Heading into pullback resistance?AUD/USD is rising towards the resistance level which is a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 0.6276

Why we like it:

There is a pullback resistance level that aligns with the 50% Fibonacci retracement.

Stop loss: 0.6321

Why we like it:

There is an overlap resistance that line sup with the 61.8% Fibonacci retracement.

Take profit: 0.6214

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Forextrading

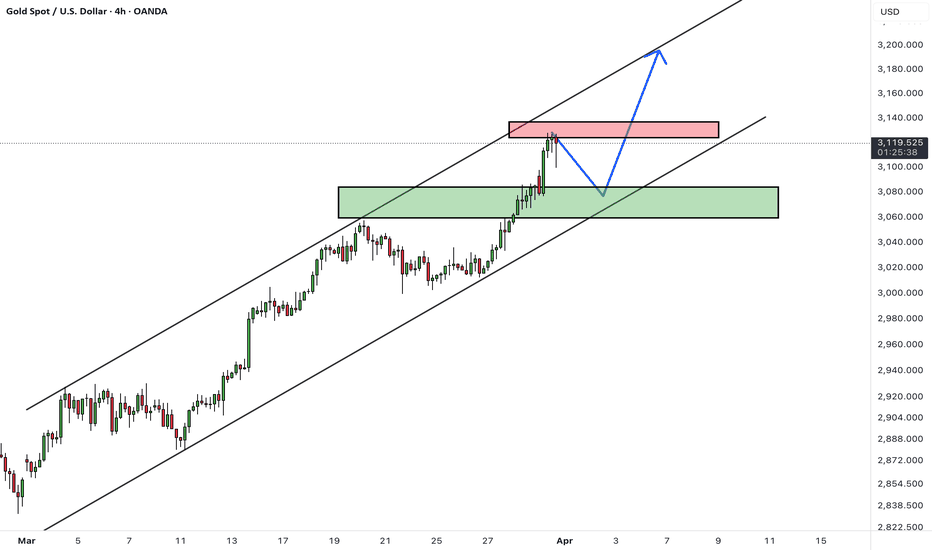

XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

Gold remains in a strong uptrend, and the first target is expected to be around $3200. At this level, due to a resistance zone, a temporary correction is likely.

This correction may extend down to the bottom of the ascending channel, which acts as a key support area. After completing the pullback, the bullish trend is expected to resume, aiming for the top of the channel as the next target.

If price breaks above the channel, higher targets could be activated.

Don’t forget to like and share your thoughts in the comments! ❤️

MarketBreakdown | EURUSD, GBPUSD, USDJPY, AUDUSD

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #EURUSD daily time frame 🇪🇺🇺🇸

For the last 2 weeks, EURUSD shows a strong bearish momentum.

The price managed to break and close below a key daily support cluster.

A strong bearish reaction that followed after its retest confirms a strong

selling pressure.

I think that the pair has a potential to drop lower this week.

2️⃣ #GBPUSD daily time frame 🇬🇧🇺🇸

In comparison to EURUSD, GBPUSD looks very stable.

The pair is consolidating within quite a wide range on a daily.

For now, probabilities are high that sideways movement will continue.

Consider trading the upper and lower boundary of the underlined channel.

Alternatively, a breakout of one of the underlined structures will give you a strong

bullish/breaish signal.

3️⃣ #USDJPY daily time frame 🇺🇸🇯🇵

Looks like the market is returning to a mid-term bearish trend.

The price is currently breaking a support line of a bearish flag pattern.

A daily candle close below its support will provide a strong bearish confirmation.

4️⃣ #AUDUSD daily time frame 🇦🇺🇺🇸

I see a completed head & shoulders pattern on a daily.

The price is currently breaking its neckline.

A daily candle close below that will provide a strong bearish confirmation

and suggest a highly probable bearish continuation.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/USD: Range-Bound with Bearish Potential Below ResistanceThe EUR/USD market recently completed an ABC pullback, briefly testing above Friday’s high, but price action remains contained within last week’s range, signaling a lack of clear trend direction.

If the price rejects the current resistance zone, a move lower is likely, possibly forming another ABC structure toward the 1.06000 support level. With the zone below 1.07700 already cleared—despite a prior false breakout—a retest of that area is possible. Unless the price manages a close above 1.08500, the pair is expected to drift toward last week’s low, with the next target at the support zone around 1.07610

NZDCAD Potential Bullish ReversalNZDCAD price seems to exhibit signs of a potential Bullish Reversal on the shorter timeframes if the price action forms a credible Higher High with multiple confluences from key Fibonacci and Support levels.

