Sellers Trapped! AUD/USD Flips Structure to BullishAustralian Dollar / U.S. Dollar (AUD/USD)

📆 Timeframe: 1-Day (1D)

📈 Technical Breakdown:

1. Sideways Consolidation Zone

The price has been consolidating within a clear horizontal range.

This range is defined by upper resistance and lower support zones, with several rejections confirming the boundaries.

2. Downtrend Resistance Line Broken

A long-standing resistance trendline has been breached to the upside.

This breakout suggests a potential trend reversal or continuation rally if price holds above.

3. Seller Trap Identified

There was a strong liquidity sweep below the support zone, labeled “Sellers Got Trapped.”

This is a classic liquidity grab, where shorts were likely triggered before price reversed sharply upward.

4. EMA 50 as Dynamic Support

Price has reclaimed the 50 EMA (0.62701), indicating a shift in short-term momentum towards the bulls.

If the price remains above this moving average, it could act as a dynamic support in the near term.

5. RSI (Relative Strength Index) at 57.62

RSI is in bullish neutral territory, suggesting there’s still room for upward momentum before overbought levels (>70).

No bearish divergence is currently visible.

✅ Bullish Outlook:

Breakout above resistance trendline ✅

Recovery above EMA 50 ✅

Seller trap below range ✅

RSI supports further move ✅

Forexsingals

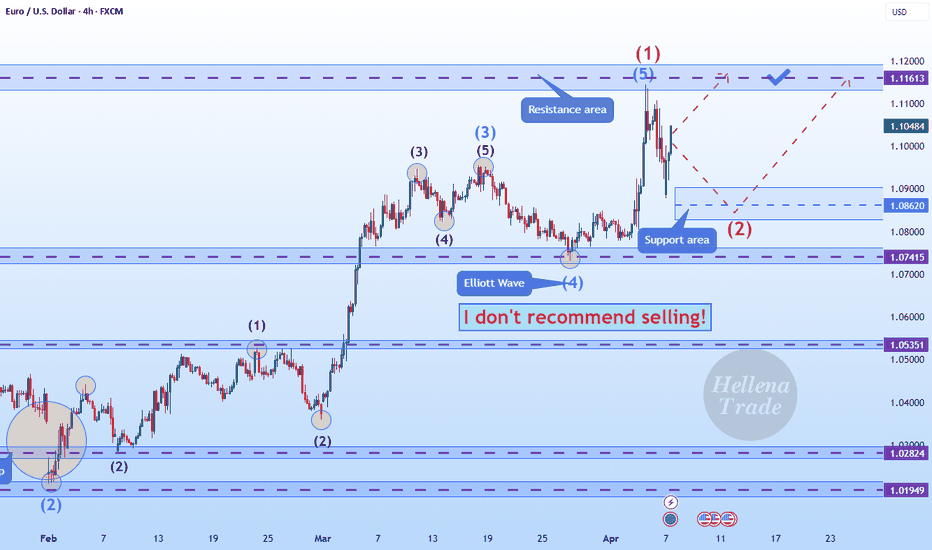

Hellena | EUR/USD (4H): LONG to the resistance area 1.11613.Colleagues, the price is in the correction of wave “2”. I believe that the upward five-wave impulse is not yet complete. In any case, I think that the price will still reach the maximum of wave “1” at 1.11613.

The question is how far will the correction of wave “2” go or is it over? There is no way to know for sure, so I don't recommend selling. I think we should stick to long positions.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

GBP/JPY Market Shift or Liquidity Grab? Here’s What I’m Seeing!Yesterday, we were focused on GBP/JPY selling off after a major support break, but today’s price action is revealing a potential shift in momentum. While the larger structure still suggests a bearish outlook, recent price behavior is showing signs of a liquidity grab before any major move.

On the H4 and H1 timeframes, we’re seeing slow but steady higher highs forming after a key support at 191.58 held. This suggests that before any deeper drop, GBP/JPY may need to sweep liquidity above recent highs at 192.50 and 193.18. The price action is creeping upward, with candle closures above key resistance levels—a major sign of potential upside before sellers truly take control.

Here’s what I’m watching:

📌 A breakout and liquidity sweep above 193.18 before a possible reversal

📌 Holding above 192.50 could indicate a continued bullish push toward 194.74

📌 If buyers fail and price rejects the highs, we may see a strong downside continuation

This is a crucial turning point—will GBP/JPY fake out buyers before dumping, or are we seeing the start of a larger move up?

GBPJPY Sell/Short SignalGBPJPY looks like a sell on the D1 and has been moving steadily down from the last entry we took. We are looking for a nice slide downward movement with key levels I marked on the chart. Last few patterns that have played out created a double top and a clear indication of an M formation to complete the full double bottom. I would like to see levels 192, 188, and 183 touch for a long term swing trade period, however, you are able to close when you wish to do so. Please be advised to use cautionary risk/reward ratios and what suits you best. If you have any questions, please feel free to message me as I love to answer questions! Thanks! Happy New Years to all! We are officially BACK!

ENTRY: 195.284 (can enter in these levels)

TP 1 (Day Trade): 192.020

TP 2 (Swing Trade): 188.006

TP 3: (extended swing trade) 183.762

SL: 50 Pips from entry

Please message me if you have any questions! Please enjoy your day and be sure to follow our page!

short term strategy for goldAt the beginning of the trading session in the US market, the world gold price increased, investors increased their gold purchases. The US August employment report was gloomy, pushing up expectations for the US Federal Reserve (Fed) to loosen monetary policy. , the possibility of the Fed cutting interest rates by 25 basis points is increasing, which could make gold prices vulnerable in the near future.

XAU Continues strong upward momentumWorld gold prices increased slightly today as investors waited for the US to announce inflation data in the next few days to predict when to cut interest rates.

The information that may surprise the gold market in the next few days is the US core personal consumption expenditures index (PCE) - an important inflation measure of the US Federal Reserve (FED).

The dollar slid to its lowest in more than a week, making gold cheaper for holders of other currencies.

Gold prices in Asian markets almost went sideways during the trading session on May 28, when the USD weakened. Meanwhile, investors are waiting for important US inflation data to give clues about when the US Federal Reserve (Fed) will cut interest rates.

“The outlook for a stronger USD is supported by a change in the US monetary policy stance, as the Fed begins to look for evidence to raise interest rates instead of easing monetary policy which could be a risk. big for the gold market.

XAUUSDHello traders, what do you think about GOLD? Gold held steady around 1995 levels. A softer US dollar and lower US Treasury yields boosted the yellow metal.

From a technical point of view: the price is expected to rise to the specified level after testing the specified zone.

What is your view? Do you agree with me?❤️

BluetonaFX - USDJPY Cannot Break 150Hi Traders!

USDJPY is struggling to break the psychological 150 level, and there might be a possibility of the US dollar slowing down due to strong data coming out of Europe.

Price Action 📊

The market has reached the psychological level of 150 and has been trying to break the level for the past three weeks without any success.

The market may have run out of buyers and may need new waves of buyers to enter the market, which may provide short-term selling opportunities.

Fundamental Analysis 📰

The US dollar continues to trade strongly amid rising yields and escalating tensions in the Middle East, after US Federal Reserve Chair Jerome Powell stopped short of hinting that US interest rates have peaked.

Strong data has started to come out of Europe with better-than-expected Flash PMIs across the EU and the UK.

Support 📉

145.073: PREVIOUS RANGE ZONE RESISTANCE

Resistance 📈

150.000: PSYCHOLOGICAL LEVEL

151.946: APEX LEVEL

Risk ⚠️

No more than 2% of your capital.

Reward 💰

At least 4% of your capital.

Please make sure to click on the like/boost button 🚀 as your support greatly helps.

Trade safely and responsibly.

BluetonaFX

BluetonaFX - GBPAUD Triangle Break SHORT Idea Hi Traders!

There is a potential triangle break on the GBPAUD 1D chart.

Price Action 📊

Descending triangle with lower highs and lower lows. The market has also broken and been below the 20 EMA for the past 5 days.

Looking for a momentum break below the support trendline for a possible short entry to the target area between 1.92500 and 1.92100.

Support 📉

1.93706: SUPPORT TRENDLINE

Resistance 📈

1.95070: PREVIOUS DAY'S HIGH

Risk ⚠️

No more than 2% of your capital.

Reward 💰

At least 4% of your capital.

Fundamental Analysis 📰

We must be careful with the high-impact data expected today from the USD and EUR and the ECB press conference later.

Please make sure to click on the like/boost button 🚀 as your support greatly helps.

Trade safely and responsibly.

BluetonaFX

BluetonaFX - SPX Approaching All-Time HighHi Traders!

We are approaching the all-time high on the S&P 500, and traders are eagerly anticipating tomorrow's Federal Reserve interest rate decision along with the FOMC minutes meeting announcement.

Looking at the technical price action on the 1W chart, the market has been in a steady bull market since October 2022. We have drawn the ascending price channel on the chart for you to see.

Before the all-time high at 4818.62 (the apex level), there is a resistance level at 4637.30. This level is key because there was a price rejection at this level 16 months ago, and we have not been above it since then.

If we get a break and close above 4637.30, then the apex level at 4818.62 is the next target, and if that breaks, then we will be trading in record-breaking territory.

On the other side, if 4637.30 holds and there is not a break and close above this level, then the bull market we have had for the past 16 months may be coming to an end, and we may get a pullback to the long-term support level at 4325.28.

Please do not forget to like, comment, and follow, as your support greatly helps.

We appreciate your continued support!

BluetonaFX

2023.7.14 USD has fallen below the 100 integer mark2023.7.14 USD has fallen below the 100 integer mark

Hello, I'm Older Duan. Today is Friday, July 14th 2023.

Now it's 17pm Beijing time.

Let me give you a quick comment on the technical forms of the current international mainstream varieties!

First, what we see is the daily graph of the dollar index.

As shown in the figure, the U.S. Dollar Index has fallen below the 100.00 integer level, coming near the daily level of 610MA!

Now, let's look at gold.

Now you can see the daily chart of gold.

The figure superimposes the combination of gold's recent bottom-up golden section and Fibonacci parameter mean square!

As shown in the figure, gold has been trading at the bottom against the 2.000 level of the gold split in the past two trading days, and it is also the highest point on February 2, 2023 ($1959.69), engaging in long short competition! Then, we can continue to use this position as an important Bitwise operation in the day later today! Above this position, bulls dominate; Below this position, bears dominate!

Let's take a look at American crude oil.

What you are now seeing is daily level candle chart of US crude oil. The graph superimposes the recent bottom-up golden section of US crude oil and the Fibonacci parameter mean square combination!

As shown in the figure, US crude oil yesterday broke through the bottom of the bullish 1.618 and daily level 233MA, and today's low hit the daily level 233MA ($76.35)! Then, in the following time today, just use this position as an important point in the day for Bitwise operation! Above this point, bulls dominate; Below this point, bears dominate!

Let's look at EURUSD.

What you can see now is the daily chart of EURUSD.

The figure superimposes the combination of European and American currencies against the recent bottom of the golden section and Fibonacci parameter mean square!

As shown in the figure, the euro rose sharply against the US dollar again yesterday, with the next strong pressure at 1.12800! Then, in the future, we can use today's opening price (1.12228) as the Bitwise operation of the day's important point! Above this position, bulls dominate; Under this position, bears dominate!

Finally, let's take a look at GBPUSD.

Now you can see the daily chart of GBPUSD.

The figure superimposes the combination of the recent bottom of the GBPUSD against the golden section and the Fibonacci parameter mean square!

As shown in the figure, the pound has reached a strong pressure level against the US dollar: the bottom is at 2.382 (around 1.31300) above the golden section! Then this position will be used as the Bitwise operation operation of the important point in the day in the future! Above this position, bulls dominate; Under this position, bears dominate!

Well, the above is a quick inventory of the technical forms of the international mainstream varieties in today's European period!

Special reminder, Today is Friday, and all important data for this week has been released. The weekly line will close tonight, and it is likely that there will be a pullback trend. Please pay attention to the risks!

Im Older Duan. Wish you happy win . Goodbye!

CADGBP Triple Bottom Chart PatternCADGBP, the Canadian Dollar against the British Pound, is showing indications of a potential reversal as it forms a triple bottom pattern on the 1-hour timeframe, finding support at a key level. This pattern suggests a potential shift from a downtrend to an uptrend.

