EURUSD Bearish Market Structure Unfolding – Liquidity Grab BelowEURUSD Bearish Market Structure Unfolding – Liquidity Grab Below Support Expected"

🔍 Technical Analysis Breakdown:

🔺 Resistance Zone (1.17500 - 1.18500)

Labelled “Strong High”, this is a high-supply zone where price previously reversed.

Multiple Break of Structure (BOS) and Change of Character (CHoCH) confirm this as a strong bearish supply area.

Any retracement toward this level could be ideal for short entries.

🟩 Fair Value Gap (FVG)

This imbalance area previously served as a magnet for price before it broke down.

Price failed to hold inside the FVG, reinforcing bearish sentiment.

🔻 Support Zone (1.13500 - 1.14000)

Marked as a "Weak Low", suggesting this level is likely to be taken out in a liquidity sweep.

Price is expected to retest and potentially break below this zone in the near term.

📉 Current Price Action

Recent CHoCH (Bearish) confirms shift in structure.

Price has made a corrective pullback and seems poised for another leg down.

Highlighted grey zone suggests price may retrace slightly higher before continuing its bearish move.

🎯 Bias: Bearish

Expecting downside continuation toward 1.13500 support, targeting liquidity below.

Traders may wait for rejection signals on lower timeframes around the minor pullback zone before executing shorts.

📚 Educational Notes:

CHoCH indicates a shift in market sentiment (from bullish to bearish).

FVG often acts as a magnet but if not respected, confirms momentum in the opposite direction.

Support/Resistance zones are used to determine institutional activity zones.

Foryourpage

"BTCUSD Technical Outlook: Support Holds, Bulls Aim for $117K""BTCUSD Technical Outlook: Support Holds, Bulls Aim for $117K"

Market Structure Overview

BOS (Break of Structure): Multiple BOS points indicate strong shifts in market direction, confirming both bullish and bearish trends across different zones.

Bearish Fair Value Gap (FVG): This zone, marked after a BOS on July 23–24, acted as a rejection area, initiating a sharp sell-off — a classic bearish imbalance fill and reversal.

Equal Lows & Sell-side Liquidity: This area attracted liquidity grabs, as smart money hunts resting stop losses below these equal lows before reversing direction.

🔸 Key Supply & Demand Zones

Previous Resistance Zone (~118,000 - 120,000): Price rejected this area after filling the imbalance, confirming it as a strong supply zone.

Support Zone (~112,000 - 113,000): Currently acting as a high-probability demand zone. Liquidity accumulation here suggests a possible bullish reversal.

📉 Liquidity Zones

Sell-side Liquidity Sweep: Price dipped below equal lows to collect liquidity, often a signal of institutional accumulation.

Liquidity/Fair Value Zone (~116,000): Acts as a magnet for price, offering potential retracement targets before any major trend continuation.

📈 Forecast & Target

Current Price: $114,061

Short-term Target: $117,546 — aligning with previous FVG imbalance and liquidity zone.

Bias: Bullish Reversal expected from support zone toward the previous inefficiency and resistance levels.

🎓 Educational Takeaways

BOS Confirmation is critical in validating trend shifts and structure breaks.

FVGs (Fair Value Gaps) highlight inefficiencies and offer high-probability reversal or continuation zones.

Liquidity Sweeps near equal lows/highs often precede smart money moves — useful for spotting entries and exits.

Volume Profile (left side) suggests higher activity zones — these areas often align with major turning points.

✅ Conclusion

BTCUSD has swept liquidity below support and is showing signs of reversal. If the bullish pressure holds above $113,000, a move toward the $117,500 zone is likely, targeting previously unfilled imbalance and trapped liquidity.

"Gold on Fire! Smart Money Bulls Aiming for Final Target🟡 "Gold on Fire! Smart Money Bulls Aiming for Final Target

Overview:

The XAUUSD chart presents a clear smart money structure, showing a bullish recovery from a strong demand zone and a current move toward a significant supply (resistance) area.

🔍 Key Technical Highlights:

Strong Support Zone

The price reacted powerfully from the well-marked strong support zone (~3,260), aligned with a previous Bullish Fair Value Gap (FVG) and BOS (Break of Structure), confirming bullish intent.

Bullish Market Structure

A clean CHoCH (Change of Character) confirmed the end of the previous bearish leg.

Multiple BOS followed, solidifying the bullish shift in momentum.

Liquidity Grab & Price Expansion

Price swept equal lows (EQL) and mitigated bullish FVG, collecting sell-side liquidity before reversing.

The breakout pushed toward the current level of ~3,380, targeting the Buy-Side Liquidity zone and resistance.

Resistance & Fair Value Gap

The final target is aligned at 3,427.83, situated inside a high-probability bearish FVG and resistance zone.

This area previously rejected price (noted with the red circle), making it a critical supply zone.

Partial Target Hit

Price has already achieved half of the projected move, indicating bullish strength and proper SMC execution.

The current consolidation near the mid-level suggests accumulation or re-accumulation before a final push toward the target.

📈 Educational Notes:

Fair Value Gaps (FVG) highlight inefficiencies in price delivery. These zones often act as magnets for price and reversal points, as seen here.

Break of Structure (BOS) and Change of Character (CHoCH) are crucial for identifying trend shifts. This chart reflects a textbook bullish transition.

Liquidity concepts (EQL, Buy-Side) emphasize institutional behavior. Price often hunts liquidity before moving to new highs or lows.

✅ Conclusion:

XAUUSD is playing out a well-structured bullish smart money setup, with price currently in mid-path toward the final target. Traders should monitor reactions at the 3,427 resistance zone, which will be critical for potential reversal or continuation scenarios.

Technical Breakdown (Smart Money Concepts-Based)📊 Technical Breakdown (Smart Money Concepts-Based):

🔹 Market Structure:

Multiple Break of Structure (BOS) signals show a bullish shift in momentum, especially after the recent CHoCH followed by BOS at the current price zone.

Strong bullish confirmation after reclaiming previous liquidity zones, indicating institutional interest.

