Biggest bear market in dollar that could lose it's statusI believe the biggest bear market in the dollar is coming soon and because of that dollar could potentially won't the world reserve currency in the future. Holding the dollar right now is the dangerous thing you can do even though everyone seems to be taking their money out of the banks. Might be safer to put some in miners, gold, silver and all commodities. Eventually all commodities prices will mean revert due to being suppressed down for so long. Paper is trash. GET OUT OF THE DOLLAR IMO!

FOOD

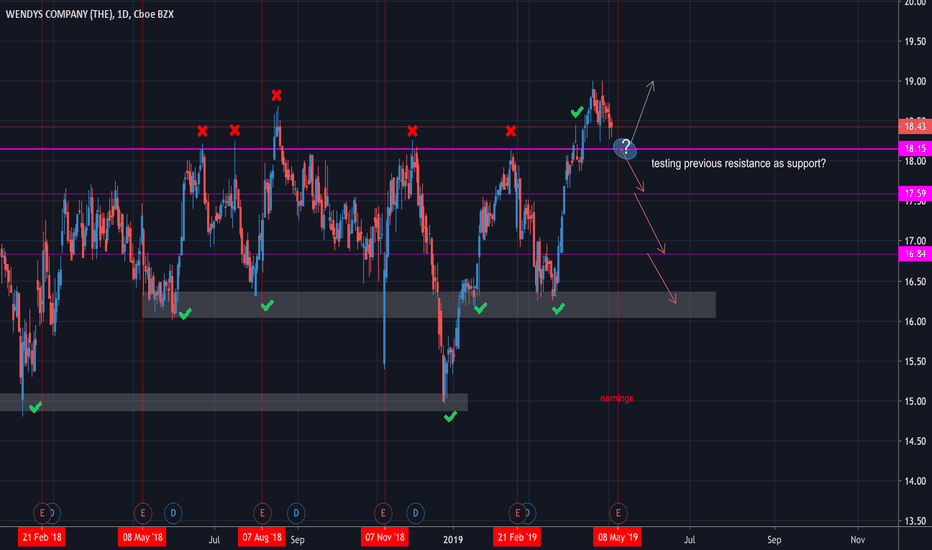

YUM BRANDS BUYING WENDY'S..? SEE ARTICLE..GREAT FIT!Hello folks..

This morning we were sent an article from a Wall Street friend dated December 27, 2019, approx. 4 weeks ago.

Here's the link...

www.restaurantbusinessonline.com

Wendy's is in an uptrend moving into earnings.

YUM Brands, with a market cap of over $30 Billion, could buy Wendy's without hesitation.

Keep a close eye on Wendy's because YUM buying Wendy's we feel would be a great fit.

Best of luck with your trades!

