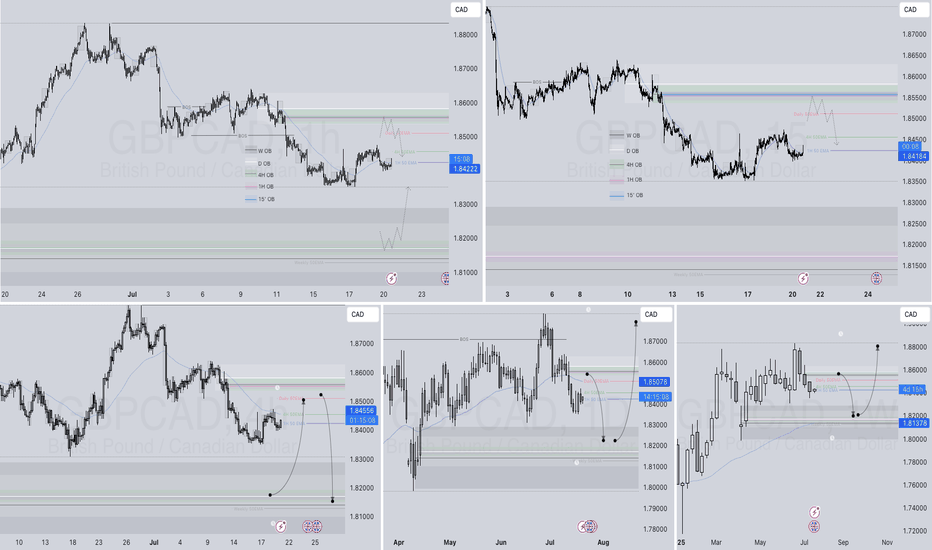

GBPUSD: Bearish Momentum vs. Fundamental Repricing – Key LevelsGBPUSD is at a critical juncture, balancing a clear technical breakdown with a fundamental backdrop favoring near-term volatility. The pair has slipped from its rising wedge structure and is now testing key retracement zones while markets reprice expectations for Fed rate cuts after weak US jobs data. Traders are closely watching whether this bearish momentum will extend toward the 1.3128 support or if a rebound from oversold conditions could trigger a corrective bounce.

Technical Analysis (8H Chart)

Pattern: Clear breakdown from a rising wedge, confirming bearish bias.

Current Level: Price sits near 1.3278, struggling to reclaim the 1.3300 resistance zone.

Key Support Zones:

1.3128 (61.8% Fibonacci retracement) – main bearish target.

1.2945 (78.6% retracement) – extended downside target if selling pressure deepens.

Resistance Levels:

1.3300 (immediate resistance, prior support now flipped).

1.3380 (secondary resistance if a retracement rally occurs).

Projection: Likely bearish continuation toward 1.3128, with a potential retest of 1.3300 before continuation.

Fundamental Analysis

Bias: Bearish in the short term, but Fed policy and risk sentiment remain key drivers.

Key Fundamentals:

USD: Weak NFP (73K), higher unemployment (4.2%), and downward revisions boost Fed cut bets (~75% for September), typically a USD-negative factor.

GBP: BOE maintains a cautious stance due to sticky inflation but lacks clear hawkish conviction as growth slows.

Tariffs: US tariffs add a mild negative weight on GBP trade sentiment.

Risks:

Hot US CPI could slow Fed cut bets, supporting USD.

Hawkish BOE comments could limit GBP downside.

Global risk sentiment shifts could either favor USD (risk-off) or weaken it further (risk-on).

Key Events:

US CPI and PPI for USD direction.

BOE policy updates and UK CPI.

US jobless claims and Fed commentary.

Leader/Lagger Dynamics

GBP/USD is a lagger, mainly reacting to USD shifts. However, its moves directly influence GBP crosses such as GBP/JPY and GBP/CHF.

Summary: Bias and Watchpoints

GBP/USD remains in a bearish phase, targeting 1.3128 with a potential corrective bounce toward 1.3300 first. The primary driver is the technical breakdown, while fundamentals add volatility around US CPI and BOE policy. If CPI surprises lower, the bearish outlook could reverse into a short-term rebound; if CPI is hot, downside momentum could extend. You should monitor USD-driven events closely as GBP/USD sets the tone for broader GBP movements.

Forexsignalservice

NZD/JPY: Bearish Breakdown from Ascending ChannelNZD/JPY has decisively broken below its ascending channel, signaling a shift from bullish structure to bearish momentum. This move aligns with fundamental headwinds for NZD and the potential for JPY strength amid intervention risks and global risk-off sentiment.

Technical Analysis (4H Chart)

Pattern: Breakout from ascending channel support confirms a bearish reversal.

Current Level: 87.12, trading below the broken trendline with strong selling pressure.

Key Support Levels:

86.00 – first bearish target and immediate support zone.

84.60 – extended bearish target if momentum continues.

Resistance Levels:

88.04 – previous support turned resistance.

89.06 – upper boundary and invalidation zone for bearish bias.

Projection: Price is expected to retest 86.00, and if broken, further decline toward 84.60 is likely.

Fundamental Analysis

Bias: Bearish.

Key Fundamentals:

NZD: Pressured by global tariffs and risk-off sentiment.

JPY: Supported by potential FX intervention from Japan’s Ministry of Finance and safe-haven demand.

US Data Impact: Weak NFP boosted Fed cut bets, but risk-off flows strengthen JPY against risk currencies like NZD.

Risks:

China stimulus or a risk-on shift could lift NZD.

Lack of BOJ action may weaken JPY temporarily.

Key Events:

RBNZ policy outlook.

BOJ comments or intervention signals.

US CPI influencing global risk sentiment.

Leader/Lagger Dynamics

NZD/JPY is a lagger, reacting to risk sentiment and JPY moves, with JPY strength leading the pair lower.

Summary: Bias and Watchpoints

NZD/JPY is bearish, with a clear technical break from its ascending channel. The pair targets 86.00 initially and 84.60 on extended downside. Key watchpoints include BOJ FX policy, RBNZ stance, and global risk sentiment, especially if markets move deeper into risk-off mode.

GBPNZD Breakout from Consolidation Bullish Momentum BuildingGBPNZD has broken out of its recent consolidation pattern and is showing signs of bullish continuation. Strong GBP fundamentals combined with NZD weakness from global risk-off sentiment and tariffs support this technical move.