🔹 Liquidity and Zones:

Buy-Side Liquidity above $3,420 is likely the short-term institutional target.

Price has clearly reacted from a strong support block near the $3,260–$3,280 area, confirming demand and institutional accumulation.

The highlighted Bullish FVG (Fair Value Gap) aligns with a mid-level retracement zone—ideal for potential pullbacks before continuation.

🔹 Key Supply & Demand:

Resistance Zone (3,420–3,450): Contains weak highs and unmitigated FVG—prime liquidity zone for a sweep.

Strong Demand Zone: Around $3,260 has shown repeated reaction; the base of bullish moves.

Imbalance Fill & Rejection Expected in FVG near $3,420.

🔮 Projection & Scenario:

Expected pullback toward $3,340–$3,350, followed by bullish continuation.

Targeting liquidity sweep at $3,420, aligned with Smart Money accumulation and distribution logic.

Monitor for reaction at $3,420 for either a rejection or a clean breakout, confirming further upside.

✅ Conclusion:

This setup suggests institutional buy-side pressure with targets on resting liquidity around $3,420. Smart Money is likely driving price toward that level to grab orders before the next big move.

BTCUSD Technical Analysis – Smart Money Concept Based

🔍 BTCUSD Technical Analysis – Smart Money Concept Based

🕒 Timeframe: Intraday (likely 1H or 4H)

📅 Date: August 5, 2025

📉 Price: ~114,445 USD

📌 Key Zones and Observations

🔴 Previous Resistance (117,000–119,000)

This area has a strong high formed after multiple equal highs (EQH), indicating a liquidity pool above.

Price sharply rejected this zone, validating it as a significant supply zone.

🔵 Support Zone & Liquidity Pool (~112,600–113,200)

This is a high-volume node (visible on VRVP) where price consolidated previously.

Market structure suggests liquidity resting below, as indicated by the marked “Target” area at 112,648.

Smart Money may aim to sweep liquidity below this support zone before any meaningful reversal.

🟤 Order Block & Rejection at 115,210–116,065

Price tapped into a bearish order block, creating a minor change of character (ChoCH) and then started to decline.

Rejection from this zone signals distribution by institutions or Smart Money, leading toward bearish continuation.

🟢 Value Gap and Imbalance (Above 115,000)

A visible value gap still remains unfilled; however, current momentum is bearish, and price failed to reclaim it, hinting downside continuation.

🔄 Market Structure

BOS (Break of Structure) to the upside confirmed short-term bullish momentum.

CHoCH back to the downside near current price reflects bearish shift in order flow.

Price is respecting lower highs, and failing to break above 115,210 confirms a bearish bias.

🎯 Target and Outlook

Primary Bearish Target: 112,648 USD

This is a liquidity pool and previous support area where institutions may look to rebalance and accumulate.

Scenario:

If price retests 115,000–115,210 again and fails, expect strong continuation downward toward the 112,648 target.

If price breaks and holds above 116,065, bullish invalidation may occur, and we can look for higher retracement toward 117,000–119,000.

✅ Conclusion

BTCUSD is currently respecting a bearish order block, with Smart Money likely targeting liquidity resting below at 112,648 USD. Unless price breaks above 116,065 with strong volume, the bias remains bearish short-term.

AUD/USD) Bearish Trend Read The captionSMC Trading point update

Technical analysis of AUD/USD (Australian Dollar / U.S. Dollar) on the 4-hour timeframe, with a likely setup for further downside. Here's a breakdown of the idea:

---

Technical Summary

Pair: AUD/USD

Timeframe: 4H

Current Price: 0.64688

EMA 200: 0.65140 (price is below = bearish bias)

RSI (14): 48.23 (neutral to slightly bearish)

--

Key Observations

1. Break of Trendline:

The previous ascending trendline (black) was broken to the downside.

This indicates a shift in market structure from bullish to bearish.

2. Resistance Rejection Zone:

Price recently retested a strong supply/resistance zone (yellow box near 0.65140) and was rejected.

This aligns with the 200 EMA → strong confluence for a sell setup.

3. Market Structure:

Price is forming lower highs, indicating sellers are gaining control.

The chart shows a projection of a bearish continuation pattern (zig-zag decline).

4. Target Zone:

Final target marked near 0.63700–0.63699, a previous support level.

This gives the setup a decent risk-reward ratio if the rejection holds.

5. RSI:

RSI is below 50, suggesting bearish momentum, but not oversold—still room to move down.

Mr SMC Trading point

---

Conclusion & Trade Idea

Bias: Bearish

Sell Zone: Near the resistance area (0.65000–0.65150)

Target: 0.63700 zone

Stop Loss: Likely above 0.65200 (above resistance and EMA 200)

Confirmation: Price action forming lower highs and staying below EMA 200

Please support boost 🚀 this analysis)

XAU/USD) Bearish Trend Read The captionSMC Trading point update

Technical analysis of Gold (XAU/USD) on the 1-hour timeframe, suggesting a potential short-term sell setup targeting a key support zone.

---

Analysis Summary

Asset: XAU/USD (Gold Spot)

Timeframe: 1H

Current Price: 3,371.56

Bias: Bearish pullback toward lower support

---

Key Technical Insights

1. FVG (Fair Value Gap):

Price tapped into a premium supply zone / FVG (highlighted in yellow at the top), showing rejection.

This zone likely acted as a liquidity grab, triggering potential reversal.

2. Structure Shift (SS):

Minor bullish market structure appears to be breaking down, signaling a shift in momentum.

3. Target Point:

Price is expected to revisit the support zone at 3,330.77, where prior accumulation and a bullish order block exist.

This also aligns with the 200 EMA around 3,340.48, adding confluence.

4. RSI (14):

RSI is currently at 54.86, indicating neutral momentum with room for downside.

---

Target Point

Target Zone: 3,330.77 (Key support and potential long re-entry area)

---

Trade Idea

Direction Entry Zone Stop-Loss Target

Sell 3,370–3,375 Above 3,390 3,330

Mr SMC Trading point

---

Summary

Gold is showing signs of short-term exhaustion after filling the FVG zone and is likely to pull back toward the 3,330 support area, making it a potential intraday short opportunity. The structure break, EMA, and RSI support this retracement.

