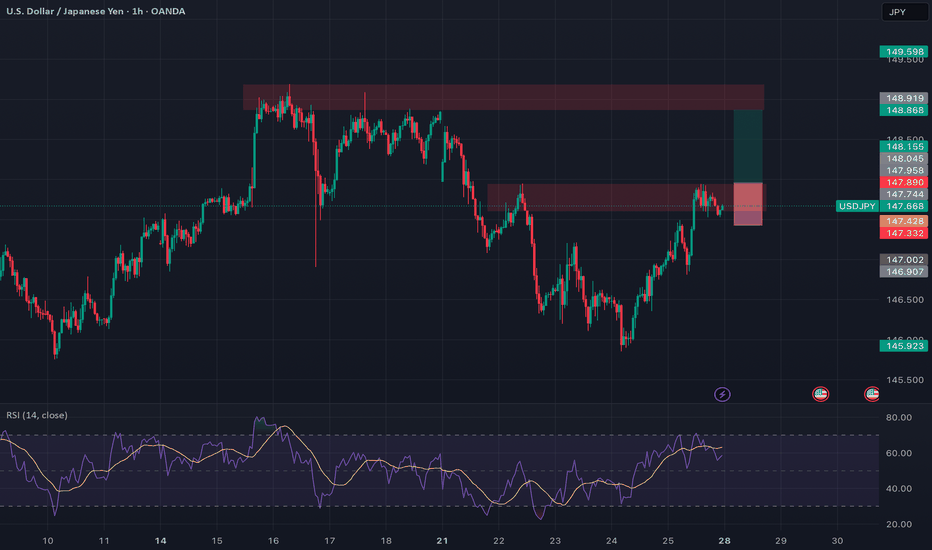

USDJPY: Breaking Out With Macro Backing 🟢 USDJPY | Breakout Opportunity Above Resistance

Timeframe: 1H

Bias: Bullish

Type: Break and Retest

📊 Technical Setup

USDJPY is currently consolidating at a key 4H resistance zone (147.75–147.90). A clean breakout and retest of this area will confirm bullish continuation.

• Entry: Above 147.90 (after confirmed candle close + retest)

• SL: Below 147.30

• TP: 148.90 / 149.60

• RR: ~1:2.5

• Indicators: RSI showing strong upside momentum, holding above 50

🧠 Fundamentals + Macro Confluence

• USD Strength: Strong macro & delayed rate cuts support USD upside

• JPY Weakness: BOJ remains dovish; risk-on sentiment weighing on JPY

• COT + Conditional Score: USD score increased to 17, JPY dropped to 8

• Risk Sentiment: VIX at 14.2 = RISK ON → bearish JPY bias

🧭 Gameplan

“Wait for confirmation above resistance before entering”

🔔 Set alerts around 147.90 and monitor lower timeframes for retest and bullish candle structure.

Forexfundamentals

GBPUSD: Selling the Retest | Clean Break, Wait for Confirmation🔻 GBPUSD | Sell the Retest of Broken Support

Timeframe: 1H

Bias: Bearish

Type: Break and Retest

📊 Technical Setup

GBPUSD has broken a key 4H support zone (~1.3460–1.3494) which now acts as a turncoat resistance. Price is currently pulling back, offering a prime opportunity to sell the retest.

• Entry: 1.3460–1.3490 (after confirmation of rejection)

• SL: Above 1.3508

• TP: 1.3398

• RR: ~1:2

• RSI: Bearish momentum, RSI < 50 with mild recovery—ideal for a fade trade

📉 Macro & Fundamental Confluence

• GBP: Despite hawkish BOE tone, GBP is showing technical weakness and soft CFTC positioning

• USD: Strong macro bias with rising conditional score and delayed Fed cuts (still supporting USD strength)

• Seasonal Bias: GBPUSD marked bearish in seasonal chart

• COT Data: GBP positioning turning bearish after previous net build-up

🧭 Gameplan

“Wait for the retest of broken support-turned-resistance to reject before entering short. Stick to the zone.”

🔔 Set alerts around 1.3460–1.3490 and monitor for bearish engulfing or pinbar confirmation.

