Next move Disruption Analysis: Bearish Risk Perspective

1. Sideways Consolidation (Red Box Zone):

The price is consolidating in a tight range between roughly 32.20 and 32.40, showing indecision and potential for either a breakout or breakdown.

Repeated rejections near the top of this box can signal exhaustion of buying pressure.

2. Volume Observation:

There’s no strong volume surge indicating accumulation; volume appears mixed and doesn't strongly support a bullish breakout.

A potential fakeout risk exists if the price spikes above the consolidation range only to fall back in (bull trap).

3. Potential Bearish Breakdown:

If the price breaks below the red box, especially under 32.20, it could trigger stop-losses and initiate a short-term bearish trend.

First downside target: 32.00 psychological level, followed by 31.80 support from previous lows.

4. Wick Rejection on Top:

The recent candles inside the box show long upper wicks — signs of selling pressure at higher levels.

Forexpower

Next move Bearish Disruption Perspective:

1. Failure to Break Above Supply

Price is struggling near 32.40–32.50, a visible resistance area from prior swing highs.

Repeated rejections here can signal seller strength or profit-taking.

2. Exhaustion Patterns

The price is forming sideways consolidation (highlighted in red).

A failure to break upward from this box and a false breakout wick would suggest buyer exhaustion.

3. Bearish Breakdown Scenario

If price breaks below the red box support (~32.30), this range could flip into resistance.

A clean drop below 32.30 would likely open the path toward 32.00 and potentially 31.80.

4. Volume Spike on Red Candle

Volume on red bars (10.64K) suggests aggressive selling pressure creeping in.

Watch for confirmation if next candles close red with high volume.

Next target Bearish Disruption Points

1. False Breakout Risk

Price is hovering near the recent highs but hasn’t made a convincing higher high.

A fakeout above 32.42 followed by a sharp rejection could trap buyers and trigger a sell-off.

2. Exhaustion at Resistance

The current level (~32.33–32.42) was a previous distribution zone on May 13–14.

Low volume follow-through may indicate weak buying interest, increasing the odds of a reversal.

3. Bearish Divergence (Potential)

If RSI or MACD shows lower highs while price pushes up, that’s a bearish divergence—a common reversal signal.

(You’d need to check indicators for confirmation.)

4. Support Flip to Resistance

If the price breaks back below the red box (~32.25), the same zone could act as resistance, turning into a supply zone.

5. Volume Clue

Volume appears lower during the recent bullish attempts, hinting at buyer fatigue.

Higher volume on red candles would validate a bearish shift.

Silver next move Weak Demand Zone Bounce

The current price action shows only a minor bounce from the demand zone.

A lack of strong bullish candles or volume confirmation may indicate weak buying interest.

2. Lower High Structure

The chart appears to be forming lower highs, suggesting a possible downtrend continuation.

If price fails to break the recent swing high near 32.70, bears might gain control.

3. Volume Concern

Recent bullish candles have decreasing volume, while the latest red candle has higher volume—this could signal a bearish divergence.

4. Bearish Trap Possibility

The current consolidation above support might turn into a distribution zone, leading to a fake breakout downward.

Gold next move The price is currently at a prior resistance level (~3,229) which may act as a supply zone. The market has already failed to break above this level multiple times in the past, indicating strong selling pressure.

2. Volume Divergence

If we analyze the volume at the most recent peaks, there's a possibility of lower buying volume despite higher prices—this could signal weakening bullish momentum.

3. False Breakout Risk

The chart suggests a possible pullback to the red demand zone before continuation. However, if the price fakes out into the zone and fails to hold above ~3,210, this could trigger a deeper selloff.

4. Double Top Formation Risk

There appears to be a potential double top pattern around 3,250–3,260, which may signal a bearish reversal if neckline support (~3,210) is broken.

5. Macroeconomic Influence

Unless supported by strong fundamentals (e.g., dovish Fed signals, rising inflation), any bullish breakout might lack fuel to sustain a rally beyond resistance.

Disruptive Bearish Scenario:

Price breaks below the red demand zone (~3,210).

Retests it as resistance.

Targets the next major support zone near 3,175–3,180.

EURUSD Bearish Structure Forming Amid Dollar UncertaintyEURUSD appears to be carving out a series of lower highs, showing potential signs of distribution. With price compressing inside a symmetrical triangle following multiple failed breakout attempts, the stage could be set for a bearish breakdown. This comes as U.S. inflation and Fed policy hold the spotlight and the euro faces political and structural crosswinds.

📉 Technical Breakdown (4H Chart)

Triple Top / Head & Shoulders Variant Forming:

Price action has traced a rounded top sequence, forming a triple top or complex head and shoulders structure.

Each rally attempt has been followed by steeper declines and faster recoveries—typical of a topping process.

Triangle Contraction Zone:

Current price is consolidating into a symmetrical triangle, which is often a continuation pattern.

Bearish breakout is expected if support around 1.1330–1.1320 fails.

Key Bearish Targets:

TP1: 1.1090 – former resistance turned support.

TP2: 1.0890 – April breakout base and key structure low.

Trade Setup (as per chart):

Sell Entry Zone: Break and retest of 1.1320–1.1300.

Stop Loss: Above 1.1527 (supply zone high).

Targets:

TP1: 1.1090

TP2: 1.0890

🌐 Macro Context

USD Side:

Fed is holding rates steady amid rising inflation fears triggered by tariffs

Tariff shocks are already pushing prices up, while growth slows—a tough environment for the Fed.

Dollar could strengthen if market sentiment shifts risk-off.

Euro Side:

Former EU Commissioner Gentiloni calls for unified borrowing to boost the euro’s global role, as U.S. stability is questioned

Political uncertainty around German leadership transitions may also weigh on the euro short term.

✅ Conclusion

EURUSD is trading at the apex of a tightening triangle pattern following a distribution structure. With a clean break of 1.1320 support, expect increased volatility and bearish momentum toward 1.1090 and 1.0890.

USDCAD – Reversal Setup Ahead of FOMC DecisionUSD/CAD has bounced off strong support near 1.3770, forming a clean bullish structure into a pivotal week dominated by the FOMC meeting. Price action shows higher lows and a tightening range, signaling a potential breakout. With the Fed expected to hold rates but maintain a hawkish tone, the USD may regain strength — especially against the CAD, which remains under pressure from trade risks and weak oil prices.

🔹 Technical Setup:

Structure: Rejection at 1.3770 support with ascending trendline developing.

Pattern: Bullish flag breakout (visible on 2H chart).

Momentum: Recovery candles suggest buyers regaining control ahead of resistance.

Key Levels:

Support: 1.3770 – 1.3780

Resistance:

TP1: 1.3852 (Fib 61.8%)

TP2: 1.3891 (swing high zone)

TP3: 1.3950 (major breakout target)

Invalidation: Below 1.3760

🧠 Fundamental View:

USD Outlook:

The Fed is widely expected to hold interest rates steady on May 7, but officials are pushing back against early rate-cut expectations. Chair Powell is likely to emphasize inflation risks and signal no imminent easing. This stance supports USD resilience, especially if the Fed reiterates “higher for longer” messaging.

CAD Outlook:

The Canadian economy continues to face export challenges from U.S. tariffs, weakening business sentiment. Meanwhile, softening oil prices reduce support for the CAD. With the Bank of Canada having already delivered several rate cuts, it remains more dovish than the Fed — creating a widening policy divergence.

💡 Trade Idea:

Bias: Bullish above 1.3780

Entry Zone: 1.3800–1.3820

Target 1: 1.3852

Target 2: 1.3891

Target 3: 1.3950

Stop Loss: Below 1.3760

📌 Watch for volatility during and after the FOMC statement and Powell’s press conference. A hawkish surprise could fuel a sharp move toward 1.39+.

GOLD UPWARD SOONThis chart showcases a liquidity grab followed by a potential bullish reaction in Gold (XAU/USD).

Key Technical Highlights:

- Resistance Zone: Clearly defined around the 3,370 level, where price has consistently faced rejection.

- Support Level: Identified near the 3,220–3,230 zone, which was recently swept to collect liquidity.