Please support boost 🚀 this analysis)

XAUUSD Technical Analysis – Bullish Continuation SetupXAUUSD Technical Analysis – Bullish Continuation Setup

📊 Market Structure Overview:

The chart shows a clear bullish structure shift, marked by multiple Break of Structure (BOS) events that validate strength from buyers. After forming equal lows and a liquidity sweep at the strong support zone, price has aggressively moved higher, breaking through minor resistance levels and showing clear bullish intent.

🧱 Key Technical Elements:

🔹 1. Strong Support Zone (Demand Rejection)

Price respected the strong demand zone between $3,260 – $3,280, where aggressive buying was seen after forming a bullish engulfing breakout. This zone aligns with previous demand and a major BOS, confirming institutional buying interest.

🔹 2. Bullish Order Flow & Break of Structure (BOS)

Multiple BOS levels across July and early August highlight a sequence of higher highs and higher lows, indicating trend continuation.

The most recent BOS after July 30 shows an impulsive break, confirming bullish dominance and clean order flow.

🔹 3. Fair Value Gaps (FVGs)

Bullish FVG (Mid-July): Price respected and bounced from this zone, showing previous imbalance was filled and used as a base for continuation.

New FVG (Above $3,420): The current upside target lies within this area, acting as a magnet for price due to unfilled orders.

🔹 4. Buy-Side Liquidity & Target Zone

The market is approaching a buy-side liquidity zone around $3,385, a key short-term target where previous highs and stop orders are likely pooled.

If liquidity above $3,385 is taken efficiently, price may expand into the FVG zone between $3,420 – $3,460.

🔹 5. Bullish Confirmation & Momentum

The candle structure shows a clean bullish impulsive move, followed by minor consolidation—likely a bullish flag/pennant indicating potential for further continuation.

Momentum is favoring buyers, and short-term consolidation above $3,340 is healthy for continuation.

🔐 Liquidity & Institutional Narrative

Equal Lows (EQL) and FVG fills suggest prior liquidity was swept and used to fuel institutional long positions.

The recent BOS confirmed that smart money has shifted bias toward longs, and price is now targeting remaining inefficiencies to the upside.

The clear alignment of BOS, liquidity sweep, and bullish FVGs reinforces a strong institutional footprint on this move.

🔍 Key Levels to Watch:

Level Type Price Zone (USD)

🔺 Resistance / FVG 3,420 – 3,460

🎯 Immediate Target 3,385

📉 Short-Term Support 3,340 – 3,320

🛡️ Major Demand Zone 3,260 – 3,280

📌 Conclusion & Outlook:

XAUUSD has initiated a strong bullish leg from the demand zone, confirming accumulation and structural reversal. Price is now moving toward the buy-side liquidity target of $3,385, with potential continuation toward the FVG resistance zone of $3,420–$3,460.

As long as price remains above the $3,320 structure support, the bullish bias remains intact. Any pullbacks should be seen as buying opportunities, especially on lower timeframe confirmations.

BTC Hits Premium Zone – Bearish Reversal Loading? BTC Hits Premium Zone – Bearish Reversal Loading?

🧠 Technical Breakdown:

🔹 1. Previous Market Structure & CHoCH

The chart shows a clear shift in structure (CHoCH) on the left, which marked the start of the bearish leg.

Break of Structure (BOS) confirms continuation of lower highs and lower lows until recent liquidity grab near the $112,551 zone.

Equal highs and liquidity above were taken out, making the move into the Premium Order Block zone highly significant.

🔹 2. Liquidity and Fair Value Gap (FVG) Zones

A major Liquidity + FVG zone was left unmitigated between $113,000–$112,000, and price is likely to revisit it.

This aligns with the target zone at $112,890, which is highlighted as a magnet for price to rebalance the inefficiency.

🔹 3. Order Block & Premium Supply Zone

A well-defined Order Block is marked just below the resistance zone near $115,166–$116,021.

Price is currently retracing into this zone, suggesting a potential reaction point for smart money to re-enter shorts.

Volume is expected to pick up here, and a reversal could initiate if price fails to break above this supply.

🔹 4. Volume Profile and Market Imbalance

Volume clusters are heaviest near the $114,000–$114,300 range, indicating high activity and previous accumulation/distribution.

Thin volume near the $112,551 zone further confirms price may drop quickly if rejection happens.

🔹 5. Support & Liquidity Sweep

Support zone around $112,551 is a previous liquidity pool and weak low that has not been fully cleared.

Price is likely to revisit this zone in the short term to clear liquidity and complete market rebalancing.

🔐 Institutional Narrative:

Smart money engineered a liquidity sweep to the downside, then caused a retracement into premium.

Now, BTC/USD is positioned in a high-risk zone where sell-side institutions may enter to push price lower.

If this order block holds, expect a rejection toward $112,890, followed by possible deeper continuation into the liquidity void below.

📌 Key Levels:

Level Price (USD)

Strong Resistance Zone 115,166 – 116,021

Order Block (Sell Area) 114,800 – 116,000 (approx.)

Immediate Support 113,000 – 112,551

Target (Liquidity Zone) 112,890

Weak Low (Final Sweep) 112,000

📉 Trade Outlook & Strategy:

🔺 If price reacts bearishly at Order Block:

Look for lower timeframe BOS/CHoCH confirmation.

Entry: Short on rejection at or near $115,000–$115,500

Target 1: $112,890

Target 2: $112,000 (extended liquidity sweep)

Stop-loss: Above $116,200 (invalidates bearish OB)

🔻 If price breaks and closes above $116,021 with momentum:

Structure flips bullish, and the OB is invalidated.

Look for long setups on retracement to $114,000 zone.

🧭 Conclusion:

BTC/USD is currently trading within a Premium Zone, testing a strong Order Block below key resistance. Price may face a bearish reaction, targeting the liquidity zone at $112,890. Smart money footprints suggest a potential trap for breakout buyers, and if momentum fades, we can expect a downside reversal to sweep remaining liquidity.

