EUR-AUD Bearish Breakout! Sell!

Hello,Traders!

EUR-AUD was trading along

The rising support line but

Now we are seeing a bearish

Breakout so we are bearish

Biased and we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Forex-trading-signals

EUR_GBP BULLISH BIAS|LONG|

✅EUR_GBP broke the key

Structure level of 0.8620

While trading in an local uptrend

Which makes me bullish

And I think that after the retest

Of the broken level is complete

A rebound and bullish continuation will follow

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD-USD Very Strong Uptrend! Buy!

Hello,Traders!

AUD-USD is trading in a

Very strong uptrend and

The pair broke a key horizontal

Level around 0.6540 which

Is now a support and we

Are already seeing a rebound

So we are bullish biased

And we will be expecting

A further move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-JPY Correction Ahead! Buy!

Hello,Traders!

GBP-JPY will soon make

A retest of the rising support

Line and as we are bullish

Biased we will be expecting

A local bullish correction

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-AUD Rising Support Ahead! Buy!

Hello,Traders!

GBP-AUD made a sharp

And sudden move down

And the pair is oversold

So after it retest the rising

Support line we will be

Expecting a local bullish

Correction and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_CAD WILL KEEP GROWING|LONG|

✅GBP_CAD is trading in an

Uptrend and the pair made a

Retest and a rebound from the

Horizontal support of 1.8675

So we are bullish biased and

We will be expecting a

Further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD-CAD Swing Short! Sell!

Hello,Traders!

NZD-CAD keeps growing

In an uptrend but the pair

Will soon retest a wide

Horizontal resistance level

Around 0.8350 so after the

Retest we will be expecting

A bearish pullback

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-CHF Long From Support! Buy!

Hello,Traders!

EUR-CHF is trading in a

Parallel range and we see

A rejection from the horizontal

Support area below around 0.9293

And we are already seeing a bullish

Reaction so a further move up

Is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_JPY WAIT FOR BREAKOUT|LONG|

✅NZD_JPY is trading in an

Uptrend and the pair has formed

A bullish triangle pattern

And we are bullish biased

So IF we see a bullish breakout

It will be our signal that

A bullish continuation is

Likely and we will be

Able to enter a long trade

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD_CHF WILL KEEP FALLING|SHORT|

✅CAD_CHF broke the key structure level of 0.5840

While trading in a strong downtrend

Which makes me bearish

And I think that after the retest of the broken level is complete

A rebound and bearish continuation will follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD-JPY Bullish Bias! Buy!

Hello,Traders!

CAD-JPY keeps trading

In an uptrend along the

Rising support line and

We are already seeing a

Bullish rebound so we are

Bullish biased and we will

Be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-CHF Bearish Breakout! Sell!

Hello,Traders!

GBP-CHF formed a H&S

Pattern and now we are

Seeing a strong bearish

Breakout of the neckline

Key level around 1.0933

Area and as the breakout

Is confirmed we will be

Expecting a further bearish

Move down towards the

Target below around 1.0867

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_AUD LOCAL SHORT|

✅EUR_AUD is going up now

But a strong resistance level is ahead at 1.8018

Thus I am expecting a pullback

And a move down towards the target of 1.7900

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD-JPY Potential Short! Sell!

Hello,Traders!

NZD-JPY is slowly approaching

A horizontal resistance level

Around 87.994 so despite

The strong uptrend

We will be expecting a

Local bearish pullback on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

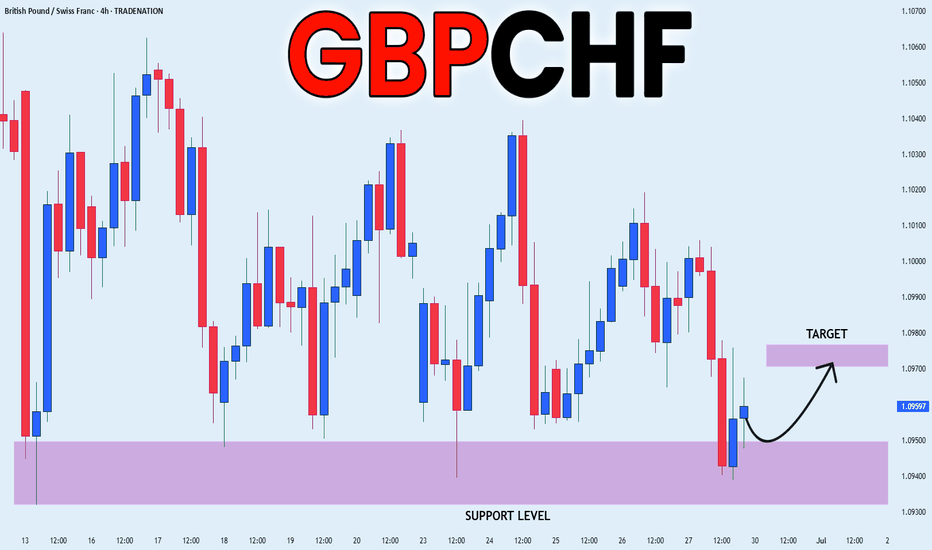

GBP_CHF RISKY LONG|

✅GBP_CHF fell down sharply

But a strong support level was hit at 1.0932

Thus as a rebound is already happening

A move up towards the target of 1.0970 shall follow

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_JPY SHORT FROM RESISTANCE|

✅NZD_JPY is set to retest a

Strong resistance level above at 88.000

After trading in a local uptrend for some time

Which makes a bearish pullback a likely scenario

With the target being a local support below at 87.341

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CHF-JPY Local Long! Buy!

Hello,Traders!

CHF-JPY is trading in a strong

Uptrend and the pair made a

Bullish breakout from the bullish

Triangle pattern and is now seems

To be consolidating above the

Support cluster around 180.740

So we are bullish biased and

We will be expecting a further

Bullish move up on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CHF Will Fall! Sell!

Hello,Traders!

USD-CHF keeps falling down

And the pair broke the key

Horizontal level of 0.8090

Decisively so we are bearish

Biased and we will be expecting

A further move down next week

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-NZD Bullish Bias! Buy!

Hello,Traders!

EUR-NZD is trading in a

Strong uptrend and the pair

Is printing higher highs and

Higher lows while breaking

Important key levels such

As 1.9270 which is now

A support and the pair

Is consolidating above the

New support so we are

Bullish biased and we will

Be expecting a further move

Further up on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-CHF Rebound Ahead! Buy!

Hello,Traders!

GBP-CHF is hovering above

The wide horizontal demand

Level around 1.0926 from

Where we are already

Seeing a bullish rebound

So a further local bullish

Move up is to be expected

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD_CHF BEARISH BREAKOUT|SHORT|

✅USD_CHF broke the key structure level of 0.8050

While trading in a strong downtrend

Which makes me bearish

And I think that after the retest of the broken level is complete

A bearish continuation will follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD-USD Will Fall! Sell!

Hello,Traders!

NZD-USD made a retest

Of the horizontal resistance

Level of 0.6087 and as it

Is a strong key structure

We will be expecting

A local move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-CAD Local Long! Buy!

Hello,Traders!

EUR-CAD is trading in an

Uptrend and the pair is

About to retest a horizontal

Support of 1.5933 and as

We are locally bullish biased

We will be expecting a

Local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.