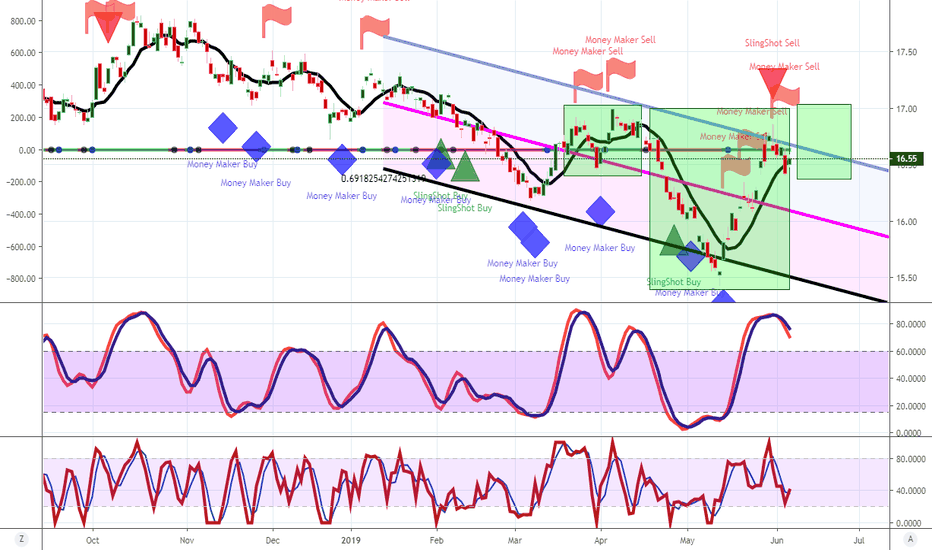

Beyond Meat: Lower buy opportunity exists.BYND topped yesterday following an impressive comeback from the November - December lows, which gave a strong bullish signal as the RSI was on a Bullish Divergence. This turned 1D extremely overbought (RSI = 85.585) and it was only natural to see investors booking profits first chance they got, and that was near the 137.00 Symmetrical Resistance.