"BTC Sweeps Liquidity – Eyeing 115K Reclaim?""BTC Sweeps Liquidity – Eyeing 115K Reclaim?"

🔍 Technical Analysis – BTC/USD

On the 1H chart, Bitcoin (BTC) is currently displaying a textbook smart money structure, with price action following key institutional footprints.

🔑 Key Observations:

Liquidity Grab at Weak Low

Price dipped below the local support (~112,500), sweeping sell-side liquidity and tapping into a possible reversal zone.

Rejection from Demand Zone (Support Area)

A strong reaction occurred right at the support level, suggesting buyer interest is still present.

Order Block & Fair Value Gap

A visible Fair Value Gap (FVG) sits above current price action, aligning with an Order Block near the 115,000 level — this is a key magnet for price to rebalance.

Target Zone

Immediate upside target is 115,000, where an order block lies. If price reaches that level, expect potential short-term resistance or reversal.

Break of Structure (BOS) Confirmations

Multiple BOS and CHoCHs indicate bearish-to-bullish attempts, but the current structure still needs confirmation above 113,500+ for bullish continuation.

🧠 Conclusion & Expectation:

BTC has swept liquidity to the downside and may now seek to fill the FVG and revisit the 115K order block. However, confirmation is required — watch for bullish engulfing candles, volume spikes, or a CHoCH above 113,500.

“Smart money doesn’t chase — it waits for liquidity, then repositions. BTC may be following the same script.”

USD/JPY) Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of USD/JPY on the 4-hour timeframe, using a combination of trendline support, key horizontal levels, and EMA 200 confluence to identify a potential bounce.

---

Technical Breakdown:

1. Market Structure:

USD/JPY experienced a sharp decline from the resistance zone near 150.445, but price is now testing a strong confluence support area:

Horizontal support zone

Rising trendline

200 EMA (146.907)

2. Support Confluence Zone:

Marked as "trend support level", this zone has historically acted as a springboard for bullish moves.

Recent price action shows a wick rejection at this zone, indicating buying pressure.

3. Resistance/Target Zones:

Target 1: 149.190 – 149.208

Target 2: 150.445 (major resistance zone)

4. EMA 200:

Price is reacting just above the 200 EMA, strengthening the bullish case for a bounce.

5. RSI (14):

RSI has dipped to 35.92, near oversold territory, suggesting the downside may be exhausted.

Prior bounce from similar RSI levels led to strong upward moves.

6. Projected Path:

The chart outlines a potential bullish recovery, targeting a climb back into the upper channel and retesting previous highs.

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bullish (Reversal from trendline + support zone)

Entry Zone: Current level near 147.40–146.90 (support confluence)

Targets:

TP1: 149.190

TP2: 150.445

Invalidation: Daily close below trendline and 200 EMA (~146.70 or lower)

Indicators: RSI supports a bounce; EMA and trendline confirm structure

Please support boost 🚀 this analysis)

XAU/USD) Bearish Trend Read The captionSMC Trading point update

Technical analysis of (XAU/USD) on the 4-hour timeframe, showing both a potential retracement and a bullish continuation.

---

Technical Breakdown:

1. Current Market Structure:

Price recently made a strong bullish push from the key support level (~3,329–3,335), breaking structure to the upside.

It is now approaching a Fair Value Gap (FVG) and resistance zone between 3,380.47 and 3,396.19.

2. Key Zones Identified:

FVG / Resistance Zone: 3,380.47–3,396.19 — where price might initially reject (red arrow) due to unfilled imbalance and previous supply.

Key Support Zone: 3,329.27–3,335.31 — potential area of re-entry or demand if price pulls back.

EMA 200 (Blue): Currently at 3,335.58, aligning with key support.

3. Price Path Scenarios:

Primary Expectation: Price may tap into the FVG, face rejection, then pull back into the key support level for a higher low.

From there, it is projected to bounce back strongly toward the ultimate target at 3,438.73, marking a 3.19% upside move.

4. RSI (14):

RSI at 64.77, indicating strong bullish momentum but not yet in overbought territory. Favorable for continuation, but a short-term correction is possible.

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bullish (after a short-term rejection)

Entry Zones:

Watch for rejection at 3,380–3,396

Look to enter on a retest of 3,335–3,329 support

Target Zone: 3,438.73

Invalidation: Sustained breakdown below 3,329 or bearish engulfing with high volume

EMA & RSI Support: EMA 200 backs bullish bias; RSI confirms momentum

Please support boost 🚀 this analysis)

DOGEUSDT Technical Analysis – Bullish Reversal Anticipated DOGEUSDT Technical Analysis – Bullish Reversal Anticipated

🔍 Key Technical Zones:

Support Zone: $0.1990 – $0.2015

Strong bullish reactions noted from this level in previous attempts.

Confluence with volume accumulation on the left (as seen in the Volume Profile).

Signifies a strong demand zone where buyers are stepping in.

Resistance Zone / Target: $0.2220 – $0.2240

Previous structural high and supply zone.

Marked as the first major liquidity area.

Also aligns with imbalance and CHoCH (Change of Character), a common SMC concept.

🔄 Market Structure:

CHoCH (Change of Character) marked multiple times, indicating attempts by bulls to reclaim structure.

Recent price action shows accumulation near support.

Sideways consolidation suggests potential for a bullish breakout.

Liquidity sweep of recent lows could indicate that smart money is accumulating positions before a move higher.

🎯 Trade Setup Idea:

Entry Area: Between $0.2000 – $0.2060 (inside the support zone)

Target: $0.22396 (as marked)

Stop Loss: Below $0.1980 (below the visible support range)

🔧 Indicators and Tools Used:

Volume Profile (VRVP): Shows most volume traded around $0.205 – $0.207, indicating strong positioning from market participants.

Smart Money Concepts (SMC): CHoCH and liquidity concepts signal potential accumulation and reversal.

Price Action Analysis: Clean swing structure with support-resistance rotation visible.