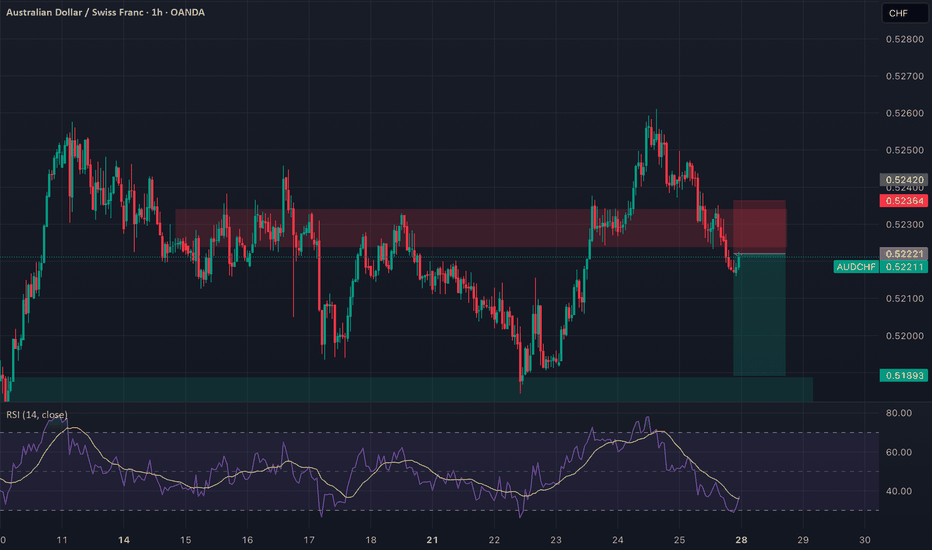

AUDCHF: Broken Support, Bearish Flow In Play Timeframe: 1H

Bias: Bearish

Type: Support Turncoat → Breakdown Play

📊 Technical Setup

AUDCHF previously broke the 4H resistance (0.5236) which flipped to support. However, price has now broken below this support, confirming it as a failed demand zone.

• Entry: Market execution or retest of 0.5236

• SL: Above 0.5245

• TP: 0.5189

• RR: ~1:2

• RSI: Below 50 and heading lower = momentum supports downside

📉 Macro & Fundamental Confluence

• AUD Weakness: RBA dovish, conditional score declining, bearish seasonality

• CHF Slightly Less Weak: Despite SNB dovish stance, CHF is outperforming AUD

• COT + Sentiment: AUD CFTC weakening, CHF holding steady

• Risk Sentiment: RISK ON environment reduces CHF demand but AUD still underperforms

🧭 Gameplan

“Support failed to hold. Bearish pressure intensifies. Target previous swing low zone.”

🔔 Watch for retest of 0.5236 for better RR setup before continuing short.

GBPJPY – Golden Pocket Breakout SetupTimeframe: 1H | 🎯 Bias: Bullish Breakout

GBPJPY is testing a key Fibonacci retracement zone (0.5–0.618) from the recent impulse leg (194.00 → 196.195). This golden pocket sits inside strong demand and could launch the next leg higher.

🔍 Technical Confluence

Fib Support Zone: 195.270–195.447 (0.618–0.5)

Price Action: Consolidating near golden pocket, showing rejection wicks

Structure: Higher highs and higher lows intact

RSI: Resetting around 45–50, leaving room for momentum buildup

Next Resistance: 196.200 (previous high), then 197.300 and 198.500

🧠 Fundamental Confluence

GBP Strength Drivers:

BoE's "hawkish cut" tone — restrictive policy to fight sticky inflation

UK macro improving: upcoming GDP & labor data could surprise to the upside

Market pricing less aggressive easing compared to peers = GBP premium

JPY Weakness Factors:

COT RSI at 100% = overbought positioning

BoJ delays normalization to 2027

Risk-on flows (VIX ~16.7) reducing safe-haven demand

Macro Flows: Bullish NASDAQ + stable oil → support GBPJPY upside

Macro Themes:

Oil & NAS100 bullish = supports GBPJPY upside

Market unwinding defensive positions = bullish for GBPJPY

🛠 Trade Plan

📥 Entry Option 1: Buy on bullish reaction from 195.27–195.45 (Fib golden pocket)

📥 Entry Option 2: Break and close above 196.200 (confirmation entry)

🛑 Stop Loss: Below 195.00 (under Fib + recent structure)

🎯 TP1: 196.80

🎯 TP2: 198.00 (measured move)

📌 “Golden pockets don’t lie when fundamentals align.”