Trade Plan :

Entry @ 0.822500

Stop Loss @ 0.81600

TP 0.9 - 1 @ 0.82830 - 0.82890

Strong Confluence Zone – Is EURJPY Ready to Fly?EURJPY is currently respecting a strong ascending trendline that has acted as dynamic support for several years. Price recently rebounded from both the horizontal support zone and the rising trendline, indicating strong buying interest at this confluence area.

Now, the pair is attempting to break above a key resistance zone marked by a descending trendline. A successful breakout above this area could signal a potential continuation of the long-term bullish trend.

The RSI is also showing a bullish divergence, which adds confluence to the bullish bias. However, rejection from resistance could trigger a retest of the support zones.

Found this helpful? Like & follow us for more high-quality market insights.

GBPUSD Dusting 350+ PIPS in Choppy Waters - Breakout is Brewing?Technical / Chart Analysis:

Double Top Formation: The chart clearly exhibits a potential double top pattern around the 1.30564 resistance level. This is a bearish reversal pattern that suggests a potential trend change from bullish to bearish.

Breakdown of Uptrend: The preceding price action shows an uptrend, which has now been halted by the double top.

Key Support Level: The most crucial level to watch is the support around 1.28642. A confirmed break below this level would validate the double top pattern and signal a potential strong move downwards.

Monthly Performance: January saw a +180 pip move, followed by February with a +230 pip gain. This demonstrates the potential for significant profits in GBPUSD through swing trading.

Swing Analysis: February's +230 pip move consisted of 3 upward swings and 2 downward swings, highlighting the importance of capturing both upward and downward momentum in this pair due to the Choppy Price Action.

Conclusion:

FX:GBPUSD is at a critical juncture. The potential double top formation suggests a bearish bias, but confirmation is needed. Traders should closely monitor the key support level at 1.28642 for a potential breakdown and look for LONG Trades on breaking key levels to the Upside

What are your thoughts on GBPUSD's potential for swing trading? Do you see a breakdown or a bounce? Share your analysis and comments below!

EUR/USD at a Pivotal Level – Will Bulls Push Higher?The EUR/USD pair is showing signs of a trend reversal after breaking above a long-term descending trendline. This breakout, coupled with an inverse head and shoulders pattern and RSI bullish divergence, signals strengthening bullish momentum. However, the price faces key resistance around 1.0500-1.0527, aligned with the 200 EMA.

A confirmed break above this level could push the pair toward 1.10+, while failure to do so may lead to a pullback before another attempt higher.

GBPUSD: Channel Up still intact but keep an eye on the 4H MA200.GBPUSD is bullish on its 1D technical outlook (RSI = 59.951, MACD = 0.008, ADX = 32.444) as the dominant pattern remains a Channel Up and despite the consolidation in recent days, the market remains supported over the 4H MA200. If it crosses over the LH trendline, go long in a similar manner as the Feb 13th break out and aim for the 2.382 Fibonacci extension (TP = 1.3200). If on the other hand the price fails and crosses under the 4H MA200, go short and aim for the S1 level (TP = 1.2555).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

XAUUSD Breakout Trade – Target Hit!In this trade, we identified a downtrend breakout on Gold (XAU/USD) using the 1-hour chart. A descending trendline was broken, signaling a shift in momentum. After price retested a key support zone around $3,023.75, buyers stepped in, confirming the breakout.

A long position was taken with a stop loss below the recent lows, ensuring a safe risk-to-reward ratio. The trade played out beautifully, with strong bullish momentum pushing the price towards our take profit (TP) level at $3,057.37.

This setup highlights the power of trendline breaks and retests, offering high-probability entries for traders. With gold showing strength, we’ll watch for further bullish continuation or potential pullbacks for new opportunities.

📊 Key Takeaways:

✔ Trendline breakout confirmed by retest

✔ Strong bullish momentum

✔ TP hit successfully for solid profits

#Gold #XAUUSD #ForexTrading #BreakoutStrategy #TradingSuccess

GBP/AUD: Consolidation Breakout Signals Bullish ContinuationThe GBP/AUD market remains in a range-bound structure, fluctuating between the 2.0300 support and 2.0600 resistance levels. Recently, price broke and closed above both a downward trendline and the previous two daily highs, reinforcing a bullish bias.