With the rest of the technical indicators pointing towards a healthy uptrend (MACD = 6.860, ADX = 32.540, Highs/Lows = 29.3471) the trend seems sustainable. Investors however should first see a clear new low (higher low) before re-entering. By our projections this will most likely be 97.50 - 91.00 Symmetrical Support Zone. 108.00 is also a candidate (but a weaker one) so tight SL is needed there. Medium term TP Zone: 160.00 - 172.00.

~~~ Our last Buy Call on Beyond Meat:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

HEINZ: Strong Value for 2020; Wait for ConfirmationOver my past several ideas I have been discussing about "value for 2020" and here is yet another example of one. Contrary to some of my other sectors that I have touted (which have already built momentum), HEINZ still has quite a bit of short interest and negative momentum.

However, this is an example of a stock that got slaughtered in 2019 and due for quite a drastic run up - when that happens is anybody's guess specifically but with a new CEO, a stock thats heavily undervalued and a juicy dividend, its hard to resist buying and holding.

With a likely short coming sometime in 2020 in Q1, I see little reason why the stock doesn't close the gap to just below $29.00, in which case the stock would be a good buy. If not, we would want to wait for a further push above this month-level consolidation before putting in a buy.

- zSplit

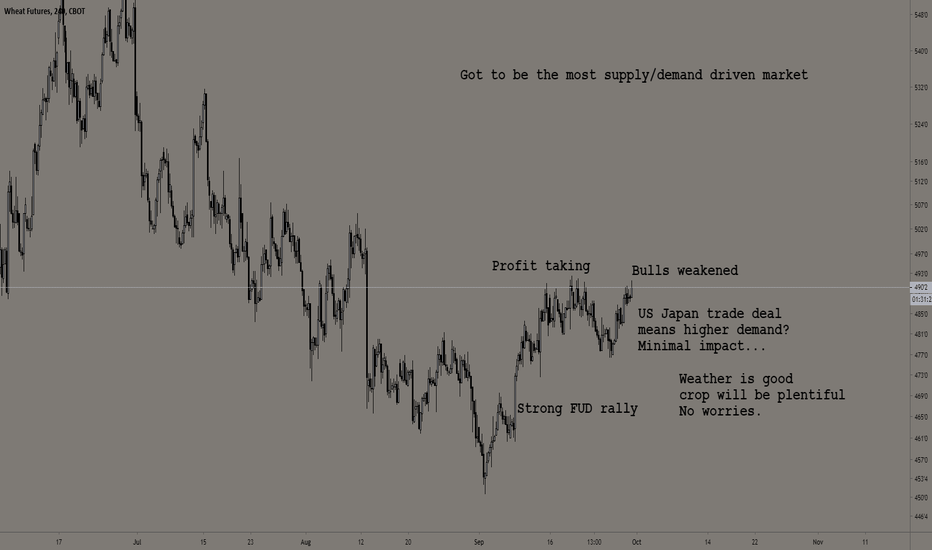

Bearish on grains & wheatBeen a while since I posted about agri.

Price is around its average now, I see no reason for it to skyrocket.

I don't think this little rally is a new trend, I see it as a correction.

And the short term uptrend is probably just noise that kindly comes fill my shorts.

Technically the price around 490-495 is a sweet spot to short this which makes it interesting.

We let the amateurs trade everything to make sure they don't miss out.

Market can stay irrational longer than you stay solvent so use a stop loss.

And also, it's not 100% sure the price is supposed to go down, might be wrong.

So in any case, stop loss (or something else) is good.

Corn/USD Bounce UpLooks bullish.. looking forward a retracement into +- 4 $ or emas line after it's challenging the resistance at $ 4.28

Indicator looks bullish, volume is rising rapidly.

DMI : +DMI is rising and -DMI is dropping hard creating a huge range between them, bullish also DMX is rising too.. bullish momentum is increasing

Macd : buy histogram is higher than the previous high.. bullish sign so far.

Volume MA is rising

Dominos Pizza (DPZ)(NYSE) Buy $286.00 >>> $269.95Deal on breakdown and return prices.

NYSE:DPZ

Dominos Pizza Inc

Stock - NYSE (USA)

Profit:Risk = 1:1

---

Sell = $286.00

Take Profit = $269.95

Stop Loss = $302.06

------

Take Profit = +5.61%

Stop Loss = -5.62%

RRGB Preview - Multi-Year Bottom CarvedRed Robin Gourmet Burgers (RRBG) has carved out a bottom inside an old demand zone, and is now heading into a mid-term supply zone. If it clears 33.66'ish, it has potential to clear the mid 30's. If it does, expect a great long opportunity. If it does not, it may become a great short.

Hain Celestial - Correction mode over?The food company, with sales of $ 2.8 billion and 7,800 employees, has already passed the correction phase at $ 25.46 and completing the wave E of 4. The complete previous upward movement has been corrected by more than 61.8% and that is a good trend reversal range.

Hain Celestial specializes in the production of organic and natural products and is currently in a restructuring phase. There is market potential in an increasingly conscious population, and after completion of the restructuring, prices of US $ 90-130 should not come as a surprise over the next 5-8 years. For investors with a long-term horizon, therefore, an entry into this stock should be considered. However, the stop loss should be set at $ 20.06 to reduce the risk.

Greetings from Hanover

Stefan Bode

P.S. If you liked it, talk about it and recommend me.

$ANFI could see another +88 percent run-up! Read Immediately.=====================

ANFI (Amira Nature Foods Ltd.)

Float: 19.52M

Alert Price: $0.44

Target Price: $6.00

Investor Presentation

========================

Members,

We have just identified a fresh trade idea to bring to our members attention that we believe could run up for easy double-digit gains.

Please turn your immediate attention to ANFI (Amira Nature Foods Ltd.).

Just like many of our previous big winners, ANFI possesses the following traits:

Low float of just 19.52M

Listed on a major exchange (NYSE)

Trading well below its average analyst price target of $6.00 (+1,265% Upside)

We've been keeping a close eye on this global provider of packaged Indian specialty riceever since we watched it run-up nearly +88% from $0.33 to $0.62 on December 26th.

ANFI's shares have since pulled back, but we believe that the next major bull run is about to kickoff today.

About Amira Nature Foods

