+330% this morning $1.25 to $5.38 on massive 270 million volume🚀 +330% this morning 💥 $1.25 to $5.38 on massive 270 million shares traded volume so far

NASDAQ:SNGX money maker of the day!

2 Buy Alerts sent out, also posted it in my premarket watchlist while it was still up only +30%!

Forget about NASDAQ:MSFT NASDAQ:META NASDAQ:AMZN NASDAQ:NVDA NASDAQ:AAPL AMEX:SPY NASDAQ:QQQ they will never be able to create such gains in a single day or should I say minutes

This isn't options trading either, it's a stock that went up that much this morning

Float

$RBCAA Looking to MoveNASDAQ:RBCAA was a pick from my July 1st, 2025 newsletter, along with $MCRI. They both had similar charts, and were both relatively flat since then. However, NASDAQ:MCRI had a single day 20% jump last week. I guess other folks are catching on. Its 50 day SMA has just recently crossed its 200 day SMA, giving us a golden cross. ROE has been increasing for 4 of the last the last 5 quarters, and the price seems to be bouncing off of it’s 50 day SMA and the baseline of its 3 year channel. Also, float has been decreasing since 2019.

Will it get a big bounce like NASDAQ:MCRI did last week? That remains to be seen, but I might be adding a little bit more to my current position.

Manage Input variables with Pine Script v5Welcome to this new tutorial that helps traders and investors better understand the powerful Pine Script programming language v5.

In this tutorial, we will program together three Input variables:

Color type Input: a color input is a parameter that allows specifying a custom color for the indicator or script. It can be used to set the color of lines, areas, texts, or other graphical components in the indicator.

Float type Input: a float input is a parameter that allows specifying a floating-point numerical value for the indicator or script. It can be used to set parameters such as threshold levels, indicator sizes, or any other numerical value that requires decimal precision.

Integer type Input: an integer input is a parameter that allows specifying an integer numerical value for the indicator or script. It can be used to set parameters such as moving average periods, length of a time interval, or any other integer numerical value.

IMPORTANT: The code used in this tutorial has been created purely for educational purposes.

Our indicator is a simple indicator that plots the close data of the underlying asset on the chart in a weighted manner. The displayed data is the sum of the close price plus 20%. The goal of the indicator is to provide a fully dynamic tool that can vary its parameters from the user interface and update automatically.

Here is the complete code for this tutorial:

//@version=5

indicator("Input Tutorial", overlay = false)

pond = input.float(defval = 0.20, title = "Float", minval = 0.10, maxval = 1, step = 0.10)

color_indicator = input.color(defval = color.red, title = "Color")

data = close + (close * pond)

linewidth_feature = input.int(defval = 1, title = "Integer", minval = 1, maxval = 10, step = 1)

plot(close, color = color_indicator, linewidth = linewidth_feature)

//@version=5

Indicates the version of the Pine Script language used in the code.

indicator("Input Tutorial", overlay = false)

Set the name of the indicator as "Input Tutorial", and overlay=false indicates that the indicator should not overlap the main chart.

pond = input.float(defval = 0.20, title = "Float", minval = 0.10, maxval = 1, step = 0.10)

Create a float input called "pond" with a default value of 0.20. The input title is "Float", and the minimum value is 0.10, the maximum value is 1, and the step is 0.10.

color_indicator = input.color(defval = color.red, title = "Color")

Create a color input called "color_indicator" with a default value of red color. The input title is "Color".

data = close + (close * pond)

Calculate a new value "data" by adding the closing price value with the closing price multiplied by the "pond" input.

linewidth_feature = input.int(defval = 1, title = "Integer", minval = 1, maxval = 10, step = 1)

Create an integer input called "linewidth_feature" with a default value of 1. The input title is "Integer", and the minimum value is 1, the maximum value is 10, and the step is 1.

plot(close, color = color_indicator, linewidth = linewidth_feature)

Plot the chart of the closing value with the color specified by the "color_indicator" input and the line width specified by the "linewidth_feature" input.

BEHOLD!!! GAINS FOR APES!!Hello everyone, I go by the name of Trexarch, or Chem..

Today I am here to display my newly drafted chart analysis for my all time favorite stock.

The analysis;

UP

That is all. Thank you.

Please check out all of my other posts related to GME to understand my full thesis.

Let’s wreck some teachers pensions, am I right boys? ;)

DRS DRS DRS DRS DRS DRS

$SQBG Short Squeeze Inbound Low float Low float + 0 shares left to short. Squeeze

Squeeze inbound check short data and interest

$OSAT LongSome big prints coming in lately...long here.

Closing print before uplist is $15.90 off $CUEN here as a sympathy.

