GOLD

This Gold (XAU/USD) outlines a bullish retracement setup, targeting a potential move toward the order block around 3,373.348. After bouncing from the support level near3,280, price is consolidating in a tight range and showing signs of upward momentum.

The move aims to revisit the order block, which previously acted as a breakdown zone. If price successfully reaches and reacts from this level, it may also attempt to fill the nearby Fair Value Gap (FVG) above.

Key Technical Zones:

- Support Level: Around 3,280, where buyers stepped in.

- Order Block: Immediate resistance and primary target at3,373.

- FVG Zone Above: Suggests a potential bullish continuation if broken.

Short-Term Target: 3,373.348

If momentum holds, a breakout above the order block may expose price to further upside toward3,440 and beyond.

Traders can watch for breakout confirmation or signs of rejection at the order block for the next directional cue.

Forexpositive

EURUSD LIVE TRADE AND EDUCATIONAL BREAK DOWN SHORTEUR/USD bounces off 1.1300, Dollar turns red

After bottoming out near the 1.1300 region, EUR/USD now regains upside traction and advances to the 1.1370 area on the back of the ongoing knee-jerk in the US Dollar. Meanwhile, market participants continue to closely follow news surrounding the US-China trade war.

BTCUSDBitcoin is currently trading near 84,949 after a strong rally, now approaching a critical order block resistance near86,000. While the overall structure remains bullish, the chart signals a potential shift in market behavior—creating a clear discrepation between price structure and projected move.

Discrepation Breakdown:

1. Rising Trend vs. Order Block Reaction

- Expected: Uptrend to continue, breaking through the resistance zone.

- Actual: Price is hesitating and forming a double-top structure inside the order block, hinting at buyer exhaustion.

- Discrepation: A bullish structure failing to maintain momen…

- Recent candles show weak buying volume near the top despite higher prices.

- Discrepation: Price is rising, but volume is not supporting it—bearish divergence, weakening the bullish outlook.

4. Fair Value Gap (FVG) Overlap

- FVG zone around 82.2k aligns with the bearish target, giving confidence to downside movement.

- Market may seek to fill that gap, creating a conflict with the bullish price structure currently visible.

Discrepation Summary Table:

| Technical Element | Market Expectation | Observed Conflict

| Uptrend + Higher Highs | Continuation toward 86,000+ | Double-top …

Although Bitcoin remains in a short-term uptrend, this chart shows clear bearish discrepation. The failure to break the order block, combined with volume divergence and trendline pressure, suggests a potential drop toward $82,232, especially if price confirms the double-top and breaks the ascending trendline.

Would you like a short version of this for social media captions too?

GOLD The chart shows price moving in a tight consolidation zone between the resistance area near 3,245 and support at3,213. While the price has tested the resistance multiple times, it has failed to break out decisively, indicating possible bearish weakness emerging.

---

🔍 Discrepation Zones (Key Conflicts):

1. Price vs. Resistance Reaction

- Expected: Breakout continuation above $3,245 due to repeated testing.

- Actual: Price rejected again after touching resistance.

- Discrepation: Buyers are unable to sustain upward momentum, revealing fading bullish strength despite frequent attempts.

---

2. Volume Behavior vs. Price Actio…

This hidden bearishness suggests sellers may be stepping in before each breakout attempt completes.

—

4. Target Discrepancy at3213.070

- While current price appears stable, the projection clearly anticipates a pullback to 3213.070.

- This level sits just above a major support block, marking a key imbalance between current consolidation and the expected move down.

—

🧭 Discrepation Summary Table:

| Element | Expected Behavior | Observed Behavior | Discrepation |

|————————–|——————————-|————————————-|———————————————|

| Resistance Test | Breakout after repeated tests | Another rejection | Buyers failing to gain momentum |

| Volume Analysis | Increased …

: Gold is showing signs of hidden bearish pressure. Although still inside a range, multiple failed breakout attempts, declining volume, and a projected drop to3213.070 point to a clear discrepation between expected bullish continuation and emerging bearish signals.

📌 Watch how price behaves near the $3,230 level. A decisive break could validate the bearish target, especially if volume increases on the move down.

Let me know if you want this turned into a social post or shorter caption!

euraud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

XAU GOLD TRADE REVIEW AND LIVE BREAK DOWN AND TEACHING LONGGold price rallies over 0.7% and ekes out a fresh all-time high at $3,086.

