Forex100academy

Harmonics Patterns on USDCADSome of my trading counterparts and colleagues asked me why I am so into USDCAD recently and still holding on to my trade since I shorted this pair during Xmas 2018 on a Weekly Bearish Bat pattern completion. So I decided to share this education segment to the trading community on some insights of my trading strategies.

Take a look at my chart on the USDCAD H4 timeframe. I have tried my level best to scale the chart so that all my analysis to identify Harmonic Patterns are still visible to viewers. Can you spot how many patterns are there? There is a potential buy opportunity now as well since H4 Bat is completed.

For Harmonic Pattern traders, we know that each pattern completes at Point D, regardless whether they are Bullish or Bearish patterns. Some of the harmonics patterns that I use:

1) Bat

2) Gartley / Deep Gartley

3) Butterfly

4) Shark

5) Crab / Deep Crab

6) 5-0

I also combine other strategies I have learned such as Supply & Demand, Structure Trading, Candlestick Analysis, and most importantly Multiple Timeframe Analysis. Back to the trade I am currently in, at the moment it is running 400+ pips of profit, closing in to 500pips while my TP1 level is at 540pips. This is my big timeframe trade and I know USDCAD has huge potential to go even lower. While having this thought, what else can I do:

- do short selling on this pair on smaller timeframes to build up my position.

- when a bullish Harmonics Pattern emerges and it fits all my trade filters, long the pair and aim for conservative targets (I am on long term bearish-ness for the pair).

- move my stop loss gradually each time a major support level is broken to lock in my profits, you dont want to give back the profits to the market!

- check my indicators on big time frame for trend reversal to determine if I should take profit early.

After trading for some years now, an important lesson I want to share with you is to stick to the few strategies that has been proven profitable over a series of back-testing. I am fortunate to learn the AUTHENTIC way to trade Harmonics Patterns and hence sharpen my trading skill dramatically. Sure there are many other trading strategies that are also profitable, however let us not go into learning everything there is to offer out there, instead focus on being a consistent and profitable trader. I always think back the very reason why I come into the trading scene about 5-6 years ago - To profit from the financial markets and free up time and life choices to pursue the more important things in life such as quality family time. I am glad that things are working out slowly for me, what about you?

Thank you for reading, one final take away I like my readers to have - stay focus on your life goals and stick to your trading plan/rules.

Do like and share this post. Follow me if my trading style suits you as I will be posting new trade ideas and analysis regularly.

USDJPY-Weekly Market Analysis-Feb19,Wk5Based of the 4-hourly chart buy zone, is great to see an emerging bullish bat completes within the zone.

Let see if it form up by 4th March 2019, if not most likely this Bullish Bat Pattern is invalid.

My exact trading decision of this will be shared with my subscribers.

This Wednesday, 26 Feb 2019, 8.08pm-10pm(+8GMT) I will be going through 12 currency pairs on the mid-week analysis

Like our facebook page so when we went live, you will be notified.

SHARE our post so more traders can benefit from the analysis and

COMMENT 1 thing that you like about the analysis.

Your support is greatly appreciated.

EURUSD-Weekly Market Analysis-Feb19,Wk51 thing I love on the bearish shark, it completes at the sell zone on the daily chart.

But 1 thing I don't like about it, the ABCD completion came into the zone of previous support which is a legit resistance area.

My exact trade plan will be shared with my subscribers.

This Wednesday, 26 Feb 2019, 8.08pm-10pm(+8GMT) I will be going through 12 currency pairs on the mid-week analysis

Like our facebook page so when we went live, you will be notified.

GBPUSD-Weekly Market Analysis-Feb19,Wk5Bullish Bat completion in the Potential Reversal Zone(PRZ) as a counter-trend trade.

I will be sharing my decision in engaging this trade and exact stops and targets with my subscribers.

This Wednesday, 26 Feb 2019, 8.08pm-10pm(+8GMT) I will be going through 12 currency pairs on the mid-week analysis

Like our facebook page so when we went live, you will be notified:

AUDCHF M15 Bearish Bat Harmonics PatternWait for price to retrace to the sell zone marked in grey and completion of the Bearish Bat Pattern.

Selling with larger timeframe downward trend.

Entry price around 0.7168

For more conservative traders, can look out for pin-bar / doji candles for confirmation before entering the short.

Do like and share this post. Follow me if my trading style suits you as I will be posting new trade ideas and analysis regularly.

Trade Ideas Position: NZDUSD SharkBullish Shark setup in this sideway market, to some of my students it is a side ways bounce on the daily chart.

This shark formation form on previous support which is ideal for me to engage and even place a pending order on this.

The exact entry, stops and targets sent to my subscribers.

