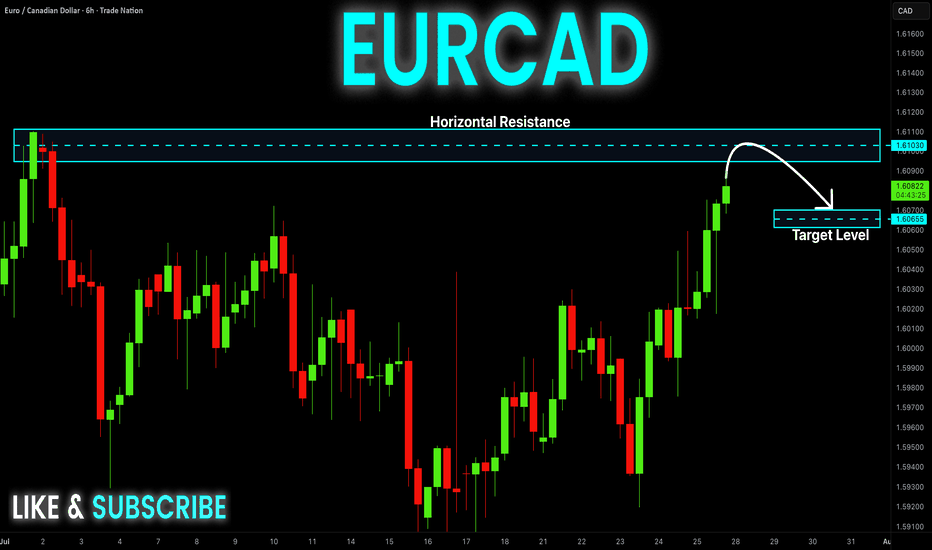

EUR-CAD Risky Short! Sell!

Hello,Traders!

EUR-CAD is trading in a

Strong uptrend so we are

Bullish biased long-term

However a strong horizontal

Resistance is ahead at 1.6110

And the pair is overbought

So after the retest of the

Resistance we will be

Expecting a bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Forex

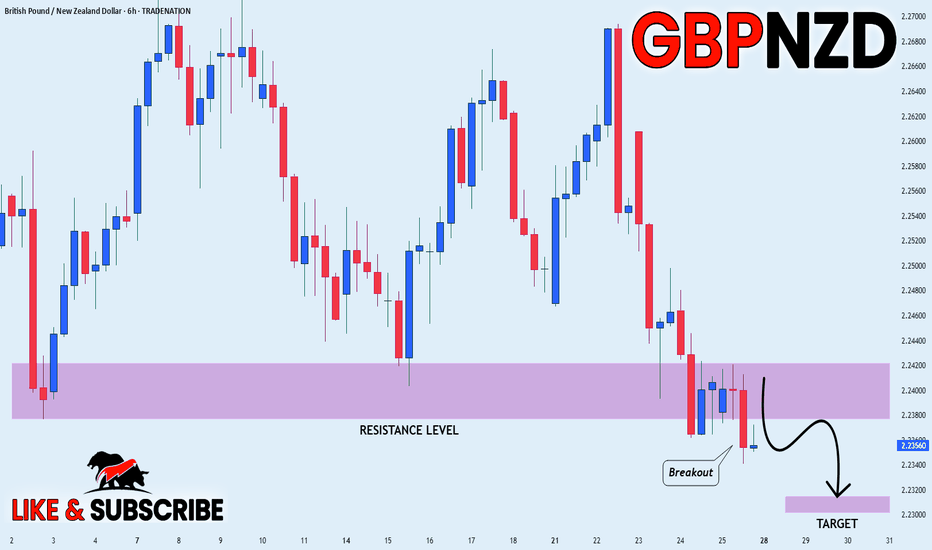

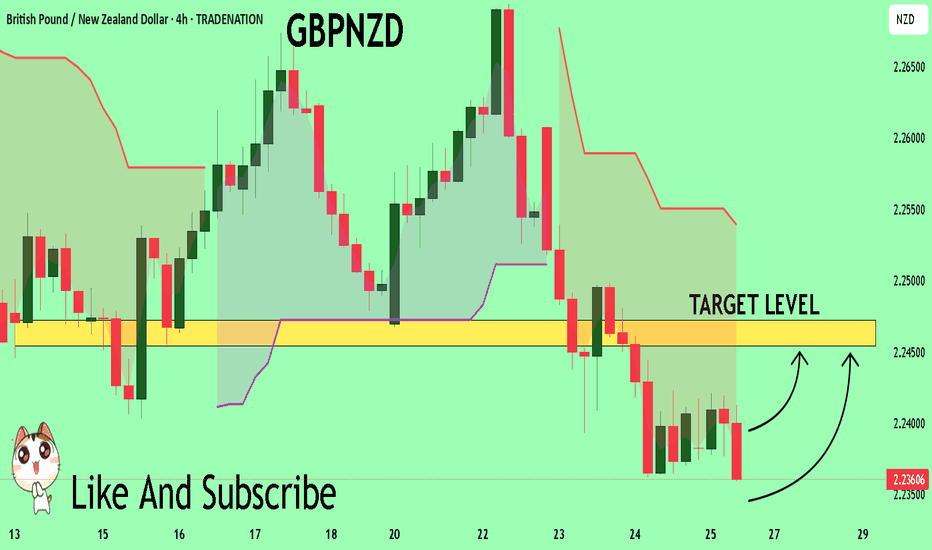

GBP_NZD BEARISH BREAKOUT|SHORT|

✅GBP_NZD is going down currently

As the pair broke the key structure level of 2.2400

Which is now a resistance, and after the pullback

And retest, I think the price will go further down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

