0.6200 resistance zone but failed, forming a rejection. This suggests potential bearish momentum ahead.

Market Structure: Still bearish overall, despite a short-term ascending channel.

Bearish Scenario: If price respects the 0.6200 resistance and breaks below the ascending channel, it could head towards 0.6000 as the next major support.

Confirmation Factors:

Price rejection at resistance.

Moving averages acting as resistance.

Possible breakdown of the ascending channel.

Dell Might Have Broken Another Bearish FlagDell Technologies has been crumbling since November, and some traders may see further downside risk.

The first pattern on today’s chart is the series of higher lows between March 10 and 25. The computer maker slipped below the rising trendline this week, which may be viewed as a potential bear-flag breakdown. (Similar moves recently resolved to the downside.)

Next, stochastics are dipping from an overbought condition. Similar turns, like on January 7 and February 21, marked tops. (See the yellow arrows in lower study.)

Third, prices are stalling at the 21-day exponential moving average (EMA). The 8-day EMA is also below the 21-day EMA. That’s potentially consistent with a short-term downtrend.

Fourth, the 50-day simple moving average (SMA) had a “death cross” below the 200-day SMA in January. That’s potentially consistent with a long-term downtrend.

Finally, DELL recently peaked near the September low of $101.41. (See white arrows on the main chart.) Has old support become new resistance?

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

USDT.D update (1H)USDT.D has vioalated the previous analysis. It's breaking out the parallel channel which may engage a bullish flag pattern to activate.

As an extra, there will be PCE reports coming soon. If you see green candles on assest, don't dive in to long positions blindly.

Many of the parameters and signals are showing that prices about to go cheapher.

Market might be about getting close to another crash!

USDT.D short term wievUSDT.D is moving in a parallel channel. It's also forming a bullish flag which is bad for the assests unless its invalidated. For a shorter wiev, it's moving in a rectangle and I'm expecting a move towards downwards.

For a longer wiev, keep an eye on the levels I marked on the chart. The level of %5.3 is strongly important for market.

Gold Daily Update - Looking Bullish!Gold has successfully broken above the critical 3030 level, at least on the shorter time frames of 30 minutes and 1 hour. It has closed above this level and is now retracing slightly, possibly to test the area again. If the price holds above this level during the London session, further upward momentum is likely. The first target could be a retest of the 3050 level, and depending on the volume during the New York session—particularly at the New York Stock Exchange's opening at 9:30 AM EST—it might even attempt to retest its all-time high.

Given this price action, the downside appears limited for now, and I wouldn't recommend shorting this market at the moment. Even though we're approaching the end of the month and quarter, when fund managers often rebalance portfolios or book profits from recent gains, the momentum currently seems firmly bullish. Shorts would only become a consideration if the price closes decisively below 3030, fails to reclaim that level, and gradually breaks below 3015. Until we see such developments, the current trend favors the bulls.

Wishing you a great day and week ahead! Don't forget to like and subscribe to my channel to keep receiving free analysis and content.

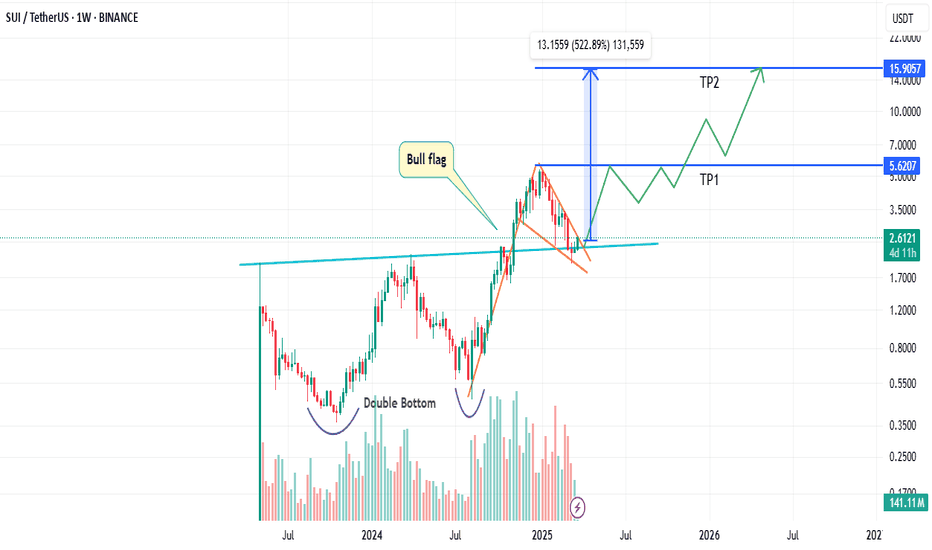

From $5 to $16 ? The SUI Setup You Need to See !Hello Traders 🐺

These days, everyone is talking about SUI—a U.S.-based cryptocurrency that’s showing serious potential to become one of the top gainers in the upcoming Altcoin Season. Let me break it down for you 👇

📈 Chart Analysis

On the chart, we can clearly see a Double Bottom formation, which led to a breakout and a rally to a new ATH at $5.62. After reaching that level, SUI pulled back to retest the previous resistance—which has now flipped into support. ✅

📉 What Now?

Currently, SUI is trading inside a falling wedge pattern, which in my opinion has great potential to act as a bull flag. Depending on how we interpret the pattern, price targets can vary—but don’t worry, I’ve simplified it for you:

🎯 Price Targets

1️⃣ First Target → Top of the falling wedge at $5.62 (ATH)

2️⃣ Second Target → Around $16 🚀

Make sure to take partial profits along the way and manage your risk properly.