With strong momentum visible on the daily timeframe, the market appears to be setting up for a consolidation expansion pattern. If the price continues to hold above the trendline and support level, a retest of last week’s high is likely, with further bullish movement possible. The next target is the resistance zone around 2.06490

CHF/USD – Rising Wedge Breakdown | Bearish Setup The CHF/USD (Swiss Franc to US Dollar) 15-minute chart is currently displaying a classic Rising Wedge Pattern, which is widely recognized as a bearish reversal pattern. This setup signals weakening bullish momentum and an increased probability of a price breakdown. The chart provides a clear sell trade setup, with key levels including entry, stop loss, and target, making it a structured and well-defined opportunity for traders.

🔹 Key Technical Elements on the Chart

1️⃣ Resistance Level (Sell Zone)

📌 Location: Near 1.1350 – 1.1360

📌 Significance:

This level represents a strong supply zone, meaning sellers have consistently pushed prices down from this area.

Price attempted to break through this zone multiple times but was rejected, reinforcing the bearish outlook.

It serves as the upper boundary of the rising wedge, confirming its role in restricting upward movement.

Traders should be cautious of any false breakouts above this level before confirming a bearish move.

2️⃣ Support Level (Demand Zone)

📌 Location: Near 1.1295 – 1.1305

📌 Significance:

This level has historically acted as a demand zone, where buyers stepped in to push prices back up.

However, the formation of the rising wedge suggests weakening demand at this level.

Once the price breaks below this support zone, it confirms a bearish trend continuation.

3️⃣ Rising Wedge Pattern (Bearish Setup)

📌 Pattern Characteristics:

The rising wedge is a bearish continuation pattern that typically signals an upcoming sell-off.

Price moves inside a narrowing upward-sloping range, where buyers lose strength while sellers gradually gain control.

The lower trendline (dotted black line) has been providing support, but as price struggles near resistance, a breakdown becomes likely.

Once price breaks below the wedge, the pattern confirms a strong bearish move.

📌 Why Is This Important?

This pattern indicates that buyers are losing momentum, and a shift toward bearish control is taking place.

The expected move is a sharp downward breakout, leading to lower price levels.

4️⃣ Trendline Support (Breakdown Confirmation)

📌 Location: The dashed black line below price action

📌 Significance:

This trendline acted as a rising support, keeping price within the wedge.

A clean break below this trendline confirms the bearish breakout.

The breakdown is expected to be followed by increased selling pressure and higher trading volume.

📉 Bearish Trade Setup (Short Position Strategy)

Based on the rising wedge breakdown, traders can consider the following sell trade setup:

✅ Entry Point: Sell below 1.1325 (Confirm breakdown with volume)

✅ Stop Loss: Above 1.1356 (To avoid false breakouts)

✅ Target 1: 1.1295 (First support level)

✅ Target 2: 1.1275 (Deeper downside potential if momentum continues)

🛠 Trade Rationale (Why Take This Trade?)

🔸 Bearish Price Action → Price is rejecting resistance and forming a lower high, signaling weakness in the uptrend.

🔸 Pattern Confirmation → The rising wedge has a high probability of breaking downward, leading to a sharp decline.

🔸 Risk-Reward Ratio → The setup provides a favorable risk-to-reward ratio, as traders can manage risk efficiently by placing a stop loss above resistance.

🔸 Volume Analysis → If selling volume increases upon breakout, the move becomes more reliable.

📊 Market Outlook & Final Thoughts

🔹 Bearish Scenario:

If price breaks below 1.1325, expect a strong decline toward 1.1295 and potentially lower.

A sharp move downward could accelerate selling pressure, targeting 1.1275 in an extended move.

🔹 Bullish Reversal Risk:

If price closes back above 1.1356, the bearish setup is invalidated.

Traders should exit shorts if price reclaims the resistance level.

🚨 Final Verdict: Bearish Breakdown Expected!

📉 Short Setup Activated – Targeting 1.1295 🚀

📊 Watch for Volume Confirmation Before Entering!

JPY/USD Descending Triangle Breakdown – Bearish Trading Setup📌 Overview: Understanding the Current Market Structure

This analysis focuses on the JPY/USD pair on the 1-hour timeframe, highlighting a well-defined descending triangle pattern, a classic bearish continuation setup. The price action indicates selling pressure increasing as lower highs form, while support remained relatively stable before ultimately breaking down.

This setup suggests a potential trend continuation to the downside, making it a compelling trade opportunity for short-sellers. Let's dive deeper into the technical breakdown, trading strategy, and market expectations.

