THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would be looking for the price to spike down into potentially the extension level 3310 and then give us the tap and bounce we wanted to be able to capture the long trade in to the 3345-50 region initially. It was those higher resistance levels that we said we would stick with and the bias was bearish below. This move resulted in a decent long trade upside into the region we wanted, and then the decline we witnessed mid-week completing all of our bearish target levels which were shared with everyone.

On top of that, we got the bounce we wanted for the long trade but only back up into the 3335 level which was an Excalibur active target. The rest, we just sat and watched on Friday as unless we were already in the move, the only thing we could have done is get in with the volume, which isn’t a great idea with the limited pull backs.

All in all, a great week in Camelot not only on Gold, but also the other pairs we trade with the DAX swing trade being a point to point swing move executed with precision by the team.

So, what can we expect in the week ahead?

We’ll keep it simple again this week but will say this, there seems we may see a curveball on the way this week. With tariff news over the weekend we may see price open across the markets with gaps, one thing we will say is if you see these gaps, don’t gap chase until you see a clean reversal!

We have the higher level here of 3375-85 resistance and lower support here 3350-45. If support holds on open we may see that push upside into the red box which is the one that needs to be monitored. Failure to breach can result in a correction all the way back down into the 3335 level initially. Again, this lower support level is the key level for this week and needs to be monitored for a breach which should then result in a completed correction of the move.

Our volume indicators are suggesting a higher high can take place here and if we do get a clean reversal we should see this pull back deeply. As usual we will follow the strategy that has been taught and let Excalibur guide the way.

KOG’s bias for the week:

Bullish above 3350 with targets above 3360, 3373, 3375 and 3383 for now

Bearish below 3350 with targets below 3340, 3335, 3329, 3320 and 3310 for now

RED BOX TARGETS:

Break above 3365 for 3372, 3375, 3382, 3390 and 3406 in extension of the move

Break below 3350 for 3340, 3335, 3329, 3322 and 3310 in extension of the move

It’s a HUGE RANGE this week so play caution, wait for the right set ups, don’t treat it like it’s your every day market condition. News from Tuesday so expect Monday to be choppy!

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Forexstrategy

GBPUSD Week 29 Swing Zone/LevelsAfter 7 straight weeks of profitable gold trading, we’re shifting gears to GBPUSD.

Why this pair? It’s offering a classic low-risk, high-reward setup that many traders appreciate:

🔒 Stop Loss: 10–15 pips

🎯 Take Profit: 50–100 pips

We’re analyzing price action using a simple but powerful concept:

Each zone is drawn based on how the high and low of one day compares with the next. For example:

Monday’s high/low vs Tuesday’s range

Tuesday’s vs Wednesday’s, and so on

This method helps spot potential continuation zones as market structure unfolds across the week.

👉 The key? Patience, and letting the levels tell the story.

As always price action determines trades

Market next move 🔍 Disrupting the Original Bullish Bias

The original analysis assumes a bullish reversal from the support zone aiming for a resistance target near $3,360. However, let’s challenge that with an alternate (bearish or neutral) perspective:

---

⚠️ 1. Support May Not Hold

Price has tested the support zone multiple times, increasing the probability of a breakdown.

Repeated testing weakens support levels; a breakdown below $3,280 could trigger panic selling or stop-loss hunts, accelerating the drop.

---

📉 2. Bearish Momentum is Dominant

The overall trend is downward, with lower highs and lower lows.

The current bounce could be a dead cat bounce — a short-lived recovery before another drop.

---

📊 3. Volume Analysis

There's no significant bullish volume spike at the support, which weakens the bullish thesis.

This suggests lack of strong buying interest, a red flag for bullish continuation.

---

🔄 4. Resistance May Hold Strong

The resistance area around $3,360 has shown previous strong rejections.

Even if price rises, it could stall or reverse before reaching the target.

Market next target 🚀 Bullish Disruption Analysis

1. Support Holds Above 35.80

The market may dip slightly but find strong support around the 35.90–36.00 zone.