📌 Conclusion:

DOGEUSDT is currently trading in a range-bound structure with a bullish bias from the support zone. If the price sustains above $0.205 and breaks above minor resistance, the upside target of $0.22396 is likely. This setup is supported by strong volume accumulation and smart money structure shifts.

BTCUSD Technical Analysis (Smart Money Concepts) BTCUSD Technical Analysis (Smart Money Concepts)

Market Structure Overview:

Break of Structure (BOS) observed multiple times confirms a strong bearish trend.

Change of Character (CHoCH) around 30th July indicated initial shift from bullish to bearish intent.

Price has been forming lower highs and lower lows, respecting the bearish structure.

Key Zones:

🔴 Previous Resistance Zone (119,000 - 120,500)

Strong supply area from where price sharply reversed.

Also aligned with a Strong High marked at ~$120,000 – key for any future bullish invalidation.

🟫 Current Target Zone – 116,000

Acts as an immediate imbalance fill/FVG retracement zone.

Target highlighted as potential retracement point before continuing lower.

🟦 Liquidity / Fair Value Gap (FVG) Zone

Located between ~115,800 and 114,500.

Price may aim to revisit this zone on pullback, filling inefficiencies.

🟩 Support Zone (~113,000)

Price currently reacting near this zone.

This area has acted as a demand zone in the past and is expected to provide short-term support.

Volume Profile & Order Flow:

Visible Range Volume Profile shows heavy activity near the resistance cluster, indicating strong distribution by institutional players.

Low volume in the FVG area further confirms inefficiency and potential for a retracement move.

Smart Money Perspective:

The current structure reflects distribution at highs, followed by markdown phase.

Price swept liquidity below local lows and may now seek to mitigate previous supply or FVG around 116,000 before resuming bearish trend.

📌 Conclusion:

Bias: Bearish until 116K is tested and rejected.

Next Move Expectation: Possible liquidity sweep → bounce to 116K → short continuation.

Invalidation Level: Break and close above 117K would signal strength returning.

✅ Educational Note:

This is a classic Smart Money trap setup — liquidity grab near lows, fakeout pump to FVG, and potential short continuation. Traders should be cautious of fake rallies into known supply zones.

BTCUSD Technical Analysis – Bearish Momentum Towards Fair Value BTCUSD Technical Analysis – Bearish Momentum Towards Fair Value Gap

Bitcoin is showing clear bearish pressure after rejecting from the previous resistance zone around 118,800 – 120,000. The market structure and smart money concepts indicate potential for further downside.

🔍 Key Observations:

Previous Resistance Respected: Price failed to break through the strong resistance zone marked near the 119,200–120,000 level, showing strong institutional selling interest.

Market Structure Breaks:

BOS (Break of Structure) and CHoCH (Change of Character) confirmed bearish shift.

Price has maintained lower highs and lower lows, signaling a bearish trend.

Liquidity/Fair Value Gap Zone: The market is currently targeting the liquidity/FVG zone between 116,400 – 116,100, which aligns with price inefficiency and unfilled orders.

Support Zone Ahead: A strong support zone is visible near 115,600 – 115,200. Expect a potential reaction or consolidation here.

📌 Strategy & Bias:

Short Bias Active until price reaches 116,116 (target).

Watch for possible bullish reversal signs in the support/FVG zone.

Ideal for scalp-to-swing short trades, with tight SL above recent EQH.

📚 Educational Notes:

Fair Value Gaps (FVG) indicate institutional imbalances and are often revisited by price.

CHoCH and BOS are early signals of smart money moves – always monitor them in confluence with volume and zones.

USD/JPY) Bullish Trend Read The captionSMC Trading point update

Technical analysis of USD/JPY on the 4-hour timeframe, with a focus on a support-resistance structure and trend

---

Technical Breakdown:

1. Market Structure:

Price is moving in a clear uptrend, making higher highs and higher lows.

A recent pullback into a support zone suggests potential for a bullish continuation.

2. Key Zones:

Support Zone: Around 147.00–147.50, highlighted in yellow — the area where price recently bounced.

Resistance Zone: Around 148.800–149.300, which price is expected to break through.

Target Point: Clearly marked at 150.519, aligning with the prior high and a projected bullish extension.

3. EMA (200):

The 200 EMA (blue) is at 146.489, far below current price — signaling strong bullish momentum.

4. RSI (14):

RSI is at 61.14, showing bullish momentum without being overbought — supportive of further upside.

No divergence is noted, which supports trend continuation.

5. Projection (Drawn Path):

The chart suggests price may bounce from support, break through resistance, and rally toward 150.519, possibly after a retest of the resistance-turned-support.

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bullish

Entry Zone: Near 147.00–147.50 (support)

Confirmation: Bullish candlestick pattern or strong bounce

Target: 150.519

Invalidation: Break and close below 146.489 (200 EMA) or sustained move below support zone

---

Please support boost 🚀 this analysis)

XAU/USD) Bearish Trend Read The captionSMC Trading point update

Technical analysis of Gold (XAU/USD) on the 1-hour timeframe, using a combination of trend lines, EMA, RSI, and price structure.

---

Technical Breakdown:

1. Price Structure:

Gold is forming a rising channel (black trend lines) within a short-term uptrend, but this is happening below the 200 EMA, which generally indicates bearish momentum.

A resistance zone is highlighted near the top of the channel, suggesting sellers might defend this level.

2. Key Level:

Resistance Level: Around 3,330–3,335 zone.

Target Point: Price is expected to break down from the channel and reach support levels near 3,284.35 and 3,282.51.

3. Moving Average (EMA 200):

Current price is below the 200 EMA (3,348.42), reinforcing a bearish bias.

4. RSI (14):

RSI is near 52.58, indicating neutral-to-slightly-overbought territory. No strong divergence is visible, but RSI is not confirming a bullish trend either.

5. Projection (Hand-drawn Path):

The drawn path shows a potential breakdown from the channel with a bearish impulse targeting lower support zones.

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bearish

Confirmation Needed: Break below channel support

Entry Zone: Near the resistance of the rising channel (~3,330–3,335)

Target Zone: 3,284.35 – 3,282.51

Invalidation: Sustained break above 3,348 (above EMA 200)

plesse support boost 🚀 this analysis)

XUA/USD) Bearish Trend Read The captionSMC Trading point update

Technical analysis of (XAU/USD) on the 1-hour timeframe, targeting a move toward the $3,310–$3,315 support zone. Here's the full breakdown:

---

Technical Analysis – Gold (1H)

1. Fair Value Gap (FVG) Supply Zones

Two FVG supply zones are marked where price previously dropped sharply:

Upper FVG zone near $3,385.49 (with red arrow: expected rejection point)

Lower FVG zone near $3,352.47

Price is expected to reject from either zone, resuming the bearish move.

2. Market Structure: Lower Highs, Lower Lows

The chart shows a clear bearish structure, with consistent lower highs and lower lows.

The current price action suggests a potential pullback into FVG, followed by another leg down.

3. Key Support Zone (Target Area)

The yellow box between $3,315.22–$3,310.99 represents a strong demand/support zone and is marked as the target point.

This level has acted as a prior accumulation zone and is likely to attract buying interest again.

4. EMA 200 Resistance

Price is trading below the 200 EMA (currently at $3,365.87) — indicating a bearish bias.

EMA also aligns near the lower FVG zone, reinforcing the area as a potential reversal point.

5. RSI Indicator

RSI at 35.38 is nearing oversold territory but still shows downward pressure.

No divergence or reversal signal yet — supports the continuation view.

Mr SMC Trading point

---

Summary

Bias: Bearish

Current Price: $3,337.02

Supply Zones (FVG):

$3,385.49 (stronger supply)

$3,352.47 (minor supply)

Support Target: $3,315.22–$3,310.99

Structure: Bearish (LL-LH formation)

EMA: 200 EMA acting as dynamic resistance

RSI: 35.38 – still bearish momentum

---

Please support boost 🚀 this analysis)

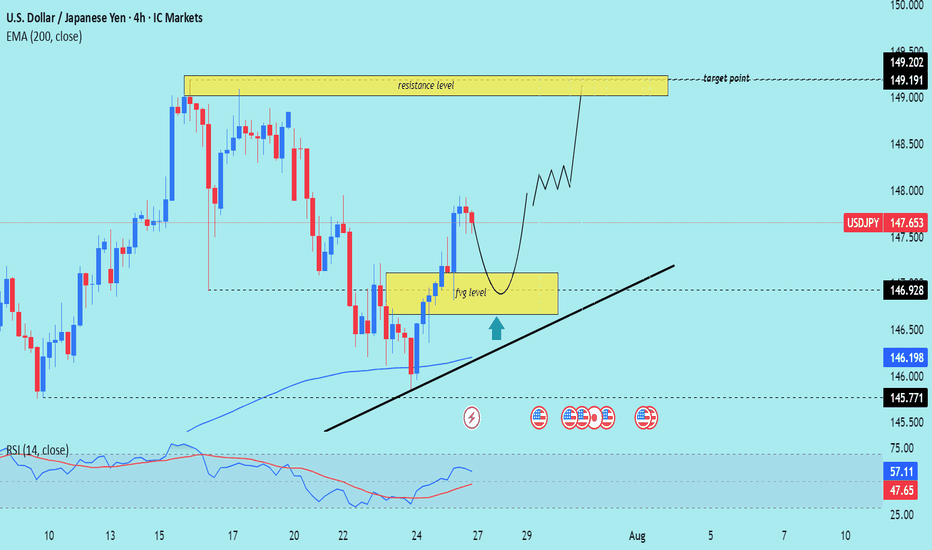

USD/JPY) Bullish Analysis Read The captionSMC Trading point update

Technical analysis of USD/JPY on the 4-hour timeframe, signaling a potential rally toward the 149.191–149.202 resistance zone. Here's the full breakdown

---

Technical Analysis – USD/JPY (4H)

1. Fair Value Gap (FVG) Support

Price recently filled a Fair Value Gap (FVG) level (yellow box) and is now pulling back toward it.

The FVG zone is expected to act as a support and potential entry point for buyers (marked by the green upward arrow).

2. Uptrend Structure

Price is moving within an ascending trendline, suggesting bullish market structure.

The current retracement is seen as a higher low setup, aligning with bullish continuation logic.

3. 200 EMA as Support

The 200 EMA at 146.198 is providing dynamic support.

Confluence between the EMA, FVG, and ascending trendline strengthens the bullish bias.

4. Resistance Target Zone

The projected target zone is between 149.191–149.202, which aligns with a previous high and key resistance level.

This zone is highlighted as the final take-profit area.

5. RSI Momentum

RSI is at 57.11, showing positive momentum but not yet overbought — which supports further upside.

RSI remains above 50, maintaining bullish momentum.

Mr SMC Trading point

---

Summary

Bias: Bullish

Current Price: 147.653

Support Zone (FVG): 146.20–146.92 (approx)

Trendline Support: Uptrend line intact

200 EMA: Acting as dynamic support (146.198)

Resistance Target: 149.191–149.202

RSI: 57.11 – healthy bullish momentum

plesse support boost 🚀 this analysis)

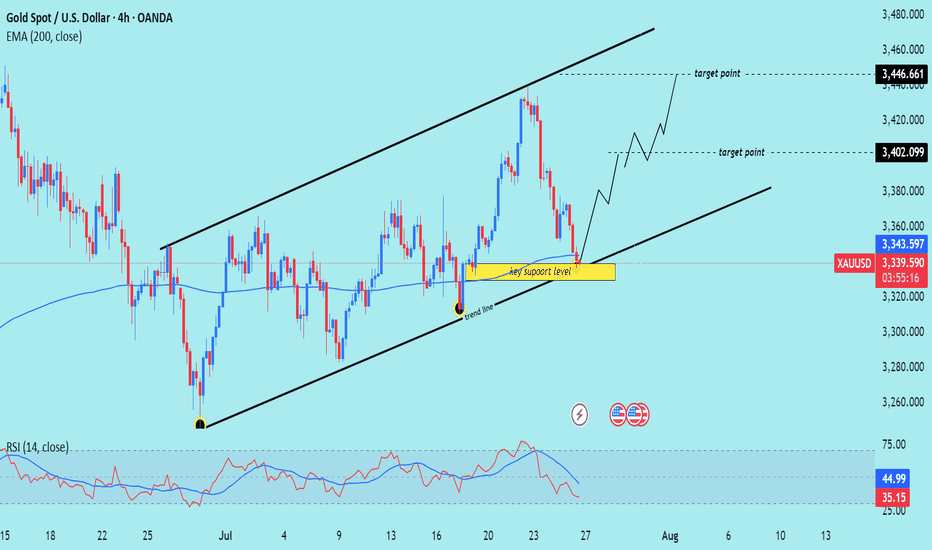

XAU/USD) bullish the support Read The captionSMC Trading point update

Technical analysis of (XAU/USD) on the 4-hour timeframe, indicating a potential bounce from a key trendline support within a rising channel.

