The Great Trap: How Billionaires Are Winning, and You're Not!The Great Crypto Trap: How Billionaires Are Winning—And You're Not

The ETFs, Saylor, and all of Trump's billionaire friends are getting richer—thanks to crypto.

Meanwhile, most retail traders are just trying to stay above water. Leverage trades are wiped out, charts feel rigged, and the market makes you feel like you're swimming against a riptide.

Why?

Because these rich guys have a plan: manipulate you and take your money. That’s how they stay rich.

Understanding their strategy is the first step to stop being their exit liquidity.

🧠 The New Battlefield

Crypto is no longer a playground for cypherpunks and tech rebels. It’s fully institutional now. We're not just trading against whales—we're fighting the same entities that own the media, control Wall Street, and write the rules.

So forget the old ways of thinking. The tables have turned.

🗓 The Sunday Rekt Routine

To maximize destruction, they need to avoid friendly fire. So they pump on the weekend when retail is free and optimistic, then dump on Monday to close the CME gap—like clockwork.

The playbook:

Weekend: Pump. Trap your long.

Monday: Dump. “Fill the gap.” Liquidate everyone.

Response:

Don’t fall for weekend FOMO. Exit Sunday afternoon. Wait until Tuesday to re-enter, once Monday’s high and low are set. Trade smart, not emotional.

📈 Top-of-the-Market FOMO

You’ve seen it before. Just before the crash, the media frenzy begins. Influencers say “Don’t miss this pump!” or “99% will miss the next big move!” The ETF gods hint at new inflows. It's a setup.

They're not hyping it for your benefit—they're offloading their bags in your face.

Just look at the charts:

BlackRock bought billions to drive BTC to 121K.

Then, in 72 hours, they dumped billions.

Saylor? Silent. No new buys. That’s not coincidence—it’s coordination.

Response:

Check the MACD, RSI, and Stochastic RSI on daily or weekly timeframes. If they're maxed out and the influencers are screaming green—it’s probably too late.

When they stop buying, the dump is already planned.

🧰 How to Outsmart Them

Watch the MACD for crossovers and divergence.

Monitor RSI zones—don’t long into extreme overbought conditions.

Use Stoch RSI to anticipate momentum shifts.

Rule: When everything is overheated, and FOMO is peaking—step back. Let them dump into each other. You’ll get your entry later, cleaner and cheaper.

⚔️ This Is War

Make no mistake: this is a war for your money.

They want yours. You want theirs.

Only the smart survive.

To be continued.

DYOR.

Fomo

You've Already Lost: The Bitcoin Delusion of FOMO and False HopeLet’s get one thing straight: if you’re staring at Bitcoin, squinting past the red flags, and convincing yourself it’s not a Ponzi scheme because of that one shiny feature that screams “legit,” you’re not investing—you’re auditioning for the role of “next victim.” And if your motivation is the fear of missing out (FOMO) or the fantasy of getting rich quick, well... congratulations. You’ve already lost.

The 99%: Red Flags Waving Like It’s a Parade

Let’s talk about the indicators—the ones that make Bitcoin look suspiciously like a Ponzi scheme. No, it’s not technically one, but the resemblance is uncanny:

- No intrinsic value: Bitcoin isn’t backed by assets, cash flow, or a government. It’s worth what the next person is willing to pay. That’s not investing. That’s speculative hot potato.

- Early adopters profit from new entrants: The people who got in early? They’re cashing out while newcomers buy in at inflated prices. That’s the classic Ponzi dynamic: old money out, new money in.

- Hype over utility: Bitcoin’s actual use as a currency is minimal. It’s slow, expensive to transact, and volatile. But hey, who needs functionality when you’ve got memes and moon emojis?

- Opaque influencers: From anonymous creators (hello, Satoshi) to crypto bros promising Lambos, the ecosystem thrives on charisma, not accountability.

- Scam magnet: Bitcoin has been the currency of choice for over 1,700 Ponzi schemes and scams, according to a University of New Mexico study cs.unm.edu . That’s not a coincidence. That’s a pattern.

The 1%: The “But It’s Decentralized!” Defense

Ah yes, the one redeeming quality that Bitcoin evangelists cling to like a life raft: decentralization. No central authority! No government control! It’s the financial revolution!

Except… decentralization doesn’t magically make something a good investment. It just means no one’s in charge when things go wrong. And when the market crashes (again), you can’t call customer service. You can tweet into the void, though.

FOMO: The Real Engine Behind the Madness

Let’s be honest. Most people aren’t buying Bitcoin because they believe in the tech. They’re buying because they saw someone on TikTok turn $500 into a Tesla. FOMO is the fuel, and social media is the match.

Bitcoin’s meteoric rises are often driven by hype cycles, not fundamentals. Tesla buys in? Price spikes. El Salvador adopts it? Price spikes. Your cousin’s dog walker says it’s going to $1 million? Price spikes. Then it crashes. Rinse, repeat.

This isn’t investing. It’s gambling with a tech-savvy twist.

The Punchline: You’ve Already Lost

If you’re ignoring the overwhelming signs of speculative mania and clinging to the one feature that makes you feel better about your decision, you’re not ahead of the curve—you’re the mark. And if your motivation is “I don’t want to miss out,” you already have. You’ve missed out on rational thinking, due diligence, and the ability to distinguish between innovation and illusion.

Bitcoin might not be a Ponzi scheme in the legal sense. But if it walks like one, talks like one, and makes early adopters rich at the expense of latecomers… maybe it’s time to stop pretending it’s something else.

