EUR_CHF SUPPORT AHEAD|LONG|

✅EUR_CHF is about to retest a key structure level of 0.9204

Which implies a high likelihood of a move up

As some market participants will be taking profit from short positions

While others will find this price level to be good for buying

So as usual we will have a chance to ride the wave of a bullish correction

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Forex-trading

EUR-USD Will Keep Growing! Buy!

Hello,Traders!

EUR-USD is trading in a

Strong uptrend and the pair

Made a strong bullish breakout

Of key horizontal level of 1.1245

Which is now a support and

As the breakout is confirmed

Which is only reinforces our

Bullish bias we will be

Expecting a further bullish

Move up towards the

Target of 1.1507

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

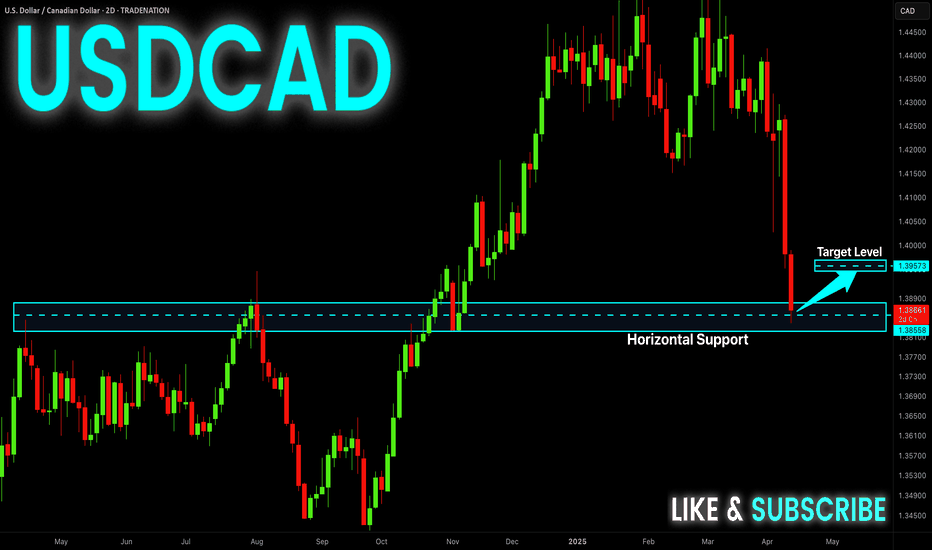

USD-CAD Swing Long! Buy!

Hello,Traders!

USD-CAD fell sharply to

Retest a horizontal support

Level of 1.3855 and as it is

A strong horizontal demand

Are we will be expecting a

Bullish correction on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD_JPY WILL FALL|SHORT|

✅USD_JPY is already making

A bearish pullback from the horizontal

Resistance of 144.500 while trading

In a downtrend so we are bearish

Biased and we will be expecting

A further bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-NZD Bullish Bias! Buy!

Hello,Traders!

EUR-NZD is approaching a

Wide horizontal support

Level of 1.9240 so as the

Pair is trading in a local

Uptrend we will be expecting

A local bullish rebound

After the pair retests the

Support on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_USD SHORT FROM SUPPLY AREA|

✅NZD_USD is going up now

But a strong resistance level is ahead at 0.5860

Thus I am expecting a pullback

And a move down towards the target at 0.5790

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-JPY Risky Short! Sell!

Hello,Traders!

USD-JPY is trading in a

Downtrend and the pair

Is making a local pullback

But will soon hit a horizontal

Resistance level of 144.700

From where we will be

Expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_NZD LOCAL LONG|

✅EUR_NZD is going down

Now but a local horizontal

Support level is ahead at 1.9300

So after the retest a local

Bullish rebound is to be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-GBP Bullish Bias! Buy!

Hello,Traders!

EUR-GBP is trading in a

Strong uptrend and the pair

Made a bullish breakout of

The key horizontal level

Of 0.8623 then surged

Further up and is now

Making a local bearish

Correction so we are

Bullish biased and after

The retest of the new

Support level we will be

Expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_USD BULLISH BREAKOUT|LONG|

✅AUD_USD is going up now

And the pair made a bullish

Breakout of the key horizontal

Level of 0.6200 which is now

A support and the breakout

Is confirmed so we are locally

Bullish biased and we will be

Expecting a further move up

After a potential pullback

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD-USD Short From Resistance! Sell!

Hello,Traders!