Thanks for reading my idea—I hope you found it helpful! 🙌 Don’t forget to like and follow for more updates and support. And always remember:

🐺 Discipline is rarely enjoyable, but almost always profitable 🐺

🐺 KIU_COIN 🐺

#PLTR preparing a nice launchpad in a FLAG form will it see 106?

Technical's:

As of pre bell PLTR has positioned and holding right above A.VWAP from the last Earnings Report (4 Feb 2025) .

coincidentally the stock teases us with a flag formation drawing buyers attention, will run all the way to 106.00 level from last month ?

For short term traders might be something to look at! remember to keep your risk into account

Not financial advice !

Nifty 50–1H Chart Analysis Using Volume Profile & Gann High Low1. Key Observations (Volume & Gann Focused)

a) Volume Profile Insights

POC (Recent Session): 23,338.85 – strong volume concentration suggesting a key decision level.

POC (Previous Structure): 22,478.95 – deep value zone indicating prior accumulation and demand interest.

Value Area High (VAH): Approx. 23,700 – marked rejection zone; price failed to sustain above.

Value Area Low (VAL): Near 22,800 – critical demand support zone based on historical value range.

b) Gann High-Low Signals

Gann Pivot High: 23,800 zone – aligns with current range high; failed breakout attempt signals potential reversal.

Gann Pivot Low: Around 22,400 – multiple tests show significant buyer defense, acting as strong base.

c) Liquidity Zones

Liquidity Trap Above 23,700–23,800: Fake breakout potential, possible stop-run for late buyers.

Liquidity Pool Below 22,800–22,400: Where institutions likely absorbed selling pressure during consolidation.

d) Volume-Based Swing Highs/Lows

Volume Swing High: 23,700–23,800 – top volume spike and seller reaction.

Volume Swing Low: 22,478.95 – high volume area supporting prior reversal, now key demand level.

2. Support & Resistance Levels

Support Levels (Volume-Based)

23,338.85 (Recent POC – watch for retest)

22,800 (VAL – volume support & midpoint consolidation)

22,478.95 (POC from prior zone – major demand)

Resistance Levels (Gann-Based)

23,700–23,800 (Range high + Gann pivot)

23,600 (upper channel boundary – supply zone)

3. Chart Patterns & Market Structure

a) Overall Trend Direction

Bullish to Neutral – recent sharp rally has entered a distribution phase near highs, with weakening momentum.

Potential transition into range-bound behavior or pullback toward lower POC zones.

b) Notable Structural Patterns

Rising Wedge/Channel Breakdown: Price beginning to pull back from upper channel.

Fakeout Above Range High: Failure to sustain above 23,800 confirms bearish intent.

Symmetrical Channel Forming: Indicates possible corrective move ahead.

4. Trade Setup & Risk Management

a) Bullish Setup

Entry Zone: 23,200–23,300 (POC retest + prior demand)

Target 1 (T1): 23,600 (upper consolidation zone)

Target 2 (T2): 23,800 (range high retest)

Stop Loss (SL): 23,050 (below channel midline)

Risk-Reward: ~1:2.5

Position Size: Risk 1–2% of capital

b) Bearish Setup

Entry Zone: 23,600–23,700 (supply zone + failed breakout)

Target 1 (T1): 22,800 (VAL and lower boundary)

Stop Loss (SL): 23,850 (above fakeout high)

Risk-Reward: ~1:2

Position Size: Risk 1–2% of capital

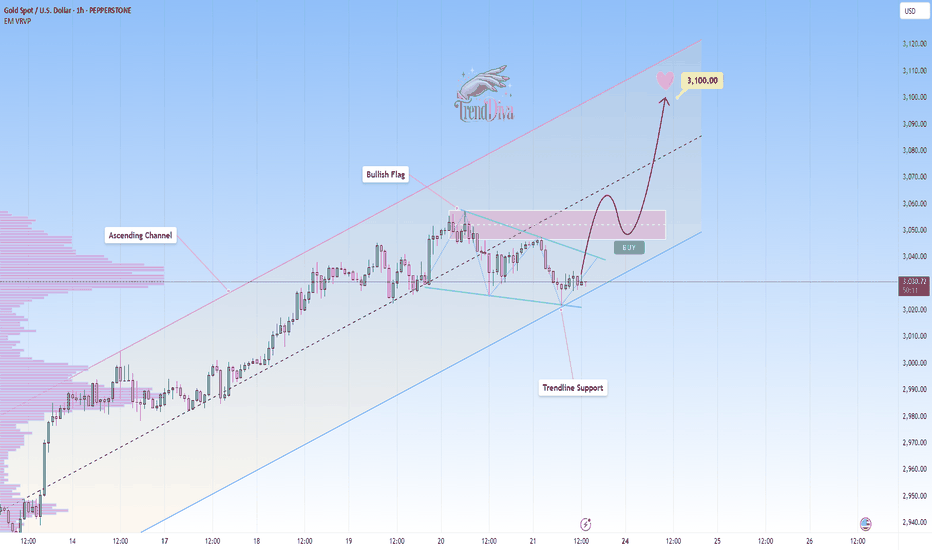

GOLD in a Bullish Flag – Breakout Incoming?OANDA:XAUUSD is undergoing a corrective move as it tests the lower boundary of the ascending channel, which serves as dynamic trendline support. The structure aligns with a bullish flag formation, indicating the potential for a continuation to the upside if buyers step in.

A successful rebound from this level could lead to a move toward the midline of the channel, with the next target at 3,100, aligning with the upper boundary of the channel. This scenario would preserve the broader bullish trend.

A confirmed breakdown below the trendline support, however, would invalidate the bullish outlook and open the door for further downside.

Monitoring candlestick patterns and volume at this critical zone is essential for identifying buying opportunities. Proper risk management is advised, always confirm your setups and trade with solid risk management.

If you have any thoughts on this setup or additional insights, drop them in the comments!