- Liquidity Zone: Price dipped below support to trigger stop-losses before rebounding, signaling a possible bullish reversal.

Projected Move:

The chart suggests a bounce toward the next target at 3251.225, aligning with a previously broken support now turned resistance.

If momentum sustains, further upside could be explored toward the mid-supply zone.

Summary: The recent liquidity sweep hints at a potential short-term bullish move, with a target retracement to 3251.225. Traders should monitor price reaction at that level for confirmation or rejection.

TARGET SUCCESSFUL

This chart displays a successful bullish breakout on Bitcoin (BTC/USD) from the previous consolidation range.

Key Levels & Zones:

-Resistance Zone: Around 95,576, which was clearly broken with strong bullish momentum.

Support Level: Maintained around 93,592, where price previously bounced from.

Fair Value Gap (FVG): Efficiently filled, providing the base for the bullish rally.

Target Achieved: The price decisively hit and exceeded the projected target of 95.576, confirming the bullish setup.

Market Sentiment: Strong bullish bias with volume surge, indicating continued interest above resistance.

Conclusion: The breakout and target completion validate the strength of the structure and buyer control in this range. Further bullish continuation could be expected if momentum sustains.

BTCUSD (BTC/USD) highlights a consolidation phase within clearly defined support and resistance zones, with price currently poised for a potential move upward.

Key Technical Zones:

- Resistance Area: Around 95,576, which has been tested multiple times with rejections—indicating strong supply.

- Support Level: Strong buying interest observed near the 92,500 region, keeping the structure intact.

- FVG (Fair Value Gap): The price filled the FVG recently, suggesting equilibrium and potential for another leg up.

Current Outlook:

- Price is holding above the FVG and is attempting a bullish rebound.

- If price maintains support above the recent lows, we may see continuation toward the target at 95,576.

Next Target: 95,576

Watch For: Rejection at resistance or volume confirmation to validate a breakout.

GOLD UPWARD COMING SOON Gold (XAU/USD) shows the price currently trading within a defined range between the support level at 3272.581 and the resistance zone around 3367.926.

Technical Highlights:

- Support Level: Strong demand seen around 3272.581 where price has previously rebounded.

- Resistance Zone: 3367.926 marks a key supply area that has held several past tests.

- Current Structure: A bullish corrective move appears underway with the potential to test the target area at 3338.838, aligning with a minor resistance zone.

- Price Behavior: Recent rejection from the support zone indicates bullish pressure; if momentum holds, price is likely to challenge the next resistance.

Next Target: 3338.838

Outlook: If gold sustains above the mid-range support, bullish continuation toward 3338.838 is favored. However, price must break minor resistance cleanly for further upside confirmation.

Would you like a social media caption or short signal text for this as well?

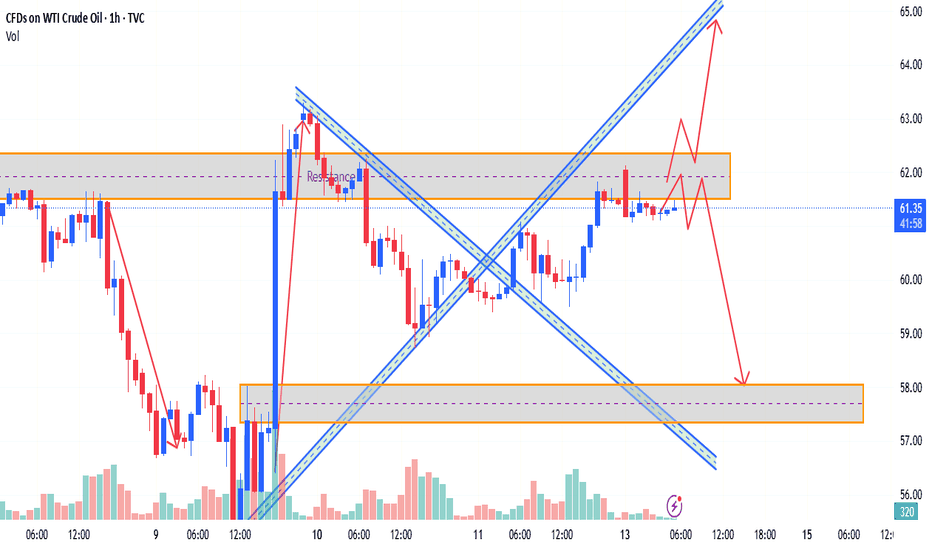

USOILOil shows price moving between a clear support level and a strong order block resistance above. Currently, price is trading inside a resistance zone around 63.25.