NZD-USD is once again

About to retest a horizontal

Resistance level of 0.5840

Which is a strong supply

Area from where a local

Bearish pullback is to

Be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCHF (1W) – Preparing for a Potential ReversalThe chart shows strong bearish momentum, but price is approaching a potential demand zone, though it hasn't fully tested it yet. The main focus is on the 0.8080–0.8095 area, aligned with the 0.618 Fibonacci level — a key point where a bounce may occur.

Key Levels:

🔹 Buy Zone #1: 0.8080–0.8095

→ 0.618 Fibonacci, previous consolidation, and a potential reversal point

🔹 Buy Zone #2: 0.7780–0.7800

→ 0.786 Fibonacci, deeper support and lower boundary of the structure

Scenario:

The current structure hints at a possible W-pattern formation after a dip into the demand zone.

If the bullish scenario plays out, potential recovery targets include:

→ 0.8300–0.8500 – initial correction targets

→ 0.8770 – major resistance (Fibo 0.236)

Alternative View:

If price breaks below the 0.7780 level, the structure would shift bearish — next area of interest could form below 0.75.

USDCHF is in a wait-and-watch zone. The downward move continues, but key levels (especially 0.8080 and 0.7780) are worth watching as potential demand zones. There’s a high probability of a technical bounce or reversal setup developing once these zones are tested.

CAD_CHF RISKY LONG|

✅CAD_CHF has retested a key support level of 0.5892

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 0.5949 is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-USD Swing Short! Sell!

Hello,Traders!

EUR-USD grew nicely

Today but will soon hit

A horizontal resistance

Level of 1.1279 so after

The retest we will be

Expecting a local bearish

Correction and a move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USOIL Oil – April 10, 2025

Price Action & Trend Analysis:

- Current Market Position:

- WTI Crude Oil is showing a bearish trend within a falling wedge pattern, a technical formation that often signals a potential breakout after consolidation. This pattern is visible with converging trendlines (blue), which suggest a potential move to the downside.

- The resistance zone is marked at 61.50, and the price is struggling to break above this level. If it does not break out of this level, further downside momentum may be expected.

Key Levels:

1. Resistance Zone:

- The resistance level is clearly marked near 61.50, and price action has repeatedly struggled to move above this level, showing signs of rejection. A failure to break this l…

ChatGPT: 4. FVG (Fair Value Gap):

- There is a Fair Value Gap (FVG) near 58.12, which indicates a possible area of imbalance where price could potentially retrace to fill the gap before moving in its next direction.

Volume Analysis:

- The volume profile indicates decreasing volume as the price approaches the resistance zone at 61.50, which may suggest a weakening of bullish momentum.

- The increasing volume near the support level at 58.00 suggests that buyers are looking to step in at these levels, but this remains to be seen as the price moves toward this region.

Key Observations:

- The bearish divergence observed between price and momentum suggests that bearish pressure is mounting, especially with the price failing to breach resistance and forming lower highs.

- T

AUD_NZD POTENTIAL SHORT|

✅AUD_NZD is going up now

But a strong resistance level is ahead at 1.094

Thus I am expecting a pullback

And a move down towards the target at 1.086

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_USD SHORT FROM RESISTANCE|

✅NZD_USD will soon retest a key resistance level of 0.5680

So I think that the pair will make a pullback

And go down to retest the demand level of 0.5620 below

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_USD SUPPORT CLUSTER|LONG|

✅GBP_USD is going down

To retest a strong support

Cluster of the rising and

Horizontal support levels

So a local rebound is to be

Expected but its a risky

Setup given the general

Volatility on the market

So use small lot size

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BTCUSD ChatGPT: Chart Analysis for Bitcoin (1-Hour Timeframe) – April 08, 2025

Key Observations:

1. Price Action and Trend:

- Bitcoin is in a downtrend, as indicated by the blue descending trendlines, creating lower highs and lower lows.

- The resistance zone is near 80,000, with 79,161 acting as a key level of resistance.

- Price is currently approaching the support level, which is in the range of 75,000 to 77,000, indicating a potential area for price reversal or further decline.

2. Order Block and FVG (Fair Value Gap):

- The order block located near 79,161 to $79,000 is an important zone where price rejected and fell previously. This suggests that sellers have been controlling this level, and it may act as a strong resistance again if the price revisits.

- …

ChatGPT: - As Bitcoin approaches the support level, a surge in volume could indicate a possible breakout or a reversal from the support zone.

4. Target and Potential Movement:

- The target for the current setup is 79,161, near the upper resistance zone, with potential upward momentum from the support area.

- Bitcoin is likely to reach the 79,161 target after bouncing from the support zone. However, if the price fails to break through the resistance, a drop back to the support zone or even further downward movement may occur.