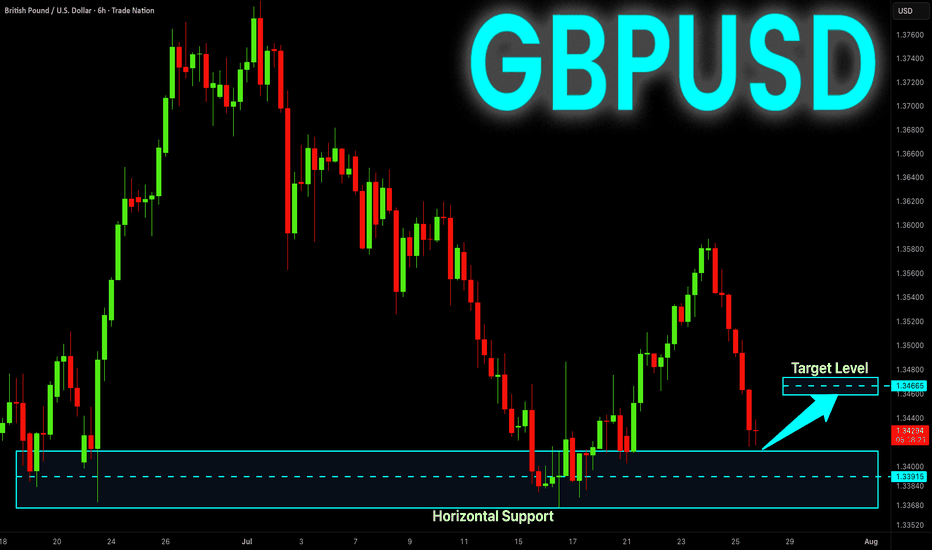

GBP-USD Support Ahead! Buy!

Hello,Traders!

GBP-USD went down but

The pair will soon hit a

Horizontal support level

Of 1.3400 from where we

Will be expecting a local

Rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY SELLUSD/JPY rises further and approaches 148.00 as the US Dollar firms up

The US Dollar rallies for the second consecutive day against the Yen, and approaches 148.00. Strong US data support the Fed's "wait and see" stance and underpin demand for the US Dollar. In Japan, the uncertain political context is likely to deter the BoJ from hiking interest rates further.

Previous market optimism is turning into caution as the market shifts its focus to the monetary policy reports by the Bank of Japan and the US Federal Reserve due next week.

The Fed is widely expected to leave interest rates unchanged next week, more so after the strong US business activity and Jobless Claims figures released on Thursday. These data confirmed that the US economy remains resilient with a healthy labour market, which gives further leeway for the Fed to await further insight into the impact of tariffs before resuming rate cuts. The US Dollar has been trading higher following Thursday’s releases.

Also on Thursday, US President Trump paid an unusual visit to the Federal Reserve, only a few days ahead of their monetary policy meeting. Trump complained about the overcosts of the headquarters’ renovation and pressed for a less restrictive monetary policy, but his unusually soft comments after the visit eased investors’ concerns about the previous attacks on the central bank's independence.

In Japan, the somewhat softer Tokyo inflation figures seen on Friday and the trade deal would help the BoJ to continue hiking interest rates, but the bank is likely to stand pat next week and probably delay further monetary tightening until the political situation clarifies. This is likely to keep the Yen upside attempts subdued in the near-term.

SUPPORT 147.642

SUPPORT 147.311

SUPPORT 146.854

RESISTANCE 148.206

RESISTANCE 147.972

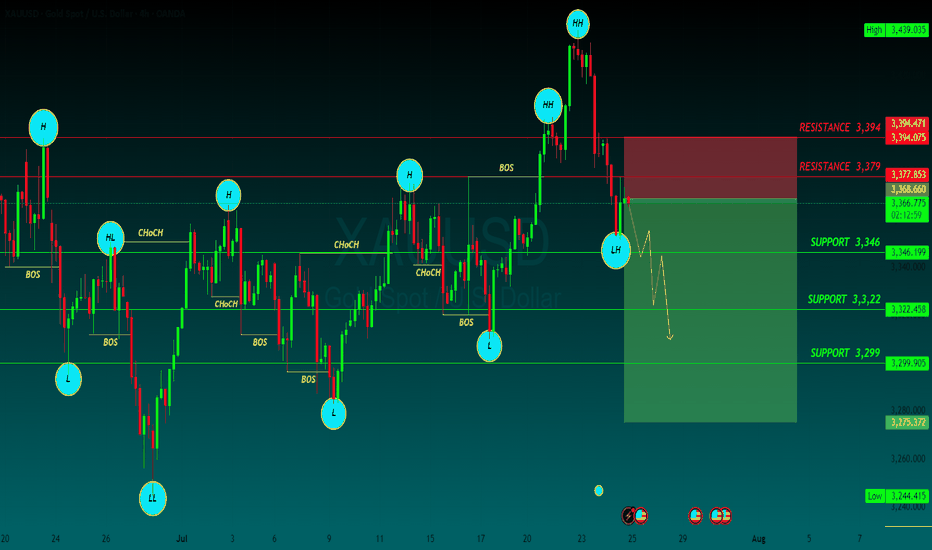

GOLD SELLGold price bears retain control amid fading safe-haven demand, rebounding USD

US President Donald Trump announced late Tuesday that his administration had reached a trade deal with Japan. Furthermore, reports that the US and the European Union are heading towards a 15% trade deal boost investors' confidence and weigh on the safe-haven Gold price for the second straight day on Thursday.

The markets do not expect an interest rate cut from the US Federal Reserve in July despite Trump's continuous push for lower borrowing costs. In fact, Trump has been attacking Fed Chair Jerome Powell personally over his stance on holding rates and repeatedly calling for the central bank chief's resignation.

Moreover, Fed Governor Chris Waller and Trump appointee Vice Chair for Supervision Michelle Bowman have advocated a rate reduction as soon as the next policy meeting on July 30. This keeps the US Dollar depressed near a two-and-a-half-week low and could offer some support to the non-yielding yellow metal.

