#FLUX/USDT Forming Bullish Falling Wedge#FLUX

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.2370, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.2340.

Entry price: 0.2495

First target: 0.2580

Second target: 0.2670

Third target: 0.2780

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

Fluxcharts

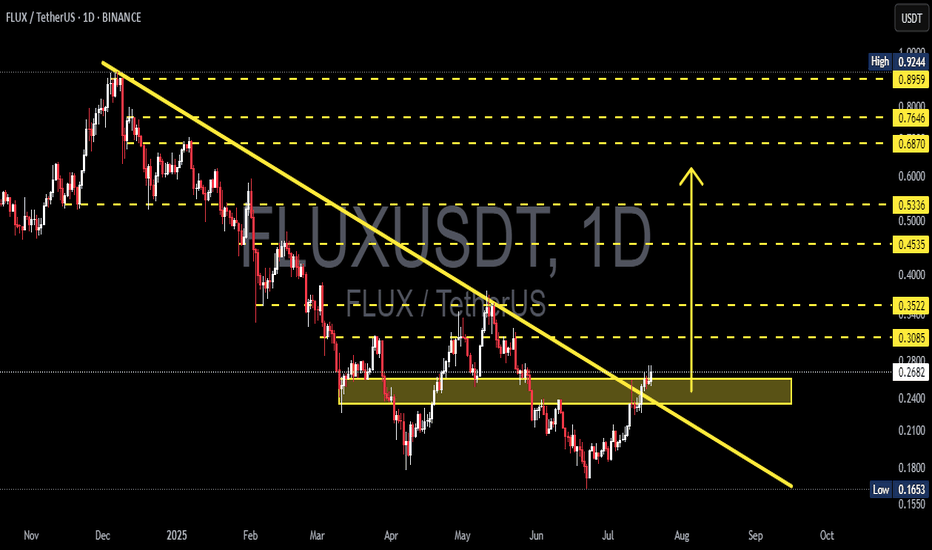

FLUX/USDT – Major Trendline Breakout!

📊 Technical Analysis Overview (Daily Timeframe)

After months of persistent downtrend pressure since late 2024, FLUX/USDT has finally flashed a high-probability bullish reversal signal. The recent breakout above a long-standing descending trendline may mark the beginning of a new bullish structure that could fuel an explosive upside move.

🔍 Market Structure & Technical Pattern

✅ Descending Trendline Breakout:

FLUX has successfully broken out of the dominant bearish trendline that has acted as resistance since December 2024. This breakout is an early sign of a trend reversal, shifting momentum in favor of the bulls.

✅ Demand Zone Reclaim (0.22 – 0.26 USDT):

This critical horizontal range has served as both support and resistance in recent months. Price has now reclaimed this zone with strength, indicating renewed buying pressure and a possible shift into accumulation or markup phase.

✅ Bullish Breakout Candle:

A strong bullish candle has closed above both the descending trendline and the demand zone, confirming breakout strength and increasing the odds of bullish continuation.

✅ Potential Bullish Continuation Setup:

If the price holds above 0.26 and prints a higher low, this will likely confirm a bullish structure and support a continuation move toward key resistance levels.

📈 Bullish Scenario – Potential Upside Targets

Should bullish momentum sustain, here are the major resistance levels to watch:

1. 0.3085 USDT – Immediate resistance zone.

2. 0.3522 USDT – Historical horizontal resistance.

3. 0.4535 – 0.5336 USDT – Consolidation range from Q1 2025.

4. 0.6870 USDT – Psychological level and potential Fibonacci confluence.

5. 0.7646 – 0.8959 USDT – Long-term bullish target, up to +200% from current levels.

📌 Note: A breakout supported by strong volume will add greater confirmation to the bullish thesis.

📉 Bearish Scenario – Watch Out for a Fakeout

Although the breakout looks promising, risks remain:

If the price fails to hold above 0.26, it may result in a false breakout.

A break below 0.24 could push price back into the 0.20 – 0.22 USDT zone.

