GBP-NZD Local Long! Buy!

Hello,Traders!

GBP-NZD fell down strongly

Through the first line of

Support but a strong support

Was hit around 2.2160 from

Where a local bullish rebound

Is likely to happen on Monday

So we will be able to enter

A long trade with the Take

Profit of 2.2300 and the

Stop Loss of 2.2123

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Forex-trading

EUR-AUD RISKY LONG|

✅EUR_AUD fell again to retest the support of 1.7700

But it is a strong key level

So I think that there is a high chance

We will see a bullish rebound and a move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-CHF Resistance Ahead! Sell!

Hello,Traders!

EUR-CHF is making a

Bullish rebound now but

The pair will soon hit a

Horizontal resistance of 0.9347

From where we will be expecting

A local bearish pullback

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_USD WILL KEEP GROWING|LONG|

✅NZD_USD is trading in an

Uptrend and the pair made a

Strong bullish breakout of the

Key horizontal level of 0.5927

Which is a support now and the

Breakout is confirmed so we

Will be expecting a further

Bullish continuation

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-AUD Bearish Triangle Pattern! Sell!

Hello,Traders!

GBP-AUD has formed a

Bearish triangle pattern

So we are bearish biased

And IF we see a bearish

Breakout then we will be

Expecting a further

Bearish continuation

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS Swing Long! Buy!

Hello,Traders!

NATGAS went down after

The support cluster breakout

Just as we predicted in my previous

Analysis but price will soon hit a

Horizontal support level of 3.00$

From where we will be expecting

A local bullish correction

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_USD WILL GO UP|LONG|

✅GBP_USD already made a

Retest of the horizontal support

Of 1.3200 and is making a bullish

Rebound so as the pair is in the

Uptrend we are bullish biased

And we will be expecting the

Pair to go further up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_CAD SHORT SIGNAL|

✅AUD_CAD made a retest

Of the horizontal resistance

Of 0.8880 then established

A beautiful double top pattern

And then broke the local neckline

Around 0.8832 so its a great

Setup for a short trade

With the TP of 0.8778 and

The SL of 0.8887 above the

Resistance upper bound

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-USD Free Signal! Buy!

Hello,Traders!

GBP-USD is trading in an

Uptrend and the pair is

About to retest a horizontal

Support level of 1.3181

From where we will be

Expecting a local rebound

As we are locally bullish biased

So we can enter a long trade

With the Take Profit of 1.3290

And the Stop Loss of 1.3147

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS SUPPORT AHEAD|LONG|

✅NATGAS is set to retest a

Strong support level below around 3.00$

After trading in a local downtrend from some time

Which makes a bullish rebound a likely scenario

With the target being a local resistance above 3.40$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_JPY LOCAL SHORT|

✅AUD_JPY price went up sharply

But a strong resistance level was hit around 91.500

Thus, as a pullback is already happening

And a move down towards the target of 89.500 shall follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-NZD Local Long! Buy!

Hello,Traders!

GBP-NZD is going down

Again to retest the horizontal

Support level of 2.2253 so

After the price hits the level

A local bullish rebound is

To be expected

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold Hits New ATH Amid Escalating US–China Tensions📌 Gold Hits New ATH Amid Escalating US–China Tensions: How Far Can It Go? 🧨📈

Gold has reached another all-time high (ATH) as geopolitical tensions between the United States and China intensify. Markets have become incredibly sensitive, reacting sharply to political rhetoric and economic policy shifts from the world’s most powerful leaders.

As investors grow increasingly uneasy, gold continues to serve its role as a safe haven — but the real question now isn't whether gold will rise, but rather: how high can it go?

🌍 Geopolitical Sensitivity at its Peak

A single tariff threat or retaliation can trigger gold to surge by $30–$50.

Conversely, a pause in policy or a diplomatic “cool down” can cause price to drop hundreds of points.

In this environment, political narratives are driving markets more than technical setups.

This is one of those rare moments where fundamentals and news flow completely overshadow traditional chart signals. Even textbook candle confirmations are losing reliability — clean bullish closures are often followed by equally strong bearish rejections.

📊 Key Levels to Watch

Support Zones:

3,280 / 3,268 / 3,258 / 3,240 / 3,230

Resistance Zones:

3,292 / 3,302 / 3,310/ 3330

⚙️ Trading Zones

🔽 Sell Zone:

Entry: 3,330 – 3,332

SL: 3,336

TP: 3,325 → 3,320 → 3,315 → 3,310 → 3,300

📈 Buy Zone #1:

Entry: 3,270 – 3,268

SL: 3,264

TP: 3,274 → 3,278 → 3,282 → 3,286 → 3,290 → 3,300

📈 Buy Zone #2:

Entry: 3,240 – 3,238

SL: 3,234

TP: 3,245 → 3,250 → 3,255 → 3,260 → 3,264 → 3,268 → 3,274 → 3,280 → OPEN

⚠️ Final Thoughts & Risk Advisory

With geopolitical tensions rising and volatility surging, trading gold requires extra caution. Avoid chasing momentum blindly — even strong confirmations can flip without warning.

This is a market driven by emotions, news headlines, and global uncertainty, not just technicals. Always stick to your trading plan, and more importantly: respect your SL/TP at all times.