900,000 float.

Good luck.

YTEN OPTIONS 3.7M FLOAT / INSIDERS BUYING/ 1/2 OF ENTERPRISE VALAll,

I highly suggest buying call options here. Just get ones further out and pay the premium. If you are unsure just buy a equal amount of PUTS with it then drop the opposing side once dropping. This has huge potential here. If you took enterprise valuation at face value this stock has 60% upside. Conservatively speaking lets even say 30%. With call options clearly that 30% is about 200% if hit correctly. See below for more details. Personally going with a combination of 1&3 due to market being horrible etc.

Enterprise Valuation: 0.397 (1.0 being at value, over 1.0 overvalued, under 1.0 being undervalued) (so WAY undervalued right now)

Float: 3.77M

Short Float: 0.5% (literally none)

Short Growth: -58% (shorts leaving the stock probably noticing the chart etc and undervalued)

CASH TO DEBT RATIO: 6.2 (THATS really good)

Option Method 1

1) Double Call to Put Ratio

2) Release Puts or Calls once direction is established

Option Method 2

1) Long call option heavy buy

2) Set stop loss or scale in if it drops (next drop isnt too far)

Option Method 3

1) Long call option light buy

2) Scale in once trend breaks

KLSE Energy Sector - Battle of the fastestA higher float stock price action are generally slower compared to a lower float stock. We pick few energy stocks (some leader and laggard) to illustrate the price action across the H4 timeframe over 2 years timeline. We also include the WTI & Brent Crude Oil price to show the sector momentum.

How we get the balance float:

We use pickastock.info to get the NOSH (ie Shares issued)

Next we use bursamarketplace.com to calculate % owned by funds, institutions, etc. The balance unutilized is what we called float (or balance float)

Balance floated shares = NOSH x balance unutilized %

Based on our stock pick in Energy sector, following is the list from lightest to the heaviest.

CARIMIN 56M float shares

WASEONG 142M float shares

MYX:DAYANG 215M float shares

MYX:SERBADK 405M float shares

MYX:ALAM 754M float shares

MYX:VELESTO 1449M float shares

MYX:SAPNRG 4130M float shares

Based on our observation, higher float shares (SAPNRG, VELESTO) tends to move slowly compared to its lower float shares (CARIMIN, WASEONG). This play significant role during sectoral play for better short-term gain. This however discount any stock-specific sentiment (ie project award, court action, etc) as that would result to individual stock demand surge/purge. As a rule of thumb, stocks with float < 500M can provide good price action.

Ending the day strong with strong stocks!Again we are talking about low float and high gap stocks with high relative volume (MACD above 0, and KDJ intersect going up), rest is pure garbage. Focus on those criterias I mentioned and go down the list of the scanner to find the ones that meet the criteria.

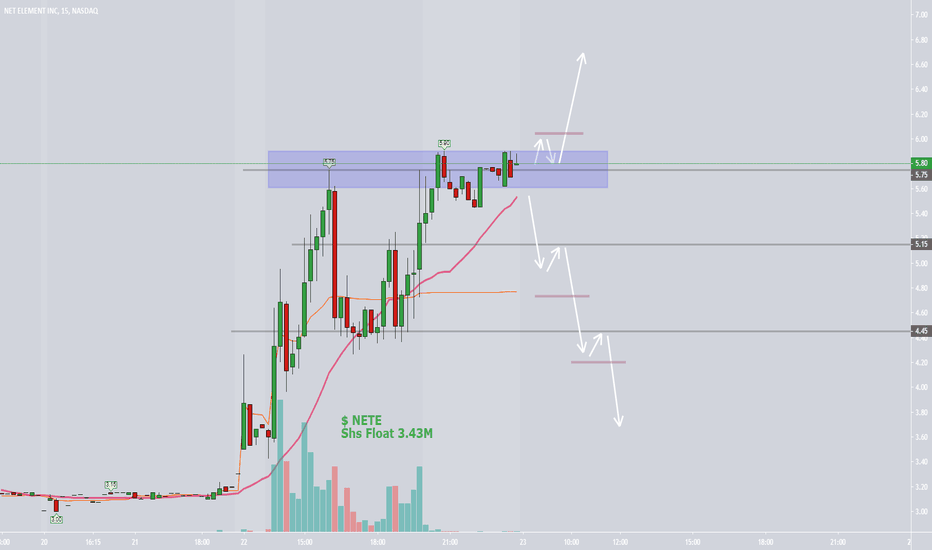

Could This Continue?Hello traders! Hope your having a great trading day. Let's get right into this, tomorrow ill be looking for the continuation trade. I will be watching the important level of 5.90 for a break above, and re-test of that zone to give us a heads up with confirmation for possible entry. Very important to watch that level, because it will need to be broken to move that momentum higher. For shorts, or people holding stock, your going to want to watch the 5.15 level for a break and re-test moving lower, as that would give the chart a bearish outlook. So watch out for both levels tomorrow, and set your alerts! @ 5.90 + 5.15! Good luck everyone! Be sure to leave a "LIKE" and follow me for more great chart analysis in the future!

