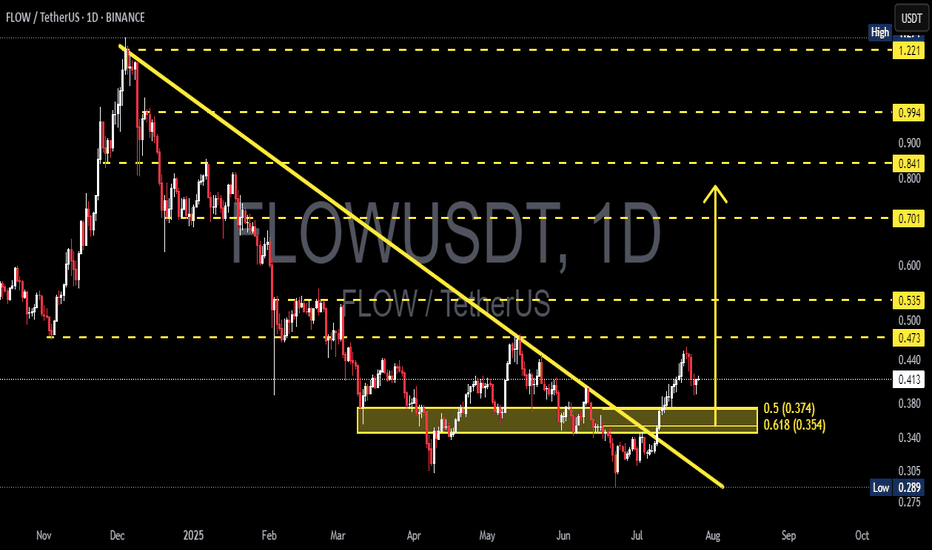

FLOWUSDT Breakout + Golden Pocket Retest: Ready to Explode?After being trapped in a persistent downtrend for months, FLOW has finally shown a major technical signal: a clean breakout from the dominant descending trendline that has defined price action since late 2024.

This breakout isn’t just visually appealing — it’s backed by strong technical confluence, including a key demand zone, Fibonacci retracement support, and potential shift in market psychology.

---

🧠 Technical Structure & Chart Breakdown

📉 Descending Trendline Breakout

The major downtrend line has been decisively broken, indicating that bearish pressure is weakening. This is an early but powerful sign that momentum may now be shifting toward the bulls.

🟨 Consolidation Zone & Flip Area (Yellow Box)

The $0.354–$0.374 zone has acted as:

Former resistance during sideways consolidation

Potential new support after the breakout (support-resistance flip)

📊 Fibonacci Retracement Levels

0.5 Fib = $0.374

0.618 Fib = $0.354

This area, also known as the "Golden Pocket", is one of the most critical levels in technical analysis. It often acts as a launchpad during bullish retests.

---

🟢 Bullish Scenario: Textbook Retest Before a Rally?

If the price holds and reacts positively from the $0.354–$0.374 zone, the following upside targets come into play:

1. 🎯 Target 1: $0.473 – Previous range resistance

2. 🎯 Target 2: $0.535 – Key horizontal level

3. 🎯 Target 3: $0.701 – Historical resistance

4. 🎯 Extended Target: $0.841 – $0.994, potentially up to $1.221 in a strong bullish expansion

For this scenario to play out, bulls must push a daily close above $0.473 to confirm strength and break market structure.

---

🔴 Bearish Scenario: False Breakout Ahead?

If the price fails to hold the golden pocket support:

The breakout could turn into a bull trap

The price may retrace toward:

$0.305 – Local support

$0.289 – The previous low

A strong bearish candle with volume below $0.354 would invalidate the breakout and may signal renewed downward pressure.

---

💡 Conclusion: Critical Decision Point Ahead

FLOWUSDT is now at a pivotal point. The breakout has happened — but the retest zone will decide everything. Will it serve as the foundation for a larger bullish rally, or will it mark the start of another bearish wave?

Watch price action closely around $0.354–$0.374 — that’s where smart money makes their move.

#FLOWUSDT #CryptoBreakout #TechnicalAnalysis #GoldenPocket #RetestZone #FibonacciLevels #AltcoinSetup #CryptoMomentum #FlowAnalysis

FLOW

Quick Lesson: Slow & Fast Flows (Study it & Benefit in Trading)It is always important to look not only at levels (supports/resistances), but how exactly price moves within them.

On the left side , we see a slow flow—a controlled and gradual decline. Sellers are patient, offloading positions over time into visible liquidity levels. Each dip is met with small bids, creating a staircase-like drop. This kind of move doesn’t trigger panic immediately, but it’s dangerous because it builds up pressure. Eventually, when buyers dry up, a larger breakdown happens.

On contrary, the right side shows a fast flow. Here, a large sell order slams into a thin order book, causing an immediate price spike down. There's little resistance, and multiple levels are skipped. This creates an inefficient move, often forming a sharp wick. These fast drops are typically caused by fear, liquidation, or aggressive exit orders. But what’s interesting is the recovery: because the move was so aggressive and liquidity was so thin, price can snap back up quickly. These are often V-shaped reversals with low resistance on the way back.

