FOXA's Uptrend: Riding Downtrend BreaksFox Corporation (FOXA) has impressively rebounded twice from the 88.6% Fibonacci support, displaying resilience. Notably, it consistently breaches downtrend trendlines. Seizing this buying chance, we remain vigilant, especially focusing on the Fibonacci support.

FOX

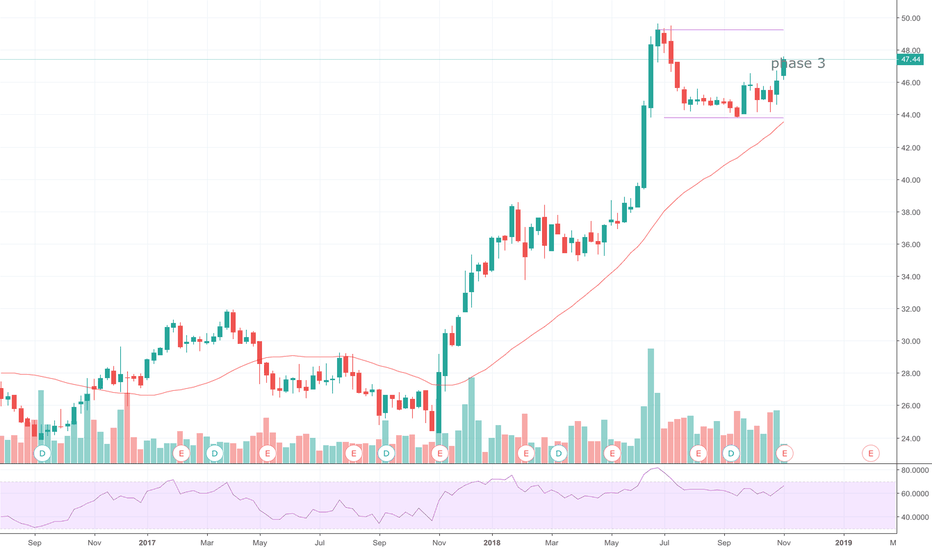

FOX - Looking to make a move or dead cat bounce? This is what I would consider a short term in and out swing trade.

FOX recently rallied from 0.03 all the way to 0.14 gaining almost 400% in basically a month.

It has since corrected over 50% from the top and it is starting to show signs of a possible reversal.

Lower times frames have been showing some bullish divergences.

4 hour time frame MACD is also looking to flip into the green side.

Based on the current market conditions and recent price action on FOX I would expect at the very least a run up towards the 0.10-0.12 area.

I will personally be exiting my position at that area.

Have any chart to share for FOX? Drop it down below :D

Polygon Labs Partners with Fox for Verify InitiativePolygon Labs partners with Fox to launch Verify, a tool for authenticating media content origin amid AI challenges.

Polygon Labs, in collaboration with Fox, announced the launch of a groundbreaking technology platform, Verify, on January 9. This innovative tool is designed to authenticate the origin of media content, a significant step forward in an era increasingly dominated by AI-generated material. Verify aims to enable users to confidently determine the true source of articles and images, ensuring that content attributed to a particular publisher indeed originates from them.

Polygons Verify Tackles Media Citation Issues

The rapid proliferation of AI-generated text and images has presented a significant challenge to the integrity of online content. Verify emerges as a solution to this growing concern, allowing users to distinguish between authentic and AI-generated content. This technology does not evaluate the truthfulness of the content but focuses on verifying its origin. The platform’s introduction directly responds to the challenges faced by media organizations and others dealing with citation or copyright issues in the AI era.

Polygon’s initiative with Fox is particularly timely, considering the legal challenges various media entities face. Fox News, part of Fox Corporation, is currently embroiled in a lawsuit with Smartmatic regarding false narratives circulated about the 2020 US Presidential Election. Similarly, Dominion Voting Systems settled a lawsuit with Fox for $787 million. These cases highlight the complexities and legal entanglements of disseminating unverified or false content.

Legal Landscape and Industry Response

The legal landscape surrounding AI-generated content has become increasingly complex. The New York Times filed a lawsuit against OpenAI and Microsoft in December, accusing them of using its content without authorization to train AI chatbots. This groundbreaking case reflects the broader challenges media organizations face in adapting to the surge of AI-generated content.

In 2023, using AI tools in content creation led to significant industry upheaval, with the Writers Guild of America and the Screen Actors Guild – American Federation of Television and Radio Artists going on strike. The strike highlighted the growing concerns over the use of AI in the media and entertainment industries, underscoring the need for tools like Verify to establish clear boundaries and origins of content.

RFOX re-testing support. This might print x2 stupidly fastThe price is on strong support.

