possible longgreetings. long time guys. Welcome back. hope you are having a profitable moment. here is a technical analysis on EURJPY.

Level PRICE on previous resistance acting as support, and also respecting 0.618 fib level, moving average acting dynamic support

if you have a different idea kindly share it below thank you

Forex-education

How To Analyze Any Chart From Scratch - Episode 9Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

Today we are going to go over a practical example on EURGBP, but you can apply the same logic / strategy on any instrument.

Feel free to ask questions or request any instrument for the next episode.

You can find the previous episodes below "Related Ideas"

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Train Your Eye To see TheImportant ThingsIn this chart I've circle a candle pattern some know as the Judas Swing. I call it the Money Swing because when you see it form profits usually follow.

When price makes this move it will drop or long according to the bias of that day.

This formation goes both ways.

When you study past price action you will notice the effect that happens after this move.

There are no coincidences in Forex. For every cause there is an effect.

The DXY has taken off like a bat out of the fires of hades:)

Another confluence WHY EURUSD is gonna break 1.0200.

Never Over Leverage.

Trust your trade set up.

Have Fun.

I AM Pro Trading Made Simple.

Education: Why your trading strategy win rate doesn't matter!What makes a profitable automated strategy?

Probably the biggest misconception for trading perpetuated in the mainstream is that you need to have a greater than 50% win rate to be profitable.

This is followed by a close second, of constantly assuming you need to have a risk-reward ratio of greater than 1:1 (e.g. 1:2, 1:3 etc). This one is perpetuated mostly by forex and stock market gurus.

By the end of this article, I hope to dispel these myths and aim to shed some truths on how to assess a profitable strategy.

Why your win rate doesn't matter:

Let's simplify this down using an example. Consider the following two strategies. Which one would you rather trade?

Strategy A: 50% win rate - When you win you make 2 dollars, but when you lose, you lose 1 dollar

Strategy B: 50% win rate - When you win you make 5 dollars, but when you lose, you lose 1 dollar

This one was a very obvious case of choosing Strategy B. In this case, both strategies have the same win rate, but Strategy B nets you 5 dollars per win, whereas Strategy A only makes you 2.

Let's take another example. A little less obvious this time. Which one would you rather trade here?

Strategy A: 90% win rate - When you win you make 1 dollar, but when you lose you lose 50 dollars

Strategy B: 10% win rate - When you win you make 200 dollars, but when you lose, you lose 1 dollar

Now the 90% win rate strategy may look attractive on the surface, but when you dig into it, you realise that you could get a massive 50 dollar loss in the 10% of times you do lose! For those of you who chose strategy B, this is the correct answer.

One way we can assess the above strategies is using Expectancy . The formula for Expectancy is as follows:

(Win % x Average Win Size) – (Loss % x Average Loss Size)

We can calculate the expectancies of the strategy below:

Strategy A:

(0.9 * 1) - (0.1 * 50) = -4.1

Meaning you are expected to lose an average of $4.10 per trade using strategy A. Not a good sign.

Strategy B:

(0.1 * 200) - (0.9*1) = 19.1

Meaning you are expected to win an average of $19.10 per trade using strategy B. This is a major winner here!

As you've probably realised. It is possible to have a profitable strategy using a low win rate. Many trend trading/breakout strategies tend to have lower win rates, but with larger rewards to risk, whilst mean-reversion strategies tend to have higher win rates with less frequent but larger drawdowns.