INDEX:BTCUSD NYSE:CRCL NASDAQ:HOOD TVC:DXY NASDAQ:MSTR TVC:SILVER TVC:GOLD NASDAQ:TSLA NASDAQ:COIN NASDAQ:MARA

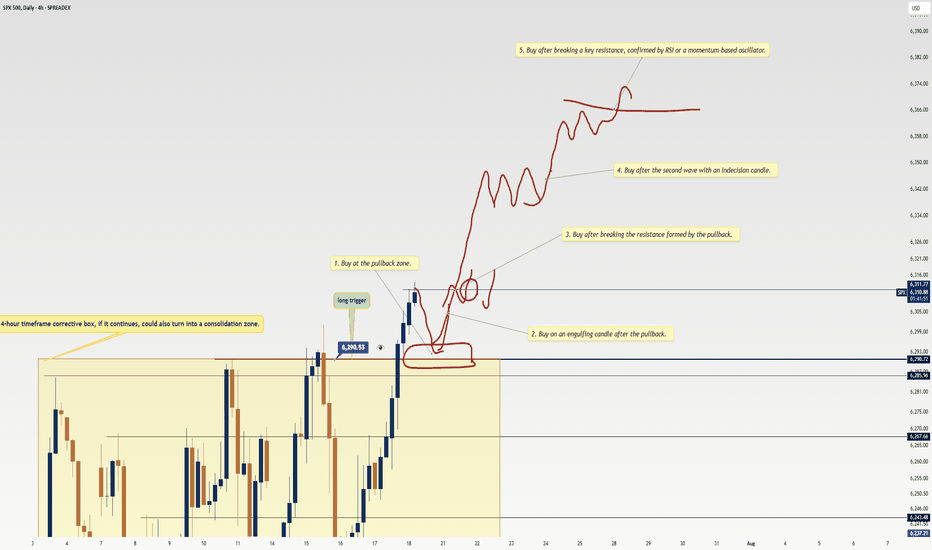

5 Proven Tricks to Trade Without FOMO After Missing Your TriggerYo traders! In this video, I’m breaking down what to do if you miss a trading trigger , so you can stay calm , avoid FOMO , and still catch the next move. We’re diving into five solid strategies to re-enter the market without losing your cool:

Buy on the pullback zone.

Buy with an engulfing candle after a pullback.

Buy after breaking the resistance formed by the pullback.

Buy after the second wave with an indecision candle.

Buy after breaking a major resistance post-second wave, confirmed by RSI or momentum oscillators.

These tips are all about keeping your trades smart and your head in the game. For more on indecision candles, check out this lesson . Wanna master breakout trading? Here’s the breakout trading guide . Drop your thoughts in the comments, boost if you vibe with it, and let’s grow together! 😎

Analyzing the Market with Fundamental and Technical AnalysisAnalyzing the Market with Fundamental and Technical Analysis

In addition to technical analysis, it's important to consider fundamental factors that could influence the market. News releases, economic reports, and central bank decisions can significantly impact price movements.

Fundamental Analysis:

Keep an eye on major economic indicators like NFP, CPI, and interest rate decisions. These factors can drive the market and change its trend direction.

Technical Analysis:

Use tools like EMA, Fibonacci, and Price Action to confirm the trend and identify entry points.

For daily updates and comprehensive market analysis, join my MMFLowTrading TradingView channel, where I combine both technical and fundamental analysis to give you the most accurate insights.

Conclusion:

Identifying market trends in one day doesn’t have to be complicated. By using the right tools like EMA, Fibonacci, and Price Action on TradingView, you can make better trading decisions every day. To take your trading to the next level, join my MMFLowTrading TradingView channel for daily updates, real-time trend analysis, and expert trading signals.

Ready to start trading with precision? Join my MMFLowTrading TradingView channel today for daily market insights and trading setups. Stay updated with real-time analysis, get actionable trading signals, and take your trading skills to the next level. Follow me now on TradingView!

Not Every Candle Needs a Reaction — I Know I’ve GrownThere was a time I thought I needed to react to every move.

A clean candle? I’d enter.

A minor imbalance? I’d take the risk.

A zone that “looked okay”? I’d justify it.

Why? Because I was chasing something.

Chasing certainty .

Chasing profit .

Chasing control .

But here’s the thing I didn’t understand back then:

Not every candle needs a reaction. And not every move is my move.

🧠 Overtrading Wasn’t a Strategy. It Was a Symptom.

It was a symptom of fear — fear of missing out (FOMO).

It was a symptom of insecurity — not trusting my own process.

It was a symptom of impatience — not letting the market come to me.

I confused activity with progress. I thought being busy on the charts meant I was becoming better. But most of the time, I was just bleeding my edge.

💡 The Turning Point

Growth didn’t happen because I learned a new indicator. It happened the moment I started asking myself:

Is this my setup? Or am I just bored, hopeful, or triggered?

When you define a clear trading plan, with criteria you believe in, the real test isn’t finding setups...it’s waiting for the right ones. Today, I can watch the market move beautifully without me and feel absolutely nothing.

That’s freedom.

That’s growth.

That’s power.

🧘🏽♂️ From Reactive to Intentional

Now, I focus on:

Waiting for my specific SMC criteria to line up

Sticking to my CRT model (PDL/PWH sweep → BOS → FVG)

Trusting that missing one trade means nothing if I stay consistent

Letting the market come to me

I’m no longer in the game to prove something. I’m here to play my edge , manage my risk , and protect my mind.

📌 Final Words

Growth in trading isn't loud. It doesn’t scream from a winning streak. It shows up quietly:

in the trades you didn’t take.

in the silence between setups.

in the patience to do nothing until it’s time.

So if you’re not constantly in a trade, that’s not weakness that’s wisdom.

Bitcoin's Market Cycles — Are We Nearing the Top?Bitcoin is approaching a critical moment and the signs are everywhere.

After more than 900 days of steady bull market growth, BTC now flirts with all-time highs (ATH) while momentum stalls, liquidity thins, and emotions run hot. You might be asking:

Are we nearing the cycle top?

Is now the time to de-risk or double down?

What comes next?

This isn’t just a question of price. It’s about timing, structure, and psychology.

In this analysis, we’ll break down Bitcoin’s historical cycles, the current macro structure, the hidden signals from Fibonacci time extensions, and how to think like a professional when the crowd is chasing FOMO.

Let’s dive in.

📚 Educational Insight: Understanding Bitcoin Cycles

Bitcoin doesn’t move in straight lines, it moves in cycles.

Bull markets grow slowly, then explode. Bear markets fall fast, then grind sideways. These rhythms are driven by halving events, liquidity expansions, and most importantly: human emotion.

Here’s what history tells us:

Historical Bull Markets:

2009–2011: 540 days (+5,189,598%)

2011–2013: 743 days (+62,086%)

2015–2017: 852 days (+12,125%)

2018–2021: 1061 days (+2,108%)

2022–Present: 917 days so far (+623%)

Bear Market Durations:

2011: 164 days (-93.73%)

2013–2015: 627 days (-86.96%)

2017–2018: 362 days (-84.22%)

2021–2022: 376 days (-77.57%)

💡 What does this tell us?

Bull markets are growing longer, while bear markets have remained consistently brutal. The current cycle has already surpassed the average bull run length of 885 days (cycles #2–#4) and is quickly approaching the 957-day average of the two most recent cycles (#3 and #4). That makes this the second-longest bull market in Bitcoin’s history.

⏳ 1:1 Fibonacci Time Extension — The Hidden Timing Signal

In time-based Fibonacci analysis, the 1.0 (1:1) extension means one simple thing: this cycle has now lasted the same amount of time as previous cycles — a perfect time symmetry.

