#FLOKI/USDT#FLOKI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel. This support is at 0.00010160.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.00010950

First target: 0.00012125

Second target: 0.00012120

Third target: 0.00012900

FLOKIUSDT

#FLOKI/USDT#FLOKI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel. This support is at 0.00006834.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.00007137

First target: 0.00007618

Second target: 0.00007274

Third target: 0.00008013

#FLOKI/USDT#FLOKI

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.00009128

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.00009363

First target 0.00009596

Second target 0.00009935

Third target 0.0001030395

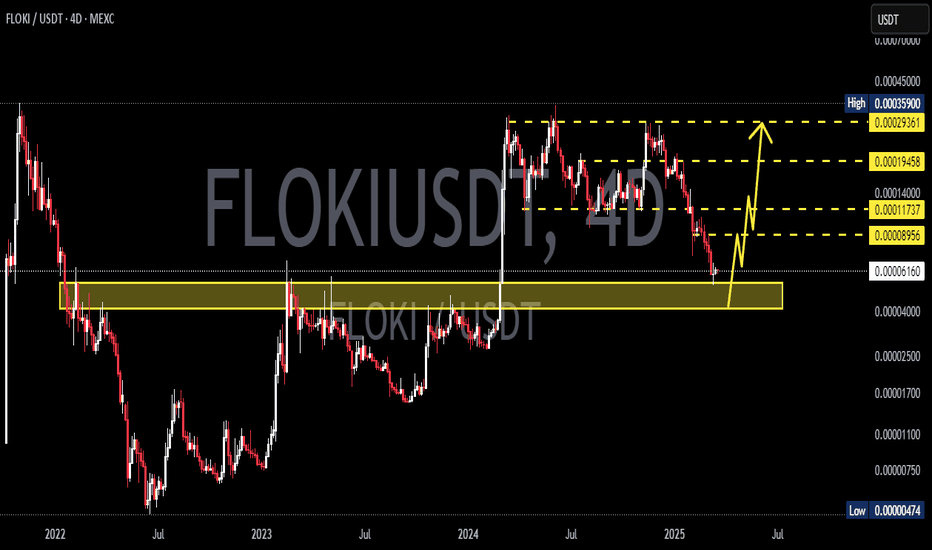

$FLOKI/USDT BREAKOUT TRADE SETUP🚨 $1000floki/USDT Breakout Trade Setup

Massive breakout from a long-term downtrend line on the 1d chart

Price has reclaimed the 0.095–0.10 resistance zone, now acting as support.

- Entry Zone: $0.096 – $0.103

- Targets:

• TP1: $0.14

• TP2: $0.18

• TP3: $0.29 (+192% from breakout zone)

Stop Loss: $0.08686

Leverage Suggestion: 3–5x max

Clean bullish structure.DYOR, NFA

$INJ Breakout Alert!CRYPTOCAP:INJ breakout alert!

-It finally broke above the downtrend line after months of

consolidation.

-Retest and holding the key support zone around $8.50–

$9.00.

-Now, we are aiming for the next leg toward $26, a

Potential 184% move.

-Trend shift confirmed. Watch closely!🚀

DYRO, NFA

Will FLOKI Hit 0.00010350 and gain 25 percent?Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for FLOKI 🔍📈.

After experiencing a prolonged and dramatic downtrend that wiped out millions of dollars from its market value, FLOKI has now reached a key support zone. Given the current technical structure, a short-term rebound appears likely. A potential price increase of up to 25% can be anticipated from this level, with a primary target set at 0.00010350.

🧨 Our team's main opinion is: 🧨

FLOKI is showing signs of a short-term bounce from key support, with a 25% upside potential and a main target at 0.00010350 if current levels hold. 🚀

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

FLOKI at Key Support – Is a Bounce Coming?The price of FLOKI has dropped back to an important level where it used to face resistance before going up. Now, this same level is acting as support, which could lead to a bounce.

We also see a bullish divergence on the RSI, It often signals that selling is slowing down and a reversal might be coming.

If the price holds above this support zone, we might see a bounce toward the $0.09 to $0.11 area.