If selling intensifies, FLUX may retest the 0.1653 USDT low.

⚠️ Always manage risk. A re-entry below the broken support would invalidate the breakout setup.

📌 Summary Strategy:

✅ Confirmed breakout from multi-month downtrend structure.

🟨 Demand zone has flipped into support.

📈 Multiple upside targets with strong reward-to-risk potential.

⚠️ Watch for confirmation via volume and price retest behavior.

#FLUXUSDT #CryptoBreakout #AltcoinAnalysis #FLUX #TechnicalAnalysis #TrendReversal #CryptoTrading #TradingViewTA #PriceAction #CryptoBulls

FLUXUSDT Forming Bullish Falling WedgeFLUXUSDT is showing promising technical signals for a potential bullish reversal after a sustained period of downward movement. The chart indicates that the price has been consolidating within a falling wedge pattern and has now broken out of that range with increasing volume — a classic sign that momentum could be shifting in favor of the bulls. With an expected gain projection of 80% to 90%+, traders are eyeing this setup for possible high-reward opportunities in the short to medium term.

The FLUX project continues to gain interest among investors due to its innovative approach to decentralized cloud infrastructure. This growing ecosystem, which supports Web3 applications and scalable decentralized computing, has captured the attention of developers and blockchain enthusiasts alike. Positive sentiment around new partnerships and development updates may add fuel to this technical breakout.

Market depth and recent trading activity suggest that strong support has been established around the recent accumulation zone, highlighted by the red box on the chart. If FLUXUSDT can hold above this level and sustain its breakout, the next resistance levels could act as stepping stones towards the projected target range. As always, monitoring volume and overall market sentiment will be crucial to confirm the breakout's strength.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#FLUX breakout confirmed.#FLUX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bounce from the lower boundary of the descending channel. This support is at 0.1840.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.1750, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of consolidation above the 100 Moving Average.

Entry price: 0.1930.

First target: 0.1994.

Second target: 0.2066.

Third target: 0.2150.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

FLUXUSDT: Patience for the Confirmed ShortFor FLUXUSDT, the prevailing market sentiment is undoubtedly bearish. While the general atmosphere leans towards further downside, the discerning investor understands the importance of strategic patience. My analysis indicates that to engage in a short position prudently, it is beneficial to await price interaction with the red box.

This is not a market to rush. The general consensus points to selling, but a disciplined approach demands specific confirmation at a predetermined level. That red box on your chart is the critical area I'm observing for a high-probability short entry.

Here’s why, and your plan for action:

Waiting for the Trigger: My intention is to initiate a short only after price has engaged with this red zone. This ensures that any move is not premature but grounded in market reaction to a key resistance area.

Confirm the Downside: Your decisive move comes with precise confirmation. This means:

Volume Footprint: I'll be meticulously scrutinizing the volume footprint as price touches the red box, seeking clear signs of renewed seller strength and distribution.

CDV (Cumulative Delta Volume): Look for CDV to turn definitively negative or show a deepening bearish divergence. This affirms that sellers are regaining undeniable control.

LTF Breakdowns: On the low timeframes (LTF), demand concrete breakdowns. Price must fail to hold, retest the red box as new resistance, and then continue lower with conviction. This is your undeniable signal.

My overall bias for FLUXUSDT remains bearish. I only trade assets showing a sudden and significant increase in volume, and while this is a short setup, the volume dynamics confirming weakness at a key resistance are what I seek.

Keep a sharp eye on that red box. If these confirmations align, you'll uncover a precise, high-probability short entry. This is where smart, confirmed decisions are made, avoiding the impulsivity that often plagues less disciplined traders.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

📊 TRXUSDT - I Do My Thing Again

📊 FLOKIUSDT - +%100 From Blue Box!

📊 SFP/USDT - Perfect Entry %80 Profit!

📊 AAVEUSDT - WE DID IT AGAIN!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

#FLUX/USDT#FLUX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.2150.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 moving average.

