80K pullback is done, but it is not for selling anymoreMorning folks,

So, the upside bounce to 80K resistance that we were watching is done now. It has happened even twice. D. Trump so efficiently tarrifying markets, and them provides them the relief that BTC mostly is just a hostage of this so called "news stream". Actually as well as all other markets.

Once 90 day tariffs postpone has been provided, stocks jumped and liquidity returns, supporting all other things around. It might be temporal? Sure. But nobody knows what in the old Donny's head.

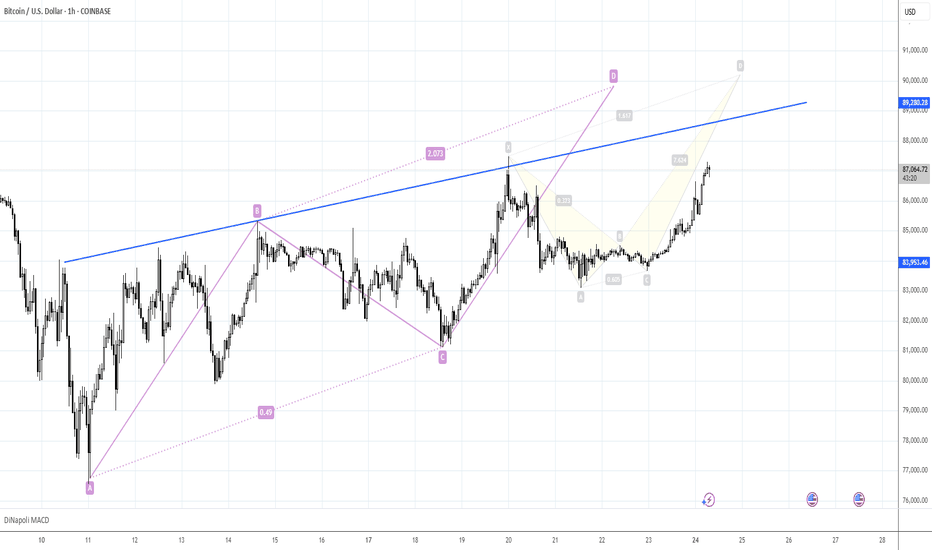

By looking at current action, it seems that 80K support is more reasonable to use for long entry with 85.5 target at least. Definitely it would be better to not sell by far...

Forexpeacearmy

Pullback to 80KMorning folks,

So, our long-term bearish journey that we were following for 4-5 weeks comes to an end. BTC more or less hit our 74K target and strong weekly support area .

The next one stands around 69K, but market strongly needs a new driving factor to break ~70K support area, and hardly this will happen this week.

Taking in consideration that market is oversold, now we set a tactical target- pullback to 80K resistance area , and then we will see, should be sell again or not.