Instead of continuing lower, buyers absorb the selling pressure, leading to a sharp bullish reversal.

2. Bullish Continuation After Consolidation

The current pullback could just be a healthy retracement following the strong recovery move from the previous dip.

This could form a bullish flag or ascending triangle, eventually breaking above 36.20 and pushing higher.

3. Volume Clue

If the pullback happens with declining red volume, while previous green candles had strong volume, it signals a temporary correction rather than a trend reversal.

Watch for a bullish engulfing candle backed by strong volume to confirm.

4. Macro Trigger / Fundamental Support

Any dovish signal from the Fed, rising inflation, or weakening USD could increase investor demand for silver, pushing prices back up.

A news-driven reversal could invalidate the bearish path quickly.

5. Bullish Price Target

If buyers take control, silver could retest and break above 36.30–36.40, aiming toward 36.60 or even 36.80.

EURUSD Analysis (MMC Strategy) : Structure Mapping + Target🧠 Overview

This analysis is based on the MMC (Market Mapping Concept), combining smart money principles, structure mapping, and price behavior analysis. EUR/USD has been showing strong bullish activity over the past few months, but we are now approaching a critical decision zone. Let’s break it all down.

🔹 1. Arc Structure – Accumulation Phase (Dec 2024 – Feb 2025)

The chart starts with a well-defined Arc formation, signaling accumulation by large players.

Price showed a series of higher lows within the arc, compressing volatility.

This is where smart money quietly loads positions before pushing price.

Key Insight: This arc often precedes an impulsive breakout, as seen next.

🔹 2. Central Zone Breakout (Feb – Mar 2025)

The price exploded out of the arc, breaking through the central compression area.

Marked as the Central Zone, this acted as both support and a launchpad.

This phase included imbalance filling, reaccumulation, and clean price action.

Observation: Notice the aggressive bullish candles—clear indication of institutional interest.

🔹 3. Structure Mapping & QFL Zone (April 2025)

A classic QFL (Quick Flip Level) was formed after the initial rally.

Price pulled back into a structure support zone, respected it cleanly, and bounced back.

This gave a textbook smart money entry.

Structure Mapping highlights how each leg of the trend is forming based on supply/demand reaction.

🔹 4. Major BOS – Break of Structure (May 2025)

Price broke the previous swing high, giving us a Major Break of Structure.

This BOS confirms a change in character (CHOCH) from ranging to trending.

After BOS, the market retested the breakout zone—providing a second ideal long entry for continuation traders.

🔹 5. Minor Resistance Zone (Current Price)

Currently, price is testing a Minor Resistance zone around 1.1400–1.1450.

This level acted as resistance earlier and may slow price down temporarily.

However, there’s still room for bullish continuation unless reversal patterns emerge.

Key Watch Point: If price shows weakness here (e.g., rejection wicks, bearish engulfing), short-term retracement may follow.

🔹 6. Next Reversal Zone (Projected Target: 1.1700–1.1800)

The green box above marks the Next Reversal Zone, based on historical supply, Fibonacci extension levels, and structure analysis.

Expect this area to act as strong resistance unless momentum is very strong.

This is a potential TP zone for long traders or an area to scout for short opportunities if reversal signals appear (divergence, order block rejection, liquidity grab).

📌 Key Levels

Zone Price Range Role

Central Zone 1.0800–1.1000 Support/Accumulation

Minor Resistance 1.1400–1.1450 Immediate Hurdle

Next Reversal Zone 1.1700–1.1800 Target / Short Setup

QFL Zone 1.1100–1.1200 Smart Money Entry Point

🧠 Strategy Outlook

✅ Bullish Bias: Structure is clearly bullish. Buyers are in control.

🕵️♂️ Watch for Reaction at Minor Resistance – a clean break = continuation, rejection = short-term pullback.

Market next move 🔻 Disruptive Bearish Analysis:

🧱 1. Failed Breakout Attempt

Price is hovering at resistance but showing indecisive candles (small bodies, wicks on both sides).