Entry price: 0.2335

First target: 0.2463

Second target: 0.2576

Third target: 0.2716

BTC- crash is coming? Most likely no)In its best traditions, bitcoin in one impulse reached the monthly target 95000, which I wrote about

The probability of a correction to set a higher low in the equilibrium area of the range is increasing.

Probably in May the crypto market will have to pass the last stability test, in case of success we will get excellent opportunities for spot and speculative positions before the next cyclical growth spiral.

For now have to wait for weekly open but there are 2 options:

pump till PWH and then move on correction

slow bleeding till 0.5 or mb till 83k in worst case and then pump to ATH

Nasdaq’s Next Move Revealed This Week – Don’t Miss the Breakout Following a strong surge at the start of the trading week, the Nasdaq reached a new high since March 26th. At this juncture, I anticipate a potential pullback before any sustained upward movement. My analysis suggests monitoring for a retracement to the New Week Opening Gap (NWOG), where price action will likely provide critical insights. I see two probable scenarios:

1. A move to the NWOG, followed by a strong bounce, potentially targeting a new all-time high, as some market commentators have suggested.

2. A weak reaction at the NWOG, leading to a breakdown below this level, with 16,000 as the next key support target.

This week's price action will be pivotal in determining the Nasdaq's near-term direction. I recommend close observation of these levels and disciplined risk management when positioning for either outcome.

EURUSD time for correctionMonthly

On the monthly timeframe, we came to the Premium zone and captured Monthly Fractal High, where previously there was predominance from the sell side.

Weekly

Price has formed a Weekly FVG, indicating strong dominance from the buy side. However, it is important to understand WHERE this has led us ? The current quotes are interesting for sellers. Hence, we should assume that the price may receive a counter offer from the sell side. It is logical to assume potential points A and B in this context.

Daily

Price has formed primary signs of change in the price delivery state:

- Bullish PD Array disrespecting

- BISI forming

- CISD forming

All this indicates a shift of initiative to the selling side, so it is logical to expect a continuation of the downward movement after interaction with the marked PD Array.

Also, I would like to draw your attention to the fact that the price is within the Inside Bar for the 3rd day already. This means that recently the price has been held within the same values, which indicates a balance of power between buyers and sellers at the current quotes. In such a situation, all we have to do is to find the optimal area to continue the downward price formation.

7 Gold Trades That Banked Over $2,500 LAST WEEK – Steal My StratMy strategy is straightforward: I trade order blocks, target premium/discount zones, and capitalize on liquidity sweeps. When these three signals align on the chart, I enter without hesitation.

Gold triggered a strong reaction off a bullish order block at $3192-3120 after forming it on May 15th( also can be seen as STB), confirming a robust uptrend and a global reversal from a deep discount zone( can be seen on 4h time frame). For the bullish momentum to solidify, price must break and close above $3250

So i will keep an eye on GOLD chart and prefer long trader to shorts

Is XRP the Next Crypto Rocket?$2,5 Breakout Targets $3.5 or moreI see a clear setup with actionable insights. The chart shows XRP forming a range and deviation at 1.77$, with a recent bullish breakout attempt. Here’s my breakdown:

Technical Analysis

Deviation of the global range points at potential consolidation(blue horizontal line)

Breakout Attempt: A sharp green candle pushed above the $2,36 resistance, but it’s yet to close convincingly above it. The red arrow projecting upward suggests optimism for a move toward $3–$3,5if the breakout holds.

Given today’s date (May 18, 2025, 03:40 PM EEST), this setup aligns with recent crypto market trends. XRP’s price action could be reacting to broader market sentiment, regulatory news, or Ripple-related developments, which have historically driven volatility.

This chart screams opportunity if the breakout holds. However, watch for a false breakout—crypto is notorious for shakeouts. A failure to close above $2,5 could see price retrace to $2,3 or lower. I’d monitor the next 2-3 weeksfor confirmation.