📊 Technical Breakdown: Chart Pattern Analysis

1️⃣ The Descending Triangle Pattern: A Bearish Signal

The descending triangle is one of the most reliable continuation patterns in technical analysis, often leading to a breakdown when support is breached. This chart confirms the pattern through:

✅ Downward Sloping Resistance Line:

The price tested this level multiple times but was consistently rejected.

Lower highs indicate sellers are dominating and buyers are failing to push higher.

✅ Flat Support Level:

The price found strong support at a key horizontal level, bouncing off multiple times.

However, each bounce became weaker, signaling buyers losing strength.

✅ Breakout & Confirmation:

The final breakdown below support occurred with strong momentum.

The price has now turned previous support into resistance, a bearish confirmation.

🔎 Implication:

A descending triangle breakout to the downside often results in an extended downward move, aiming for the measured move target based on the triangle’s height.

2️⃣ Key Price Levels & Trading Zones

📌 🔴 Resistance Zone (Upper Triangle Boundary):

0.006700 – 0.006750

This level acted as a strong rejection zone, confirming lower highs.

It now serves as a resistance level after the breakdown.

📌 🟢 Support Level (Triangle Base):

This level previously held price from breaking lower multiple times.

However, with each bounce becoming weaker, it finally gave way.

Break & Close below this level confirms the bearish continuation.

📌 🎯 Target Projection (Based on Triangle Breakout):

0.006448 (Final Target) – This level aligns with historical price action and the triangle’s projected move.

📌 🚨 Stop Loss Placement:

Above the last swing high (~0.006752)

If price reclaims this zone, the bearish outlook becomes invalid.

📈 Price Action & Market Sentiment

3️⃣ Bearish Momentum & Breakdown Confirmation

✅ Lower Highs Indicate Weakness:

Buyers attempted multiple recoveries but were consistently rejected at lower levels.

This pattern suggests exhaustion in buying pressure.

✅ Breakout Candle Strength & Volume Confirmation:

The price broke support with strong momentum and increased volume, confirming sellers’ control.

A breakdown without volume is often a fakeout, but this chart shows clear momentum.

✅ Potential Retest Before Further Drop:

After a breakdown, price often retests the broken support before continuing lower.

A pullback to the resistance zone (~0.006650 - 0.006700) could offer an ideal short entry.

✅ Bearish Trend Confirmation:

The price remains below key resistance and continues forming lower lows.

The downtrend structure remains intact, reinforcing the bearish sentiment.

📉 Trading Strategy: How to Trade This Setup?

🔹 Entry Strategy:

Ideal Entry: Short after a pullback to broken support (~0.006650 - 0.006700).

Aggressive Entry: Short immediately on the breakdown if momentum remains strong.

🔹 Stop Loss Placement:

Place above last swing high (0.006752) to avoid being stopped out by noise.

Ensures protection against sudden bullish reversals or fakeouts.

🔹 Take Profit Targets:

✅ First Target: 0.006500 (Psychological level)

✅ Final Target: 0.006448 (Triangle measured move)

🔹 Risk Management:

Use a Risk-to-Reward ratio (RRR) of at least 1:2 for an optimal trade setup.

Never risk more than 2% of total capital per trade.

⚠️ Market Outlook & Key Watchpoints

📌 Scenario 1: Bearish Continuation (High Probability)

If price retests the broken support and faces rejection, expect further downside.

Target remains at 0.006448.

📌 Scenario 2: Fake Breakdown & Bullish Reversal (Low Probability)

If price closes above 0.006750, it invalidates the bearish setup.

In that case, a bullish move towards 0.006800+ is possible.

📢 Final Thoughts:

The bearish breakout is clear, but waiting for a proper pullback before entry is ideal.

Volume confirmation is crucial to avoid fakeouts.

If support turns into resistance, a high-probability short trade is set up.

🔹 What’s your take on this setup? Will JPY/USD reach its target? Drop your thoughts below! 🚀

#JPYUSD #ForexTrading #TechnicalAnalysis #PriceAction

EURUSD

Hello Traders! 👋

What are your thoughts on EURUSD?

The EURUSD entered a corrective phase after hitting the anticipated resistance zone and was rejected from this area, as previously analyzed. The price is now approaching a key support level. At this support level, there is a possibility of a new bullish move starting, which could lead to a breakout above the previous resistance and push the price toward the next identified target.

Will EURUSD hold the support and push higher, or is there more downside ahead? Let us know your thoughts!

