Technical Analysis of DAX Index (March 13, 2025, 15-Minute ChartTrend Identification:

The price action is moving within a rising channel (highlighted in purple), indicating a potential short-term bullish trend.

The 200-period moving average (maroon line) is above the price action, suggesting a larger timeframe bearish bias, but price is attempting to reclaim higher levels.

The Point of Control (POC) at 22,658.69 indicates the area of highest traded volume and a key decision zone.

Support & Resistance Levels:

Immediate Resistance: 22,720 (upper boundary of the rising channel).

Major Resistance: 22,800 (previous swing high).

Immediate Support: 22,560 (lower boundary of the channel).

Key Support: 22,440 (recent swing low and potential reversal area).

Chart Patterns & Market Structure:

The price recently bounced from the lower boundary of the channel, suggesting buying pressure at support.

A Volume Profile (VPVR) shows strong volume concentration around 22,658, reinforcing it as a key pivot zone.

The recent sharp rejection from the lows aligns with potential bullish continuation, targeting the upper channel boundary.

Trade Setup & Risk Management:

📈 Bullish Trade Setup (Trend Continuation)

Entry: Buy near 22,600–22,620 on minor pullbacks.

Stop-Loss: Below 22,540 (previous swing low).

Target 1: 22,720 (upper channel boundary).

Target 2: 22,800 (major resistance zone).

Risk-Reward Ratio (RRR): ~1:2.5

📉 Bearish Trade Setup (Reversal Play)

Entry: Sell near 22,720–22,740 if price rejects resistance with strong bearish candles.

Stop-Loss: Above 22,780.

Target 1: 22,600 (POC and key support).

Target 2: 22,440 (lower channel boundary).

RRR: ~1:2

Risk Management & Position Sizing:

Risk 1-2% of capital per trade to maintain disciplined exposure.

Adjust position size based on stop-loss distance to keep risk consistent.

Monitor volume dynamics for confirmation of trade direction.

Flag

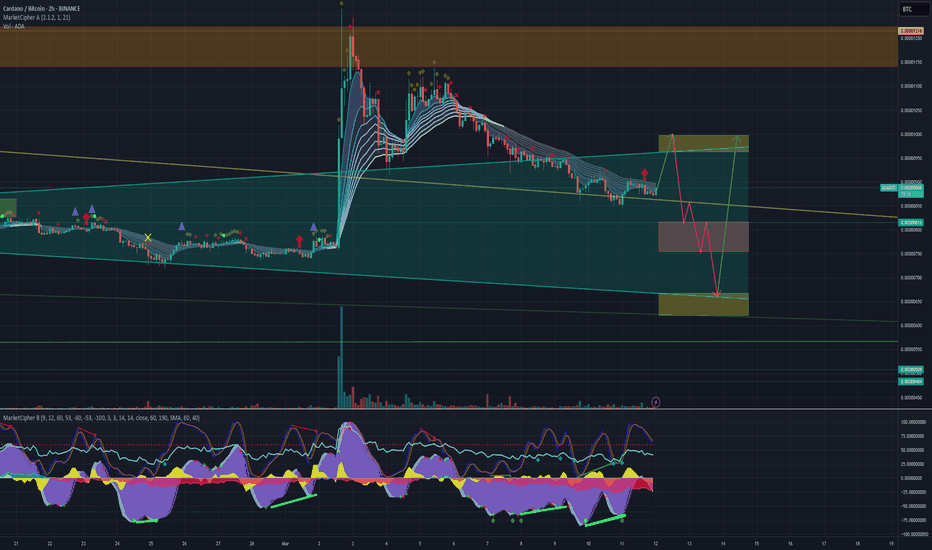

Orbs to provide a 20x?Welcome back dearest reader!

Today we will analyse another project called Orbs. Looking at their website the fundamentals look great! But other than that, the chart also looks fantastic!

When looking at past performance its clear orbs has been in a massive flag formation since march 2021, it has broken out in october 2023 and has just now touched a very important support zone! Expecting upside momentum from here untill august.

Target: 0.40$

Stoploss: 0.0145$

SILVER (XAGUSD): Bullish Continuation Ahead

Silver formed a strong bullish pattern on a 4H.

I see a bullish flag with a candle close above its resistance line.

I think that the market is going to continue rising.

Next resistance 34.2

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NIFTY Flag BreakoutNIFTY...Finally after a long time has given a good AD ratio...Flat was forming now broke out...see chart...tgt calculated and marked on the chart....Good momentum also exists...Also note if the tgt is achieved ..then on a larger time frame a larger pattern will be broken..But we will come to that once that is achieved..Now we wait for this tgt to be achieved.

The last opportunity If you did not take the January 17th post serious when BABA was 84 dollars, you have to be brave enough to pull the trigger after a 75% move in 2 months.

But most people will sit and wait for a big correction to get involved while they don’t think in the past 4 weeks when market was correcting, BABA stayed flat and as soon as selling pressure decreased, BABA break above the resi.

GBPUSD: UP After the News 🇬🇧🇺🇸

GBPUSD looks bullish after the release of the US news.

I see a bullish breakout of a resistance line of a falling wedge pattern.

The price is going to retest the current high first - 1.2987,

and continue growing to 1.3 level then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold (XAU) Eyes Breakout from Bull Flag Pattern TechnicalGold (XAU) is consolidating in a tight range (2,900–2,903) following a bullish flag pole formation, signaling potential continuation of the uptrend. Key levels to watch:

- Breakout Resistance: 2,903.31 (flag upper boundary). A close above targets 3,000.00 (psychological resistance).

- Support Zone: 2,900–2,880. A breakdown here may invalidate the pattern.

Technical Rationale: The bull flag pattern suggests accumulation after a sharp rally, with the RSI-neutral price action (+0.03%) indicating balanced momentum. The flag’s proximity to yearly highs reinforces bullish bias if breakout occurs.

Fundamental Catalyst: Macro risks (rate cut expectations, geopolitical tensions) could amplify safe-haven demand, aligning with the technical setup.

Action: Monitor for volume-backed breakout above 2,903.31 for long entries. Tight stop-loss advised below 2,880.

Risk Disclaimer: Trade with managed risk; patterns may fail amid shifting macro drivers.

NZDCAD: Strong Bullish Signals 🇳🇿🇨🇦

I see 2 strong price action confirmations on NZDCAD:

the price broke a resistance line of a bullish flag

and then formed a confirmed change of character CHoCH on a 4H.

I think that the market will continue a bullish rally.

Next resistance - 0.83

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD/CHF: Bearish Trend Pauses, but Breakdown Risks RemainThe strong bearish trend for USD/CHF stalled this week, with buying support emerging beneath .8774, continuing the pattern seen in December. The net result has been a grind higher before running into resistance at .8854, forming what resembles a bear flag on the charts. That should put traders on alert for a potential downside break and resumption of the bearish trend.

Indicators like RSI (14) and MACD are providing mixed signals on price momentum, with the former trending higher while the latter remains below the signal line. However, the modest RSI (14) uptrend looks vulnerable, mirroring the unconvincing price action.

If the price breaks down from the bear flag, immediate levels of note include .8774, .8711, and .8617, the latter being a more substantial support level. On the topside, a break of .8854 would put .8920 and .8966 on the radar for bulls.

The price is hanging around the 200-day moving average like a bad smell this week, but having traded through it on multiple occasions like it didn’t exist, it shouldn’t be a major consideration for traders.

Good luck!

DS

Tellor (TRB) a hidden gem, will previous price action repeat?Hello again dear reader for a another analysis.

From August to December 2023 TRB has seen a MASSIVE move of 7000% gains over the course of just 126 days. Since then it has corrected a whopping 96%!

There is now a reason to be bullish on this coin. Looking at the drawn structure we can see multiple important touch zones described with the letters ''A till F'' (NOT ELLIOT). It is quite possible price action might correct further till 19$ where a big support zone lies, but there is no guarantee that ''will'' happen.

Target: 1200$ (M-cap of 3B which is very achievable)

Stoploss: 15$

I aim to keep analysis simple and easy to understand. Any questions of requests for analysis feel free to ask!

