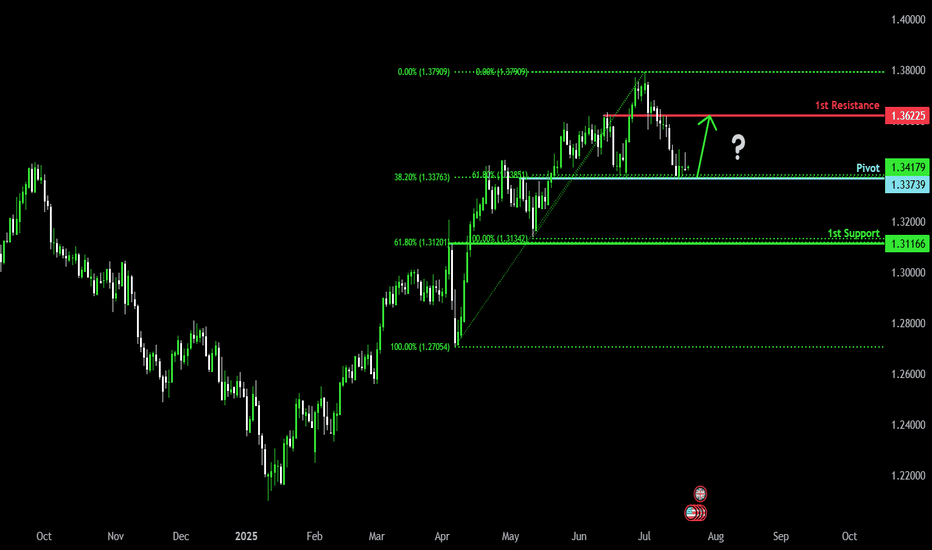

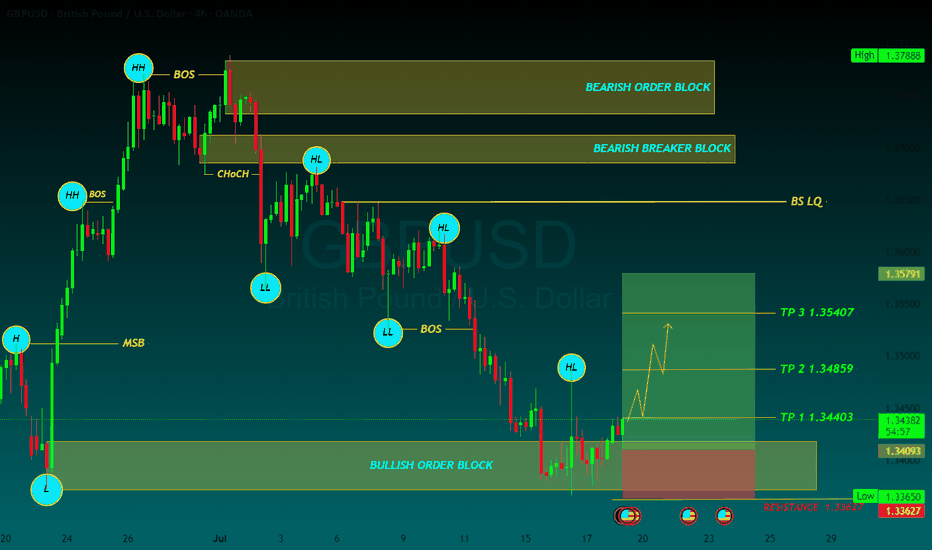

Bullish bounce?The Cable (GBP/USD) is falling towards the pivot and could bounce to the 1st resistance which is a pullback support.

Pivot: 1.3373

1st Support: 1.3116

1st Resistance: 1.3622

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Forexsignals

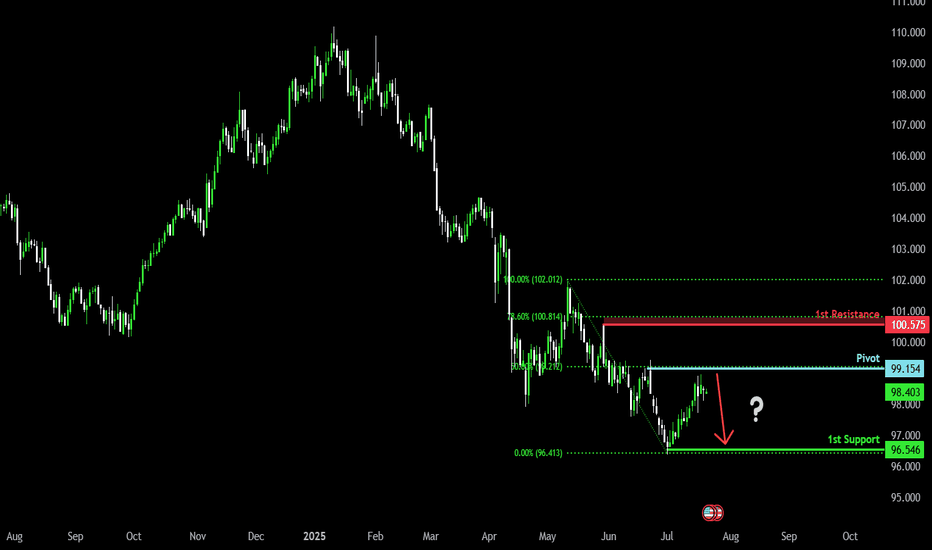

Bearish drop off 50% Fibonacci resistance?The US Dollar Index (DXY) is rising towards the pivot which acts as a pullback resistance and could drop to the 1st support.