This hints at buyer exhaustion rather than breakout momentum.

📉 2. Bearish Divergence (Possible)

If momentum indicators (e.g., RSI or MACD—not shown here) are diverging from price, it could signal a reversal.

Price rising while momentum flattens or drops suggests a fakeout is likely.

🕳️ 3. Liquidity Grab Trap

The chart may show a classic “bull trap”:

Price broke resistance briefly but quickly fell back.

This signals institutional liquidity grab, possibly before a downward push.

🔽 4. Volume Imbalance

The spike in volume earlier may be followed by decreasing bullish volume, indicating weak follow-through.

Sellers could take over if bulls can’t sustain pressure.

Market next move 🔻 1. False Breakout Risk

Price is hovering right at the resistance-turned-support zone.

The candles above this zone have long upper wicks, signaling rejection and selling pressure.

This may be a bull trap before reversal.

---

📉 2. Decreasing Bull Volume

Volume peaked earlier, but the most recent green candles are showing lower volume, suggesting weakening bullish momentum.

Lack of strong follow-through volume often precedes reversals.

---

🕳️ 3. Overextended Rally

Gold has moved sharply upward recently (over +2.5%).

There may be a need for a cooldown or retracement, especially if no fresh catalysts emerge.

---

⚠️ 4. Macro Factors Unpriced

The chart includes a U.S. event icon, likely representing upcoming economic data (e.g., Fed comments, job reports).

Any hawkish surprise (rate hike concerns, strong jobs report) could cause a sharp reversal in gold due to rising yields and a stronger USD.

We could see an upward move up to $3350!There is a lot of buy-side liquidity resting in the gold market. There are 2 to 3 daily highs currently unchallenged, and even a weekly high is in place. The market has already moved downward and created inducement (a trap or manipulation to draw sellers in), which now makes the market appear bullish from this point.

We could see an upward move up to $3350 or even higher—especially if a 4-hour candle closes above $3360. At this point, it’s better to wait for clear displacement (strong movement indicating a direction). After that, we’ll see how the market develops.

Do Your Own Research (DYOR)! This is not financial advice.

Market next target

⚠️ Disruption Points:

1. Dubious Support Zone

The boxed zone (highlighted as support) shows multiple rejections but no clear bullish rejection candles (e.g., no hammer, bullish engulfing).

This may be a false base forming before another breakdown, especially with declining volume.

2. No Confirmed Reversal Pattern

The chart lacks a proper reversal structure like a double bottom, inverse head-and-shoulders, or bullish divergence.

A few sideways candles ≠ trend reversal—this might just be consolidation before further drop.

3. Weak Buyer Commitment

Volume has steadily decreased as the price attempted to base out.

If buyers were serious, we’d expect to see surging green volume bars, not this tapering activity.

4. Downtrend Still Dominant

The overall market structure is still lower highs and lower lows.

Jumping into a long trade against the trend without a confirmed break above the last swing high (≈1.13250) is premature.

5. Risk-Reward Imbalance

The arrowed path assumes an ideal rise without considering realistic pullbacks or market resistance.

If a stop is set below 1.12800 (support low) and the target is 1.13400, reward is tight compared to the risk, especially if price continues chopping sideways.

Market next move Original Analysis Summary:

The chart shows a support area around the 3340 USD level.

There are two bullish scenarios outlined with blue and yellow arrows, implying a price increase from the support zone.

---

Disruption/Critical Analysis:

1. Overreliance on Short-Term Support:

The chart assumes the marked support area will hold, but no confirmation (like a bullish candlestick pattern or strong buying volume) is evident yet. A break below that zone could lead to a bearish move instead.

2. Volume Weakness:

Recent candles near the support zone are not backed by significantly increasing volume. This suggests weak buying interest, making the bullish forecast potentially over-optimistic.

3. No Consideration of Macroeconomic Events:

The chart doesn't factor in fundamental drivers (like U.S. economic data, Fed announcements), which can easily invalidate technical patterns.

Market next move Original Analysis Summary:

Identifies a bullish structure breaking above a support area.

Projects a potential continuation to higher targets.

Suggests consolidation and bounce from support before climbing.

---

Disruptive Bearish Interpretation:

1. Lower High Possibility:

Recent price action might be forming a lower high rather than a continuation signal, signaling weakness in buying pressure.

2. Volume Imbalance:

Notice how the large green candle was followed by lower bullish volume, suggesting buying momentum is fading.

3. Breakout Trap:

The "Support area" may instead be a liquidity zone where breakout traders entered long positions and could now be trapped. A break below this area could cause a panic sell-off.

4. Trendline Respect (Rejection):

Price is currently retesting the underside of a descending trendline — a common reversal spot.

USDCHF 30M Smart Money Entry from Demand — Watch This Level🧠 USDCHF 30M | SMC Precision Entry

Let’s break down this sniper play on USDCHF that’s setting up right from a Smart Money demand zone.

🔻 1. Liquidity Sweep Into Demand

Price broke structure earlier, then pulled back into a clear demand block.

We saw liquidity grabbed beneath multiple swing lows before this sharp rejection.

This is classic Smart Money accumulation — they take out weak hands before pumping it up.

🧱 2. Order Block + FVG Alignment

Price is reacting off a refined OB zone (marked in red) with a Fair Value Gap right above.

That OB was the last down move before the push up, and price just tapped into it clean.

The overlap of these two areas adds confluence for bulls.

📈 3. Entry + TP Setup (RRR ≈ 3:1)

📍 Entry Zone: 0.84070 – 0.84200 (inside OB)

❌ Stop-Loss: Below OB, around 0.84000

✅ Take Profit: 0.84750 (clean imbalance above)

There’s a wide imbalance zone above, which price may be magnetized toward.

🔥 4. Why This Works

✅ Liquidity Grab

✅ OB + FVG Confluence

✅ Bullish Reaction Wicks

✅ Tight SL Below Structure

✅ Clean RRR

This setup is Smart Money 101 — let them sweep, you step in with precision 💯

💬 Drop “📍USDCHF OB Tap” if you saw this coming.

📊 Follow @ChartNinjas88 for SMC setups that work.

Trend Changing Pattern (TCP) in Action: Live ExampleHey traders,

Following up on yesterday’s lesson about the Trend Changing Pattern (TCP), I wanted to share a real-time example using the CADJPY pair in an intraday downtrend.

Today, we spotted a TCP setup where price action gave us a classic reversal signal:

The market manipulated the low of the TCP zone with a single break.

This was followed by a W pattern and a second attempt that failed to make a lower low.

That failure to create a new low acted as our entry confirmation for a long position.

🔹 Entry: 103.71 (Long)

🔹 Stop Loss: 103.28 (Just below the break low for protection)

This trade setup perfectly illustrates how price structure and momentum shifts can help you catch early entries during trend reversals.

Stay sharp, manage your risk — and have a blessed trading day!

GBP/USD Breakdown – Support Under Pressure, Bearish Target AheadChart Analysis:

The GBP/USD pair is currently trading around 1.29578, facing resistance near 1.30366.

A support zone has been identified around 1.29000, which the price is testing.

If this support level breaks, we could see a bearish move toward the next target near 1.26970.

Strong support is positioned lower, which may act as a key reversal point if the decline continues.

Trading Outlook:

Bearish Scenario: If the price breaks below the current support, a drop toward 1.26970 seems likely.

Bullish Scenario: If GBP/USD holds above support, we may see a retest of resistance at 1.30366.

Conclusion:

Traders should watch for a confirmed breakout or rejection at support before taking positions. A clean break below could trigger a stronger bearish move. 🚨

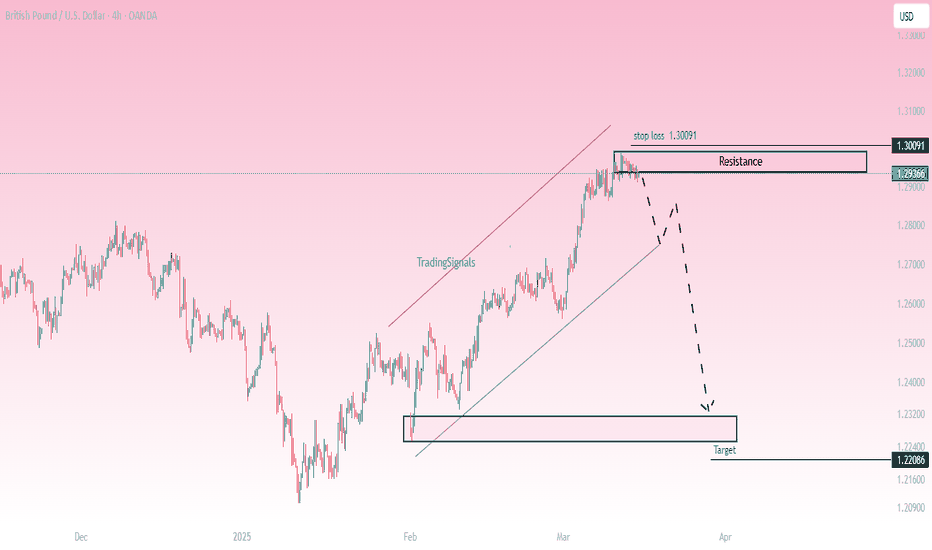

GBP/USD - Potential Bearish Reversal Setup

📉Market Structure:

The pair has been in an uptrend, forming a rising channel. However, price is now facing strong resistance around 1.2936 - 1.3009, showing signs of exhaustion. A potential reversal could be forming.

🔍 Key Levels:

Resistance Zone: 1.2936 - 1.3009

Current Price: 1.2936

Target Support: 1.2208

📊 Trade Idea:

A rejection from the resistance zone could initiate a bearish move.

A confirmed breakdown below 1.2900 may trigger further downside toward the 1.2208 target zone.

Stop-loss placed above the 1.3009 resistance to manage risk.

🚨 Confirmation & Risk Management:

Bearish Confirmation: Rejection from resistance with strong selling momentum.

Invalidation: A breakout above 1.3009, indicating bullish continuation.

Risk Management: Stop-loss at 1.3009 with a favorable risk-to-reward ratio.

This setup suggests a short opportunity if price respects resistance and begins a downward move. Traders should watch for confirmation signals before entering.

I HAVE A NEW STRATEGY! Watch it work for me. SAYS SELL🚨 Exclusive Trading Opportunity – Limited Time Only! 🚨

I've developed an amazing new trading strategy that’s completely unique and never seen before! It’s called the Skyline Scalping Strategy, and it’s designed to pinpoint market direction with extreme accuracy—something that can easily be back-tested by reviewing my previous predictions.

For a limited time, I’ll be posting daily trade signals based on this strategy, allowing you to see exactly where I anticipate the market will move next. Whether you're an amateur trader or a seasoned professional, this is your chance to witness something game-changing in action.

⚠️ Disclaimer: I’m not providing financial advice—just sharing the direction I am planning to make money. The Skyline Scalping Strategy works exclusively on the daily chart, so stay tuned and watch as the predictions unfold!

FOLLOW NOW and don’t miss out on these powerful insights! 📊🔥

Vertical lines are colored and placed to indicate the expected direction of the price. Just my thoughts.

Analysis Gold buy NowDistance Analysis from Current Price (2,921.67 USD)

1. Resistance Level (2,955.44 USD)

Distance from Current Price: 33.77 USD

2. Intermediate Resistance (Green Line around 2,940 USD

Distance from Current Price: 18.33 USD

3. Support Level (Middle Red Zone around 2,910 USD)

Distance from Current Price: 11.67 USD

4. Major Support (Lower Red Line around 2,900 USD)

Distance from Current Price: 21.67 USD

---

Potential Price Movements:

Bullish Case:

If the price breaks above 2,940, it may rise toward the major resistance at 2,955.44 (+33.77 USD).