Here’s how I measured it:

Average bull market length #2–#4(2011–2021): 885 days

Average bull market length #3–#4(2015–2021): 957 days

Today’s date: May 27, 2025 = Day 917

✅ Result: We are well inside the time window where Bitcoin historically tops out.

You don’t need to be a fortune teller to see that this is a zone of caution. Markets peak on euphoria, not logic and this timing confluence is a red flag worth watching.

🗓️ "Sell in May and Go Away" — Not Just a Meme

One of the oldest market adages is showing its teeth again.

Risk assets — including Bitcoin — tend to underperform in the summer months. Why?

Lower liquidity

Institutional rebalancing

Exhaustion from prior run-ups

Vacations and reduced trading volumes

And here we are:

Bitcoin is hovering near ATH

It's been in an uptrend for 917 days

We just entered the time-extension top zone

Liquidity is thinning across the board

You don’t need to panic. But you do need to think like a professional: secure profits, reduce exposure, and wait for structure.

😬 FOMO Is a Portfolio Killer

This is where most traders make their worst decisions.

FOMO (Fear of Missing Out) isn’t just a meme — it’s the reason so many people buy tops and sell bottoms.

Before entering any trade right now, ask yourself:

Where were you at $20K?

Did you have a plan?

Or are you reacting to headlines?

📌 Clear mind > urgent clicks

📌 Patience > chasing green candles

📌 Strategy > emotion

Let the herd FOMO in. You protect your capital.

Will This Bear Market Be Different?

Every past cycle saw BTC retrace between 77%–94%. That was then. But this time feels… different.

Here’s why:

Institutions are here — ETF flows, sovereign wealth funds, and major asset managers

Regulation is clearer — and risk capital feels safer deploying in crypto

Supply is tighter — much of BTC is now held off exchanges and in cold storage

While a massive crash like -80% is less likely, that doesn’t mean a correction isn’t coming. Even a 30%–40% drop from here would wreak havoc on overleveraged traders.

And that brings us to…

🚨 Altseason? Or Alt-bloodbath?

Here’s the hard truth:

If BTC corrects, altcoins will crash — not rally.

Most altcoins have already seen strong rallies from their cycle lows. But if BTC drops 30%, many alts could tumble 50–80%.

Altseason only happens when BTC cools off and ranges — not when it dumps. Don’t get caught holding the bag. Be tactical. Be disciplined.

So Where’s the Next Big Level?

You may be wondering: “If this is the top… where do we fall to?”

Let’s just say there’s a very important Fibonacci confluence aligning with several other key indicators. I’ll reveal it in my next analysis, so stay tuned.

🧭 What Should You Do Right Now? (Not Financial Advice)

✅ Up big? — Take some profits

✅ On the sidelines? — Wait for real setups

✅ Emotional? — Unplug, reassess

✅ Are you new to Trading? — study, learn (how to day trade) and prepare for the next cycle

The best trades come to the calm, not the impulsive.

💡 Final Words of Wisdom

Bitcoin rewards discipline. It punishes emotion.

Right now is not about catching the last 10% of upside — it’s about:

Watching structure for potential trend change

Measuring risk

Avoiding overexposure

Protecting what you’ve earned

📌 The edge isn’t in indicators. It’s in mindset. Stay prepared, stay sharp because in this market…

🔔 Remember: The market will always be there. Your capital won’t — unless you protect it.

The next big opportunity doesn’t go to the loudest.

It goes to the most ready.

_________________________________

Thanks for reading and following along! 🙏

Now the big question remains: Is a bear market just lurking around the corner?

What are your thoughts? Let me know in the comments. I’d love to hear your perspective.

_________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

SOL Hits Major Resistance — Patience Over FOMOOne of the most common mistakes traders make—especially in fast-moving markets—is jumping into trades impulsively at major resistance. It feels exciting when price is surging, but ironically, this is often where risk is highest and reward is most limited.

Why? Because historical resistance zones—like the $175–$183 region on SOL—tend to attract heavy sell pressure. These are levels where many past buyers look to exit, where smart money hunts liquidity, and where false breakouts are most common. Without volume confirmation and a proper retest, breakouts through such zones often fail.

That’s why experienced traders wait. The smarter approach is to let the market come to you, and only act when one of two things happens:

A pullback into a well-defined, confluence-rich support zone

A clean breakout above resistance, followed by a retest and confirmation

SOL has respected structure beautifully, but now is not the time to chase. Either wait for a healthy correction into support, or let price prove its strength through a confirmed breakout. No trade is also a trade — and capital preservation is the foundation of long-term success.

Patience isn’t passive — it’s a strategy. Let the market come to your desired levels. You don't need to catch every move, only the high-probability trades and there aren’t born from impulse — they’re built on patience, structure, and right timing. 💎

Technical Breakdown

SOL has entered a major resistance zone between $175 and $183 — a historically significant level respected for over a year.

Within this zone lie two key highs:

$179.85: Recently swept with a clean Swing Failure Pattern (SFP)

$180.52: Still untested — if broken, it would confirm a strong bullish continuation

Breaking through such a well-established resistance on the first attempt is uncommon — it typically requires momentum and structure. A rejection here would suggest that SOL needs a healthy correction before mustering the strength for a true breakout.

📉 Elliott Wave Count

Looking at the structure, we’ve completed a 5-wave sequence — signaling the potential end of this impulse leg. According to Elliott Wave Theory, a corrective phase is now expected before continuation.

📐 Additional Confluence: Fib Speed Fan

The 0.618 Fib Speed Fan — drawn from the all-time high at $295.83 to the swing low at $95.26 — aligns perfectly with this resistance zone, adding more weight to the idea of a potential rejection or pause.

🟢 Long Setup: The Next High-Probability Entry Zone

We now shift our focus to where the next long opportunity could arise. Here’s the technical confluence:

Anchored VWAP from the recent low at $141.41 sits at $164.70

4H bullish order block around $164.46

0.382 Fib retracement of the full 5-wave impulse: $165.42

0.412 Fib retracement: $164.25

All these levels converge in a tight band, providing a solid long entry zone between:

Long Entry Zone: $165.50 to $164.25

Stop-Loss: Below $160 (to protect against any deep wick)

Targets:

TP1: $171.75 (Point of Control from the range)

TP2: $180.00 (resistance retest)

TP3: $200.00 (psychological level)

Estimated R:R: ~6:1 — High-conviction setup

Bonus: If price returns to this $165 zone within 24 hours, it will also be supported by the 0.618 Speed Fan — adding one more layer of support.