---

Analysis Summary

Pair: XAU/USD (Gold Spot vs. USD)

Timeframe: 4H

Current Price: 3,338.715

Bias: Bullish rebound within ascending channel

---

Key Technical Elements

1. Ascending Channel:

Price has been respecting a well-defined rising channel, bouncing between support and resistance levels.

2. Key Support Zone:

The yellow highlighted area marks a critical support level and lower boundary of the channel.

Also intersects with the trendline, strengthening the potential for a bounce.

3. 200 EMA (Dynamic Support):

The 200 EMA at 3,343.616 lies just below current price, acting as a dynamic support level.

4. RSI (14):

RSI is around 34.93, nearing the oversold zone, suggesting a buying opportunity may be near.

---

Target Points

First Target: 3,402.099

Second Target: 3,446.661

---

Trade Idea

Direction Entry Zone Stop-Loss Target Zones

Buy 3,330–3,345 Below 3,320 3,402 / 3,446

Mr SMC Trading point

---

Summary

Gold is currently testing a key support level and ascending trendline. If price holds above this area, we can expect a bullish rebound toward 3,400–3,446 levels, aligning with the upper channel resistance.

Please support boost 🚀 this analysis)

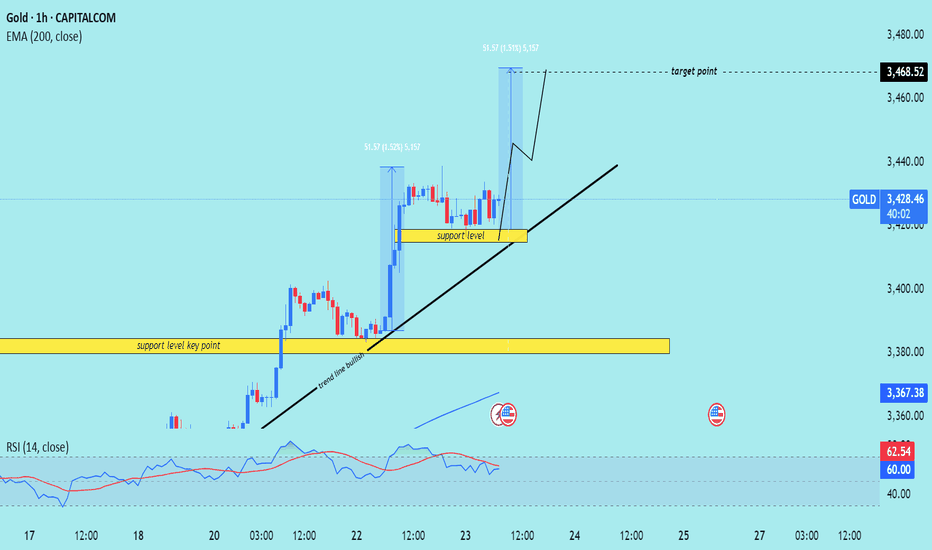

XAU/USD) Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of Gold (XAU/USD) on the 1-hour timeframe. Here's a breakdown of the key trading

---

Technical Overview

Price: $3,428.71 (currently near the upper consolidation)

EMA 200: Around $3,367.38 (well below price, indicating strong uptrend)

Target Point: $3,468.52

Indicators:

RSI (14): 60.19–62.55 → shows moderate bullish momentum, not yet overbought.

---

Key Technical Elements

1. Bullish Breakout Structure:

Price has broken out of a previous range, and is forming a bullish flag or rectangle, which typically leads to continuation higher.

Measured move projection from previous leg (approx. $51.57 gain) targets the $3,468.52 level.

2. Strong Support Zones:

Two yellow zones highlighted:

Upper support level (around $3,415): acting as immediate structure support.

Lower key support (around $3,380): crucial structure level from where the trend initiated.

3. Trend Line Support:

A clearly marked ascending trend line supporting higher lows—indicating bulls are in control.

Expect price to stay above this trend line to maintain bullish bias.

4. Volume & RSI Confirmation:

RSI remains in a bullish zone but isn’t overbought → leaves room for upside.

Volume remains steady, confirming healthy consolidation.

Mr SMC Trading point

---

Conclusion & Trade Idea

Bias: Bullish

Entry Zone: On breakout or retest of minor support ($3,415–$3,420)

Stop Loss: Below trendline or below $3,415

Target: $3,468.52

Confirmation: Hold above trendline + RSI staying above 50

This is a classic bullish continuation setup supported by structure, RSI, and trend momentum. Traders could look for buying opportunities on minor dips or trendline retests.