AUDCAD - Fundamentals vs Momentum – Betting on CAD🕓 Timeframe: 4H | ⚠️ Bias: Bearish From Supply Zone

AUDCAD is rejecting the 0.8940–0.8960 supply zone, a key resistance that's been respected multiple times. With RSI turning over near overbought and CAD fundamentals improving, this looks like a clean short opportunity.

📊 Technical Confluence

🔴 Resistance Zone: 0.8940–0.8960 (historical supply zone)

📉 Bearish Structure Intact: Still in a broader HTF downtrend (lower highs)

⚠️ RSI Divergence: Slowing near 62, suggesting momentum exhaustion

🕯️ Price Action: Current candle showing indecision – early signs of rejection

🌍 Fundamental Confluence

🇦🇺 AUD Weakness:

RBA paused rates, inflation easing → Dovish

AUD overextended after sentiment shift (conditional score ↑ too fast)

AUD vulnerable if sentiment shifts risk-off

🇨🇦 CAD Strength:

BoC holding firm on rates, hawkish tone

Oil production recovering → CAD-positive

COT net long position + seasonal strength

🎯 Trade Plan

📍 Entry: 0.8940–0.8955 (on bearish confirmation: engulfing/pin bar)

🛑 Stop Loss: 0.8975 (above resistance zone)

🎯 Take Profit 1: 0.8870 (mid-range)

🎯 Take Profit 2: 0.8830 (into demand zone)

⏱️ Optional: Partial entry now, scale in at 0.8960 if tapped

🧠 “Don’t chase the move. Sell the retest when momentum fades and fundamentals align.”

USDCAD Short Setup – Support Broken, More Downside Ahead?Bias: ✅ Strong Sell

Timeframe: 4H

Pair: USDCAD

Week: 26–30 May 2025

⸻

🔍 Technical Setup:

USDCAD just broke a major support zone around 1.3732, opening the door for continued downside into the next demand zone.

• Entry: Break and retest or continuation below 1.3732

• Stop Loss: Above resistance at 1.3813

• Take Profit: Next support near 1.3467

• Risk-Reward Ratio: ~3.9R

• Structure: Lower highs, clean breakdown, bearish momentum

⸻

🧠 Macro Confluence:

• 📉 USD Weakness: Dovish Fed, weak macro outlook (Investogenie Score 1.8 ↓)

• 🇨🇦 CAD Recovery: Hawkish BoC, conditional score surged from 2 → 10

• 📊 Seasonals: CAD favored

• 🧾 COT: Net bearish shift in USD, CAD corrective phase expected

• ⚠️ News Risk: CAD GDP & US GDP this week could accelerate the move

⸻

⚠️ Risk Notes:

• Watch for FOMC and GDP reports before scaling positions

• Break & close confirmed – trail stops on lower timeframe

⸻

📌 Momentum is in favor – ride the breakdown, but stay data-aware.

Share setups or feedback below 👇

USDJPY Short Setup – Bearish Breakout WatchBias: ✅ Strong Sell

Timeframe: 4H

Pair: USDJPY

Week: 26–30 May 2025

🔍 Technical Setup:

USDJPY is sitting on a critical support zone around 142.55. A decisive break and 4H close below this level would confirm a bearish continuation.

Entry: Break below 142.55

Stop Loss: Above resistance at 142.80

Take Profit: Major support around 140.05

Risk-Reward Ratio: ~4R

Structure: Lower highs, pressure on demand – momentum building

🧠 Macro Confluence:

📉 USD Weakness: Dovish Fed, worsening macro (Investogenie Score 1.8 ↓)

💴 JPY Strength: Seasonal bias, bullish COT positioning, risk-off sentiment

🧾 COT: JPY net long positions at 92% RSI

📊 Conditional Scores: JPY ↑, USD ↓

⚠️ Risk Sentiment: VIX 22.68 – risk-off favors JPY

⚠️ Risk Notes:

Wait for confirmation candle before entry

Watch FOMC + GDP (USD) for volatility spikes

Consider scaling in on retest of broken support

📌 Let the level break before jumping in. Precision matters.

Share your thoughts or charts below 👇

EURUSD Long Setup – Bullish Breakout PlayBias: ✅ Strong Buy

Timeframe: 4H

Pair: EURUSD

Week: 26–30 May 2025

🔍 Technical Analysis:

EURUSD has broken through a prior resistance and is currently testing a second resistance zone at 1.13983. I’m looking for a confirmed breakout above this level to enter long.