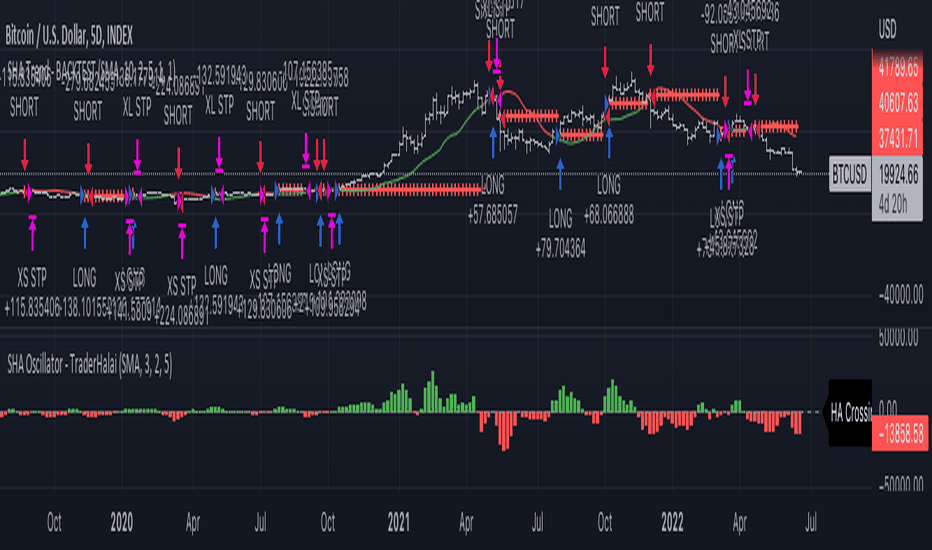

The backtest shown in this post shows an example of a low win rate, and high win amount strategy using the Smoothed Heikin Ashi Trend on Chart indicator which I have developed, with an overall positive expectancy, backtest (note, no strategy is perfect, should not just blindly trust backtest data).

Why you may still choose to define a risk/reward

Better consistency of your strategy

Psychological factor of knowing that you can be expected to lose only x amount (assuming no slippage etc)

As an aside, note that defining a fixed risk-reward may hurt your win rate (which could impact your expectancy) so it's important to backtest to see if you get better results with defined risk-reward parameters. This is beyond the scope of the current article, but an important consideration.

Why do traders gravitate toward a higher win rate?

The simple answer here is that everyone wants to be a winner! It's human nature to want to be right, whether this be about a market direction or when to open or close a trade. It's often easier to brag about how much you win whether that be on social media or just feeling good about yourself.

For algorithmic traders, having a higher win rate may also provide psychological benefits, as losing 20 times in a row can sometimes be very daunting for traders and can throw doubt into the efficacy of your system.

I hope that through this article, I have managed to convey that it may be prudent consider strategies with low win rates also, as these can be very profitable in their own right.

Digging further:

This article is only just scratching the surface of how to create and validate if a strategy is something that you should consider trading. There are many aspects of backtesting including Monte Carlo simulation, understanding standard deviation of returns and risk, Sharpe ratio, Sortino ratio, walk-forward analysis, and out-of-sample analysis to name a few that you should conduct before you evaluate a strategy as suitable for live trading.

If you've made it this far, thanks for reading. If you like the content, feel free to like and share, as well as check out some of the free scripts, strategies and indicators that I have published under the scripts tab.

Thank you!

Disclaimer: Not to be taken as financial advice, anything published by me is purely for education and entertainment purposes

4 Wick Drop Formula on BitcoinMy previous charts that predicted the Bitcoin DUMP were on the Weekly TF.

This chart is a day later of the Daily TF. Same chart just broken down to the Daily TF.

In Real Time my Formula is holding up and Bitcoin is dumping faster the the General Lee!!!

I would say 29k to 27 4k and STILL DROPPING is a DUMP!

Could this be the last run on liquidity before Bitcoin turns BULLISH and never returns to these prices again in the history of EARTH????

Think about this narrative:

Sell as low as you can go. Then when we see the bottom SET we position ourselves to be BULLS when the Bullrush on Bitcoin begins.

The signs before the bullrush will be consolidation and excitement for us.

Because will have weathered the storm, and will capitalize on the greatest WEALTH CREATION in the history of human civilization!

This is when those predictions of Bitcoin going to he MOON in Nov 2021 are validated. (funny how the market moves that way)

Exciting times we are in for sure!

As always: NEVER over leverage.

Trust your trade set up.

Have fun!