Rustle

Silver (XAG/USD) Technical Analysis – March 13, 2025 (15-Min Cha1. Trend Identification

Short-Term Uptrend Developing:

The price is trading above the 200-period moving average (blue line), indicating bullish momentum.

The Point of Control (POC) at 33.017 suggests a key liquidity zone where buyers have been active.

Key Resistance Levels in Focus:

The price is currently struggling near 33.043, with the next resistance at 33.259 (higher POC level).

A break above 33.259 could trigger a further rally.

2. Key Support & Resistance Levels

Immediate Support: 33.000 - 33.017 (POC, psychological level).

Immediate Resistance: 33.259 (higher POC, recent high).

Upside Target: 33.500 - 33.600 (upper channel projection).

Downside Risk: 32.900 - 32.800 (lower channel support).

3. Volume Analysis

Last 120 Bars: Up Vol > Down Vol by +26.82%, indicating strong buyer dominance.

Last 60 Bars: Up Vol > Down Vol by +41.46%, further confirming short-term bullish strength.

Interpretation:

Buyers are clearly in control, but the resistance at 33.259 needs to be breached for a strong continuation.

If price pulls back to 33.017 and finds support, it may provide a better entry point.

4. Chart Patterns & Projections

Bullish Continuation Scenario:

If price breaks above 33.259, it is likely to rally toward 33.500 - 33.600 (upper trend channel).

Bearish Pullback Scenario:

A failure to break 33.259 could lead to a retracement toward 32.900 - 32.800.

Trade Setups & Risk Management

1. Long Trade Setup (Bullish Scenario)

Entry: Buy above 33.259 (breakout confirmation) or on a pullback to 33.017 (strong support).

Stop-Loss: Below 32.900 (recent low & lower channel boundary).

Targets:

First Target: 33.400

Final Target: 33.600 (upper channel resistance).

Risk-Reward Ratio: 1:3 or better.

2. Short Trade Setup (Bearish Pullback Scenario)

Entry: Sell below 33.000 (breakdown confirmation).

Stop-Loss: Above 33.100 (recent consolidation zone).

Targets:

First Target: 32.900

Final Target: 32.800 (lower channel support).

Risk-Reward Ratio: 1:2 or better.

DAX Index Technical Analysis – March 12, 2025 (15-Min Chart)1. Trend Identification

Reversal to Bullish Momentum:

The price has broken above the 200-period moving average (red line), indicating a shift from bearish to bullish sentiment.

The Point of Control (POC) at 22,324.82 previously acted as strong support, from which price has bounced.

Volume Confirmation of Bullish Move:

The last 60 bars show an up-volume dominance of +32.10%, confirming that buyers are gaining control.

However, the 120-bar volume is still slightly negative (-1.71%), indicating lingering selling pressure.

2. Key Support & Resistance Levels

Immediate Support: 22,500 - 22,550 (recent breakout zone).

Stronger Support: 22,324 (POC) – a critical level where buyers stepped in.

Immediate Resistance: 22,700 - 22,750 (local resistance zone).

Upside Target: 23,000 - 23,200 (upper trend channel projection).

3. Volume Analysis

Last 120 Bars: Up Vol < Down Vol by -1.71%, showing slight selling pressure.

Last 60 Bars: Up Vol > Down Vol by +32.10%, indicating strong short-term buying activity.

Interpretation:

Bullish Confirmation: Buyers have stepped in aggressively, pushing price above the 200-MA and key support zones.

Watch for Pullbacks: A retracement toward 22,500 - 22,550 could provide a better long entry before continuation.

4. Chart Patterns & Projections

Bullish Continuation Scenario: If price holds above 22,550, it is likely to move toward 23,000 - 23,200 within the ascending channel.

Bearish Pullback Scenario: If price fails to hold 22,500, a retracement to 22,324 or lower is possible.

Trade Setups & Risk Management

1. Long Trade Setup (Bullish Scenario)

Entry: Buy near 22,550 (pullback entry) or above 22,750 (breakout confirmation).