Pivot: 99..15

1st Support: 96.54

1st Resistance: 100.57

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

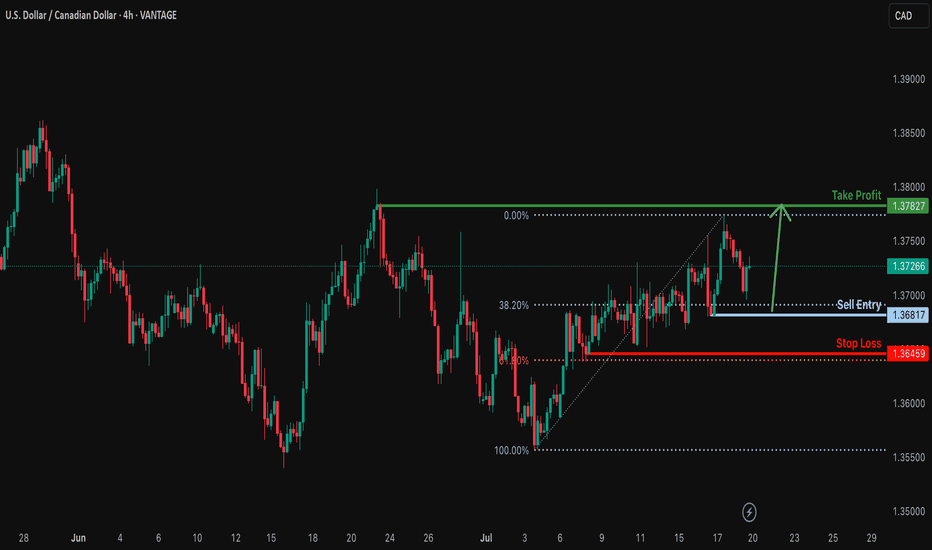

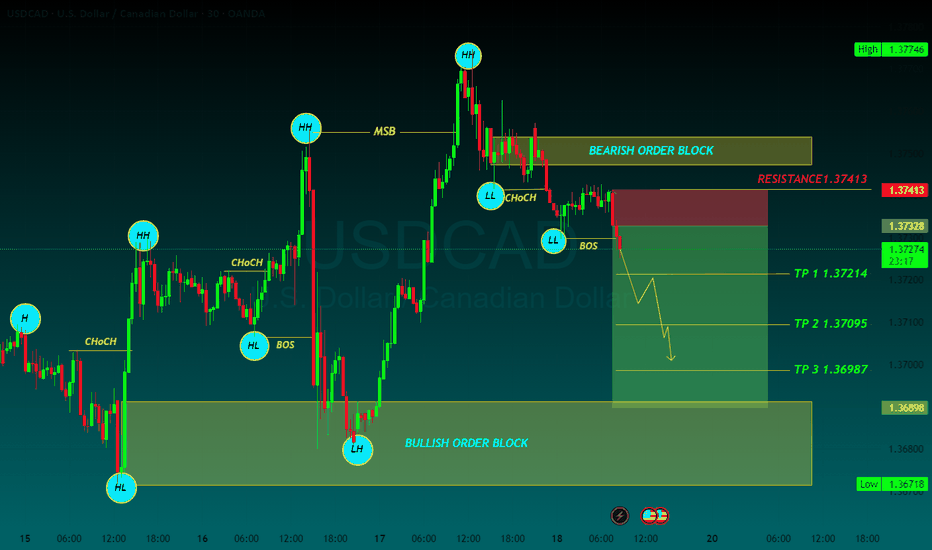

Bullish bounce off pullback support?USD/CAD is falling towards the support level which is a pullback support that lines up with the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.3681

Why we like it:

There is a pullback support level that aligns with the 38.2% Fibonacci retracement.

Stop loss: 1.3645

Why we like it:

There is a pullback support that lines up with the 61.8% Fibonacci retracement.

Take profit: 1.3782

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

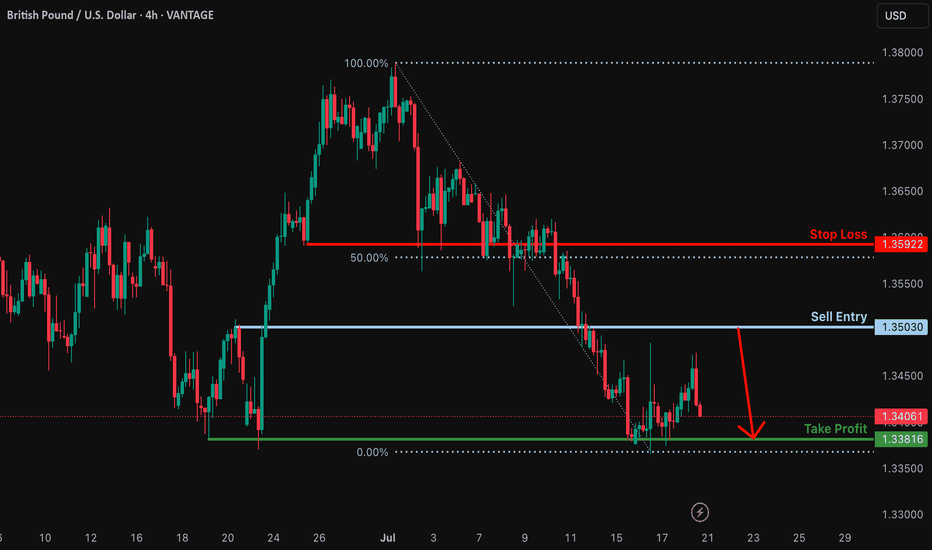

Bearish reversal off pullback resistance?GBP/USD is rising towards the resistance which is a pullback resistance and could drop from this level to our take profit.