Traders now look forward to the release of flash PMIs, which would provide a fresh insight into the global economic health and influence the safe-haven commodity. Apart from this, the crucial European Central Bank policy decision might infuse some volatility in the markets and drive the XAU/USD pair.

Meanwhile, the US economic docket features Weekly Initial Jobless Claims and New Home Sales data, which, in turn, would drive the USD and contribute to producing short-term trading opportunities around the commodity. Nevertheless, the fundamental backdrop warrants caution for aggressive traders.

SUPPORT 3,346

SUPPORT 3,322

SUPPORT 3,399

RESISTANCE 3,394

RESISTANCE 3,379

GBPUSD Idea – Demand Zones & Potential Reversal Play🧠 MJTrading:

After a steady downtrend, GBPUSD is now approaching a strong 4H demand zone (Support 1), where we previously saw explosive bullish reactions.

Price is also extended from both EMAs, showing potential for a technical pullback or full reversal.

💡Scenarios to consider:

🔹 If Support 1 holds → we may see a bounce toward 1.3500+

🔹 If broken → Support 2 & 3 offer deeper liquidity and high-probability demand zones

👀 Watch for:

Bullish reversal candles (engulfing / hammer)

Bullish divergence on lower timeframes

Volume spikes on reaction

⚠️ Invalidation:

If Support 3 breaks with strong momentum, we might enter a bearish continuation phase.

#GBPUSD #Forex #ChartDesigner #SmartMoney #PriceAction #MJTrading #ForexSetup #TrendReversal #SupportZones

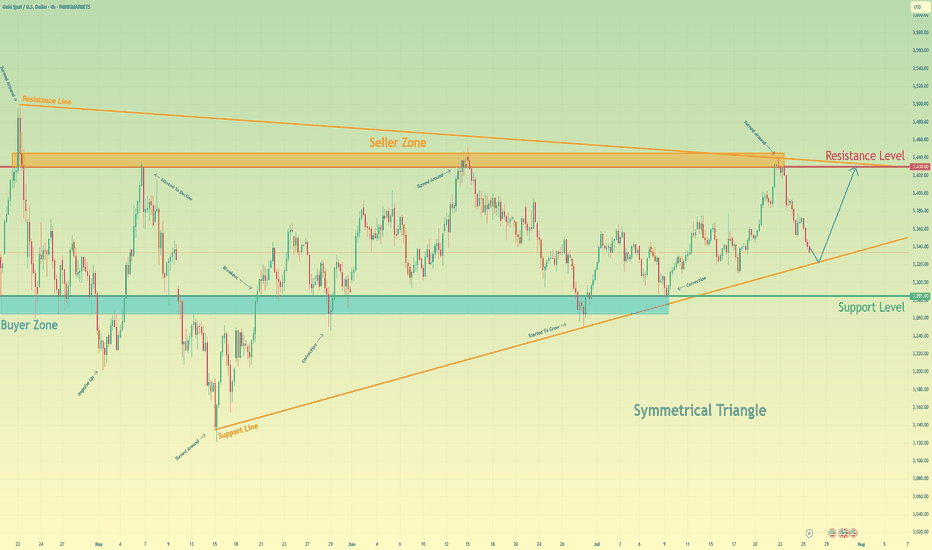

Gold will rebound from support line of triangle and rise to 3430Hello traders, I want share with you my opinion about Gold. Following a sequence of significant upward trends and the subsequent downward corrections that defined its range, gold has entered a broad market zone of consolidation. This battleground is clearly anchored by the historically significant buyer zone around 3285 and a formidable seller zone near 3430. Currently, the asset's price action is coiling and contracting within the confines of a large symmetrical triangle, a classic pattern that signifies a period of equilibrium and energy build-up before a potential high-volatility breakout. After a recent upward rebound was decisively rejected by the upper resistance line, the price is now in a corrective descent, heading towards the crucial ascending support line of the triangle. The primary working hypothesis is a long scenario, which is based on the expectation that this downward move will find strong buying interest on this key trendline, respecting the pattern's integrity. A confirmed and strong bounce from this level would signal another complete upward rotation within the triangle is underway. Therefore, the tp is logically and strategically set at the 3430 resistance level, as it not only aligns with the formation's upper boundary but also represents the major seller zone, a natural magnet for price on such a rebound. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

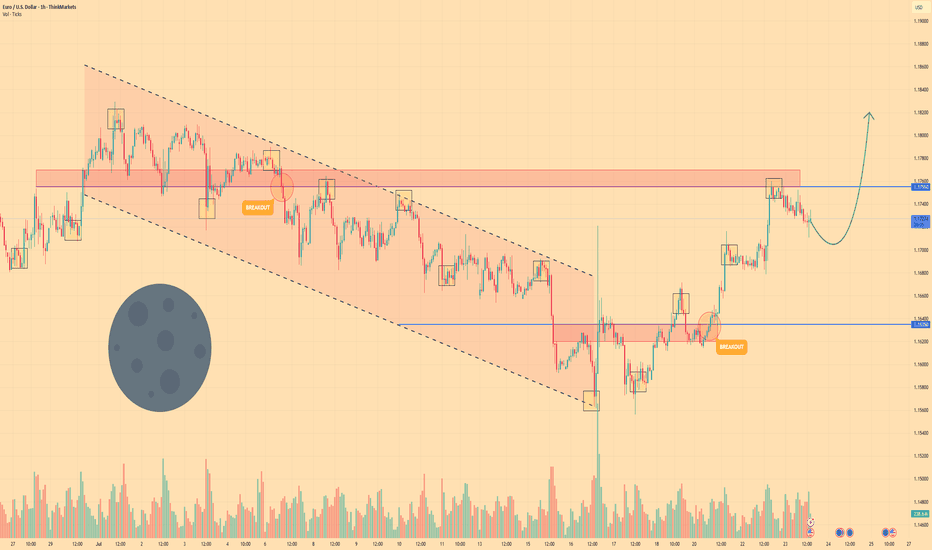

Euro may reach resistance level, break it and continue to growHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

For an extended period, the price was dictated by a descending channel, with each rally attempt failing at its upper boundary.