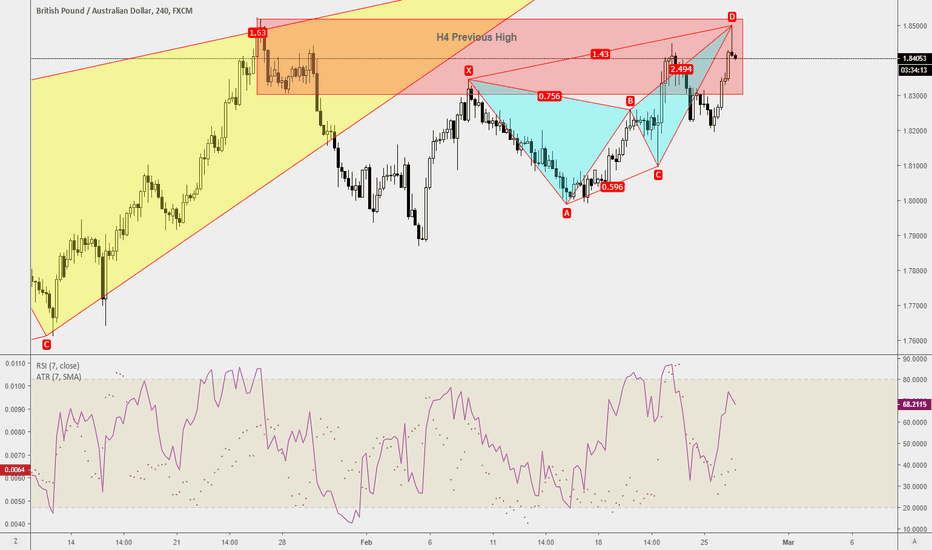

GBPNZD H1 Bearish BatH1 Bearish Bat Harmonics Pattern

The pattern will complete at point D however I am entering trade on a deeper price represented by the black dotted line. Reason for this is because this is GBPNZD - GBP cross pair and tend to be more volatile and higher broker spread.

I saw bigger Bullish Harmonics Patterns on H4 and Daily on the Higher timeframe and gave me added reason to short this pair at this level.

Entry: 1.8965

SL: 1.9032 (-67pips)

TP1: 1.8846 (+119pips)

TP2: 1.8780 (+185pips)

Do like and share this post. Follow me if my trading style suits you as I will be posting new trade ideas and analysis regularly.

Trade Ideas Position: USDCAD BatA bullish bat pattern on this setup gives a good consideration to engage the trade.

If you have spotted, CADJPY gives an Emerging Bearish Shark Formation and such give traders more thoughts on currency correlation.

Will this affect your trade plan?

Think about it.

Exact Trade Plan sent to my subscribers.

Trade Ideas Position: AUDUSD GartleyA bullish gartley setup in the midst of our 2:1 for a double bottom retest that we shared yesterday during our Mid Week Analysis LIVE session on Facebook.

Like our page if you don't wish to miss the next time we head in online.

Exact Entry Stops and Targets will we shared wit my subscribers.

Trade Ideas Position: NZDUSD BatBearish Bat formation forming up. One nice thing on this formation is the Pt D completion is not just near X but is near a consolidation area.

But what I don't quite like is the recent bullish candle is stronger than the bearish candle.

Exact Entry, Stops and Targets sent to my subscribers.

Trade Ideas Review : EURJPY BatJust like all other traders, at the moment when this trade is engaged, the trader(I) see this trade as a Profitable Trade, hence, I've engaged the trade.

What makes me different is that the trading system has been tested, I emotionless engage the trade in acceptance of the worst case scenario, in this case, losing.

The outcome on either Profit or Loss doesn't surprise me in any way.

In this case, a 38pips if a standard contract traded, it's a 380USD/lot gained. To me, I measure all profitability in pips and not in %gained as each trader might engage the same trade in a different approach.

This trade was spotted last week during our Live Mid-Week Analysis, full video version can be found on our facebook page, under Mid-Week Analysis. EURJPY was our fourth analysis of the session.

So what are you waiting for? Like our facebook page and join our live session.

Trade Ideas Position: EURJPY BatSpotted this trade yesterday, what's even more interesting is that my colleague spotted this too.

The purple zone is potential price zone for our counter trend move.

A new colour scheme I've added to my list apart from the usual pink and cyan that represent sell or buy zone.

Exact Entry, Stops and Targets sent to my subscribers.

GBPUSD-Weekly Market Analysis-Feb19,Wk4This week for the Weekly Market Analysis for GBPUSD, I'm waiting for a shorting opportunity back into the sell zone.

Such an opportunity could happen in any moment as this is when I will be waiting for a double top on the lower time frame, in this case, the 1-hourly chart(on the left.)

You can watch the video version of this analysis on our facebook page.