Don’t forget to like and share your thoughts in the comments! ❤️

Is There the Best Time to Trade Forex in the UK?Is There the Best Time to Trade Forex in the UK?

Grasping the nuances of forex market hours is essential for traders aiming to optimise their strategies. Operating continuously from Sunday evening to Friday night, the currency market accommodates participants across various time zones without being anchored to a singular physical location.

For those in the UK, recognising when to engage can dramatically influence outcomes. This FXOpen article discusses the pivotal currency trading sessions that may be optimal for UK-based traders.

Understanding Forex Market Hours

Understanding currency exchange market hours is crucial for anyone involved in the global foreign exchange market. Although you may already know this, let us remind you.

The forex market operates on a 24/5 basis, opening during weekdays and closing at weekends. This round-the-clock trading is possible because it’s not tied to a physical location; instead, it relies on a decentralised network of banks, businesses, and individuals exchanging currencies across different time zones.

For traders in the UK, knowing the best forex trading hours can be key to effective trading. The currency market is broadly divided into four main 9-hour-long windows, each starting at different times to cater to traders across the globe. The forex session times UK traders need to be aware of are:

- Sydney Session: 9:00 PM GMT - 6:00 AM GMT

- Tokyo Session: 11:00 PM GMT - 8:00 AM GMT

- London Session: 8:00 AM GMT - 5:00 PM GMT

- New York Session: 1:00 PM GMT - 10:00 PM GMT

Note that during British Summer Time (BST), some of these times are shifted forward by one hour.

These forex market trading times are essential to know, as they indicate when liquidity and volatility are likely to increase, potentially offering favourable market conditions.

The Optimal Times to Trade Forex in the UK

In navigating currency trading, UK-based traders should be aware of two key sessions: London and New York. These periods are optimal forex market hours in the UK, offering greater volumes, volatility, and liquidity. They’re also the periods that see the most releases for three of the major economies: the UK, Eurozone, and the US.

The core forex trading times in the UK are anchored around the London session, which is central to global forex market operations due to London's key position in the financial world. The London trading session time in the UK commences at 8:00 AM GMT (winter time).

This period, ending at 5:00 PM GMT (winter time), is pivotal as it accounts for roughly half of the forex transactions globally, making it a prime trading time due to the high liquidity and the potential for more pronounced price movements.

Likewise, the London-New York trading session time in the UK can be especially advantageous. It’s a crucial overlapping window occurring from 1:00 PM to 5:00 PM GMT (winter time), offering an avenue for traders seeking to maximise their potential returns due to the surge in activity and high-profile economic releases from the US.

During this window, the US stock market opens at 2:30 PM GMT. This secondary opening can also have a notable effect on US dollar-based pairs.

Economic Releases and the Impact on Trading Times for UK Traders

Economic releases and central bank announcements significantly influence UK forex trading times, often driving prices higher or lower. Many UK economic releases—affecting GBP currency pairs—are scheduled around 7:00 AM GMT. This timing offers traders opportunities to engage in trends post-release during the early hours of the London open.

However, some UK data and plenty of Eurozone data are released between 8:00 AM GMT and 10:00 AM GMT, periods typically characterised by increased liquidity and volatility, providing fertile ground for traders.

Likewise, many high-profile US economic announcements—non-farm payrolls, inflation statistics and employment data— are made between 1:00 PM GMT and 3:00 PM GMT. Given the US dollar's dominance on the world stage, these releases can present significant trading opportunities.

Although activity tends to quiet down after London closes, the late hours of the New York session still offer potential entries, albeit with generally lower volatility and volume.

Notably, Federal Reserve interest rate decisions are announced at 7:00 PM GMT with a press conference held after that can cause outsized price movements. The same can be said for the Bank of England and European Central Bank’s interest rate decisions at 12:00 PM GMT and 1:15 PM GMT, respectively, and their subsequent press conferences.

The Worst Time to Trade Forex in the UK

The worst times to trade forex in the UK often occur after 8:00 PM GMT, during the tail end of New York’s hours, when liquidity and volume significantly decrease. This reduction in activity can lead to less favourable trading conditions, including wider spreads and slower execution times.

Additionally, while the Asian session forex time in the UK, partially overlapping with the Sydney session, runs from 11:00 PM to 8:00 AM GMT, it presents challenges for UK traders.

Despite offering trading opportunities, especially in Japanese yen, Australian dollar, and New Zealand dollar-based pairs, the volumes during this period are substantially lower compared to the London and New York sessions. The Tokyo session forex time in the UK accounts for particularly unsociable hours anyway, so many UK traders are unlikely to engage in currency trading during this period.