Markets are heading into safe-haven Gold while Equities and Cryptocurrencies drop.

Gold traders are now targeting $3,100 in the near term.

Gold price (XAU/USD) is printing another record performance this Friday, hitting $3,086 as the new all-time high for now and trading around $3,077 at the time of writing. Bullion sees another wave of safe-haven inflow, this time from investors that are exiting Equity and Crypto positions. From here, the next big psychological target and level to beat will be $3,100.

eurjpy analysis ellio. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

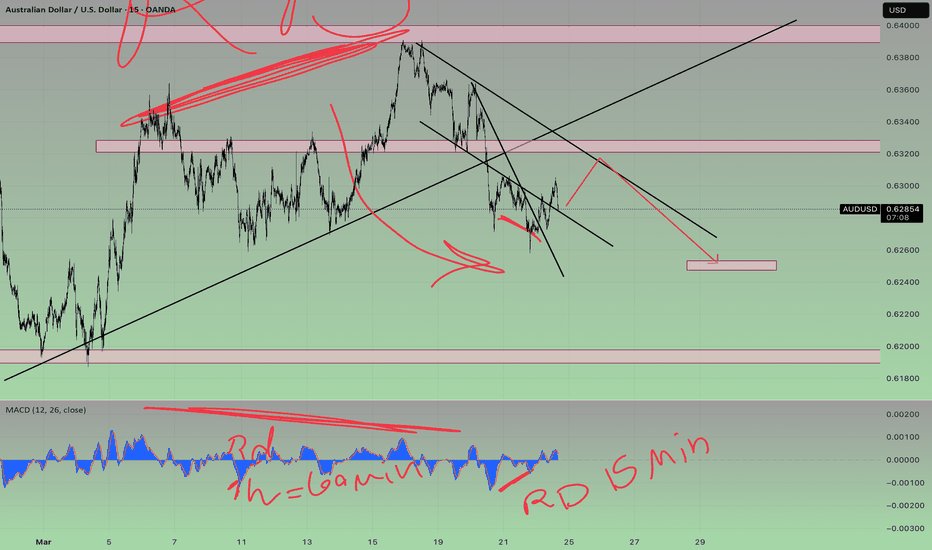

AUDUSD BUYWe have a specific type of divergence on the 1-hour timeframe ⏳, indicating a potential drop 📉 in the higher timeframe. On the other hand, the lower 15-minute timeframe 🕒 gives us a buying perspective 📈. So, the analysis will be as shown in the image.

#audusd #ForexTrading #PriceAction #ForexSignals #TradingAnalysis 💹

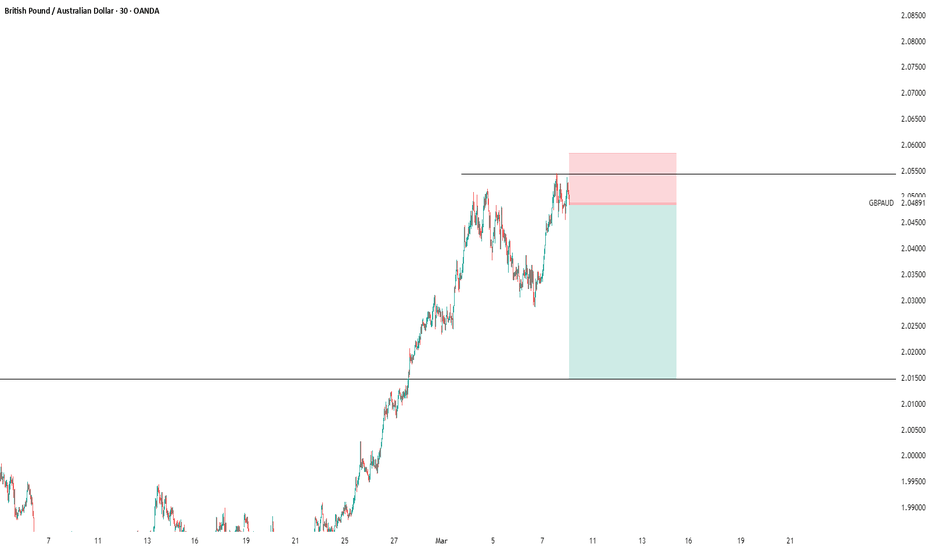

gbpaud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

"EUR/USD Bearish Breakdown – Targeting 1.0802 Support"This chart is a 30-minute timeframe analysis of EUR/USD, showing a potential bearish move.