Try to look for such setups on the chart and learn how the price behaves . Studying such cases will help you identifying upcoming sell-offs/pumps and earn on them.

Flow: Your Altcoin ChoiceBefore starting, I want to show you the linear chart for FLOWUSDT. I always use the log. chart to be able to see the high and lows and the candles more clearly.

When the candles become flat and almost invisible, it means the market is trading at bottom prices. This is FLOWUSDT long-term:

This applies to all pairs and Cryptocurrency projects. When the candles become almost invisible, it means that the current neutral market cycle has been exhausted. Next comes the bull market.

Now we can go to the full chart with all the data and drawings.

The logarithmic chart reveals all the info but it is hard to appreciate how low really a Crypto pair is trading in relation to past action. This is very important if you do your own technical analysis and numbers. This is important if you do your own search for good entry prices. Just go linear and see what the chart reveals.

FLOWUSDT is trading at a new All-Time Low. The ATL session has no bearish volume but instead is about to close green. Bears are gone. They had control of the market for so long, but this is over now.

A new ATL is good because it opens the doos for new players and also maximum growth. A bull market cannot come out of a new All-Time High. Out of an All-Time High, only a bear market can develop. Out of bottom prices, we can see sustained long-term growth. So there is always some positive that can be extracted out of the negative.

When prices are high, all is good because we are growing; there is money and there are profits. When prices are low, all is good because we can prepare for a growth phase. Regardless of how you look at it, everything is always nice, good, positive and great. Adopt the right mentality and you're bound to achieve success.

It is impossible to mistake the action on the chart. A bear market, a sideways market and then comes... A bull market.

» The bear market is marked as (1) on the chart.

» The sideways market is marked as (2).

» The bull market comes next, (3).

I am keeping it simple, because there is not much more for me to say; I am keeping it simple, because simple is best.

Namaste.

#FLOW (SPOT) IN ( 0.600- 0.750) T.(6.900) SL(0.556)BINANCE:FLOWUSDT

#FLOW/ USDT

Entry ( 0.600- 0.750)

SL 1D close below 0.556

T1 1.100

T2 1.550

T3 2.600

T4 4.100

T5 6.900

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX #REZ #DUSK #BNX #SPELL #POWR #JOE #TIA #TFUEL #HOT #AVAX #WAXP #OGN #AXS #GALA #ONE #SYS #SCRT #DGB #LIT #QI #FIL #GLMR #ATOM #LTC #MANA #ONT #TLM #SLP #ROSE #NEO #EGLD #CHR #FLOW

TradeCityPro | FLOWUSDT New Weekly Move?👋 Welcome to TradeCityPro Channel!

Let’s analyze the weekly crypto watchlist together during the final hours of the market holiday.

🌐 Overview Bitcoin

Before diving into today’s altcoin analysis, let’s take a quick look at Bitcoin. In the 1-hour timeframe, Bitcoin has broken its trendline but remains below the key resistance level of 98606, which it has been rejected from twice, highlighting its significance.

At the start of the new week, I anticipate a potential upward move, likely during the U.S. session. If Bitcoin breaks 98606, a long position can be opened. If Bitcoin dominance is breaking 57.08 simultaneously, long positions on Bitcoin itself are preferable. Otherwise, if dominance faces rejection or forms red candles, a quick switch to altcoins is recommended.

📊 Weekly Timeframe

In the weekly timeframe, this altcoin, like most of the crypto market, is still in its range box, continuing its oscillation within this boundary.

After breaking 0.674, FLOW attempted to reach the range’s upper boundary but faced rejection. Even RSI was rejected at 70, preventing FLOW from reaching the resistance at 1.460.

On the positive side, during this pullback, the volume of red candles decreased, and FLOW is now at a previous resistance-turned-support level, suggesting the potential for a rebound.

Keep in mind that the main support level is 0.463. If it breaks, exiting this coin would be wise. A re-entry can be considered upon a breakout above 1.460 with momentum confirmation.

📈 Daily Timeframe

In the daily timeframe, after a fake breakdown below the key support level of 0.509, FLOW bounced back strongly, initiating a move toward the resistance at 1.169.

If we use Fibonacci levels (ignoring fakeouts), the 0.7 level emerges as a key support. It acts as a previous resistance-turned-support and aligns with the significant 0.618 Fibonacci retracement level.

The 0.7 level has been tested twice, with the price bouncing each time. If FLOW breaks 0.809, it could start a move toward 0.969 and eventually 1.169.

For spot buying, wait for a breakout above 0.809, with: Risky Stop-Loss: 0.7 Conservative Stop-Loss: 0.509 For futures trading, consider a position after a breakout above 0.809.