Founded in 1915, Amira has evolved into a global provider of packaged Indian specialty rice, with sales in over 40 countries today. Amira sells Basmati rice, premium long-grain rice grown only in certain regions of the Indian sub-continent, under their flagship Amira brand as well as under other third party brands. Amira sells its products primarily in emerging markets through a broad distribution network. Amira’s headquarters are in Dubai, United Arab Emirates, and it also has offices in India, Germany, the United Kingdom, and the United States.

Company Highlights:

Large Staple Consumer Category with Highly Supportive Industry and Sub Category Fundamentals

A Market Lead with Differentiated Business Model

Globally Diversified with Wide Customer Base and Broad Product Portfolio

Vertically Integrated "State-of-the-art" Supply Chain and Operations

Strong Financial Track Record, Underpinned by Stable Margins

Highly Experienced and Successful Management Team

Entered into a, approximately $30 million contract, to supply third party branded basmati rice to a repeat customer in the Europe, Middle East, and Africa (“EMEA”) region. The Company expects to recognize the benefit of this contract in the fiscal 2020 ending March 31, 2020.

Since its founding in 1915, Amira has evolved from a domestic, family owned Indian business to a professionally managed, global branded, publicly traded, growing packaged food company.

ANFI has a market capitalization of $11.75M as of Dec. 21, 2018. Now, based on value ratios, Amira could be considered undervalued. For example, currently, the stock is trading at a price-to-sales ratio of 0.03, while the industry average is 1.90, according to Morningstar. Additionally, it had a price-to-earnings ratio (P/E) of 1.15, while its competitors had an average P/E of 11.79.

Not only is the stock potentially undervalued based on its revenues and earnings, ANFI is also trading well below its book value, with a price-to-book ratio of 0.05, while the industry average is 1.81.

With ANFI trading well below the industry average for some key valuation ratios, it could be a value play, and could even attract potential buyers.

Moreover, Amira was able to increase at a compound annual growth rate of 15.5% between 2010 and 2017. With such high revenue growth rates, this company could be significantly undervalued by the market.

According to Finviz, over 50% of the company is owned by insiders. That in mind, that shows that the company’s officers, directors, and key insiders are confident in the company.

The Company has received numerous accolades:

Since 2010, Amira has been recognized in multiple years by the World Economic Forum as a “Global Growth Company”, an

invitation-only community consisting of ~300 of the world’s fastest-growing corporations

The World Consulting & Research Corporation named Amira one of “Asia’s Most Promising Brands”

Planman Marcom voted Amira the “INDIAN POWERBRAND” in the Food Category in 2011 and 2013

Amir was voted best partner in the “Staples” category in 2013 at the Bharti Walmart Private Limited Annual Supplier Conference

VWP World Brand recognised the Amira Brand as “The Admired Brand of India” in 2014–2015

Inc. India featured Amira as one of India’s fastest growing mid-sized companies in 2010, 2011, 2012 and 2013

Product Portfolio

Approximately three quarters of sales come from Basmati rice, the core focus of the company;

Sells more than 20 owned brands globally, spanning numerous price points;

Amira in India

Amira has established 15 Company managed distribution centers in India to provide it greater control over its expansion efforts in its home country location.

Amira is one of a handful of large relevant players in the domestic India market.

Amira represents a meaningful opportunity to consolidate the market over time.

Recent Developments

Amira Nature Foods Ltd Announces $30 Million Contract with Repeat Customer

ANFI entered into a, approximately $30 million contract, to supply third party branded basmati rice to a repeat customer in the Europe, Middle East, and Africa (“EMEA”) region. The Company expects to recognize the benefit of this contract in the fiscal 2020 ending March 31, 2020.

“We are extremely pleased to continue our relationships with our customers in the EMEA region”, stated Karan A. Chanana, Amira’s Chairman.

Market Outlook

Rice is a $275bn Global Staple Category with Favorable Market Conditions

Rice is the primary staple for >50% of the world’s population and provides > 20% of the global caloric intake

Represents 30% of caloric consumption in Asia(4)

Defensive and non-cyclical with steady growth

Improves with age and has an extremely long shelf life (up to 5+ years) if stored properly

Global rice consumption is growing, estimated to reach c.483 million metric tonnes in 2017(5)

The global rice market is estimated at $275B and has grown at 2% volume CAGR over the 2010 – 2015 period

Technical Analysis

As we stated above, we've been keeping a close eye on this global provider of packaged Indian specialty riceever since we watched it run-up nearly +88% from $0.33 to $0.62 on December 26th.

The float of ANFI is extremely low for a NYSE listed company at just 19.52M.

ANFI shares are trading near the lower end of their 52-week price channel, and we see plenty of upside from today's alert price.