Trading the London Session: A Strategy

The Asian-London Breakout Strategy leverages the unique dynamics between the calmer Asian session and the volatile London session. It involves setting buy/sell stop orders at the high and low points of the Asian period’s range, aiming to capture movements as London opens at 8:00 AM GMT.

With stop-loss orders placed above or below the range and a strategic approach to take profit – either at the end of the London session or by trailing a stop loss during the day – traders can potentially capitalise on the surge in activity. To delve deeper into this strategy and other session-based setups, consider exploring FXOpen’s 3-session trading system article.

The Bottom Line

Understanding forex trading hours and leveraging optimal times are pivotal for achieving favourable outcomes in currency trading. Luckily, UK-based traders are well placed to take advantage of the many opportunities the currency market presents, given their ability to trade both the London and New York sessions.

For UK traders seeking to navigate the complexities of markets with a trusted broker, opening an FXOpen account can provide all of the tools and insights necessary for effective trading.

FAQs

When Do the Forex Markets Open in the UK?

Forex opening times in the UK start at 8:00 AM GMT (winter time) and at 7:00 AM GMT (summer time) when the London session begins, marking the start of significant trading activity due to London's central role in the global currency arena.

What Time Does the Forex Market Open on Sunday in the UK?

The forex market opens on Sunday at 9:00 PM GMT (winter time) and at 10:00 PM GMT (summer time) in the UK, coinciding with Sydney’s opening and marking the beginning of the trading week.

What Time Does the Forex Market Close on Friday in the UK?

The forex market closes at 10:00 PM GMT (winter time) and at 9:00 PM GMT (summer time) on Friday in the UK, concluding with the end of the New York session and wrapping up the trading week.

Can You Trade Forex on Weekends?

Currency trading on weekends is not possible as the market is closed. Trading resumes with the opening of the Sydney session on Sunday at 9:00 PM GMT (winter time) and at 10:00 PM GMT (summer time).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

CAD/JPY: Bullish Structure Holds with Breakout PotentialThe CAD/JPY market continues to show bullish strength, forming a clear sequence of higher highs and higher lows. On the daily timeframe, an inside bar pattern has emerged, indicating a period of consolidation that may lead to a bullish continuation, especially with the candle closing above the 105.000 level.

At the moment, the price is testing Monday’s high, and a breakout above this point could trigger further upside. The market may form a range around the current level before continuing its move higher from the previous week’s high and the upward trendline. The next target is the resistance zone around 106.300

What Is a Liquidity Sweep and How Can You Use It in Trading?What Is a Liquidity Sweep and How Can You Use It in Trading?

Mastering key concepts such as liquidity is crucial for optimising trading strategies. This article explores the concept of a liquidity sweep, a pivotal phenomenon within trading that involves large-scale players impacting price movements by triggering clustered pending orders, and how traders can leverage them for deeper trading insights.

Understanding Liquidity in Trading

In trading, liquidity refers to the ability to buy or sell assets quickly without causing significant price changes. This concept is essential as it determines the ease with which transactions can be completed. High liquidity means that there are sufficient buyers and sellers at any given time, which results in tighter spreads between the bid and ask prices and more efficient trading.

Liquidity is often visualised as the market's bloodstream, vital for its smooth and efficient operation. Financial assets rely on this seamless flow to ensure that trades can be executed rapidly and at particular prices. Various participants, including retail investors, institutions, and market makers, contribute to this ecosystem by providing the necessary volume of trades.

Liquidity is also dynamic and influenced by factors such as notable news and economic events, which can all affect how quickly assets can be bought or sold. For traders, understanding liquidity is crucial because it affects trading strategies, particularly in terms of entry and exit points in the markets.

What Is a Liquidity Sweep?

A liquidity sweep in trading is a phenomenon within the Smart Money Concept (SMC) framework that occurs when significant market players execute large-volume trades to trigger the activation of a cluster of pending buy or sell orders at certain price levels, enabling them to enter a large position with minimal slippage. This action typically results in rapid price movements and targets what are known as liquidity zones.

Understanding Liquidity Zones

Liquidity zones are specific areas on a trading chart where there is a high concentration of orders, including stop losses and pending orders. These zones are pivotal because they represent the levels at which substantial buying or selling interest is anticipated once activated. When the price reaches these zones, the accumulated orders are executed, which can cause sudden and sharp price movements.