If the price breaks below the support, the idea may not work, so it’s important to manage risk.

Breaking: TokenFi ($TOKEN) Surge 11%, More Gains Ahead?TokenFi ($TOKEN) a project that aims to simplify the crypto and asset tokenization process and eventually become the foremost tokenization platform in the world has seen its native token surge 11% today breaking loose from a consolidation zone.

A token that once surged to about $200 million in market cap before retracing to $18 million market cap is gaining traction, albeit listed on major exchanges like Kraken, Bybit, Gate.IO, MEXC and quite a number of exchanges- with the market cap at $18 million, this proffers early opportunity for traders to capitalize on the dip as a run to a $100 million market cap is feasible.

For $TOKEN coin, a break above the $0.020 price pivot could spark a bullish renaissance for the asset. Similarly, should the asset consolidate, the 61.5% Fibonacci retracement point is a suitable level for a cool-off before picking liquidity up.

About TokenFi

TokenFi aims to simplify the crypto and asset tokenization process and eventually become the foremost tokenization platform in the world.

The tokenization industry is projected to be a $16 trillion industry by the year 2030. BlackRock, the world’s biggest institutional investor with $10 trillion of assets under management, strongly believes in the industry’s potential, which they call "the next evolution in markets”.

TokenFi is launched by the highly experienced and connected Floki team that launched the popular Floki token that went to an ATH valuation of $3.5 billion. They will be leveraging this same experience to make TokenFi the number one tokenization platform in the industry.

TokenFi Price Live Data

The live TokenFi price today is $0.018083 USD with a 24-hour trading volume of $14,220,544 USD. TokenFi is up 9.69% in the last 24 hours, with a live market cap of $18,083,753 USD. It has a circulating supply of 1,000,019,789 TOKEN coins and a max. supply of 10,000,000,000 TOKEN coins.

Will Floki drop 32% to 0.000052 or reverse soon?Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Floki 🔍📈.

Upon closely analyzing the Floki chart, it's clear that there is a notable increase in selling volume, particularly in the red candles, signaling strong bearish pressure. Floki has lost several crucial support levels, including its key golden zones, and is now entrenched in a powerful downward channel. I project a further decline of at least 32%, bringing the price to the significant daily support level of 0.000052. After reaching this support, we could see the market consolidate within a range, potentially leading to a period of sideways movement.📚🙌

🧨 Our team's main opinion is :🧨

Floki is in a strong downtrend, likely to drop 32% to 0.000052 , where it could consolidate before any potential recovery.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

#FLOKI at a Make-or-Break Moment – Major Breakout Incoming?Yello, Paradisers! Is #FLOKI gearing up for a massive breakout, or are we about to see another leg down? Let's look at the latest analysis of #FLOKIUSDT:

💎The price has been consolidating within a falling wedge formation on the 12-hour timeframe, a pattern that often leads to a bullish reversal. This pattern and a liquidity sweep at the lower boundary have already shaken out impatient traders. But remember, no move is confirmed until we see a decisive breakout. A decisive move above key resistance is needed to confirm the shift in momentum.

💎#FLOKI is currently testing the descending resistance of this wedge, and a breakout above $0.00019 could trigger a strong rally. If bulls take control, the next major target will be the supply wall between $0.00028 - $0.00030, where significant selling pressure is likely to emerge. A clean move above this area could open the doors for an extended bullish run. However, failure to break above resistance could lead to another pullback before any real upside momentum develops.

💎On the downside, #FLOKIUSD is sitting on a strong support zone around $0.00011. Buyers have consistently stepped in at this level, reinforcing its importance. If this support holds, we can expect a bounce and a potential attempt to break out of the wedge. The next line of defense for the #FLOKIUSDT is at the demand zone at $0.000086 if the above support fails.

💎However, if #FLOKI loses this support and a candle closes below $0.000086, the bullish scenario would be invalidated, exposing the price to further downside toward the lower support zone.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴

Is Floki Inu really just another version of Dogecoin?Hello and greetings to all the crypto enthusiasts, ✌

Reading this educational material will require approximately 10 minutes of your time . For your convenience, I have summarized the key points in 10 concise lines at the end . I trust this information will prove to be insightful and valuable in enhancing your understanding of Floki Inu and its role in the global financial landscape.