Trading Made Simple.

Liquidity Run ExplainedLiquidity run is when price reaches for Buy Sell stops.

The wicks indicate price exhaustion.

"Liquidity Runs" are when price wicks just above the candle for Liquidity aka Buy/Sell Stops, then resumes trend.

This is also known as a #Pullback.

Notice how price doesn't break Resistance level. It wicks up to take out Liquidity then resumes the trend.

Institutional Maket Structure in action!

WHEN EURUSD HAS REACHED IT'S ADR LIMITS!This chart illustrates the Power of knowing the ADR (Average Daily Range) of your pair.

Here we see EURUSD has gone 82pips from the Sydney Tokyo Sessions.

It has to pull back at some point.

This is where we leverage the ADR and short at the highest point.

Happy Trading Family!

GBP/USD - ANALYSIS - @TradersLounge.USHello, everyone! Here's my analysis for GBP/USD!

Price has just reached support on the Daily. We've seen consistent moves to the downside for this second half of January. These next few days should give us a clear outlook on how the market is going to react to this 1.34xx area. Also, a new monthly candle will open on Tuesday!

Here's what I''ll be on the lookout for:

4H/2H - Bear flag is forming so I'll be looking to trade accordingly. If bear flag fails, I'll look for higher lows and for price to break our previous lower high at the 1.35xx area in order to take buys.

Let me know what you see on GU! #HappyTrading

Miajah

Lead Trader @ Trader's Lounge

Why did I fail?How many traders do you think ask this question to themselves? Well, if we dig deeper into statistics, we’ll see that #1 reason differentiating successful traders from the rest 90%+ is proper use of margin and leverage. For every $50,000 in their account, most experienced forex traders and money managers trade one standard lot. If they traded a mini account, this indicates that for every $5,000 in their account, they trade one mini lot. Allow it to soak in for a couple of moments. Why do less experienced forex traders believe they can win by trading 100K standard lots with a $2,000 account or 10K micro lots with $250 if professionals trade like this? Never open a "regular account" with only $2,000 or a "micro account" with $250, no matter what the forex brokers tell you. Some even enable you to start an account for as little as $25! The number one reason rookie traders fail is because they are undercapitalized from the start and have a poor understanding of how leverage works.

However, this all also goes back to our previous lessons on figuring out what type of trader you are. For instance, we’re slightly more aggressive (and as our SL are usually extremely tight), we stick with 1% (which still allows us to open 2 lots for 50.000$). However, if you have hard time monitoring the trade or prefer to have more “breathing room” for a trade, consider 1 lot for 100.000$ of your trading capital.

All the best and stay safe, fam!

GBPUSD LONG POSITION TRADEI just found a double bottom close to my monthly low/support. I'm getting In now because I'm occupied this week and this is close to support entry. RSI at 45, 200, 100, and 50 EMA right above me so It might be a struggle to get to 1.34771. Send me a message so I'll show you how I draw my support and resistance lines. Merry Christmas

XAUUSDLaid out my trading plan for the Pre NY/NY OPEN Session.

Stated both bias for buys and sells.

Higher probability of it going higher as the Daily candle has closed bullish above the range but also since it was a strong rejection area previously, it can also reject the area once again and continue bearish. Let's see.

Be patient. Wait for the candles to print.

YOU GET PAID TO WAIT.

XAUUSD (Gold) To 1834? Risk Hedges Are In Action...Gold has had an extremely bullish run forward throughout October.

The market has created a solid bounce in between 1717.00 - 1721 at the start of the month, creating new key demand zones in the 1750 region.

On the 8th October the market tested a 1780.00 strong supply zone that has previously taken the market to the downside, the market decided to re-test the new 1780.00 support before continuing further to the upside creating new highs, making it a clear new bullish market emergence.

After the breakout of 1780.00 the market tested the next strong level of supply at 1800.00, allowing the market to test a minor support of 1760.00, we believe this was a strong liquidity grab to allow the market to accelerate and create new highs way beyond 1800.00, possibly towards 1834/1835.00 as there is clear bullish momentum in the market and has been for the last few days, there is a very high probability that the market will reach those levels.