How Liquidity Sweeps Function

The process begins when market participants, especially institutional traders or large-scale speculators, identify these zones. By pushing the market to these levels, they trigger other orders clustered in the zone. The activation of these orders adds to the initial momentum, often causing the price to move even more sharply in the intended direction. This strategy can be utilised to enter a position favourably or to exit one by pushing the price to a level where a reversal is likely.

Liquidity Sweep vs Liquidity Grab

Within the liquidity sweep process, it's crucial to distinguish between a sweep and a grab:

- Liquidity Sweep: This is typically a broader movement where the price action moves through a liquidity zone, activating a large volume of orders and thereby affecting a significant range of prices.

- Liquidity Grab: Often a more targeted and shorter-duration manoeuvre, this involves the price quickly hitting a specific level to trigger orders before reversing direction. This is typically used to 'grab' liquidity by activating stops or pending positions before the price continues to move in the same direction.

In short, a grab may just move slightly beyond a peak or low before reversing, while a sweep can see a sustained movement beyond these points prior to a reversal. There is a subtle difference, but the outcome—a reversal—is usually the same.

Spotting a Liquidity Sweep in the Market

Identifying a sweep involves recognising where liquidity builds up and monitoring how the price interacts with these zones. It typically accumulates at key levels where traders have placed significant numbers of stop-loss orders or pending buy and sell positions.

These areas include:

- Swing Highs and Swing Lows: These are peaks and troughs in the market where traders expect resistance or support, leading to the accumulation of orders.

- Support and Resistance Levels: Historical areas that have repeatedly influenced price movements are watched closely for potential liquidity buildup.

- Fibonacci Levels: Common tools in technical analysis; these levels often see a concentration of orders due to their popularity among traders.

The strategy for spotting a sweep involves observing when the price approaches and breaks through these levels. Traders look for a decisive move that extends beyond the identified zones and watch how the asset behaves as it enters adjacent points of interest, such as order blocks. The key is to monitor for a subsequent reversal or deceleration in price movement, which can signal that the sweep has occurred and the market is absorbing the liquidity.

This approach helps traders discern whether a significant movement is likely a result of a sweep, allowing them to make more informed decisions about entering or exiting positions based on the anticipated reversal or continuation of the price movement.

How to Use Liquidity Sweeps in Trading

Traders often leverage liquidity sweeps in forex as strategic indicators within a broader Smart Money Concept framework, particularly in conjunction with order blocks and fair value gaps. Understanding how these elements interact provides traders with a robust method for anticipating and reacting to potential price movements.

Understanding Order Blocks and Fair Value Gaps

Order blocks are essentially levels or areas where historical buying or selling was significant enough to impact an asset’s direction. These blocks can act as future points of interest where the price might react due to leftover or renewed interest from market participants.

Fair value gaps are areas on a chart that were quickly overlooked in previous movements. These gaps often attract price back to them, as the market seeks to 'fill' these areas by finding the fair value that was previously skipped.

Practical Application in Trading Strategies

Learn how liquidity sweeps can be applied to trading strategies.

Identifying the Trend Direction

The application of liquidity sweeps starts with understanding the current trend, which can be discerned through the market structure—the series of highs and lows that dictate the direction of the market movement.

Locating Liquidity Zones

Within the identified trend, traders pinpoint liquidity zones, which could be significant recent swing highs or lows or areas marked by repeated equal highs/lows or strong support/resistance levels.

Observing Order Blocks and Fair Value Gaps

After identifying a liquidity zone, traders then look for an order block beyond this zone. The presence of a fair value gap near the block enhances the likelihood of the block being reached, as these gaps are frequently filled.

Trade Execution

When the price moves into the order block, effectively sweeping liquidity, traders may place limit orders at the block with a stop loss just beyond it. This action is often based on the expectation that the order block will trigger a reversal.

Utilising Liquidity Sweeps for Entry Confidence

The occurrence of a sweep into an order block not only triggers the potential reversal but also provides traders with greater confidence in their position. This confidence stems from the understanding that the market's momentum needed to reach and react at the block has been supported by the liquidity sweep.

By combining these elements—trend analysis, liquidity zone identification, and strategic use of order blocks and fair-value gaps—traders can create a cohesive strategy that utilises sweeps to enhance decision-making and potentially improve trading results.

The Bottom Line

Understanding liquidity sweeps offers traders a critical lens through which to view market dynamics, revealing deeper insights into potential price movements. For those looking to apply these insights practically, opening an FXOpen account could be a valuable step towards engaging with the markets more effectively and leveraging professional-grade tools to navigate liquidity phenomena.