Personal Insight & Technical Analysis of Floki Inu

Cryptocurrencies linked to well-known figures like Elon Musk tend to have great potential but come with substantial volatility and risk. While the current technical chart for Floki Inu shows an upward trend, some short-term pullbacks may occur before any sustained growth. However, this analysis should be seen as a personal viewpoint, not as financial advice, and it’s important to be aware of the high risks that come with investing in meme coins and that being said, please take note of the disclaimer section at the bottom of each post provided by the website ,.

Floki Inu Overview

Floki Inu, a meme coin inspired by Elon Musk’s dog, has made waves in the cryptocurrency space, standing out as one of the most influential and talked-about projects. Built on the Ethereum blockchain, Floki Inu began as a meme coin but quickly evolved into something much larger, gaining significant attention due to its sizable market cap and the backing of a passionate community. In this overview, we will dive into what Floki Inu is, who created it, its origin story, how to buy it, its potential as an investment, its utility, and what makes it unique compared to other meme coins.

How to Buy Floki Inu

To acquire Floki Inu, you must first sign up on a cryptocurrency exchange that supports it. Look for a platform with strong security features, such as two-factor authentication and data encryption, to ensure the safety of your investments. Additionally, consider the transaction fees, as these can eat into your profits. The exchange should also be user-friendly and offer an easy interface for smooth trading. To make the best choice, reading reviews and feedback from other users is essential for selecting a trustworthy platform.

The History of Floki Inu

Floki Inu was born out of a single tweet by Elon Musk on June 25, 2021, where he announced he would soon adopt a Shiba Inu puppy named Floki. This tweet sparked the creation of the Floki Inu cryptocurrency, which was initially developed by an anonymous creator but soon abandoned. Despite this, a passionate community took over and revived the project by July 6, 2021. The project quickly gained traction, especially after Musk’s tweet on September 12, when he revealed his family had received the puppy. By that time, Floki Inu was already being actively traded. Initially launched as an ERC-20 token on the Ethereum blockchain, Floki Inu has grown into a multifaceted project that includes Web 3.0, decentralized finance (DeFi), and Metaverse elements, transforming it from a meme coin into "The People’s Crypto."

Floki Inu’s Mission

Floki Inu stands out not only for its cryptocurrency potential but also for its commitment to social causes. The primary mission of the Floki Inu team is to build schools in underdeveloped countries and combat food insecurity worldwide. Their charitable initiatives have attracted attention from major institutions, such as Nasdaq, which listed Floki Inu as one of the top metaverse projects to watch in 2022. Additionally, Floki Inu has partnered with the Million Gardens Movement, led by Kimbal Musk, to fight global food insecurity. These charitable goals give Floki Inu a sense of purpose beyond just financial speculation, aiming to make a real-world impact.

Floki Inu Use Cases

Floki Inu’s value is reflected in its versatility and the range of use cases it supports:

1. Investment – Many see Floki Inu as a potential investment, especially due to Elon Musk’s influence on the price movements of meme coins. Investors hope for gains based on social media hype and increased market attention.

2. Trading – Just like other cryptocurrencies, Floki Inu can be traded to benefit from price fluctuations in the market. Traders can buy and sell the token to capitalize on short-term movements.

3. Staking – Floki Inu can be staked in various wallets, allowing users to lock their tokens and earn rewards over time, which adds an additional layer of utility for holders.

4. Charitable Initiatives – Perhaps one of its most unique attributes, Floki Inu is heavily focused on charitable projects, especially around education and addressing global food insecurity, distinguishing it from other meme coins in terms of long-term vision.

Floki Inu’s Ecosystem

Floki Inu’s ecosystem is broad, encompassing several ambitious projects that are still under development. These projects span areas like NFTs, DeFi, and the Metaverse. Here’s a look at the main initiatives within the Floki Inu ecosystem:

- Valhalla – Floki Inu has ventured into the NFT gaming space with its game, Valhalla. This game is based on NFTs, and players can earn FLOKI tokens by participating, with full ownership of the tokens they acquire. These tokens can be used for in-game purchases, creating a dynamic and rewarding experience for players.