125% is the psychological level for Take Profit target 1 @ 0.19 USDT

astounding Risk Reward Ratio. Potentially moving past ATH with the tokens usual volatility on the way up!

I'm making sure to place a tight stop loss though, in case BTC prints more downtrend.

BLOK, DROP & POP UPGood morning,

Innovation fuels the new market and design of this everchanging environment we call crypto. BLOK, a recent release, has been surging and has only recently let up for what seems to catch a bit of breath of fresh air before it continues into the marathon of crypto trading. Do you see BLOK becoming a new foundation in the crypto market, or is it just "another brick in the wall?" Please let me know in the comments.

$FOXA FOX CORPORATION and its fantastic budget dataMy Marketmiracle advisor generated an input signal for the $FOXA stock with an ambitious target of 42.43 USD and a potential profit of 13.95%

Incusiorite I analyzed the graph and the first thing I noticed is that the presented balance sheet data are decidedly above the estimates of analysts.

Surely this is an aspect to consider but that alone already justifies such a consistent appreciation.

So I expect price behaviour like the one I drew freehand.

This idea is based on a signal generated by the advisor Marketmiracle, down on this page you will find the link to the page of signals of the advisor that you can see for free without any cost or registration

Fox News ShortFox News Short Thesis: 1) death rates higher for fox news viewers www.youtube.com 2) Fox news ratings plummeting after calling election for Biden time.com 3) Fox news actively threatening guests not to appear on Newsmax www.businessinsider.com

dilille010

risk reward of 4.3 for stop loss 30.36 and target of 21.27

3 BUYOUT OFFERS @ $20 A SHARE - TRADING AT HUGE DISCOUNTTGNA received 3 buyout offers in cash.

Last night, another offer was announced at $20 a share.

In this crazy market, to have a company getting so many buyout offers is in our opinion, very rare.

TGNA has quality assets that are in big demand.

TGNA is the largest owner of NBC, CBS, ABC and FOX stations in the top-25 U.S. markets.

Overall TGNA / its stations reach approx. 39% of the United States.

In our opinion, the stock is trading at a huge discount.

In a market like this, TGNA is a stock you want to buy and hold.

There could be a bidding war soon.

LONG

DISCLAIMER

This website and our posts are for general information only. No information, forward looking statements, or estimations presented herein represent any final determination on investment performance. While the information presented in this website and our posts has been researched and is thought to be reasonable and accurate, any investment is speculative in nature. StockKid, and/or our agents cannot and do not guarantee any rate of return or investment timeline based on the information presented herein.

By reading and reviewing the information contained in this website and our posts, the user acknowledges and agrees that StockKid, and/or our agents do not assume and hereby disclaim any liability to any party for any loss or damage caused by the use of the information contained herein, or errors or omissions in the information contained in this website or our posts, to make any investment decision, whether such errors or omissions result from

negligence, accident or any other cause.

Investors are required to conduct their own investigations, analysis, due diligence, draw their own conclusions, and make their own decisions. Any areas concerning taxes or specific legal or technical questions should be referred to lawyers, accountants, consultants, brokers, or other professionals licensed, qualified or authorized to render such advice.

In no event shall StockKid, and/or our agents be liable to any party for any direct, indirect, special, incidental, or consequential damages of any kind whatsoever arising out of the use of this website, our posts or any information contained herein. StockKi

FOX slowstoch is coming out the 20 zone.FOX slowstoch is coming out the 20 zone.

Title touched a support at 35.32 for two consecutive days and slowstochastic crossing above 20 could be a good signal of reversing.

Stock strenght is above 65.

Watch the stock and lets see on lower timeframes if there is a entry signal.

Disclaimer:

This is just my tought: don't invest based on this idea.

Will 21st Century Fox make a bid for Sky PLC?The share price of Sky PLC spiked as much as 30% earlier today as news broke out about a potential takeover from 21st Century Fox. Fox already holds 39% of Sky PLCs shares and a preliminary deal has now been reached for Fox to purchase the remaining stake at £10.75 per share. Sky currently operates in five different countries within the EU and with the current weakness of the pound, UK companies are attractive for foreign companies. If this deal successfully goes through, it will greatly increase Fox’s market share of the Global Television industry. Rupert Murdoch, executing co-chairman of 21st Century Fox has made it clear previously that he would like to own all of Sky. Fox have until 6th January 2017 to make their intentions clear or walk away for six months due to the UK Takeover rules. From the chart, we can see that Sky PLCs share price shot up towards the trendline before retracing to close just below it. Over the next month, we would expect to see some retracement until Fox make their intentions clear or make a formal offer. If no deal is made or the shareholders of Sky reject the proposed offer, the share price of Sky would be expected to fall back towards £7.90. If a deal is successful, price could head in excess of £12.00 depending on Fox’s plans with Sky PLC.