Stop-Loss: Below 22,500 (recent support).

Targets:

First Target: 22,900

Final Target: 23,200 (upper channel resistance).

Risk-Reward Ratio: 1:3 or better.

2. Short Trade Setup (Bearish Pullback Scenario)

Entry: Sell below 22,500 (breakdown confirmation).

Stop-Loss: Above 22,700.

Targets:

First Target: 22,400

Final Target: 22,324 (POC & key support).

Risk-Reward Ratio: 1:2 or better.

US 100 Technical Analysis – March 12, 2025 (15-Min Chart)1. Trend Identification

Bearish Bias:

The price is trading below the 200-period moving average (red line), indicating overall bearish momentum.

The Point of Control (POC) at 19,449.24 represents a high liquidity area, acting as a strong resistance level.

Short-Term Consolidation:

The price is oscillating around 19,375, suggesting market indecision before a breakout or breakdown.

2. Key Support & Resistance Levels

Immediate Resistance: 19,400 - 19,450 (POC and recent highs).

Immediate Support: 19,300 (lower consolidation boundary).

Stronger Support: 19,000 (psychological level & lower trend channel).

Upside Target: 19,500 - 19,600 (breakout scenario).

3. Volume Analysis

Last 120 Bars: Up Volume < Down Volume by -15.53%, indicating stronger selling pressure.

Last 60 Bars: Up Volume < Down Volume by -10.28%, reinforcing short-term bearish dominance.

Interpretation:

Bearish Sentiment Dominates: Selling pressure is higher, increasing the probability of a breakdown below 19,300.

If buyers regain control near 19,300, a bounce toward 19,450 is possible.

4. Chart Patterns & Projections

Bearish Breakdown Scenario: If price fails to hold 19,300, it could drop to 19,000 (blue channel projection).

Bullish Reversal Scenario: A breakout above 19,450 could trigger a move toward 19,500 - 19,600.

Trade Setups & Risk Management

1. Short Trade Setup (Bearish Breakdown)

Entry: Sell below 19,300 (confirmed breakdown).

Stop-Loss: Above 19,400 (previous resistance).

Targets:

First Target: 19,150 (mid-support).

Final Target: 19,000 (key support).

Risk-Reward Ratio: 1:2 or better.

2. Long Trade Setup (Bullish Breakout)

Entry: Buy above 19,450 (confirmed breakout).

Stop-Loss: Below 19,375 (recent consolidation zone).

Targets:

First Target: 19,500 (local resistance).

Final Target: 19,600 (upper channel).

Risk-Reward Ratio: 1:3 or better.

Technical Analysis of Gold (XAU/USD) – 1H Chart1. Trend Identification

Transition from Consolidation to Uptrend:

The price has broken out of a prolonged consolidation phase around the Point of Control (POC) at 2911.933.

The 200-period moving average (blue line) was previously acting as resistance but now appears to be flipping into support.

Short-Term Bullish Momentum with Caution:

The projected price path (blue and red channels) suggests an uptrend toward the 3,020 - 3,060 zone but with potential retracements.

However, recent volume analysis suggests short-term selling pressure is increasing, which could lead to a pullback before continuation.

2. Key Support & Resistance Levels

Immediate Support: 2,900 - 2,911 (POC and recent breakout zone).

Immediate Resistance: 2,920 - 2,930 (current price range resistance).

Stronger Resistance: 3,000 - 3,020 (psychological level & upper channel).

Downside Risk: If price falls below 2,900, it may test 2,880 - 2,860.

3. Volume Analysis

Last 120 Bars Volume:

Up Vol < Down Vol by -0.28% (neutral to slightly bearish sentiment).

Last 60 Bars Volume:

Up Vol < Down Vol by -23.28%, showing short-term selling pressure dominance.

Interpretation:

The long-term volume trend is neutral, but short-term volume suggests sellers are controlling the market, which could lead to a temporary pullback before continuation.

4. Chart Patterns & Projections

Bullish Scenario: If the price sustains above 2,911, it could trend toward 3,020 - 3,060 within the ascending channel.