$BBBY - Long if it breaks out of this wedge..**Not saying to long $BBBY!**

If this breaks out of this wedge I think it will sharply rise up as there is currently 32% short float.

There is also 32% short float - if this isn't a strong indicator than nothing is.

TA is also telling me bullish conditions when looking at indicators on the daily - weekly actually makes a very bearish/overbought case.

The mixed signals say to avoid, but will be fun to watch the bulls take on the bears here as both sides have logic behind there trade.

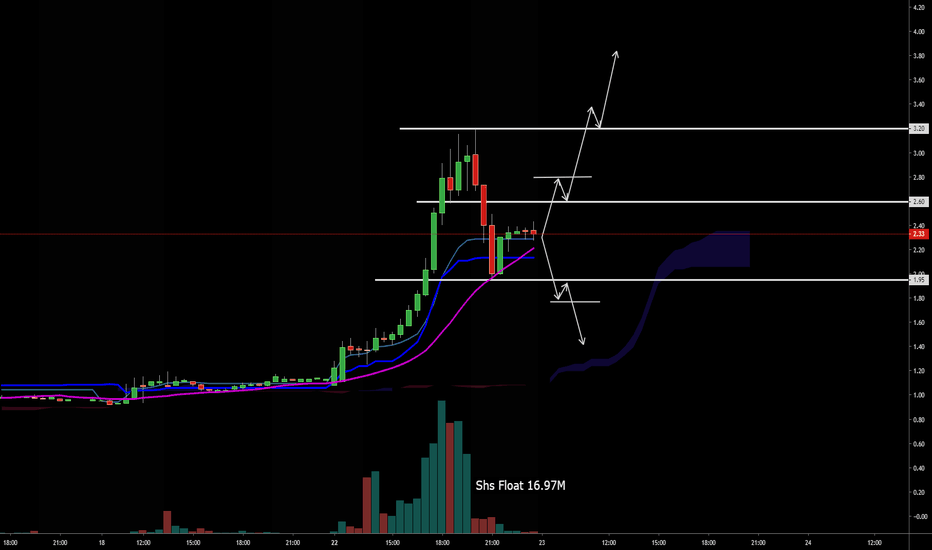

Shineco Added Cannabis SectorShineco stock gapped up this morning from news of them releasing a cannabis sector for their business. Shs Float is sitting at 16.39M with marketcap at 28.38M. We will be watching this stock for a continuation play tomorrow! Watch my full video review for $TYHT by using the link in my signature description!

LFIN: SHORTFIN orLONGFIN? How NOT to trade Low Float StocksBearish Crab harmonic completed on LFIN prior to a "investigation" for shady business and a pathetic attempt to halt T12 Trading. Any IPO is usually traded ridiculously high allowing short sellers to profit from this so early shorts were already placed with predictable stop losses. The hidden selling pressure behind IPO lead price being popped up by "bulls" to run the stop hunt above the 0.618 $65 price.

All of these levels will have to be recreated with price action, for now my opinion on the price is neutral, looks overly hyped but most newbie investors are just trading it for the % and point moves

The VPVR fired shorts covering at 0.236 or of the 1.618 fib extension of the bearish three drives, however we are now in a potential consolidation at the 0.618 $35 which will be covered by other late shorts back up to VWAP price.

Nonetheless there is no clear direction for the trend can only gauge directional momentum and potential reversal points using aroon and previous support levels

IFON found bottom, looking for big reversalA lot of nice movement the past couple days, seems to have found the bottom, trying to bounce off trend line. Easy PT 5.90, possible PT up to 8.88. Company partnered with Apple, thats all the DD you need to do.

10 Year Treasury rates to break resistance or one more dip firstThe 10 year appears to want to either break above the resistance or take on more small trip down to the e wave on this a,b,c,d,e triangle. If it hits the lower triangle boundary and then bounces, then probability is greater that it will then break the upper resistance. So if you are looking to lock a rate, or float watch both triangle boundaries to see what happens. If it breaks lower boundary, then rates could drop so you can float if the rate drifts down into the lower boundary as long as it does not break the upper boundary first.

Not intended as investment advice. This is an opinion only. Make of it what you will after doing your own analysis first.