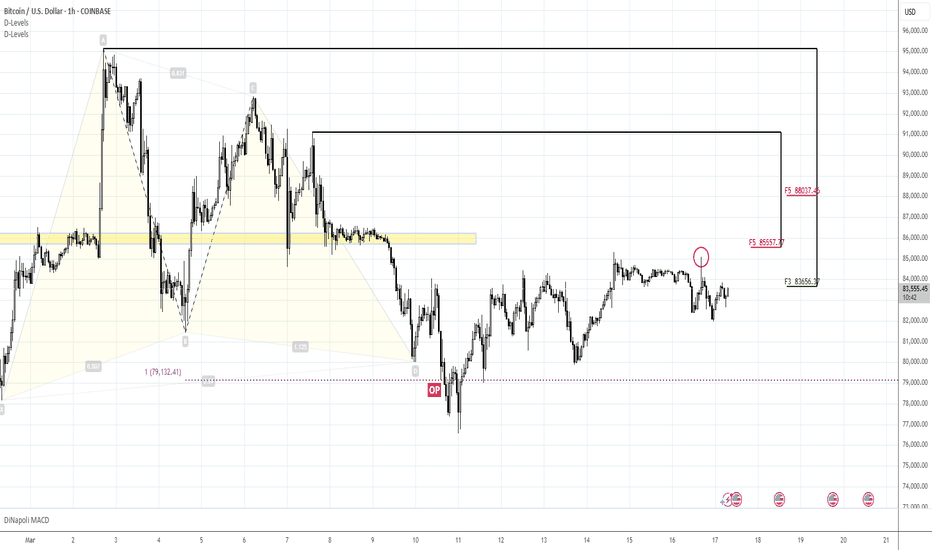

86K for another short sellMorning folks,

So, not occasionally we said in previous 2-3 updates that BTC action doesn't look bullish and we suggest a new nosedive. Now we have bearish engulfing pattern on weekly chart . And consider these two Fib levels for another short entry attempt. Of course, 86K would be just perfect, but it could start earlier. One of the possible shapes we consider a downside butterfly.

In general, re-test of 70-73K area on average fits to our long-term view.

In a case if 86K will be broken, it could mean that market is tending to 93.5K target, based on daily AB=CD pattern . But we consider this scenario as less probable due on overall BTC heavy performance in a recent few weeks.

Thus, for now, if you want to make a scalp long trade, you could try, but better to set initial target not higher than 86K.

Our major scenario is bearish and we consider 84K and 86K Fib levels for accumulation of a bearish position, unless something extraordinary will happen.

Profit to everybody, Peace.

90-91K Short setup updateMorning folks,

So, today we need just 1H chart as not many events happened. In a recent two weeks people start making upside revisions on BTC price, based on recent JPow comments on QT contraction.

We agree that it has some reasons and supportive to BTC, but they forget that GDP forecast was cut, while inflation increased, which points on stagflation signs.

This is the reason why we do not want to overestimate the positive effect of QT contraction. We still think that BTC could show the pullback to ~70K area.

Now we have three different patterns that point on this level. Since our last update we've got the flag consolidation, that suggests upside continuation. AB-CD based pattern also point on 90-91K area.

So, we still keep our idea to consider shorts around 90-91K area

Watching for the same 90K area Part IIMorning folks,

Here is just minor update to our last idea. BTC mostly was flat in recent two sessions, so action is started only today.

So, the plan that we've prepared remains valid. Since an area around 90K is a strong resistance, we think that short entry attempt there is relatively safe, and at least should give us the chance to turn it to breakeven trade.

Now, on 1H chart we have two patterns that point on the same area.

90-91K seems interesting for short sellingMorning folks,

So, our worryings were not in vain - we've got action to 88-89K area. Now our 4H "222" Sell is completed.

At the same time, now we have the bigger one on a daily chart. Since 90-91K is a rather strong resistance area, we suggest that attempt to sell there should be relatively safe, once the upside AB=CD target around 90.5K will be completed.

So, I mark this idea as "bearish" although price could raise a bit more.

88K is not excluded but not granted as wellMorning folks,

So, we set for 85K sell and it worked. Downside reaction happened, but still, we call you to move stops to breakeven for some case.

The problem that we see is the market behavior. We see it not natural for normal bearish market. BTC stands stubbornly around K-resistance, not showing normal downside extension.

Our scenario of downside continuation from ~85K area is not broken yet, it is valid, and maybe everything will happen as we've suggested initially.

But we see the risk in the way of market behavior. It could lead to more extended upside bounce in the way of upside AB=CD pattern right to 88k resistance .

It means that if you already have bearish positions - move stops to breakeven. If you don't - do not take the new once for awhile. Or, at least, you could take but not more than 25-30% of your normal lot.

Our bearish scenario remains valid until market stands under 85.1K spike (because this is bearish reversal session on daily chart) and below 85.5K resistance in general. Upside breakout means an action to 88K.

Since we do not have the breakout it, I mark our update as "bearish", but we warned you... Take care.

Selling?Morning folks,

So, Monday's plan has worked perfect, we're at 85K. Today we have to keep an eye on daily chart, where bearish grabber pattern might be formed and trigger downside action.