The chart indicates a potential bullish move, targeting the 64.22 level, where the order block resides.

Key Technical Points:

- Support Level: Strong demand area near 62.00.

- FVG (Fair Value Gap): Gap filled below current price.

- Resistance Zone: Price facing resistance around 63.00-63.50.

- Order Block: Major target area near 64.22.

Target Projection: $64.22

Outlook:

If buyers sustain momentum above the resistance zone, we could see a rally toward the 64.22 target at the order block. Confirmation of a breakout and retest would strengthen the bullish bias.

Would you like me to also create a quick short caption for social media posting?

BTCUSD Bitcoin (BTC/USD) highlights price movement between a key resistance zone and a strong support level. Price has currently pushed back into the Fair Value Gap (FVG) zone near 94,600, setting up a potential short-term reversal.

The expectation shown on the chart is for price to react from the FVG/resistance area and move lower toward the support level, targeting around 92,947.

Key Technical Points:

- Resistance Zone: 95,500 -95,750

- FVG Area: Current price is testing imbalance at 94,600.

- Support Level: Strong demand zone near92,750.

- Target Projection: $92,947

Outlook: Price is likely to face selling pressure around the FVG and resistance zone, leading to a possible drop towards the support zone. Traders should monitor bearish confirmations for potential short opportunities.

Would you also like me to create a short caption for posting this chart on social media?

GOLD Gold (XAU/USD) shows price action ranging between a strong support level and a visible order block above. Price recently tested the support zone near 3,260.000, showing potential signs of a bullish reaction.

The chart highlights a possible upward move toward the Fair Value Gap (FVG) zone, targeting around 3325.626.

Key Technical Points:

- Support Level: Price bounced from the 3,260.000 zone.

- FVG Area: Gap available for price to fill up toward 3325.626.

- Order Block: Major resistance near the 3,440.000 region.

- Structure: A potential bullish short-term recovery setup.

Target Projection: $3325.626

If buyers maintain control around the current support, we could see a move into the FVG before facing major resistance at the order block above. Watch closely for bullish confirmations or possible rejections around the FVG area.

SILVER Silver (XAG/USD) shows a potential bearish correction setup forming after rejection from the upper resistance channel. Price is currently consolidating below the resistance zone after testing the upper band and is projected to move downward toward the order block and potentially the support trendline.

The chart suggests a bearish move targeting the next level at 32.8153, which aligns with a confluence of support between the lower trendline and the order block zone.

Key Technical Elements:

- Resistance Zone: Price failed to break above33.70, confirming a strong supply area.

- Bearish Projection: Lower highs and consolidation hint at possible downside movement.

- Next Target: 32.8153

- Order Block Trendline Support: Could serve as a bounce zone or continuation support.

Outlook: If price breaks below the intermediate channel support, it may trigger further downside toward32.81. However, watch for reactions around the order block for potential bullish reversals. This setup is ideal for short-term traders monitoring key levels for entry and risk control.

USOILThis chart for WTI Crude Oil presents a bullish continuation setup following a rebound from the support level around 61.50. After breaking above a minor consolidation range, price is now retracing slightly before potentially continuing its upward movement.

The chart highlights a target at63.95, just below the upper resistance zone, which previously acted as a strong supply area.

Technical Breakdown:

- Support Level: Firm bounce near 61.50, confirming demand.

- Minor Breakout: Price broke above local structure and retesting for continuation.

- Resistance Zone: Located near64.00, target aligns with historical supply.

- Next Target: 63.95

Volume spikes during the bounce suggest strong buyer interest. A clean break and hold above 63.00 could open the path toward the $63.95 target. Traders may look for bullish price action confirmation for entry.