The market has broken yet again 1800.00 ready to make moves up towards 1834.00 region, the market has also crossed the 20 AND 60 Day moving averages, adding extra confluence to this set up.

Let's see how this beauty plays, let's get these pips!

Happy Trading!

SGB Capital

Welcome to The Pivot Point.So whilst most people just see them as lines on a chart, I don't find many people know how to calculate them or have any real strategy around them.

Here's an intro to Pivot Points;

Summary

Pivot points are used by traders in equity and commodity exchanges. They're calculated based on the high, low, and closing prices of previous trading sessions, and they're used to predict support and resistance levels in the current or upcoming session. These support and resistance levels can be used by traders to determine entry and exit points, both for stop-losses and profit taking.

How to Calculate Pivot Points

There are several different methods for calculating pivot points, the most common of which is the five-point system. This system uses the previous day's high, low, and close, along with two support levels and two resistance levels (totaling five price points), to derive a pivot point. The equations are as follows, with the added R & S 3!

Indicators

You may have already seen but @TradingView has a couple of built in indicators for pivots such as this one below; where these levels are automated for you.

For stocks, which trade only during specific hours of the day, use the high, low, and close from the day's standard trading hours.

In 24-hour markets, such as the forex market in which currency is traded, pivot points are often calculated using New York closing time (4 p.m. EST) on a 24-hour cycle. Since the GMT is also often used in forex trading, some traders opt to use 23:59 GMT for the close of a trading session and 00:00 GMT for the opening of the new session.

While it's typical to apply pivot points to the chart using data from the previous day to provide support and resistance levels for the next day, it's also possible to use last week's data and make pivot points for next week. This would serve swing traders and, to a lesser extent, day traders.

This info is all on free sites such as investopedia.com & Babypips.com

Alternative Methods

Another common variation of the five-point system is the inclusion of the opening price in the formula:

And a method by Tom DeMark;

Pivot points can be used in two ways. The first way is to determine the overall market trend. If the pivot point price is broken in an upward movement, then the market is bullish. If the price drops through the pivot point, then it's is bearish.

Some people use pivot points in short term/scalp type strategies - One such method is the rejection;

where as another is taking the break of;

The Bottom Line

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Pivot points are based on a simple calculation, and while they work for some traders, others may not find them useful. There is no assurance the price will stop at, reverse at, or even reach the levels created on the chart. Other times the price will move back and forth through a level.

www.investopedia.com

Here's another example of how they are used in one of our custom indicators - to help assess the current trend and various levels.

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

Improve Forex TradingWhen I was learning how to trade and when I was watching and reading different trading educators, these words naturally pissed me off. What the hell are you talking about? What confirmation?

It was a full-blown mystery...🤯

Then, once I started to mature in trading and trade full-time, I became an author on TradingView.

Posting my forecasts and trading setups, I frequently mentioned the confirmation.

And now the newbies that are reading me and learning from me are pissed off...🤬

That is so funny I guess.

But the truth is that the confirmation must become a fundamental part of your trading strategy. It is your key to successful trading.

What exactly is the confirmation?

It depends on many many different things, in this article I will discuss with you the 4 main types of confirmation and give you detailed examples.

1️⃣ - PRICE ACTION CONFIRMATION

That is actually what I prefer.

Analyzing different markets and searching for decent trading opportunities often times we find some peculiar instruments to watch.

Identifying the market trend and key levels we find the potential spots to trade from.

But do we just open the trade once the "ZONE" is spotted?

I wish it could be that simple...

Trading just the zone, without additional clues brings very negative figures. We definitely need something else.

Price action & candlestick patterns can be those clues.

Accurate reflection of the current local market sentiment makes the patterns a very reliable confirmation.

Dodji's, pin bars, double tops/bottoms ...

Proven by history, the skill of identification & reading the patterns will pay off quickly.