🔴 Short Setup: Reversal Play at $200

For those watching from the sidelines or looking to fade the rally, the psychological level at $200 presents a strong short opportunity — but only on confirmation (e.g., SFP or bearish engulfing).

Short Entry: On rejection at $200

Stop-Loss: $206.10

Target: $187.00

Estimated R:R: ~2:1

🧠 Summary:

Completed 5-wave structure → potential correction phase underway

Strong resistance at $175–$183 with SFP and speed fan alignment

High-probability long setup at $165.5–$164.25 with multi-layered confluence

Potential short at $200 on confirmation

⚠️ Key Takeaway: Don’t Chase the Highs

This is where many traders slip — FOMOing into trades at major resistance. Please, don’t do it. Instead, wait for:

A pullback into well-defined support (like the $165 zone), or

A clean breakout above $180, followed by a confirmed retest

____________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

$10 to $80 in 1 day $BULL$10 to $80 in 1 day 💣 How do you know market is in a bubble?

When NASDAQ:HOOD valuation is so high their competitor NASDAQ:BULL decides to do IPO to catch some of the makert delusion going on and they fit right into all of it with their value going from $260 Million to $2 Billion in a day

Mastering Volatile Markets: Why Patience is Your Biggest Edge█ Mastering Volatile Markets Part 3: Why Patience is Your Biggest Edge

If you've read Part 1 about position sizing and Part 2 on liquidity , then you already know how to adapt to the mechanics of volatile markets. The next great tool in your arsenal will be patience.

Your biggest opponent in wild markets is your own mind.

In volatile markets, your emotions can easily get the best of you. Fear of missing out (FOMO) is one of the most dangerous emotions that drives poor decisions.

█ FOMO (Fear of Missing Out) Hits Hardest in Volatile Markets

Wild price swings, like 300-500 point moves in the Nasdaq or Bitcoin jumping $1000 in seconds, can make it feel like easy money is everywhere.

You can quickly get the overwhelming temptation to chase moves , especially when it seems like you're missing every opportunity.

This is where most traders lose.

Let me state some harsh truths that I had to learn the hard way through many losses:

Volatility doesn't equal opportunity.

Fast moves don't mean easy trades.

Most wild price moves are designed to trap liquidity and punish impatience.

The true reality is that the market wants you to overreact in these conditions.

It wants you to buy after a big move.

It wants you to short after a flush.

It thrives on you being emotional, chasing, and reacting.

Because reactive traders = liquidity providers for smart money.

Every single trader has made this mistake — not just once, but over and over again. Jumping into the market after a big move, hoping it will continue… but what usually happens? The market snaps back and stops you out.

Can you relate? Share your story or experience with this in the comments below!

█ What Experienced Traders Do Instead

⚪ They Know the First Move is Often the Trap

Breakout? Expect a fakeout.

Breakdown? Expect a snapback.

New high? Watch for stop hunts.

New low? Watch for a flush.

Effectively speaking, pro traders don't chase the market. We wait for stop hunts to complete, liquidity grabs to finish, price to return into their zone, and for confirmations before entering the market.

⚪ They Train Patience Like a Skill

Professional traders aren't more patient because they're "special." We are patient because we’ve learned the hard way that chasing leads to pain.

⚪ They Know When Not to Trade

It is bad to trade when there’s no clear structure, no clean confirmation, if the spread is too wide or when the liquidity is too thin.

Instead, pro traders let the market come to them , not the other way around.

⚪ They Turn FOMO into Confidence

Instead of saying, "I'm missing the move…" , I recommend you think:

"If it ran without me — it wasn't my trade."

"If it comes back into my setup — now it's my trade."

█ So, what have we learned today?

Volatility triggers FOMO. FOMO triggers bad decisions. Bad decisions trigger losses.

To win long-term, you must stay calm, selective and professional. Let other traders be emotional liquidity. That's how you survive volatile markets.

█ What We Covered Already:

Part 1: Reduce Position Size

Part 2: Liquidity Makes or Breaks Your Trades

Part 3: Why Patience is Your Biggest Edge

█ What's Coming Next in the Series:

Part 4: Trend Is Your Best Friend

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

What to do after you missed a big price move (Example: EUR/USD)There was a big fast move in EUR/USD last week.

The ‘European currencies’ did especially well versus the US dollar, including GBP/USD and USD/CHF as well as the ‘Skandies’ SEK/USD and NOK/USD.

If you rode the move, then job done. If you did ride the move up, you might have taken full profits already - or maybe you are leaving a little bit of the position open to ride any continuation of the move.

But, what to do if you missed it completely?

Explosive moves in the market usually mean traders who were on the ‘losing’ side step out for a while, having lost confidence in their view. For example if you were bearish and the market makes a significant move higher - you’re probably going to be a lot less confident in your bearish view - but perhaps also not ready to take an opposite bullish view. The loss of sellers in the market can see the up-move continue with minimal pullback.

This might suggest buying any small dips to ride the next leg higher, and emotionally it would offer some salvation to capture the second leg of the move even if you missed the first leg. However, what you are doing here is ‘chasing the market’.

One trouble is that after a big move in the market, there is no definitive place to put your stop loss, except at the beginning of the move - which is now far away. That's a bad risk: reward.

It is tempting to place a closer (more manageable) stop loss under lower timeframe levels of support - but then you find yourself trading an unknown strategy that requires different rules to follow because it is based on a lower timeframe.

And indeed, after a sharp move in the market - there is still a chance for a sharp pullback to match. Why? Because buyers quickly take profits on their unexpected quick gains, which will create selling pressure into minimal support - because the next support level is far away.

A sharp pullback would mean an opportunity to buy into the uptrend at a lower level, closer to the previous support. But then the flipside of the sharp pullback is that it raises questions over the sustainability of the initial move.

Probably the biggest takeaway here is not to think about this ‘explosive’ move in isolation.

Instead of forcing a trade, consider:

1. Waiting for the right setup in the same market. If your strategy is based on structured breakouts, wait for the next clean consolidation or pattern before re-engaging. A big move often leads to a new setup—but forcing a trade in the middle of a volatile move isn’t a strategy, it’s FOMO.

2. Looking at uncorrelated markets. Just because EUR/USD already made a big move doesn’t mean you have to trade it now. If you want to be in at the start of a move, shift focus to another market that hasn’t yet made its move.

3. Sticking to your edge. If your strategy works over hundreds of trades, don’t abandon it just because one market moved without you. The next opportunity will come—if not in this market, then in another.

Again, the best trades don’t come from reacting to what already happened, but from positioning for what’s about to happen. If you missed the move, accept it, reset, and wait for the next high-quality setup—whether in the same market or somewhere else.