---

Please support boost 🚀 this analysis)

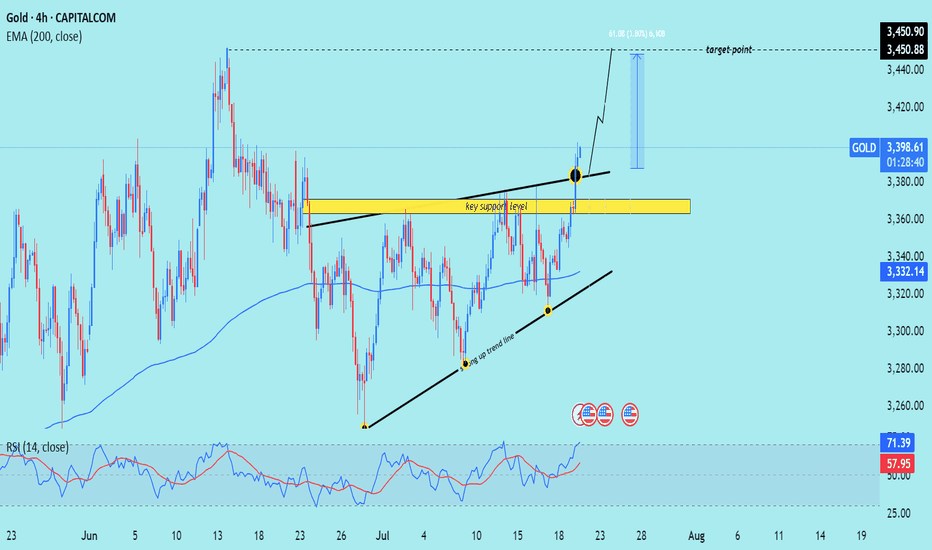

XAU/USD) breakout analysis Read The captionSMC Trading point update

Technical analysis of (XAU/USD) on the 4-hour timeframe, highlighting a move toward the $3,450 target. Here's the full technical breakdown

---

Technical Analysis – Gold (4H)

1. Breakout from Resistance Zone

Price has broken above a key horizontal resistance level (now turned support, marked in yellow).

The breakout is confirmed by a strong bullish candle with momentum, suggesting buyers are in control.

2. Ascending Triangle Formation

Price formed an ascending triangle, a classic bullish continuation pattern.

The breakout above the upper boundary confirms the pattern, projecting a potential measured move.

3. Trendline Support & Higher Lows

The structure shows a rising trendline (black), where price bounced multiple times — confirming a higher low sequence.

The confluence of trendline support + breakout level adds strength to the bullish case.

4. 200 EMA Confluence

The 200-period EMA (3,332.13) has been acting as a dynamic support throughout.

Price retested it earlier in the move, then surged upward — validating trend continuation.

5. RSI Indicator

RSI is at 71.13, entering overbought territory.

This implies strong bullish momentum, but a short-term pullback to retest the breakout level is possible.

6. Target Projection

Target Point: $3,450.90, calculated from the height of the triangle (~61 pts or 1.80%) added above the breakout zone.

A retest of the breakout area (yellow zone) around $3,370–$3,380 could offer a better entry before continuation.

Mr SMC Trading point

---

Summary

Bias: Bullish

Current Price: $3,397.62

Support: $3,370–$3,380 zone (previous resistance turned support)

Trend: Higher lows + breakout above resistance

EMA Support: 200 EMA at $3,332.13

Target: $3,450.90

RSI: 71.13 – bullish but near overbought

Please support boost 🚀 this analysis)

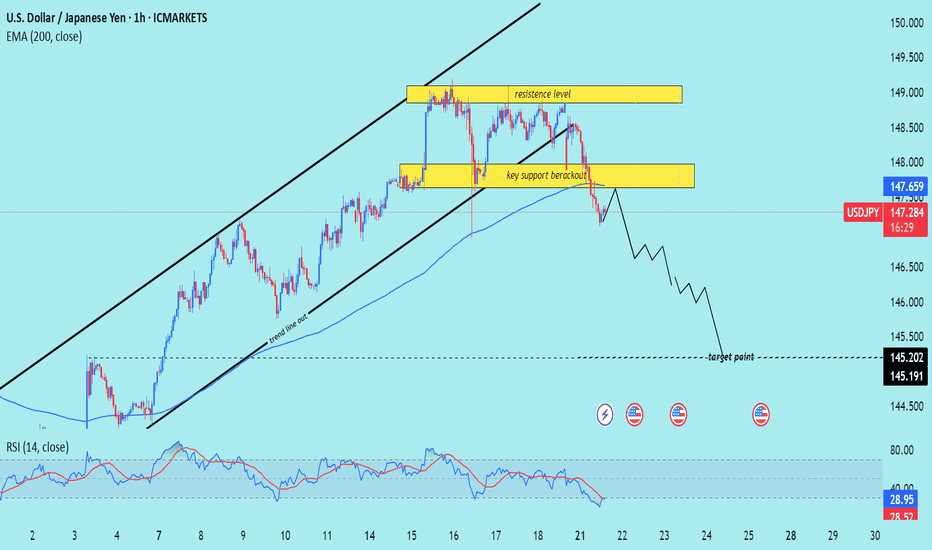

USD/JPY) bearish Trend Read The captionSMC Trading point update

Technical analysis of USD/JPY on the 1-hour timeframe, signaling a potential drop toward the 145.200 – 145.191 target zone. Here's the detailed breakdown:

---

Technical Analysis – USD/JPY (1H)

1. Rising Channel Breakdown

Price has broken below an ascending channel, confirming a trend line breakout and signaling a trend shift from bullish to bearish.

The trend line cut and rejection from the upper resistance zone support the bearish reversal.

2. Key Support Breakout

A crucial horizontal support zone around 147.80–148.00 was broken.

The break-and-retest of this area (yellow box) acts as a confirmation of bearish momentum continuation.

3. Bearish Momentum Below EMA

Price is trading below the 200 EMA (147.659) — a strong signal of downward bias on this timeframe.

The EMA has flipped from dynamic support to resistance.

4. RSI Oversold but Bearish

RSI is at 29.41, in oversold territory, which may hint at a short-term bounce.

However, the broader structure suggests more downside potential before a deeper retracement.

5. Target Projection

Projected target zone is between 145.200–145.191, aligning with previous structure lows and likely liquidity zone.

Mr SMC Trading point

Summary

Bias: Bearish

Current Price: 147.307

Key Resistance: 147.80–148.60 zone

Structure: Rising channel break + key support breakout

200 EMA: Above price (bearish signal)

RSI: 29.41 – oversold but momentum remains bearish

Target: 145.200–145.191

Please support boost 🚀 this analysis)