Technical Analysis (4H Chart)

Pattern: Breakout from a descending channel with bullish follow-through.

Current Level: 2.2418, trading above the breakout level, confirming momentum shift.

Key Support Levels:

2.2294 – recent breakout support and invalidation point for bulls.

2.2222 – secondary support if a deeper pullback occurs.

Resistance Levels:

2.2500 – near-term resistance and potential target for the breakout.

2.2690 – extended bullish target if momentum continues.

Projection: Likely to continue higher toward 2.2500, with room for 2.2690 if GBP strength persists.

Fundamental Analysis

Bias: Bullish.

Key Fundamentals:

GBP: Supported by BOE’s cautious stance on inflation and the relative resilience of the UK economy.

NZD: Pressured by global tariffs, weaker risk sentiment, and limited domestic growth catalysts.

USD Factor: Fed rate cut expectations indirectly support GBP crosses against risk currencies like NZD.

Risks:

Hawkish surprise from RBNZ could strengthen NZD.

BOE dovish signals could stall GBP upside.

Key Events:

BOE meeting and UK CPI.

RBNZ policy decision.

Risk sentiment trends globally.

Leader/Lagger Dynamics

GBP/NZD is a leader among GBP crosses, with GBP strength and NZD weakness driving momentum. It also aligns with EUR/NZD upside moves, reinforcing the bearish NZD outlook.

Summary: Bias and Watchpoints

GBP/NZD is bullish, having broken consolidation with upside targets at 2.2500 and 2.2690. The main drivers are GBP’s policy support, NZD’s risk-off weakness, and global tariff concerns. Watch for BOE and RBNZ updates as potential volatility triggers.

USD/JPY: Fifth Wave Target in SightUSD/JPY is painting a textbook five-wave impulse structure from the recent lows, and we're now positioned for what could be the final act of this motive sequence.

Current Wave Count

✅ Waves 1-3 Complete: Clean impulsive structure with wave 3 showing strong extension

✅ Wave 4 in Progress: Currently correcting from the 150.94 high

🎯 Wave 5 Setup: Targeting completion around 151.95 - 152.20

Key Levels to Watch

Support Zone: 150.00 area (ideal wave 4 retracement)

This aligns with wave principle fourth-wave correction parameters

Provides a healthy pullback without threatening wave 1 overlap

Target: 151.95 - 152.20 zone for wave 5 completion

Classic 5 vs 1+3 projection

Trade Strategy

Monitor for supportive price action near 150.00

Look for an impulsive price action to confirm wave 5 beginning

Structure suggests one more leg higher before a larger correction

The beauty of Elliott Wave: when the count is this clean, the roadmap becomes crystal clear. Let's see if USD/JPY delivers this final push to complete the sequence.

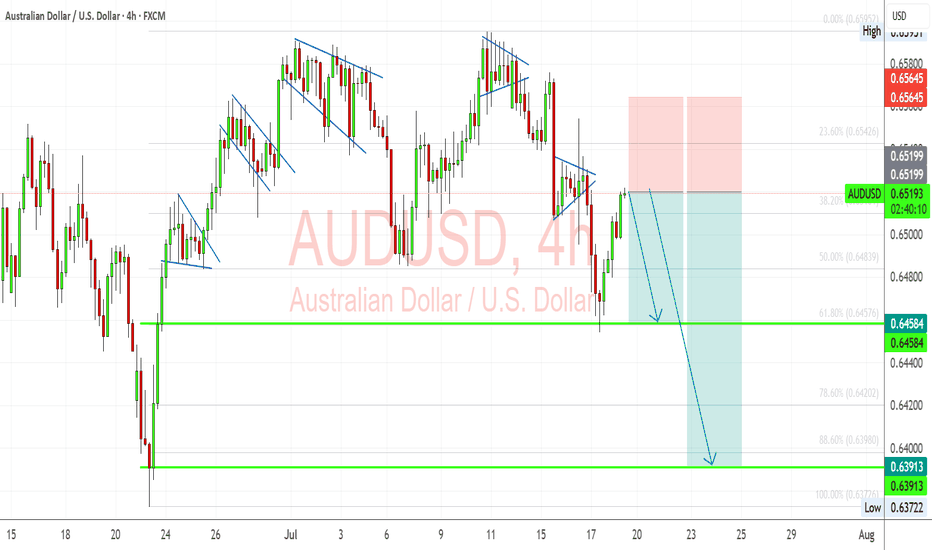

AUDUSD – DAILY FORECAST Q3 | W31 | D30 | Y25📊 AUDUSD – DAILY FORECAST

Q3 | W31 | D30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:AUDUSD

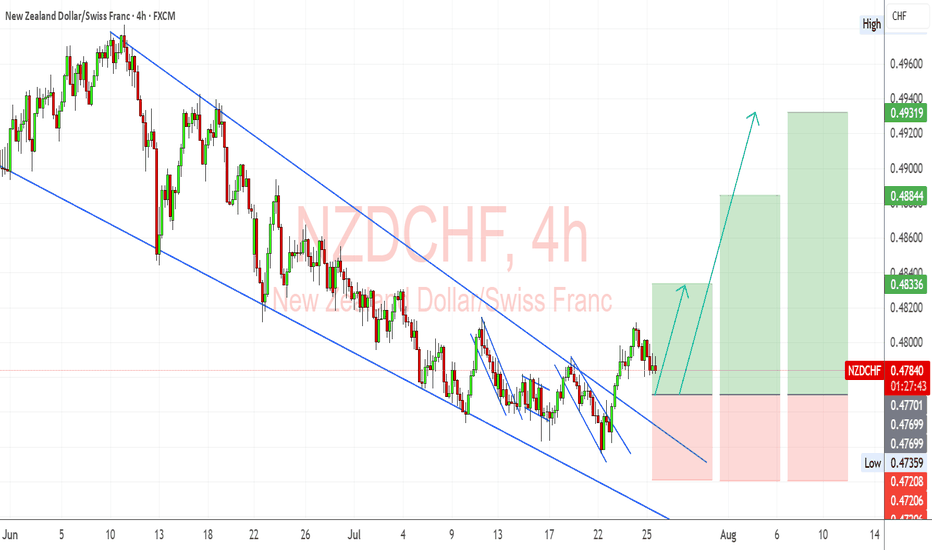

NZDCHF – Bullish Breakout Sets Stage for ReversalNZDCHF has broken decisively out of a long-term descending channel, signaling a potential trend reversal. Price action confirmed multiple bullish flags within the falling structure, followed by a clean breakout and higher low retest, supporting a bullish continuation bias.