FOMO and Hope for a Price Reversal: Two Psychological Traps❓ Have you ever entered a trade out of fear of missing out (FOMO) or held on to a losing position, hoping the market would turn in your favor?

Psychological mistakes are a huge factor in whether a trader succeeds or fails. One of the most common and damaging mistakes is FOMO (Fear of Missing Out), followed by holding onto trades because of an unrealistic hope that the market will reverse despite all evidence pointing to the opposite. These behaviors are far too common, even among experienced traders. Understanding and avoiding them is essential to improve your trading results. 🧵

💡In this article, we’ll break down the psychological mistakes every trader faces, how to identify them, and practical strategies to prevent them from affecting your trades.

The Psychological Side of Trading 🧠

In trading, emotions can be our worst enemy. Here are two common psychological traps that many traders fall into:

🔮 FOMO (Fear of Missing Out):

What It Is: FOMO is when you enter a trade impulsively, simply because you see others making profits or you fear missing the "big move."

Why It Happens: The market seems to be moving in one direction, and you don't want to miss out on potential profits. This often happens when you're watching others on social media or in trading groups.

Impact: This leads to impulsive decisions, often entering trades late in the trend or at inappropriate levels.

Tip: To combat FOMO, stick to your pre-defined trading plan and only take trades based on your specific criteria. Remember, there will always be new opportunities.

🔎 Unrealistic Hope in Price Reversals:

What It Is: This is when you hold onto a losing position, hoping that the market will reverse in your favor, despite clear signs to the contrary.

Why It Happens: It’s often rooted in the belief that “the market can’t keep going against me,” or the hope that the trend will change.

Impact: This often results in larger losses because the trader doesn't cut their losses early and ends up holding onto a position until it’s too late.

Tip: When you see signs that the market is continuing against you, cut your losses quickly. Trading is about being patient and disciplined, not about hoping for a reversal.

🛠 Strategies and Tools for Managing Emotions 📈

Trading is all about control—control over risk, strategy, and most importantly, over your emotions. Here are some tools and strategies to keep your psychology in check:

1. Position Sizing & Risk Management

Position Sizing: One of the most effective ways to reduce emotional stress and maintain control over your trades is by managing your position size. A general rule of thumb is to risk 1-2% of your total account balance on each trade. However, this percentage can vary based on your risk tolerance, experience, and self-awareness. As you gain more experience and better understand your risk profile, you may adjust this amount accordingly, but always ensure you're comfortable with the risk you're taking.

2. Stick to Your Strategy

Trading Plan: Make sure you have a solid trading plan and stick to it. Your plan should include:

Entry signals

Exit signals

Risk management rules (e.g., stop-loss, take-profit levels)

Don't Chase the Market: If you missed the breakout, don’t chase it. There will always be new opportunities, and chasing the market often leads to poor entry points and higher risks.

3. Psychological Self-Awareness

Track Your Emotions: Keep a trading journal to track not only your trades but also your emotional state. Understanding your psychological triggers (e.g., fear, greed) can help you avoid emotional mistakes.

Set Realistic Expectations: Remember, trading is a marathon, not a sprint. Accept that you will have losses, and focus on your long-term profitability rather than on every single trade.

Successfully navigating trading isn’t just about technical indicators or chart patterns—it’s also about controlling your emotions. FOMO and holding on to unrealistic hopes can seriously damage your trading performance. The key is to develop a strong psychological mindset: stick to your strategy, manage your risk, and always make decisions based on data, not emotions.

💌Now, it’s your turn!

Which psychological mistakes have you encountered in your trading journey? Share your experiences in the comments below and let’s learn from each other!

I’m Skeptic , here to simplify trading and help you achieve mastery step by step. Let’s keep growing together! 🤍

My FOMO Nightmare: How Missing One Trade Changed My Trading LifeI remember the day like it was yesterday. I was scrolling through X (Twitter), seeing everyone go wild over this one stock. My heart raced as I watched the price skyrocket, but I hesitated. I hadn't done my homework on this one, and something felt off. But the fear of missing out? That was eating at me.

The next day, I woke up to see the stock had crashed. My initial relief turned into regret. Maybe I could've sold at the peak if I had just jumped in like everyone else. That's when FOMO, or Fear Of Missing Out, became my trading nemesis:

-Hasty Actions: I started jumping into trades at the last minute, driven by the buzz on social media, not by my own analysis.

-Screen Addiction: I couldn't step away from my screen, worried I'd miss the next big move. My life began revolving around the market's every twitch.

- Chasing Losses: After missing a few opportunities, I found myself in a dangerous cycle, trying to make up for lost gains with even riskier trades.

But here's the twist in my story. One evening, after a particularly bad day of chasing trends, I sat back and realized how this fear was controlling me, not my strategy. I decided to change. I set strict rules for myself: no trading based on social media hype, sticking to my research, and remembering that every market has its patterns - there's always another chance if you miss one.

Now, I trade with a calm mind, knowing that if I miss one trade, there'll be another. If you've ever felt that burning desire to join the rush, only to regret it later, you're not alone. Let's share our stories and strategies for overcoming FOMO. DM me if you want to chat about how we can keep our heads in the game, not just our eyes on the screen.

Kris/ Mindbloome Exchange

Trade What You See

TradeCityPro | ICPUSDT Missed the Market Move? Don’t FOMO👋 Welcome to TradeCityPro Channel!

Let’s analyze the market during a day when it has finally shown some movement, focusing on coins with clear triggers.

💥 Avoid FOMO

The reason we create daily content for this community is to emphasize the importance of analyzing the market daily and identifying triggers before taking trades. This prevents you from acting impulsively and becoming a profit target for others who entered earlier.

🌐 Overview Bitcoin

Before analyzing today’s altcoin, let’s quickly review Bitcoin on the 1-hour timeframe. As mentioned yesterday, Bitcoin’s movement was predicted. After breaking the 98606 trigger, a long position with a stop loss at 97343 was suggested, considering the potential for whale-driven moves at higher levels.

Additionally, if Bitcoin dominance broke the 57.08 resistance, opening positions on Bitcoin was the preferred approach. Otherwise, a switch to altcoins was recommended.

Here’s my position: R/R 3. The triggers I share are the same ones I use in my trades. Remember, not every day requires action!

If you missed the move, should you open a long position after breaking 102208? Not yet. While the current timeframe suggests caution due to overbought conditions, you can consider this on the 15-minute chart. My recommendation: focus on identifying altcoin triggers to stay ahead of the market.