Entry: 1.3603

Why we like it:

There is a pullback resistance level.

Stop loss: 1.3592

Why we like it:

There is a pullback resistance that is slightly above the 50% Fibonacci retracement.

Take profit: 1.3361

Why we like it:

There is a pullback support.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

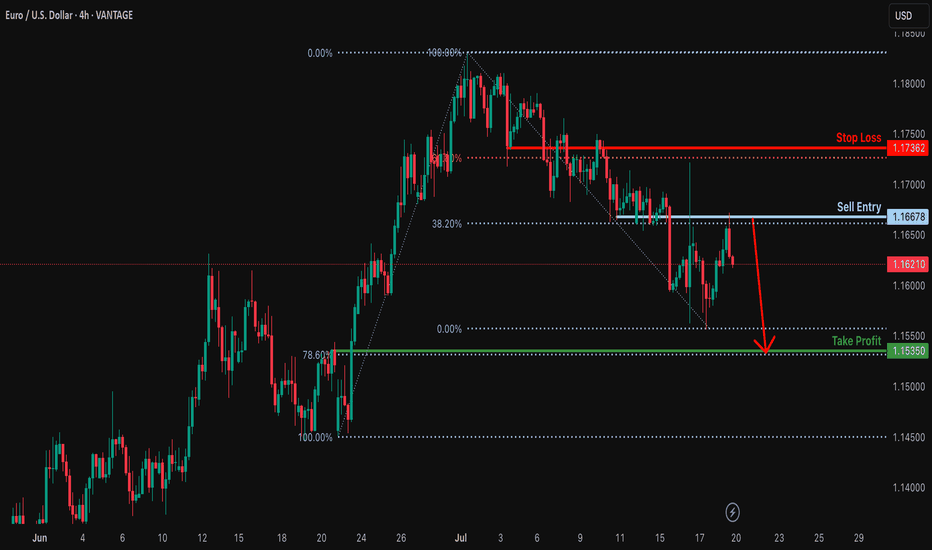

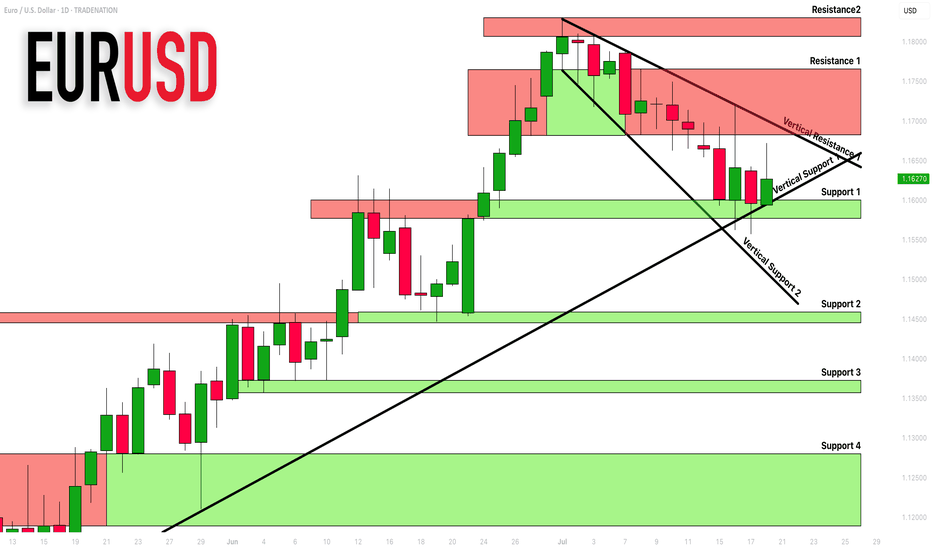

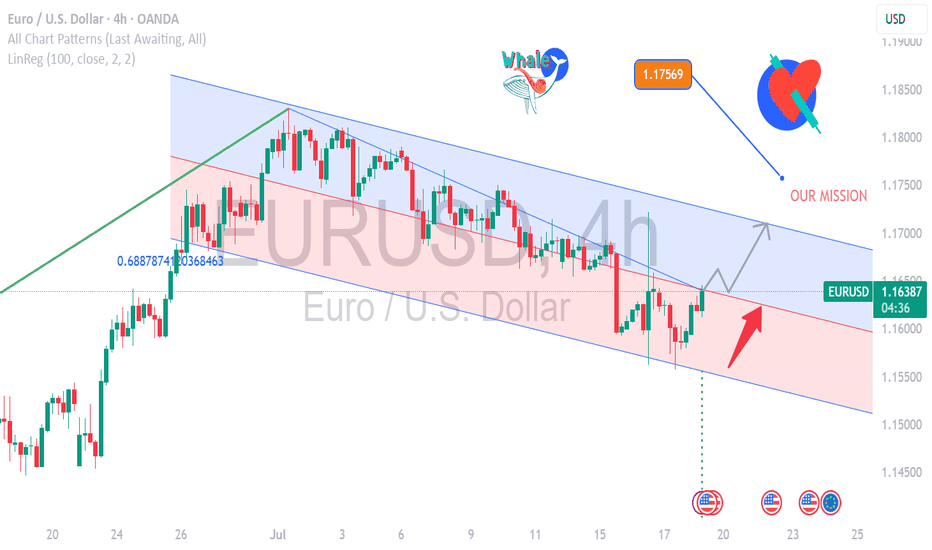

Bearish drop?EUR/USD has rejected off the resistance level which is a pullback resistance that lines up with the 38.2% Fibonacci retracement and could drop from this level to our tale profit.