Currently, the pair is stabilizing just above prior resistance turned support around 0.4760–0.4780, forming a potential launchpad for the next leg higher.

Upside Targets:

TP1: 0.48336

TP2: 0.48844

TP3: 0.49319

Invalidation Zone:

A drop below 0.4720 would invalidate the breakout structure and expose the downside.

Fundamental Drivers:

🇳🇿 NZD Strength: RBNZ remains relatively hawkish compared to other central banks, and the Kiwi may gain from improving risk sentiment and easing global recession fears.

🇨🇭 CHF Weakness: Swiss Franc is under mild pressure as safe-haven flows weaken amid improving tone on US-China-EU trade headlines and fading ECB rate cut bets.

🗓️ Macro Flow: Upcoming risk events (Fed comments, trade updates, and NZ economic prints) could inject momentum into the pair, especially if risk appetite improves.

Bias: ✅ Bullish (Buy)

Confidence: ★★★★☆

Watch for: Clean hold above 0.4770 zone + bullish momentum continuation.

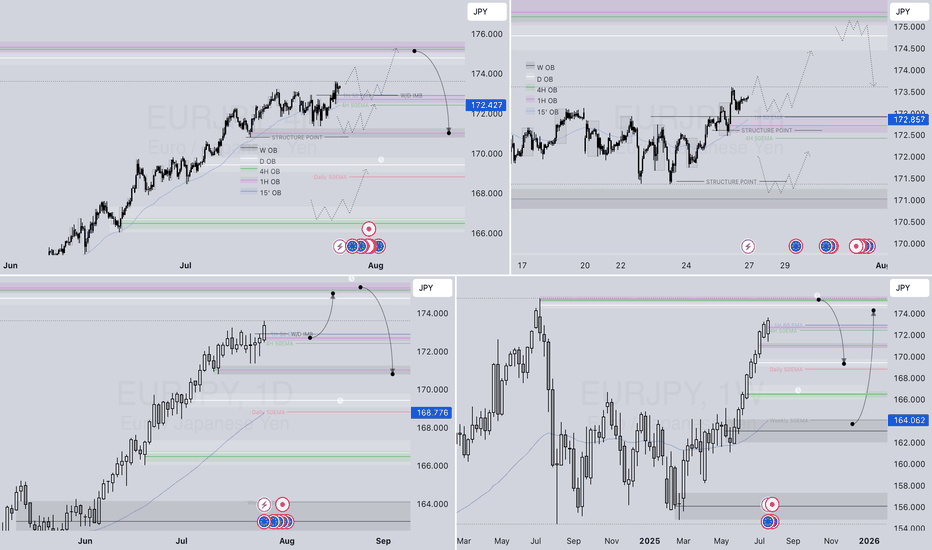

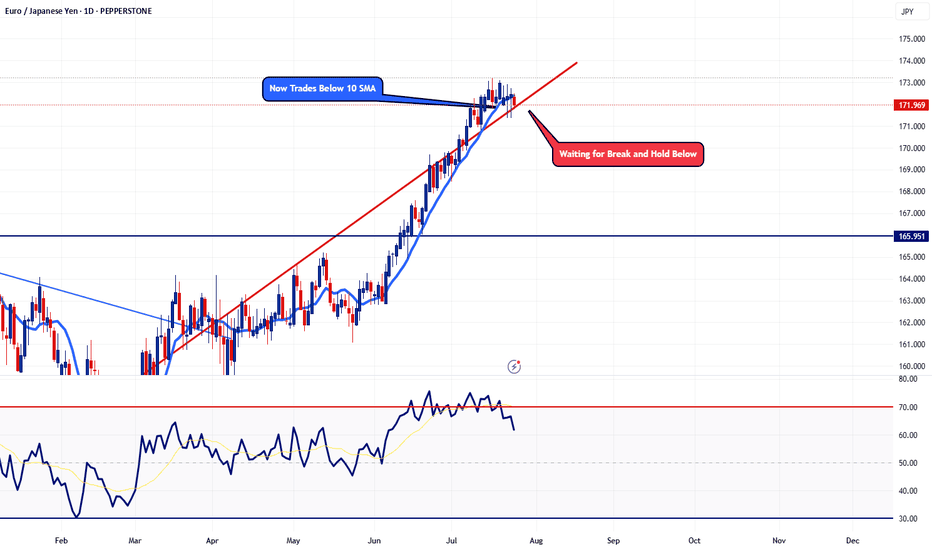

EURJPY – WEEKLY FORECAST Q3 | W31 | Y25📊 EURJPY – WEEKLY FORECAST

Q3 | W31 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

OANDA:EURJPY

NZD/USD "KIWI HEIST" – BEARISH BANK ROBBERY!🦹♂️ NZD/USD "THE KIWI HEIST" – BEARISH BANK ROBBERY PLAN! 🚨💰

(Thief Trading Style – Short Entry Strategy for Maximum Loot!)

🎯 MASTER TRADING HEIST BLUEPRINT

🔥 Thief’s Technical & Fundamental Analysis Confirms:

NZD/USD is OVERBOUGHT + TREND REVERSAL!

Police (Bulls) set a TRAP near the Red Zone (Support) – Time to ESCAPE with profits before they catch us!

✔ Entry Point (Bearish Loot Grab):

*"The vault is UNLOCKED! Swipe SHORT anywhere – but for SAFER HEIST, use Sell Limit orders (15m/30m pullbacks). Pro Thieves use DCA/Layering for max gains!"*

✔ Stop Loss (Escape Route):

"SL at nearest 4H Swing High (0.60400). Adjust based on YOUR risk tolerance & loot size!"

✔ Target 🎯 (Profit Escape):

0.58900 (or exit earlier if cops (bulls) show up!)

⚠️ THIEF’S WARNING – NEWS & RISK MANAGEMENT

📢 High-Impact News = VOLATILITY TRAP!

Avoid new trades during news releases.

Trailing SL = Lock profits & evade market cops!

💥 SCALPERS & SWING THIEVES – QUICK NOTES:

Scalpers: Only quick LONG scalp plays (use Trailing SL!).

Swing Thieves: Hold for the BIG BEARISH LOOT! 🏦

📉 WHY NZD/USD IS BEARISH? (Thief’s Intel Report)

Overbought + Trend Reversal Signals!

Bulls (Police) losing strength at Resistance!

For FULL Intel (Fundamentals, COT Report, Sentiment, etc.) – Klickk 🔗!

🚀 BOOST THIS HEIST! (Like & Share for More Loot Plans!)

💖 "Hit 👍 BOOST to strengthen our THIEF SQUAD! More heists = More profits!"

📌 DISCLAIMER (Stay Safe, Thieves!):

This is NOT financial advice. Trade at your own risk & manage positions wisely!

🤑 NEXT HEIST COMING SOON… STAY TUNED! 🎭

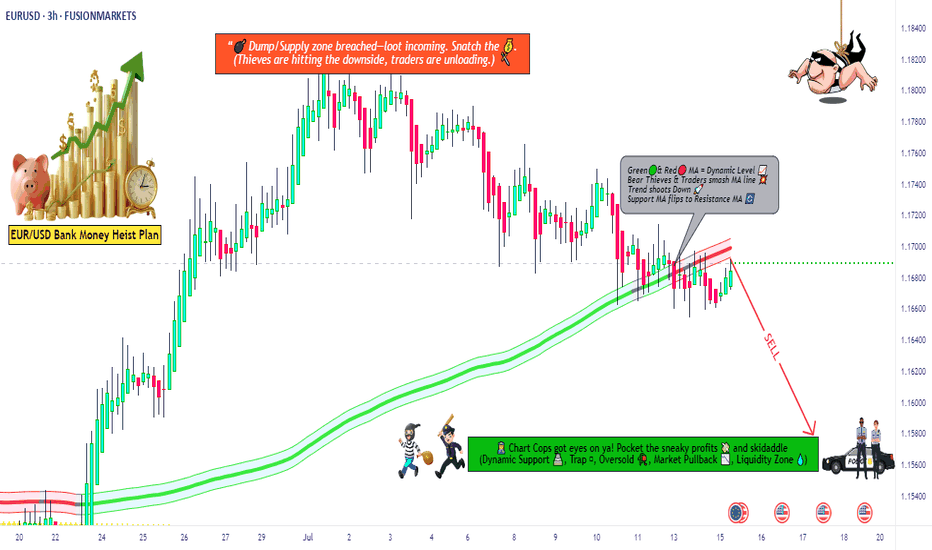

EUR/USD Robbery Blueprint Bear Strike Activated!💣🎯Operation Fiber Down: EUR/USD Robbery Blueprint (Day Trade Edition) 💰🔫

🚨 Thieves, Hustlers & Chart Bandits Assemble! 🚨

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

Welcome back to another Thief Trading Operation, where the money never sleeps—and neither do we. Let’s break into the vault of EUR/USD “The Fiber” with surgical precision. 🧠💼🕶️

🧨 THE MASTER ROBBERY PLAN: EUR/USD SHORT STRIKE 🔍💸

💀 Market Bias: Bearish – Trend Reversal + Supply Trap Setup

🎯 Target: 1.15800

🛑 Stop-Loss: Near Swing High (around 1.17400 – 3H chart view)

🕓 Timeframe Focus: 15m / 30m / 3H

🧭 ENTRY ZONE:

👣 Plan your entry from recent high retests—that’s where the big money bulls get trapped.

🎯 Use Sell Limit Orders (DCA style / Layered Limit Orders) like a true thief setting up tripwires.

💼 RISK STRATEGY:

💡 SL should match your lot size and order count—not one-size-fits-all!

📌 Place above key structure or swing level (e.g. 1.17400) based on timeframe.

🔍 BEHIND THE SCENES – THE WHY:

The EUR/USD "Fiber" pair is showing all the classic signs of a trend shift and bear raid setup, including:

📰 Fundamentals weakening the Euro

💣 COT Report reveals institutional exits

🍂 Seasonal Bias points to downward trend

📉 Intermarket Pressure from bond yields & USD strength

📊 Sentiment turning overly bullish = trap zone

⛽ Storage & Inventory imbalances adding fuel

📌 Reminder: Before any robbery, study the layout—Macro, Fundamentals, Sentiment, and Intermarket are your blueprint.

🚨 HEIST ALERT – PROTECT THE LOOT:

🕰️ High-Impact News Events? Tighten up!

💼 Don’t take fresh entries during releases.

🔐 Use Trailing SLs to lock in profits.

🎯 Exit with grace before the sirens start.

⚡🔥JOIN THE CREW, BOOST THE LOOT🔥⚡

💥 Smash the Boost Button 💥 if you're vibing with the Thief Trading Movement.

We ain’t just trading—we’re executing strategic robberies on the market’s weaknesses.

🧠💪 Every like = more power to the crew. Every comment = a new map to a vault.

We rob, retreat, and repeat. Let’s make money with skill, not luck. 🕶️💰🚁

⚠️ LEGAL COVER (For the Lawyers 😏):

This plan is not investment advice, just an organized heist blueprint by chart robbers.

Always manage your own risk and update your plan as the market evolves.

🕶️ Stay ready for the next master plan... Until then, keep your charts clean and your stops tight. 🕶️💣📉

– Thief Trader Out 🐱👤🚀

USD/CAD Institutional Buy Zone – Thief Trading Alert!🔥 USD/CAD "LOONIE BANK HEIST" 🔥 – THIEF TRADING STYLE (BULLISH SNIPER PLAN)

💸 ATTENTION: Market Robbers & Profit Pirates!

"Steal Like a Pro – Escape Before the Cops Arrive!"

🎯 MASTER TRADE PLAN (Based on Thief Trading Tactics):

Entry Zone (Pullback Heist):

📌 Pullback-1: Market Maker Trap Zone (1.35400+) – Wait for retest!

📌 Pullback-2: Institutional Buy Zone (1.33500+) – Confirm bullish momentum!

"Patience = Perfect Heist Timing. Don’t rush—ambush the trend!"

🎯 Profit Target: 1.38100 (or escape earlier if momentum fades).

🛑 Stop Loss (Escape Route): Nearest 4H Swing Low (wick/close) – Adjust based on risk & lot size!

🚨 SCALPERS’ WARNING:

"Only snipe LONG! Big pockets? Strike now. Small stack? Join swing robbers & trail your SL!"

📉 WHY THIS HEIST? (Bullish Triggers):

Technical + Fundamental alignment (COT, Macro, Sentiment).

Overbought but institutional demand holding strong.

"Bears are trapped—time to rob their stops!"

⚠️ CRITICAL ALERT:

News = Volatility = Police Ambush!

Avoid new trades during high-impact news.

Trailing SL = Your Getaway Car! Lock profits before reversals.

💥 BOOST THIS HEIST!

"Hit 👍, 🔔 Follow, and 🚀 Boost to fuel our next robbery! Let’s drain the banks together!"

🔮 NEXT HEIST COMING SOON… Stay tuned, partner! 🎭💰

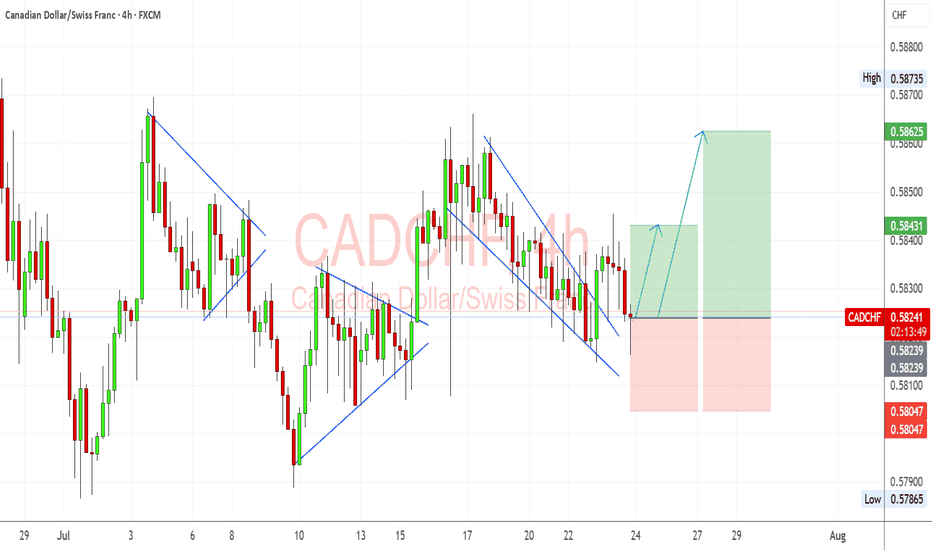

CADCHF Bullish Reversal in Motion Channel Break & Momentum ShiftCADCHF setup is developing into a potential bullish recovery after a breakout from a falling wedge. I’m looking for signs of buyer control as price attempts to build higher structure off the recent breakout.

📊 Technical View (My Setup Insight):

Falling Wedge Breakout: Price has cleanly broken out of the descending channel/wedge formation. That’s often a reversal signal, especially near support zones.

Support Holding: The pair found buyers around 0.5810–0.5820, an area tested multiple times in July. This zone has acted as a soft base.

Bullish Flag Recovery: Prior corrective patterns (flags/pennants) were followed by strong impulsive moves, and we may be repeating this pattern now.

Next Targets:

TP1: 0.5843 – aligns with previous structure and minor resistance.

TP2: 0.5862 – near the most recent high and top of consolidation.

Stop-Loss: Below 0.5800 to invalidate the reversal structure.

🧮 Fundamental Drivers (My Outlook):

CAD Support from Oil Stability: Oil prices have firmed around $78–$80, which helps the CAD via improved trade and energy revenue prospects.

SNB Stance Neutral-Dovish: Swiss inflation remains soft, and SNB has signaled comfort with its current policy rate, reducing CHF bullish pressure.

BoC Hawkish Bias: Despite softening Canadian CPI, the BoC remains cautious and hasn’t ruled out future hikes. CAD remains supported relative to CHF.

Global Risk Mood: CHF is sensitive to risk-off flows. With equities and commodities rebounding modestly, safe haven flows into CHF may slow.

⚠️ Risks to the Setup:

A sudden drop in oil prices could hurt CAD.

Risk-off sentiment due to geopolitical tensions or US equity selloffs could fuel CHF strength.

Any surprise SNB jawboning about FX could cause CHF to spike.

📆 Upcoming Events to Monitor:

Canadian GDP / Retail Sales – if strong, reinforces CAD recovery.

Swiss KOF Economic Barometer – gives insight into CHF macro tone.

Oil Inventories – strong builds or drawdowns influence CAD indirectly.

🔁 Leader/Lagger Context:

CADCHF is often a lagger, especially when risk sentiment or oil makes bigger moves. It can follow USDCHF or USDCAD behavior due to shared components.

If oil or global risk sentiment shifts, CADCHF tends to react with a small lag, making it great for secondary confirmation trades.

🧩 Summary – Bias & Watchpoints:

I currently hold a bullish bias on CADCHF following the falling wedge breakout and support defense. Fundamentals are moderately in favor of CAD due to oil stability and BoC’s cautious stance versus the more passive SNB. Key risks include any renewed CHF demand from risk-off shifts or soft Canadian economic surprises. The most critical levels now lie at 0.5843 and 0.5862 for upside targets, while 0.5800 remains key invalidation support.

EURJPY - Potential Topping ActionTaking a look at the daily timeframe, price action is now trading below the 10 SMA. This pair has not traded below the 10 SMA since May 26. Now I'm just waiting for a few more confirmation before I'm fully confident. For now, adding a few small sells won't hurt.

Trade Safe - Trade Well

EURUSD Bearish Ahead as US Resilience Meets Eurozone FragilityEURUSD has shifted into bearish territory, pressured by growing divergence between a resilient US economy and a struggling Eurozone. The pair recently rejected the 1.1700 zone, forming multiple bearish structures on the 4H chart. With sticky US inflation, Trump’s renewed tariff agenda, and a dovish ECB, EUR/USD appears poised for a deeper move toward 1.1527 and possibly 1.1445 in the coming sessions. This setup is both technically and fundamentally aligned, but key event risk remains.

🔸 Technical Structure (4H)

Clear rejection from the 1.1700–1.1710 zone.

Bearish pennants and wedge patterns confirm continuation lower.

Downside targets:

🔹 First: 1.1637

🔹 Second: 1.1527

🔹 Final: 1.1445

Risk zone: Above 1.1785 (invalidates short bias if broken cleanly).

🧭 Key Fundamentals

🇺🇸 Dollar Strength: Sticky inflation, stable labor market, and geopolitical risk all favor USD demand.

🇪🇺 Euro Weakness: ECB dovish tone persists amid weak data, soft PMIs, and stagnating growth.

Yield Spread: US-Euro real yield spread supports further EUR/USD downside.

Tariff Pressure: Trump’s 50% tariff plan and tensions with the EU weigh on EUR.

⚠️ Risks to Watch

A surprise dovish pivot from the Fed.

Weak US CPI or disappointing retail sales.

Major risk-on flows that trigger broad USD weakness.

New EU fiscal stimulus or Germany/France recovery surprises.

📆 Key Events Ahead

🇺🇸 US Core CPI – A hot print supports USD strength.

🇺🇸 Retail Sales & Powell testimony – Watch tone on rate cuts.

🇪🇺 German ZEW Sentiment, Eurozone HICP inflation – Weak readings would further drag EUR.

🔄 Leader or Lagger?

EUR/USD is a lagger to GBP/USD, often following UK-driven USD moves.

Acts as a leader for EUR/JPY, EUR/AUD, EUR/CHF – weakness here cascades across EUR crosses.

Tracks broad USD sentiment – dovish Fed pricing boosts EURUSD, while rate hike fears drag it.

✅ Summary: Bias and Watchpoints

EUR/USD is bearish below 1.1700 as economic divergence, sticky US inflation, and rising geopolitical tensions favor the dollar. ECB policy remains soft, offering little support to the euro. Key risk lies in a dovish Fed pivot or softer US data. Watch US CPI and Powell for clues. This pair is likely to lag GBP/USD moves, but will lead EUR crosses lower if the downside momentum continues.

AUDUSD: Bearish Flag Retest Within Macro HeadwindsAUDUSD is developing a clean bearish technical setup just as macro fundamentals increasingly weigh on the Australian dollar. The pair recently completed a rising wedge breakout and is now retesting broken structure within a larger downtrend. With risk sentiment shaky due to U.S. tariff threats and dovish repricing of the RBA’s outlook, Aussie bulls may struggle to sustain momentum. A confirmed breakdown below 0.6458 could open the door toward June’s swing low near 0.6390.

🧠 Technical Breakdown:

✅ Bearish Flag Structure:

The chart shows a sequence of bearish flags and rising wedges, all of which have historically broken lower. The latest breakout to the downside was sharp, and the current rally appears corrective.

✅ Fib Levels & Confluence:

Price is hovering near the 38.2% retracement (0.6510) from the last leg down. The invalidation zone around 0.6565 aligns with a supply zone, making it an ideal SL area.

✅ Target Zones:

First support: 0.6458

Measured move: 0.6390 - 0.6370

These coincide with Fib 61.8% & 100%, adding technical confluence.

📉 Fundamental Drivers:

Dovish RBA Signals: Labour data missed expectations, and June inflation slowed (4.8% vs. 4.9% expected), softening the RBA’s hawkish stance.

Stronger USD Outlook: Powell’s reappointment risk and rate-cut delay pricing have supported the dollar. U.S. data (Retail Sales, CPI) still signal sticky inflation and strong labor.

Tariff Risk from Trump: With the U.S. floating global 10% tariffs, risk assets like AUD (a high-beta currency) face downside pressure.

⚠️ Risks to Bearish Bias:

Stronger-than-expected China stimulus could support AUD as a proxy.

A dovish Fed pivot or soft U.S. data might undercut USD strength.

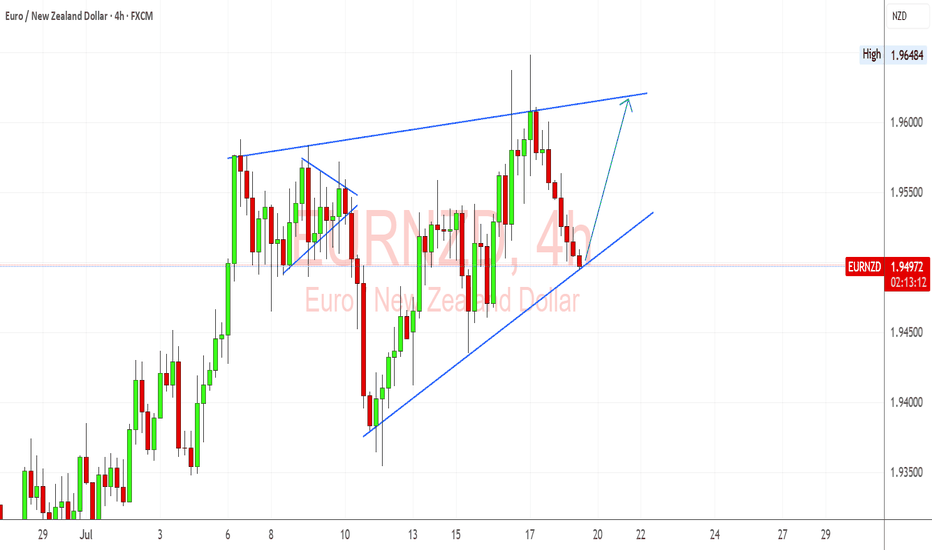

EURNZD Trendline & Hawkish ECB Bias Support Bullish ContinuationEURNZD is holding beautifully above the ascending trendline on the 4H, and I’m watching this level closely for a bounce continuation setup. Fundamentally, the euro remains supported by sticky inflation and hawkish ECB commentary, while the kiwi is showing softness after dovish signals from the RBNZ and mixed jobs data. If this trendline holds, I’ll be targeting a retest of the upper wedge resistance near 1.9640.

🔍 Technical Setup (4H):

Structure: Ascending triangle forming – price is pressing into dynamic support.

Support Zone: Around 1.9480 trendline area – price rejected this level several times in July.

Resistance Target: 1.9640 highs – double top and triangle resistance.

Bullish Confirmation: Rebound with bullish engulfing or strong 4H close above 1.9525 could trigger long setup.

Invalidation: Clean break below trendline and 1.9440 invalidates bullish scenario short-term.

💡 Fundamental Insight:

EUR Drivers:

ECB members remain cautious about declaring victory on inflation.

German and Eurozone CPI data remain above target, supporting higher-for-longer ECB stance.

Speculation that ECB won't cut aggressively compared to RBNZ.

NZD Weakness:

RBNZ minutes show concern over downside inflation risks.

Labor market cooling, and migration pressures remain high.

Commodity and China-linked sentiment weakening NZD.

⚠️ Key Risks:

If Eurozone inflation or PMI data surprises to the downside, EUR may weaken.

RBNZ hawkish pivot or surprise tightening would flip sentiment toward NZD.

Global risk-on could favor NZD as a high-beta currency.

🧭 Summary:

I’m bullish on EURNZD as long as price holds above the trendline near 1.9480. The technical structure shows a clean ascending pattern, and the fundamentals currently favor EUR strength over NZD. My eyes are on a potential move toward 1.9640, especially if upcoming ECB rhetoric stays hawkish. EURNZD tends to lead NZD-crosses like NZDJPY or NZDCHF in risk-off regimes and could signal euro strength if it breaks out. Watching closely for price action confirmation.

GBPCAD Q3 | D21 | W30 | Y25📊GBPCAD Q3 | D21 | W30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT 📊

EURUSD Q3 | D21 | W30 | Y25 📊EURUSD Q3 | D21 | W30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT 📊

EURJPY SHORT – DAILY FORECAST Q3 | W29 | D14 | Y25 GAP SHORT!!!!💼 EURJPY SHORT – DAILY FORECAST

Q3 | W29 | D14 | Y25

📊 MARKET STRUCTURE SNAPSHOT

EURJPY is currently reacting from a key higher time frame supply zone, with price action showing weakness at premium levels. Structure and momentum are now aligning for a short opportunity backed by multi-timeframe confluence.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Strong reaction and early signs of distribution.

Previous bullish momentum is losing steam; structure is flattening with rejection wicks forming.

✅ 4H Order Block

Break of internal structure (iBoS) confirms a short-term bearish transition.

✅ 1H Order Block

1H structure shift bearish

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

The confluences are stacked.

Let execution follow discipline, not emotion.

Stealing Pips Like a Pro – AUD/NZD Long Heist, MA Breakout Setup🎯 AUD/NZD Heist: Bullish Bank Robbery 🚀💰 (Thief Trading Style)

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Money Makers & Robbers, 🤑💸✈️

Based on 🔥Thief Trading Style🔥 (technical + fundamental analysis), here’s our master plan to loot the AUD/NZD "Aussie vs Kiwi" Forex Bank!

🔎 The Heist Setup (Long Entry Focus)

🐂 Bullish Breakout Strategy:

Entry: Wait for MA breakout (1.08150) then strike!

Alternative Entry: Place Buy Stop above MA OR Buy Limit near pullback zones (15-30min timeframe).

Pro Tip: Set an ALERT for breakout confirmation!

🛑 Stop Loss (Thief’s Safety Net):

"Yo, listen up! 🗣️ If you're entering via Buy Stop, don’t set SL until after breakout!

Thief’s SL Zone: Nearest swing low (1.07500 – 3H timeframe).

Adjust SL based on your risk, lot size, and trade plan.

🎯 Profit Targets:

1st Target: 1.08600 (or escape earlier if cops lurk!).

Scalpers: Only scalp LONG! Use trailing SL to protect gains.

⚠️ Critical Heist Rules:

Avoid news chaos! 🚨 No new trades during high-impact news.

Lock profits with trailing stops.

Cops (Bears) are strong near resistance – don’t get caught!

💥 Boost the Heist!

💖 Hit the "Boost" button to strengthen our robbery squad! More likes = more 💰easy money heists!

Stay tuned for the next big steal! 🏆🚀🐱👤

"Vault Breached! NZD/USD Bullish Loot (Live Heist)"🚨 "THE KIWI BANK HEIST" 🏦💰

NZD/USD Bullish Raid – Loot Fast Before the Cops Arrive!

🌟 Greetings, Money Bandits! 🌟 (Hola! Bonjour! Ciao! Konnichiwa!)

🔥 Thief Trading Intel:

The Vault is Open! 🏦➡️📈 – Price is bullish, but overbought.

Red Zone = Police Trap! 🚨 (Resistance/Reversal Risk)

Escape Plan: Take profits near 0.62400 (or bail early if traps trigger).

🔐 ENTRY: "BREAK IN NOW!"

"Buy the dip!" – Use 15M/30M swing lows for stealthy entries.

Set Alerts! ⏰ (Don’t miss the heist!)

🛑 STOP-LOSS: "THIEF’S SAFETY NET"

"Hide at 0.59500 (4H Swing Low)" – Adjust based on your loot size!

🎯 TARGET: "GRAB & VANISH!"

"0.62400 or escape earlier!" – Don’t get greedy; cops (bears) are lurking.

⚡ SCALPERS’ NOTE:

"Only steal LONG!" – Use trailing SL to protect your bag.

"Rich? Charge in! Poor? Wait for swings!"

📡 FUNDAMENTAL BACKUP:

"Kiwi is bullish… but check the news!" 📰 (COT, Macro Data, Sentiment)

⚠️ ALERT: Avoid trading during high-impact news – cops (volatility) love chaos!

💥 BOOST THIS HEIST! (Like & Share = More Loot!)

🚀 "Support the crew! Hit 👍, and let’s rob this market blind!" 💸🤝

Next heist coming soon… Stay tuned, bandits! 🏴☠️🎭

GBP/NZD: The Great Liquidity Grab? (Long Trade Plan)"🏦💰 GBP/NZD BANK VAULT RAID: Bullish Heist in Progress! (Long Setup) 💰🏦

🚨 Overbought Trap? Or Trend Continuation? Here’s How to Loot Pips Safely! 🚨

🦸♂️ GREETINGS, MARKET MARAUDERS!

To all the Profit Pirates & Risk-Takers! 🌍💸

Using our 🔥Thief Trading Tactics🔥 (a ruthless combo of price action + liquidity grabs + macro triggers), we’re executing a bullish heist on GBP/NZD ("Sterling vs Kiwi")—this is not advice, just a strategic raid blueprint for those who trade like outlaws.