In general upside action is rather slow, so bearish context stands intact. We see only one risk for it - non-market driving factors, such as a D. Trump flood on X. But, this is out of our control.

That's why we keep everything as it is - 85K is considered for short entry. If we get daily bearish grabber also - all the better.

Next target stands around 74K

Pullback to 85K for sellingMorning folks,

So, everything goes with the plan - nothing to change on major picture. We keep our bearish view on BTC and now consider 68-74K area as the next destination point. But this could take a few weeks.

In fact, previous 68K top also will be a big test. Downside break will open road to 52-55K. While if BTC will be able to stay in 70-80K range, it will keep long term bullish context. It should be interesting...

Meantime, BTC once again hits oversold areas as on weekly as on daily charts. As we promised - D. Trump verbal boost lasted just 2 days and was reversed down. We see some intention market manipulations from D. Trump administration but this is not the subject for this update.

In short-term - 2-3 days BTC needs to relief oversold pressure, so minor bounce is quite possible. For example, based on "222" pattern on 1H chart we could see attempt to bounce up from 79K and up to 84-85K area.

Those who wants to sell - that might be the chance.

For now I mark this update as bullish, because of suggested bounce. But our longer term view remains bearish still.

Bearish until 98-100K Morning folks,

So, Old Donny euphoria was over on the next day, as we've suggested. ETH was even worse than BTC...

And we're skeptic on coming Crypto Summit tomorrow. What could happen in three days? A lot of speech and empty promises definitely will sound, but where the real deals? Recently. S. Lummis said that BTC Reserve issue is still under question and no guarantees that it will be formed. That's it... Nothing is prepared for BTC Reserve forming. Coming D. Trump talks could shake the market, but that will be only emotions.

Speaking practically, we suggest that until BTC stands under 98-100K area - context remains bearish. We see a few patterns, and this butterfly one of them. If you want to go short - this is the point that you have to think about. Based on the butterfly, the risk is not too big.

If even we will get "222" Sell - setup remains bearish, because upside AB=CD agrees with daily Fib resistance level. Only upside breakout of 98-99K will give BTC theoretical chances to start wobbling in 100-108K range.

Thus, for now we're not ready to speak about BTC buying. Albeit you want to make a bet on Summing euphoria tomorrow.

Verbal intervention was great but what's on the back?Morning folks,

So, the pullback that we were waiting for is done. Although we thought that it will be driven by some natural forces and reasons. The way how it has happened and by what factors make us to be caution on its perspectives.

Indeed, it was just verbal intervention from D. Trump. It had bad week - scandal in White House with Zelensky, stocks are falling, crypto are falling, inflation expectations are raising, March debt ceil and shutdown is almost here, EU "allies" do not want to work together... So, to say couple of words and pump the market is not a bad idea at all.

But, what is on the back? Nothing. Special Committee will make Reserve report only by July. I'm sure on crypto Summit this week we also will hear a lot of bravery speeches, but this is just words.

This is a reason why we do not want to buy BTC now and prefer to watch for reversal signs around our resistance 96-97K area. Sooner or later but fundamentals should return control over the market.

I do not have yet the specific picture but, since we have strong upside momentum - it should fade and appearing, say H&S or butterfly pattern, together with completion upside XOP target seems as great combination. Once this patterns will be formed, we could try to use it for short entry.

70K doesn't look impossible nowMorning folks,

So, our trading plan worked just great - DRPO on weekly in fact hit 81-82K, so it's minimal target is done.

In fact, BTC, as a Gold now are victims of massive sell-off on stock market. Investors meet margin calls and urgently need cash to fill it back to initial level. That's why they sell everything that they could to get the money. While this process will be underway - BTC remains under pressure. Not occasionally as insiders as Buffett were sitting on cash bags.

Today BTC is oversold. So we do not consider any new shorts and prefer to get the rally to sell into. Supposedly 92.50-92.85 resistance looks interesting for this.

As market probably will close below Dec lows, this is bad for long-term picture and former 70K top might be re-tested in perspective of a few weeks.

Pain or gainMorning folks,

So, everything goes accurately with the plan - our 1H H&S is ready to start. Even small "222" Buy already has been formed on the bottom.

So, if you would like to buy - this is the point where you have to decide. Upside target is 100.5-101.2K.

At the same time - don't forget that the H&S has to be considered in context of our big bearish weekly DRPO Sell pattern.

If H&S will be completed at 101K - we consider it as a chance to get the short position at better price. Conversely, if BTC starts dropping and H&S start failing. It could mean that downside action starts immediately.

Other words speaking, if BTC will show upside action at all - it has to start it right now. Otherwise, be prepared for collapse.

I mark this setup as a bullish, because of H&S. But in general we have mid term bearish view.

H&S is just a retracement step before downside action.

Another attempt for the 101-102K bounceMorning folks,

So market stands in the narrow range for the 3rd week already and not leaving hopes to show the bounce up to 101-102K area. Last attempt (in the way of cup pattern that we've discussed last time) has failed.

We don't care about it because mostly stay focused on weekly bearish DRPO pattern. Thus, any bounce here we consider first as a chance to Sell. And only second as a possible upside continuation.

For now BTC is trying to make an another attempt and form reverse H&S pattern on 1H chart. So target remains the same 101-102K. We have no intention to go long right now. But, if you trade intraday or just search chances to buy - maybe be this setup might be useful to you.

Supposedly 96K is an area where decision on position taking has to be made.

I keep the "bearish" mark for this setup. But, as now as last time - the bounce to 101-102K area are not excluded.

Bearish context holds. Pullback to 101-102KMorning folks,

A recent few sessions have rather narrow range, so we have little changes since our last discussion.

We have confirmed DRPO "Sell" pattern on weekly chart, so we keep bearish general view on BTC, with potential downside target around 80-81K. This also makes us to not consider any long positions. If even upside bounce will happen - we try to use this rally for short entry later.

Still for intraday traders, if you want to buy BTC, here is some thoughts. First is, and actually why we stay away from longs for now - take a look, after impressive jump BTC stands too long in sideways action. This is not good for bullish scenario.

Now it seems that something like "Cup" or reverse H&S pattern is still forming here. So if you finally will decide to buy - currently is the point where you have to make a decision on entry. Because BTC has to start upside action right now, right from this point or it will not start it at all and drop. We suggest that 101-102K is an area where it would be better to out.

I mark this update as bearish in a row with our major view, but as we've said 101-102 pullback is not excluded.

No longs by far. 90-92K stands in focusMorning folks,

Last time we were speaking about possible upside bounce to ~102.5K area. But BTC has failed three attempts to move out from support level where it stands. Despite that upside momentum was not bad.

With the recent high CPI on the table and weekly DRPO "Sell" pattern on the back, we suggest that downside action could start at any time. First target will be ~90-92K area just because this is daily oversold. Weekly pattern suggest target around 80-81K.

By this reason we do not consider any new intraday longs by far. Besides, on daily chart today we could get bearish grabber that supports adea of 90-92K lows level.

Tricks around 102.4K targetMorning folks,

So, our weekly bearish DRPO "Sell" pattern has been confirmed. It means that until market either complete its 81K target or remains under 102.5K its invalidation point - this pattern presents the risk for the bulls.

With all this stuff on the table we make two decisions. First is - we cut potential upside target down to 102.4K area by two reasons. First - this is 0.618 expansion and it agrees with major 5/8 resistance level. Second - this is invalidation point of weekly DRPO "Sell" pattern.

So, conclusion is follows. For long-term traders we suggest to not consider any new long positions until DRPO is valid. For short entry with DRPO - keep an eye on 102.5K area.

For intraday traders we suggest that long position is still acceptable but with the new 102.4K target and very tight stop - just under 94K lows. Market has to start upside action now. If it will not happen, then it will not happen at all and weekly DRPO will start working.

I mark this setup as "Bullish" because of 102.4 target. But, in general we have bearish view until DRPO stands in place.