Entry: 1.1667

Why we like it:

There is a pullback resistance that aligns with the 38.2% Fibonacci retracement.

Stop loss: 1.1736

Why we like it:

There is an overlap resistance that aligns with the 61.8% Fibonacci retracement.

Take profit: 1.1535

Why we like it:

There is a pullback support that lines up with the 78.6% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

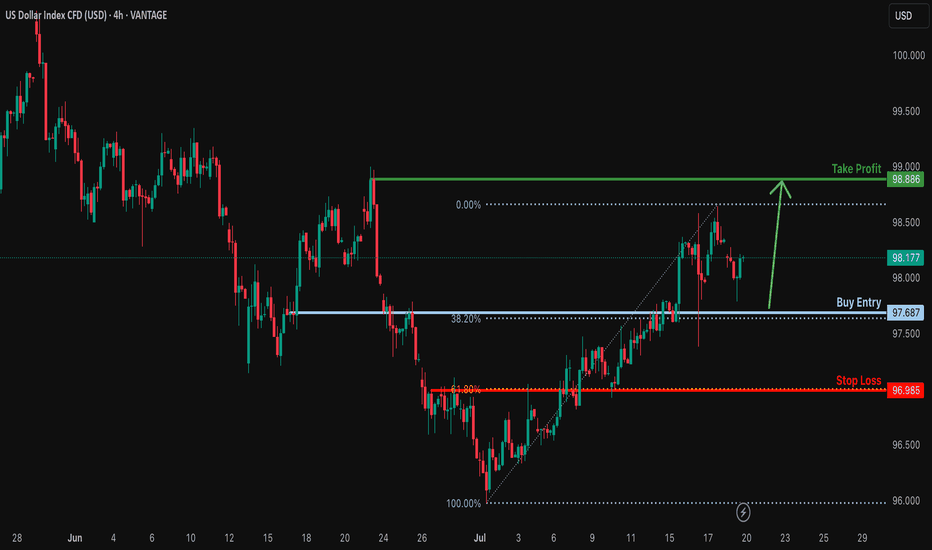

Bullish continuation for the Dollar?The price is falling towards the support level which is a pullback support that lines up with the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 97.68

Why we like it:

There is a pullback support that aligns with the 38.6% Fibonacci retracement.

Stop loss: 96.98

Why we lik eit:

There is an overlap support that aligns with the 61.8% Fibonacci retracement.

Take profit: 98.88

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

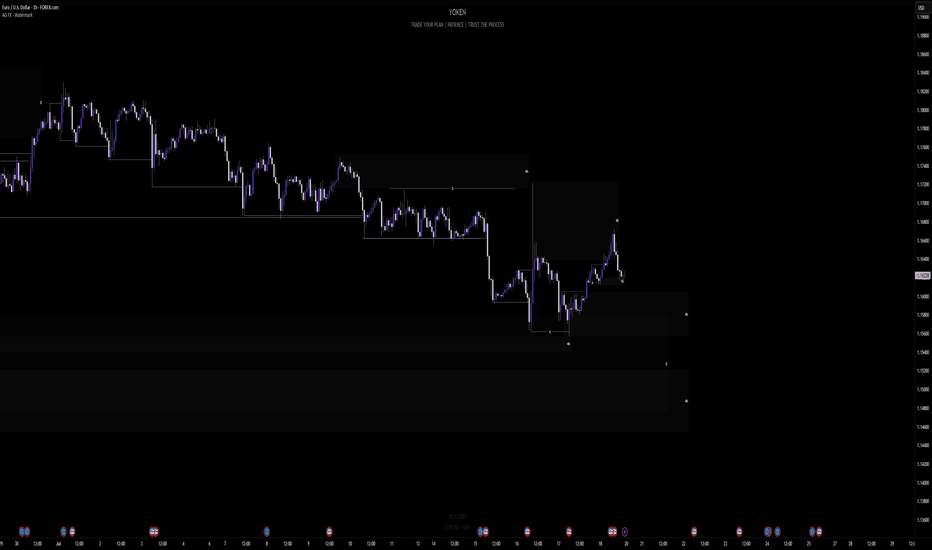

Week of 7/20/25: EURUSD AnalysisLast week's price action was bearish and has finally reached the extreme daily demand level and provided some reaction. Price has swept bulls and bears, so now we follow internal structure and wait to see where price actually wants to go. If internal 1h structure breaks bearish, we have confirmation to trade bearish until price goes deeper into the daily extreme zone.