Bearish Scenario: A breakdown below 2,900 could lead to a correction toward 2,880 - 2,860.

Trade Setups & Risk Management

1. Long Trade Setup (Bullish Scenario)

Entry: Buy on breakout above 2,930 (confirmation of strength).

Stop-Loss: Below 2,900 (previous support zone).

Targets:

First Target: 2,980 (mid-channel resistance).

Final Target: 3,020 - 3,060 (upper channel boundary).

Risk-Reward Ratio: 1:3 or better.

2. Short Trade Setup (Bearish Pullback Scenario)

Entry: Sell below 2,900 (confirmed breakdown).

Stop-Loss: Above 2,920 (previous support turned resistance).

Targets:

First Target: 2,880 (key support).

Final Target: 2,860 (lower channel boundary).

Risk-Reward Ratio: 1:2 or better.

LinkedIn Post: Professional Market Insight on Gold (XAU/USD)

📊 Gold (XAU/USD) – Technical Outlook & Trade Setup 📊

Gold has broken out of a consolidation phase around $2,911 and is now trading near resistance at $2,920 - $2,930. While the long-term trend remains bullish, short-term volume indicates increasing selling pressure (-23.28%), suggesting a possible pullback before continuation.

🔍 Key Observations:

✅ Support Zone: $2,900 - $2,911 (Point of Control).

✅ Resistance Zone: $2,920 - $2,930 (immediate breakout level).

✅ Potential Bullish Move: If Gold sustains above $2,930, we could see a rally toward $3,020 - $3,060.

✅ Potential Bearish Pullback: A rejection at $2,920 could lead to a retest of $2,880 - $2,860.

📈 Trade Setup:

Bullish Play: Buy above $2,930, stop below $2,900, targets $2,980 - $3,060.

Bearish Play: Sell below $2,900, stop above $2,920, targets $2,880 - $2,860.

🔑 Risk Management: Disciplined trade execution and strong risk-reward ratios are key! Always protect capital first.

What’s your outlook on Gold? Let’s discuss in the comments! 👇 #Gold #Trading #XAUUSD #RiskManagement #TechnicalAnalysis

Technical Analysis of Silver (XAG/USD) – 1H Chart1. Trend Identification

Medium-Term Bullish Trend: The price has been rising since early March, reclaiming the 200-period moving average (blue line), a sign of renewed buying strength.

Short-Term Consolidation: The price is currently testing resistance near the Point of Control (POC) at 32.551, indicating an important decision point for the next move.

Bearish Short-Term Volume Shift: The last 60 bars show higher selling volume (-33.63%), suggesting potential weakness in the short term before a breakout or pullback.

2. Key Support & Resistance Levels

Immediate Resistance: 32.55 - 32.60 (POC and recent highs).

Immediate Support: 32.00 - 32.20 (recent demand zone).

Stronger Support: 31.80 - 31.50 (lower channel boundary).

Upside Targets: 33.00 - 33.20 (upper channel projection).

3. Volume Analysis

Last 120 Bars Volume: Up Vol > Down Vol by 12.95%, showing medium-term buying dominance.

Last 60 Bars Volume: Up Vol < Down Vol by 33.63%, indicating short-term selling pressure, which may lead to a minor pullback before continuation.

4. Chart Patterns & Projections

The projected path (blue and red channels) suggests two scenarios:

Bullish Breakout: Above 32.55, targeting 33.00 - 33.20.

Bearish Pullback: A rejection at 32.55 could push the price toward 31.80 - 31.50 before a potential recovery.

Trade Setups & Risk Management

1. Long Trade Setup (Bullish Scenario)

Entry: Buy on breakout above 32.60 (confirmation of resistance breach).

Stop-Loss: Below 32.20 (to avoid false breakouts).

Targets:

First Target: 33.00

Final Target: 33.20 (upper channel boundary).

Risk-Reward Ratio: 1:3 or better.

2. Short Trade Setup (Bearish Pullback Scenario)

Entry: Sell below 32.20 (confirmed breakdown).

Stop-Loss: Above 32.60 (recent resistance).