The downward trend culminated in a test of the crucial support level at $1.1635, where sellers were unable to secure a foothold, signaling a potential momentum shift.

This shift was confirmed when buyers took control, launching an upward impulse that decisively breached the long-standing resistance of the channel's upper trendline.

After the breakout, the price established a new local support base above the former channel, solidifying the change in market structure.

The subsequent rally carried the asset's price to the significant horizontal resistance zone around $1.1755, where the upward advance has temporarily stalled.

I expect that after a brief consolidation, bullish pressure will resume, enabling the price to break the $1.1755 barrier and continue towards the $1.1820 target.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

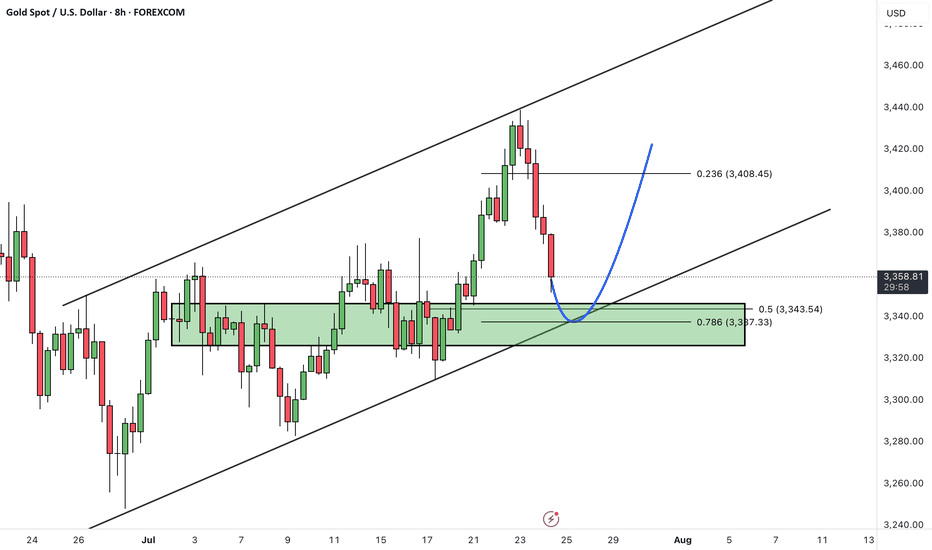

XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

Gold entered a corrective phase after reaching the top of its ascending channel. Price is now approaching the channel bottom, which coincides with a key support zone.

As long as the channel support holds, we expect a bullish reaction from this area, potentially driving price back toward the next target level.

The uptrend remains valid as long as price does not break and close below the lower boundary of the channel.

A rebound from channel support may signal the start of the next upward leg.

Invalidation occurs only if price breaks and holds below the channel.

💡 Will gold bounce from channel support and resume its rally? Share your view in the comments! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️

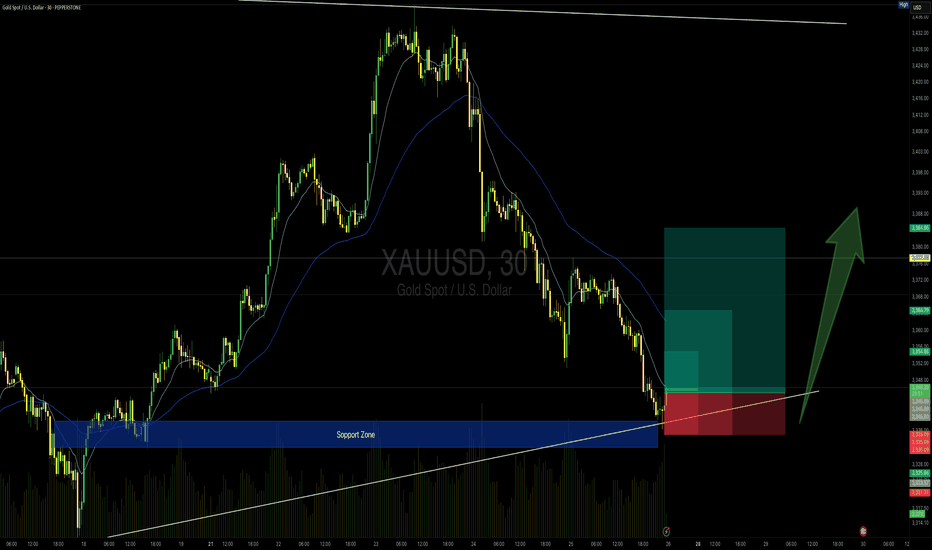

GOLD 30min Buy Setup (High Risk - High Reward)📍 TVC:GOLD 30min Buy Setup – MJTrading View

After an extended bearish leg, price has tapped into a strong support zone that previously acted as a launchpad. Also touching the main Uptrend...

We now see initial signs of absorption with potential reversal setup forming just above the ascending trendline.

🔹 Entry Zone: 3344–3346

🔹 SL: Below 3335 (under structure & wick base)

🔹 TP1: 3355

🔹 TP2: 3365

🔹 TP4: 3385+ (if momentum sustains)

🔸 RR: Up to 1:4 depending on target selected

🧠 Context:

– Still inside broader bullish structure (macro HL)

– Support zone coincides with rising trendline

– Potential for bullish reaccumulation after sharp drop

– Volume spike near zone suggests active buyers

Stay sharp and manage your risk please...

See the below Idea for full concept:

"Support isn't just a level — it’s a battlefield. If buyers win, they don’t look back."

#MJTrading #Gold #BuySetup #PriceAction #SmartMoney #ChartDesigner #ReversalSetup #MarketStructure

Psychology Always Matters:

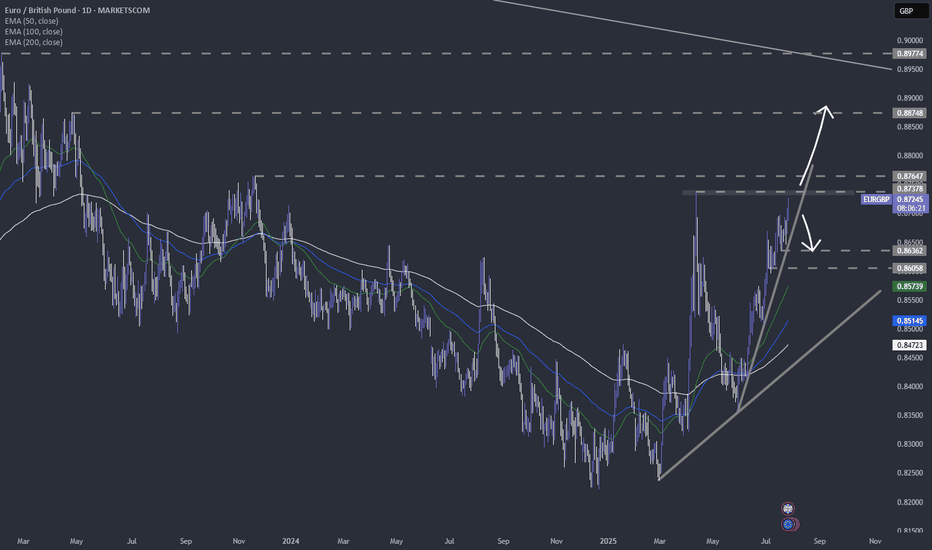

EURGBP near the current highest point of 2025.FX_IDC:EURGBP is slowly approaching a strong area of resistance, which is the current highest point of 2025. Let's dig in...

MARKETSCOM:EURGBP

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

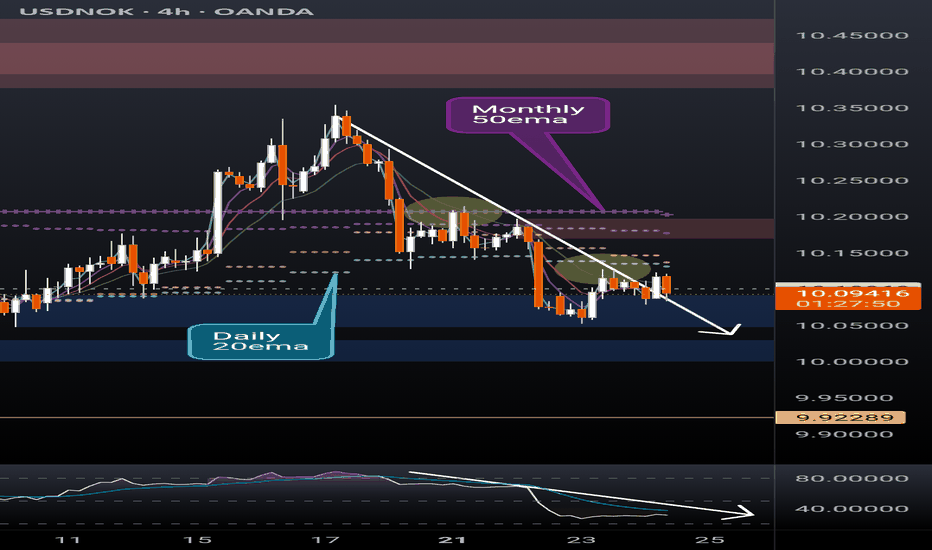

USDNOK short potential setupUSDNOK recently broke down below the monthly 50ema (overlayed on this 4h chart) and has rejected off the daily 20ema (overlayed) twice this week. RSI is showing bearish momentum after a brief overbought period while the PA has remained in a strong downtrend. Short setup potential is evident but not certain.

I'm a cat not a financial advisor.

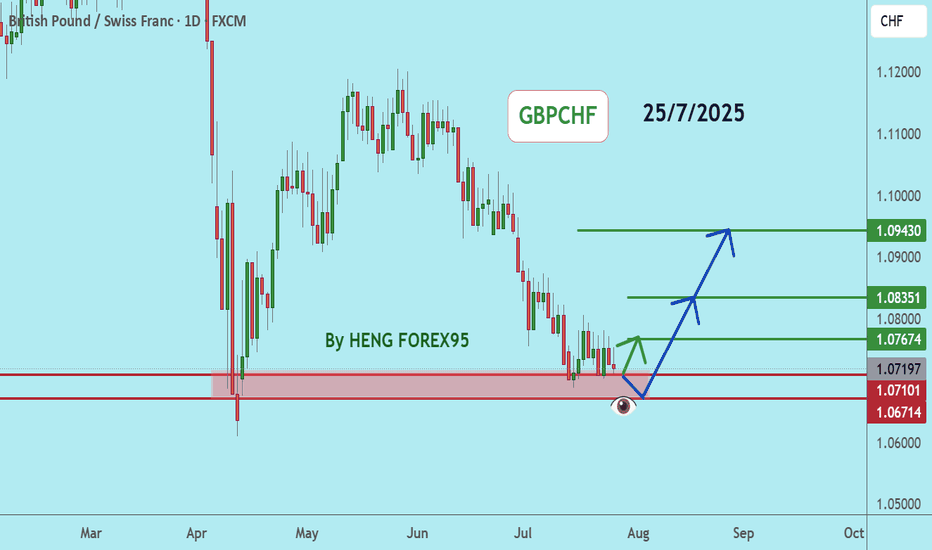

GBPCHFGBPCHF price is near the main support zone 1.07101-1.06714. If the price cannot break through the 1.06714 level, it is expected that the price will rebound. Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