Being in some sense the language of the market, the patterns are the fundamental part of my trading strategy.

2️⃣ - FIBONACCI LEVELS

Fibonacci levels are a very popular technical tool. Being applied properly it helps the trader to confirm or, alternatively, disqualify the identified "ZONE".

With multiple different methods like confluence trading, fibs are applied in hedge funds and various banking institutions.

The main problem with the fibs, however, is complexity and a high degree of subjectivity. Meeting different traders and watching different posts on TradingView I noticed that all traders tend to have their own vision. There is no universal system to apply here, a proper fib.confirmation technique can be built only with long-lasting backtesting and practicing.

3️⃣ - FUNDAMENTAL NEWS

The figures in the economic calendar, news, tweets. Actual fundamental news can become your best confirmation tool.

However, the main obstacle right here is the promptness, validity and reliability of the data that you get.

The information shouldn't be delayed and it must be objectively true.

The search for such a source is by itself is a very time-consuming and labor-intensive business not even mentioning its potential costs.

And that is not all. Knowing how to make sense of that data, its proper perception, and understanding requires a solid economical and financial background and experience.

At the end of the day, becoming an expert in fundamental analysis , the trader can easily sort the trading zones and trade only the ones that are confirmed by a decent fundamental trigger.

4️⃣ - TECHNICAL INDICATORS

I believe all the traders apply some indicators. From a simple moving average to some complex composite algorithms, indicators play a very important role in trading.

Being 100% objective and providing up-to-date real numbers and figures, they are our allies in a battle against subjectivity.

For many traders, the various signals from indicators are considered to be accurate and reliable confirmations.

Many algotrading solutions are operating simply relying on such signals and being able to bring consistent profits proves the power of technical indicators.

What confirmation type should you rely on?🧐

I guess the main rule right here is that the confirmation must MAKE SENSE to you. You should feel the logic behind that. It must make you confident in your action, even in case of the occasional losses, it must keep you calm and humble.

Let me know in a comment section what confirmation do you prefer!

Apple baked p(high)Apple is a simple one here - it's running out of momentum, the volume is ascending lower as the price moving higher. The new high level here will be a monthly 3 in Elliott terms and therefore we can expect a nice correction.

The stochastic agrees - the monthly has a little to go but it's a slow grind up, the weekly stochastic is now in the overbought zone.

So not much more to say on this one.

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

AUD/CAD Shorts - setting up Head & Shoulders pattern failureExpecting price to create a head and shoulders formation over today into the start of next week where we will see a rally, then price collapse in on itself. 75% of retail traders are in Bullish positions here adding liquidity to this short entry.

Trading Basics Part 1:How Candlesticks Work!

Hello,Traders!

Japanese Candlesticks are thought to have been invented by the Japanese rice traders

And then made their way into the West where they were used for stocks, forex and commodity trading.

Reading candlesticks is quite easy: the body represents an area that indicates the price distance between the open and close of the candle, while wick’s ends indicate the full magnitude of the movement in-between open and close. Thus, when picking the timeframe for your chart, you are deciding on how much time will be contained between open and close of each candle.

If open is below the close, the candle is bullish , and if open is above the close, the candle is bearish , which is usually represented by different colors of the bodies and wicks on the chart, typically, green and red.

Some of you might ask me, why am I explaining things that seems to be obvious and self evident, yet my experience of Coaching, paints a different picture, with thecandlesticks being undervalued and misunderstood by many, despite them being the staple of technical analysis .

In my trading strategy, which is based on multi timeframe top-down technical analysis ,

we examine multiple timeframes, from 1 week to 1 hour, going from higher to the lower timeframes. Looking for strong levels on weekly and daily and for patterns and confirmations on 4 hour and 1 hour charts. Which means that we are opening 1 week/1 day candle like a Russian doll, finding multiple candles inside the other. We enter the trade only if we are getting the same bias on all timeframes that were of our interest!

If you found my post helpful and interesting, please, like comment and subscribe!

Thank you!