- FlokiFi – FlokiFi is a suite of decentralized finance (DeFi) products, which aims to bring innovation to the space. The first product launched under FlokiFi is the FlokiFi Locker, designed to be a leading protocol for securing digital assets. Additional staking products are planned but haven’t been fully disclosed yet.

- FlokiPlace– An NFT marketplace called FlokiPlace is in the works, where users can buy and sell NFTs and digital assets. The platform is intended to expand the use of Floki Inu, positioning it as a viable alternative to traditional currencies like Bitcoin and even the US Dollar for digital transactions.

- Floki University – Floki Inu is also focused on education with the creation of Floki University, a Metaverse-based platform designed to teach users about cryptocurrency and blockchain technology. The university will offer free courses on crypto basics and specialized content, with the possibility of some advanced courses requiring payment in FLOKI tokens. The ultimate goal is for Floki University to become a leading educational platform in the crypto space, providing a large database of resources to users worldwide.

These projects are still in development but showcase the ambitious nature of Floki Inu’s ecosystem. They represent the broader vision of the team to transform the project into a multifaceted platform that not only participates in the crypto market but also makes a tangible impact through education, gaming, and charitable work.

In conclusion, Floki Inu has moved beyond being a simple meme coin and is working to build a comprehensive and impactful ecosystem. Its commitment to charity, educational initiatives, and its diverse technological projects position it as one of the most interesting and innovative meme coins in the market today. Whether you are considering investing in Floki Inu or just exploring its potential, it’s clear that it has a lot to offer, both as a digital asset and as a project with a deeper purpose.

🧨 Our team's main opinion is: 🧨

Floki Inu is a meme coin inspired by Elon Musk’s dog.

It was launched on the Ethereum blockchain and quickly gained popularity.

The project was revived by a passionate community after its initial abandonment.

Floki Inu has evolved from a meme coin into a multifaceted ecosystem.

Its mission focuses on charitable causes, including building schools and combating food insecurity.

The coin’s use cases include investment, trading, staking, and charitable initiatives.

Floki Inu is developing projects in NFTs, DeFi, and the Metaverse.

Valhalla, an NFT game, and FlokiFi, a DeFi product, are key components.

Floki University is an educational platform teaching crypto and blockchain technology.

Floki Inu aims to make a lasting impact on both the crypto world and society.

Give me some energy !!

✨We invest countless hours researching opportunities and crafting valuable ideas. Your support means the world to us! If you have any questions, feel free to drop them in the comment box.

Cheers, Mad Whale. 🐋

Is FLOKIUSDT About to Explode or Collapse?Yello, Paradisers! Are we on the verge of a breakout for FLOKIUSDT, or is a deeper retracement looming? Let’s break it down with clear action steps to keep you on the right side of the trade.

💎FLOKIUSDT has recently shown a bullish I-CHoCH (Internal Change of Character) and is currently undergoing a healthy retracement. This retracement is a critical moment that could lead to significant price movement depending on what happens next.

💎If FLOKIUSDT bounces from the current price and successfully breaks the resistance trendline, it will significantly increase the probability of a bullish continuation. This would signal the market’s intent to push higher, making it a potential opportunity for well-planned entries.

💎Should the price dip lower to grab inducement before bouncing, keep an eye on the strong support zone. A bounce from this level paired with a bullish I-CHoCH on lower timeframes will increase the odds in your favor, making it a better entry for those looking to go long.

💎If the price breaks and closes a candle below the strong support zone, it will invalidate the bullish setup entirely. In that case, the best strategy would be to wait patiently for clearer price action to form before making any moves.

As always, it’s essential to stay disciplined and follow a high-probability strategy. Trading without confirmation can expose you to unnecessary risks, so be sure to wait for the market to show its hand before committing to a trade.

MyCryptoParadise

iFeel the success🌴

$FLOKI is again in my buy zone. Refill your bag opportunity..SEED_DONKEYDAN_MARKET_CAP:FLOKI has a history of impulsive pumps, and this green box has proven to be a reliable indicator for identifying entry points.