Traders observing this potential reversal might consider a take profit level at 0.5983, targeting an upward price movement towards this objective. To manage risk effectively, it is advisable to place a stop loss at 0.5932, serving as a protective measure if the reversal does not materialize as anticipated.

While the triple bottom pattern and support level offer encouraging signals, it is essential to consider other factors such as overall market conditions, fundamental analysis, and prevailing market sentiment. Relying solely on technical patterns may not guarantee successful trades, so it is important to closely monitor the market for any changes or developments.

Looking forward to read your opinion about it!

CADAUD Falling Wedge PatternCADAUD, the Canadian Dollar against the Australian Dollar, is showing signs of a potential reversal as it reaches the end of a falling wedge pattern at a key support level. This pattern typically indicates a potential trend reversal from a downtrend to an uptrend.

Traders considering this potential reversal may set a take profit level at 1.1148, aiming for an upward price movement towards this target. To manage risk, it is recommended to place a stop loss at 1.0960, serving as a safeguard in case the reversal does not materialize as anticipated.

While the falling wedge pattern and support level provide encouraging signals, it's crucial to consider other factors such as market conditions, fundamental analysis, and overall market sentiment. Technical patterns alone do not guarantee successful trades, and it's essential to closely monitor the market for any potential changes.

Looking forward to read your opinion about it.

GoldViewFX - 4H MARKET UPDATEHey Everyone,

Please see update on our 4H chart idea which is playing out as analysed. We got a nice drop into the retracement range followed with a prefect bounce with candle wicking out on our 1967 Goldturn support into our first target.

Although our 1H chart idea has opened both ways with the swing range being open; the 4H chart is still supporting above the retracement range, as EMA5 remains above the retracement range.

We remain Bullish with our long term plans and will continue to track the price level to level when buying dips from support levels with the short term trend down.

We also have a long range Axis target at 2052 on the 4H chart.

BULLISH TARGETS

2005 - DONE

2022 -

2039 -

2052 -

BEARISH TARGETS

1993 - DONE

1980 - DONE

EMA5 CROSS AND LOCK BELOW 1980 WILL OPEN THE SWING RANGE

SWING RANGE

1960

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Please don't forget to like, comment and follow to support us, we really appreciate it!

GoldViewFX

XAUUSD TOP AUTHOR

USDJPY setup Analysis Hello Traders,

We see a bullish head and shoulders in formation.

Scenario 1: We would like to see price give bullish price action and confirmation to enter buys (Longs)

Scenario 2: We would see the possibility of sell pressure continuing, Therefore, invalidating the head and shoulder formation and reaching lows.

Have a good week of trading!!

EURCHF:BEARISH POSITIONS BELLOW 0.9786OANDA:EURCHF

Hello folks, this is my analysis brought to you after deeply analyzing the EUR/CHF Forex pair from a technical and fundamental perspective:

Pivot point: 0.9786

Stop loss :0.9822

Take profit: 0.9604

Current price at the moment of generating this post: 0.9742

Risk/Reward Ratio : 1.84

If this post was useful to you, do not forget to like and comment.❤️

Trade Safely,

Best Regards,

Yasser Tavarez

EURBGP Long TradePlenty of trading opportunities in the Forex market today

I think the EURGBP is going to go back to major resistance level I am going long. The risk reward on this one is about 1:8, pretty good.

The stochastic oscillator is one of the indicators I look at when trading and it is extremely bullish on this one, atleast for now haha.

Long at market prices

GBPJPY DAILY ANALYSIS, the crucial support line lies around 149First, let us cover some historical points in GBP/JPY's near history. Looking at the bigger picture, we are in the clear consolidation zone. The crucial support line lies around 149. The pivotal resistance line would be near 158. We are currently in the downtrend, on our way to the support line as we hit resistance. We can even see a strong chart pattern, a double top with neckline broken. That shows down movement for us. Price will most likely hit the support line and yet again bounce from it. That would make a significant entry point for buyers (if confirmed). Regardless, price action can still break this support zone and start the downtrend.

Use this information at your own risk. This analysis is to point out the high probability key points. For day traders, it is crucial to know the bigger picture. Have fun trading!