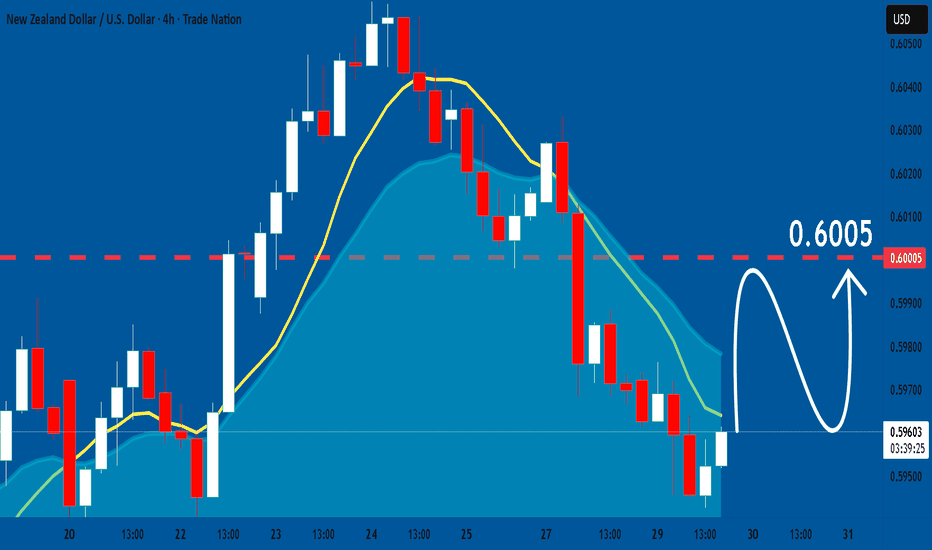

NZDUSD: Market Sentiment & Price Action

Looking at the chart of NZDUSD right now we are seeing some interesting price action on the lower timeframes. Thus a local move up seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Forx

AUD/USD ShortThe Australian dollar depreciated past $0.722 on Friday amid a wider risk-off sentiment, while traders braced for a more aggressive tightening by the Federal Reserve. The US central bank is set to meet on Jan. 25-26, and although it is not expected to move rates, an increasing number of Fed officials indicated readiness for a faster path towards policy normalization. The aussie reversed course from the previous session when it hit a high of $0.7276 on stronger-than-expected employment numbers, which raised expectations of an early hike on the official cash rate. Meanwhile, the Reserve Bank of Australia has repeatedly insisted that a hike in domestic rates is not likely until 2023, or until inflation pushes sustainably within its 2-3% target range. The RBA also lagged behind other major central banks in dialing back pandemic-era stimulus, but is set to decide whether to end its bond-buying early this year at its Feb. 1 meeting.

XAUUSD BIAS: SELL; CHART: H1

Hello traders, I'm here again! What's happening in the world of GOLD now? Currently, the market is down, and the USD is stronger. I hope you see how I mapped out the chart and marked the higher-highs and higher-lows. Now, a change of structure has occurred. Lower-lower has been formed while Lower-higher is yet to be formed, which willreverse after the price retracted back to the resistance level, as drawn by a blue line in the chart above.

Entry: 1984.00

Take Profit: the extreme low or 1944.79

Stop loss: 199p. 87

Watchlist Midweek Review: Feb 06-10,23Hey there, so this has turned out to be a very interesting week, in that price has really begun to move and the overall market structure is definitely begun to take shape. That being said, the pairs that we will be focusing on for the remainder of the week does offer some significant opportunities and if you would like to know more about how these pairs could set you up for this week, then take a watch, and enjoy.

Also, if you have any questions regarding any of the pairs on the watchlist, or any pair in general. Feel free to reach out and I will be happy to share my views, thoughts and opinions. For the most part, I wish you an awesome, and profitable day further.

Until next time, keep well and bye for now.

Analysis USDCAD : 📅 1/23/2023Analysis USDCAD :

With the formation of a side way and weakness in the downward trend, we can expect to move towards the specified goals.

.

.

price: 1.33800

sl: 1.33150

tp1: 1.34330

tp2: 1.34940

tp3: 1.35700

tp4: 1.36340

.

.

👤 Alireza hajighasem : @alirezahajighasem

.

.

📅 1/23/2023

GBPUSD H1: Bullish outlook seen, further upside above 1.2000On the H1 time frame, prices are showing bullish order flow and a throwback to the support zone at 1.2000, in line with the Fibonacci confluence levels could present an opportunity to play the bounce to the resistance zone at 1.2080. This resistance zone coincides with the 78.6% Fibonacci extension. Prices are holding above the Ichimoku cloud as well, supporting the bullish bias.

Analysis DXY : 📅 09.30.2022DXY analysis:

Considering the lack of ability to climb and the weakness, it is expected to continue the upward trend in the one-hour time frame.

And the formation of a new downward trend at this time expected a downward movement to the specified targets.

If the range of 114,000 is broken, we can expect the price to rise again.

.

.

Descending targets:

110,300

108.450

.

.

👤 Alireza hajighasem : @alirezahajighasem

.

.

📅 09.30.2022

USDCHF H4 Potential Bounce | 5th July 2022On the H4, with price moving above the ichimoku cloud, we have a bullish bias that price will rise from our 1st support at 0.96375 where the horizontal pullback support is to our 1st resistance at 0.97334 in line with the horizontal swing high resistance and 3.2 Fibonacci retracement. Alternatively, price may break 1st support and head for 2nd support at 0.95817 where the horizontal pullback support.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.