Another strong move appears to be on the horizon.

Altseason is approaching, with bullish divergence on the RSI and a MACD reset on the daily timeframe. My green line is currently acting as support.

Strategy: Enter as low as possible within the green box and sell at the peak of the next impulsive move.

As always, DYOR (Do Your Own Research).

What are the key features of the Floki Inu and its future?Hello and greetings to all the crypto enthusiasts, ✌

Overview of Floki Inu:

In the world of cryptocurrency, numerous projects exist, each falling into specific categories based on their characteristics and objectives. One such category is meme coins, which, despite their whimsical nature, have captured the attention of investors and enthusiasts alike. Among the most popular and disruptive meme coins in the crypto space is Floki Inu, a project that has gained significant attention with its remarkable market cap and immense influence in the crypto industry.

Floki Inu is a meme coin inspired by the name of Elon Musk's dog, built on the Ethereum blockchain. In this analysis, we will explore what Floki Inu is, who its creators are, its origins, how to purchase it, its use cases, whether it represents a sound investment, and what sets it apart from other competing meme coins.

My Personal Perspective and Technical Analysis of Floki Inu:

Cryptocurrencies associated with famous personalities inherently carry high potential, but they are also characterized by significant volatility and high risk. However, they can be good options for short-term and periodic gains. The technical chart of this asset currently shows a promising upward trend, though we might observe some bearish consolidations before this upward movement fully materializes. That being said, please take note of the disclaimer section at the bottom of each post provided by the website, this is merely my personal opinion and should not be interpreted as financial advice.

How to Buy Floki Inu?

First, you need to create an account on an exchange that lists Floki Inu. It’s essential to choose a secure trading platform with strong security measures like two-factor authentication and data encryption. The transaction fees should also be reasonable to avoid diminishing your profits. Make sure the platform supports Floki Inu and offers an easy-to-use interface for smooth trading. Reading user reviews and online feedback can help you choose the right platform.

The History of Floki Inu:

What is the story behind the creation of Floki Inu, and how did it all begin?

The creation of Floki Inu stems from a single tweet. On June 25, 2021, Elon Musk, the CEO of Tesla and the current owner of Twitter, tweeted that he would soon be adopting a Shiba Inu puppy, which he intended to name Floki. Little did anyone know, this tweet would spark the creation of a new meme coin bearing the name of Musk’s dog.

Following the tweet, an anonymous developer created Floki Inu, only to abandon the project shortly thereafter. However, less than two weeks later, on July 6, 2021, a passionate community of supporters and enthusiasts revived the project, taking matters into their own hands.

The team behind Floki Inu recognized the significant influence Musk had on the price movements of meme coins such as Dogecoin and Shiba Inu. Interestingly, on September 12, when Musk tweeted that his family had received the puppy, Floki Inu was already actively being traded in the market. The token was deployed on the Ethereum blockchain as an ERC-20 token. However, Floki Inu quickly evolved from a simple meme coin to a multifaceted project that now includes elements of Web 3.0, decentralized finance (DeFi), and the Metaverse. Floki Inu has since become known as The People’s Crypto.

Floki Inu’s Mission:

The Floki Inu team asserts that the project is part of a broader movement aimed at charitable activities, including building schools and addressing food insecurity.

Their primary vision is to build schools in underdeveloped countries around the world. This mission has even garnered recognition from major institutions; for instance, Nasdaq (the New York Stock Exchange) listed Floki Inu as one of the top metaverse projects to invest in during 2022.

The Floki Inu team is also collaborating with the Million Gardens Movement, led by Kimbal Musk, Elon Musk's brother. According to Floki Inu’s official website, it is the only cryptocurrency project that has an official partnership with this movement. The goal of their collaboration is to combat global food insecurity.

Use Cases of Floki Inu:

Floki Inu’s utility can be summarized in four key areas:

1. Investment: Floki Inu has garnered attention as a meme coin, largely due to Elon Musk’s tweets, which have historically influenced the price movements of cryptocurrencies. Many investors may purchase Floki Inu with the expectation that it will experience similar price increases driven by social media attention.