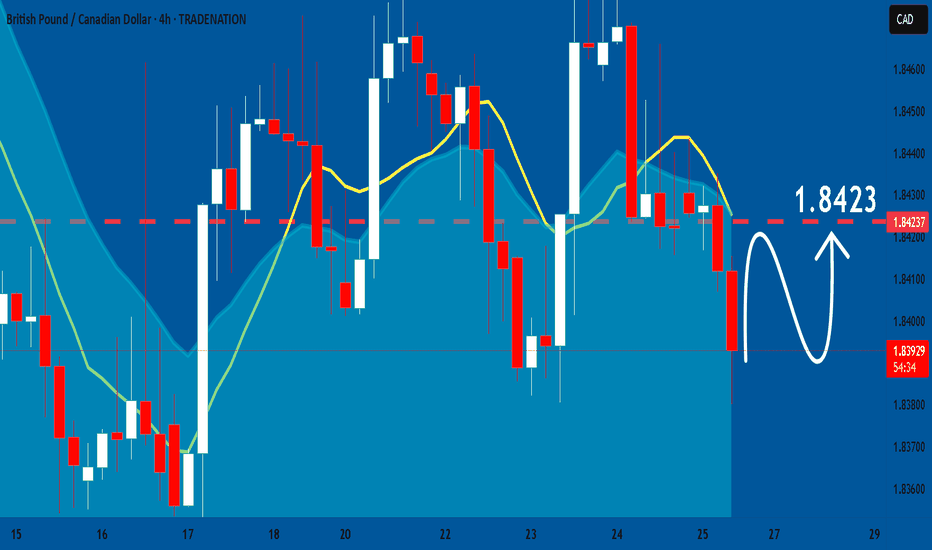

GBPCAD: Growth & Bullish Continuation

The price of GBPCAD will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD: Long Signal with Entry/SL/TP

EURUSD

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy EURUSD

Entry - 1.1724

Stop - 1.1714

Take - 1.1743

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

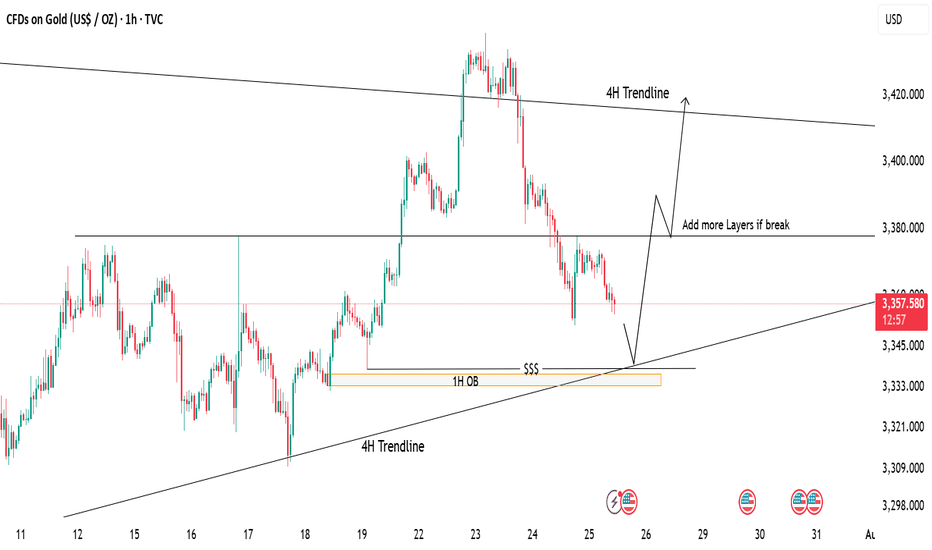

Gold Tapping Into Major Support – Eyes on Bullish ReversalPrice is currently retracing after a strong drop from recent highs. We're now approaching a key demand zone, aligning with:

📍 1H Order Block (OB)

📍 4H Trendline Support

📍 Liquidity Zone ($$$)

📉 If price taps into this area, it may offer a high-probability long setup.

📈 First target: 3380 (mid-range resistance)

🧱 If this breaks, we can look to scale in/add more positions, targeting the 4H trendline zone near 3420.

⚠️ Waiting for price reaction at support – patience is key!

GBPNZD Will Explode! BUY!

My dear friends,

My technical analysis for GBPNZD is below:

The market is trading on 2.2361 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 2.2454

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

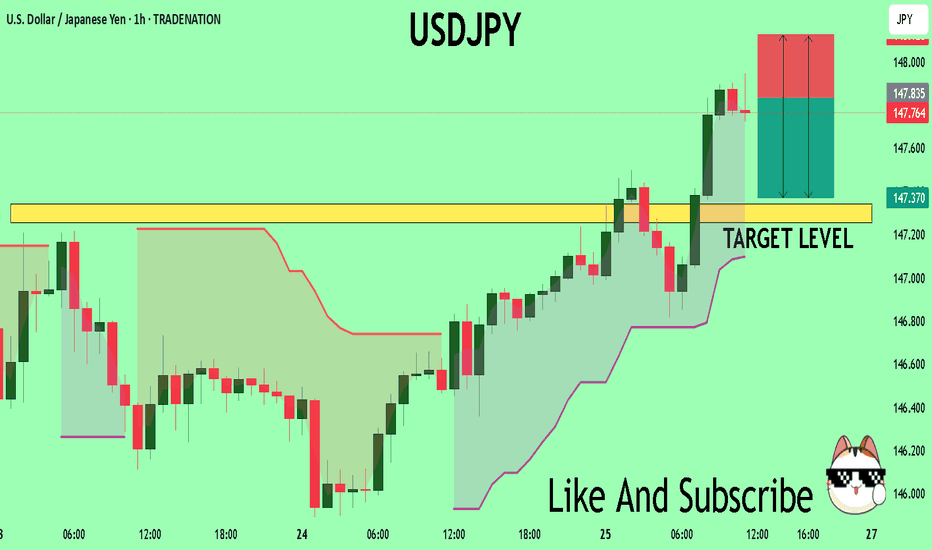

USDJPY Under Pressure! SELL!