Targets:

First Target: 31.80 (lower channel mid-support).

Final Target: 31.50 (strong support zone).

Risk-Reward Ratio: 1:2 or better.

Technical Analysis of EUR/USD (1H Chart)1. Trend Identification

Bullish Trend: The price has been in a strong uptrend, trading well above the 200-period moving average (blue line), indicating continued buying interest.

Current Consolidation: The price is moving sideways near 1.0844 (Point of Control - POC), suggesting accumulation before a potential breakout or breakdown.

2. Key Support & Resistance Levels

Immediate Resistance: 1.0885 - 1.0900 (recent highs).

Immediate Support: 1.0844 (POC level) – a crucial liquidity zone.

Stronger Support: 1.0800 (psychological level and near the moving average).

Upside Targets: 1.1000 - 1.1100 (upper channel projection).

3. Volume Analysis

Last 120 Bars Volume: Up Vol > Down Vol by 37.23%, indicating strong bullish dominance.

Last 60 Bars Volume: Up Vol > Down Vol by 3.44%, showing that buyers are still in control, but with less dominance than the broader trend.

4. Chart Patterns & Projections

The projected path (blue and red channels) suggests two scenarios:

Bullish breakout above 1.0900, with a move toward 1.1000 - 1.1100.

Bearish breakdown below 1.0840, leading to a retracement toward 1.0700 - 1.0600.

Trade Setups & Risk Management

1. Long Trade Setup (Bullish Scenario)

Entry: Buy on breakout above 1.0900.

Stop-Loss: Below 1.0840 (previous support).

Targets:

First Target: 1.1000 (psychological level).

Final Target: 1.1100 (upper channel boundary).

Risk-Reward Ratio: 1:3 or better.

2. Short Trade Setup (Bearish Breakdown Scenario)

Entry: Sell below 1.0840 (confirmed breakdown).

Stop-Loss: Above 1.0900.

Targets:

First Target: 1.0700 (mid-channel support).

Final Target: 1.0600 (lower channel boundary).

Risk-Reward Ratio: 1:2 or better.

Bullish Continuation Pattern (Bullish Flag)Bullish Continuation Pattern, Bullish Flag

🔹 Bullish Flag – The price had a strong upward move, followed by a slight consolidation. If it breaks above resistance, it could continue the uptrend.

📊 Key Levels to Watch:

Target 1.57000

Stop Loss 1.55300

Support: Around 1.555

Resistance: Around 1.561 - 1.565

If price breaks above resistance with volume, it could indicate a strong bullish move! 🚀

⚠️ Risk Management: Always use 1-2% risk per trade to protect capital.

📌 Trade Wisely & Stick to Plan! 🚀

EURCAD chart shows a Bullish Flag PatternThis EURCAD chart shows a **Bullish Flag Pattern**, as indicated on the chart.

**Key Observations:**

- **Bullish Flag Pattern**: This is a continuation pattern that typically signals a potential upward breakout after consolidation.

- **Resistance Zone**: Around **1.56200 - 1.56400**.

- **Support Zone**: Around **1.55600 - 1.55700**.

- **Moving Averages**: Price is trading above the moving averages, indicating bullish momentum.

- **Volume Analysis**: Increased volume on the breakout suggests strong buying pressure.

### **Trading Plan:**

- **Entry**: If price retraces to support and shows bullish confirmation, a buy trade can be placed near **1.55700 - 1.55800**.

- **Stop Loss (SL)**: Below **1.55400** to minimize risk.

- **Take Profit (TP)**: Around **1.57000 - 1.57500** in case of a breakout.

Have you considered this alternative?Chiliz (CHZ) leads innovation in fan engagement with their favorite teams through blockchain technology. Its platform enables the creation of Fan Tokens that offer users exclusive access to experiences and decisions related to sports clubs, eSports teams, and more.

Chz has been trading in a massive bullflag as seen in the above analysis. Although it hasn't seen alot of love recently i suspect it will do well in the coming months ahead.

Target: 3$

Stoploss: 0.032 (upon re-entry of the channel)

Rustle