GOLD

This Gold (XAU/USD) outlines a bullish retracement setup, targeting a potential move toward the order block around 3,373.348. After bouncing from the support level near3,280, price is consolidating in a tight range and showing signs of upward momentum.

The move aims to revisit the order block, which previously acted as a breakdown zone. If price successfully reaches and reacts from this level, it may also attempt to fill the nearby Fair Value Gap (FVG) above.

Key Technical Zones:

- Support Level: Around 3,280, where buyers stepped in.

- Order Block: Immediate resistance and primary target at3,373.

- FVG Zone Above: Suggests a potential bullish continuation if broken.

Short-Term Target: 3,373.348

If momentum holds, a breakout above the order block may expose price to further upside toward3,440 and beyond.

Traders can watch for breakout confirmation or signs of rejection at the order block for the next directional cue.

USOIL Chart Overview:

WTI Crude is trading around 61.44, consolidating inside a key resistance zone near62.00. After a strong bullish impulse, price has stalled under this resistance, forming both bullish and bearish paths, highlighting a conflicting market structure

Key Discrepations Identified:

1. Bullish Momentum vs. Resistance Reaction

- Expected: Continuation to 64+ after breakout.

- Reality: Price is struggling below resistance, rejecting upper boundary multiple times.

- Discrepation: Bullish momentum is slowing, and repeated rejections are exposing potential reversal pressure.

2. Volume Strength vs. Breakout Potential

- Volume d…

- Visually this implies strength, but price is hovering in indecision, neither breaking up nor down convincingly.

- Discrepation: Chart setup shows both bullish continuation and bearish breakdown possibilities, confusing structure

4. Double Scenario Projection

- The projection shows both:

- A bullish breakout to 64.

- A rejection and selloff to 58.

- Discrepation: Market is giving mixed technical signals, suggesting traders should wait for confirmation before committing

Discrepation Summary Table:

| Element | Expectation | Observed Reality | Discrepation | Projection Conflict | Clear trend continuation | Dual projection shown | Market indecision + low conviction |

📉 Conclusion:

While WTI remains inside a short-term bullish structure, the presence of conflicting breakout signals, resistance rejections, and declining volume point toward a discrepation. Traders should watch the 62.00 resistance zone closely. A clear rejection or breakout will resolve this divergence, with downside targeting 58.00, and upside toward $64.00.

Let me know if you'd like a summarized version for a caption or post!

GOLD This 1-hour chart of Gold (XAU/USD) presents a detailed technical outlook showing a bullish breakout from a downtrend, followed by a strong rally, and a potential upcoming retracement.

Key highlights from the chart:

- The price previously broke out from a descending trendline, confirmed by the breakout above the 3,132.939 resistance level, followed by a continuation of the uptrend.

- The chart shows multiple FVGs (Fair Value Gaps) and support/resistance zones, which have been respected throughout the price movement.

- After bottoming out around 2,974.936, Gold began a bullish rally, forming higher highs and breaking past the 3,067.613 and 3,139.363 levels.

- The recent high around 3,220 marks a resistance zone, where price has currently stalled and is showing …

The volume profile shows a strong increase during bullish movements, indicating strong buyer interest. Traders will be watching the 3,168–3,150 zone closely—if it holds as support, it may offer a fresh opportunity for long positions toward a retest of 3,220 or higher. However, a break below this zone could signal a deeper correction.

Summary:

- Trend: Bullish

- Current Action: Pullback from resistance

- Watch Support: 3,168.521

- Potential Setup: Buy on pullback if support holds, otherwise wait for confirmation before re-entry.

BTCUSD Market Discrepancy Analysis (April 11, 2025)

📉 Chart Overview:

The chart reflects Bitcoin (BTC/USD) on the 1-hour timeframe, with significant price movements between 77,417 (support) and 83,846 (resistance). The asset recently rallied to fill a Fair Value Gap (FVG) before facing resistance and dropping back to retest the lower region.

1. Resistance Rejection at $83,846:

- The price spiked aggressively into the resistance zone, but quickly reversed after failing to sustain above it.