My dear subscribers,

My technical analysis for USDJPY is below:

The price is coiling around a solid key level - 147.83

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 147.34

My Stop Loss - 148.12

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

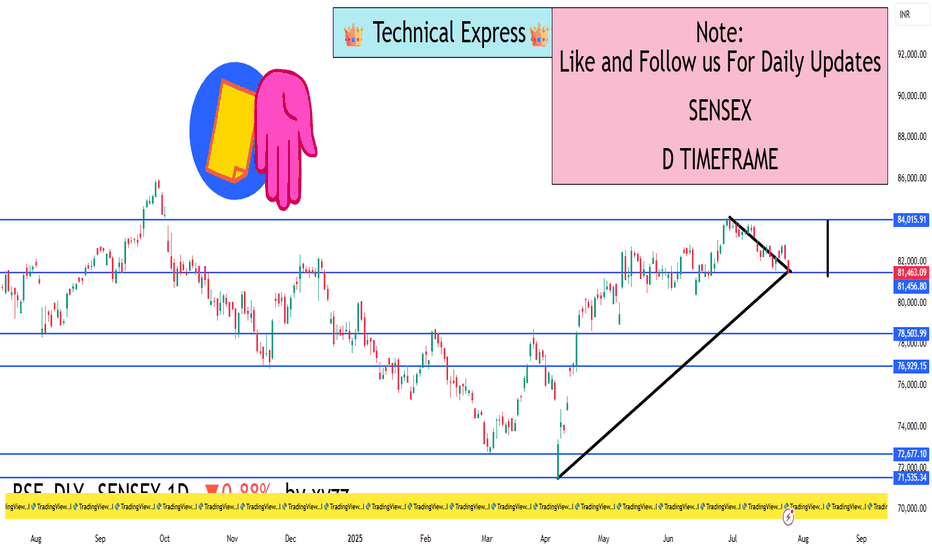

SENSEX 1D Timeframe📉 SENSEX Daily Overview (as of July 25, 2025)

Current Price: Around 81,460

Daily Change: Down by approximately 720 points (–0.9%)

Day’s High: About 82,070

Day’s Low: About 81,400

Previous Close: Around 82,184

📊 1-Day Candlestick Analysis

The candle for today is bearish, indicating strong selling pressure.

The price opened near previous levels but faced resistance at around 82,000.

Sellers dominated most of the day, pushing the index toward the 81,400 support zone.

🔍 Key Support and Resistance Levels

Level Type Price Range

Resistance 82,000 – 82,200

Support 81,400 – 81,000

If Sensex breaks below 81,400, the next target could be around 80,500 or 79,900.

If it holds above support and bounces, it could retest 82,200.

🧠 Technical Trend Analysis

Short-Term Trend: Bearish

Medium-Term Trend: Neutral to mildly bullish (as long as above 80,000)

Market Structure: Lower highs forming, suggesting pressure building on bulls

Indicators (assumed):

RSI may be approaching oversold

MACD likely showing bearish crossover

Volume increasing on red candles—indicating strong sell interest

📌 Sentiment & Market Context

Financial stocks (like banking, NBFCs) are under pressure.

Global cues (such as interest rate uncertainty and geopolitical concerns) are impacting investor confidence.

FII outflows and weak earnings in key sectors are adding to bearish momentum.

The broader trend remains range-bound, but with short-term downside bias.

✅ Strategy Suggestions (For Traders & Investors)

Swing Traders: Wait for a reversal candle (like a bullish engulfing or hammer) before considering long positions.

Breakout Traders: Watch for breakdown below 81,000 for continuation of the fall.

Positional Traders: Can wait to enter near 80,000–79,500 if the market holds that key level.

🔄 Summary

SENSEX is under pressure with a drop of 720+ points.

Technical structure suggests caution, especially if 81,000 breaks.

Support: 81,000 – 80,500

Resistance: 82,000 – 82,200

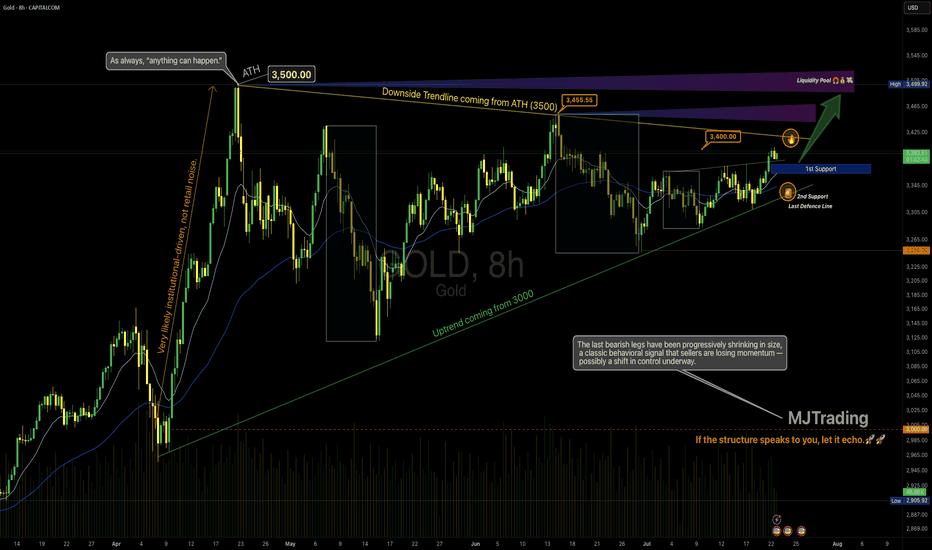

Gold – Bear-to-Bull Transition in Motion?🧠 MJTrading:

TVC:GOLD – 8H Chart: Bulls, It’s Your Move.

