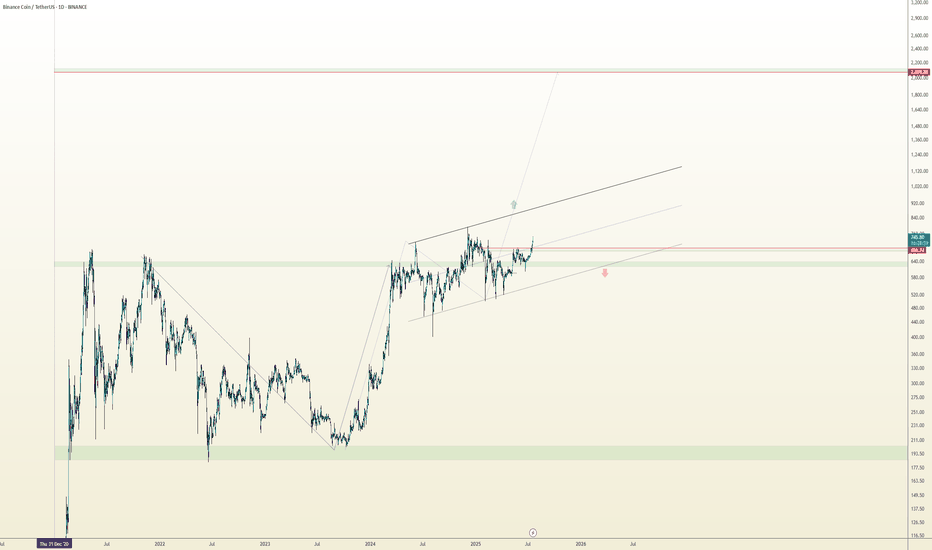

Perfect Sync: V Reversal Meets Bull Flag

Two clean and classic technical structures:

✅ V-Reversal Formation

✅ Bull Flag – still active and building pressure

After a sharp reversal, the price entered a bullish continuation phase.

Currently moving within the flag structure toward its upper edge.

If we see a breakout to the upside, the move could match the flagpole length, which aligns well with the target from the V-reversal pattern.

📍 Bullish scenario remains valid as long as we stay within structure.

📉 Breakdown below $570 invalidates this setup.

🧠 Important Reminder:

Enter only after a confirmed breakout.

✅ Apply strict risk management

✅ Never risk more than 1% of your capital on a single position.

Everything’s clear. No noise. Just wait for confirmation — let the market come to you.

Flagpatternsignal

XRPUSDT Breaks Out of Bullish Flag - Big Moves Ahead!BINANCE:XRPUSDT has broken out of a classic bullish flag pattern on the weekly chart, signaling a strong continuation to the upside. This textbook setup is known for its high success rate, and the breakout suggests the potential for significant gains if momentum continues.

The CRYPTOCAP:XRP community remains strong, with long-term holders showing confidence and resilience. With the current market structure and support from loyal investors, there’s a real possibility for the price to double from this breakout zone.

The strategy is simple. Buy and hold for the long term. But as always, traders must manage risk carefully and use a proper stop loss. Let the flag fly high. CRYPTOCAP:XRP could be ready for a major pump from this level.

BINANCE:XRPUSDT Currently trading at $2.43

Buy level : Above $2.4

Stop loss : Below $1.9

Target : $5

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

The Flag Chart Pattern ExplainedHello, traders! 👋🏻

If price action had a way of saying, “HOLD MY BEER, I’M NOT DONE YET,”— it would be through a flag pattern. This classic continuation setup is where strong trends take a breather before launching their next move. Whether you're seeing a bullish flag chart pattern or a bearish flag pattern, you’re looking at a market that’s just catching its breath before running again.

Let’s break down how this works and what to watch for!

What Is a Flag Pattern?

A flag pattern forms when the market makes a strong move (called the “flagpole”), then consolidates in a narrow, counter-trend range that looks like a flag. Eventually, the price breaks out in the direction of the original trend.

Think of it like a runner sprinting, slowing down to recover, and then taking off again. That pause? That’s your flag.

There Are Two Main Types:

🟢 Bull Flag Pattern (Bullish Flag Pattern)

It appears after a sharp upward move. The flag part slopes downward or moves sideways.

It also might signal a continuation of the bullish trend. This is the kind of setup that gets traders excited — it’s all about momentum.

🔴 Bear Flag Pattern (Bearish Flag Pattern)

It appears after a sharp downward move. The flag part slopes upward or consolidates sideways. It also might signal a continuation of the bearish trend. When the market pauses in a falling trend, the bear flag pattern warns that sellers are just regrouping before the next drop.

How to Recognize a Flag Chart Pattern

Spotting a Flag Trading Pattern Is Fairly Straightforward — Just Look For:

✔ A Strong Price Move (the Flagpole)

✔ A Tight Consolidation That Slopes Opposite the Trend

✔ Lower Volume During Consolidation

✔ A Breakout in the Direction of the Original Trend

📊 Real Example: BTC Flag Pattern in 2024

Take a look at the chart above. From October to March 2024, Bitcoin made a massive upward move from around $40,000 to $72,000+ — this was the flagpole.

Then, from March through November 2024, BTC entered a long, downward-sloping consolidation channel, forming the flag itself. Despite the lower highs and lower lows, the pullback was contained within parallel trend lines — a classic setup.

Once the price broke above the top of the flag, it kicked off a second leg, surging to a new all-time high above $108,000. That breakout confirmed the bullish flag pattern and rewarded traders who recognized the structure early.

This BTC move is a textbook example of how a bull flag chart pattern plays out in real markets — offering clean entry signals and strong momentum if the pattern completes.

There are variations, too — like the rising flag pattern, which can appear in both bullish and bearish conditions, depending on the context. Some traders even debate whether a flag pattern is a continuation or a subtle reversal flag pattern — so CONTEXT MATTERS.

Final Thoughts: Trust the Flag, Not the Noise

The flag chart pattern is a reminder that not every pullback means the trend is over. Sometimes, it’s just the market catching its breath. Whether you’re spotting a bull flag pattern in a crypto rally or a bear flag pattern in a downtrend, learning to trade these setups can possibly add precision to your strategy.

So, next time you see a price taking a nap in a narrow channel, ask yourself: Is this a bullish flag chart pattern gearing up for another leg up? Or is it a bearish flag pattern just waiting to drop the floor out? Let the structure tell the story and the trend do the rest.

This analysis is performed on historical data, does not relate to current market conditions, is for educational purposes only, and is not a trading recommendation.

CARDANO|The start of a new bullish waveHello friends, I hope you are doing well.

You can see the popular Cardano currency in the 4-hour time frame.

Now it would be a good place for us to have an analysis of this currency.

In the daily time frame, it had an eroding downward trend in the form of a descending channel, which has now broken this channel upwards. In fact, it is also considered a flag pattern.

In the 4-hour time frame, a descending channel has broken upwards, and an important supply area that has prevented price growth twice has also broken upwards. This is a sign of aggressiveness and significant upward movement.

Bitcoin is very bullish and Cardano shows signs of further growth.

Look for opportunities to enter buy positions in the demand areas drawn on the chart.

The short-term targets are 0.61 and 0.64 , and the long-term target is 0.83.

DXY Bull Flag SetupHi Traders!

There is a bull flag pattern developed on the DXY 4H chart.

Here are the details:

The price action looks bullish, and the market looks like it is about to complete the consolidation phase in the flag's channel as the flag pattern is in its late stages.

The market is still above the 20 EMA, which is a bullish signal. As long as the market remains above the EMA and flag channel support, our view will remain bullish.

Preferred Direction: Buy

Resistance (FLAG CHANNEL): 104.669

Support (FLAG CHANNEL): 103.808

Technical Indicators: 20 EMA

Please make sure to click on the like/boost button 🚀 as your support greatly helps.

Trade safely and responsibly.

BluetonaFX

Bearish and Bullish Flag Chart PatternsFlag Pattern:

A flag is a chart pattern formed during a counter-trend move after a sharp price movement.

Why is it called Flag?

It is named because of the way it reminds the viewer of a flag on a flagpole.

What does the Flag Pattern represent?

It signifies trend reversals or breakouts after a period of consolidation.

The five main characteristics of a Flag Pattern are:

1. The preceding trend

2. The consolidation channel

3. The volume pattern

4. A breakout

5. A confirmation occurs when the price moves in the same direction as the breakout.

How to identify the Flag Pattern:

The most important part of the flag pattern is to identify a strong trend (in either direction, as the flag may be inverted, triggering a bearish move!). Take a look at the higher time frames when you find a flag pole to ensure the price is not simply ranging. It could be meeting a large area of resistance!

Bullish Flag Pattern:

When the prices are in an uptrend, a bullish flag pattern shows a slow consolidation lower after an aggressive uptrend. This indicates that there is more buying pressure moving the prices up than down and indicates that the momentum will continue in an uptrend.

Traders wait for the price to break above the resistance of the consolidation after this pattern is formed to enter a long position.

The breakout indicates that the prior uptrend will continue.

Example of a Bullish Flag Pattern:

Bearish Flag Pattern:

When the prices are in a downtrend, a bearish flag pattern shows a slow consolidation higher after an aggressive downtrend. This indicates that there is more selling pressure moving the prices down than up and indicates that the momentum will continue in a downtrend.

Traders wait for the price to break below the support of the consolidation after this pattern is formed to enter a short position.

Example of a Bearish Flag Pattern:

Conclusion:

A flag pattern is a type of chart continuation pattern that shows candlesticks contained in a small parallelogram. When the prices are in an uptrend, a bullish pattern shows a slow consolidation lower after an aggressive uptrend. When the prices are in a downtrend, a bearish pattern shows a slow consolidation higher after an aggressive downtrend. It is formed when there is an increase in demand or supply that causes the prices to move up or down.