Potential Scenarios:

- Bullish Reversal: If Bitcoin bounces from the support level and breaks above the resistance at 79,161, it may push higher towards 80,000 and beyond. The FVG area will be a critical point to monitor for further upward m…

ChatGPT: Currently, Bitcoin is at a pivotal point, testing support while trying to break through resistance. The next price action will depend on how Bitcoin reacts at these key levels. Traders should keep an eye on 79,161, which could be a crucial turning point for the market direction. If the support holds, a reversal is possible, but failure to maintain the support could lead to further declines.

GBP-USD Strong Breakout! Sell!

Hello,Traders!

GBP-USD made a bearish

Breakout of the key wide horizontal

Level of 1.2851 then made a

Pullback so we are bearish

Biased and a further bearish

Continuation is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

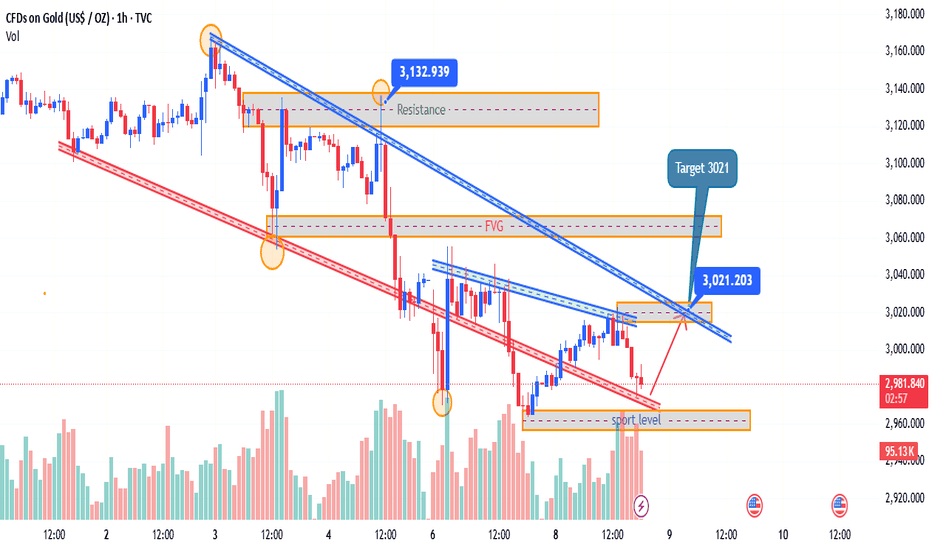

Gold ChatGPT: Chart Analysis for Gold (XAU/USD) – April 08, 2025 – 1-Hour Timeframe

Key Observations:

1. Trend and Price Action:

- The price of Gold is currently in a downtrend, as indicated by the red trendline showing lower highs and lower lows. The price has recently broken below the previous support level, signaling a continuation of the bearish movement.

- The resistance zone near 3,141.64 remains a significant barrier for any upward movement, while the support level at 2,960.00 is holding the price from falling further.

2. Order Block and FVG (Fair Value Gap):

- The order block located at 3,138.95 to 3,141.64 has been a key area where price rejection occurred. The price approached this area but failed to break above, indicating strong selling pressure. This …

ChatGPT: - The target for the current bearish setup is 3,021, which aligns with the support level near 2,987.47. If the price continues to decline, this target could be reached soon, with further downside movement expected.

- If the price holds at the support level and forms a bullish reversal pattern, it may head back towards the resistance zone. However, until the support level holds, the price is likely to continue the downward trajectory.

4. Volume and Market Sentiment:

- The volume shows a consistent decline, confirming the selling pressure. The recent spikes in volume near the support level suggest that the market is reacting to the critical support area.

- Market sentiment remains bearish, with the price currently below its recent highs and the resistan…

ChatGPT: - Bullish Reversal Scenario: If Gold finds support at 2,960 and forms a bullish pattern (such as a reversal candle or engulfing candle), the price might move towards 3,141.64 again.

Conclusion:

The price of Gold is currently in a downtrend, facing resistance around 3,141.64 and support near 2,960. Traders should watch for price action near these levels to assess the next move. The target of 3,021 is the key level to focus on, and a breakout below this could lead to further downside. If the support level holds, there could be a potential for a bullish rebound towards resistance.

NZDUSD: Support & Resistance Analysis and Key Levels 🇳🇿🇺🇸

Here is my latest structure analysis and

important supports & resistances on NZDUSD.

Support 1: 0.5506 - 0.5538 area

Support 2: 0.5470 - 0.5479 area

Resistance 1: 0.5644 - 0.5683 area

Resistance 2: 0.5796 - 0.5854 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.