📊 Weekly Timeframe

ICP has seen a significant move since its support at 2.868, rallying by around 400%. Recently, it has consolidated and established strong support at 6.603, which aligns with the 0.5 Fibonacci level and the 50% Dow Theory level, highlighting its importance.

If you entered at lower levels, consider taking out your initial investment or exiting below 6.603. If you bought after the 9.684 breakout, patience is key. Given the potential for an early breakout above 14.879, maintain a stop loss at 6.603.

For re-entry, a break above 9.684 signifies a lift-off from the midline of its horizontal range, suggesting a stronger likelihood of breaking 14.879. Increased volume confirmation post-breakout can validate a buying opportunity.

Let’s address the fake breakout at 14.879. Unlike the 2.868 level, which saw sustained price action and a move upwards post-daily box formation, the 14.879 breakout was merely a single candle spike followed by an immediate reversal.

📈 Daily Timeframe

ICP remains in its large range box, oscillating between 6.691 and 15.22. A sharp move is expected upon breaking either the upper or lower boundary of this range.

ICP has already begun moving after breaking its smaller box resistance at 9.834. It has retested this breakout, unlike some coins that re-enter their boxes, underscoring ICP's bullish momentum compared to peers.

Currently, ICP faces resistance at 12.409, which was previously ignored but has regained significance. Staying above 11.281 provides an opportunity for small preemptive buys, but the main trigger remains 15.22.

⏱ 4-Hour Timeframe

ICP’s chart looks promising, as it has broken out of its 4-hour box and is consolidating below the next resistance level, presenting a potential entry trigger.

Drawing Fibonacci levels from the start of the drop reveals reactions at all levels. Currently below 0.618, breaking this level could propel ICP to the 13.697 resistance. Remaining above 11.333 and the 0.382 Fibonacci level highlights the importance of the 12.476 resistance.

📈 Long Position Trigger

If you didn’t open a position at 11.333, it’s still fine. Momentum has entered this chart. After breaking 12.476, you can open a long position with a tighter stop. Ensure volume increases and RSI enters overbought territory to manage risk.

📉 Short Position Trigger

Currently, I’m not planning any short positions. If 12.476 faces a fake breakout and reverses, I’ll look for short setups in lower timeframes using a fake breakout strategy.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

The Cycles of Cryptocurrencies: Patience is Key!Hey, let's share with beginners, ok =)?

The cryptocurrency market is widely known for its volatility, and understanding the cycles of highs and lows is essential for those looking to invest wisely. These cycles are a natural part of the financial ecosystem and often follow patterns similar to those of other speculative markets.

During moments of high prices, known as “bull runs,” enthusiasm takes over. Headlines boast astronomical gains, investors pour in en masse, and there’s a general feeling that "this time is different." Many beginners end up buying at the peak, driven by the fear of missing out (FOMO).

On the other hand, moments of low prices, or “bear markets,” bring uncertainty and pessimism. Prices plummet, and the same investors who bought during the hype start selling, often out of desperation or lack of understanding of the cycles. It's important to remember that markets have historically recovered, rewarding those who remain calm and patient.

The lesson here is clear: don’t act on impulse. Experienced investors see downturns as opportunities to buy assets at lower prices, while beginners end up selling at a loss—losses that could have been avoided with a long-term strategy.

If you're just starting in the cryptocurrency world, remember: patience is key. Avoid acting emotionally, always educate yourself about the market, and understand that opportunities aren’t lost—they simply change hands. Plan your investments, set clear goals, and above all, don’t panic.

Share! =)

STEPN - Looking great, don't let FOMO draw you inYes, this looks like a fantastic time to buy. But is it? No. Until the super simple chart with the trend line is breached decisively, there shall be no buy. If the trendline is not broken, then we're just set for more down and lower lows. Want to lose all your money? Plough it in based on FOMO. If you do not want you bank account to go to $0.00 then step back, zoom out and keep an eye on the signals to ensure you're not putting good money after bad. All the glitters is NOT gold. Follow for more.

TradeCityPro | SUIUSDT The Best Coin of the Week?👋 Welcome to TradeCityPro Channel!

Let’s dive into the analysis of SUI, a coin that has recently caught significant attention for its impressive performance. Despite being a young coin listed in mid-2023, SUI has managed to climb to the 15th rank in the market.

🌐 Overview Bitcoin

As always, we begin by analyzing Bitcoin. On the 1-hour timeframe, after rejecting and setting a new ATH at $108,230, Bitcoin has entered a downtrend, which appears to have ended at $92,400.

However, the market is at a critical decision point. If Bitcoin fails to hold above $96,277 and breaks $99,079, a bullish continuation can be expected, proving this decline was merely corrective. Otherwise, breaking below $96,277 could signal shorting opportunities. Yet, caution is advised—secure profits quickly and avoid greed.

Bitcoin dominance, which has recently attracted much attention, saw a pullback to the 60% resistance level. This move, accompanied by market corrections, led to larger declines for altcoins, indicating the need for Bitcoin dominance to form lower highs—a shift that may be underway.

🕵️♂️ Previous Analysis

we had identified a PRZ area, and after breaking the 3.4295 support, it reacted to this zone. Following the rebound, it reached the resistance level we had previously identified at 4.7422. Currently, it is fluctuating just below this resistance.

📊 Weekly Timeframe

On the weekly timeframe, SUI has shown remarkable bullish momentum. After breaking the $1 resistance, it rallied toward $5 and currently trades at $4.5468.

The coin experienced strong volume inflows, maintaining RSI in the overbought zone for weeks. Yet, a breakout above 84.09 could justify additional entries.

If this week’s candle closes green, it will highlight strong buyer activity, reinforcing SUI’s exceptional performance amid market corrections. For those who entered at $1 or $1.76, transferring assets to DeFi platforms could be a wise move for leveraging SUI’s growth.

Using Fibonacci retracement, we identified potential future targets at $5.73, $14.56, and $23.83, depending on market cap movements.

📈 Daily Timeframe

On the daily timeframe, after breaking the $1.0273 range, SUI initiated its primary uptrend, forming new resistances and continuing upward. Yesterday’s daily candle confirmed strong buying interest, showcasing the coin’s superior recovery compared to others in the market.

Even now, an entry with a stop-loss at $3.1340 could be considered for high-risk buyers. Volume data also clearly indicates significant inflows.

Key support levels align with Fibonacci retracements, with $2.3716 being the most crucial level—serving as both a 0.382 Fibonacci level and a previously broken resistance turned support.