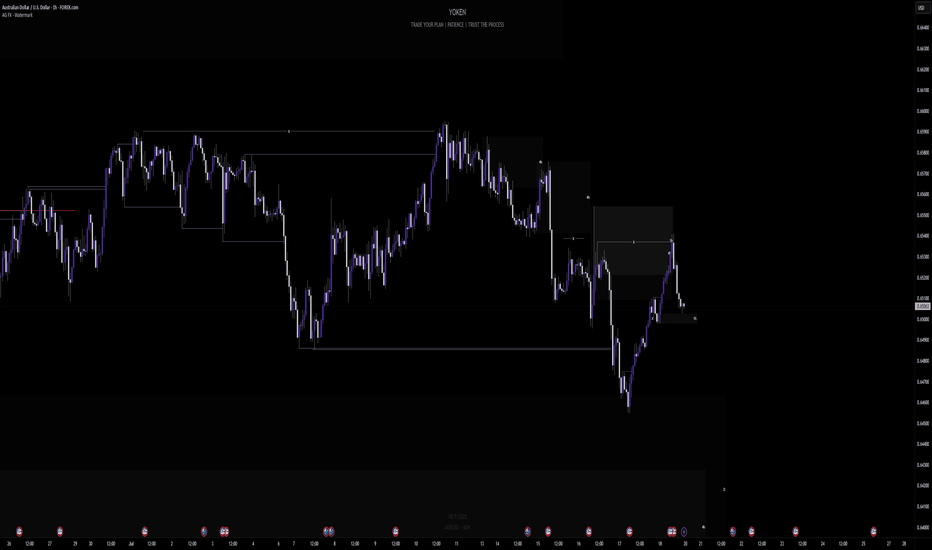

Week of 7/20/25: AUDUSD AnalysisLast week's price action was bearish and this week I will follow bearish order flow unless internal 1h structure continues to be bullish. I'm going to look for shorts after 1h internal structure is broken as confirmation, then take trades down to the daily demand zone and then look for bullish signals.

EURUSD: Support & Resistance Analysis For Next Week 🇪🇺🇺🇸

Here is my latest structure analysis and important supports/resistances

for EURUSD for next week.

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

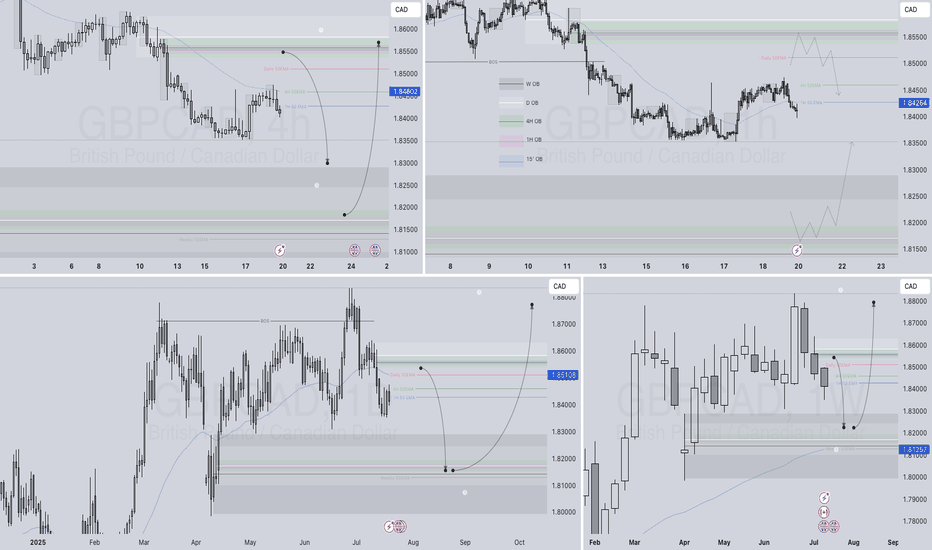

GBPCAD – WEEKLY FORECAST Q3 | W30 | Y25📊 GBPCAD – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊

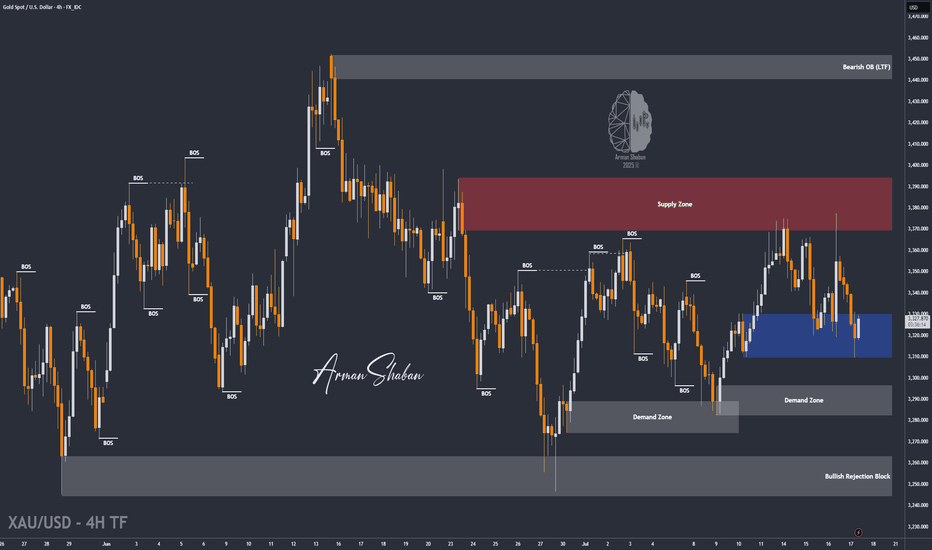

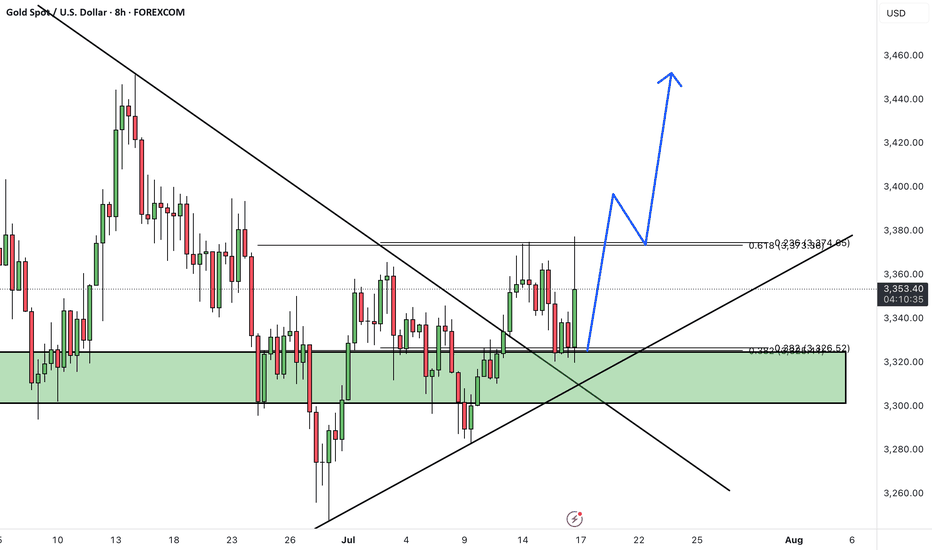

Gold. 14.07.2025. The plan for the next few days.The nearest resistance zones are where it's interesting to look for sales. It's not certain that there will be a big reversal, but I think we'll see a correction. We're waiting for a reaction and looking for an entry point.

The post will be adjusted based on any changes.

Don't forget to click on the Rocket! =)

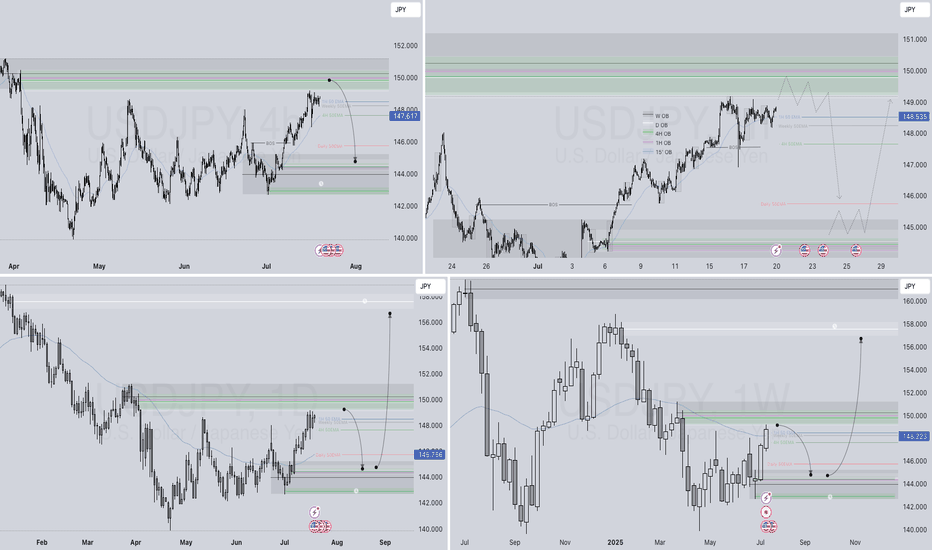

USDJPY – WEEKLY FORECAST Q3 | W30 | Y25📊 USDJPY – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊

EURUSD – WEEKLY FORECAST Q3 | W30 | Y25📊 EURUSD – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊

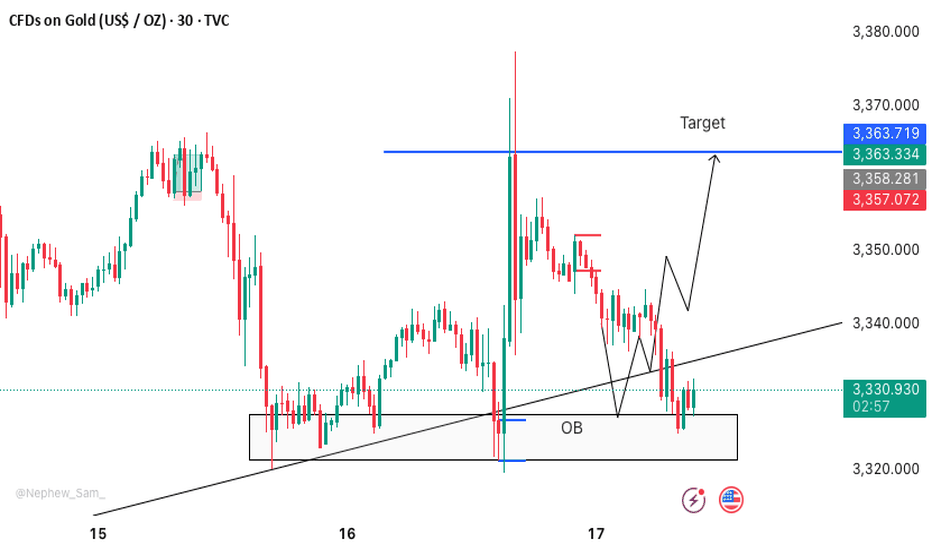

XAU/USD | First LONG to $3345, Then a Potential DROP Below $3300By analyzing the gold chart on the 4-hour timeframe, we can see that last night the price first tapped into the $3340 level, showing an initial push up to $3352. However, the drop intensified soon after, breaking the $3340 resistance and, according to the second scenario, falling to $3310. Upon reaching this key demand level, buying pressure kicked in, pushing the price back up to $3325. Now, the key question is whether gold can hold the $3310 support. If this level holds, we can expect a rise toward $3331 as the first target and $3345 as the second. After this move, a rejection from the $3345 area could trigger another drop, possibly pushing gold below $3300. So, first LONG, then SHORT!