Key Observations:

Resistance Zone (Red Highlighted Area ~1.0856)

Price attempted to break above but got rejected multiple times, indicating strong selling pressure.

Break & Retest Formation

The price has dropped below 1.0836 and is now testing this level as resistance.

This suggests a classic break-and-retest pattern, which could lead to further downside movement.

Bearish Expectation (Red Arrow & Green Zone)

The chart suggests a short position, with a target around 1.0802 (blue horizontal support).

The stop-loss is placed above 1.0856 (resistance), minimizing risk.

Trade Setup Analysis:

Entry: Below 1.0836, after confirmation of resistance hold.

Stop-Loss: Above 1.0856 (previous resistance).

Take-Profit: Around 1.0802 (support).

Risk-Reward Ratio: Favorable, as the target is significantly lower than the stop level.

Conclusion:

This is a bearish setup with expectations of further downside towards 1.0802. However, if price reclaims 1.0856, the setup might become invalid, and bulls could regain control. Let me know if you need further insights! 📉🔥

XAUUSD buy now 1. Support Adjustment:

The current support area is around 2,900, but if you want more distance, you might consider a lower range, around 2,880–2,895 for a stronger support base.

2. Resistance Adjustment:

The resistance is currently around 2,940. You could extend it further upwards, possibly in the 2,950–2,960 range, to create more distance between support and resistance.

MY analysis on Gold in 1H chart its again downwords gold xauusd is in downword we can take sell positions for some time as it almost touches the EMA200 and again going downwords .

Key Observations:

Downtrend Channel Breakout:

The price was previously in a descending channel (marked in blue).

A breakout to the upside occurred, signaling a potential reversal or retracement.

200 EMA Resistance (Blue Line at ~2897):

The price approached the 200 EMA, which is a strong dynamic resistance.

The rejection at this level (highlighted by the red arrow) suggests selling pressure.

Bearish Rejection (Yellow Circle & Red Arrow):

A wick at the 200 EMA shows that buyers attempted to push higher but faced resistance.

This could be a sign of a potential trend continuation to the downside.

Potential Downside Target (Blue & Red Zones):

A short-term support zone is marked in blue, where price might retest.

A larger support block (red zone) indicates a deeper pullback if bearish momentum continues.

Volume Increasing:

Volume is rising, which could indicate stronger price action, whether continuation or reversal.

Possible Trading Scenarios:

Bearish Case (Most Likely):

If price continues to reject the 200 EMA, it could drop toward the red support zone (~2,860-2,870).

A break below this level could lead to further downside.

Bullish Case (Less Likely):

If price reclaims the 200 EMA and holds above it, it could target the next resistance zone (~2,920).

Conclusion:

Bias: Bearish below 200 EMA unless price breaks above.

Potential Trade: Watch for a retest of the blue zone for a possible short entry targeting the red support block.

Would you like an entry/exit plan based on this setup?

Kingprotrader: Gold Spot (USD) 1H: Bearish Momentum

1. **Current Price & Movement:**

- Gold is trading at **2,861.880 USD**, down **0.53%** (-15.290) in the past hour.

- Short-term bearish momentum is evident, but key support/resistance levels should be monitored for trend confirmation.

2. **EMA (200, close) Analysis:**

- The listed EMA values (2,954.172 to 2,861.880) are descending, indicating a **downtrend** over the 200-period horizon.

- The current price aligns with the **200 EMA (2,861.880)**, suggesting this level is acting as **dynamic support/resistance**. A sustained break below could signal further downside, while a rebound might hint at a trend reversal.

3. **Key Levels:**

- **Immediate Support**: **2,825.000** (critical level to watch; a breach could accelerate selling pressure).

- **Upper Resistance Levels**: 2,900.000 and 2,921.335 (potential targets if price reverses upward).

5. **Conclusion:**

- **Bearish bias** dominates due to the descending EMA structure and recent price decline.

- Monitor the **200 EMA (2,861.880)** and Risk management (stop-losses) is critical due to volatility.

audjpy analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpaud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade