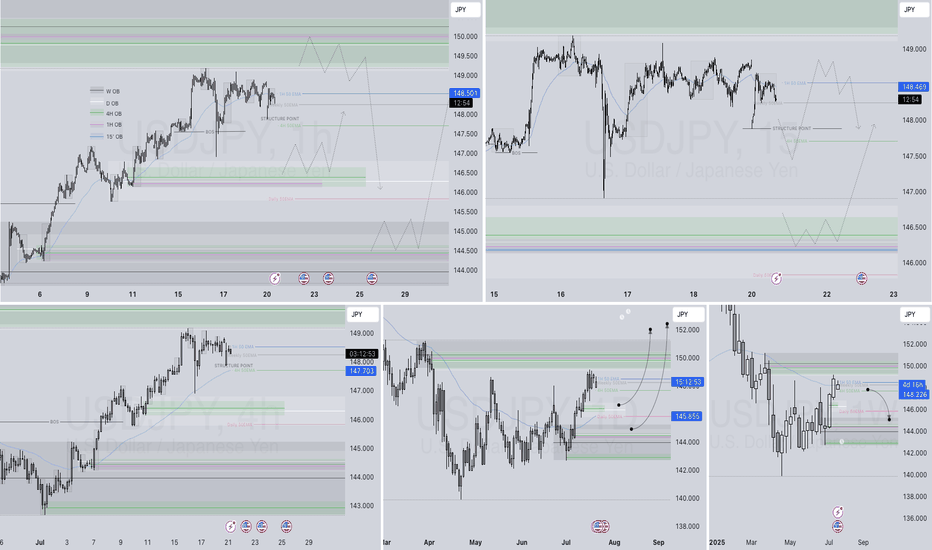

USDJPY Q3 | D21 | W30 | Y25📊USDJPY Q3 | D21 | W30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT 📊

Forexsignalsforex

EURUSD Analysis – Short Bias Builds on Key Resistance RejectionEURUSD pair is currently testing a critical resistance zone around 1.1495–1.1500, with bearish rejection beginning to form on the 4H timeframe. The technical setup suggests a potential lower high forming within the context of a broader downtrend, supported by a confluence of horizontal resistance and bearish risk catalysts.

🔍 Technical Overview:

Resistance Zone: 1.1495–1.1575 (multi-timeframe key levels)

Support Levels to Watch: 1.1234 (range base) and 1.1086 (swing low)

Price Action: After a sustained rally, price is showing exhaustion near previous highs, and a rejection pattern is emerging, suggesting selling interest.

Risk Management: Stop placed above 1.1575 high, with downside targets near 1.1234 and extended toward 1.1086.

🧠 Fundamental Backdrop:

ECB Policy Outlook: Lagarde recently warned that a stronger euro and higher tariffs may hurt EU exports. This dovish tone could weigh on EUR sentiment in the medium term.

US Dollar Strengthening: The latest US labor market data (ADP, JOLTS) beat expectations, showing continued resilience in employment and wage growth. This supports the Fed's data-dependent approach, favoring a stronger USD.

Macro Tensions: Global trade concerns (Trump’s tariffs, weak China demand, Germany’s slowing job market) are adding pressure to EUR while supporting safe-haven USD flows.

ECB Consumer Expectations Survey (April): Highlights persistent inflation fears and deteriorating economic confidence.

⏳ Scenario Outlook:

✅ Bearish Bias Preferred below 1.1500 with confirmation of rejection.

🎯 Target Zone 1: 1.1234 – Strong structure & demand zone.

🎯 Target Zone 2 (Extended): 1.1086 – Major low from mid-May.

❌ Invalidation: A breakout and close above 1.1575 would neutralize the bearish outlook and open up higher targets toward 1.17.

Conclusion: The EURUSD pair presents a compelling short opportunity, with both technical resistance and macro pressure aligning for a retracement or reversal. Short setups are favored unless bulls reclaim and hold above the 1.1575 handle.

“Can You Snatch Profits from USD/CHF’s Wild Swings?”🔥 Swissy Snatch Strategy: USD/CHF Stealth Trade Plan 🔥

👋 Greetings, Profit Pirates & Chart Ninjas! 🕵️♂️💸

Welcome to the Swissy Snatch Strategy—a cunning, calculated raid on the USD/CHF market. This plan fuses razor-sharp technicals with real-time fundamentals to snatch profits from Swissy’s wild swings.

Let’s move like shadows, strike fast, and vanish with the gains! 🌑📈

📜 The Swissy Snatch Blueprint

Entry Triggers 🔑:

🔼 Bullish Ambush: Enter long on a breakout above ~0.86500 (key resistance/EMA level), signaling a potential rally.

🔼 Pullback Ambush: Buy at ~0.85800 (Institutional Trap zone for a dip-buy).

💡 Pro Tip: Set price alerts at these levels to trade without staring at charts! 🔔

Stop Loss (SL) 🛡️:

🟢 Bullish Trade: Place SL below the recent 4H swing low (~0.85300 for breakout trades) to cushion against wicks.

📉 Stay Flexible: Adjust SL based on risk tolerance, lot size, and volatility (ATR ~60 pips daily). This is your safety net!

Take Profit (TP) 💰:

🚀 Bullish Raiders: Target ~0.86900 (Fibonacci 61.8% retracement from 0.9000–0.8200) or exit on fading volume.

🚪 Escape Tactic: Watch RSI for overbought (>70) signals to dodge reversals. Consider partial profits at ~0.86000 (1:1 risk-reward).

🌐 Why Trade USD/CHF Now?

USD/CHF is a volatility goldmine, driven by:

💵 USD Strength: Hawkish Fed signals (e.g., Powell’s May 2025 comments on sustained 4% rates) and robust Q1 2025 GDP (2.8% annualized) fuel USD bullishness, pushing USD/CHF higher.

🇨🇭 CHF Weakness: Swiss National Bank (SNB) holds rates steady at 1.25% (Q4 2024 decision), with low safe-haven demand for CHF due to easing geopolitical tensions (e.g., US-China trade talk progress).

📈 Yield Differentials: US 10-year Treasury yields at 4.2% (May 19, 2025) attract capital to USD, supporting USD/CHF uptrends.

📊 Technical Edge: RSI (14-day) at 52 signals neutral momentum with room for a bullish push. Fibonacci retracement levels highlight resistance at 0.86900 and support at 0.85500.

🎢 Volatility: USD/CHF’s daily ranges of 0.8–1.2% (80–120 pips) offer quick profit potential for agile traders.

Current price (May 19, 2025): ~0.8620, testing resistance at 0.86500.

📊 Real-Time Sentiment Snapshot (May 19, 2025)

Retail Traders:

📈 Bullish: 40% 🌟 (Betting on USD strength).

📉 Bearish: 45% ⚡ (Cautious on CHF safe-haven spikes).

⚖️ Neutral: 15% 🧭 (Awaiting US data clarity).

Institutional Traders:

🏦 Bullish: 60% 🏦 (Favoring USD on yield spreads).

📉 Bearish: 30% 📉 (Hedging for CHF strength).

⚖️ Neutral: 10% ⚖️ (Monitoring Fed/SNB cues).

⚠️ Key Risks:

US CPI: A hotter-than-expected print could spike USD/CHF to 0.8700. A miss may test 0.85500.

SNB: Dovish SNB comments could weaken CHF further, boosting your bullish setup.

Geopolitics: Sudden US-China trade escalations may strengthen CHF, invalidating longs.

Technical Validation (May 19, 2025)

Price Action: USD/CHF at ~0.8620, eyeing resistance at 0.86500–0.8700, with support at 0.85500–0.85800 (4H chart).

EMA: 50-EMA (~0.8600) acts as dynamic support. A breakout above 0.86500 confirms bullish momentum.

Fibonacci: From March 2025 high (0.9000) to April low (0.8200), 61.8% retracement (~0.8680) matches your TP of 0.86900.

RSI (14-day): At 52, room for upside if US data supports USD.

Volume: Rising on recent upticks, supporting breakout potential.

ATR (14-day): 60 pips, guiding SL (50–60 pips) and TP (~100–120 pips).

Strategy Enhancements

To make the Swissy Snatch even deadlier:

Refined Entries: Confirm 0.86500 breakout with volume spike or 0.85800 pullback with RSI >40.

Timeframe Clarity: Use 1H or 4H for entries, 4H for swing lows (SL).

Bearish Contingency: Short below 0.85500 (support break) if CPI disappoints, targeting 0.85000.

ATR Scaling: Adjust SL/TP to ATR (e.g., SL at 1x ATR, TP at 2x ATR) for volatility-adapted trades.

Chart Visuals: For TradingView, annotate EMA, Fib levels, and RSI to boost engagement.

Join the Swissy Snatch Squad!

👉 Smash that Boost button to make this strategy a TradingView legend! 🚀

Every like and share fuels more high-octane trade plans.

Let’s conquer USD/CHF together! 🤜🤛

Keep charts locked, alerts primed, and trading spirit electric.

See you in the profit zone, ninjas! 🏴☠️📈

AUD/CHF Loonie Heist: Sniping Swiss Profits with Thief Trading!🌍 Hello Global Traders! 🌟

Money Makers, Risk Takers, and Market Shakers! 🤑💸✈️

Dive into our AUD/CHF "Aussie vs Swiss" Forex heist, crafted with the signature 🔥Thief Trading Style🔥, blending sharp technicals and deep fundamentals. Follow the strategy outlined in the TradingView chart, focusing on a long entry targeting the high-risk MA Zone. Expect a wild ride with overbought conditions, consolidation, and potential trend reversals where bearish players lurk. 🏆💰 Celebrate your wins, traders—you’ve earned it! 💪🎉

Entry 📈: The vault’s open! Grab bullish opportunities at any price, but for precision, set buy limit orders on a 15 or 30-minute timeframe near swing lows or highs for pullback entries.

Stop Loss 🛑:

📍 Place your Thief SL at the recent swing low on the 4H timeframe (0.52300) for scalping or day trades.

📍 Adjust SL based on your risk tolerance, lot size, and number of open orders.

Target 🎯: Aim for 0.56000.

💵 AUD/CHF is riding a bullish wave, fueled by key market drivers. ☝

Unlock the full picture—dive into Fundamentals, Macro Insights, COT Reports, Quantitative Analysis, Sentiment Outlook, Intermarket Trends, and Future Targets. Check 👉🌎🔗.

⚠️ Trading Alert: News & Position Management 📰🚨

News can shake the market hard. Protect your trades by:

Avoiding new entries during news releases.

Using trailing stops to lock in profits and shield running positions.

📌 Markets move fast—stay sharp, keep learning, and adapt your strategy as conditions evolve.

💖 Power up our heist! 🚀 Tap the Boost Button to amplify our Thief Trading Style and make stealing profits a breeze. Join our crew, grow stronger, and conquer the markets daily with ease. 🏆🤝❤️

Catch you at the next heist, traders—stay ready! 🤑🐱👤🤩

EURUSD Bearish Structure Forming Amid Dollar UncertaintyEURUSD appears to be carving out a series of lower highs, showing potential signs of distribution. With price compressing inside a symmetrical triangle following multiple failed breakout attempts, the stage could be set for a bearish breakdown. This comes as U.S. inflation and Fed policy hold the spotlight and the euro faces political and structural crosswinds.

📉 Technical Breakdown (4H Chart)

Triple Top / Head & Shoulders Variant Forming:

Price action has traced a rounded top sequence, forming a triple top or complex head and shoulders structure.

Each rally attempt has been followed by steeper declines and faster recoveries—typical of a topping process.

Triangle Contraction Zone:

Current price is consolidating into a symmetrical triangle, which is often a continuation pattern.

Bearish breakout is expected if support around 1.1330–1.1320 fails.

Key Bearish Targets:

TP1: 1.1090 – former resistance turned support.

TP2: 1.0890 – April breakout base and key structure low.

Trade Setup (as per chart):

Sell Entry Zone: Break and retest of 1.1320–1.1300.

Stop Loss: Above 1.1527 (supply zone high).

Targets:

TP1: 1.1090

TP2: 1.0890

🌐 Macro Context

USD Side:

Fed is holding rates steady amid rising inflation fears triggered by tariffs

Tariff shocks are already pushing prices up, while growth slows—a tough environment for the Fed.

Dollar could strengthen if market sentiment shifts risk-off.

Euro Side:

Former EU Commissioner Gentiloni calls for unified borrowing to boost the euro’s global role, as U.S. stability is questioned

Political uncertainty around German leadership transitions may also weigh on the euro short term.

✅ Conclusion

EURUSD is trading at the apex of a tightening triangle pattern following a distribution structure. With a clean break of 1.1320 support, expect increased volatility and bearish momentum toward 1.1090 and 1.0890.

EUR JPY Trade Setup Daily Timeframe EUR JPY has formed a break and retest pattern breaking a key support level and retesting it turning support into resistance.

So we will be looking for selling opportunities to get our entry lets scale down to the lower timeframe to identify patterns and entry confirmations.

EUR JPY Trade Setup Daily TimeframeEUR JPY has broken through a major resistance level, which has now turned into a support level, forming break and retest pattern on the daily timeframe.

We’ll be looking for buy entries from the retest level. to get our entry, let’s scale down to lower timeframes to identify chart patterns and candlestick confirmations.

📉🔄📈

Foreign exchange trading skills worth collecting (Part 1)

Charlie Munger once said that if you are allowed to punch a maximum of 20 holes in a piece of paper, each time you punch means you lose a trading opportunity, and after 20 times, your opportunities will be used up. At this time, will you cherish every opportunity?

The same is true in foreign exchange trading. For each transaction, you must treat your account balance as the last bullet. This requires us to constantly reflect and sum up our experience so that every transaction can gain something, whether it is money or experience, we must accumulate something.

The following are 72 trading tricks that I have carefully compiled for you. I hope it will help you on your trading journey! The content is too long, divided into 3 articles,introduction. Please pay attention to it.

72 foreign exchange trading tricks

1. Only use the money you can afford to lose: If you use your family's funds to engage in trading, you will not be able to calmly use your mental freedom to make sound buying and selling decisions.

2. Know yourself: You must have a calm and objective temperament, the ability to control emotions, and will not suffer from insomnia when holding a trading contract. Successful commodity traders seem to have always been able to remain calm during the transaction.

3. Do not invest more than 1/3 of the funds: The best way is to keep your trading funds three times the margin required to hold the contract. In order to follow this rule, it is okay to reduce the number of contracts when necessary. This rule can help you avoid using all the trading funds to decide on buying and selling. Sometimes you will be forced to close the position early, but you will avoid big losses.

4. Do not base trading judgment on hope: Do not hope too much for immediate progress, otherwise you will buy and sell based on hope. Successful people can be unaffected by emotions in buying and selling. When a novice hopes that the market will turn in his favor, he often violates the basic rules of buying and selling.

5. Take proper rest: Buying and selling every day will dull your judgment. Taking a break will give you a more detached view of the market; it will also help you look at yourself and the next goal from another state of mind, so that you have a better perspective to observe many market factors.

6. Do not close profitable contracts easily, and keep profits continuous: Selling profitable contracts may be one of the reasons for the failure of commodity investment. The slogan "As long as there is money to be made, there will be no bankruptcy" will not apply to commodity investment. Successful traders say that you can't close a position just for the sake of profit; you must have a reason to close a profitable contract.

7. Learn to love losses: If you can accept losses calmly and without hurting your vitality, then you are on the road to success in commodity investment. Before you become a good trader, you must get rid of your fear of loss.

8. Avoid entering and exiting at market prices: Successful traders believe that buying and selling at market prices is a manifestation of lack of self-discipline. Unless you use market prices to close a position, you should aim to avoid market orders as much as possible.

9. Buy and sell the most active contract months in the market: This makes trading easier.

10. Enter the market when there is a good chance of winning: You should look for opportunities with a small possibility of loss and a large possibility of profit. For example, when the price of a commodity is close to its most recent historical low, then the possibility of it rebounding upward may be greater than the possibility of it falling.

11. Pick up unexpected wealth: Sometimes you buy and sell a commodity and get a greater profit than expected in a short period of time. Rather than waiting a few days to see why profits come so quickly, it is better to take them and run!

12. Learn to short sell: Most new investors tend to buy up, that is, buy in markets that they think will rise, but because the market often falls faster than it rises, you can quickly make profits by selling at high prices and buying at low prices. Therefore, the counter-trend operation method is worth learning.

13. After making a decision, act decisively and quickly: The market is not kind to those who procrastinate. So one of the methods used by successful traders is to act quickly. This does not mean that you have to be impulsive, but when your judgment tells you that you should close your position, do it immediately without hesitation.

14. Choose a conservative, professional and conscientious salesperson: A good salesperson must be able to pour cold water on you in time to prevent you from overdoing it in this market; at the same time, he must also have professional knowledge to provide you with exceptions that may occur at any time in the market.

15. Successful operations are like slowly climbing up a slope, while failed operations are like rolling down a slope: the stories of getting rich in one day that are widely circulated in the market are just stories. Without a solid foundation, even if you get one day's wealth, you can't keep it. Therefore, successful operators must try to create a framework, cultivate good operating habits, and slowly establish a successful operating model.

16. Never violate good rules: What is a good rule? As long as you think it is a good rule that can help you make a profit or reduce losses in operation, it is a good rule, and you should not violate it. When you find that you have violated a rule, leave the market as soon as possible, otherwise you should at least reduce the volume of operations.

17. Putting it in your pocket is real: a wave of market conditions cannot rise continuously without rest, and you must learn to put the profits in your pocket to avoid the profits on the books turning into losses.

18. Try to use the market for hedging: when the overall economy weakens, market risks increase. In order to reduce risks and increase profits, hedge and sell hedging in the market in order to form a price insurance function.

19. Buy when there is a rumor that the price is going to rise, and sell when it really rises: If there is a rumor in the market that the price is going to rise, then you should buy based on this news, but when this news comes true, it is time to sell. For one sell, there may be multiple sell news, because the market tends to build news into the market price.

20. The bull market will be crushed by itself: This is an old trading rule in the trading market. It says that when the price of a bull market soars, it may be crushed to the limit by its own weight. So, when you are in a bull market, you should be particularly bearish on news.

21. Detect price trends: The price chart is one of the basic tools of successful traders. You can use it to see the main trend of prices. A common mistake made by commodity investors is to buy when the market is basically trending down, or sell when it is rising.

22. Pay attention to the breakout points in the trend chart: This is the only method used by some successful traders. They draw a curve chart of the trading price for several consecutive days. If the price trend breaks through the previous trend and remains for more than two or three days in a row, it is usually a good buy or sell prompt.

23. Pay attention to the 50% retracement point in the main trend: You may often hear that the market is running in a technical rebound. This means that after a big rise (or fall), the market will have a 50% reverse movement.

24. When choosing buying and selling points, use the half-cut rule: This means finding the range of commodity buying and selling, and then cutting the range in half, buying in the lower half, or selling in the upper half. This rule is particularly useful when the market follows the chart track.

I hope it helps you. The rest will be updated in new articles. If you need it, you can check it on the homepage after following it.

EURCAD Analysis Price is currently in a William-Certified RangeEURCAD Analysis

Price is currently in a William-Certified Range (WCR), hovering near the 4H Support at 1.45500.

Scenario 1:

BUY entries can be taken the moment a bullish confirmation pattern is formed, with targets set at the 4H Resistance at 1.47200.

Scenario 2:

SELL entries can be taken after price breaks through the 4H support, retests it and forms a bearish confirmation pattern.

Targets will be placed at the next 4H Support at 1.44800.

EURUSD BUY | Day Trading AnalysisHello Traders, here is the full analysis.

Watch strong action at the current levels for BUY. GOOD LUCK! Great BUY opportunity EURUSD

I still did my best and this is the most likely count for me at the moment.

Support the idea with like and follow my profile TO SEE MORE.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

Patience is the If You Have Any Question, Feel Free To Ask 🤗

Just follow chart with idea and analysis and when you are ready come in THE GROVE | VIP GROUP, earn more and safe, wait for the signal at the right moment and make money with us💰

CHFEUR Potential reversal There are signs of a potential reversal in the CHFEUR currency pair. With a take profit level set at 1.027, traders are anticipating a favorable price movement to reach this target. Meanwhile, a stop loss at 1.024 is placed to limit potential losses in case the reversal does not materialize as expected.

It's important to consider that technical analysis provides insights based on historical price patterns and indicators. However, market conditions are subject to change, and there is no guarantee that the anticipated reversal will occur or that the price targets will be reached.

The entry point for GBPUSD is imminent

Previously, when GBPUSD touched 1.19250, we emphasized that there was strong support at that level, and there was a demand for a rebound. The consecutive two rallies were both quick rebounds after testing the support, but the sustainability of the upward trend was weak, and there was a subsequent decline after being under pressure.

However, when the market enters our buying zone again, I will still act decisively and continue to position myself long at the previous key support level, waiting for the market to stabilize and further form an upward breakthrough.

As I focus more on long-term positioning and swing trading, the trading cycle may be longer, and long-term positioning requires a relatively large amount of capital and a good investment mindset. I will also keep updating and promptly notify when the layout point is reached.

Operational suggestions: buy at 1.19200-1.19400, with the first profit target at 1.21500 and the second profit target at 1.22700.

I have in-depth research on futures products such as cryptocurrencies, forex, stocks, gold, and crude oil, and I also update some daily operational layouts. Thank you for your attention and likes, and friends with questions can leave me a message promptly, and I will provide the most secure advice, hoping to help you.

FX:GBPUSD

EURUSD Price Action Analysis Profit outcomeEUR/USD has delivered what we needed and delightful trader we are. Price created a reasonable Break of market structure, traded into a delightful order block and Boom! Price flew to the moon with profits of 1:3 RR already. Though still expecting a further push to the buy stops.

GBPAUD - 30MGBPAUD - 30M

Price has finally broken the 1.8400 daily support where it was showing a very strong resistence, giving us a nice break with a new LL formation leading us to a perfect TP 2 yesterday, but today it seems like it is respecting the previous bearish structure forming a new one right below it so if we zee a break of the inner structure (red zone) i would like to short it again , also this structure lines up with a descencing TL and 38% fib lets see how price reacts in the following hours

AUDCAD MULTI-MONTH REVERSAL!!!The double bottom pattern consists of two lows around the same level of support and indicates a possible bullish reversal signal.

Price is also resting at a key level of support and resistance

Once those levels of support or resistance are broken, the supply and demand dynamics which produced them are shifted

Support is the amount of demand that is strong enough to prevent the stock from dropping any further.

The level at which supply is strong enough to prevent the price from rising is referred to as resistance.

Looking at the trade setup at the current levels the market is showing a low risk entry relative to our upside targets on the daily time frame

We are also seeing slight bullish divergence on the RSI on the double bottom pattern

Like for more and let me know what you think

USD/CHF Signal - USD Retail Sales - 17 Aug 2021USDCHF is trading to the downside today prior to the USD Retail Sales data, which records the total receipts for retail stores domestically. JP Morgan has stated they expect the data to be disappointing from the -0.2% consensus, which will be USD bearish. Technically the pair has broken the ascending trendline and we anticipate downside into the 0.9080 level.

USD/JPY Updated Entries + ExitsHow To Play The Chart Entries/Exits:

Buy at green support entry, if it breaks by -35 pips (count it out) then enter a sell and ride to TP1, 2 and 3. Trail stop at each TP which means place your stop loss in profit but with enough room to be able to continue the sell if it continues. Same thing at resistance, sell but if broken by 30 pips then enter the buy and ride to TP1. Each TP is a support or resistance zone , so you could then even take a sell after TP1 for the buys have been hit and if it breaks out then just repeat.

EURUSD Uptrend 04 03 2021EURUSD Uptrend 04 03 2021

Continuing its movement in the global uptrend that began in May 2020, the price came to the support zone in the middle of this 1.205 channel. This zone formed at the intersection of the strong support level and the line formed in the middle of the channel. And from this zone, we have repeatedly been able to observe the price correction. This time, too, the price touched the zone at the beginning of the week, increased minimally and rolled back again. Therefore, now I expect it to consolidate in the zone and continue to grow. Thus, my final target is the resistance line at 1.223.