THE LATEST VIDEO ANALYSIS :

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

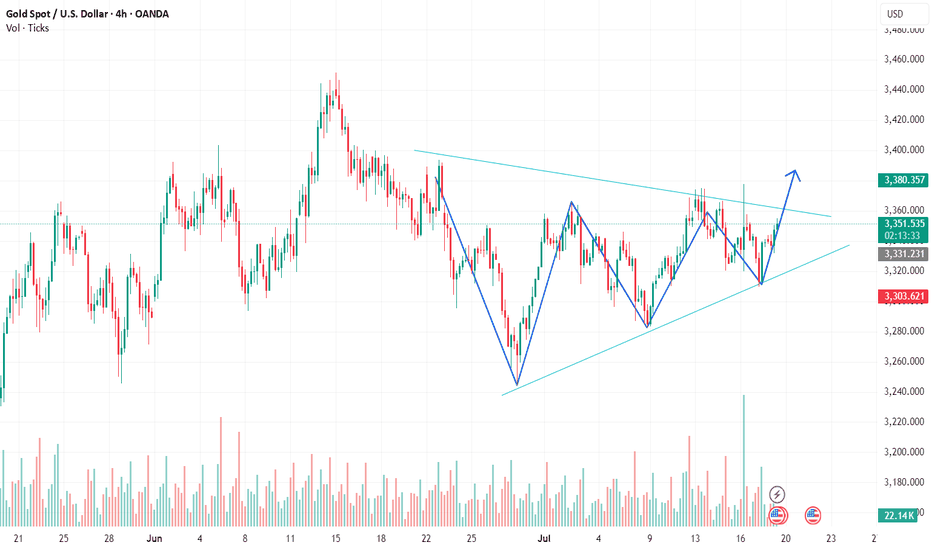

XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

Gold has broken above its descending trendline and completed a successful pullback to the breakout level. Now, the price appears ready to resume its upward move, but it's still facing resistance near the $3375 level.

We expect another attempt to break through the $3375 resistance zone.

A confirmed breakout above this area would open the path toward higher targets and potentially trigger strong bullish momentum.

As long as price holds above the broken trendline and key support zone, the overall bias remains bullish.

Don’t forget to like and share your thoughts in the comments! ❤️

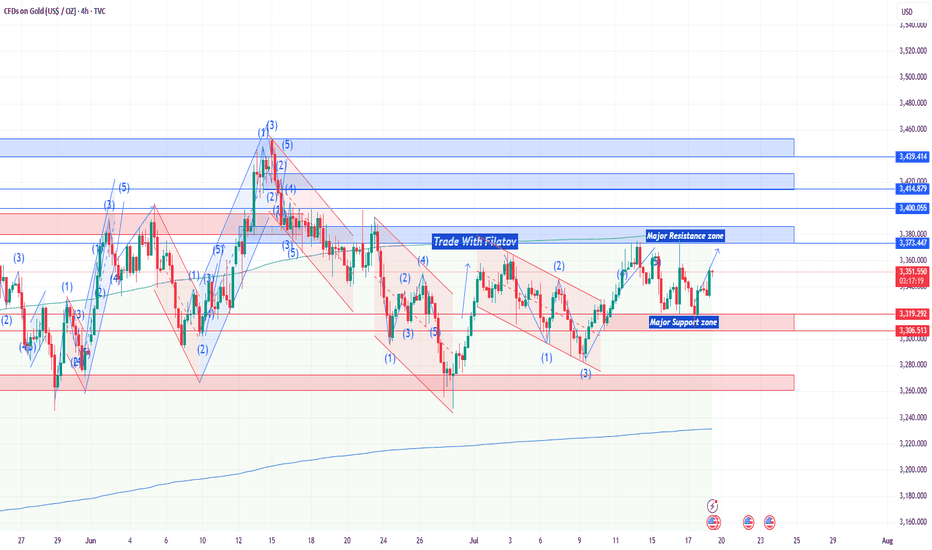

GOLD H1 Technical Analysis🧠 Chart Breakdown & Trade Idea: Symmetrical Triangle Formation

We’re observing a symmetrical triangle formation — a classic consolidation pattern that often precedes a strong breakout move. The price has been making higher lows and lower highs, gradually tightening within two converging trendlines.

This pattern indicates that buyers and sellers are in a temporary equilibrium, with volatility compressing. The market is clearly waiting for a catalyst to decide the next big move.

🔍 Key Observations:

1. Trendlines:

- The upper resistance trendline is sloping downward, connecting several lower highs.

- The lower support trendline is sloping upward, connecting multiple higher lows.

2. Volume Pattern:

- Volume has been tapering off during the consolidation phase — a typical behavior during triangle formation.

- A volume spike at the breakout point would confirm the direction and strength of the move.

3. Price Action:

- The price has bounced cleanly off the lower trendline and is now approaching the upper boundary.

- A strong V-shaped recovery from support indicates buyer dominance at lower levels.

- The market is now testing the triangle’s upper resistance again — a crucial inflection point.

🚀 What the Chart is Saying

The chart is signaling a potential bullish breakout. The consistent formation of higher lows shows increasing demand, and the price is now poised to test — and possibly break — the descending resistance.