⏱ 4-Hour Timeframe

On the 4-hour timeframe, after the Fed meeting and Powell's speech caused market declines, SUI quickly rebounded from the $3.5013 support level, showing a sharp recovery back toward its highs.

📈 Long Position Trigger:

breaking $4.7955 offers an ideal entry point, with orders placed above resistance due to potential whale activity. Ensure a wide stop-loss to avoid being stopped out by volatility.

📉 Short Position Trigger:

while I wouldn’t short SUI personally, breaking $4.345 could justify a position with a tight stop-loss. Regardless, secure profits quickly to mitigate the risk of rapid reversals.

🔗 Chart: 4H SUI Chart

💡 BTC Pair Insight

Against BTC, SUI is one of the most bullish pairs in the market. While most coins show red candles against Bitcoin, SUI strives to close green. If it breaks the 0.00004306 resistance and RSI confirms above 74.98, a strong upward trend could follow, benefiting both BTC and USDT pairs.

🌞 Conclusion

SUI stands out as a strong contender this week, displaying exceptional resilience and bullish momentum. With clear triggers for both long and short positions, the coin offers opportunities for strategic trading. Ensure careful risk management and stay prepared for rapid market shifts.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | MAGICUSDT Market Correction and Fear!👋 Welcome to TradeCityPro Channel!

Let’s take a look together at a so-called bloody day in the market, as some friends call it, with a quick glance at the chart to analyze the events and help you make more thoughtful decisions without acting on your emotions.

🌟 Bitcoin Overview

Before starting the analysis, as usual, let’s take a look at Bitcoin. On the 1-hour timeframe, Bitcoin is experiencing red candles with high volume, indicating that it is currently correcting on its higher timeframe.

However, this event is accompanied by an increase in Bitcoin dominance, leading to more significant altcoin sell-offs. Naturally, altcoins are seeing larger red candles and experiencing steeper declines. But does this mean that the trend is changing?

From my perspective, no, and as long as Bitcoin remains above $80,000, we are still bullish and have no reason to exit. These red candles are merely corrections, which are entirely natural, as the market hasn’t seen any significant profit-taking since Bitcoin broke above $73,000. Make logical decisions, and during a bull market, don’t sell your assets prematurely unless they hit your predefined levels.

🌞 Daily Timeframe

On the daily timeframe, MAGIC broke out of its 112-day range and resistance at $0.4302, moving toward the $0.7130 resistance, almost matching the size of its previous range.

Typically, the risk-to-reward ratio of patterns leads to the formation of significant support or resistance levels, shaping collective decisions.

After facing rejection and forming a lower high, MAGIC broke below $0.5573 and returned to the weekly box and support at $0.4302, which can act as a strong support for slowing down the bearish momentum and reversing it.

Currently, bearish momentum remains strong, and I refrain from buying during declines. However, if the support fails or the RSI re-enters its range, this could serve as a trigger for entry. For now, I prefer to watch, and if there is a significant reversal candle, it will be a pleasant surprise due to the strong momentum, with my stop-loss level already defined.

These conditions occur in bull markets and are completely natural. So, avoid FOMO and don’t let your emotions guide your decisions.

Practice risk and capital management, follow the analyses, and define your levels. For example, as long as Bitcoin remains above $80,000, I won’t sell and will even look for entry triggers. Futures positions currently make little sense, but if you have any, be sure to take profits and avoid greed!

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | OPUSDT Analysis Prepare Your Bullish Triggers!👋 Welcome to TradeCityPro Channel!

Let’s dive into the market and analyze OPUSDT, focusing on a detailed breakdown of its structure. Remember, those who stay calm and manage their emotions during market corrections are the ones who profit big in the bull run.

🌍 Market Overview

As always, we start with Bitcoin. Currently, it’s undergoing a minor pullback with hourly red candles and good volume. However, this is a positive development as it signals a potential pullback in Bitcoin dominance, possibly forming a lower high on the daily timeframe—a bullish indicator for altcoins.

Currently, Bitcoin is fluctuating around the 94,660 support. If this level is broken and Bitcoin moves toward 91,000 with a rising dominance, altcoins could see another 20-30% drop.

🕒 Weekly Time Frame

OP is a relatively new coin, part of the Layer 2 category, and hasn’t experienced a bull run yet.

The weekly candle shows a strong rejection at 2.688, making it a better resistance level than the previous 3.016. This rejection also enhances the significance of the 2.688 entry point.

Additionally, there’s a hidden trendline that has acted as support in the past, and after breaking it, the price pulled back. It has rejected this level again, suggesting potential future significance.

For safer entries, wait for support confirmation on lower timeframes or a breakout above 2.688. If you already bought at the 1.93 breakout, hold your position and remain patient.

📊 Daily Time Frame

On the daily chart, after breaking out of the accumulation box between 1.324 and 1.833, the price moved the size of the box to reach its first target (R:R 1). From there, it faced a heavy rejection.

pullback to the 1.833 support seems logical as this level aligns with the 50% Fibonacci retracement and Dow Theory principles. Confirmation on lower timeframes could signal a bullish reversal.

For now, wait for the downward momentum to fade before planning new entries. If the market moves sharply upward, this could introduce strong bullish momentum, allowing for higher-risk entries.

🕒 4-Hour Time Frame

On the 4-hour chart, the coin broke a rising trendline, leading to a drop. I personally didn’t open any short positions, nor would I recommend them in this context.

If 2.049 support is broken and Bitcoin dominance rises, the price could drop further to 1.833. Decision-making at that level will be key.

📈 Long Position Trigger

if the price ranges between 2.049 and 2.283 and starts gaining bullish momentum, a breakout above 2.283 with increasing volume would offer an early entry opportunity.

📉 Short Position Trigger

while breaking 2.049 might seem like a trigger, I still don’t recommend it. If you choose to short, watch the RSI, which is deeply oversold.

💡 BTC Pair Insight

In the current conditions, the Bitcoin pair (OPBTC) might not hold much significance. Coins that have either not dropped much or completed healthy corrections with declining bearish momentum are more favorable.

For OPBTC, the key trigger would be a breakout above 0.00002975, which could signal the start of its upward move in a bullish market.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | TRX : An Intense and Unexpected Pump👋 Welcome to TradeCity Pro!

In today’s analysis, I’ll review TRX, which recently experienced a sharp and unexpected pump. Many traders in various communities seem to have succumbed to FOMO following yesterday’s surge. This analysis will focus on managing profits and navigating a coin that has already pumped significantly.

📅 Weekly Timeframe: Sharp Rally

In the weekly timeframe, there’s a well-established, long-term trendline that has repeatedly supported the price. I’ve often emphasized that if you’re holding TRX, it’s worth holding as long as the price stays above this trendline.

