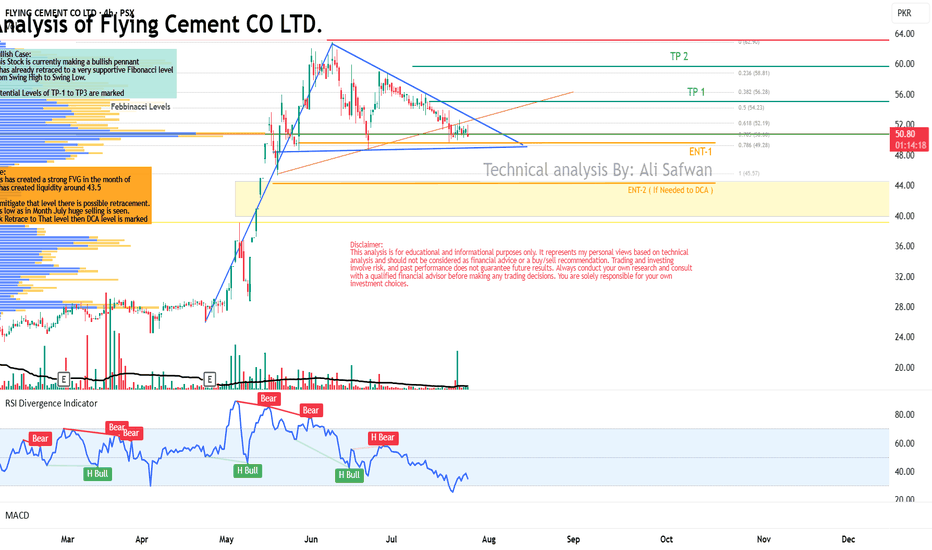

Technical Analysis of Flying Cement CO LTD.Bullish Case:

This Stock is currently making a bullish pennant

it has already retraced to a very supportive Fibonacci level

from Swing High to Swing Low.

Potential Levels of TP-1 to TP3 are marked

Bearish Case:

This Stock is has created a strong FVG in the month of

May which has created liquidity around 43.5

In order to mitigate that level there is possible retracement.

Possibility is low as in Month July huge selling is seen.

Incase Stock Retrace to That level then DCA level is marked

Flying

Flying cement breakout level for flying to 34.96 level26.62 is breakout level of Flying cement to fly to levels of 29.76 and 34.96 levels,

Today it was on lower lock and dropped 10% to level of 25.88. Iff tommorrow it again pick momentum and crosses level of 26.62 than it can fly to 29.76 and 34.96 level.

Note: Trade at your own risk.

EURUSD - HOPING THE EURO CONTINUE FLYING UPSo how I feel about this trade,

Euros were wining this battle, I didn't see the USD pulling up a fight, overall move was BULLS

we have a break of structure indicting Bulls are in control...

however price does need to retrace as you see broken structure again to the downside, also price showed it was in a (range) I would wait for the breakout to show clear direction were the market wants to go Long term..

Imbalance, Potential move back....Bias Long

Aerwins - keep watchi mentioned this one several times as you know, only, this time, we're close. to something...that's all i know..beyond fundamental and technicals.

goodluck friends!

More testing for LiliumAlthough sadden to hear that lilium is no longer entering the market in central Florida it is exciting to see their continued growth and testing for developing a quality product. With shares hitting the low of about .38 price is now moving up towards $1 at a quite rapid pace. Although there are still many hurdles in the US for this technology. Other country may not be as slow to adopt this growing method of travel. Options trading may be limited although as confidence in the product rises the narrative may change.

EZJ awaiting a correction.EasyJet - 30d expiry - We look to Buy at 353.1 (stop at 329.8)

A lower correction is expected.

Short term RSI is moving lower.

A higher correction is expected.

Bespoke support is located at 350.

We look to buy dips.

338 has been pivotal.

The 50 day moving average should provide support at 352.

Our profit targets will be 409.8 and 419.8

Resistance: 430 / 448 / 480

Support: 400 / 370 / 350

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Flying Taxis I think this is a great company and may be a good stonk for buy and hold.

Check it out, JOBY.

Potential a bottom has been found recently. I am happy to see a strong rebound, in the case major indexes suffer more downside in the near term, this chart is in a good position to form a higher low.

EURNZD STILL FLYING!!! Over 650 pips in PROFIT!WHAT A TRADE!!

This BUY on EURNZD STILL OPEN! Now running over 650 pips in profit!

Afternoon traders!

A lot of messages recently reagding the buy and sell strategy we use and how it works so i thought ill make a quick video for you all explaining how it works, what it does and how you can use it! hopefully this answers alot of your questions but dont hesistate to drop me a message if not. :)

What is our strategy?

Our strategy is a trend following strategy - that is coded in pine script to use with the trading view platform - the entries are shown automatically! NOTHING is done manually, it can be used on any instrument and time frame. However, we have hard coded specific parameters for when trading the H1 time frame, so we can back up over 4200 previous trades to confirm our edge from previous data. This gives us confidence in execution and belief in our trading strategy for the long term.

The strategy simply sits in your trading view, so you will see exactly what we see - the trade, entry price, SL and multiple TPs (although we hold until opposite trade as this is the most profitable longer term plan), lot size, etc.

This could be on your phone trading view app, or laptop of course.

The hard work is done, so we have zero chart work time, no analysis, no time front of the chart doing technical analysis - technical analysis is very subjective - you may see different things at different times - how do you have a rigid trading plan on a H&S shoulder pattern? Your daily routine, diet, sleep, exercise can affect what you 'see' and your decision making, this doesn't happen when a strategy is coded like this; what we do have is a mechanical trading strategy...

What does this mean?

It means, we are very clear on our entry and our exit and use strict risk management (this is built in - put in your account size, set your risk in % or fixed amount and it will tell you what lot size to trade!) so we have no ego with our position and we are comfortable with all outcomes - its simply just another trade. This free's our mindset from worry and anxiety as we take confidence from knowing our edge is there and also that we have used sensible risk management.

The strategy itself can be used as a live trading journal too!

NEO should start flying It is difficult to predict, but may be a point to get back the believe in NEO and its stabilisation in the nearest future. Long time NEOBTC show free fall. It reached support zone - accumulation zone. So, it is time to start flying from this zone. First it should break out resistance line of the wedge, let´s see. Any more ideas in this regard?