Bearish Case:

If the price drops below 2,910, it could decline toward 2,900 (-21.67 USD).

EUR/USD Technical Analysis: Consolidation, Demand Zones✅ Daily Timeframe Insights:

The EUR/USD has been consolidating between the 25% and 75% levels of its range. A potential upside continuation is expected if the demand zone at the bottom of the range holds. We’re eyeing a breakout of key levels for a bullish push.

✅ Weekly Timeframe Overview:

The EUR/USD is poised to target the previous week's high, supported by a weekly structural shift. This aligns with a broader retracement from liquidity lows, indicating strong momentum for further upside in the short term.

✅ Key Levels to Watch:

Resistance at 1.04670 (December high) is critical for further bullish confirmation.

Immediate downside risk arises if the current demand zone fails to hold.

✅ Economic Impact:

Today’s inflation data release will likely drive significant volatility. Traders should prepare for rapid price action and adjust strategies accordingly.

⚙️ Technical Tools & Key Concepts Used:

Liquidity zones

Supply & demand analysis

Fibonacci retracements (0.5 and 0.618 levels)

Weekly and daily fractal structure shifts

🚀 Forecast Summary:

While the bullish trend remains intact, news events like inflation figures could create temporary volatility or even reversals. For now, EUR/USD’s demand zones remain in control, favoring upside continuation. A break below key levels would signal short-term bearish opportunities.

Tags:

#EURUSD #ForexTrading #TechnicalAnalysis #SupplyAndDemand #PriceAction #TradingStrategy

TOSH/USD Long Setup | Fresh H1 Demand Zone Formation TOSH/USD is setting up for a potential long opportunity as price hovers around $0.000800, preparing to form a fresh demand zone on the H1 timeframe.

✅ Supply & Demand Strategy – A new demand zone is developing, indicating strong buyer interest.

✅ Bullish Reversal Potential – If price confirms the zone, we may see an upward move.

✅ Key Support Levels – Watching for confirmation around $0.000800 to validate entry.

✅ Risk-to-Reward Optimization – Stop-loss below the demand zone, targeting higher liquidity levels.

💡 Trading Plan:

🔹 Entry: Await confirmation of demand zone formation.

🔹 Targets: Look for potential resistance levels above.

🔹 Risk Management: Use proper SL & position sizing.

📊 What’s Next?

If buyers step in at the new demand zone, we could see bullish momentum taking price towards the next resistance levels. Stay tuned for updates!

#TOSHUSD #CryptoTrading #SupplyAndDemand #ForexStrategy #TradingView

GBP/USD Bullish Setup: Buyers Show Strong InterestAnalysis:

The Cable (GBP/USD) on the hourly chart has demonstrated impressive strength to the upside recently. However, on Friday, we observed a trend-changing pullback, with price retreating from a high of 1.2502 to a low of 1.2426.

Following this, the price broke the previous high again before creating a momentum low at 1.2414 earlier today.

On the 5-minute chart, a bullish setup has now formed following the momentum low. This suggests that buyers remain engaged, and we could see a bullish move back towards the 1.2499 level or potentially the high of 1.2524.

Entry Price: 1.2447 Long Entry

Stop Loss: 1.2412

Happy trading!

London Session Forex Market Analysis: USD Strength Leads the wayHi Traders,

Here’s a quick market analysis for the London session.

We’ve observed some notable movements in the currency pairs under review. As a quick recap from our weekly trade planning session (Portfolio Selection):

Strong currencies: USD remains the leader, followed by JPY, CAD, CHF, and AUD.

Weak currencies: EUR, NZD, and GBP.

The USD's bullish momentum is clearly dominating across the board, providing opportunities to target selling the weaker currencies against the USD.

Remember to approach the markets with a clear plan and stick to your trading plan.

Happy Trading!