The resistance level at 0.809 is crucial, offering a solid opportunity for both spot and futures trades.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

#FLOW (SPOT) entry range (0.480- 0.580) T.(1.183) SL(0.437)BINANCE:FLOWUSDT

entry range (0.480- 0.580)

Target1 (0.658)- Target2 (0.913)- Target3 (1.183)

SL .1D close below (0.437)

*** Collect in the entry range ****

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW ****

Crypto Money Flow CycleHello,

The Crypto Money Flow Cycle is a flow model that discusses the route of investments from fiat to Bitcoin, from Bitcoin to altcoins, and backward into fiat, booking profit at every step. The model theorizes that most Bitcoins in circulation aren't mined but are bought for fiat. Before every bull run, investors don't necessarily buy mining equipment but purchase Bitcoins from their fiat money. As more and more money flows from fiat into Bitcoin, Bitcoin price rallies. At this phase, Bitcoin usually pumps more than most altcoins. At the end of the phase, investors buy altcoins from their Bitcoins.

They prioritize large caps like Ethereum. So, the price of large caps rallies compared to fiat and Bitcoin. Usually, these rallies outperform Bitcoin because the investors can afford to invest not only the initial fiat value but all the profits so far. That is Bitcoin's performance on fiat compounded by the large caps' performance compared to Bitcoin.

Over time, investors move the value from large caps to medium caps and from medium caps to small caps, pumping the markets in this order. Since the investment in medium caps is larger with the profit than the large caps, medium caps usually pump more, and similarly, small caps pump even more when money from medium caps flows into them.

To realize all the profit so far, investors can exchange small-cap altcoins back into Bitcoin, which means Bitcoin will pump once again. Then all the money so far, which is the initial fiat value compounded by the profit from each phase can return into fiat. Usually, this is when Bitcoin suffers correction and drags altcoins with itself.

That's how the Crypto Money Flow Cycle usually works. It's a model, which might or might not be true. However, I can say AI could trade the estimated phases with a success rate of over 71.23%, which means there might be more to this model than luck.

Regards,

Ely

FLOWUSDT Reversal Confirmed!FLOWUSDT technical analysis update

The price of FLOWUSDT has formed a triangle pattern at the bottom, with the 100 EMA acting as resistance for the past 150 days. Now, the price has broken through the triangle's resistance and crossed above the 100 EMA on the daily chart. In the coming days, we can expect a strong bullish move.

FlowFlow is an interesting blockchain platform which was in a downtrend move since the birth! It is evident from the chart that lower lows were made one after another. However, price have recently broke the downtrend line and if one higher high and one higher low occur, we can hope for a reversal. Let's see what happens.

High Potenzial Invest Flow/EurAfter years and month of downtrend, now the important volume comes in and also the trendline broke through with this massiv volumen. In my eyes a no brainer, now investing some money and in the next month to years in combination with the industry / german / europe crisis it´s a very good way to diversify your money. The potenzial is up to x 40 maybe a new higher high x 70, but with a easy attitude and a realistic mind first realization from x8 - x10 because the volatility of crypto assets and then buying back with cost average. gl & hf

WHAT'S FLOWING: CRYPTO | FX | ASIAIn today's episode of "What's Flowing," we're analyzing a range of markets with distinctive bullish and bearish signals. Here’s a quick rundown:

Bullish Setups:

UNIUSD - Strong buying interest with a bullish push, showing potential for further gains.

EOSUSD - Also on the bull side, indicating strength in the current momentum.

AVAUSD - Demonstrating bullish signals, with traders looking for upward movement.

Bearish Setups:

AUDNZD - The pair is on the bearish side, with sellers dominating the flow.

EURCHF - Showing bearish tendencies, suggesting potential downside.

GBPAUD - Leaning towards a bearish setup, with sell pressure evident.

Additionally, China50 and Japan225 indices are showing bearish pressure as well, hinting at risk-off sentiment in the Asian markets.

FLOW Technical AnalysisFLOW/USDT has been in a prolonged downtrend, with the price consistently respecting a descending resistance trendline since March 2024. Currently trading at $0.537, the pair is approaching key resistance near $0.593, where it has previously been rejected multiple times. The failure to break above this level continues to reinforce the bearish sentiment. The market is watching closely for a breakout above this trendline, which could signal a potential shift in momentum toward the upside.

On the downside, FLOW has found support in the $0.471-$0.507 range naked , highlighted by the yellow zone on the chart. This area has held firm during recent pullbacks, preventing further declines. If the price fails to break through resistance and reverses from current levels, a retest of this support zone seems likely. A break below this key support could push the price toward the next critical level at $0.390, where further bearish movement might slow down.

Despite the ongoing bearish trend, a breakout above $0.593 and the descending channel upper boundary would open the door for a potential rally. The next major resistance levels sit at $0.683 - $0.711, highlighted by the green zone on the chart, offering targets for bulls if the market shifts in direction. Until this breakout happens, the overall trend remains bearish, and traders should approach with caution, particularly around the critical support and resistance zones