107.60KMorning folks,

So, BTC has shown the pullback that we've discussed, but it was even stronger. Thus, we had have to postpone our plans for short entry. Besides, now situation stands so that our weekly pattern (DRPO "Sell") might not be confirmed this week.

To keep it simple - no new shorts by far. For now we focus only on intraday setups. For example, on 4H chart. If we could to use 8H or 10H chart instead, then we could see nice big bullish engulfing pattern. As usual it has AB=CD upside target, which is around 107.5K for now.

"C" point lows seems to be a vital area for this setup, just because this is 5/8 support and breakout of 95K level will change everything here. So, decision on entry has to be made fast, while price is not too far from vital area.

Watching for 98.2K resistance for short entryMorning folks,

So, this week / our DRPO "Sell" pattern is one step closer to confirmation and has a good chances to start working this week.

Meantime, due to weekend collapse BTC now is overextended. The problem is not about BTC itself but in jump of the USD, triggered by Donny's tariffs. We suggest to get technical rally, back to ~98.2K resistance area and consider short entry there if DRPO still will be OK.

If DRPO will be confirmed this week, its target stands around 81K support area. So, it is worthy to pay attention to...

Postpone shorts for awhileMorning folks,

So, the pullback that we've discussed last time is done and even slightly more extended, in a way of AB=CD .

By our previous plan, somewhere around we should start thinking about the short entry. So, is it time? We think it is not quite yet. And the reason stands with the pattern that now is forming on weekly chart - bullish grabber. This pattern suggests the challenge of the top again in any way.

Does it mean that the bearish scenario, especially our DRPO "Sell" pattern has totally failed. Not quite. The test of the top might be fast, just in a way of spike. In this case bearish setup will stand. But this will be later. For now - we consider no shorts, at least on daily/weekly charts.

On intraday charts, since we have "222" Sell, right, scalp traders could consider shorts for a few hours with very close target - around 103K. But this is not our primary scenario so far.

So, to be absolutely sure with this, let's wait for weekly close price to understand do we really get the grabber on weekly TF or not...

Bearish adventure startsMorning folks,

So, here we go... downside action starts as we've discussed last time. On weekly chart we still wait for confirmation in a way of price close below 3x3 DMA.

While on a daily one price hits oversold level. Those who know about this - we have DiNapoli bullish "Stretch" pattern for now, suggesting the pullback. That's why we do not consider immediate short entry.

Our 4H Diamond has worked just perfect. So everything goes absolutely fine.

For now we consider no longs on daily/weekly basis and waiting for the bounce, supposedly to ~102.20K area. Scalp traders on 1H TF and below could consider scalp long position with the same target.

I mark this setup as bullish because of this pullback. But, in general we keep bearish view...

Downside potential is 81KMorning folks,

So, our bearish ideas seem to be correct last time... Now we think that weekly TF is most perspective for BTC, because here we could get DiNapoli DRPO "Sell". First signs are already here, but for final confirmation we need close below MA line.

Meantime, on intraday charts, BTC is forming the Diamond consolidation , and on the same weekly one we have "Shooting star" on top. So, if you would like to go short earlier, you could use both pattern with the stops against the recent top.

Conservative traders could wait for confirmation of the pattern still. We consider no longs by far.

Hi chances on reversalMorning folks,

So, by introducing $Trump Token, old Donny has put the start of global US Dollar devaluation. And Melania probably will add today...

All our short-term targets are done - weekly grabbers and H&S failure has worked fine, BTC has challenged the top of 108K. We consider this action as hype and emotional. Mostly due euphoria around D. Trump inauguration.

Due to oversold on Monthly and Daily time frames, chances on reversal are significant. So we intend to watch for DRPO "Sell" pattern on weekly chart.

Still, Donny could tell us a lot today, and madness could continue a little bit. We do not exclude that BTC could try to reach nearest upside extension around 113.5K before reversal starts.

We do not call right now for taking short positions, let's see what will be on Thu, prefer to wait for patterns and signs for reversal first. But we call to consider long positions close or, at least tight stops around them.

Take care.