2. Trading: As with other cryptocurrencies, Floki Inu can be traded to capitalize on price fluctuations, with traders seeking to profit from short-term market movements.

3. Staking: Floki Inu is also a cryptocurrency that can be staked in various wallets, offering users the opportunity to earn rewards in return for locking their tokens in a staking mechanism.

4. Charitable Initiatives: This is perhaps the most distinguishing feature of Floki Inu. The project positions itself as a charitable movement, with its long-term vision of building schools and addressing food insecurity globally.

The Floki Inu Ecosystem:

Floki Inu has developed a unique ecosystem comprising several distinct projects that are still under development. These projects span areas such as non-fungible tokens (NFTs), decentralized finance (DeFi), and the Metaverse. Given that the adoption of Floki Inu in DeFi platforms or NFT marketplaces is currently limited, the development team is focused on expanding the token’s utility and broadening its acceptance through these diverse initiatives.

Some of the key projects within the Floki Inu ecosystem include:

Valhalla: An NFT-Based Game

Floki Inu has entered the NFT gaming space with its game, Valhalla, which is centered around NFTs. In this game, players can earn rewards based on their participation, with full ownership of the FLOKI tokens they acquire. These FLOKI tokens act as the in-game currency, which can be used for purchases within the game.

FlokiFi: A DeFi Project

FlokiFi refers to a collection of decentralized finance (DeFi) products that Floki Inu plans to launch in the future. The first product in this suite is the FlokiFi Locker, which is designed to be one of the most innovative protocols in the industry for securing digital assets. There are also hints of new staking products in the works, although specific details have yet to be disclosed.

FlokiPlace: An NFT Marketplace

In line with the growing popularity of NFTs, Floki Inu aims to create FlokiPlace, a marketplace dedicated to NFTs and digital assets. The goal of FlokiPlace is to facilitate the buying and selling of NFTs and other digital products, while also establishing Floki Inu as a viable alternative to Bitcoin, Dogecoin, and even the US Dollar as a medium of exchange.

Floki University: A Metaverse Platform for Crypto Education

Floki University is an educational platform designed to teach individuals about cryptocurrency and blockchain technology. This metaverse-based university will offer a range of educational resources, with a focus on raising awareness of the Floki Inu ecosystem. Most of the courses will be available for free, though some specialized courses may require a fee, which can be paid using the FLOKI token.

The long-term vision for Floki University is to become a leading platform with the largest database of crypto-related content, accessible to users worldwide using the FLOKI token.

🧨 Our team's main opinion is: 🧨

Floki Inu is a meme coin inspired by Elon Musk's dog, launched in 2021, and built on the Ethereum blockchain. It aims to be more than just a meme, with a focus on charitable projects like building schools and tackling food insecurity. The ecosystem includes NFT games, DeFi projects, a marketplace, and an educational platform, positioning Floki Inu as both an investment and a movement.

Give me some energy !!

✨We invest countless hours researching opportunities and crafting valuable ideas. Your support means the world to us! If you have any questions, feel free to drop them in the comment box.

Cheers, Mad Whale. 🐋

FLOKI can riseBINANCE:FLOKIUSDT

✅ Floki has broken its short-term downtrend line and resistance at 1900 on the four-hour time frame, and with the break of resistance at 2100, it can move towards the following targets:

2540, 2840, 3280

✅ The 1800 range has now become Floki's support 👌

⚠️ Disclaimer:

This is not financial advice. Always manage your risks and trade responsibly.

👉 Follow me for daily updates,

💬 Comment and like to share your thoughts,

📌 And check the link in my bio for even more resources!

Let’s navigate the markets together—join the journey today! 💹✨

Time to Snag FLOKI: Eyes on the 0.000145 SupportTime to start positioning for the next move on FLOKI. The recent move was relatively weak compared to other memecoins, so I’m looking for a better entry.

I want to accumulate below 0.000145. If I see weakness below that level, I’ll cut it and look to buy back at the 0.000108 region.

We have roughly a month to accumulate, so patience is key.