FAQs

What Is a Liquidity Sweep?

A liquidity sweep occurs when large market participants activate significant orders within liquidity zones, causing rapid price movements. It's a strategic manoeuvre to capitalise on accumulated buy or sell orders at specific price levels.

What Is a Sweep Trade?

A sweep trade is a large order executed through multiple different areas on a chart and venues to optimise execution. This is common in both equities and derivatives trading to minimise market impact.

How to Spot a Liquidity Sweep?

Liquidity sweeps can be identified by sudden, sharp movements towards areas dense with orders, such as previous swing highs or lows or known support and resistance levels, followed often by a rapid reversal.

What Is the Difference Between a Liquidity Sweep and a Liquidity Grab?

A liquidity sweep is a broader market move activating a large volume of orders across a range of prices. In contrast, a grab is a quick, targeted action to hit specific order levels before the price reverses direction.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EURUSD: Channel Down on 1H targeting 1.07640EURUSD is neutral on its 1H technical outlook (RSI = 48.104, MACD = 0.000, ADX = 18.254) as it is at the top of the 5 day Channel Down and around the 1H MA50. This is the new bearish wave. Short and aim for a -0.62% decline (TP = 1.07640).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBP/JPY: Bullish Momentum Builds Near Key ResistanceThe GBP/JPY market is currently developing an ABC pattern, with point C forming near the 196.000 level. Recently, the price broke above both a downward trendline and the 194.000 support, signaling a potential shift in momentum.

At present, the pair is testing last week’s high, which aligns with the 195.000 psychological level. A strong bullish candle has emerged on the daily chart, indicating growing bullish pressure. The market may enter a consolidation phase around this level before attempting a breakout above the previous week’s high. The next target is the resistance zone at 195.750

GBPNZD: Fractured Ascent Signals Potential ReversalGBPNZD 4-hour chart reveals a compelling narrative of a weakening bullish trend potentially poised for a significant reversal. The pair's recent price action exhibits characteristics of a rising wedge pattern, a formation often indicative of an impending downside breakout.

Key Technical Observations:

Rising Wedge Formation: The converging trendlines point to a potential exhaustion of the upward momentum. The upper trendline has seen repeated rejections, suggesting a lack of sustained buying pressure.

Critical Support Level: The 2.25359 level is acting as a crucial support zone. A decisive break below this level would confirm the wedge breakdown and likely trigger a sharp bearish move.

Resistance Zone: The area around 2.27505 represents a significant resistance zone. Failure to break above this level reinforces the bearish outlook.

Potential Downside Targets: The chart indicates potential targets at 2.22934 and the low of 2.16774. These levels could act as significant support zones during a potential downtrend.

Trading Implications:

Short Entry Consideration: Traders should closely monitor the price action for a decisive break below the 2.25359 support. A confirmed breakdown could signal a strong short entry opportunity.

Stop-Loss Placement: A prudent stop-loss should be positioned above the recent swing high or the upper trendline of the wedge to mitigate risk.

Risk Management: Given the potential for increased volatility during a breakout, sound risk management is paramount.

Considerations:

Confirmation of Breakdown: A break below the 2.25359 support should be accompanied by strong bearish momentum and ideally, an increase in trading volume to validate the signal.

Fundamental Factors: Upcoming economic data releases from both the UK and New Zealand should be closely monitored, as they could significantly impact the pair's price action.

Conclusion:

The GBPNZD chart presents a compelling case for a potential bearish reversal. The rising wedge pattern, coupled with the critical support at 2.25359, suggests a high probability of a downside breakout. Traders should exercise caution and await confirmation of the breakdown before initiating short positions. Effective risk management is crucial to navigate the potential volatility associated with this trade setup.

Tue 25th Mar 2025 USD/SGD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a USD/SGD Buy. Enjoy the day all. Cheers. Jim

EUR/USD: Sideways Movement Persists Below Key LevelThe EUR/USD market remains in a consolidation phase just below the November 2024 low. Recently, the price experienced false breakouts beneath both a key support level and last week's low, followed by a strong bullish rebound. This pattern suggests a likelihood of continued sideways movement in the near term.

At present, the price is testing the previous day’s high. If upcoming news does not negatively affect sentiment, the market may attempt a move higher, especially after multiple failed breakdowns of support. However, until a decisive break occurs beyond last week’s range, price action is expected to remain range-bound. The next target lies at the resistance zone around 1.08820