📈 THE HEIST PLAN (LONG ENTRY FOCUS)

🎯 Profit Zone: 2.28700 (or escape earlier if momentum stalls)

💥 High-Stakes Play: Overbought but squeezing higher—trap for bears.

🕵️♂️ Trap Spot: Where sellers get liquidated.

🔑 ENTRY RULES:

"The Vault’s Open!" – Swipe bullish loot on pullbacks (15-30min TF).

Buy Limit Orders near swing lows for better risk/reward.

Aggressive? Enter at market—but tighter stops.

📌 SET ALERTS! Don’t miss the breakout retest.

🛑 STOP LOSS (Escape Route):

Thief SL at recent swing low (2H timeframe).

⚠️ Warning: "Ignore this SL? Enjoy donating to the market."

🎯 TARGETS:

Main Take-Profit: 2.28700 (or trail partials).

Scalpers: Ride long waves only. Trailing SL = VIP exit pass.

📡 FUNDAMENTAL BACKUP (Why This Heist Works)

Before raiding, check:

✅ COT Data (Are funds long GBP/short NZD?)

✅ Rate Spreads (GBP vs NZD yield shifts)

✅ Commodity Correlations (Dairy prices? Risk mood?)

✅ Sentiment Extreme (Retail over-shorting?)

🚨 NEWS RISK ALERT

Avoid new trades during RBNZ/BOE speeches (unless you like volatility casinos).

Trailing stops = your bulletproof vest.

💣 BOOST THIS HEIST!

👍 Smash Like to fuel our next raid!

🔁 Share to recruit more trading bandits!

🤑 See you at the target, rebels!

⚖️ DISCLAIMER: Hypothetical scenario. Trade at your own risk.

#Forex #GBPNZD #TradingView #LiquidityGrab #TrendContinuation #ThiefTrading

💬 COMMENT: "Long already—or waiting for a deeper pullback?" 👇🔥

GBP/CAD: Smart Money Heist Strategy – Ready for the Breakout?💼💣 GBP/CAD Forex Bank Heist Plan 🚨 | "Thief Trading Style" 💹💰

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Welcome to all strategic traders, market tacticians & opportunity seekers! 🧠💸

Here’s our latest Forex blueprint based on the exclusive “Thief Trading Style” – a blend of tactical technicals, smart fundamentals, and stealthy price action moves. We’re preparing for a potential breakout heist on the GBP/CAD a.k.a “The Pound vs Loonie”.

🗺️ Heist Strategy Overview:

The market is forming a bullish setup with signs of consolidation, breakout potential, and trend reversal dynamics. We're eyeing a long entry, but timing is everything. This setup seeks to "enter the vault" just as resistance is breached and ride the move until the ATR High-Risk Zone—where many market players may exit.

🎯 Entry Plan:

📈 Primary Trigger Zone: Watch for a break and close above 1.87000.

🛎️ Set an alert! You’ll want to be ready when the opportunity knocks.

📍Entry Tips:

Place Buy Stop orders above the moving average or

Use Buy Limit entries on pullbacks near recent 15/30min swing lows.

(Perfect for both scalpers and swing traders!)

🛑 Stop Loss Placement:

Thief Trading Style uses a flexible SL system:

Recommended SL at the nearest 4H swing low (~1.85700)

Adjust SL based on your lot size, risk appetite & number of orders

🎤 Reminder: Set SL after breakout confirmation for buy-stop entries. No fixed rule—adapt to your style but manage risk wisely.

🎯 Target Zone:

🎯 Primary TP: 1.89000

🏃♂️ Or exit earlier if price enters a high-risk reversal area

🧲 Scalpers: Stick to long-side trades only and protect your profits with a trailing SL.

🔍 Why GBP/CAD? (Fundamental Notes):

Current momentum is bullish, supported by:

📊 Quant & Sentiment Analysis

📰 Macro Fundamentals & COT Data

📈 Intermarket Trends & Technical Scoring

Get the full data klick it 🔗

⚠️ Caution During News:

To avoid volatility spikes:

Refrain from entering new positions during high-impact news

Use trailing SLs to protect running profits

❤️ Show Support & Stay Tuned:

Smash the 🔥Boost Button🔥 if you love this kind of analysis!

Support the strategy, strengthen our community, and let’s continue this journey of smart, stylish trading.

Stay tuned for the next “heist plan” update—trade smart, stay alert, and manage your risk like a pro. 🏆📈🤝

"NZD/USD Bullish Heist! Steal Pips Before the Reversal Trap! 🏴☠️ NZD/USD Kiwi Heist Masterplan – Steal the Bull Run! 💰

🌟 Hola, Money Makers & Market Marauders! 🌟

Welcome to the Thief Trading Style raid on the NZD/USD "The Kiwi" Forex vault. Follow the blueprint sketched in the chart for a bold long takeover — escape the high‑risk Yellow MA Zone before guards tighten!

🎯 Heist Blueprint

1. Entry 🚀

"The vault swings wide—yank that Bull loot at any price!"

Drop your buy-limit orders within the next 15–30 min (or at the latest swing low/high). Don’t sleep—set chart alerts for the perfect breach.

2. Stop‑Loss 🛑

Thief-style SL lurks at the nearest 5h swing‑low wick (≈ 0.60400) for intra‑day.

Adjust your SL based on your risk appetite, position size, and combo of orders.

3. Target 🎯

Aim to escape by 0.62000, or bail early for safety.

4. Scalpers’ Edge 🔍

Only rob on the long side. Big bankroll? Go all‑in. Prefer safety? Slide into the swing crew with a trailing SL to lock in your spoils.

🔍 Market Intel

Why the Kiwi Loot is Ripe:

Bullish momentum marches on, fueled by macroeconomic clues, COT data, sentiment shifts, inter-market moves — all pointing upward.

📚 For Full Recon:

Dive into the fundamental, macro, COT, quant, sentiment & intermarket intel — plus trend targets and scorecards. Check the data here 👉🔗🔗

⚠️ Caution Zone

News Watch & Position Safety:

Major news = guarded vault. Don't open new trades during release windows.

If you're in already, use trailing stops to shield your haul and lock in gains.

💪 Support the Crew

Smash that “Boost” to fuel our team and keep the raid running smooth. With Thief Trading Style, every day’s a payday.

🗓️ Stay tuned for the next Kiwi Heist – we’re just getting started. Happy robbing, legends! 🐱👤💥