Shares of ANFI were up as much as nine percent in after hours trading, which could indicate a major announcement from the Company in the immediate future.

We believe that ANFI's next big bullish run-up could start today, and urging all of our members to act fast, start their research, and consider building a position in ANFI this morning at 9:30AM EST

(*Remember to use a Stop-Loss Order or basic Limit Order to protect your gains, as well as limit possible losses.)

Best Regards,

The TopMarketGainer Team

Don't Miss Our Next Huge Winner...

Text 'GAINS' to '67076'

to have our Trade Alerts

Delivered Direct

to your Cell Phone.

(There is no charge.

Msg&data rates may apply.)

DISCLAIMER

This newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. This newsletter is owned, operated and edited by both MJ Capital, LLC and PennyStockLocks, LLC. Any wording found in this e-mail or disclaimer referencing to “I” or “we” or “our” refers to MJ Capital, LLC and PennyStockLocks, LLC. Our business model is to be financially compensated to market and promote small public companies. By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature, and are therefore are unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis of making investment decisions, and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. MJ Capital does NOT own any shares of the companies mentioned herewithin, nor intends to buy any in the future.

MJ Capital’s business model is to receive financial compensation to promote public companies. We have been compensated five thousand dollars by World Wide Holdings dba Invictus Resources to conduct investor relations advertising and marketing for ANFI. Any compensation is a major conflict of interest in our ability to be unbiased. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. The investor relations marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, MJ Capital often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice.

Love Terra Tech. and all they've got going!Downward pennant, bearish reversal pattern. Likely to bounce up in the coming month.

This company is strategically placed to quickly take advantage of further legalization here in the U.S. and outside as well. Check out their other enriched food products besides cannabis as well! They've got a bunch of hydroponic food farms that are prepped for cannabis when legalized in those areas. Love this company, and going to be holding for a long time.

www.terratechcorp.com

Blue Apron possible Cup and HandleI am not licensed or certified by any individual or institution to give financial advice. I am not a professional Stock trader.

I think Blue Apron (APRN) could be forming a possible Cup and Handle. The 10 Day Exponential Moving Average (EMA) and 20 Day EMA seem to be holding up as support every few days. I have entered a Bullish position already by purchasing Stock. Hopefully, I'm right. :) There are a couple lines that could serve as Resistance. The blue dotted horizontal line I have drawn is based off an area of Resistance from February 08-16, 2018. The solid green line is drawn off a high wick on February 13, 2018.

Let me know what you think, and if you have any questions.

EBRO FOODS ... FROM SPAIN TO TEH WORLDI'm very instinctiv when I 'm looking for a good share to buy.

I was buying in the shop were I always used to go and then I found a new brand of Pasta. The package was nice, it was an italian brand, I cooked it and it was really good, al dente!

So I asked me, why this good and unknown Pasta is now in this market? I made a quick Research and I discovered that behind this Pasta there was Ebro Food a big industry.

I personally think that Alimentation is changing, as well consumism. Big industry have to Change their products and target if they want survive. Trying to overfeed people (in europe for sure) is no more the way to improve profitability .

If the quantity that you sell is lower, then you have to sell better quality at higher Price.

I think that ebro Foods understood this and is trying to expand this type of market and I suppose they will succed.

Looking at the Charts we can see that there is a clear resistance around 21.4 Dollars pro Shares- Since April 2016 we rebounded against this resistance, forming an ascending triangle. A break out of this line will rapidly bring the share around 26 Dollars pro Shares.

Now we just had a strong Impulse and the shares reached again the resistance.

I find disturbing that CMF is decreasing, which could be a bearish divergence. moreover there is some Distribution and no more accumulation.

I think that this Graphs explain the Situation. Good products in a uncertain market.

In the next months we will assist to an important movement up or down. A catalyst is what is needed.

I will try to buy the break out, but for the Moment I stay away from Ebro Food.

BIO

APRN food service? what's not to love?Has been consistently beating on earnings report, and it's looking poised to go on a huge bull run this year. Gains will occur this season, summer it will be a bulking phase, carbs are welcome at this time. "If you can't handle me when I'm bulking you don't deserve me when I'm cut." Can this stock double and hit 5? it's a possibility and a high one