#FLUX/USDT#FLUX

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a rebound from the lower limit of the descending channel, this support is at a price of 0.2820

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.3231

First target 0.3430

Second target 0.3600

Third target 0.3773

BTC TO THE MOON! or no?)I am closely analyzing Bitcoin’s (BTC) recent price action following its decisive break above the critical $88,700 resistance level. This breakout has shifted market dynamics, and several scenarios now appear plausible based on current structure and momentum:

Pullback and Continuation: BTC may experience a corrective move back to the $88,000–$89,000 zone, likely retesting the breakout level as support. For this bullish scenario to remain valid, BTC must reclaim and close above the prior monthly high (PMH) by the end of the current monthly candle, signaling strong buyer commitment and paving the way for further upside.

Immediate Advance with Later Correction: Alternatively, BTC could continue its ascent toward the PMH, potentially encountering resistance at this key level. A rejection here might trigger a retracement to the $88,000–$89,000 range, where buyers could step in to defend the newly established support.

Bearish Breakdown: Should BTC fail to hold above $88,000, a breakdown below this level could accelerate selling pressure, targeting the $83,000 region. Such a move would likely liquidate a significant number of leveraged long positions, amplifying volatility and potentially resetting the market for a deeper correction.

At the time of this analysis, BTC is trading at approximately $91,234, with a 24-hour high of $91,898 and a low of $90,123 as of April 24, 2025, reflecting heightened volatility post-breakout. Traders should monitor price action around the aforementioned levels, particularly the $88,000–$89,000 zone and the PMH, as these will be critical in determining the next directional move. Risk management remains paramount in this high-probability setup.

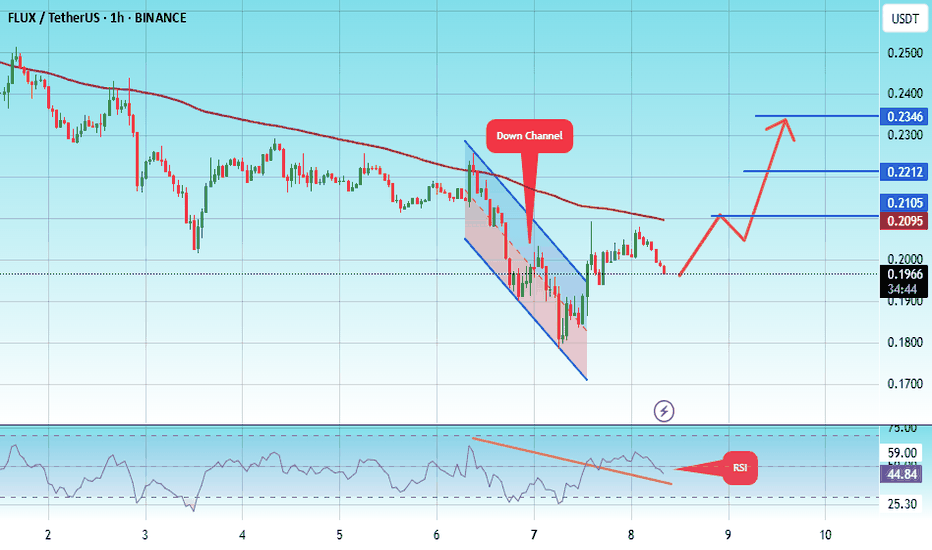

#FLUX/USDT#FLUX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 0.1766.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.1966

First target: 0.2095

Second target: 0.2212

Third target: 0.2346

#FLUX/USDT#FLUX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 0.1766.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.1966

First target: 0.2095

Second target: 0.2212

Third target: 0.2346

#FLUX/USDT#FLUX

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.3175

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.3364

First target 0.3500

Second target 0.3600

Third target 0.3755

#FLUX/USDT#FLUX

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.3962

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.4160

First target 0.4277

Second target 0.4400

Third target 0.4572

#FLUX/USDT #FLUX

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.4370

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.4966

First target 0.5110

Second target 0.5300

Third target 0.5540

#FLUX/USDT #FLUX

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.5600

Entry price 0.5700

First target 0.5896

Second target 0.6138

Third target 0.6376