📸 Viewing Tip:

🛠️ Some layout elements may shift depending on your screen size.

🔗 View the fixed high-resolution chart here:

The impulsive move from 3000 to 3500 wasn’t just a trend — it was a statement of strength.

That rally carved the ATH, then left behind weeks of digestion and structural compression.

Now, the market may be setting up for its next decision.

Notice how each bearish leg has been shrinking — a classic behavioral signal that sellers are losing momentum — possibly a shift in control underway.

We’re also pressing above the downtrend line from the ATH (3500), while the uptrend from 3000 remains clean and respected.

We’re now testing the 3400 zone — a key battleground.

📍 If bulls want to reclaim the momentum and show dominance, this is the moment to act.

🔹 1st Support: 3363–3377

🔹 2nd Support: Rising trendline

🎯 Target Zone: 3455–3500+ (Liquidity Pool & ATH proximity)

⚠️ Break back inside the triangle could delay the breakout narrative.

⚠️ If momentum fails to increase from here, and bulls can’t break out with conviction, the market is likely to remain range-bound for longer — extending the sideways phase between 3250–3500.

💭 If you’re watching for a new ATH… stay sharp, stay structured — the market rewards patience and readiness.

“If the structure speaks to you, let it echo, boost it.”

📐 MJTrading 🚀

What do you think?

#GoldAnalysis #XAUUSD #MarketStructure #LiquiditySweep #AnythingCanHappen

#MJTrading

#ChartDesigner

Psychology Always Matters:

Click on them for the caption...

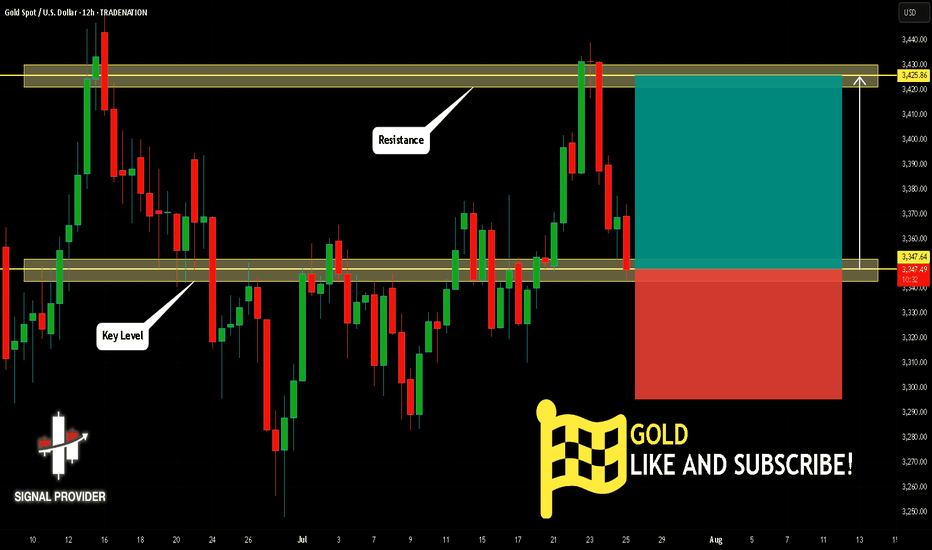

GOLD Will Move Higher! Buy!

Here is our detailed technical review for GOLD.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 3,347.64.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 3,425.86 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

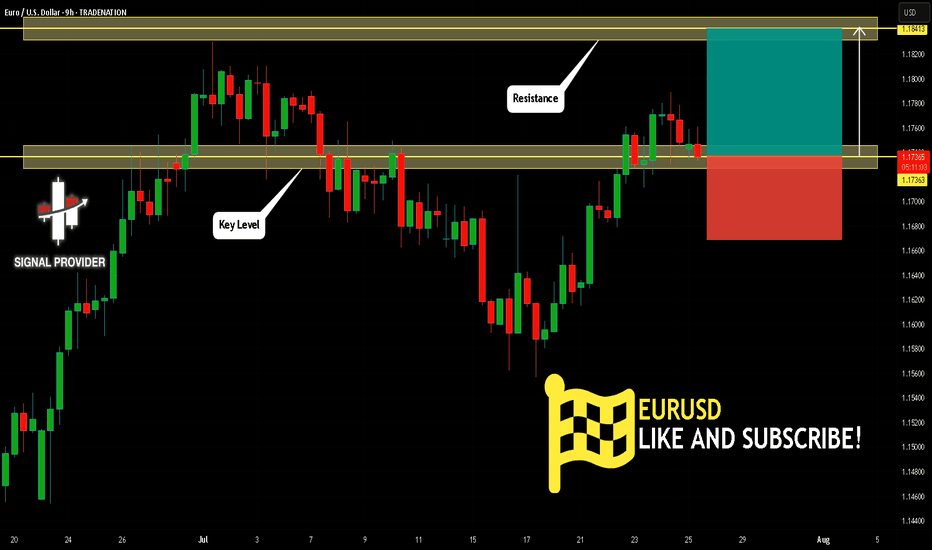

EURUSD Is Bullish! Long!

Take a look at our analysis for EURUSD.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 1.173.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 1.184 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!