Entry: Break and 4H close above 1.13983

Stop Loss: Below support zone at 1.13545

Take Profit: Targeting resistance zone near 1.15454

Risk-Reward Ratio: ~3.36R

Structure: Higher highs forming, potential breakout continuation

🧠 Macro Confluence:

📉 USD Weakness: Dovish Fed + poor fundamentals (Investogenie Score 1.8 ↓, Conditional Score 3 ↓)

📈 EUR Strength: Improving Eurozone outlook, strong COT positioning, ECB easing bias

📊 Seasonal Bias: EURUSD bullish for this period

⚠️ Risk Management:

Watch for FOMC and GDP releases (USD) mid-week

Avoid premature entries without clear break and 4H confirmation

Optional: Wait for break & retest for higher probability

Drop your thoughts or setups below 👇

USDJPY Daily Forecast: Slight Bearish Bias Amid Fundamental FactUSDJPY Daily Forecast: Slight Bearish Bias Amid Fundamental Factors (31/10/2024)

Introduction

In today's trading session on October 31, 2024, USDJPY appears to carry a slightly bearish bias due to various fundamental drivers impacting both the US Dollar (USD) and the Japanese Yen (JPY). This article provides a detailed analysis of USDJPY, focusing on the major economic and geopolitical factors contributing to the bearish outlook. By considering both macroeconomic trends and the latest technical indicators, traders can better navigate potential setups for the USDJPY pair.

Key Fundamental Drivers Impacting USDJPY Today

1. Federal Reserve’s Dovish Policy Outlook

- The Federal Reserve has recently hinted at maintaining a dovish stance, signaling a potential pause on interest rate hikes. This policy outlook is generally bearish for the USD, as lower interest rates reduce the Dollar’s appeal to investors seeking yield. As a result, the USD could experience downward pressure against the Japanese Yen, contributing to a slight bearish bias for USDJPY.

2. Bank of Japan's Commitment to Policy Adjustments

- The Bank of Japan (BOJ) has gradually shown signs of flexibility in its yield curve control policy, which could strengthen the Yen. Any indication of a potential shift away from ultra-loose monetary policy is generally supportive for JPY, as it attracts investors looking for stability in an uncertain global environment. This shift increases the possibility of a bearish trend in USDJPY.

3. US Treasury Yields and Safe-Haven Demand

- The recent volatility in US Treasury yields has led to fluctuating demand for USD-denominated assets. Lower yields often make the Dollar less attractive, especially in comparison to the Yen, which is considered a traditional safe haven. With a potential decline in yields, demand for USD could weaken, encouraging investors to turn toward JPY and reinforcing the slight bearish outlook for USDJPY.

4. Global Economic Uncertainty and Risk Sentiment

- The recent geopolitical tensions and economic uncertainties have led to higher risk aversion in the markets. In times of heightened uncertainty, the Yen benefits as a safe-haven currency. This risk-off sentiment may draw investors to JPY, increasing its strength against USD and creating bearish pressure on the USDJPY pair.

5. Japanese Economic Data

- Stronger-than-expected Japanese economic data, including stable GDP growth and improved manufacturing output, have added positive momentum to the Yen. These indicators reflect Japan’s gradual recovery, making the Yen more attractive and adding pressure on USDJPY from the Japanese side.

Technical Analysis of USDJPY (31/10/2024)

From a technical perspective, USDJPY trades below its 50-day moving average, a signal commonly associated with bearish trends. The Relative Strength Index (RSI) also hovers near the 40 level, suggesting potential downside momentum. Key support levels around 147.50 and resistance near 150.00 should be monitored.

Key Support: 147.50

Key Resistance: 150.00

Conclusion: USDJPY Outlook for 31/10/2024

Given today’s fundamentals and technical conditions, USDJPY exhibits a slightly bearish bias. Factors such as the Federal Reserve’s dovish stance, the BOJ’s gradual policy adjustments, and risk aversion in global markets are all contributing to the current outlook. However, traders should remain attentive to any unexpected shifts in global economic data or central bank announcements.

For those watching the USDJPY today, focusing on these fundamental drivers and key support levels can provide valuable insights for trading the pair amid a slightly bearish sentiment.

SEO-Keywords:

#USDJPYForecast

#ForexAnalysis

#USDToday

#JapaneseYen

#CurrencyMarket

#USDJPYOutlook

#BearishUSDJPY

#TradingUSDJPY

#ForexFundamentals

NZDUSD Daily Outlook: Slight Bullish Bias Amid Today !!NZDUSD Daily Outlook: Slight Bullish Bias Amid Current Market Conditions (31/10/2024)

Introduction

As we delve into today’s trading session, the NZDUSD pair shows signs of a slightly bullish bias due to a combination of fundamental drivers and current market conditions. This article provides a comprehensive analysis of the NZDUSD's outlook on October 31, 2024, shedding light on the key factors impacting the New Zealand Dollar (NZD) and the US Dollar (USD) in today’s trading environment. With the right blend of technical and fundamental insights, we aim to offer valuable insights for traders considering NZDUSD positions.

Key Fundamental Drivers Impacting NZDUSD Today

1. China's Economic Growth and Its Influence on NZD

- The New Zealand Dollar, a commodity-linked currency, closely correlates with China's economic health due to New Zealand's export reliance. Recent reports suggest a moderate recovery in China's industrial and manufacturing data, which bodes well for NZD. Increased demand for New Zealand exports, especially dairy, bolsters the Kiwi's outlook, creating an overall positive sentiment for NZDUSD.

2. Federal Reserve’s Dovish Stance

- A significant driver for NZDUSD is the Federal Reserve’s dovish stance, with expectations for a pause on future rate hikes. This has resulted in a softer USD as investors anticipate fewer rate hikes going forward. A dovish Fed policy tends to weaken the USD, increasing the attractiveness of the NZD and slightly tilting NZDUSD towards bullishness.

3. New Zealand's Stable Economic Indicators

- New Zealand’s recent economic data reveals consistent GDP growth, low unemployment rates, and a robust labor market. This stability has created an optimistic environment for the New Zealand Dollar. Additionally, the Reserve Bank of New Zealand (RBNZ) has maintained a steady rate outlook, supporting the Kiwi by keeping investors interested in NZD assets due to positive yields.

4. US Treasury Yield Fluctuations and Its Impact on USD

- The ongoing fluctuations in US Treasury yields have contributed to the USD's recent mixed performance. A decline in yields typically makes the USD less attractive, as lower yields reduce the appeal for foreign investors. As a result, NZDUSD may benefit from a weaker USD, supporting a bullish bias in today’s trading.

5. Market Sentiment and Risk Appetite

- Recent geopolitical tensions and global market fluctuations have impacted the broader market sentiment. The Kiwi typically gains when there is a higher risk appetite among investors. As volatility stabilizes, we may see increased demand for higher-yielding currencies, which could strengthen NZDUSD’s position, albeit moderately.

Technical Analysis of NZDUSD (31/10/2024)

Looking at today’s technical setup for NZDUSD, the pair trades above its 50-day moving average, a potential bullish indicator. The Relative Strength Index (RSI) currently sits near the 60 mark, indicating a neutral to slightly bullish sentiment. Support levels at 0.5850 and resistance near 0.5920 will be critical zones to monitor.

Key Support: 0.5850

Key Resistance: 0.5920

Conclusion: NZDUSD Outlook for 31/10/2024

With today’s economic data and current sentiment, the NZDUSD pair leans towards a slightly bullish outlook. Strong economic fundamentals from New Zealand, coupled with a softer US Dollar from a dovish Federal Reserve stance, are influencing the pair's potential upward movement. However, traders should stay vigilant to potential changes in Treasury yields and any abrupt shifts in global risk sentiment.

By focusing on today’s fundamental and technical drivers, NZDUSD traders can better gauge the market’s slight bullish bias.

SEO Keywords:

#NZDUSDAnalysis

#NewZealandDollar

#USDForecast

#ForexTrading

#FXMarket

#BullishBias

#CurrencyTrading

#ForexFundamentals

#NZDUSDOutlook

EURJPY-4H-BEARISH CONTINUATIONHere is a details analysis of EURJPY:

EUR (Euro):

1. Scorecard: Bullish sentiment, indicating an expectation for an increase in value.

2. COT-FLIP: Bearish sentiment, suggesting a potential decrease.

3. Seasonal Analysis: Bearish outlook, implying a likelihood of a decrease.

4. Fundamentals (LEI, ENDO, EXO): All bullish, indicating positive economic factors that could contribute to an increase in value.

JPY (Japanese Yen):

1. Scorecard: Bullish sentiment, indicating an expectation for an increase in value.

2. COT-FLIP: Bullish sentiment, suggesting a potential increase.

3. Seasonal Analysis: Bullish outlook, implying a likelihood of an increase.

4. Fundamentals (LEI, ENDO, EXO): All bullish, indicating positive economic factors that could contribute to an increase in value.

EURJPY Pair:

1. Scorecard: Bearish sentiment, suggesting a decrease in value.

2. COT-FLIP: Bearish sentiment, indicating a potential decrease.

3. Seasonal Analysis: Bearish outlook, implying a likelihood of a decrease.

4. Fundamentals (LEI, ENDO, EXO): Bullish, indicating positive economic factors, but the overall sentiment is still bearish due to other factors.

5. Technical Analysis:

Trend: Bearish, indicating a downward trajectory in the market.

No specific diversions, continuation patterns, reversal patterns, or harmonics were identified.

Overall Assessment:

The EUR is expected to increase in value based on various indicators, including bullish sentiment and positive fundamentals.

The JPY is also anticipated to increase in value due to similar bullish indicators.

However, the EURJPY pair is likely to decrease overall, despite bullish fundamentals for both currencies individually, mainly due to bearish sentiment reflected in the scorecard and other factors such as technical analysis indicating a bearish trend.

This comprehensive analysis considers multiple factors to provide a detailed theoretical outlook for the EUR, JPY, and the EURJPY pair for the first week of May

EURNZD-4H-BULLISH CONTINUATION OF TRENDEURNZD analyzes currency pairs using a mix of fundamental and technical analysis, supplemented with some sentiment indicators such as the Commitment of Traders (COT) report, Leading Economic Indicators (LEI), external and endogenous factors (EXO and ENDO), and seasonal trends. Let’s break down the analysis:

1. Fundamental Analysis

LEI, EXO, ENDO: All are improving, which suggests strengthening fundamentals potentially for the EUR against the NZD. The overall trend of improvement in these indicators supports a bullish fundamental outlook for the EUR relative to the NZD.

SCORECARD 3:(COMBINATION OF FUNDAMENTALS SCORE) Shows a mix of bullish and bearish sentiment but leans bullish in the final score.

2. Sentiment

COT-FILP: This sentiment indicator leans towards bearish, as non-commercial long positions are increasing and short are decreasing. This suggests that traders, perhaps the larger speculative ones, are entirely convinced of the bullish scenario or are positioning long.

3. Seasonal:

Indicates a typical pattern of an initial retracement in the first week followed by bullish sentiment. This aligns with some natural ebb and flow seen in currency pairs due to cyclical economic factors.

4. Technical Analysis

Trend: Bullish, suggesting that recent movements support a continuation of upward momentum for EURNZD.

Diversions: These are in sync, which likely means there is an upward momentum.

Continuation and Reversal Patterns: You can noted a bullish continuation pattern and no significant reversal patterns, which typically suggests that the current trend (upward, in this case) is likely to continue.

Overall Bias

Despite some bearish sentiment from the COT report and mixed signals of SCORECARD 3, the fundamental improvements and supportive technical patterns lead to a predominantly bullish final score and overall bias.

Interpretation and Trading Strategy

Given the bullish fundamentals, supportive technical patterns, and despite some bearish sentiment signals, the recommended position seems to be leaning towards a bullish stance on the EURNZD. However, it would be prudent to consider risk management strategies, given the mixed sentiment signals:

Entry Point: Look for temporary retracements on daily fvg and 50% fib retracement as potential entry points, especially in the first week if the seasonal pattern holds.

Stop-Loss: Set stop-loss orders below key technical levels to protect against unforeseen reversals, particularly since the COT and FUNDAMENTAL SCORECARD show some bearish sentiment.

Take-Profit: Establish profit targets at technically and fundamentally significant levels, considering both recent highs and any resistance levels identified by your technical analysis.

As always, keep monitoring the market for any changes in fundamentals and sentiment that could affect the validity of this analysis.

NZDUSD-4H-TREND CONTINUATIONNZDUSD is looking bearish in HTF

1. Conditional Scoring:

Bearish sentiment is derived from expectations of deteriorating economic conditions in New Zealand relative to the US.

2. COT-FILP:

Bearishness is based on speculative positioning in the futures market, where traders anticipate a decline in the NZDUSD exchange rate.

3. Seasonal Patterns:

Bearishness during the first two weeks of May since the last 5, 10, and 15yr is attributed to seasonal factors, such as decreases in exports or shifts in interest rate differentials.

4. Fundamentals:

Improvements in leading economic indicators and exogenous factors suggest strength in the NZD, while a decline in endogenous factors implies potential weakness in the currency.

5. Technicals:

Bearishness in the trend and continuation pattern suggests a downward trajectory in the NZDUSD pair, while bullish divergences might indicate a potential reversal despite other technical factors pointing to bearish.

Overall, the analysis concludes with a bearish outlook for the NZDUSD pair, considering both fundamental and technical factors.

XAUUSD bullish Gold struggle to sell read the caption (XAU/USD) strong bullish back on Monday as investors reconsider the outlook on interest rates by the Federal Reserve (Fed) Xauusd uptrend and Make some sideways move Policymakers are consistently resistance the tight interest narrative to ensure the return of inflation to the 2% target in a sustainable manner. The precious metal is facing some bullish as the prospect of imminent rate cuts fades amid still-high price pressure

Navigating Forex Success: Mastering the Most Vital Fundamentals

Forex trading, the largest and most liquid financial market in the world, offers endless opportunities for profit. Yet, success in this dynamic arena hinges on a solid understanding of fundamental analysis. In this comprehensive article, we will explore the most crucial forex fundamentals that every trader should grasp. We will provide real-world examples to illustrate their impact and share how they can influence your trading decisions.

The Cornerstones of Forex Fundamentals

1. Interest Rates: Central banks set interest rates, which have a significant influence on currency values. Higher interest rates in a country can attract foreign capital, boosting the value of its currency.

2. Economic Indicators: Economic data releases, such as GDP, employment figures, and inflation rates, provide insights into a country's economic health. Positive data can lead to a stronger currency, while negative data may weaken it.

3. Political Stability and Economic Performance: Political stability and the overall health of an economy play a crucial role in currency valuation. Countries with stable governments and strong economic performance tend to have stronger currencies.

Real-World Examples

Example 1: EUR/USD and Interest Rates:

Example 2: GBP/USD and Economic Indicators:

Mastering the most vital forex fundamentals is essential for navigating the complex world of forex trading successfully. By staying informed about interest rates, economic indicators, political stability, and economic performance, you can make informed trading decisions and better understand the forces driving currency markets. With these fundamentals as your foundation, you'll be better equipped to seize opportunities and manage risks in the ever-evolving world of forex. 🌍📈💰

What do you want to learn in the next post?

USDCAD - Short opportunity if price holds below resistance areaFundamentally speaking, there is a chance that USD could be dropping lower if this month's CPI prints a lower number than the previous month's number. Furthermore, combined with CAD fundamentals that starting to align with Oil price fluctuation provide a quite stable CAD outlook.

In terms of technical perspective, a big rejection candle that is present on top of the marking area provides a signal that a continuation to the downside is quite possible.

In conclusion, as long as the price did not move higher and close higher than the high of the rejection candle, a short position is preferable.

"Trading is NOT about how often you are right!! Trading is a mathematical calculation of the ratio of the results you WILL get to the risk you MAY spend!!!"

XAUUSD as gold beautiful respected the 1821 and 1822 suppport zone and heading back to where it break the support (SBR) strong resistance as highlighted with rectangle 1871 -1880 gold can fall below accordinglly and continution with bearish.

this is not financel advice please trade with your own alalysis and own risk. what you all think about it let me know.

BEARISH ON EURUSDEntry 1.0590

SL 1.0840

TP: Open

Feel the EUR will continue to see further struggle as the energy crisis continues. Let us also be aware that smart money is adding into their short positions. We did see some bullish movements as sentiment changes for the past month or so. However, we are now anticipating a large bearish move as more of a fundamental trend begins. Which you can see a major rejections off major resistance level

Thesis: Trend contiuation on NZDUSDWhat are institutional traders doing:

NZD as a long % of 41.09 and USD of 76.29%

What are retail traders doing:

32% of retail traders are long on NZDUSD while 68% are short. Remember, when over 60% of retail traders tilt one way, statistically and historically, institutional traders will push the opposite way.

What history tells us?

Historical data tells us that the market tends to rise during this month

Fundamentals: GDP growth favors the USD while inflation, unemployment and interest rates favor NZD