$RIDE - The wedge continuesHi all,

Nothing's changed with Lordstown's position. This post relates not to Lordstown's financials or fundamentals but to chart technicals.

In my own data that i follow for all stocks, Lordstown seems to be nothing special and has absolutely nothing going for it. In terms of charting, Lordstown is in a huge bull wedge (which doesn't make sense, i know, but there it is...).

The wedge continues. A couple of the previous candle wicks from the last 15 days have extended the wedge's range slightly to a new possible low of $1.6. That or the wedge is about to be broken out of for reasons i'm not sure of.

Suddenly all other companies e.g NKLA are considering a reverse split to get them out of a similar position like Lordstown had. Funnilly NKLA is an actual scam with it's president Milton being convicted of fraud and all that, meanwhile our boi Hightower with his wheel motor hubs isn't doing terribly in terms of the hardware/tech and actually has something that doesn't need to be pushed to make it roll on a road like NKLA did.

Excessive bearishness on Reddit boards and such are making me bullish on this stock. I'd like to think there's a possibility that RIDE will make it out of the hole. If it does, all these bears are going to have their accounts blasted.

I re-iterate that i think that for surprising reasons, this wedge will break out eventually. My investment horizon on RIDE is long term and not meant to be a short term trade. The wheel hub technology in my opinion could actually be very big as long as Ride can make it out of it's hole.

The market is moving upwards with no regard to any of the doom and gloom being blasted to us by the financial media. During this time, RIDE has underperformed or as it should be said... shorted. This is a good way to do things if you're a short seller because if the market is eventually bound to correct hard, when it does, market makers and others will take care of shorting all stocks including RIDE for you and the resulting dump will be pretty damn big.

Not only would you have managed to make a stock go down (and against the market) but when the market actually dumps and all stocks have to follow, it'll move down with the market for free.

The problem arises when the market isn't giving you your all so awaited correction within a certain timeframe. If this happens, the short becomes more expensive to fund. Since RIDE has already been long time favorite short since 2021, i believe that at any time now, any kind of surprise by Lordstown itself can catch plenty of the institutional bears by surprise, but really not as much as the retail bears who have gotten cushy with short selling on Lordstown.

If and in my opinion, WHEN Hightower is done with the current Foxconn "situation", some shorts could get blasted out of the water. Persistence/conviction shorting into RIDE's good news will be obvious what everyone will be doing for another 1-2 years after that because shorts just like longs want to avoid the reality of things. Then those shorts will get blasted out of the water taking us higher, the cycle would continue.

Again, this all will happen only and only if Hightower & Foxconn happens. Foxconn isn't in a great (but not terrible) place either with Revenues down 11% Y.O.Y due to their TV/Computer screen section. In my opinion diversifying into EV regardless of this issue with revenue would be a good idea just to diversify risk with what exactly happened with Foxconn & Sharp. Hopefully Foxconn's management sees exactly that and will know what to do about it.

My position as usual is 1000 x $0.5 calls bought and 1000 x $0.5p sold for 2025 pre-split. Hoping to add more as the price touches sub $2 due to the insistent bears conviction shorting this stock on the status quo. The status quo in my opinion has made everyone too cushy, if it changes as these things sometimes do, that'll be a nice sight.

Foxconn

Apple & Foxconn Broke Labor Law for iPhonesApple, together with its manufacturing partner, Foxconn violated a Chinese labor rule. The two firms are using too many temporary staff in the world’s largest iPhone factory. In addition to that, the companies confirmed this after a report about them with allegedly harsh working conditions.

And these claims were from China Labor Watch, who issued the report before an Apple event on Tuesday to announce new iPhones. The non-profit advocacy group is investigating conditions in Chinese factories. Aside from that, it has found out other alleged labor rights violations by Apple partners in the past.

Recently, CLW stated undercover investigators worked in Zhengzhou plant of Foxconn in China. And this includes a person employed for four years. Then, one of the main findings is the Temporary staff, also known as dispatch workers. Also, they made up around 50% of the workforce in August. In the Chinese labor law, it stipulates a maximum of 10%, according to CLW.

Apple and Foxconn Side

After conducting the investigation, Apple explained that it found the dispatch workers’ percentage exceeding its standards. And as of now, it is working carefully with Foxconn to resolve the matter. Also, Foxconn Technology Group confirmed the violation after an operational review.

For years, the supply chain of Apple never stopped facing criticism regarding its poor labor standards. And the firm had encouraged its manufacturing partners to have better factory conditions or risk losing business. But suppliers and assemblers are always attempting to churn out more handsets. Formally called as Hon Hai Precision Industry Co., Foxconn, employed tens of thousands of temporary workers. And they did this to boost production and meet iPhone demand during the key holiday season every year.

CLW stated in its report, “Our recent findings on working at Zhengzhou Foxconn highlights several issues.” And these “are in violation of Apple’s own code of conduct.” It also added that Apple has the power to make fundamental improvements to the working conditions along its supply chain. However, it is currently transferring costs from the trade war through its suppliers to workers and profiting from the exploitation of Chinese workers.

More stock news

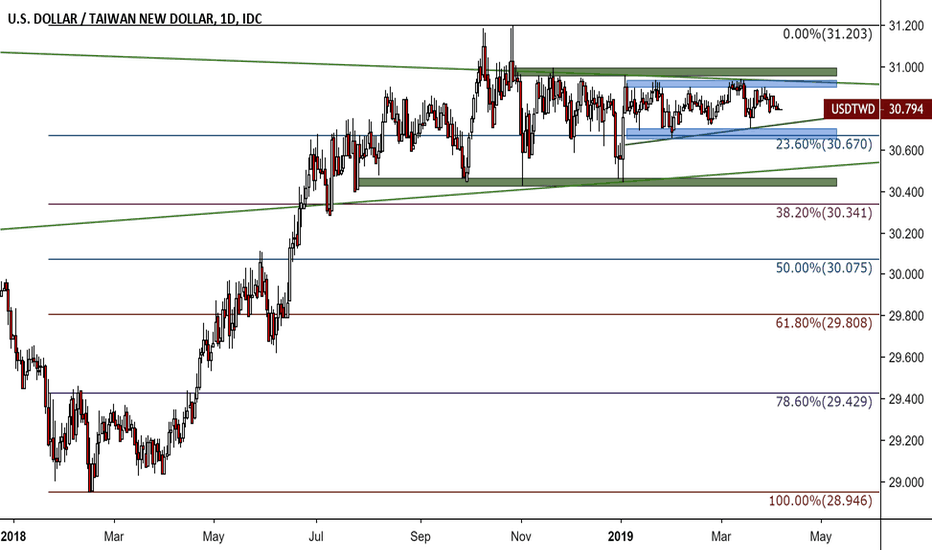

The Low Volatility Taiwan Dollar Is Now Less VolatileThe already incredible low volatility of the US dollar to the Taiwan dollar somehow over the past few weeks managed to drop volatility even lower than before. The range trading has tightened further from 30.42 to 31 by a tighter range of 30.65 to 30.94. This is truly incredible, even for the foreign exchange market which has suffered (or enjoyed given your financial position) from extremely low volatility compared to other asset classes such as commodities or equities. The question remains if this volatility can be sustained and if so for how long. Clearly, this pair suffers from low liquidity which can be seen by long tails of the candlesticks indicating short-term volatility. Less clear is the fact that this pair is still manipulated by the central bank. Either way, USDTWD is a fairly stable pair to invest in with foreign exchange risk extremely low, at least for now.