📊 The trading volume has consistently increased during the price’s rise from $0.0493 to $0.1446. After hitting this resistance, the market consolidated between $0.1084 and $0.1446 for a while.

🚀 Once the critical resistance at $0.1446 was broken, TRX achieved a new all-time high. After surpassing $0.1675, the price saw a massive pump. The RSI climbed past 80.97 and now stands at an extraordinary 91.72, indicating extremely overbought conditions. At such high RSI levels, I typically wait for a correction before making any moves.

✅ Profit-Taking Strategy

For those who have been holding TRX, consider taking some profits now. With the RSI at such elevated levels and the price nearing the 1.272 Fibonacci level, the likelihood of a correction is significant. I personally take profits at this stage and recommend you do the same. However, do not sell all your holdings, as there’s always the potential for further upward movement.

📈 If the rally continues, the next target would be the 1.618 Fibonacci level, often considered a critical resistance. Nevertheless, taking profits now is wise, especially since many holders are likely over 100% in profit, providing an excellent opportunity to withdraw your initial investment.

🛒 Advice for New Investors

If you don’t already hold TRX, do not buy at this stage. This is not an optimal entry point. Current long-term holders are likely to be taking profits, so it wouldn’t be prudent to buy while they are exiting. Patience is key; wait for a correction or a better setup before considering an entry.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Fighting Emotions: Overcoming Greed and Fear in the MarketThere are moments in life that remain etched in memory forever, dividing it into "before" and "after." For me, that pivotal moment was the fateful day I lost an enormous sum of money—enough to live comfortably for 3–5 years. This loss was not just a financial blow but a deep personal crisis, through which I found the true meaning of trading and life.

When I first embarked on the trading path, success came quickly. My initial trades were profitable, charts followed my forecasts, and my account grew at an incredible pace. Greed subtly crept into my heart, whispering, "Raise the stakes, take more risks—the world is yours." I succumbed to these temptations, ignoring risks and warnings. It felt as if this success would last forever.

But the market is a force of nature that doesn’t tolerate overconfidence. On what seemed like an ordinary day, everything changed. Unexpected news rocked the market, and my positions quickly went into the red. Panic consumed me, and instead of stopping and accepting the losses, I decided to recover them. That mistake cost me everything.

In just a few hours, I lost an amount that could have secured my life for years. I stared at the screen, unable to believe my eyes. My heart was crushed with pain and despair. In that moment, I realized that greed had brought me to the brink of ruin.

After that crash, I was left in an emotional void. Fear became my constant companion. I was afraid to open new positions, afraid even to look at the charts. Every thought about trading filled me with anxiety and regret. I began doubting myself, my abilities, and my chosen path.

But it was in that silence that I started asking myself important questions: How did I end up here? What was driving me? I realized that greed and a lack of discipline were the reasons for my downfall.

Understanding my mistakes, I decided not to give up. I knew I had to change my approach not just to trading but to life as well. I began studying risk management, trading psychology, reading books, and talking to experienced traders.

Key Lessons I Learned:

Acceptance of Responsibility : I stopped blaming the market or external circumstances and took full responsibility for my decisions.

Establishing Clear Rules : I developed a strict trading plan with clear entry and exit criteria.

Emotional Control : I began practicing meditation and relaxation techniques to manage my emotions.

Gradually, I returned to the market, but with a new mindset. Trading was no longer a gambling game for me. I learned to accept losses as part of the process, focusing on long-term stability rather than quick profits.

Risk Diversification : I spread my capital across different instruments and strategies.

Continuous Learning : I invested time in improving my skills and studying new analytical methods.

Community and Support : I found like-minded people with whom I could share experiences and get advice.

That day when I lost everything became the most valuable lesson of my life. I realized that true value lies not in the amount of money in your account but in the wisdom and experience you gain. Greed and fear will always be with us, but we can manage them if we stay mindful and disciplined.

Takeaways for Traders :

Don’t Let Greed Cloud You r Judgment: Set realistic goals and celebrate every step forward.

Fear is a Signal : Use it as an opportunity to reassess your actions and strengthen your strategy.

Risk Management is Your Best Friend : Always control risks and protect your capital.

My journey was filled with pain and suffering, but it was these hardships that made me stronger and wiser. If you are going through difficult times or standing at a crossroads, remember: every failure is an opportunity to start over, armed with experience and knowledge.

Don’t give up. Invest in yourself, learn from your mistakes, and move forward with confidence. Let your path be challenging, for it is through overcoming obstacles that we achieve true success and inner harmony.

Your success begins with you.

If you enjoyed this story, send it a rocket 🚀 and follow to help us build our trading community together.

How TradingView Helps Me Not Miss TradesHey,

In this video I provide several examples that help me to not miss any trading opportunities and provide me more clarity and confidence in my trading. I share my trading style, the usage of tradingview alerts and multi-timeframe analysis to time it right.

Often traders struggle with missing trades, this is why you might miss them:

- Lack of confidence

- Lack of chart time

- Lack of knowledge

If you solve them one by one, your trading performance can improve fast.

Kind regards,

Max Nieveld

3 Bullish-Bitcoin Charts 4 The Knocker-Know-It-Alls!

3 Charts very recently taken showing that BTCUSD is headed to 100,000 - possibly by the end of the week. 500,000 is possible by the end of the year - that's right only 8 weeks away.

I sometimes wonder whether some very experienced traders have a concept of value. I am speaking of the cowards who wrote Cryptocurrency off in recent months, even when big Crypto's like BTCUSD were hugging their 200 daily average on D-charts. Maybe it served their agendas, maybe revengeful attacks due to losing big sums of money on Crypto, we all been there I think.

Anyway, is FOMO striking you yet? Are you sticking to your guns not to buy Solana and Bitcoin which are suppose to increase 10-fold in the months ahead.

You see, its simply a sling-shot effect for Cryptocurrency. They were pulled back in their prices quite substantially earlier in the year, then a compression / squeeze period after their selldown (no clear direction), then brought in the sling-shot, launching Crypto prices with compounded buying momentum many more times than their original sell-downs.

Thanks for reading. Here are my accumulated positions in Crypto, in case you are wondering.

AudioUSD, HotUSD, SolUSD, FTMUSD, BTCUSD,TRXUSD, ADAUSD (biggest unrealised profits), DOGEUSD (same big runner), GRTUSD, KNCUSD, HBARUSD (only loser in the red), APTUSD (bought at the weekend & doing well).

That's it I think. Plenty of positions. You don't need this many. Only need 2 or 3 star performers.