If the breakout happens with above-average volume, it would validate the pattern and open the door for a sharp upward rally.

🎯 Trade Setup (When to Buy)

✅ Buy Entry:

- Wait for a confirmed breakout — a candle close above the upper trendline with strong volume.

- Ideally, price should break above the recent swing high to avoid a false breakout.

🛑 Stop Loss:

- Just below the most recent higher low or the triangle’s lower trendline.

🎯 Take Profit:

- Measure the widest part of the triangle and project it upward from the breakout point.

- This gives you a realistic and technical target area.

📌 Conclusion:

This symmetrical triangle is nearing its apex, and the current setup favors the bulls. A breakout above resistance, accompanied by volume, could offer a high-probability long trade. Patience is key — wait for confirmation before entering.

TradeIdea – Gold (XAUUSD)Looks like a bullish breakout is brewing!

✅ Price has broken out of the descending channel

✅ Retested the global trendline support

✅ Reclaimed the 200-day moving average (MA200)

✅ Momentum indicator surged above the 100 mark

✅ Visible imbalance zone above — potential target area

📌 If price consolidates above $3350, consider a long setup:

🎯 Target 1: $3370

🎯 Target 2: $3375

🧠 Watch for confirmation before entry — structure and momentum alignment is key.

FX Setup of the Day: EURAUD SELL ZONEHey traders 👋

📌 SELL / EURAUD – Technical Breakdown

🟢 Entry: 1.78579

🎯 Target 1: 1.78304

🎯 Target 2: 1.78026

🎯 Target 3: 1.77636

🔴 Stop Loss: 1.79039

📈 Risk/Reward Ratio: 2.00

I’ve carefully validated these levels and crafted a clean, focused analysis for you.

Every like seriously fuels my drive to produce more top-tier content 📈

Your support genuinely means a lot to me.

Thanks from the heart to everyone showing love 💙

🎯 Clear targets, solid strategy.

🤝 Let’s move forward with logic and discipline.

EUR/USD Flexing Strength- Is the Next Big Coming? EUR/USD Market Update – Bullish Setup at 1.16440

EUR/USD is trading around 1.16440, maintaining its bullish momentum in the current uptrend.

🔹 Current Price: 1.16440

🔹 Support Zone: 1.1600 – 1.1620

🔹 Resistance Zone: 1.1680 – 1.1700

🔹 Trend: Strong bullish structure with clear upward momentum

The pair is holding above key support and aiming for the next resistance at 1.1700. A breakout above this level could open the door to further upside. Traders watching for a retest near support or breakout entry above resistance.

🎯 Trading Plan:

Buy on dips above 1.1620 or wait for a confirmed breakout above 1.1680 with volume.

#EURUSD #ForexAnalysis #BullishSetup #ResistanceSupport #TechnicalAnalysis #PriceAction #TrendTrading #SmartTrader #FXSignals

USDCAD SELLUSD/CAD retakes 1.3700, eyes multi-week top amid a broadly firmer USD

The USD/CAD pair attracts some dip-buying during the Asian session on Thursday and climbs further beyond the 1.3700 mark amid a broadly firmer US Dollar. Spot prices have now reversed the previous day's retracement slide from a three-week high and seem poised to appreciate further

The year will be politically marked by Trump’s return to the White House. A Republican government is seen as positive for financial markets, but Trump’s pledge to cut taxes and impose tariffs on foreign goods and services may introduce uncertainty to both the political and economic landscape.

Canada’s political crisis peaked in late 2024 with a no-confidence vote against Prime Minister Justin Trudeau, leading to snap elections and a weakened Liberal minority government. Policy uncertainty and economic challenges dominate 2025’s outlook, raising concerns over market stability and investor confidence.

The BoC is set to continue easing interest rates through 2025, at least at a faster pace than the Fed is expected to, which could apply pressure on CAD’s already-rising rate differentia

TP 1 1.37214

TP 2 1.37095

TP 3 1.36987

RESISTANCE 1.37413

GBPUSD BUYGBP/USD rises to near 1.3450 due to improved market sentiment, UoM Consumer Sentiment eyed

GBP/USD gains ground after registering small losses in the previous session, trading around 1.3440 during the Asian hours on Friday. The pair appreciates as the US Dollar edges lower due to dovish remarks from the Federal Reserve officials.

The Relative Strength Index (RSI) indicator on the 4-hour chart stays below 40, reflecting bearish conditions for GBP/USD. The Fibonacci 61.8% retracement level of the latest uptrend seems to have formed a pivot level at 1.3400.

In case GBP/USD fails to stabilize above 1.3400, technical sellers could remain interested. In this scenario, 1.3300 (Fibonacci 78.6% retracement) and 1.3275 (100-day Simple Moving Average) could be seen as next support levels. On the upside, resistance levels could be spotted at 1.3470 (Fibonacci 50% retracement), 1.3500 (static level, round level) and 1.3540 (Fibonacci 38.2% retracement).

TP 1 1.34403

TP 2 1.34859

TP 3 1.35407

RESISTANCE 1.33627

Gold 15-Min Chart Analysis Alert!Gold has successfully broken above the descending trendline, showing early signs of bullish momentum. Price has reclaimed structure and is now trading above the breakout level.

📌 Retest Zone:

We can expect a possible pullback towards the marked zone for a healthy retest before continuing the upward move.

🎯 Bullish Target:

As long as price holds above the support area, the bullish bias remains intact with targets around 3351+.