- This price rejection is clear evidence of strong seller presence.

- The FVG zone just below the resistance appears to have been filled, triggering a sharp correction.

2. Failed Breakout or Bull Trap:

- The s…

- This suggests that buying pressure was temporary, and mostly driven by short-term momentum traders rather than real demand.

4. Incomplete Fair Value Gap at77,417:

- Price moved sharply down and almost touched the FVG area near 77,417, but did not completely fill it.

- This leaves an imbalance and suggests that the market may revisit this area to fully mitigate it.

5. False Break of Lower High:

- The high near 82,290 was breached temporarily, but price did not close above convincingly.

- Indicates a fake breakout structure within a broader bearish context.

---

🔧 Technical Summary:

| Zone | Level | Status |

|------------------|-----------------|-------------------------|

| Resistance | 83,846 | Rejected |

|…

This chart shows a clear discrepation between price momentum and volume confirmation. While price temporarily surged into a resistance zone, it lacked the strength to hold above key breakout levels, suggesting the rally was unsustainable.

> The Fair Value Gap (FVG) at77,417 remains unfilled, and current price structure points to a potential return to that zone. Expect bearish continuation unless BTC reclaims and sustains above $82,290 with volume.

---

Let me know if you want this in a simplified caption format for social sharing!

BTCUSD TARGET COMPLETE Market Analysis for Bitcoin (BTC/USD) – April 10, 2025

Price Action Overview:

- Bitcoin (BTC) is currently consolidating between 79,161 and 81,520, with price action forming within this range. A move to 79,161 has been achieved, completing the target and fulfilling the bearish target outlined earlier.

- BTC seems to be struggling around 81,500, and is showing potential signs of exhaustion at the upper end of the range near the resistance zone.

Key Levels to Watch:

1. Resistance Zone (Red Box):

- The resistance level is clearly marked near 82,000 and 81,500, with price struggling to break above this level. If Bitcoin fails to break out of this resistance zone, the price could reverse towards support levels.

- The upper resistance zone remains a key level…

ChatGPT: - An FVG (Fair Value Gap) is evident in the 79,161 to 78,500 region. This could act as an area to fill, and could potentially see price retracement or sideways consolidation before a possible move up.

Market Structure Analysis:

- Bearish Trend: Bitcoin's price has been on a downward trend forming a descending triangle, indicating bearish sentiment.

- Breakout Potential: A breakout from the current consolidation zone will be important. Bitcoin will likely test 79,161 again. If it fails to hold support, further downside may be possible.

Volume & Momentum:

- Volume: The volume analysis shows increasing buying volume at lower levels, suggesting potential support around 79,161. However, the volume is diminishing at resistance levels, which indicates that bullish…

GOLD Chart Analysis for Gold (XAU/USD) – April 10, 2025

Key Observations:

1. Price Action and Trend:

- The price is currently in an uptrend, forming a bullish channel (green box) as it moves upwards.

- Resistance is positioned near 3,134.588 and 3,123.580 which are key levels to watch for potential price rejection or breakout.

- Support levels are defined at 3,067.613 and 2,974.936. The price has recently bounced off the support level, suggesting that the trend is still intact and may continue to push higher.

2. Key Levels:

- Resistance: The resistance level near 3,134.588 is being tested currently. A breakout above this level could indicate further bullish momentum.

- Support: The support zone near 3,067.613 is crucial. If the price drops below thi…

ChatGPT: - The volume bars show a spike in activity, suggesting market indecision, but also strong bullish sentiment near the support level.

4. Target Price and Future Projections:

- The target price for this move is 3,134.588, where the price is expected to test resistance. If it breaks this level, the next target could be near 3,150.00.

- The bullish channel suggests that Gold is still trending upward, and the price is likely to continue moving towards the upper boundary of the channel.

Scenario Predictions:

1. Bullish Scenario:

- If Gold successfully breaks the resistance at 3,134.588, it could continue to push higher towards the next resistance zone around 3,150.00.

- Support level at 3,067.613 holds strong, and the price continues to make higher highs…