AUDUSD - Resistance Test Points to Imminent Price CorrectionThe AUD/USD pair has shown impressive upside momentum in recent days, recovering sharply from its early April lows near 0.5900 to now testing the key resistance zone highlighted in blue around 0.6400. After such a substantial rally of approximately 500 pips, technical indicators suggest the pair is becoming overextended in the short term. We anticipate a corrective pullback as price encounters this significant resistance level, which previously acted as support in mid-March. This correction would be a healthy development within the broader market structure, potentially setting up better entry opportunities for those still bullish on the Australian dollar in the medium term.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Forex-trade

GBP/JPY testing critical zoneThe GBP/JPY is testing a critical resistance area between 189.20 to 190.00. For as long as this area holds as resistance, the path of least resistance remains to the downside.

Should the selling resume from here, we could see the Guppy trade down to test the key support range between 185.00 to 186.00 again.

However, if the GBP/JPY breaks decisively above the 189.20 to 190.00 range, then that could potentially pave the way for a short-squeeze rally towards the next major resistance in the 193.00 to 194.20 range, where we also have the 200 day MA converging.

By Fawad Razaqzada, market analyst with FOREX.com

USDJPY - Bearish Momentum Points to Further Downside PotentialBased on the USD/JPY 4-hour chart, the higher probability move appears to be to the downside. The pair has established a clear downtrend since early February, with lower highs and lower lows, and recently broke below the significant support level around 144.00. The recent steep decline from late March to early April shows strong bearish momentum, with price now hovering near 143.50 after a modest retracement. The charted projection suggests further downside movement with potential targets around 142.00-141.00 in the short term, while the highlighted support zone around 142.00 and major support at 139.64 could attract price action. With resistance firmly established in the 147.00-148.00 region and the overall bearish structure intact, sellers appear to have control of this market for the foreseeable future.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

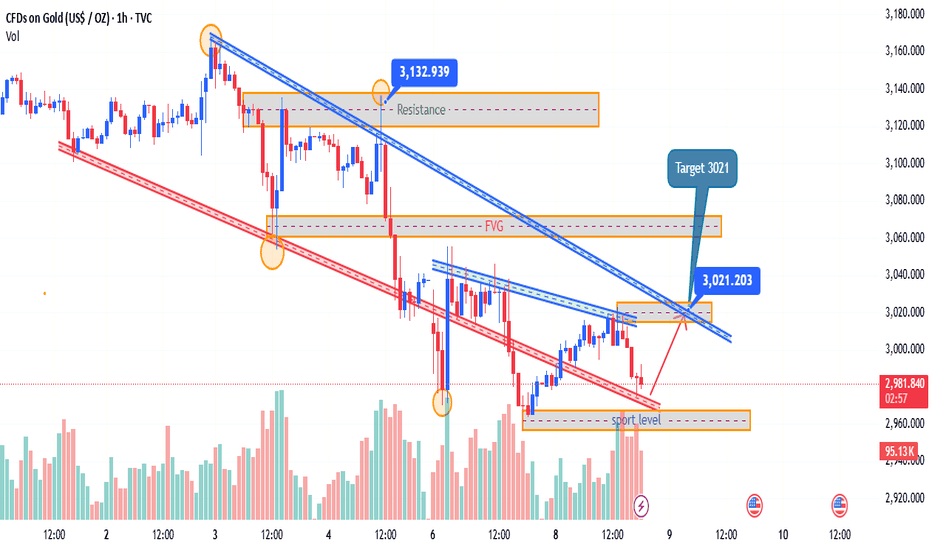

Gold ChatGPT: Chart Analysis for Gold (XAU/USD) – April 08, 2025 – 1-Hour Timeframe

Key Observations:

1. Trend and Price Action:

- The price of Gold is currently in a downtrend, as indicated by the red trendline showing lower highs and lower lows. The price has recently broken below the previous support level, signaling a continuation of the bearish movement.

- The resistance zone near 3,141.64 remains a significant barrier for any upward movement, while the support level at 2,960.00 is holding the price from falling further.

2. Order Block and FVG (Fair Value Gap):

- The order block located at 3,138.95 to 3,141.64 has been a key area where price rejection occurred. The price approached this area but failed to break above, indicating strong selling pressure. This …

ChatGPT: - The target for the current bearish setup is 3,021, which aligns with the support level near 2,987.47. If the price continues to decline, this target could be reached soon, with further downside movement expected.

- If the price holds at the support level and forms a bullish reversal pattern, it may head back towards the resistance zone. However, until the support level holds, the price is likely to continue the downward trajectory.

4. Volume and Market Sentiment:

- The volume shows a consistent decline, confirming the selling pressure. The recent spikes in volume near the support level suggest that the market is reacting to the critical support area.

- Market sentiment remains bearish, with the price currently below its recent highs and the resistan…

ChatGPT: - Bullish Reversal Scenario: If Gold finds support at 2,960 and forms a bullish pattern (such as a reversal candle or engulfing candle), the price might move towards 3,141.64 again.

Conclusion:

The price of Gold is currently in a downtrend, facing resistance around 3,141.64 and support near 2,960. Traders should watch for price action near these levels to assess the next move. The target of 3,021 is the key level to focus on, and a breakout below this could lead to further downside. If the support level holds, there could be a potential for a bullish rebound towards resistance.

USDCAD - Hunting for Bullish Entries?The USD/CAD pair has experienced a notable correction from the 1.4400 resistance level, with price currently being at the 1.4215 area. If a correction happens like the one highlighted by the arrows, traders may find an attractive buying opportunity on smaller timeframes, aligning with the larger bullish trend that's been in place since February. The recent pullback could provide an ideal entry for those looking to capitalize on the prevailing uptrend, targeting a potential move back toward the orange horizontal resistance at 1.4400. However, caution is warranted – should price sharply break below the blue support box with conviction, the bullish thesis would be invalidated, suggesting instead a strategy of selling any minor retracements as the pair could then accelerate to the downside. This critical juncture demands close monitoring of price action for confirmation of either scenario in the coming sessions.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY - Critical area for the pair!The USD/JPY pair currently sits at a critical technical juncture, trading around the 149.84 level, where market participants are closely watching for directional cues. The price action has been respecting an ascending trendline since early March, suggesting underlying bullish momentum, while simultaneously testing the lower boundary of a significant resistance zone highlighted in blue on the chart. This confluence creates a decisive moment for traders – a break below the trendline could trigger another downward leg toward support near 149.00, while sustained strength above the current level might signal continuation of the uptrend toward the upper resistance band at 151.00. The chart's annotated projection suggests the possibility of one more pullback before resuming higher, making this a pivotal area for determining whether bears will gain temporary control or if bulls will maintain dominance without further consolidation.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCAD - Higher Probability Upside Within Broader CorrectionThe USD/CAD 4-hour chart displays a complex price structure with recent upward momentum after finding support in the blue reaction zone (approximately 1.4250-1.4280). Currently trading around 1.4350, the pair appears poised for continued upside movement, with the higher probability scenario being a break above the orange resistance line at 1.4402. This view is supported by the recent series of higher lows and the bullish reversal from the support zone. However, traders should approach this opportunity cautiously, as we remain within a larger corrective structure in the broader market context. This suggests that while the immediate bias favors upside movement, price may still experience downward swings before a definitive breakout. A prudent approach would be to take this trade piece by piece, using smaller position sizes and tighter risk management to navigate potential volatility until the orange resistance is decisively broken.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BTCUSD 15MINTS CHART TECHNICAL ANALYSIS NEXT MOVE POSSIBLE..This chart shows a potential bullish move for Bitcoin (BTC/USD).

The price is currently in a support zone (blue area) around 81,800-82,000.

A breakout from this level is expected, leading to a rise toward 83,224 (resistance level).

If momentum continues, BTC could reach 84,457.

The blue arrows indicate the expected bullish movement.

GBPJPY - Higher Probability Favors Upside ContinuationThe GBP/JPY pair is displaying strong bullish momentum as it trades near 192.25, having recently tested but failed to break through the key resistance level at 193.05. After forming a higher low structure within an ascending trendline since late February, the pair shows notable strength with buyers stepping in at each pullback. Technical analysis suggests that the higher probability move is a continuation to the upside, with price likely to break above the horizontal resistance at 193.05 after a possible minor retracement. If this bullish scenario plays out, we could see the pair extend toward the 194.50 level before potentially reaching higher targets as indicated by the upward-pointing arrow on the chart. The ascending trendline and the support zone marked by the blue box near 191.00 should provide solid foundations for this anticipated upward move, keeping the overall bullish bias intact as long as price remains above these key structural levels.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY - Bullish pattern towards descending trendlineThe USD/JPY pair appears to be forming a potential reversal pattern after reaching a low around 146.50 in early March. Having bounced from this support level, the price is now hovering near 148.60 with indications of a larger corrective move ahead. Technical analysis suggests we are expecting a bigger correction in this area, with the price likely to test higher levels before encountering significant resistance. The initial price target will be the upper boundary of the blue box area (approximately 150.50-151.00), with potential to go toward the descending trendline that has been capping price action since January.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

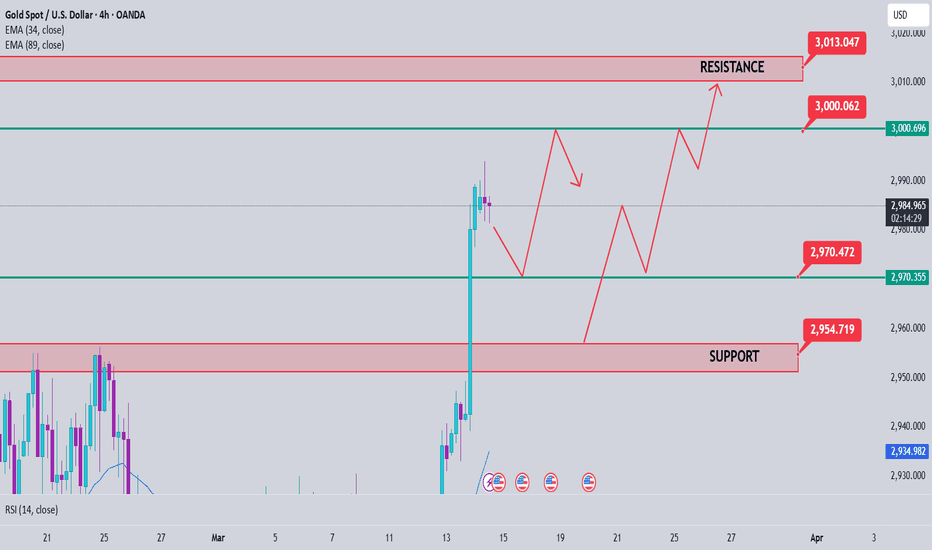

Gold Price Analysis March 14⭐️Fundamental analysis

Optimistic comments from the White House and Canada, along with news that enough Democrats have voted to avoid a US government shutdown, have boosted investor sentiment. However, gold's gains were capped by a stronger US dollar, which was bought for the third consecutive session.

However, expectations that the Fed will cut interest rates multiple times this year could limit the strong recovery of the US dollar. In addition, concerns about former President Trump's tough trade policies and their impact on the global economy continue to support gold prices. This suggests that any correction in gold could be a buying opportunity, helping the precious metal maintain its upward trend for the second consecutive week.

⭐️Technical analysis

any pullback today is considered a reasonable buy 2970 is the area where the European session Gold can find deeper and 2953 are the two BUY zones today. The sell zone is still noticeable around the 3000 round resistance and the 3015 border is considered resistance today. When gold has ATH, the FOMO is very high, so this is a difficult time to trade. Pay attention to volume and good capital management.

USDCAD - Bullish ProspectsUSD/CAD's 4-hour chart suggests that if we see a nice correction in the current area around 1.434, we may experience a continuation to the upside as indicated by the arrow on the chart. The pair has been showing volatility since early March, reaching a peak of approximately 1.4540 before pulling back. The projected path illustrated with the zigzag line indicates a potential corrective move down followed by renewed bullish momentum. This potential upside continuation would likely target levels beyond the recent high, with the current consolidation possibly serving as a base for the next leg up. The highlighted blue box area represents a support zone that could contain the correction before the anticipated upward move materializes. Traders should watch for price action confirmation within this region to validate the bullish scenario.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY - Bigger correction on the daily timeframeUSD/JPY's daily chart indicates we're expecting a larger correction in the near term, followed by a likely continuation of the downtrend toward the blue box target area (143.50-146.00). After reaching peaks near 162.00 in July 2024 and 158.00 in December 2024/January 2025, the pair has established a series of lower highs, creating a clear downtrend pattern. Currently trading around 148.05, the price sits at a critical juncture, with the projected path suggesting a temporary bounce (as illustrated by the zigzag line) before bearish momentum likely resumes. This outlook is supported by the consistent lower highs since mid-2024, the price's position near a historical support/resistance level, February's failed attempt to sustain prices above 150, and the overall downward momentum that has dominated since December 2024.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPUSD - Retracement to the trendline?The GBP/USD pair has exhibited a strong bullish trend since its January lows, currently trading at 1.2876. After reaching recent highs, the price is now at a critical decision point as shown by the chart's resistance area (upper red box) and ascending trendline. The sharp upward movement followed by the recent pullback suggests potential exhaustion of buying momentum, with the red downward-pointing arrows indicating a possible corrective phase ahead.

Two scenarios appear most likely from this technical formation: either price continues higher to break above the upper resistance box before initiating a correction, or an immediate correction begins from current levels. In both cases, the lower orange box around the 1.2700-1.2720 area serves as a reasonable target, as does the ascending trendline (marked by the red dashed line) that has supported the uptrend since January. Traders should watch for potential reversal signals or consolidation patterns to confirm which scenario is unfolding. As always don't jump into trades and wait for confirmation!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPY - More downside?GBP/JPY appears to be in a potentially bearish setup after recently testing resistance. The chart shows that price has formed a significant consolidation zone with clear upper and lower boundaries marked by the red horizontal lines. After making a recent high, the price seems to be struggling to break above the upper resistance zone highlighted by the pink box. The long downward-pointing red arrow marked on the chart is our highest probability move that we anticipate right now.

Given the recent price action and failure to establish new highs above resistance, the higher probability move is likely downward. This bearish outlook is supported by the apparent double top formation near the resistance zone and the pronounced selling pressure that has emerged after testing these levels. Traders should watch for a potential breakdown below recent support levels, which could accelerate the downside move toward the lower boundary of the range as indicated by the arrow's trajectory.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY: Bullish Recovery After Sharp Correction – Short-Term Buy📈 Trade Details:

Entry: Current price 157.823

🎯 Take Profit 1: 158.000

🎯 Take Profit 2: 158.275

🎯 Take Profit 3: 158.500

🛡 Stop Loss: 157.500

💡 Analysis:

Earlier today, USDJPY experienced a sharp correction after hitting intraday highs. However, the U.S. dollar remains resilient, supported by strong economic data and market sentiment favoring risk-off assets.

The correction appears to be a retracement within a larger bullish trend, presenting a buy opportunity as the pair looks poised to recover toward key resistance levels. A break above 158.000 could open the door for further upward movement, targeting 158.275 and 158.500 in the short term.

🚨 Risk Management:

Tight stop-loss placement at 157.500 to protect against unexpected reversals.

Adjust take-profit levels based on price action and volatility.

Let’s aim for profits and disciplined trading today! 💹

GBPAUD SELL | Idea Trading AnalysisGBPAUD is moving on support zone

We expect a decline in the channel after testing the current level

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity GBPAUD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

CHF/JPY Analysis The pair has shown some bearish momentum, reaching a zone of interest for potential reactions. While a short-term bounce is possible due to oversold conditions and the proximity to a key weak low, the risk here is not negligible. Market dynamics suggest this could be a countertrend move, so it's vital to manage risk carefully.

Key Observations:

Weak low interaction: The price is sitting near a potential liquidity zone, making a reaction plausible.

Risk Note: Larger trends still lean bearish; any bounce may face resistance.

Always prioritize risk management and trade responsibly!