May you all be PROFITABLE,

Beautiful Buy Setup - Bullish Flag Pattern USD/JPY A very clean buy setup has presented itseld on USD/JPY. We can see a clear bullish flag pattern form right within a discounted Fibonacci retracement zone. We can also see price is respecting the 78.60% very nicely & the lower region of the flag pattern trendline.

AUDUSDIn this chart ( AUDUSD ), we see a disconnected channel pattern that will probably break upwards. In the lower time frame, we see a flag pattern that has the ability to continue based on the current momentum.

Of course, we have to wait until this channel breaks apart and then make a decision.

wait my friend...

AUDNZDHi;

AUDNZD

In the daily time frame, the movement is quite clear. Selling pressure can also be detected in lower time frames, and according to the rapid downward wave that has been created recently, the probability of exiting this correction, which is similar to the flag pattern, will be very high.

GOLD: bearish pattern created Hey guys, last week I was bullish on gold, but after the recent PA I changed my bias to short.

-First, the price formed the so-called "Bearish Flag" formation, this is a pattern that is a trend continuation and the TP is the duplication from the initial leg.

-Second, looking at the DXY I am more for a strong dollar for the near future judging by the recent candles and the strength of the momentum.

I won't be rushing to enter a position because gold and DXY are at a very indecisive point right now, so I will wait for a good correction that will at least give me a good RR

GBPAUD SELL!GBPAUD broke the Trendine to downside in March 2022 and ever since has been trading within a Rectangle Pattern as shown in the Chart. Price recently retested that Trendline and moved down quickly , managing to break even the Rectangle Pattern to downside and is currently retesting the lower limit of the Pattern . I expect a brief flag pattern followed by a downward move all the way to the Next Target 1.72713 !

🚩 Bull Flags VS Bear Flags🚩What is a Flag Pattern?

A flag pattern is a commonly observed technical analysis pattern used to identify potential continuation of current market trends.

It is characterized by a period of consolidation, where the market experiences a relatively small range of movement, following a significant price movement.

This pattern is formed as the market returns to a state of equilibrium, following a large move. The flag pattern is considered a continuation pattern,

as it often indicates that the market will continue to move in the same direction as the preceding trend, once the flag breaks out.

This breakout typically occurs when the price of the security breaches the upper or lower boundary of the flag, and it is usually accompanied by an increase in trading volume.

📈📉The difference between a Bull flag VS Bear flag

The difference between a bullish and a bearish flag is in the direction of the price movement. With the bullish flag, the idea is to participate in a strong uptrend. Meanwhile, with the bearish flag pattern, the idea is to trade short in the direction of the prevailing downtrend.

- Downtrend vs uptrend: Bull flag and bear flag are both continuation patterns that form when the price of a stock or asset pulls back from the predominant trend in a parallel channel.

- Bull flag: A bull flag is a sharp, strong volume rally of an asset or stock that portrays a positive development.

- Bear flag: A bear flag is a sharp volume decline on a negative development.

- Bull flag and bear flag share the same traits: Traits of Flag Patterns include support and resistant levels, flag, flag pole, breakout points and price projections.

📍Entry opportunities

The most important component of any flag pattern trade is the entry. It’s generally advisable to wait for a candle to close beyond the breakout point before creating any orders to avoid being burned by a false signal. In the example above, the entries are made on a High risk - High reward mindset with stop loss bellow the flag pattern. Most traders will enter a flag pattern trade on the day after the price has broken beyond the trend line. The length of the flag pole is typically used to calculate the profit target. Even when the formation of a flag pattern is obvious, there is no guarantee that the price will move in the expected direction. As with most technical analysis, you will get the best results from flag patterns by applying them to longer-term charts as you will have more time to consider your strategy and analyze the price action.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work , Please like, comment and follow ❤️

eicher all time higheicher has been at all-time high

it has given a weekly breakout and if it closes above 3348 this month then a monthly breakout

we fear that all-time high stock can turn down first. but mostly this is a wrong assumption

all-time high stocks are momentum and the strong break-out stock we should be in these stocks

if fear is there of losing then betting a small amount on how these stocks react can give good practical learning.

now important

eicher has given flag monthly break out and box break out at 3018

box breakout minimum target of 3769 but usually its gets doubled in bull run so target is 4504

flag breakout target 4839

USDJPY sell!Price is currently trading inside what appears to be a bearish flag pattern . i expect the price to go up till the upper limit of the pattern and then continue the downward movement all the way till 131.4 ( the next major support level ) . In an event where price manages to break the 131.4 support to downside , we would potentially be looking at a change in the direction of the trend to downside . For now , my next Target is 131.4 after the flag pattern is finished forming !

Sell GJ at the end of current 30min stickAs ypu can see, price has tested a resistance 4 times, with multiple small double tops, price has finally broken out the bottom of the flag channel that it has been in all week.

We have broken below, retested the support as a resistance, if the current stick ends bearish its a sell. Further confirmation is the rejection off the 200ema