💬 How are you approaching gold in this macro environment? Share your views below – are you holding long or fading the rallies? 👇👇👇

NZD_JPY SHORT SIGNAL|

✅NZD_JPY went up and

Retested the horizontal

Resistance above around 85.023

So we are locally bearish biased

And we can now take a short

Trade with the TP of 83.645

And the SL of 85.405

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD-JPY Will Fall! Sell!

Hello,Traders!

NZD-JPY went up sharply

But then hit a horizontal

Resistance of 85.069

From where we are already

Seeing a bearish pullback

So we will be expecting

A local bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD-USD BEARISH BIAS|SHORT|

✅AUD_USD will soon retest a key resistance level of 0.6409

So I think that the pair will make a pullback

And go down to retest the demand level below at 0.6318

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-USD Support Ahead! Buy!

Hello,Traders!

EUR-USD is making a bearish

Correction towards the

Horizontal support of 1.1197

So after the retest we will be

Expecting a bullish continuation

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

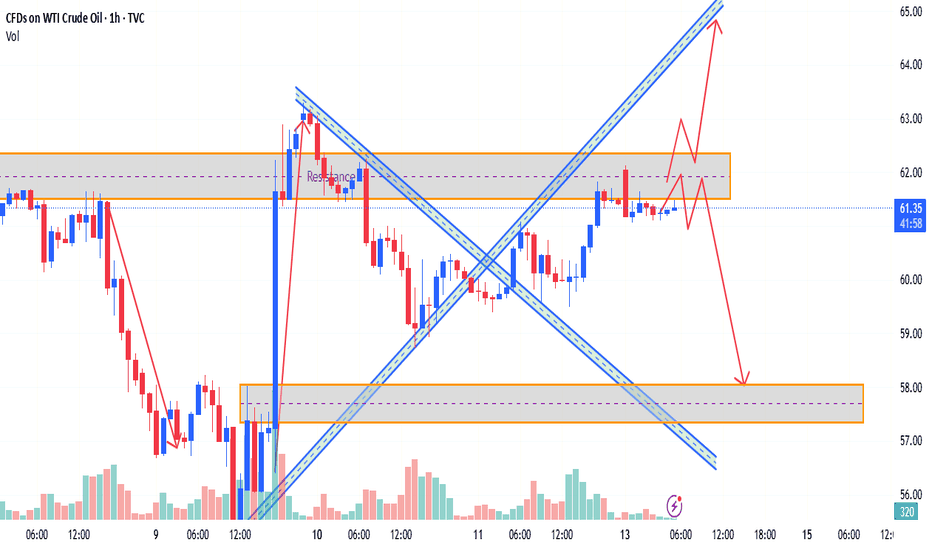

USOIL Chart Overview:

WTI Crude is trading around 61.44, consolidating inside a key resistance zone near62.00. After a strong bullish impulse, price has stalled under this resistance, forming both bullish and bearish paths, highlighting a conflicting market structure

Key Discrepations Identified:

1. Bullish Momentum vs. Resistance Reaction

- Expected: Continuation to 64+ after breakout.

- Reality: Price is struggling below resistance, rejecting upper boundary multiple times.

- Discrepation: Bullish momentum is slowing, and repeated rejections are exposing potential reversal pressure.

2. Volume Strength vs. Breakout Potential

- Volume d…

- Visually this implies strength, but price is hovering in indecision, neither breaking up nor down convincingly.

- Discrepation: Chart setup shows both bullish continuation and bearish breakdown possibilities, confusing structure

4. Double Scenario Projection

- The projection shows both:

- A bullish breakout to 64.

- A rejection and selloff to 58.

- Discrepation: Market is giving mixed technical signals, suggesting traders should wait for confirmation before committing

Discrepation Summary Table:

| Element | Expectation | Observed Reality | Discrepation | Projection Conflict | Clear trend continuation | Dual projection shown | Market indecision + low conviction |

📉 Conclusion:

While WTI remains inside a short-term bullish structure, the presence of conflicting breakout signals, resistance rejections, and declining volume point toward a discrepation. Traders should watch the 62.00 resistance zone closely. A clear rejection or breakout will resolve this divergence, with downside targeting 58.00, and upside toward $64.00.

Let me know if you'd like a summarized version for a caption or post!

SILVER SHORT FROM STRONG RESISTANCE|

✅SILVER is going up now

Following the market-wide

Bullish rebound on most assets

But a strong wide resistance

Level is ahead around 33.00$

Thus I am expecting a pullback

And a move down towards

The local target of 31.75$

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_USD SWING LONG|

✅EUR_USD made a strong

Breakout of the massive wide

Key horizontal level of 1.1235

Which is now a support and

As the breakout is confirmed

And the pair is in a strong

Uptrend our bullish bias is

Confirmed and we will be

Expecting further growth

On Monday

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_CAD LOCAL REBOUND COMING|LONG|

✅EUR_CAD is trading in

A strong uptrend and the pair

Made a local correction on Friday

To retest the local horizontal

Support level of 1.5700 so

A bullish continuation is to

Be expected but a small

Lot size use is advised

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-CHF Local Bullish Bias! Buy!

Hello,Traders!

EUR-CHF has hit a horizontal

Demand level abound 0.9202

And we are already seeing a

Local bullish rebound so

Despite this being a counter

Trend long, we will still be

Expecting a local bullish

Correction on Monday

Because the pair seems to

Be oversold, however, we

Would suggest using small

Lot size due to how risky and

Volatile the market has been

These last few weeks

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.